How Much Is Prime Worth in the competitive beverage market? This question is crucial for understanding the potential financial success of its creators, Logan Paul and KSI. HOW.EDU.VN delves into a detailed analysis of Prime’s valuation, comparing it with industry peers and exploring its potential to create the first YouTube creator billionaire, offering insights into the brand’s market position and future prospects. Discover expert perspectives and strategic advice on navigating the dynamic beverage industry.

1. Prime’s Market Position: A Deep Dive

Understanding Prime’s market position requires a comprehensive analysis of its competitors, revenue, and potential valuation. This section explores these key elements to provide a clear picture of where Prime stands in the beverage industry.

1.1. Identifying Prime’s Competitors

To accurately assess Prime’s worth, it’s essential to compare it with similar companies in the athletic drink, energy drink, and enhanced water categories. The following table lists some of Prime’s key competitors, providing a basis for valuation analysis:

| Company | Category |

|---|---|

| BodyArmor | Athletic Drink |

| Gatorade | Athletic Drink |

| Powerade | Athletic Drink |

| Celsius | Energy Drink |

| Monster Energy | Energy Drink |

| Rockstar Energy | Energy Drink |

| Liquid Death | Enhanced Water |

This comparison helps establish a benchmark for evaluating Prime’s financial performance and market potential.

1.2. Revenue, Valuation, and Multiples of Competitors

Analyzing the revenue, valuation, and multiples of Prime’s competitors provides valuable insights into potential valuation ranges. Here’s a detailed look at some key competitors:

| Company | Valuation | Revenue | Multiple | Growth Rate | Status | Owner/Investor |

|---|---|---|---|---|---|---|

| BodyArmor | $8B | $1.4B | 5.7x | 63.4% | Acquired | Coca-Cola |

| Gatorade | $8.3B | $1.8B | 4.6x | 6.3% | Acquired | Pepsi |

| Celsius | $13.1B | $952M (TTM) | 13.8x | 108% | Publicly Traded | Pepsi |

| Monster Energy | $55.6B | $6.7B | 8.3x | 13.9% | Publicly Traded | Coca-Cola |

| Liquid Death | $700M | $130M | 5.4x | 259.4% | Private | Live Nation, Science Ventures |

Understanding these metrics allows for a more informed estimation of Prime’s potential market value.

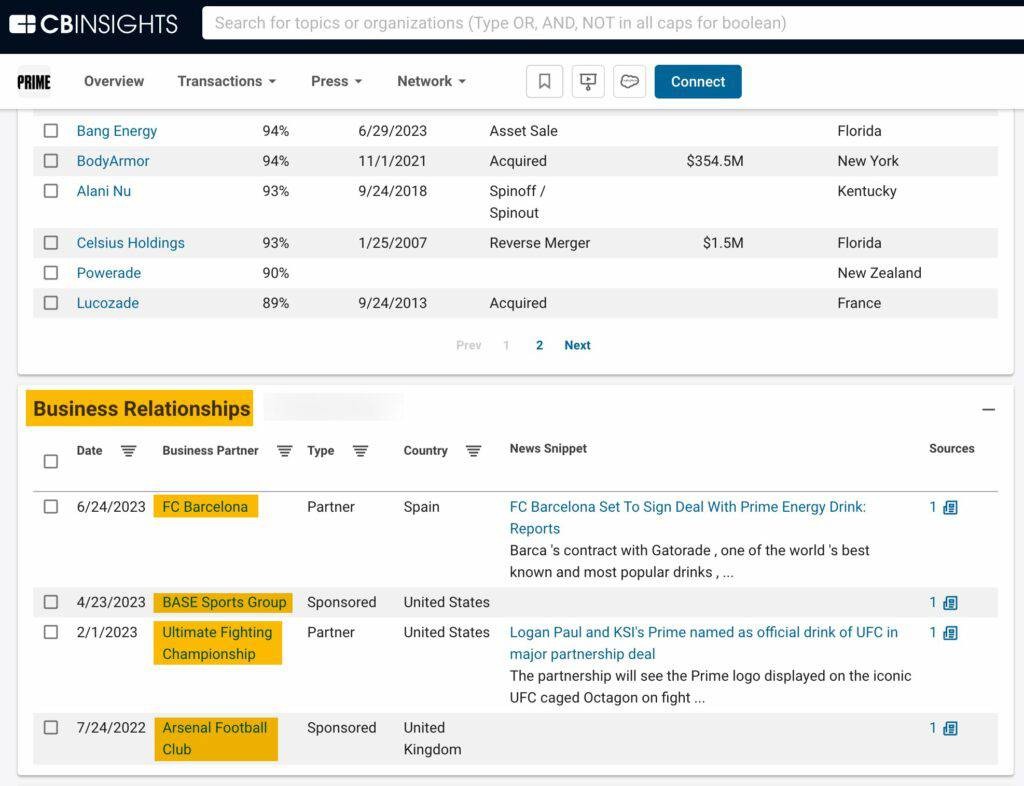

1.3. The Role of Congo Brands: The Secretive Incubator

Congo Brands, a CPG product incubation firm, plays a crucial role in Prime’s success. They specialize in partnering with influencers to create and market beverages, offering services such as talent management, logistics, branding, and product development. According to CB Insights, Congo Brands operates as a “white-label beverage manufacturer,” collaborating with influencers to jointly create and market beverages in exchange for equity. This model has proven successful for brands like Alani Nu and 3D Energy Drinks.

2. Strategic Market Defense by Coca-Cola & Pepsi

Coca-Cola and PepsiCo are key players in the beverage market, employing aggressive strategies to protect and expand their market share. Their actions significantly influence the competitive landscape for brands like Prime.

2.1. Market Dominance Tactics

Coca-Cola and PepsiCo maintain their market dominance through various tactics, including:

- Acquisitions: Acquiring promising beverage companies to integrate innovative products into their portfolios.

- Investments: Investing in emerging brands to gain a strategic foothold in high-growth segments.

- Distribution Partnerships: Leveraging extensive distribution networks to ensure their products reach a wide consumer base.

- Competitive Pricing: Employing competitive pricing strategies to maintain affordability and attract consumers.

These tactics pose both opportunities and challenges for Prime as it navigates the competitive beverage market.

2.2. Coca-Cola’s and PepsiCo’s Investments

The following table highlights key investments and acquisitions made by Coca-Cola and PepsiCo in the beverage market:

| Company | Owner/Investor |

|---|---|

| Gatorade | Pepsi |

| Rockstar Energy | Pepsi |

| Celsius | Pepsi |

| Powerade | Coca-Cola |

| BodyArmor | Coca-Cola |

| Monster Energy | Coca-Cola |

These investments demonstrate the strategic importance of acquiring and partnering with innovative beverage brands to maintain market leadership.

3. Prime’s Valuation: Estimating Its Worth

Estimating Prime’s valuation involves analyzing its revenue, growth rate, and comparable industry multiples. This section provides a detailed breakdown of the valuation process.

3.1. Revenue Analysis

Accurate revenue figures are crucial for estimating Prime’s valuation. Based on available data:

- 2022 Revenue: Reports indicate Prime’s revenue was $250 million.

- 2023 Projected Revenue: Run rate trend data suggests a potential revenue of $540 million to $672 million. The average of these projections is $606 million.

- Conservative Revenue Estimate: Applying a 25% discount to the $606 million projection yields a conservative revenue estimate of $455 million.

These figures provide a range for assessing Prime’s potential valuation based on different scenarios.

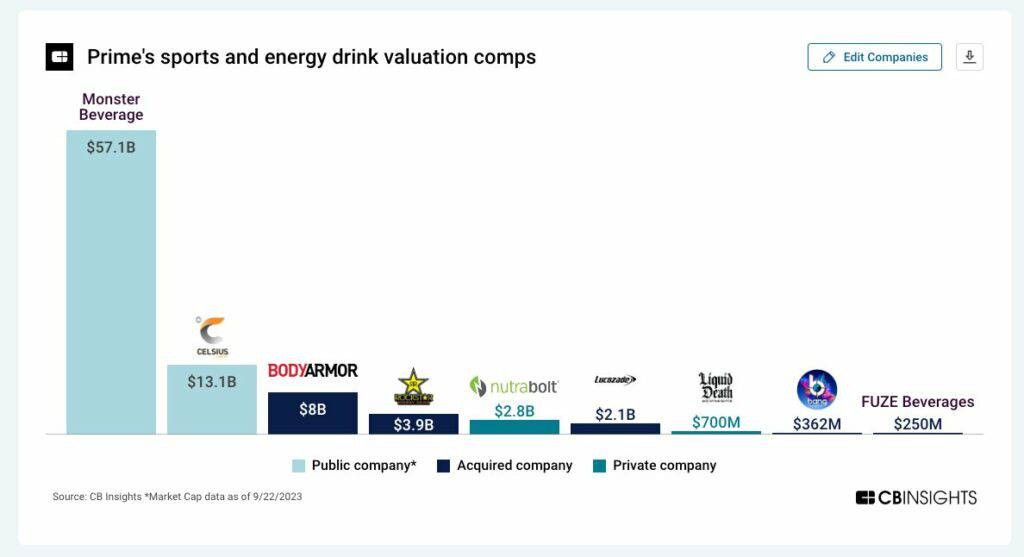

3.2. Industry Multiple Analysis

The industry multiple is a key factor in determining Prime’s valuation. By examining multiples from publicly traded companies and recent deals since 2020, we can derive a reasonable range:

- Comparable Companies: BodyArmor, Monster Beverage, Rockstar Energy, Nutrabolt, Celsius, and Liquid Death.

- Median Revenue Multiple: The median revenue multiple for these companies is 6.8x.

- High Valuation Multiple: Celsius Holdings trades at a 13.8x multiple, representing a high-end valuation scenario.

Using these multiples, we can estimate Prime’s valuation under different scenarios.

3.3. Valuation Scenarios

The following scenarios provide a range of potential valuations for Prime:

- Scenario 1: Median Industry Multiple + Conservative Revenue: Valuation = 6.8x * $455M = $3.1 billion

- Scenario 2: Median Industry Multiple + Aggressive Revenue: Valuation = 6.8x * $606M = $4.1 billion

- Scenario 3: Celsius Multiple + Conservative Revenue: Valuation = 13.8x * $455M = $6.3 billion

- Scenario 4: Celsius Multiple + Aggressive Revenue: Valuation = 13.8x * $606M = $8.4 billion

The average of these scenarios yields an estimated valuation for Prime of $5.5 billion.

4. Potential Acquirers of Prime

Prime’s potential in the beverage market makes it an attractive acquisition target for several key players.

4.1. Obvious Choices: Pepsi and Coca-Cola

Pepsi and Coca-Cola are the most likely acquirers due to their aggressive strategies for market share growth and their history of acquiring innovative beverage brands.

4.2. Other Potential Suitors

Other companies that may be interested in acquiring Prime include:

- Keurig Dr Pepper: Known for investing in and acquiring beverage brands.

- Monster Beverage: Although tied to Coca-Cola, Monster could still be a potential acquirer seeking to diversify its portfolio.

- Celsius: While also linked to Pepsi, Celsius could explore acquiring Prime to further expand its market presence.

4.3. Strategic Importance of Acquisitions

Acquiring Prime would allow these companies to:

- Expand Market Share: Gain a larger share of the rapidly growing energy and athletic drink market.

- Diversify Product Portfolio: Add a popular and innovative brand to their existing product lineup.

- Leverage Distribution Networks: Utilize established distribution channels to increase Prime’s market reach.

5. Financial Implications for Logan Paul and KSI

Prime’s valuation has significant financial implications for its creators, Logan Paul and KSI.

5.1. Ownership Stakes

While the exact ownership stakes are not publicly known, media reports suggest Logan Paul owns approximately 20% of Prime.

5.2. Potential Net Worth

Based on a valuation of $5.5 billion, Logan Paul’s stake could be worth $1.1 billion. This valuation also positions KSI as a potential billionaire.

5.3. The First YouTube Billionaires

If Prime continues to grow and achieve higher valuations, Logan Paul and KSI could become the first YouTube creators to reach billionaire status, surpassing other prominent figures like MrBeast.

6. Navigating Challenges and Seeking Expert Guidance

Many individuals face challenges in understanding complex market dynamics and investment opportunities. Seeking expert guidance can provide clarity and support in making informed decisions.

6.1. Common Challenges

- Difficulty Finding Qualified Experts: Identifying professionals with the right expertise and experience.

- High Costs and Time Investment: Securing high-quality advice can be expensive and time-consuming.

- Concerns about Confidentiality and Reliability: Ensuring the privacy and accuracy of shared information.

- Difficulty Articulating Complex Issues: Clearly communicating needs to receive the best support.

6.2. How HOW.EDU.VN Can Help

HOW.EDU.VN connects you with top experts and Ph.Ds worldwide, offering personalized advice and solutions for complex issues. Our services ensure confidentiality, reliability, and practical, actionable insights.

6.3. Benefits of Expert Consultation

- Direct Access to Experts: Connect with leading professionals for personalized advice.

- Save Time and Money: Efficiently address challenges with targeted support.

- Ensure Confidentiality and Reliability: Trust in secure and accurate information.

- Receive Practical Solutions: Get advice that can be immediately applied to achieve desired outcomes.

For expert consultation and answers to your questions, contact HOW.EDU.VN at 456 Expertise Plaza, Consult City, CA 90210, United States. Reach us via WhatsApp at +1 (310) 555-1212 or visit our website at HOW.EDU.VN.

7. FAQ: Frequently Asked Questions About Prime’s Valuation

7.1. What factors influence Prime’s valuation?

Prime’s valuation is influenced by its revenue, growth rate, market position, and industry multiples of comparable companies.

7.2. How does Prime compare to its competitors?

Prime competes with athletic drinks, energy drinks, and enhanced water brands like BodyArmor, Gatorade, Celsius, and Monster Energy.

7.3. What role does Congo Brands play in Prime’s success?

Congo Brands incubates and manages Prime, providing talent management, logistics, branding, and product development services.

7.4. Who are the potential acquirers of Prime?

Potential acquirers include Pepsi, Coca-Cola, Keurig Dr Pepper, Monster Beverage, and Celsius.

7.5. What is the estimated valuation range for Prime?

Based on various scenarios, Prime’s estimated valuation ranges from $3.1 billion to $8.4 billion.

7.6. How much are Logan Paul and KSI worth due to Prime?

Logan Paul’s stake could be worth $1.1 billion, potentially making KSI a billionaire as well.

7.7. What challenges do companies face in the beverage market?

Challenges include intense competition, evolving consumer preferences, and the need for innovative marketing strategies.

7.8. How can HOW.EDU.VN help with market analysis?

HOW.EDU.VN connects you with top experts for personalized market analysis and strategic advice.

7.9. What are the benefits of seeking expert consultation?

Benefits include direct access to experts, time and cost savings, ensured confidentiality, and practical solutions.

7.10. How can I contact HOW.EDU.VN for consultation?

Contact us at 456 Expertise Plaza, Consult City, CA 90210, United States, via WhatsApp at +1 (310) 555-1212, or visit our website at how.edu.vn.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or investment advice. Consult with a qualified professional before making any investment decisions.