A gold quarter’s worth depends on whether it’s a gold-plated coin or a genuine, U.S. Mint-issued gold quarter. At HOW.EDU.VN, we understand the complexities of valuing precious metal coins and are here to offer clarity; knowing the difference is crucial to understand its market value and potential as an investment, which can be affected by factors like gold price fluctuations and condition. If you’re seeking reliable advice on precious metal investments, including valuable gold coinage and current gold values, HOW.EDU.VN connects you with seasoned financial experts.

1. Gold Quarter Value 101: Understanding The Basics

While the concept of gold quarters might seem novel, gold coins have a rich history, dating back to the Coinage Act of 1792 in the United States. This act paved the way for the creation of gold coins like the $10 Eagle, $5 Half-eagle, and $2.50 Quarter-eagle. It’s essential to distinguish gold quarters from Quarter-eagles, as the latter generally holds a significantly higher value.

Throughout the 19th and 20th centuries, the U.S. Mint occasionally released commemorative gold coins, such as the 1903 Louisiana Purchase Expo dollar, the 1916 McKinley Memorial dollar, and the 1922 Grant Memorial dollar.

Towards the end of the 20th century, the growing collector’s market for gold coinage prompted the U.S. Mint to introduce coins specifically for collectors, known as Not Intended For Circulation (NIFC) coins. These commemorative gold and silver coins, including rarities like the 2014 National Baseball Hall of Fame and Museum coin ($5 face value) and the 2000 Library of Congress bimetallic eagle ($10 face value), were exclusively created for collectors.

1.1 The Standing Liberty Centennial Gold Coin (2016)

The Standing Liberty Centennial Gold Coin, released in 2016, stands as the sole officially recognized gold quarter in circulation. Composed of 99.99% 24-karat gold, it carries a face value of 25 cents. This coin, weighing 0.25 troy ounces, features a “W” hallmark on its obverse side, signifying its origin from the West Point, New York mint. The U.S. Mint produced only 91,752 of these Standing Liberty Centennial quarters.

The obverse side of a Standing Liberty Centennial Gold Coin

The obverse side of a Standing Liberty Centennial Gold Coin

The aftermarket value of a Standing Liberty Centennial gold quarter is primarily based on its melt value, which directly correlates with the current spot price of gold. Since the coin contains 0.25 ounces of pure gold, its resale value is approximately one-fourth of the price of a one-ounce gold bullion bar.

As of the latest market update, the spot price of gold bullion is $2,352.87 per ounce. Consequently, a U.S.-minted gold quarter, containing 0.25 ounces of pure gold, has a melt value of approximately $588.21.

It’s important to note that this valuation assumes the coin is in excellent condition, with a sharp strike and full original luster, showing only minor contact marks (MS-66/67). A gold quarter in pristine, uncirculated condition (MS-70), free from any wear, scratches, or contact marks visible under 5x magnification, can often command a premium of 15-25% above its weight in gold.

To determine the melt value of your gold coin, you can utilize a gold price calculator, which provides up-to-the-minute data to calculate the market price of aftermarket gold based on its weight, purity, and bid price.

2. Factors Affecting Gold Quarter Value

Several factors influence the worth of a gold quarter, making it essential for investors and collectors to understand these elements when assessing their value.

2.1 Gold Spot Price

The most significant determinant of a gold quarter’s value is the spot price of gold. This is the current market price at which gold can be bought or sold for immediate delivery. Since gold quarters are made of gold, their value fluctuates in tandem with changes in the spot price.

2.2 Gold Content

The gold content of a quarter refers to the actual amount of pure gold contained within the coin. The Standing Liberty Centennial Gold Coin, for example, contains 0.25 troy ounces of pure gold. The higher the gold content, the more valuable the quarter will be.

2.3 Coin Condition

The condition of a gold quarter plays a crucial role in determining its value, especially for collectors. Coins in pristine, uncirculated condition (MS-70) command higher premiums than those with wear, scratches, or contact marks. Professional grading services, such as the Numismatic Guaranty Corporation (NGC) and the Professional Coin Grading Service (PCGS), assess a coin’s condition on a scale from 1 to 70, with 70 being the highest grade.

2.4 Rarity and Mintage

The rarity of a gold quarter, determined by its mintage figures, can significantly impact its value. Coins with lower mintage numbers are generally more sought after by collectors, as their scarcity drives up demand and prices.

2.5 Collector Demand

Collector demand is a subjective factor that influences the value of gold quarters. The popularity of a particular design, historical significance, or the coin’s appeal to specific collector niches can all contribute to its desirability and market value.

2.6 Economic Factors

Economic conditions, such as inflation, interest rates, and overall economic stability, can affect the value of gold quarters. During times of economic uncertainty, investors often turn to gold as a safe-haven asset, driving up demand and prices.

2.7 Market Sentiment

Market sentiment, reflecting the overall attitude and expectations of investors and collectors, can impact the value of gold quarters. Positive sentiment, fueled by bullish forecasts or favorable market trends, can lead to increased buying activity and higher prices.

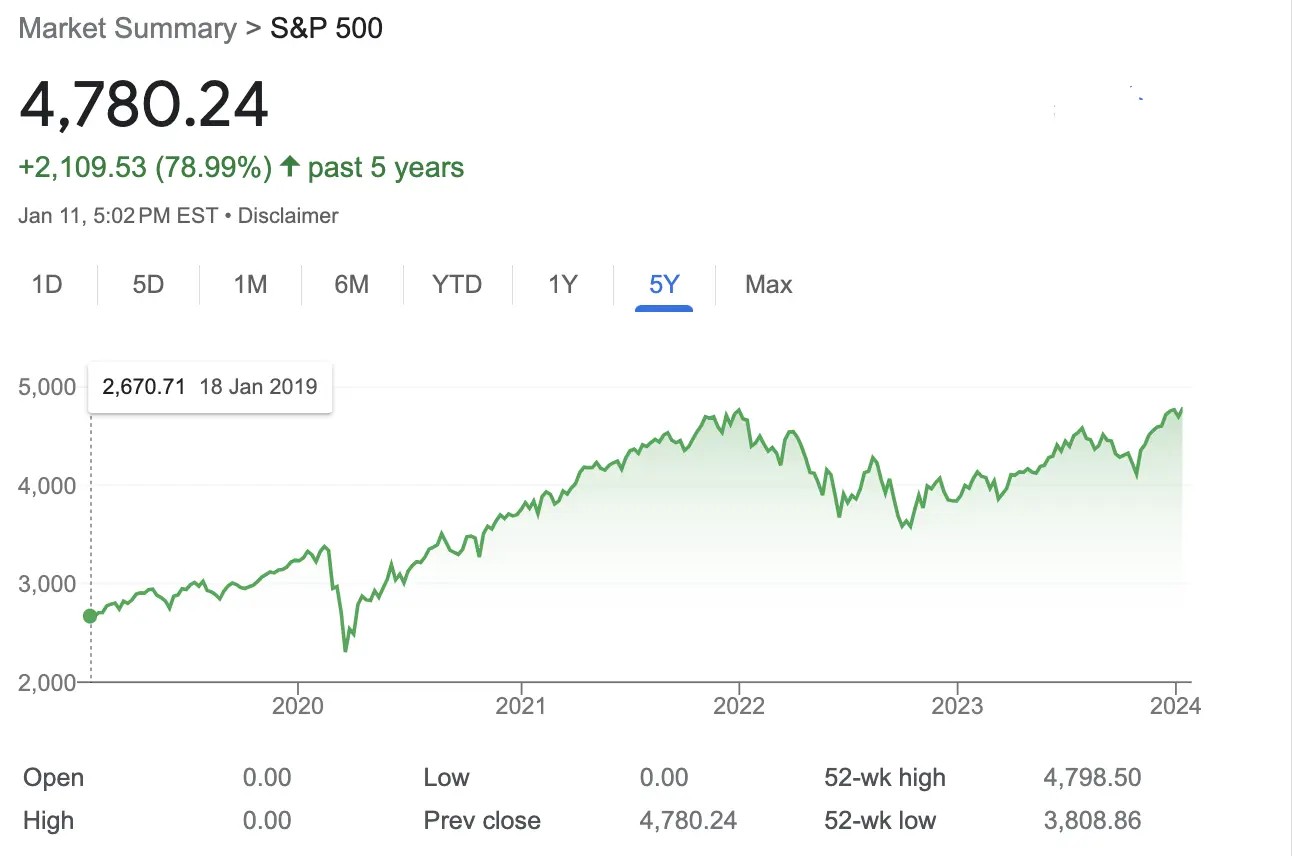

3. Price History of Gold Quarters

Since their original minting in 2016, gold quarter prices have fluctuated in accordance with the spot price of gold bullion. Below is the year-end price history of MS-66/67 condition Standing Liberty Centennial Gold Coins for every year they have been in circulation:

| Year | Price |

|---|---|

| 2016 | $289.78 |

| 2017 | $324.12 |

| 2018 | $320.41 |

| 2019 | $348.25 |

| 2020 | $483.87 |

| 2021 | $438.70 |

| 2022 | $463.50 |

| 2023 | $495.26 |

| 2024 | $588.21 |

The value of gold quarters has generally shown an upward trend over the past several years.

4. Are Gold Quarters a Worthwhile Investment in 2025?

Gold quarters can serve as a valuable addition to any investment portfolio, acting as a diversifier and hedge against instability in the equities market. In late 2024, the price of gold reached all-time highs, surpassing the critical resistance point of $2,660 per ounce. Some analysts speculate that a cup and handle pattern is forming in the price of gold, potentially leading to a $3,000 price per ounce in the near future.

The prevailing sentiment among analysts and market observers suggests that gold’s bullish trajectory will continue throughout 2025. Building on its strong performance in 2024, driven by geopolitical tensions, persistent inflation, and evolving monetary policies, gold has maintained its appeal to investors as a reliable hedge against uncertainty. Key factors include ongoing inflationary pressures, despite gradual interest rate cuts by the Federal Reserve, increasing gold purchases by central banks, and heightened demand for physical gold amid global economic uncertainty. Should these conditions persist, a gold quarter containing 0.25 ounces of gold could potentially reach a melt value of approximately $625.

4.1 Gold’s Performance as a Safe Haven

Gold continues to demonstrate its reliability as a safe-haven asset during periods of volatility and systemic instability. Its ability to preserve value, even during stock market downturns, underscores its importance as a hedge in diversified portfolios.

- During the global financial crisis (October 2007 to March 2009), gold prices increased by 25.5%, while the S&P 500 dropped by 56.8%.

- The dot-com bubble collapse (March 2000 to October 2002) saw the S&P 500 lose 49%, whereas gold prices rose by 12.4%.

- In 2020, during the height of the coronavirus pandemic, gold hit a then-record high of over $2,000 per ounce as investors sought refuge from market volatility.

4.2 Current Market Dynamics

In 2025, gold’s enduring appeal is supported by several factors:

- Central Bank Purchases: Central banks worldwide continue to diversify their reserves away from fiat currencies, with gold buying reaching record levels in recent years.

- Geopolitical Risks: Ongoing tensions in Eastern Europe, the Middle East, and Asia-Pacific create uncertainty that supports gold demand.

- Economic Instability: Slower-than-expected global economic recovery and high sovereign debt levels have investors turning to tangible assets like gold.

- Weaker U.S. Dollar: As the Federal Reserve continues to ease interest rates, a weakening dollar further boosts gold prices in 2025.

4.3 Why Consider Gold in Your Portfolio

Gold remains a reliable hedge against inflation, currency devaluation, and market instability. For long-term investors, gold has shown steady appreciation over decades, complementing riskier assets like equities. Amidst ongoing uncertainties in 2025, gold IRAs and 401(k)s offer a tax-advantaged way to incorporate gold into retirement portfolios.

As history demonstrates, gold outperforms in times of crisis, making it an indispensable tool for risk-averse investors aiming to safeguard wealth. Whether through physical gold, ETFs, or a gold-backed IRA, gold continues to serve as a cornerstone of financial security in uncertain times.

Pro Tip for 2025: Monitor geopolitical developments and interest rate announcements closely, as these remain the key determinants of gold’s trajectory this year.

5. Factors to Consider Before Investing in Gold Quarters

Before diving into gold quarter investments, consider these important factors:

- Budget: Determine how much capital you’re willing to allocate to gold quarters.

- Storage: Decide where you’ll store your gold quarters securely, such as a safe deposit box or home safe.

- Market Trends: Stay updated on market trends, gold prices, and economic indicators that could influence your investment.

- Risks: Understand the risks associated with gold investments, including price volatility and market fluctuations.

- Investment Goals: Determine your investment goals, whether it’s long-term wealth preservation or short-term gains.

- Diversification: Assess how gold quarters fit into your overall investment portfolio diversification strategy.

- Expert Advice: Seek advice from financial advisors or precious metal experts to make informed decisions.

6. Where to Buy and Sell Gold Quarters

When it comes to buying and selling gold quarters, several avenues are available:

- Local Coin Shops: Reputable coin shops often deal in gold quarters and can provide fair prices and expert advice.

- Online Marketplaces: Online platforms like eBay and specialized coin forums offer opportunities to buy and sell gold quarters, but exercise caution and verify the seller’s reputation.

- Precious Metal Dealers: Precious metal dealers specialize in buying and selling gold, silver, and other precious metals, including gold quarters.

- Auction Houses: Auction houses that specialize in numismatic items can provide a platform for selling valuable gold quarters to collectors.

- Pawn Shops: Pawn shops may buy gold quarters, but their offers might be lower than other options.

- Direct Sales: Selling directly to collectors or investors can sometimes yield better prices, but it requires networking and negotiation skills.

- Online Dealers: Online dealers offer convenience and a wide selection of gold quarters, but research their reputation and ensure secure transactions.

7. How to Care for and Store Gold Quarters

Proper care and storage are crucial for preserving the value of your gold quarters. Here are some essential tips:

- Handling: Handle gold quarters with clean, dry hands or wear cotton gloves to prevent fingerprints and smudges.

- Cleaning: Avoid harsh cleaning methods or abrasive materials, as they can damage the coin’s surface and reduce its value.

- Protective Holders: Store gold quarters in protective holders or capsules made of inert materials to shield them from scratches and environmental damage.

- Climate Control: Store gold quarters in a cool, dry environment with stable humidity levels to prevent corrosion or tarnishing.

- Security: Keep gold quarters in a secure location, such as a safe deposit box or a home safe, to protect them from theft or loss.

- Insurance: Consider insuring your gold quarter collection against theft, damage, or loss, especially if it’s of significant value.

- Regular Inspection: Periodically inspect your gold quarters for any signs of damage or deterioration, and take corrective action if necessary.

8. Gold Quarters Frequently Asked Questions (FAQs)

8.1 How many gold quarters are there?

Excluding gold-plated quarters, there are 91,752 authentic gold quarters in existence that have been minted by the U.S. government since 1792.

8.2 Are gold coins a good investment?

In the past 5-year period, gold coins have appreciated in value significantly. Although past results are not indicative of future performance, the fact remains that gold quarters and coins hold great potential as an investment asset.

8.3 How much is a gold quarter worth?

The value of a gold quarter varies based on factors like gold price, condition, and rarity.

8.4 Why are there gold quarters?

Originally, gold quarters were minted as a form of currency and legal tender by the U.S. Mint. Eventually, these were phased out in favor of non-precious metals, although the U.S. Mint still periodically issues commemorative gold coins and quarters as collector’s items.

8.5 What is a 24k gold plated state quarter worth?

Unfortunately, 24k gold plated state quarters are virtually worthless as a collector’s item. Since they do not have any melt value, they are not bought or sold on the aftermarket. Therefore, they’re worth little more than their face value (~$0.25).

8.6 How much does a gold quarter weigh?

Officially sanctioned U.S. gold quarters weigh 0.25 troy ounces, or about 7.8 grams. For reference, a regular copper-nickel quarter weighs 5.7 grams.

9. Understanding The 1788 Quarter Value

The 1788 quarter, officially known as the 1788 Statehood Quarter Dollar, typically holds a value of around 25 cents, equivalent to its face value. This coin was produced in 2000 to commemorate Virginia’s statehood and consists of a 3:1 ratio of copper and nickel. It’s important to note that it’s often mistaken for a gold coin, which it is not.

10. The Bottom Line: Expert Financial Advice is Here

Gold-plated quarters hold minimal value, but genuine gold quarters can be worth hundreds of dollars each. Their precise resale value depends on the current gold spot price, which fluctuates daily.

In times of economic uncertainty, gold and gold quarters can serve as safe-haven assets. At HOW.EDU.VN, we understand that navigating the world of precious metal investments can be challenging. That’s why we offer a platform where you can connect with experienced financial experts who can provide personalized guidance and advice tailored to your specific situation.

Ready to explore the potential of gold quarter investments?

Contact HOW.EDU.VN today to schedule a consultation with one of our trusted financial advisors. They can help you:

- Assess the value of your existing gold quarters.

- Develop a comprehensive investment strategy.

- Make informed decisions about buying or selling gold quarters.

- Navigate the complexities of the precious metal market.

Don’t leave your financial future to chance. Trust the experts at HOW.EDU.VN to provide the knowledge and support you need to make sound investment decisions.

Contact us today:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Let how.edu.vn be your guide to financial success.

Disclaimer: The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.