The cost of a four-year college education can be a significant investment, but understanding the expenses involved is crucial for financial planning. At HOW.EDU.VN, we provide expert insights into the financial aspects of higher education, helping you navigate tuition fees, living expenses, and potential long-term financial implications. Investing in education is an investment in yourself.

Table of Contents

- What Is the Average Cost of 4 Years of College?

- How Does the Type of Institution Affect College Costs?

- What Are the Additional Costs to Consider Beyond Tuition?

- How Does Location Impact the Cost of College?

- What Are the Historical Trends in College Tuition?

- How Does Lost Income Factor into the Total Cost of College?

- What Is the Cost of Borrowing for College?

- What Are the Ways to Reduce the Financial Burden of College?

- How to Plan for College Expenses Early?

- What are the Benefits of Consulting with Financial Experts at HOW.EDU.VN?

- Frequently Asked Questions (FAQs)

1. What Is the Average Cost of 4 Years of College?

The average cost of four years at college varies significantly based on the type of institution—whether it’s a public or private college—and whether the student is attending from in-state or out-of-state. Understanding these costs can help you plan effectively for higher education expenses. Let’s break down the expenses:

- Public In-State: For students attending a public four-year college in their home state, the average annual cost is approximately $27,146. Over four years, this totals about $108,584.

- Public Out-of-State: Out-of-state students can expect to pay more. The average annual cost is $45,708, amounting to $182,832 over four years.

- Private Nonprofit: Private nonprofit universities are generally the most expensive. The average annual cost is $58,628, totaling $234,512 for a four-year degree.

These figures cover tuition, fees, books, supplies, and room and board for students living on campus. However, they do not include personal expenses, transportation, or potential income loss due to not working full-time.

2. How Does the Type of Institution Affect College Costs?

The type of college significantly impacts the overall cost of education. Public colleges typically receive state funding, which helps to lower tuition costs for in-state residents. Private colleges, however, rely more on tuition fees, endowments, and donations, resulting in higher costs.

2.1. Public vs. Private Institutions

Public Colleges:

- In-State Tuition: Averages around $9,750 per year.

- Out-of-State Tuition: Averages around $28,386 per year.

- Overall Cost: Lower due to state subsidies.

Private Colleges:

- Tuition and Fees: Averages around $38,421 per year for nonprofit institutions.

- Overall Cost: Higher but may offer more financial aid opportunities.

2.2. For-Profit vs. Nonprofit Institutions

Nonprofit Institutions:

- Mission: Focused on educational outcomes and student success.

- Tuition Costs: Higher, but often reinvested in academic resources and student services.

- Financial Aid: May have access to more grants and scholarships.

For-Profit Institutions:

- Mission: Aim to generate profit for shareholders.

- Tuition Costs: Can be lower than private nonprofit, but outcomes vary.

- Financial Aid: Limited financial aid options and potential for higher debt burdens.

Choosing the right type of institution depends on your financial situation, academic goals, and career aspirations.

3. What Are the Additional Costs to Consider Beyond Tuition?

Beyond tuition, numerous additional costs can significantly impact the overall expense of attending college. These expenses include books and supplies, room and board, transportation, and personal expenses.

3.1. Books and Supplies

The cost of textbooks and supplies can vary widely depending on the program and courses taken. On average:

- Public 4-Year Institutions: Students spend around $1,220 annually.

- Private Nonprofit Institutions: Students spend approximately $1,215 annually.

- Public 2-Year Institutions: Students spend around $1,467 annually.

3.2. Room and Board

Whether a student lives on or off campus significantly impacts the cost of housing.

- On-Campus at 4-Year Institutions: Averages around $12,917 annually.

- Off-Campus at Public 4-Year Institutions: Averages around $11,983 annually.

- On-Campus at Private Nonprofit Institutions: Averages around $13,842 annually.

3.3. Transportation

Transportation costs depend on whether the student commutes, lives on campus, or needs to travel home frequently.

- Public Transportation: Varies by city, but monthly passes can range from $50 to $150.

- Car Ownership: Includes expenses like gas, insurance, and maintenance, which can add up to several thousand dollars per year.

3.4. Personal Expenses

Personal expenses encompass a range of costs, including clothing, entertainment, healthcare, and miscellaneous items.

- On-Campus Students: May spend around $3,790 annually.

- Off-Campus Students: May spend around $4,720 annually.

Understanding these additional costs is crucial for creating a realistic college budget and avoiding financial strain during your academic journey.

4. How Does Location Impact the Cost of College?

The geographic location of a college plays a significant role in the overall cost of attendance. Tuition and fees, as well as living expenses, can vary dramatically from state to state and even city to city.

4.1. In-State vs. Out-of-State Tuition

One of the most significant location-based costs is the difference between in-state and out-of-state tuition at public colleges. In-state tuition is heavily subsidized by the state government, making it much more affordable for residents.

- In-State Tuition: Averages $9,750 nationally.

- Out-of-State Tuition: Averages $28,386 nationally.

For example, states like Vermont and New Hampshire have some of the highest in-state tuition rates, while states in the South and Plains regions generally have lower rates.

4.2. Cost of Living

The cost of living in a particular city or state also affects the overall cost of college. Urban areas tend to have higher costs of living compared to rural areas, impacting housing, transportation, and personal expenses.

- High Cost of Living Areas: Cities like New York City, San Francisco, and Boston have significantly higher living expenses.

- Low Cost of Living Areas: States in the Midwest and South often have more affordable living costs.

4.3. Regional Differences

Regional differences extend beyond just tuition and living expenses. They also include the availability of financial aid, job opportunities, and cultural experiences.

- Northeast: Known for high tuition rates and competitive job markets.

- South: Generally more affordable tuition and living costs.

- Midwest: Offers a balance of affordability and access to quality education.

- West Coast: High living costs, but also offers numerous tech and innovation opportunities.

Considering these regional differences can help you make an informed decision about where to pursue your higher education.

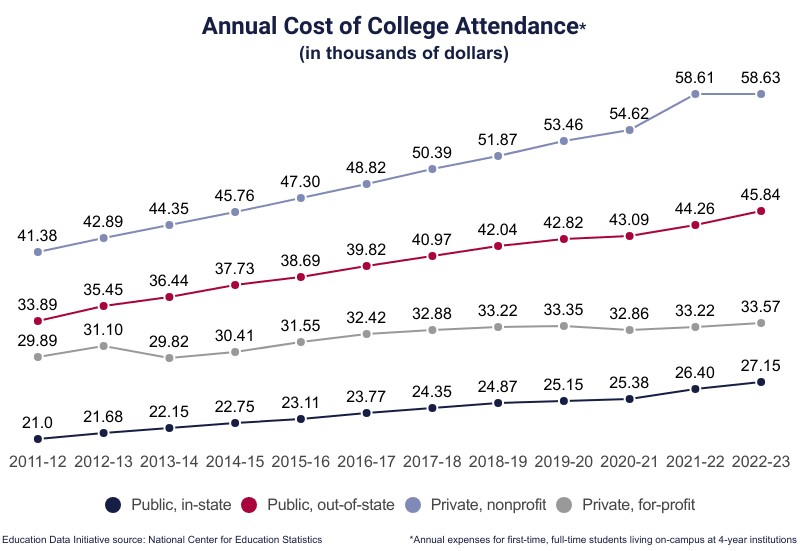

5. What Are the Historical Trends in College Tuition?

College tuition has seen significant increases over the past few decades, outpacing inflation and wage growth. Understanding these historical trends can help you appreciate the financial challenges students face today and plan accordingly.

5.1. Tuition Inflation

Since the 1960s, college tuition has risen dramatically. In 1963, the annual cost of tuition at a four-year public college was $243, equivalent to $2,489 in November 2024 dollars. From 1963 to 2022, the cost of tuition at a four-year public college increased at an annual rate of 2.34% after adjusting for inflation.

5.2. Comparison to Wage Growth

Tuition inflation has far outpaced wage inflation. From 2000 to 2020, average postsecondary tuition inflation exceeded wage inflation by 111.4%. This disparity makes it increasingly difficult for families to afford higher education without substantial financial aid or loans.

5.3. Impact on Student Debt

The rising cost of tuition has led to a significant increase in student loan debt. The average federal student loan debt is $38,375. This debt can take many years to repay, impacting graduates’ financial futures.

5.4. Factors Contributing to Tuition Increases

Several factors have contributed to the rising cost of college tuition, including:

- Decreased State Funding: Public colleges have seen reductions in state funding, leading to higher tuition fees.

- Increased Demand: As more students seek higher education, demand drives up prices.

- Administrative Costs: Colleges have expanded administrative staff and resources, adding to operational costs.

- Technology and Infrastructure: Investments in technology and campus infrastructure contribute to higher expenses.

Understanding these historical trends and contributing factors can help students and families prepare for the financial realities of college education.

6. How Does Lost Income Factor into the Total Cost of College?

One often overlooked aspect of the cost of college is the potential income a student forgoes while attending school. This lost income can be a significant factor in the overall financial burden of higher education.

6.1. Potential Earnings

High school graduates have the potential to earn a substantial income if they enter the workforce directly after graduation. The median weekly income for a high school graduate is $899, or $46,748 per year. Over four years, this amounts to $186,992.

6.2. Opportunity Cost

The opportunity cost of attending college includes not only tuition and fees but also the income a student could have earned during those years. For many students, this lost income represents a significant financial sacrifice.

6.3. Impact on Long-Term Finances

While attending college can lead to higher earning potential in the long run, the immediate loss of income can create financial challenges. Students may need to rely on loans, part-time jobs, or financial support from family to cover their expenses.

6.4. Balancing Work and School

Many students attempt to mitigate the impact of lost income by working part-time while attending college. However, balancing work and school can be challenging and may affect academic performance.

6.5. Strategies to Minimize Lost Income

- Summer Jobs: Working full-time during the summer can help offset some of the lost income.

- Internships: Internships provide valuable work experience and may offer compensation.

- Online Courses: Taking online courses can offer more flexibility for working students.

- Accelerated Programs: Completing a degree in a shorter amount of time can reduce the overall income loss.

Considering the impact of lost income is an essential part of planning for the financial costs of college.

7. What Is the Cost of Borrowing for College?

For many students, borrowing money is necessary to finance their college education. However, the cost of borrowing includes not only the principal amount but also interest and fees, which can significantly increase the overall expense.

7.1. Average Student Loan Debt

The average federal student loan debt is $38,375. This amount can vary depending on the type of institution, degree program, and individual borrowing habits.

7.2. Interest Rates

Interest rates on student loans can vary depending on the type of loan and the year it was issued. Federal student loans typically have fixed interest rates, while private student loans may have variable rates.

7.3. Repayment Plans

The standard repayment plan for federal student loans is 10 years, but longer repayment plans are available. The longer the repayment period, the more interest you will pay over the life of the loan.

7.4. Impact of Interest on Total Cost

Student borrowers pay an average of $2,636 in interest each year. Over the life of the loan, this can add up to tens of thousands of dollars, significantly increasing the total cost of college.

7.5. Strategies to Minimize Borrowing Costs

- Apply for Grants and Scholarships: Grants and scholarships do not need to be repaid, reducing the need for loans.

- Choose a Lower-Cost Institution: Attending a public college or community college can significantly reduce tuition costs.

- Work Part-Time: Earning income while in school can help offset expenses and reduce borrowing.

- Pay Off Loans Early: Making extra payments can reduce the principal balance and the amount of interest paid over time.

Understanding the costs of borrowing for college is crucial for making informed financial decisions and minimizing the long-term impact of student loan debt.

8. What Are the Ways to Reduce the Financial Burden of College?

Attending college can be expensive, but there are several strategies to reduce the financial burden and make higher education more affordable.

8.1. Apply for Financial Aid

- FAFSA: Fill out the Free Application for Federal Student Aid (FAFSA) to determine eligibility for federal grants, loans, and work-study programs.

- CSS Profile: Some private colleges require the CSS Profile for additional financial aid consideration.

8.2. Seek Scholarships and Grants

- Merit-Based Scholarships: Awarded based on academic achievement, talent, or other criteria.

- Need-Based Grants: Awarded based on financial need.

- Private Scholarships: Offered by organizations, foundations, and companies.

8.3. Choose an Affordable College

- Community Colleges: Offer lower tuition rates and can be a cost-effective way to complete general education requirements before transferring to a four-year university.

- Public Colleges: Typically offer lower tuition rates for in-state residents.

8.4. Live at Home

- Reduced Living Expenses: Living with family can significantly reduce housing and food costs.

8.5. Work Part-Time

- Income Generation: Working part-time can help offset expenses and reduce the need for loans.

8.6. Buy Used Textbooks

- Cost Savings: Used textbooks are often significantly cheaper than new ones.

8.7. Take Advantage of Tax Credits

- American Opportunity Tax Credit (AOTC): Can provide up to $2,500 per student per year for eligible education expenses.

- Lifetime Learning Credit (LLC): Can provide up to $2,000 per tax return for education expenses.

8.8. Consider Tuition Reimbursement Programs

- Employer Sponsorship: Some employers offer tuition reimbursement programs for employees pursuing higher education.

By implementing these strategies, students and families can effectively reduce the financial burden of college and make higher education more accessible.

9. How to Plan for College Expenses Early?

Planning for college expenses early is crucial for managing the financial burden and ensuring access to higher education. Starting early allows families to save, invest, and explore financial aid options effectively.

9.1. Start Saving Early

- 529 Plans: These tax-advantaged savings plans are designed specifically for education expenses. Contributions may be tax-deductible, and earnings grow tax-free.

- Coverdell Education Savings Accounts (ESAs): Allow contributions to grow tax-free and can be used for various education expenses.

- Custodial Accounts: Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts can be used to save for a child’s future education.

9.2. Set Financial Goals

- Estimate Future Costs: Research the current cost of college and project future expenses based on historical tuition inflation rates.

- Create a Budget: Develop a budget that includes savings goals for college expenses.

9.3. Explore Financial Aid Options

- Research Scholarships: Begin researching scholarship opportunities early in high school.

- Understand Grant Programs: Learn about federal and state grant programs and eligibility requirements.

9.4. Improve Financial Literacy

- Teach Children About Money: Educate children about saving, budgeting, and the importance of financial planning.

- Seek Professional Advice: Consult with a financial advisor to develop a comprehensive college savings plan.

9.5. Consider Career Paths

- Research Job Prospects: Explore potential career paths and earning potential to help determine the return on investment for different degree programs.

- Align Education with Career Goals: Choose a major that aligns with career goals and offers strong job prospects.

9.6. Monitor Savings and Investments

- Regularly Review Portfolio: Monitor the performance of college savings and investment accounts.

- Adjust Strategy as Needed: Adjust savings and investment strategies based on market conditions and financial goals.

By starting early and implementing a comprehensive college savings plan, families can effectively prepare for the financial challenges of higher education.

10. What are the Benefits of Consulting with Financial Experts at HOW.EDU.VN?

Navigating the complexities of college finances can be overwhelming. Consulting with financial experts at HOW.EDU.VN provides personalized guidance and support to help you make informed decisions and achieve your educational goals.

10.1. Personalized Financial Planning

- Tailored Advice: Receive customized financial plans based on your unique circumstances, goals, and risk tolerance.

- Comprehensive Assessment: Experts assess your current financial situation, including income, assets, and expenses, to develop a comprehensive strategy.

10.2. Expert Knowledge and Insights

- Up-to-Date Information: Access the latest information on financial aid, scholarships, and college savings plans.

- Industry Expertise: Benefit from the knowledge and experience of financial professionals who specialize in education planning.

10.3. Strategic Savings and Investment Strategies

- Optimized Savings Plans: Learn how to maximize your savings through tax-advantaged accounts like 529 plans and Coverdell ESAs.

- Diversified Investment Options: Discover investment options that align with your risk tolerance and financial goals.

10.4. Financial Aid Guidance

- Application Support: Receive assistance with completing the FAFSA and CSS Profile to maximize your eligibility for financial aid.

- Scholarship Resources: Access a database of scholarships and grant opportunities to help reduce the financial burden of college.

10.5. Debt Management Strategies

- Loan Counseling: Understand the terms and conditions of student loans and develop a repayment strategy that fits your budget.

- Debt Consolidation Options: Explore options for consolidating or refinancing student loans to lower interest rates and monthly payments.

10.6. Long-Term Financial Security

- Retirement Planning: Integrate college savings with long-term retirement planning to ensure financial security for the future.

- Estate Planning: Learn how to incorporate college savings into your estate plan to protect your assets and provide for your family.

Consulting with financial experts at HOW.EDU.VN empowers you to make informed decisions, optimize your financial resources, and achieve your educational goals with confidence. Contact us today at 456 Expertise Plaza, Consult City, CA 90210, United States or Whatsapp: +1 (310) 555-1212 to schedule a consultation and take control of your financial future. Visit our website at HOW.EDU.VN for more information.

11. Frequently Asked Questions (FAQs)

Q1: What is the average cost of tuition at a public four-year college?

The average cost of in-state tuition at a public four-year college is approximately $9,750 per year. Out-of-state tuition averages around $28,386 per year.

Q2: How much does it cost to attend a private nonprofit university for four years?

The average annual cost to attend a private nonprofit university is $58,628. Over four years, this totals approximately $234,512, including tuition, fees, and living expenses.

Q3: What are the main factors that influence the cost of college?

The main factors include the type of institution (public vs. private), residency status (in-state vs. out-of-state), location, and additional expenses like room and board, books, and personal expenses.

Q4: How can I reduce the cost of college?

You can reduce costs by applying for financial aid, seeking scholarships and grants, choosing an affordable college, living at home, working part-time, buying used textbooks, and taking advantage of tax credits.

Q5: What is a 529 plan, and how can it help with college savings?

A 529 plan is a tax-advantaged savings plan designed for education expenses. Contributions may be tax-deductible, and earnings grow tax-free, making it an effective way to save for college.

Q6: Should I consider community college before transferring to a four-year university?

Yes, attending community college for the first two years can significantly reduce tuition costs while completing general education requirements before transferring to a four-year university.

Q7: What is the impact of lost income on the total cost of college?

Lost income is a significant factor. The potential earnings a student forgoes while attending college can be substantial, adding to the overall financial burden.

Q8: How does borrowing for college affect my long-term financial health?

Borrowing increases the total cost of college due to interest and fees. It’s important to minimize borrowing and develop a repayment strategy to avoid long-term financial strain.

Q9: Are there tax benefits for college expenses?

Yes, the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) can provide tax relief for eligible education expenses.

Q10: Where can I get personalized advice on planning for college expenses?

Contact financial experts at HOW.EDU.VN for personalized guidance and support. Visit us at 456 Expertise Plaza, Consult City, CA 90210, United States, or call us at Whatsapp: +1 (310) 555-1212. You can also visit our website at HOW.EDU.VN for more information.

Do you find yourself struggling with the complexities of college finances? Do you dream of a future where your educational investments pay off without crippling debt? At HOW.EDU.VN, our team of over 100 renowned Ph.D. experts is dedicated to providing you with personalized advice and strategic solutions. We understand the challenges you face and are committed to helping you navigate the financial landscape of higher education with confidence.

Don’t let financial uncertainty hold you back. Contact HOW.EDU.VN today at 456 Expertise Plaza, Consult City, CA 90210, United States or Whatsapp: +1 (310) 555-1212. Let us help you create a roadmap to a brighter, more secure future. Visit our website at how.edu.vn and take the first step towards achieving your educational and financial goals.