How Much Can I Make Driving For Lyft? If you’re considering becoming a Lyft driver, understanding potential earnings is crucial. This guide, brought to you by HOW.EDU.VN, dives deep into factors influencing your income, offering insights into maximizing your earning potential in the rideshare industry. Explore the intricacies of rideshare economics, discover strategies for boosting your profits, and learn how to navigate the dynamic world of Lyft driving with expert guidance.

1. Understanding Lyft Driver Earnings: The Basics

Driving for Lyft can be a flexible way to earn income, but the actual amount you make varies considerably. Let’s break down the key components that determine your earnings.

1.1. Lyft’s Pay Structure: A Breakdown

Lyft’s payment structure is based on several factors, including:

- Base Fare: A fixed amount charged for every ride.

- Per-Mile Rate: A rate charged for each mile driven during the ride.

- Per-Minute Rate: A rate charged for each minute the ride takes.

- Service Fee: A percentage Lyft takes from the fare.

- Tips: Passengers can tip drivers through the app, and 100% of the tip goes to the driver.

- Bonuses and Incentives: Lyft offers various bonuses and incentives like ride streaks, challenges, and surge pricing.

1.2. Factors Affecting Your Hourly Rate

Several elements influence how much you earn per hour driving for Lyft:

- Location: Big cities and areas with high demand generally offer better earning potential.

- Time of Day: Peak hours, such as rush hour, weekends, and special events, usually mean higher demand and surge pricing.

- Lyft’s Commission: Lyft takes a percentage of each fare, which can vary.

- Expenses: You’re responsible for your vehicle’s gas, maintenance, insurance, and depreciation.

- Driving Strategy: Efficient driving, knowing the best routes, and maximizing bonuses can significantly impact earnings.

- Acceptance Rate: Your acceptance rate can affect your eligibility for bonuses and promotions. A lower acceptance rate can also impact your visibility to potential riders.

1.3. Real-World Examples of Lyft Driver Earnings

To give you a clearer picture, here are some examples of potential earnings:

| Scenario | Hourly Earnings (Gross) | Weekly Earnings (Gross) | Notes |

|---|---|---|---|

| Part-time in a small city | $10 – $15 | $100 – $300 | Fewer riders, lower surge pricing. |

| Full-time in a big city | $20 – $30 | $800 – $1200 | Higher demand, more opportunities for bonuses, but also higher expenses. |

| Peak hours only | $30 – $40+ | Varies | Driving during surge pricing times can dramatically increase income, but it’s not consistent. |

| During events (concerts, games) | $35 – $50+ | Varies | Significant boost in earnings for limited hours. |

Note: These figures are gross earnings and do not account for expenses.

2. Breaking Down the Costs: Expenses to Consider

While driving for Lyft can be a great way to earn money, it’s essential to factor in the expenses that come with it. Understanding these costs will give you a realistic view of your net earnings.

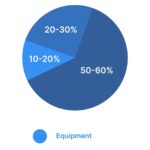

2.1. Vehicle Expenses: Gas, Maintenance, and Depreciation

The most significant costs are related to your vehicle:

- Gas: This is an obvious and ongoing expense. The amount you spend on gas depends on your car’s fuel efficiency and how much you drive.

- Maintenance: Regular maintenance like oil changes, tire rotations, and brake replacements are essential to keep your car running smoothly.

- Depreciation: Your car loses value over time due to wear and tear. The more you drive, the faster it depreciates.

2.2. Insurance: Understanding Rideshare Coverage

Standard auto insurance policies often don’t cover you when you’re driving for a rideshare company. You need rideshare insurance, which provides coverage during different periods:

- Period 0: When your app is off. Your personal auto insurance applies.

- Period 1: When your app is on, but you haven’t accepted a ride request. You need rideshare insurance that covers this gap.

- Period 2 & 3: When you’ve accepted a ride request and are transporting a passenger. Lyft’s insurance policy covers you.

2.3. Taxes: What You Need to Know as an Independent Contractor

As a Lyft driver, you’re an independent contractor, meaning you’re responsible for paying self-employment taxes. This includes Social Security and Medicare taxes, as well as income tax. You’ll need to track your income and expenses and file Schedule C with your tax return.

2.4. Other Potential Costs: Cleaning, Phone, and More

Other costs to consider include:

- Car washes and detailing: Keeping your car clean is essential for maintaining a good rating.

- Phone plan: You need a reliable smartphone with a data plan to use the Lyft app.

- Accessories: Phone mounts, chargers, and other accessories can make your driving experience more comfortable.

2.5. Calculating Your Net Earnings

To calculate your net earnings, subtract your expenses from your gross earnings. Here’s a simplified example:

- Gross Earnings: $1,000

- Gas: $200

- Maintenance: $50

- Insurance: $100

- Depreciation: $150

- Taxes (estimated): $200

- Total Expenses: $700

- Net Earnings: $300

This example highlights the importance of tracking your expenses carefully to understand your true profitability.

3. Strategies to Maximize Your Lyft Earnings

Now that you understand the basics of Lyft driver earnings and expenses, let’s explore strategies to boost your income.

3.1. Driving During Peak Hours and Surge Pricing

One of the easiest ways to increase your earnings is to drive during peak hours and when surge pricing is in effect. Surge pricing occurs when demand is high, and Lyft increases fares to attract more drivers.

- Identify Peak Times: Analyze your local market to determine the busiest times. Typically, these include weekday mornings and evenings (rush hour), Friday and Saturday nights, and during special events.

- Use Lyft Driver App: The Lyft driver app shows areas with surge pricing. Head to these areas to maximize your earnings.

- Stay Informed: Keep an eye on local events that may increase demand, such as concerts, sports games, and festivals.

3.2. Understanding and Utilizing Lyft’s Bonus Programs

Lyft offers various bonus programs and incentives to attract and retain drivers. Take advantage of these to boost your earnings.

- Ride Streaks: Earn extra money by completing a certain number of rides in a row without declining or canceling any.

- Challenges: Complete a set number of rides within a specific timeframe to earn a bonus.

- Referral Bonuses: Refer new drivers to Lyft and earn a bonus when they complete a certain number of rides.

3.3. Maintaining a High Acceptance Rate and Driver Rating

Your acceptance rate and driver rating can significantly impact your earnings. Lyft may offer bonuses or promotions to drivers with high acceptance rates. A high driver rating can lead to more ride requests and higher tips.

- Accept Rides Strategically: Avoid declining too many rides, as this can lower your acceptance rate.

- Provide Excellent Service: Be friendly, courteous, and professional. Keep your car clean and offer amenities like phone chargers or water.

- Ask for Feedback: Encourage passengers to leave positive reviews.

3.4. Choosing the Right Times and Locations to Drive

Strategic driving involves choosing the right times and locations to maximize your earning potential.

- Target High-Demand Areas: Focus on areas with a high concentration of bars, restaurants, hotels, and event venues.

- Avoid Low-Demand Areas: Steer clear of areas with low population density or limited activity.

- Consider Airport Runs: Airports can be lucrative, but be aware of airport regulations and waiting times.

3.5. Efficient Driving Habits: Saving Time and Gas

Efficient driving habits can save you time and money, increasing your overall profitability.

- Plan Your Routes: Use GPS navigation to find the fastest and most efficient routes.

- Avoid Traffic: Be aware of traffic patterns and avoid congested areas.

- Maintain Your Vehicle: Regular maintenance can improve your car’s fuel efficiency and prevent costly repairs.

- Drive Smoothly: Avoid hard acceleration and braking, which can waste gas.

4. Real-World Strategies: Case Studies and Driver Insights

Let’s delve into real-world scenarios and insights from experienced Lyft drivers to provide practical advice on maximizing your earnings.

4.1. Case Study 1: The Weekend Warrior

Scenario: Sarah works a full-time job during the week and drives for Lyft on weekends to supplement her income.

Strategy:

- Focus on Peak Hours: Sarah drives primarily on Friday and Saturday nights, from 6 PM to 3 AM, when demand is highest.

- Target Entertainment Districts: She concentrates on areas with bars, restaurants, and live music venues.

- Utilize Lyft’s Heatmap: Sarah uses the Lyft driver app to identify areas with surge pricing and high demand.

- Offer Amenities: She provides phone chargers, bottled water, and snacks to passengers, increasing her chances of receiving tips.

Results: Sarah earns an average of $300 – $400 each weekend, significantly boosting her monthly income.

4.2. Case Study 2: The Full-Time Driver

Scenario: John drives for Lyft full-time and relies on it as his primary source of income.

Strategy:

- Strategic Scheduling: John drives during a variety of peak hours, including weekday mornings and evenings, as well as weekends.

- Maintain High Ratings: He consistently provides excellent service, earning a high driver rating and receiving more ride requests.

- Participate in Bonus Programs: John takes advantage of Lyft’s ride streaks and challenges to earn extra money.

- Track Expenses Diligently: He carefully tracks his gas, maintenance, and other expenses to understand his net earnings.

Results: John earns a consistent income, averaging around $800 – $1200 per week, after expenses.

4.3. Insights from Experienced Drivers

Here are some valuable insights from seasoned Lyft drivers:

- Know Your Market: Understand the unique characteristics of your local market, including peak hours, high-demand areas, and popular events.

- Be Adaptable: Be prepared to adjust your driving strategy based on changing conditions, such as weather, traffic, and special events.

- Provide Excellent Customer Service: A positive attitude, clean car, and helpful demeanor can go a long way in earning tips and positive reviews.

- Stay Informed: Keep up-to-date with Lyft’s policies, bonus programs, and driver resources.

- Know When To Drive: One Uber driver mentioned in the article, “It started out as a decent night, with mostly short rides from hotels and dropping people off at bars and restaurants. I love this crowd because nobody is too tipsy yet, but they are tipsy with their spending habits and usually throw a couple extra bucks my way.”

5. Maximizing Tips: Providing Excellent Service

Tips can significantly boost your earnings as a Lyft driver. Providing excellent service is key to increasing your chances of receiving generous tips.

5.1. Creating a Positive Passenger Experience

- Be Friendly and Courteous: Greet passengers with a smile and engage in polite conversation.

- Offer Assistance: Help passengers with their luggage or other belongings.

- Maintain a Clean Car: Keep your car clean and well-maintained.

- Drive Safely: Obey traffic laws and drive smoothly.

- Respect Passenger Preferences: Ask passengers if they have any preferences regarding music or route.

5.2. Small Touches That Make a Difference

- Provide Phone Chargers: Offer phone chargers for passengers to use during the ride.

- Offer Bottled Water: Provide complimentary bottled water.

- Provide Snacks: Offer small snacks, such as mints or candies.

- Offer Wi-Fi: If possible, provide Wi-Fi access in your car.

5.3. Communicating Effectively with Passengers

- Confirm Pickup Location: Verify the pickup location with passengers before arriving.

- Provide ETAs: Give passengers an estimated time of arrival (ETA).

- Inform Passengers of Traffic: Let passengers know if there are any traffic delays.

- Thank Passengers for Riding: Express your gratitude to passengers for choosing Lyft.

5.4. Dealing with Difficult Passengers

- Stay Calm: Remain calm and professional, even when dealing with difficult passengers.

- Set Boundaries: Clearly communicate your boundaries and expectations.

- End the Ride: If a passenger becomes unruly or violates Lyft’s policies, you have the right to end the ride.

- Report Incidents: Report any incidents to Lyft support.

6. Understanding Lyft’s Insurance Coverage

Navigating the complexities of insurance coverage while driving for Lyft is critical for your protection. Understanding the different periods and applicable coverage ensures you’re adequately insured.

6.1. Lyft’s Insurance Policy: What It Covers

Lyft maintains an insurance policy that covers drivers during Period 2 and Period 3:

- Period 2: When you’ve accepted a ride request and are en route to pick up the passenger.

- Period 3: When you’re transporting a passenger.

Lyft’s policy provides liability coverage, as well as uninsured/underinsured motorist coverage.

6.2. The Gap in Coverage: Period 1 and Your Options

Period 1, when your app is on but you haven’t accepted a ride request, is often referred to as the “gap” in coverage. During this period, your personal auto insurance may not provide coverage. You have several options to address this gap:

- Rideshare Insurance: This is a specialized type of insurance that covers you during all periods of driving for a rideshare company.

- Hybrid Policies: Some insurance companies offer hybrid policies that combine personal and commercial coverage.

- Lyft’s Contingent Coverage: Lyft provides limited contingent coverage during Period 1, but it may not be sufficient in all cases.

6.3. Comparing Rideshare Insurance Providers

Several insurance companies offer rideshare insurance. Compare quotes and coverage options to find the best fit for your needs.

| Provider | Coverage Options | Price | Notes |

|---|---|---|---|

| State Farm | Rideshare insurance | Varies | Offers comprehensive coverage, including Period 1 coverage. |

| Allstate | Rideshare endorsement | Varies | Adds rideshare coverage to your existing Allstate policy. |

| Geico | Hybrid policy | Varies | Combines personal and commercial coverage. |

| Progressive | Rideshare insurance | Varies | Provides coverage during all periods of driving for a rideshare company. |

6.4. Staying Informed and Compliant

- Read Your Policy Carefully: Understand the terms and conditions of your insurance policy.

- Update Your Insurance: Inform your insurance company that you’re driving for Lyft.

- Comply with Regulations: Comply with all state and local insurance regulations.

7. Tax Implications for Lyft Drivers

Understanding the tax implications of driving for Lyft is essential for managing your finances and avoiding surprises during tax season.

7.1. Understanding Self-Employment Taxes

As an independent contractor, you’re responsible for paying self-employment taxes, which include Social Security and Medicare taxes. These taxes are typically paid by employers for employees, but as a self-employed individual, you’re responsible for both the employer and employee portions.

7.2. Deductible Expenses: What You Can Write Off

You can deduct various business expenses to reduce your taxable income. Common deductible expenses for Lyft drivers include:

- Mileage: You can deduct the standard mileage rate for every business mile you drive.

- Gas: If you don’t deduct mileage, you can deduct the actual cost of gas.

- Maintenance: You can deduct the cost of vehicle maintenance and repairs.

- Insurance: You can deduct the portion of your insurance premiums that relates to business use.

- Phone: You can deduct the portion of your phone bill that relates to business use.

- Supplies: You can deduct the cost of supplies, such as phone chargers, water, and snacks.

7.3. Tracking Your Income and Expenses

Accurate record-keeping is essential for tax purposes. Keep track of your income and expenses using a spreadsheet, accounting software, or a mobile app.

7.4. Quarterly Taxes: Avoiding Penalties

You may be required to pay estimated taxes quarterly to avoid penalties. Consult with a tax professional to determine if you need to pay quarterly taxes and how much to pay.

7.5. Resources and Tools for Tax Preparation

Several resources and tools can help you prepare your taxes:

- IRS Website: The IRS website provides information on self-employment taxes and deductible expenses.

- Tax Software: Tax software like TurboTax and H&R Block can help you prepare your tax return.

- Tax Professionals: Consult with a tax professional for personalized advice.

8. The Future of Rideshare Driving: Trends and Predictions

The rideshare industry is constantly evolving. Staying informed about the latest trends and predictions can help you adapt and thrive as a Lyft driver.

8.1. The Impact of Autonomous Vehicles

Autonomous vehicles have the potential to disrupt the rideshare industry. While it’s unlikely that self-driving cars will completely replace human drivers in the near future, they could gradually take over certain routes or areas.

8.2. The Rise of Electric Vehicles

Electric vehicles (EVs) are becoming increasingly popular, and they offer several benefits for rideshare drivers, including lower fuel costs and reduced emissions.

8.3. Changing Regulations and Legislation

Regulations and legislation governing the rideshare industry are constantly evolving. Stay informed about the latest laws and regulations in your area.

8.4. The Growing Demand for Rideshare Services

Despite the challenges, the demand for rideshare services is expected to continue growing in the coming years. This presents opportunities for drivers who are willing to adapt and innovate.

9. Risks and Challenges of Driving for Lyft

Driving for Lyft, while offering flexibility and income potential, also comes with its share of risks and challenges. Understanding these can help you prepare and mitigate potential issues.

9.1. Safety Concerns

- Passenger Behavior: Dealing with intoxicated, rude, or even dangerous passengers can be a significant concern.

- Driving Conditions: Navigating through heavy traffic, adverse weather, and unfamiliar areas can increase the risk of accidents.

- Late-Night Driving: Driving late at night can expose you to higher risks of crime and fatigue.

9.2. Financial Instability

- Income Fluctuations: Earnings can vary significantly depending on demand, time of day, and surge pricing, making it challenging to budget and plan financially.

- Unexpected Expenses: Vehicle repairs, maintenance, and increased insurance costs can strain your finances.

- Competition: An increasing number of drivers can lead to lower fares and fewer ride requests.

9.3. Health and Well-being

- Long Hours: Spending extended periods behind the wheel can lead to fatigue, back pain, and other health issues.

- Stress: Dealing with difficult passengers, navigating traffic, and managing finances can be stressful.

- Lack of Benefits: As an independent contractor, you typically don’t receive health insurance, paid time off, or retirement benefits.

9.4. Legal and Regulatory Issues

- Changing Regulations: Rideshare regulations can change frequently, potentially impacting your ability to drive or your earnings.

- Liability Concerns: Being involved in an accident while driving can lead to legal liabilities and financial burdens.

- Background Checks: Maintaining a clean driving record and passing background checks is essential to continue driving for Lyft.

10. Alternative Rideshare and Delivery Options

While Lyft offers a specific set of opportunities, exploring other rideshare and delivery services can provide additional income streams and diversification.

10.1. Uber

Uber is Lyft’s primary competitor and offers a similar platform for rideshare driving.

- Wider Market Presence: Uber often has a larger market presence in some areas, potentially offering more ride requests.

- Different Incentives: Uber’s bonus programs and incentives may differ from Lyft’s, providing additional earning opportunities.

- Driver Preferences: Some drivers prefer Uber’s app interface or passenger demographics.

10.2. DoorDash and Uber Eats

DoorDash and Uber Eats focus on food delivery, offering a different type of driving experience.

- Less Passenger Interaction: Delivering food involves less direct interaction with customers compared to rideshare driving.

- Shorter Trips: Delivery trips are typically shorter, potentially reducing wear and tear on your vehicle.

- Flexible Hours: You can often set your own hours and work during peak meal times.

10.3. Instacart

Instacart involves grocery shopping and delivery, providing another alternative to traditional rideshare.

- Shopping and Delivery: You’ll be responsible for shopping for groceries and delivering them to customers.

- Potential for Tips: Customers often tip for grocery delivery services.

- Varying Demand: Demand for grocery delivery can fluctuate based on the time of day and week.

10.4. Comparing Earnings and Requirements

| Service | Earning Potential | Requirements |

|---|---|---|

| Lyft | Varies | Valid driver’s license, clean driving record, background check, vehicle requirements. |

| Uber | Varies | Valid driver’s license, clean driving record, background check, vehicle requirements. |

| DoorDash | Varies | Valid driver’s license, clean driving record, background check, vehicle requirements (may vary by location). |

| Uber Eats | Varies | Valid driver’s license, clean driving record, background check, vehicle requirements (may vary by location). |

| Instacart | Varies | Valid driver’s license, clean driving record, background check, vehicle requirements (may vary by location). |

FAQ: Earning with Lyft – Your Questions Answered

- How much can I realistically earn per hour driving for Lyft? Realistically, you can earn between $15 to $30 per hour before expenses, depending on your location, time of day, and surge pricing.

- What are the main expenses I need to consider as a Lyft driver? The main expenses include gas, vehicle maintenance, insurance, taxes, and depreciation.

- How can I maximize my earnings during peak hours? Focus on driving in high-demand areas during rush hour, weekends, and special events, and take advantage of surge pricing.

- What is the importance of maintaining a high acceptance rate? A high acceptance rate can qualify you for bonuses and promotions, and improve your visibility to potential riders.

- How does Lyft’s insurance coverage work, and what are my options for the “gap” period? Lyft provides coverage during Periods 2 and 3. For Period 1, consider rideshare insurance or a hybrid policy.

- What are some effective strategies for increasing my tips? Provide excellent customer service, maintain a clean car, offer amenities, and communicate effectively with passengers.

- What tax deductions can I claim as a Lyft driver? Common deductions include mileage, gas, maintenance, insurance, phone, and supplies.

- How often should I pay my self-employment taxes? Consider paying estimated taxes quarterly to avoid penalties.

- What are some of the risks and challenges of driving for Lyft? Safety concerns, financial instability, health issues, and changing regulations are some of the risks.

- Are there alternative rideshare or delivery options I should consider? Uber, DoorDash, Uber Eats, and Instacart are some alternatives to consider.

Driving for Lyft can be a rewarding experience, offering flexibility and income potential. By understanding the factors that influence your earnings, implementing effective strategies, and staying informed about the latest trends, you can maximize your success as a Lyft driver.

Are you seeking expert advice on navigating the rideshare industry or managing your finances as a driver? At HOW.EDU.VN, our team of experienced PhDs is ready to provide personalized guidance and support. Connect with us today to gain valuable insights and achieve your financial goals. Contact us at 456 Expertise Plaza, Consult City, CA 90210, United States, Whatsapp: +1 (310) 555-1212, or visit our website at how.edu.vn.