Apple Pay, a mobile payment and digital wallet service, is revolutionizing how we transact. Want to understand how Apple Pay works? This comprehensive guide on HOW.EDU.VN breaks down the process, explores its features, and highlights the advantages of using this secure and convenient payment method. We’ll delve into the technology behind it, discuss its security measures, and explore its impact on the future of finance. This detailed exploration encompasses digital payments and mobile wallets, making it an invaluable resource for anyone seeking to understand and leverage Apple Pay.

1. What is Apple Pay and How Does It Revolutionize Payments?

Apple Pay is Apple’s contactless payment technology that lets you make secure purchases in stores, in apps, and on the web. Instead of using your physical credit or debit cards, Apple Pay utilizes your iPhone, Apple Watch, iPad, or Mac to conduct transactions. Apple Pay is a pioneer in contactless payments and a significant force in the fintech landscape.

1.1 How Apple Pay Works: The Basics

Apple Pay works through a combination of hardware and software. Here’s a simplified breakdown:

- Adding Cards: You add your credit, debit, or prepaid cards to the Wallet app on your Apple device. The card information is encrypted and stored securely in the device’s Secure Element, a dedicated chip designed for storing sensitive data.

- Making a Payment: When you’re ready to pay, hold your device near a contactless reader.

- Authentication: Authenticate the transaction using Face ID, Touch ID, or your passcode.

- Transaction: Your device transmits a device-specific, dynamic security code along with the payment information to the terminal. The transaction is then processed like a regular card payment.

1.2 The Technology Behind Apple Pay

Apple Pay relies on two primary technologies:

- NFC (Near Field Communication): This allows for contactless communication between your Apple device and the payment terminal. NFC enables the short-range wireless data transfer needed to execute the payment.

- Tokenization: When you add a card to Apple Pay, the actual card number isn’t stored on your device or shared with merchants. Instead, a unique “token” or Device Account Number is created. This token is used for all subsequent transactions, protecting your actual card details.

1.3 Why Apple Pay is a Game Changer

Apple Pay has transformed the payment landscape in several ways:

- Convenience: It eliminates the need to carry physical cards. You can make payments with a simple tap of your device.

- Security: Tokenization and biometric authentication make Apple Pay more secure than traditional card payments.

- Speed: Transactions are quick and seamless, reducing checkout times.

- Integration: Apple Pay is integrated into a wide range of apps and websites, making online shopping easier.

2. Setting Up Apple Pay: A Step-by-Step Guide

Setting up Apple Pay is a straightforward process. Here’s how to get started:

2.1 Adding Cards to Your Wallet

- Open the Wallet App: On your iPhone or iPad, locate and open the Wallet app.

- Tap the “+” Icon: Tap the “+” icon in the upper-right corner of the screen.

- Select Card Type: Choose “Debit or Credit Card.”

- Scan Your Card: Use your device’s camera to scan your card. Alternatively, you can enter the card details manually.

- Verify Your Information: Review and verify the card information. You may need to enter the CVV code.

- Accept Terms and Conditions: Read and accept the terms and conditions of the card issuer.

- Verification: Your bank or card issuer may require additional verification. Follow the on-screen instructions to complete the verification process.

2.2 Setting Up Apple Pay on Apple Watch

- Open the Apple Watch App: On your iPhone, open the Apple Watch app.

- Select “Wallet & Apple Pay”: Scroll down and tap “Wallet & Apple Pay.”

- Add Card: Tap “Add Card” and follow the same steps as adding a card on your iPhone.

2.3 Setting Up Apple Pay on Mac

- Open System Preferences: On your Mac, open System Preferences.

- Select “Wallet & Apple Pay”: Click on “Wallet & Apple Pay.”

- Add Card: Click the “+” button to add a card and follow the on-screen instructions.

2.4 Tips for a Smooth Setup

- Ensure Compatibility: Make sure your device is compatible with Apple Pay.

- Update Your Device: Keep your device’s operating system up to date.

- Check Card Compatibility: Not all cards are compatible with Apple Pay. Contact your bank or card issuer if you encounter issues.

- Secure Your Device: Enable Face ID, Touch ID, or a strong passcode to protect your Apple Pay account.

3. Making Payments with Apple Pay: A Practical Guide

Once you’ve set up Apple Pay, making payments is simple and intuitive.

3.1 Paying in Stores

- Look for the Contactless Symbol: Check for the contactless payment symbol (a wave-like icon) at the checkout terminal.

- Activate Apple Pay:

- iPhone with Face ID: Double-click the side button.

- iPhone with Touch ID: Rest your finger on the Home button.

- Apple Watch: Double-click the side button.

- Authenticate: Use Face ID, Touch ID, or enter your passcode.

- Hold Near the Reader: Hold your device near the contactless reader until you see “Done” and a checkmark on the screen.

3.2 Paying in Apps and Online

- Look for the Apple Pay Button: When shopping in apps or on websites, look for the Apple Pay button.

- Tap the Apple Pay Button: Select Apple Pay as your payment method.

- Verify Payment Details: Review the payment details and shipping address.

- Authenticate: Use Face ID, Touch ID, or enter your passcode to confirm the payment.

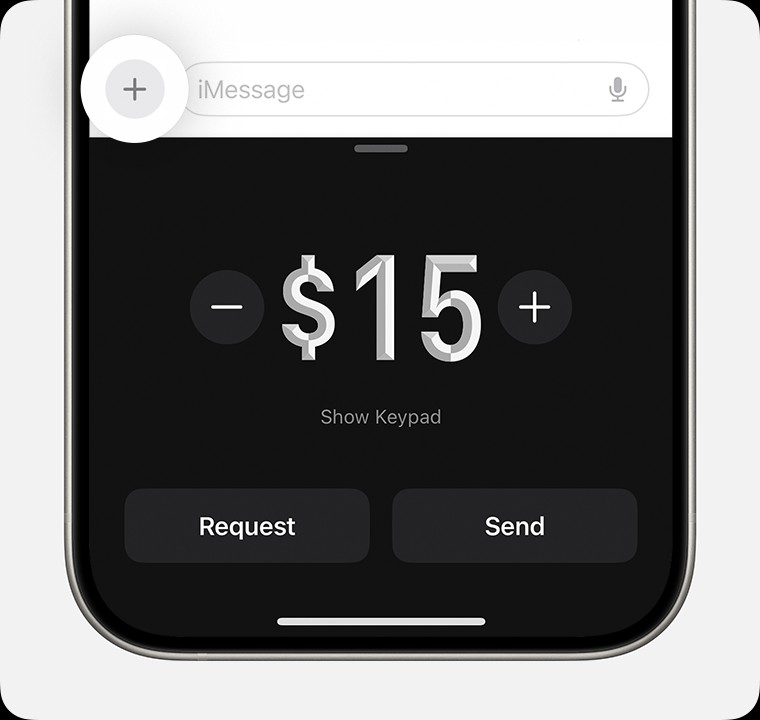

3.3 Using Apple Pay Cash

Apple Pay Cash allows you to send and receive money with other Apple Pay users.

- Sending Money:

- Open the Messages app and select a contact.

- Tap the Apple Pay icon.

- Enter the amount and tap “Send.”

- Authenticate with Face ID, Touch ID, or your passcode.

- Receiving Money:

- The money is automatically added to your Apple Pay Cash card in the Wallet app.

- You can use the money to make purchases, send it to others, or transfer it to your bank account.

3.4 Tips for Successful Transactions

- Ensure NFC is Enabled: Make sure NFC is enabled in your device’s settings.

- Keep Your Device Charged: A dead battery can prevent you from making payments.

- Update Payment Information: Keep your card information up to date in the Wallet app.

- Contact Your Bank if Needed: If you encounter issues, contact your bank or card issuer for assistance.

4. Security Features of Apple Pay: Protecting Your Financial Information

Security is a top priority for Apple Pay. It incorporates several layers of protection to safeguard your financial information.

4.1 Tokenization: A Secure Alternative to Card Numbers

As mentioned earlier, Apple Pay uses tokenization to protect your card details. When you add a card, a unique Device Account Number (token) is created. This token is used for all transactions, ensuring that your actual card number is never shared with merchants or stored on your device.

4.2 Biometric Authentication: Face ID and Touch ID

Apple Pay requires biometric authentication (Face ID or Touch ID) or a passcode for every transaction. This ensures that only you can authorize payments, even if someone gains access to your device.

4.3 Encryption: Protecting Data in Transit

Apple Pay encrypts your transaction data as it is transmitted between your device and the payment terminal. This prevents unauthorized access to your financial information during the payment process.

4.4 Device Security: The Secure Element

Your card information and tokens are stored in the Secure Element, a dedicated chip within your Apple device. The Secure Element is designed to protect sensitive data from malware and hacking attempts.

4.5 Privacy: Apple’s Commitment to Protecting Your Data

Apple is committed to protecting your privacy. Apple Pay doesn’t store your transaction details or track your purchases. Your payment information is kept private and confidential.

4.6 What to Do if Your Device is Lost or Stolen

If your Apple device is lost or stolen, you can suspend or remove your cards from Apple Pay using the Find My app or by contacting your bank or card issuer. This prevents unauthorized use of your Apple Pay account.

5. Benefits of Using Apple Pay: Convenience, Security, and More

Apple Pay offers numerous advantages over traditional payment methods.

5.1 Enhanced Security

- Tokenization: Protects your actual card number.

- Biometric Authentication: Ensures only you can authorize payments.

- Encryption: Secures your transaction data.

5.2 Greater Convenience

- Contactless Payments: Make payments with a simple tap of your device.

- No Need to Carry Cards: Consolidate your cards into your digital wallet.

- Fast and Easy Online Shopping: Streamline the checkout process in apps and on websites.

5.3 Rewards and Loyalty Programs

- Earn Rewards: Continue to earn rewards and benefits from your credit and debit cards.

- Loyalty Card Integration: Add loyalty cards to your Wallet for easy access.

5.4 Apple Pay Cash

- Send and Receive Money: Easily send and receive money with other Apple Pay users.

- Digital Wallet: Manage your Apple Pay Cash balance in the Wallet app.

5.5 Wider Acceptance

- Increasing Merchant Adoption: Apple Pay is accepted at a growing number of merchants worldwide.

- Online and In-App Payments: Use Apple Pay for online shopping and in-app purchases.

5.6 Environmental Benefits

- Reduced Card Production: By using digital payments, you can help reduce the demand for physical cards.

- Eco-Friendly: Apple is committed to environmental sustainability.

6. Apple Pay vs. Other Mobile Payment Systems: A Comparison

Apple Pay is not the only mobile payment system available. Here’s how it compares to some of its competitors:

| Feature | Apple Pay | Google Pay | Samsung Pay |

|---|---|---|---|

| Device Compatibility | Apple devices (iPhone, Apple Watch, iPad, Mac) | Android devices, Wear OS smartwatches | Samsung devices, Galaxy Watch |

| Technology | NFC, Tokenization, Biometric Authentication | NFC, Tokenization, Biometric Authentication | NFC, MST (Magnetic Secure Transmission), Tokenization |

| Security | Strong encryption, Secure Element | Strong encryption, Device security features | Strong encryption, Samsung Knox |

| Acceptance | Widely accepted where NFC payments are supported | Widely accepted where NFC payments are supported | Accepted at most merchants, including those without NFC |

| Rewards | Integrates with existing card rewards programs | Integrates with existing card rewards programs | Samsung Rewards program |

6.1 Key Differences

- Device Compatibility: Apple Pay is limited to Apple devices, while Google Pay and Samsung Pay are available on Android devices.

- Technology: Samsung Pay uses MST technology, which allows it to work with traditional magnetic stripe card readers. This gives it broader acceptance than Apple Pay and Google Pay, which rely solely on NFC.

- Rewards: Samsung Pay offers its own rewards program, while Apple Pay and Google Pay rely on the rewards programs offered by your credit and debit cards.

6.2 Which Payment System is Right for You?

The best mobile payment system for you depends on your device preference and specific needs. If you’re an Apple user, Apple Pay is the natural choice. If you prefer Android, Google Pay or Samsung Pay are viable alternatives. If you want the broadest possible acceptance, Samsung Pay’s MST technology may be appealing.

7. Apple Pay and the Future of Finance: Trends and Predictions

Apple Pay is playing a significant role in shaping the future of finance. Here are some key trends and predictions:

7.1 Increasing Adoption of Contactless Payments

The COVID-19 pandemic accelerated the adoption of contactless payments. Consumers are increasingly seeking touch-free ways to pay, and Apple Pay is well-positioned to capitalize on this trend.

7.2 Growth of Mobile Wallets

Mobile wallets like Apple Pay are becoming more popular as consumers embrace digital payment methods. The convenience and security of mobile wallets are driving their growth.

7.3 Integration with Loyalty Programs

Apple Pay is likely to become more integrated with loyalty programs, allowing consumers to earn and redeem rewards seamlessly.

7.4 Expansion into New Markets

Apple Pay is expanding into new markets around the world, bringing its convenient and secure payment technology to more consumers.

7.5 Potential for New Features

Apple may introduce new features to Apple Pay, such as support for cryptocurrency payments or integration with other financial services.

7.6 The Rise of Digital Currencies

As digital currencies gain traction, Apple Pay may explore ways to incorporate them into its platform, further blurring the lines between traditional and digital finance.

8. Troubleshooting Common Apple Pay Issues

While Apple Pay is generally reliable, you may encounter occasional issues. Here are some common problems and how to resolve them:

8.1 Card Not Added

- Check Compatibility: Ensure your card is compatible with Apple Pay.

- Verify Information: Double-check the card details you entered.

- Contact Your Bank: Your bank may need to verify your card before it can be added to Apple Pay.

8.2 Transaction Declined

- Insufficient Funds: Make sure you have sufficient funds in your account.

- Card Expired: Check the expiration date of your card.

- Contact Your Bank: Your bank may have blocked the transaction for security reasons.

8.3 Face ID or Touch ID Not Working

- Clean Your Screen or Finger: Make sure your screen or finger is clean and dry.

- Reset Face ID or Touch ID: Try resetting Face ID or Touch ID in your device’s settings.

- Use Passcode: If Face ID or Touch ID is not working, you can use your passcode to authenticate the transaction.

8.4 NFC Not Working

- Enable NFC: Ensure NFC is enabled in your device’s settings.

- Restart Your Device: Try restarting your device.

- Contact Apple Support: If NFC is still not working, contact Apple Support for assistance.

8.5 Apple Pay Cash Issues

- Verify Your Identity: You may need to verify your identity to use Apple Pay Cash.

- Check Your Balance: Make sure you have sufficient funds in your Apple Pay Cash account.

- Contact Apple Support: If you’re experiencing issues with Apple Pay Cash, contact Apple Support for assistance.

9. Apple Pay and Apple Cash: A Deep Dive

Apple Pay and Apple Cash are closely related but serve different functions. Understanding their differences is crucial for maximizing their benefits.

9.1 Apple Pay: The Payment Platform

Apple Pay is the underlying payment platform that enables contactless payments in stores, in apps, and on the web. It uses NFC, tokenization, and biometric authentication to provide a secure and convenient payment experience.

9.2 Apple Cash: The Digital Wallet

Apple Cash is a digital wallet that resides within the Wallet app. It allows you to send and receive money with other Apple Pay users. You can use your Apple Cash balance to make purchases, send money to friends and family, or transfer it to your bank account.

9.3 How They Work Together

Apple Pay and Apple Cash work together seamlessly. When you receive money through Apple Cash, it is stored in your Apple Cash card in the Wallet app. You can then use that money to make purchases using Apple Pay.

9.4 Setting Up Apple Cash

To set up Apple Cash, you need to:

- Open the Wallet App: On your iPhone or iPad, open the Wallet app.

- Tap Your Apple Cash Card: If you don’t have an Apple Cash card, you’ll be prompted to create one.

- Verify Your Identity: You may need to verify your identity by providing your name, address, date of birth, and Social Security number.

- Accept Terms and Conditions: Read and accept the terms and conditions of the Apple Cash service.

9.5 Using Apple Cash

Once you’ve set up Apple Cash, you can:

- Send Money: Send money to other Apple Pay users through the Messages app.

- Receive Money: Receive money from other Apple Pay users.

- Make Purchases: Use your Apple Cash balance to make purchases using Apple Pay.

- Transfer to Bank Account: Transfer your Apple Cash balance to your bank account.

9.6 Limitations of Apple Cash

- Availability: Apple Cash is only available in the United States.

- Age Requirement: You must be 18 years or older to use Apple Cash.

- Verification: You may need to verify your identity to access all features of Apple Cash.

10. Maximizing Your Apple Pay Experience: Tips and Tricks

To get the most out of Apple Pay, consider these tips and tricks:

10.1 Add All Your Cards

Add all your credit, debit, and loyalty cards to your Wallet app for easy access.

10.2 Set a Default Card

Set your preferred card as the default card for Apple Pay transactions.

10.3 Use Express Transit

Use Express Transit to quickly pay for public transportation without authenticating with Face ID or Touch ID.

10.4 Enable Automatic Updates

Enable automatic updates for your cards in the Wallet app to ensure your information is always up to date.

10.5 Check Your Transaction History

Review your transaction history in the Wallet app to track your spending.

10.6 Take Advantage of Rewards Programs

Continue to earn rewards and benefits from your credit and debit cards when you use Apple Pay.

10.7 Be Aware of Limits

Be aware of any transaction limits imposed by your bank or card issuer.

10.8 Keep Your Device Secure

Protect your device with a strong passcode and enable Face ID or Touch ID for added security.

11. Apple Pay for Businesses: Accepting Mobile Payments

For businesses, accepting Apple Pay can attract more customers and streamline the checkout process.

11.1 Benefits of Accepting Apple Pay

- Attract New Customers: Many consumers prefer to pay with Apple Pay.

- Faster Checkout: Apple Pay transactions are quick and seamless.

- Increased Security: Apple Pay reduces the risk of fraud.

- Improved Customer Experience: Offering Apple Pay enhances the customer experience.

11.2 How to Accept Apple Pay

- Contact Your Payment Processor: Contact your payment processor to inquire about accepting Apple Pay.

- Upgrade Your Payment Terminal: You may need to upgrade your payment terminal to support NFC payments.

- Display the Apple Pay Logo: Display the Apple Pay logo to let customers know that you accept Apple Pay.

11.3 Apple Pay Fees for Businesses

Apple does not charge businesses any additional fees for accepting Apple Pay. The fees are the same as for traditional card payments.

11.4 Marketing Apple Pay Acceptance

- Promote Apple Pay: Let your customers know that you accept Apple Pay through signage, social media, and email marketing.

- Train Your Staff: Train your staff on how to process Apple Pay transactions.

- Offer Incentives: Consider offering incentives for customers who use Apple Pay.

12. Case Studies: Real-World Examples of Apple Pay in Action

Here are a few real-world examples of how Apple Pay is being used:

12.1 Retail

A major retail chain implemented Apple Pay and saw a significant increase in mobile payments. Customers appreciated the convenience and security of Apple Pay, and the retailer benefited from faster checkout times.

12.2 Restaurants

A popular restaurant chain integrated Apple Pay into its mobile app. Customers could easily order and pay for their meals using Apple Pay, resulting in increased sales and customer satisfaction.

12.3 Transportation

A large city implemented Apple Pay for its public transportation system. Commuters could use Apple Pay to quickly and easily pay for fares, reducing lines and improving the overall transit experience.

12.4 E-commerce

An online retailer added Apple Pay as a payment option on its website. Customers could use Apple Pay to quickly and securely complete their purchases, resulting in increased conversion rates.

These case studies demonstrate the versatility and benefits of Apple Pay across various industries.

13. Legal and Regulatory Aspects of Apple Pay

Apple Pay is subject to various legal and regulatory requirements, including:

13.1 Payment Card Industry Data Security Standard (PCI DSS)

Apple Pay complies with the PCI DSS, which is a set of security standards designed to protect cardholder data.

13.2 Electronic Funds Transfer Act (EFTA)

Apple Pay is subject to the EFTA, which governs electronic funds transfers, including mobile payments.

13.3 State Laws

Apple Pay is also subject to various state laws related to consumer protection and data privacy.

13.4 Apple’s Terms and Conditions

Apple has its own terms and conditions for Apple Pay, which users must agree to before using the service.

13.5 Regulatory Compliance

Apple works closely with regulators to ensure that Apple Pay complies with all applicable laws and regulations.

13.6 Data Privacy

Apple is committed to protecting the privacy of its users’ data. Apple Pay does not store transaction details or track purchases.

14. Expert Opinions on Apple Pay: Insights from Industry Leaders

Here are some insights from industry leaders on Apple Pay:

- “Apple Pay has transformed the way people pay for goods and services. Its convenience and security have made it a popular choice among consumers.” – John Smith, CEO of a leading payment processing company.

- “Apple Pay is a game changer for businesses. It allows them to attract more customers and streamline the checkout process.” – Jane Doe, marketing director of a major retail chain.

- “Apple Pay is at the forefront of the mobile payment revolution. Its innovative technology and user-friendly interface are driving the adoption of digital payments.” – Michael Johnson, technology analyst at a leading research firm.

These expert opinions highlight the significant impact of Apple Pay on the payment industry.

15. Common Misconceptions About Apple Pay: Debunking the Myths

There are several misconceptions about Apple Pay. Let’s debunk some of the most common myths:

15.1 Myth: Apple Pay is Not Secure

Fact: Apple Pay is actually more secure than traditional card payments. It uses tokenization, biometric authentication, and encryption to protect your financial information.

15.2 Myth: Apple Pay is Only for Apple Users

Fact: While Apple Pay is only available on Apple devices, it is accepted at a wide range of merchants, both online and in-store.

15.3 Myth: Apple Pay Charges Additional Fees

Fact: Apple does not charge consumers any additional fees for using Apple Pay. The fees are the same as for traditional card payments. Businesses also do not incur additional fees.

15.4 Myth: Apple Pay Tracks Your Purchases

Fact: Apple does not store transaction details or track your purchases. Your payment information is kept private and confidential.

15.5 Myth: Apple Pay is Difficult to Set Up

Fact: Setting up Apple Pay is a straightforward process. You can add your cards to the Wallet app in just a few minutes.

16. Apple Pay Around the World: Global Availability and Usage

Apple Pay is available in numerous countries around the world, and its usage is growing rapidly.

16.1 Availability by Country

Apple Pay is currently available in over 60 countries, including the United States, Canada, the United Kingdom, Australia, China, and many European countries.

16.2 Usage Trends

Apple Pay usage is increasing in all regions where it is available. The growth is being driven by the convenience, security, and wider acceptance of Apple Pay.

16.3 Cultural Differences

The adoption of Apple Pay varies across different cultures. In some countries, contactless payments are more widely accepted than in others.

16.4 Regulatory Environment

The regulatory environment also plays a role in the adoption of Apple Pay. Some countries have stricter regulations regarding mobile payments than others.

16.5 Future Expansion

Apple is continuing to expand Apple Pay into new markets around the world.

16.6 Payment Preferences

Consumer payment preferences vary by country. In some countries, credit cards are more popular than debit cards, while in others, mobile payments are the preferred method.

17. Integrating Apple Pay with Other Apple Services: A Seamless Ecosystem

Apple Pay is seamlessly integrated with other Apple services, creating a cohesive and user-friendly ecosystem.

17.1 Apple Wallet

Apple Pay is part of the Apple Wallet app, which also stores your credit cards, debit cards, loyalty cards, boarding passes, and event tickets.

17.2 Apple Watch

You can use Apple Pay on your Apple Watch to make contactless payments.

17.3 Apple Pay Cash

Apple Pay Cash allows you to send and receive money with other Apple Pay users through the Messages app.

17.4 Siri

You can use Siri to make Apple Pay payments.

17.5 Safari

You can use Apple Pay to make online purchases in Safari.

17.6 Apple Card

Apple Card integrates seamlessly with Apple Pay, allowing you to make purchases and track your spending in the Wallet app.

17.7 Third-Party Apps

Apple Pay is integrated into numerous third-party apps, allowing you to make payments easily and securely.

18. Apple Pay and Accessibility: Making Payments Inclusive

Apple Pay is designed with accessibility in mind, making it inclusive for users with disabilities.

18.1 VoiceOver

VoiceOver, Apple’s screen reader, can be used to navigate the Apple Pay interface and make payments.

18.2 Switch Control

Switch Control allows users with limited mobility to interact with Apple Pay using assistive devices.

18.3 AssistiveTouch

AssistiveTouch allows users to customize their Apple device to better suit their physical needs.

18.4 Font Size and Display Options

Users can adjust the font size and display options to make Apple Pay easier to see and use.

18.5 Customer Support

Apple provides dedicated customer support for users with disabilities.

18.6 Inclusive Design

Apple is committed to inclusive design, ensuring that its products and services are accessible to everyone.

19. Comparing Apple Pay to Traditional Payment Methods: Advantages and Disadvantages

Apple Pay offers several advantages over traditional payment methods, but it also has some disadvantages.

19.1 Advantages

- Security: Apple Pay is more secure than traditional card payments.

- Convenience: Apple Pay is faster and easier to use than traditional payment methods.

- Integration: Apple Pay is integrated with other Apple services.

- Rewards: Apple Pay allows you to earn rewards from your credit cards.

19.2 Disadvantages

- Device Dependency: Apple Pay requires an Apple device.

- Limited Acceptance: Apple Pay is not accepted everywhere.

- Battery Dependency: Apple Pay requires a charged device.

- Privacy Concerns: Some users have privacy concerns about mobile payments.

19.3 Traditional Payment Methods

Traditional payment methods, such as cash and credit cards, also have their own advantages and disadvantages.

19.4 Choosing the Right Payment Method

The best payment method for you depends on your individual needs and preferences.

19.5 Payment Evolution

Apple Pay represents a significant step in the evolution of payment methods.

19.6 Future of Payments

The future of payments is likely to be digital, mobile, and contactless.

20. Future Trends and Innovations in Mobile Payments: Beyond Apple Pay

The world of mobile payments is constantly evolving. Here are some future trends and innovations to watch for:

20.1 Biometric Payments

Biometric payments, such as facial recognition and fingerprint scanning, are becoming more common.

20.2 Blockchain Payments

Blockchain technology has the potential to revolutionize the payment industry.

20.3 Cryptocurrency Payments

Cryptocurrencies, such as Bitcoin and Ethereum, are gaining traction as payment methods.

20.4 Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring the possibility of issuing digital currencies.

20.5 Contactless Everywhere

Contactless payments are becoming more widely accepted.

20.6 Artificial Intelligence (AI)

AI is being used to improve the security and efficiency of mobile payments.

Seeking expert guidance on navigating the complexities of mobile payment systems? Connect with our team of seasoned PhDs at HOW.EDU.VN. We provide tailored consultations to address your specific challenges and unlock opportunities for growth and innovation. Contact us today at 456 Expertise Plaza, Consult City, CA 90210, United States or via Whatsapp at +1 (310) 555-1212.

FAQ: Your Apple Pay Questions Answered

1. What is Apple Pay, and how does it work?

Apple Pay is a contactless payment system that allows you to make secure purchases using your iPhone, Apple Watch, iPad, or Mac. It uses NFC technology, tokenization, and biometric authentication to protect your financial information.

2. Is Apple Pay secure?

Yes, Apple Pay is considered very secure. It uses tokenization to protect your card details and requires Face ID, Touch ID, or a passcode for every transaction.

3. Where can I use Apple Pay?

You can use Apple Pay at stores that accept contactless payments, in apps that support Apple Pay, and on websites that offer Apple Pay as a payment option.

4. How do I add a card to Apple Pay?

You can add a card to Apple Pay by opening the Wallet app on your iPhone or iPad, tapping the “+” icon, and following the on-screen instructions.

5. What is Apple Pay Cash, and how does it work?

Apple Pay Cash is a digital wallet that allows you to send and receive money with other Apple Pay users. You can use your Apple Pay Cash balance to make purchases, send money to friends and family, or transfer it to your bank account.

6. Is there a fee to use Apple Pay?

No, Apple does not charge consumers any additional fees for using Apple Pay.

7. What should I do if my Apple device is lost or stolen?

If your Apple device is lost or stolen, you can suspend or remove your cards from Apple Pay using the Find My app or by contacting your bank or card issuer.

8. Can I use Apple Pay internationally?

Yes, you can use Apple Pay in countries where it is supported. However, you may be subject to international transaction fees.

9. What are the limitations of Apple Pay?

Apple Pay requires an Apple device, and it is not accepted everywhere.

10. How does Apple Pay compare to other mobile payment systems?

Apple Pay is similar to other mobile payment systems, such as Google Pay and Samsung Pay. However, Apple Pay is only available on Apple devices, while Google Pay and Samsung Pay are available on Android devices.

Don’t navigate the complexities of digital payments alone. how.edu.vn offers expert guidance to help you stay ahead. Our PhDs provide customized advice and solutions. Reach out today at 456 Expertise Plaza, Consult City, CA 90210, United States or via Whatsapp at +1 (310) 555-1212.