Are you wondering how much Cash App charges for its services? At HOW.EDU.VN, we understand the importance of knowing the costs associated with payment platforms to manage your finances effectively. Cash App provides convenient digital transactions, but certain fees apply depending on the type of transaction. Let’s explore Cash App transaction fees, including transfer fees, instant deposit fees, and potential charges for business use, helping you make informed decisions and potentially minimize expenses when using digital wallets and mobile payment apps.

Table of Contents

- Understanding Cash App Fees: A Comprehensive Guide

- Decoding Cash App Fees: What Costs Can You Expect?

- Cash App Transaction Fees: A Detailed Breakdown

- Maximizing Cash App: Tips to Minimize and Avoid Fees

- Cash App Fees for Businesses: What Merchants Need to Know

- International Transfers and Cash App: Understanding Currency Conversion Fees

- Bitcoin and Cash App: Fees Associated with Cryptocurrency Transactions

- Cash App ATM Withdrawal Fees: How to Avoid Unexpected Charges

- Comparing Cash App Fees to Other Payment Platforms

- Expert Insights: How to Efficiently Manage Your Cash App Usage

- Frequently Asked Questions (FAQ) About Cash App Fees

1. Understanding Cash App Fees: A Comprehensive Guide

How Much Does Cash App Charge for its services? It’s a critical question for anyone using this popular mobile payment platform. While Cash App offers many free services, understanding its fee structure is essential to avoid unexpected costs. Like other Peer-to-Peer (P2P) services, Cash App generally doesn’t charge for basic functions like downloading the app or sending and receiving money from linked bank accounts or debit cards. However, certain transactions incur fees.

This guide provides a comprehensive overview of all potential Cash App fees, including charges for credit card transactions, instant deposits, business transactions, and ATM withdrawals. By understanding these costs, you can use Cash App more effectively and make informed decisions about how you send and receive money. We also provide valuable tips on minimizing or avoiding these fees altogether. For personalized guidance and expert advice on managing your digital finances, connect with our team of experienced financial professionals at HOW.EDU.VN.

2. Decoding Cash App Fees: What Costs Can You Expect?

What costs can you expect when using Cash App? While Cash App is known for its convenience and ease of use, several potential fees can impact your experience. Knowing these fees upfront helps you make informed choices and avoid surprises.

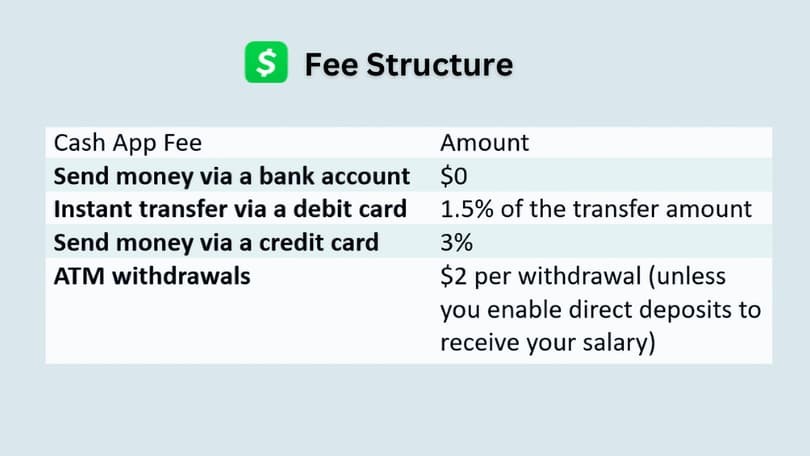

Here’s a breakdown of the most common Cash App fees:

- Credit Card Transfers: Cash App charges a 3% fee for sending money using a credit card. This fee covers the processing costs associated with credit card transactions.

- Instant Deposits: While standard deposits to your bank account are free, instant deposits incur a fee ranging from 0.5% to 1.75% of the transfer amount. This fee provides immediate access to your funds.

- Business Transactions: For business accounts, Cash App charges a 2.75% fee per transaction. This fee is automatically deducted from payments received.

- ATM Withdrawals: Cash App charges a $2.50 fee for each ATM withdrawal, in addition to any fees charged by the ATM operator.

- International Transfers: Sending money internationally incurs a currency conversion fee, typically around 1% of the transaction amount.

- Bitcoin Transactions: Buying and selling Bitcoin on Cash App may involve fees based on market conditions, usually ranging from 2% to 3%.

By understanding these potential costs, you can strategically use Cash App to minimize fees and maximize your savings. If you’re looking for personalized advice on managing your finances with Cash App, reach out to the financial experts at HOW.EDU.VN. Our team of Ph.D.s are ready to provide tailored solutions for your financial needs.

3. Cash App Transaction Fees: A Detailed Breakdown

How much does Cash App charge for different types of transactions? Understanding the specific fees associated with each transaction type is crucial for effective financial management. Let’s delve into a detailed breakdown of Cash App’s transaction fees:

3.1 Sending Money

- Debit Card or Bank Account: Sending money via Cash App using a linked debit card or bank account is typically free. This is the most cost-effective way to send funds to friends and family.

- Credit Card: If you choose to send money using a credit card, Cash App charges a 3% fee. This fee is applied to the total transaction amount and is added to your payment.

3.2 Receiving Money

- Standard Deposits: Receiving money into your Cash App account is free. Standard deposits to your linked bank account are also free, but they usually take 1-3 business days to process.

- Instant Deposits: If you need immediate access to your funds, you can opt for an instant deposit. Cash App charges a fee ranging from 0.5% to 1.75% of the transfer amount for this service.

3.3 Business Transactions

- Business Accounts: If you use Cash App for business purposes, a 2.75% fee is applied to each transaction. This fee is automatically deducted from the payment you receive.

3.4 ATM Withdrawals

- Withdrawal Fee: Cash App charges a $2.50 fee for each ATM withdrawal. In addition to this fee, you may also be charged a fee by the ATM operator.

3.5 Bitcoin Transactions

- Buying and Selling Bitcoin: Cash App charges fees for buying and selling Bitcoin, which can range from 2% to 3% depending on market conditions and volatility.

3.6 International Transfers

- Currency Conversion Fee: When sending money internationally, Cash App charges a currency conversion fee, typically around 1% of the transaction amount. This fee is applied to the converted amount.

Understanding these detailed transaction fees allows you to optimize your Cash App usage and avoid unnecessary expenses. For tailored financial advice and strategies, contact the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can help you navigate the complexities of digital finance and develop a personalized financial plan.

4. Maximizing Cash App: Tips to Minimize and Avoid Fees

How can you minimize or avoid fees when using Cash App? By implementing a few strategic practices, you can enjoy the convenience of Cash App without incurring unnecessary costs. Here are some tips to help you maximize your Cash App experience:

- Use Debit Cards or Bank Accounts: Always fund your Cash App transactions directly from your linked bank account or debit card to avoid the 3% fee associated with credit card transactions.

- Opt for Standard Transfers: If you don’t need immediate access to your funds, choose the standard deposit option. Standard transfers are free and typically take 1-3 business days to process.

- Avoid Frequent ATM Withdrawals: Minimize ATM withdrawals to avoid the $2.50 Cash App fee and any additional charges from the ATM operator. Consider using your Cash App debit card for purchases instead.

- Consolidate Business Transactions: If you’re using Cash App for business, try to consolidate larger transactions rather than numerous small ones to reduce the overall impact of the 2.75% business transaction fee.

- Monitor Bitcoin Transactions: Keep a close eye on market conditions and volatility when buying and selling Bitcoin on Cash App to make informed decisions and minimize fees.

- Limit International Transfers: Be mindful of the currency conversion fee when sending money internationally. Explore alternative options if the fees are too high.

- Take Advantage of Cash App Boosts: Cash App Boosts offer discounts on debit card purchases at select merchants. Check the available Boosts regularly to save money on everyday expenses.

- Set Up Direct Deposit: Setting up direct deposit can waive ATM fees and provide other benefits.

By following these tips, you can strategically use Cash App to your advantage while minimizing fees. For personalized financial guidance and expert strategies, consult the Ph.D. experts at HOW.EDU.VN. Our team is dedicated to helping you achieve your financial goals. You can visit us at 456 Expertise Plaza, Consult City, CA 90210, United States, or reach out via WhatsApp at +1 (310) 555-1212.

5. Cash App Fees for Businesses: What Merchants Need to Know

How much does Cash App charge for business transactions, and what do merchants need to know? If you’re a business owner using Cash App to accept payments, understanding the associated fees is crucial for managing your revenue effectively.

Cash App charges a 2.75% fee for each business transaction. This fee is automatically deducted from the payment you receive. For example, if a customer sends you $100 through Cash App, you will receive $97.25 after the fee is deducted.

Here are some key considerations for merchants using Cash App:

- Fee Structure: The 2.75% fee applies to all transactions received through your Cash App business account. This fee covers the cost of processing the payment and providing the service.

- Transparency: Cash App provides a transparent fee structure, so you always know how much you’ll be charged per transaction.

- Ease of Use: Despite the fee, Cash App offers a convenient and user-friendly platform for accepting payments from customers.

- Alternative Options: Consider alternative payment processing options to see if they offer lower fees or better features for your business.

- Budgeting: Factor the Cash App transaction fee into your pricing and budgeting to ensure you’re accounting for the cost of accepting payments.

While the 2.75% fee can impact your profit margins, Cash App’s ease of use and accessibility can be a valuable asset for small businesses and freelancers. For personalized advice on managing your business finances and optimizing payment processing, consult the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can provide tailored solutions to help your business thrive.

6. International Transfers and Cash App: Understanding Currency Conversion Fees

How much does Cash App charge for international transfers, and how do currency conversion fees work? If you need to send money internationally, understanding Cash App’s policies and fees is essential for making informed decisions.

Cash App allows you to send money internationally between two accounts, but a currency conversion fee applies to such transactions. The fee is typically around 1% of the total transaction amount. For example, if you’re sending $100 to someone in another country, you might be charged a $1 currency conversion fee.

Here are some important considerations for international transfers with Cash App:

- Currency Conversion Fee: The currency conversion fee is applied when Cash App converts your money from one currency to another. This fee can vary depending on the currencies involved and market conditions.

- Exchange Rates: Cash App uses its own exchange rates, which may differ from the official exchange rates. Be sure to check the exchange rate before completing your transaction.

- Transfer Limits: Cash App may have limits on the amount of money you can send internationally. Check the app for specific limits.

- Alternative Options: Explore alternative options for international money transfers, such as Wise (formerly TransferWise), Remitly, or Xoom, which may offer lower fees or better exchange rates.

While Cash App offers the convenience of international money transfers, it’s important to be aware of the currency conversion fees and exchange rates involved. For personalized financial advice and strategies, consult the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can help you make informed decisions and optimize your international money transfers.

7. Bitcoin and Cash App: Fees Associated with Cryptocurrency Transactions

How much does Cash App charge for Bitcoin transactions, and what fees should you be aware of? If you’re buying or selling Bitcoin on Cash App, understanding the associated fees is crucial for managing your cryptocurrency investments effectively.

Cash App charges fees for buying and selling Bitcoin, which can range from 2% to 3% depending on market conditions and volatility. These fees are dynamic and can fluctuate based on the current state of the cryptocurrency market.

Here are some key considerations for Bitcoin transactions on Cash App:

- Dynamic Fees: The fees for buying and selling Bitcoin on Cash App are dynamic and can change based on market conditions.

- Volatility: Cryptocurrency prices are highly volatile, so fees can fluctuate significantly.

- Transaction Fees: Cash App charges a transaction fee for each Bitcoin purchase or sale. This fee is typically a percentage of the transaction amount.

- Network Fees: In addition to Cash App’s transaction fees, you may also be charged network fees by the Bitcoin network. These fees are used to process transactions and can vary depending on network congestion.

- Alternative Options: Explore alternative options for buying and selling Bitcoin, such as cryptocurrency exchanges like Coinbase or Binance, which may offer lower fees or more features.

While Cash App offers a convenient platform for buying and selling Bitcoin, it’s important to be aware of the fees involved and how they can impact your investment returns. For personalized financial advice and strategies, consult the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can help you make informed decisions and optimize your cryptocurrency investments.

8. Cash App ATM Withdrawal Fees: How to Avoid Unexpected Charges

How much does Cash App charge for ATM withdrawals, and how can you avoid these fees? If you frequently withdraw cash from ATMs using your Cash App debit card, understanding the associated fees is essential for managing your money effectively.

Cash App charges a $2.50 fee for each ATM withdrawal. In addition to this fee, you may also be charged a fee by the ATM operator. These fees can quickly add up if you make frequent ATM withdrawals.

Here are some tips to help you avoid unexpected ATM charges:

- Minimize ATM Withdrawals: Try to minimize ATM withdrawals by using your Cash App debit card for purchases whenever possible.

- Cash Back at Stores: Take advantage of cash-back options at grocery stores and other retailers to get cash without paying ATM fees.

- Set Up Direct Deposit: Setting up direct deposit can waive ATM fees and provide other benefits.

- Check ATM Fees: Before using an ATM, check the fees charged by the ATM operator. Look for ATMs with lower fees or no fees.

- Consider Alternative Options: Explore alternative options for accessing cash, such as using a traditional bank account with free ATM withdrawals.

While Cash App offers the convenience of ATM withdrawals, it’s important to be aware of the fees involved and how to avoid them. For personalized financial advice and strategies, consult the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can help you make informed decisions and optimize your cash management.

9. Comparing Cash App Fees to Other Payment Platforms

How do Cash App fees compare to those of other payment platforms like PayPal, Venmo, and Zelle? When choosing a mobile payment app, understanding and comparing the fee structures is crucial for making informed financial decisions.

Here’s a comparison of Cash App fees to other popular payment platforms:

| Feature | Cash App | PayPal | Venmo | Zelle |

|---|---|---|---|---|

| Sending Money (Debit/Bank) | Free | Free (US), Fee (International) | Free | Free |

| Sending Money (Credit) | 3% | 2.9% + Fixed Fee | 3% | Not Applicable |

| Receiving Money | Free (Standard), Fee (Instant) | Free (US), Fee (International) | Free (Standard), Fee (Instant) | Free |

| Instant Transfer | 0.5% – 1.75% | Fee Varies | 1.75% | Not Applicable |

| Business Transactions | 2.75% | Fee Varies | Fee Varies | Not Applicable |

| ATM Withdrawals | $2.50 + ATM Fee | Not Applicable | Not Applicable | Not Applicable |

| International Transfers | Currency Conversion Fee (~1%) | Fee Varies | Not Supported | Not Supported |

| Bitcoin Transactions | 2% – 3% | Not Supported | Not Supported | Not Applicable |

As the table shows, Cash App offers competitive fees for many common transactions, but it’s important to compare the specific fees for the types of transactions you make most often. For personalized financial advice and strategies, consult the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can help you make informed decisions and optimize your use of mobile payment platforms.

10. Expert Insights: How to Efficiently Manage Your Cash App Usage

How can you efficiently manage your Cash App usage to minimize fees and maximize its benefits? With expert insights, you can make informed decisions and optimize your Cash App experience.

Here are some expert tips for efficiently managing your Cash App usage:

- Track Your Transactions: Regularly review your Cash App transaction history to identify any fees you’re paying and look for ways to reduce them.

- Set a Budget: Create a budget for your Cash App spending to avoid overspending and incurring unnecessary fees.

- Link Your Bank Account: Link your bank account to Cash App to avoid credit card fees and take advantage of free standard transfers.

- Use Cash App Boosts: Take advantage of Cash App Boosts to save money on everyday purchases.

- Avoid Unnecessary ATM Withdrawals: Minimize ATM withdrawals and use your Cash App debit card for purchases whenever possible.

- Consider Alternatives: If you’re frequently paying high fees on Cash App, consider alternative payment platforms that offer lower fees for your specific needs.

- Stay Informed: Stay informed about Cash App’s fee structure and any changes to its policies.

By following these expert insights, you can efficiently manage your Cash App usage and optimize your financial outcomes. For personalized financial advice and strategies, consult the expert team at HOW.EDU.VN. Our Ph.D.-level consultants are dedicated to helping you achieve your financial goals. We are located at 456 Expertise Plaza, Consult City, CA 90210, United States, and can be reached via WhatsApp at +1 (310) 555-1212.

11. Frequently Asked Questions (FAQ) About Cash App Fees

What are some frequently asked questions about Cash App fees? Here are some common questions and answers to help you better understand Cash App’s fee structure:

Q1: Does Cash App charge a fee to send money?

A: No, Cash App does not charge a fee to send money if you use a linked debit card or bank account. However, there is a 3% fee for sending money using a credit card.

Q2: Does Cash App charge a fee to receive money?

A: No, Cash App does not charge a fee to receive money. However, if you want to transfer the money to your bank account instantly, there is a fee ranging from 0.5% to 1.75%.

Q3: How much does Cash App charge for business transactions?

A: Cash App charges a 2.75% fee for each business transaction.

Q4: What is the fee for ATM withdrawals on Cash App?

A: Cash App charges a $2.50 fee for each ATM withdrawal, in addition to any fees charged by the ATM operator.

Q5: Are there any fees for buying or selling Bitcoin on Cash App?

A: Yes, Cash App charges fees for buying and selling Bitcoin, which can range from 2% to 3% depending on market conditions.

Q6: Does Cash App charge a fee for international transfers?

A: Yes, Cash App charges a currency conversion fee for international transfers, typically around 1% of the transaction amount.

Q7: How can I avoid fees on Cash App?

A: You can avoid fees on Cash App by using a linked debit card or bank account, opting for standard transfers instead of instant transfers, and minimizing ATM withdrawals.

Q8: What is Cash App Boost?

A: Cash App Boost is a feature that offers discounts on debit card purchases at select merchants.

Q9: How do Cash App fees compare to PayPal fees?

A: Cash App and PayPal have different fee structures. Cash App is generally cheaper for personal transactions, while PayPal may be better for business transactions.

Q10: Where can I get personalized financial advice about Cash App?

A: You can get personalized financial advice about Cash App from the expert team at HOW.EDU.VN. Our Ph.D.-level consultants can help you make informed decisions and optimize your financial outcomes.

For more information or personalized assistance, visit how.edu.vn or contact us via WhatsApp at +1 (310) 555-1212. Our team of Ph.D. experts is here to help you navigate the complexities of digital finance and achieve your financial goals. Don’t hesitate to reach out for expert advice tailored to your unique needs.