Are you curious about How Much Do A Banker Make and eager to understand the compensation structures in the banking industry? At HOW.EDU.VN, we provide clear insights into banking salaries, bonuses, and benefits, giving you a complete picture of potential earnings in this field. Discover detailed compensation information, explore different banking roles, and gain clarity on the financial rewards of a banking career, all while connecting with top experts for personalized advice and career guidance.

1. Understanding Banker Salaries: An Overview

What is the typical banker salary, and what factors influence it? Banker salaries vary widely based on factors such as experience, role, location, and the size of the financial institution. Here’s a comprehensive look at banker compensation:

1.1. Entry-Level Banker Salaries

Entry-level positions, such as bank tellers or customer service representatives, generally offer modest salaries. According to the U.S. Bureau of Labor Statistics, the median annual wage for bank tellers was around $32,000 as of May 2023. These roles often serve as a starting point for a career in banking.

1.2. Mid-Level Banker Salaries

As bankers gain experience and move into roles like loan officers, financial analysts, or branch managers, their salaries increase substantially. Loan officers, for example, had a median annual salary of approximately $78,000 as of May 2023. Financial analysts can expect to earn even more, with median salaries around $95,000.

1.3. Senior-Level Banker Salaries

Senior-level positions, such as investment bankers, portfolio managers, and chief financial officers (CFOs), command the highest salaries. Investment bankers can earn base salaries ranging from $150,000 to over $500,000, with potential bonuses that can significantly increase their total compensation. CFOs often earn salaries well into the six-figure range, depending on the size and complexity of the financial institution.

2. Key Factors Influencing Banker Salaries

What are the most significant factors that determine a banker’s salary? Several elements play a crucial role in determining compensation levels within the banking sector.

2.1. Experience and Education

Experience is a primary driver of salary growth in banking. Entry-level positions require minimal experience, while senior roles demand years of expertise. Education also matters, with advanced degrees like MBAs or specialized certifications leading to higher earning potential.

2.2. Role and Responsibilities

The specific role a banker holds significantly impacts their salary. Positions with greater responsibility and decision-making authority, such as portfolio managers or investment bankers, typically offer higher compensation.

2.3. Location

Geographic location affects banker salaries due to varying costs of living and regional economic conditions. Bankers in major financial centers like New York City or London tend to earn more than those in smaller cities or rural areas.

2.4. Size and Type of Institution

The size and type of financial institution also influence salaries. Large multinational banks and investment firms generally pay more than smaller community banks or credit unions.

2.5. Performance

Individual performance plays a vital role in determining bonuses and salary increases. Bankers who consistently meet or exceed targets are rewarded with higher compensation.

3. Breaking Down the Components of Banker Compensation

What makes up the total compensation package for a banker? Understanding the various components of banker compensation provides a clearer picture of potential earnings.

3.1. Base Salary

The base salary is the fixed amount a banker earns before any additional incentives. It is typically paid on a bi-weekly or monthly basis and is the most stable part of a banker’s income.

3.2. Bonuses

Bonuses are performance-based incentives that can significantly increase a banker’s total compensation. They are typically awarded annually and are tied to individual, team, or company performance.

3.3. Stock Options

Some banks offer stock options as part of their compensation packages, particularly to senior-level employees. Stock options give bankers the right to purchase company shares at a predetermined price, potentially leading to significant gains if the company performs well.

3.4. Benefits

Employee benefits are an important part of the overall compensation package. These may include health insurance, retirement plans (such as 401(k)s), paid time off, and other perks.

3.5. Deferred Compensation

Deferred compensation is a portion of a banker’s earnings that is paid out at a later date, often after retirement. This can be a tax-advantaged way to save for the future and incentivize long-term commitment to the company.

4. Investment Banker Salaries: A Detailed Look

How much do investment bankers make, and what factors affect their high earning potential? Investment banking is known for its high compensation levels, but the actual amount can vary based on several factors.

4.1. Entry-Level Investment Banker Salaries

Entry-level positions in investment banking, such as analyst roles, typically offer base salaries in the range of $85,000 to $100,000. However, bonuses can significantly increase total compensation, often doubling the base salary.

4.2. Mid-Level Investment Banker Salaries

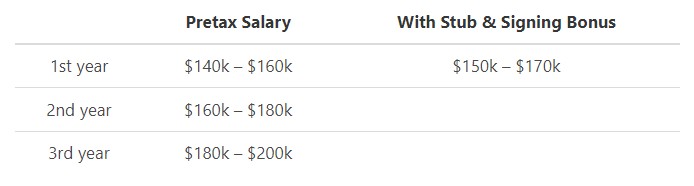

As investment bankers progress to associate positions, their base salaries increase to $150,000 to $250,000. With bonuses, total compensation can range from $300,000 to $500,000 or more.

4.3. Senior-Level Investment Banker Salaries

Senior-level investment bankers, such as vice presidents and managing directors, can earn base salaries of $300,000 to over $1 million. Bonuses at this level can be substantial, often exceeding the base salary and resulting in total compensation packages worth several million dollars.

4.4. Factors Influencing Investment Banker Salaries

Several factors influence investment banker salaries, including the size and prestige of the firm, the banker’s performance, and the overall market conditions. Investment bankers who work on high-profile deals and generate significant revenue for their firms are typically rewarded with higher compensation.

5. Regional Differences in Banker Salaries

How do banker salaries vary across different regions and countries? Banker salaries can differ significantly depending on the geographic location.

5.1. United States

In the United States, banker salaries are generally highest in major financial centers like New York City, San Francisco, and Chicago. Cost of living and local economic conditions play a significant role in determining compensation levels.

5.2. Europe

In Europe, banker salaries tend to be highest in cities like London, Zurich, and Frankfurt. These cities are major financial hubs with a high concentration of banking activity.

5.3. Asia

In Asia, banker salaries are competitive in cities like Hong Kong, Singapore, and Tokyo. Rapid economic growth and increasing financial activity in these regions have led to higher demand for banking professionals.

5.4. Emerging Markets

In emerging markets, banker salaries may be lower than in developed countries, but they are often higher compared to other professions in those regions. As these markets continue to grow, demand for skilled bankers is expected to increase, potentially driving up salaries.

6. The Impact of Technology on Banker Salaries

How is technology changing the landscape of banker salaries? The rise of technology is transforming the banking industry, leading to both new opportunities and challenges for banking professionals.

6.1. Automation

Automation is streamlining many routine banking tasks, reducing the need for certain entry-level positions. This may lead to slower salary growth for some roles.

6.2. Fintech

The growth of fintech companies is creating new opportunities for bankers with technology skills. Those who can leverage technology to improve efficiency, enhance customer service, and drive innovation are in high demand and can command higher salaries.

6.3. Cybersecurity

With increasing cyber threats, cybersecurity experts are becoming essential in the banking industry. Bankers with cybersecurity skills can earn significant salaries due to the critical nature of their work.

6.4. Data Analytics

Data analytics is playing an increasingly important role in banking, helping institutions make better decisions and manage risk. Bankers with data analytics skills are highly valued and can expect competitive salaries.

7. Comparing Banker Salaries to Other Finance Professions

How do banker salaries compare to those in other finance professions? Banker salaries are often compared to those in other finance-related fields.

7.1. Financial Analysts

Financial analysts typically earn slightly less than investment bankers at the entry and mid-levels but can still command high salaries with experience.

7.2. Accountants

Accountants generally earn less than bankers, but their skills are essential to the financial industry.

7.3. Financial Advisors

Financial advisors can earn similar salaries to bankers, particularly if they manage a large client base and generate significant revenue.

7.4. Actuaries

Actuaries, who assess and manage financial risks, can earn competitive salaries, especially with advanced certifications and experience.

8. Strategies for Maximizing Your Banker Salary

What strategies can help you maximize your earning potential in the banking industry? There are several steps you can take to increase your salary as a banker.

8.1. Education and Certifications

Pursue advanced degrees and professional certifications to enhance your skills and knowledge. This can make you more attractive to employers and lead to higher salaries.

8.2. Networking

Build a strong professional network to learn about job opportunities and gain insights into salary trends.

8.3. Performance

Focus on consistently meeting or exceeding performance targets to earn bonuses and salary increases.

8.4. Negotiation

Be prepared to negotiate your salary when accepting a new job or receiving a promotion. Research industry benchmarks and know your worth.

8.5. Continuous Learning

Stay up-to-date with industry trends and technologies to remain competitive and increase your earning potential.

9. The Role of Bonuses in Banker Compensation

How do bonuses impact overall banker compensation, and what factors influence bonus amounts? Bonuses are a significant component of banker compensation, often accounting for a large percentage of total earnings.

9.1. Performance-Based Bonuses

Many banks offer performance-based bonuses tied to individual, team, or company performance. These bonuses incentivize bankers to work hard and achieve specific goals.

9.2. Discretionary Bonuses

Some banks also offer discretionary bonuses, which are not tied to specific performance metrics. These bonuses are typically awarded at the discretion of management and can be influenced by factors such as overall company performance and individual contributions.

9.3. Bonus Structures

Bonus structures vary widely among banks. Some banks offer a fixed percentage of base salary as a bonus, while others use a more complex formula that takes into account multiple factors.

9.4. Factors Influencing Bonus Amounts

Several factors influence bonus amounts, including the bank’s overall financial performance, the banker’s individual performance, and the prevailing market conditions. Investment bankers who work on high-profile deals and generate significant revenue for their firms are typically rewarded with larger bonuses.

10. Career Paths and Salary Progression in Banking

What are the typical career paths in banking, and how do salaries progress as you advance? Understanding the typical career paths and salary progression in banking can help you plan your career and maximize your earning potential.

10.1. Retail Banking

Retail banking offers entry-level positions such as bank tellers and customer service representatives. As you gain experience, you can move into roles like loan officer, branch manager, and regional manager.

10.2. Commercial Banking

Commercial banking involves working with businesses to provide financial services such as loans, lines of credit, and cash management. Career paths in commercial banking include credit analyst, relationship manager, and senior lender.

10.3. Investment Banking

Investment banking is a high-pressure, high-reward field that involves advising companies on mergers and acquisitions, underwriting securities offerings, and providing other financial services. Career paths in investment banking include analyst, associate, vice president, and managing director.

10.4. Wealth Management

Wealth management involves helping individuals and families manage their finances and investments. Career paths in wealth management include financial advisor, portfolio manager, and trust officer.

10.5. Risk Management

Risk management involves identifying, assessing, and mitigating financial risks. Career paths in risk management include risk analyst, risk manager, and chief risk officer.

11. Negotiating Your Banker Salary: Tips and Strategies

How can you effectively negotiate your salary when accepting a job or receiving a promotion? Negotiating your salary is a crucial skill for maximizing your earning potential as a banker.

11.1. Research Industry Benchmarks

Before entering salary negotiations, research industry benchmarks to understand the typical salary range for your position and experience level. Websites like Glassdoor, Salary.com, and Payscale can provide valuable data.

11.2. Know Your Worth

Assess your skills, experience, and accomplishments to determine your value to the company. Be prepared to articulate your strengths and how you can contribute to the organization’s success.

11.3. Be Confident

Approach salary negotiations with confidence and a positive attitude. Believe in your worth and be prepared to advocate for yourself.

11.4. Be Prepared to Walk Away

Know your bottom line and be prepared to walk away if the employer is not willing to meet your salary expectations. Having alternative job offers can give you leverage in negotiations.

11.5. Focus on the Total Package

Consider the entire compensation package, including base salary, bonuses, benefits, and other perks. Sometimes, accepting a slightly lower base salary may be worthwhile if the overall package is more attractive.

12. The Future of Banker Salaries: Trends and Predictions

What trends and predictions can help you understand the future of banker salaries? The banking industry is constantly evolving, and several trends are expected to impact banker salaries in the future.

12.1. Technology and Automation

The increasing use of technology and automation is expected to streamline many banking tasks, potentially reducing the need for certain entry-level positions. This may lead to slower salary growth for some roles.

12.2. Fintech Growth

The continued growth of fintech companies is creating new opportunities for bankers with technology skills. Those who can leverage technology to improve efficiency, enhance customer service, and drive innovation are in high demand and can command higher salaries.

12.3. Cybersecurity Concerns

With increasing cyber threats, cybersecurity experts are becoming essential in the banking industry. Bankers with cybersecurity skills can earn significant salaries due to the critical nature of their work.

12.4. Data Analytics

Data analytics is playing an increasingly important role in banking, helping institutions make better decisions and manage risk. Bankers with data analytics skills are highly valued and can expect competitive salaries.

12.5. Regulatory Changes

Regulatory changes can also impact banker salaries. New regulations may require banks to hire more compliance officers and risk managers, potentially driving up salaries for these positions.

13. Understanding the Impact of Education on Banker Salaries

How does your level of education influence your earning potential as a banker? Education is a significant factor in determining banker salaries, with advanced degrees often leading to higher compensation.

13.1. Bachelor’s Degree

A bachelor’s degree in finance, economics, or a related field is typically required for entry-level positions in banking. While a bachelor’s degree can provide a solid foundation for a career in banking, it may not be sufficient for advancing to senior-level positions.

13.2. Master’s Degree

A master’s degree, such as an MBA or a Master of Finance, can significantly increase your earning potential as a banker. Advanced degrees provide you with more specialized knowledge and skills, making you more attractive to employers.

13.3. Professional Certifications

Professional certifications, such as the Chartered Financial Analyst (CFA) or the Certified Financial Planner (CFP), can also enhance your career prospects and lead to higher salaries. These certifications demonstrate your expertise in a specific area of finance.

13.4. Doctoral Degree

A doctoral degree, such as a Ph.D. in finance or economics, is typically required for academic or research positions in banking. While a doctoral degree may not be necessary for most banking roles, it can open doors to high-level positions in areas such as risk management and quantitative analysis.

13.5. Continuous Learning

Regardless of your level of education, continuous learning is essential for staying competitive in the banking industry. Attend conferences, take online courses, and read industry publications to stay up-to-date with the latest trends and technologies.

14. The Importance of Networking for Career Advancement

How can building a strong professional network help you advance your career and increase your salary? Networking is a crucial skill for career advancement in the banking industry.

14.1. Attend Industry Events

Attend industry conferences, seminars, and workshops to meet other banking professionals and learn about new trends and opportunities.

14.2. Join Professional Organizations

Join professional organizations, such as the American Bankers Association or the Financial Management Association, to connect with other bankers and access valuable resources.

14.3. Use Social Media

Use social media platforms, such as LinkedIn, to connect with other banking professionals and stay up-to-date with industry news.

14.4. Seek Mentorship

Seek mentorship from experienced bankers who can provide guidance and advice on career advancement.

14.5. Build Relationships

Focus on building genuine relationships with other banking professionals, rather than simply collecting contacts.

15. Understanding the Role of Location in Determining Salaries

How does the geographic location of your job affect your earning potential as a banker? Location is a significant factor in determining banker salaries, with major financial centers typically offering higher compensation.

15.1. Major Financial Centers

Major financial centers, such as New York City, London, and Tokyo, typically offer the highest banker salaries due to the high concentration of banking activity and the high cost of living.

15.2. Regional Differences

Banker salaries can vary significantly across different regions of the same country. For example, banker salaries in the Midwest may be lower than those on the East or West Coast.

15.3. Cost of Living

The cost of living in a particular area can also impact banker salaries. Areas with a higher cost of living typically offer higher salaries to compensate for the increased expenses.

15.4. Local Economic Conditions

Local economic conditions can also affect banker salaries. Areas with a strong economy and a thriving banking industry may offer higher salaries to attract and retain top talent.

15.5. International Opportunities

Working in an international location can also impact banker salaries. Some international locations may offer higher salaries and other benefits to attract bankers from other countries.

16. Salary Transparency and Its Impact on Banker Compensation

How does salary transparency affect banker compensation, and what are the benefits and drawbacks of increased transparency? Salary transparency is an increasingly important topic in the banking industry.

16.1. Increased Awareness

Salary transparency can increase awareness of pay disparities and promote fairness in compensation.

16.2. Negotiation Power

Salary transparency can give employees more power in salary negotiations, as they have more information about what their peers are earning.

16.3. Employee Satisfaction

Salary transparency can increase employee satisfaction, as employees feel more valued and appreciated when they know they are being paid fairly.

16.4. Competition

Salary transparency can increase competition among employers, as they strive to offer competitive salaries to attract and retain top talent.

16.5. Privacy Concerns

One potential drawback of salary transparency is that it can raise privacy concerns among employees who may not want their salaries to be public knowledge.

17. The Role of Soft Skills in Enhancing Salary Potential

How can developing strong soft skills help you increase your earning potential as a banker? While technical skills are essential in the banking industry, soft skills can also play a significant role in enhancing your salary potential.

17.1. Communication Skills

Strong communication skills are essential for building relationships with clients and colleagues, and for effectively conveying complex financial information.

17.2. Leadership Skills

Leadership skills are essential for managing teams and leading projects. Bankers with strong leadership skills are often promoted to higher-level positions with higher salaries.

17.3. Problem-Solving Skills

Problem-solving skills are essential for identifying and resolving complex financial issues. Bankers with strong problem-solving skills are highly valued and can command higher salaries.

17.4. Adaptability

The banking industry is constantly evolving, so adaptability is a crucial skill for staying competitive. Bankers who are able to adapt to new technologies and changing market conditions are more likely to succeed and earn higher salaries.

17.5. Teamwork

Teamwork is essential for collaborating with colleagues and achieving common goals. Bankers who are effective team players are highly valued and can contribute to a positive work environment.

18. Ethical Considerations in Banker Compensation

What ethical considerations should be taken into account when determining banker compensation? Ethical considerations are crucial in the banking industry, and compensation practices should align with ethical principles.

18.1. Fair Pay

Bankers should be paid fairly for their work, regardless of their gender, race, or other personal characteristics.

18.2. Transparency

Compensation practices should be transparent and easy to understand, so that bankers know how their pay is determined.

18.3. Accountability

Bankers should be held accountable for their performance and ethical behavior.

18.4. Incentives

Incentives should be designed to promote ethical behavior and discourage excessive risk-taking.

18.5. Compliance

Compensation practices should comply with all applicable laws and regulations.

19. The Impact of Economic Conditions on Banker Salaries

How do economic conditions influence banker salaries, and what can you expect during times of economic growth or recession? Economic conditions can have a significant impact on banker salaries.

19.1. Economic Growth

During times of economic growth, banker salaries tend to increase as demand for banking services rises.

19.2. Recession

During times of recession, banker salaries may decrease as demand for banking services declines. Some bankers may also lose their jobs during recessions.

19.3. Market Volatility

Market volatility can also impact banker salaries. During times of high market volatility, investment bankers may earn higher bonuses due to increased trading activity.

19.4. Interest Rates

Interest rates can also affect banker salaries. Higher interest rates can lead to increased profits for banks, which may result in higher bonuses for bankers.

19.5. Regulatory Changes

Regulatory changes can also impact banker salaries. New regulations may require banks to hire more compliance officers and risk managers, potentially driving up salaries for these positions.

20. Frequently Asked Questions About Banker Salaries

What are some of the most common questions people ask about banker salaries? Here are some frequently asked questions about banker salaries.

20.1. What is the average salary for a banker?

The average salary for a banker varies depending on the role, experience, location, and other factors. Entry-level positions may pay around $30,000 per year, while senior-level positions can pay well into the six-figure range.

20.2. How much do investment bankers make?

Investment bankers can earn high salaries, particularly at the senior level. Entry-level investment bankers may earn around $85,000 to $100,000 per year, while managing directors can earn several million dollars per year.

20.3. What factors influence banker salaries?

Several factors influence banker salaries, including experience, education, role, location, size of the institution, and performance.

20.4. How can I increase my salary as a banker?

You can increase your salary as a banker by pursuing advanced degrees, obtaining professional certifications, networking, focusing on performance, and negotiating your salary.

20.5. What are the best cities for bankers?

The best cities for bankers include New York City, London, Tokyo, and other major financial centers.

20.6. How does technology impact banker salaries?

Technology is transforming the banking industry, leading to both new opportunities and challenges for banking professionals. Bankers with technology skills are in high demand and can command higher salaries.

20.7. What are the ethical considerations in banker compensation?

Ethical considerations in banker compensation include fair pay, transparency, accountability, incentives, and compliance.

20.8. How do economic conditions impact banker salaries?

Economic conditions can have a significant impact on banker salaries. During times of economic growth, banker salaries tend to increase, while during times of recession, they may decrease.

20.9. What is the role of bonuses in banker compensation?

Bonuses are a significant component of banker compensation, often accounting for a large percentage of total earnings.

20.10. What are the future trends in banker salaries?

Future trends in banker salaries include the increasing use of technology and automation, the growth of fintech companies, increasing cybersecurity concerns, and the growing importance of data analytics.

Investment Banker

Investment Banker

Unlock Your Earning Potential with Expert Guidance from HOW.EDU.VN

Do you have more questions about banker salaries or career paths in finance? At HOW.EDU.VN, we connect you with leading PhDs and experts who can provide personalized advice and insights. Whether you’re exploring career options, seeking salary negotiation tips, or aiming to maximize your earning potential, our team is here to support you.

Contact us today to schedule a consultation and take the next step toward a successful and financially rewarding career in banking.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: how.edu.vn