Are you wondering, how much does a bachelor’s degree cost? The cost of a bachelor’s degree can vary significantly based on the type of institution, location, and individual circumstances, but HOW.EDU.VN provides expert insights to help you navigate these expenses. We connect you with leading experts who can offer personalized advice on managing and understanding the costs associated with higher education. Understanding these expenses involves considering tuition, fees, and living costs, but with proper guidance, you can make informed decisions about your academic future.

1. Understanding the Average Cost of College

The cost of college encompasses several factors, with the average annual expense in the United States totaling $38,270 per student, including books, supplies, and living expenses. It’s important to break down these costs to fully understand the investment required for a bachelor’s degree.

What are the key components of college costs?

The cost of attendance (CoA) includes tuition and fees, books and supplies, and room and board for students living on campus. However, it doesn’t include transportation costs, personal expenses, or student loan interest. Knowing these components helps in budgeting and financial planning.

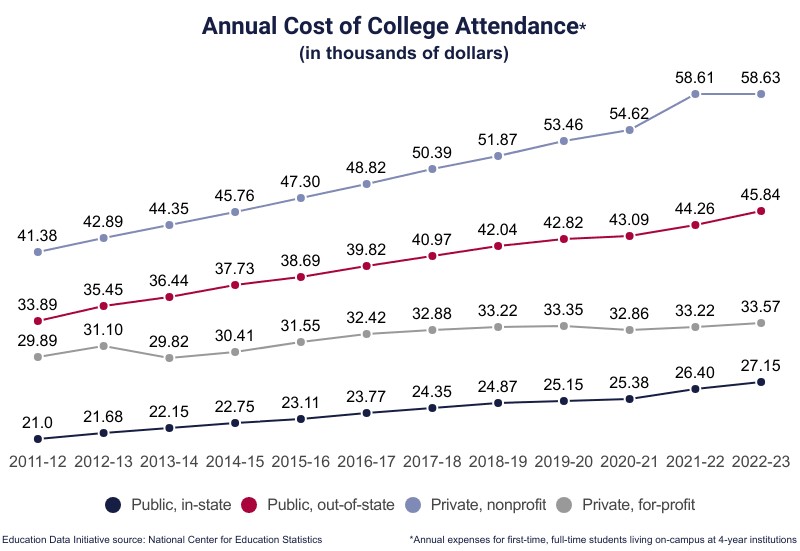

How much does it cost to attend a public college?

For an in-state student attending a public 4-year institution and living on campus, the average cost is $27,146 per academic year. This includes tuition, fees, and room and board. Out-of-state students face higher costs, averaging $45,708 per year.

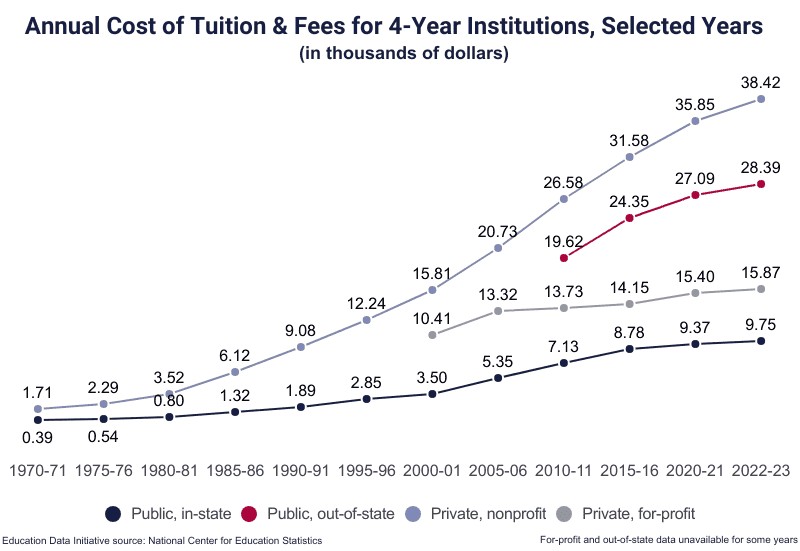

What are the tuition costs at public vs. private institutions?

The average in-state tuition at a public 4-year institution is $9,750, while out-of-state tuition averages $28,386. Private, nonprofit universities charge an average of $38,421 in tuition and fees, with a total cost of attendance of $58,628 per year for students living on campus.

2. Detailed Breakdown of Annual College Costs

To better understand the financial commitment required for higher education, let’s examine the costs associated with different types of institutions in more detail.

What are the costs for public colleges?

| Institution Type | Cost of Tuition | Cost of Attendance |

|---|---|---|

| 4-Year In-State | $9,750 | $27,146 |

| 4-Year Out-of-State | $28,386 | $45,708 |

| 2-Year In-District | $3,598 | $17,439 |

These figures provide a clear comparison of costs for in-state versus out-of-state students and the differences between 2-year and 4-year institutions.

What are the costs for private colleges?

| Institution Type | Cost of Tuition | Cost of Attendance |

|---|---|---|

| 4-Year Nonprofit | $38,421 | $56,628 |

| 4-Year For-profit | $15,868 | $33,574 |

| 2-Year Nonprofit | $20,019 | $36,026 |

| 2-Year For-profit | $16,444 | $26,640 |

Private institutions, particularly nonprofit ones, generally have higher tuition costs but may offer more financial aid opportunities.

3. The Total Cost of a Bachelor’s Degree

While annual costs are important, understanding the total cost of a bachelor’s degree provides a more comprehensive view of the investment required.

How much does a 4-year degree cost at a public institution?

The average cost of attendance for an in-state student at a public 4-year institution is $27,146 per year, totaling $108,584 over four years. Out-of-state students pay $45,708 per year, amounting to $182,832 over four years.

What is the total cost of a private university?

Students at private, nonprofit universities pay $58,628 per year, or $234,512 over four years. These figures highlight the significant financial commitment required for a private education.

How long does it really take to get a bachelor’s degree?

Only 42.0% of bachelor’s degree-seeking students graduate within four years. The majority, 97%, graduate within six years, bringing the 6-year average cost of attendance to $229,620.

What are the hidden costs of a college degree?

Besides tuition and fees, students may face significant lost income by not working full-time, averaging $46,748 per year. Additionally, student borrowers pay an average of $2,636 in interest each year, often spending around 20 years repaying their loans.

What’s the ultimate price of a bachelor’s degree?

Considering lost income and loan interest, the ultimate price of a typical bachelor’s degree may reach as high as $562,868. This comprehensive cost underscores the importance of financial planning and exploring all available funding options. For expert advice on managing these costs, HOW.EDU.VN is your go-to resource, connecting you with experienced professionals who can provide personalized guidance.

4. Public vs. Private: Calculating the Total Cost of Tuition

When planning for a bachelor’s degree, it’s essential to understand the total cost of tuition at both public and private institutions.

How much is the total tuition at a public college?

| Institution Type | Total Cost of Tuition | Total Cost of Degree |

|---|---|---|

| 4-Year In-State | $39,000 | $108,584 |

| 4-Year Out-of-State | $113,544 | $182,832 |

| 2-Year In-State | $7,196 | $34,878 |

These figures illustrate the significant difference in tuition costs between in-state and out-of-state students.

What is the total cost of tuition at a private college?

| Institution Type | Total Cost of Tuition | Total Cost of Degree |

|---|---|---|

| 4-Year Nonprofit | $153,684 | $226,512 |

| 4-Year For-profit | $63,472 | $134,296 |

| 2-Year Nonprofit | $40,038 | $72,052 |

| 2-Year For-profit | $32,888 | $53,280 |

Private institutions, especially nonprofit ones, often have much higher tuition costs, impacting the overall cost of obtaining a degree.

5. How Much Does Tuition Really Cost?

Tuition and fees constitute a significant portion of college expenses. Understanding the averages can help students and families plan more effectively.

What is the average cost of tuition across all institutions?

The average cost of tuition at any 4-year institution is $17,709, which makes up 46.3% of college costs for a first-time, full-time student living on campus. This is a crucial factor to consider when budgeting for college.

What are the in-state and out-of-state tuition costs at public institutions?

In-state tuition at public 4-year institutions averages $9,750, representing 35.9% of the cost of attendance for a full-time student living on campus. Out-of-state tuition averages $28,445, making up 62.1% of the cost of attendance for on-campus students.

What are the tuition costs at private institutions?

Among private 4-year institutions, the average tuition and fees at a typical nonprofit college total $38,421 annually, equivalent to 65.5% of college costs for a student living on campus. For-profit institutions charge an average of $15,868 annually, which is 47.3% of the cost of attendance.

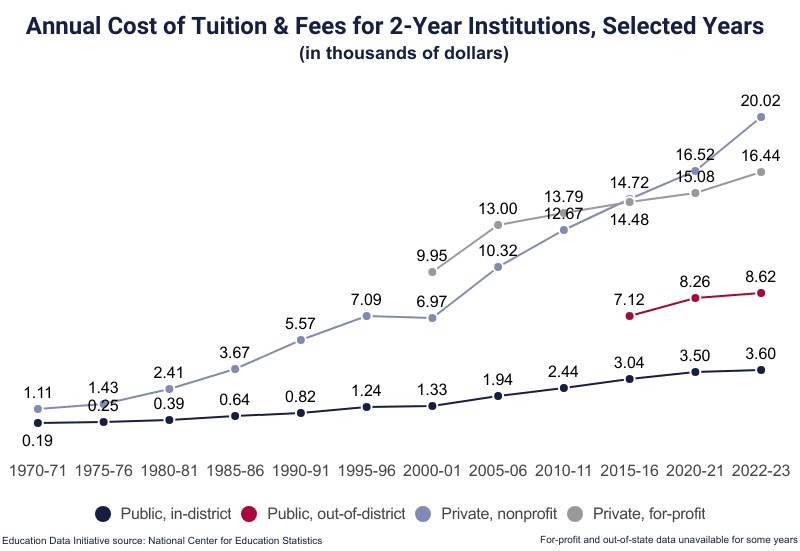

How do tuition costs compare at 2-year institutions?

The average cost of tuition and fees at any 2-year institution is $3,885, or 22.3% of the cost of attendance. Public 2-year institutions or community colleges charge an average of $3,598 annually for in-district tuition and fees, which is 21.6% of the cost of attendance. Private 2-year institutions charge $20,019 for nonprofit schools and $16,444 for for-profit schools.

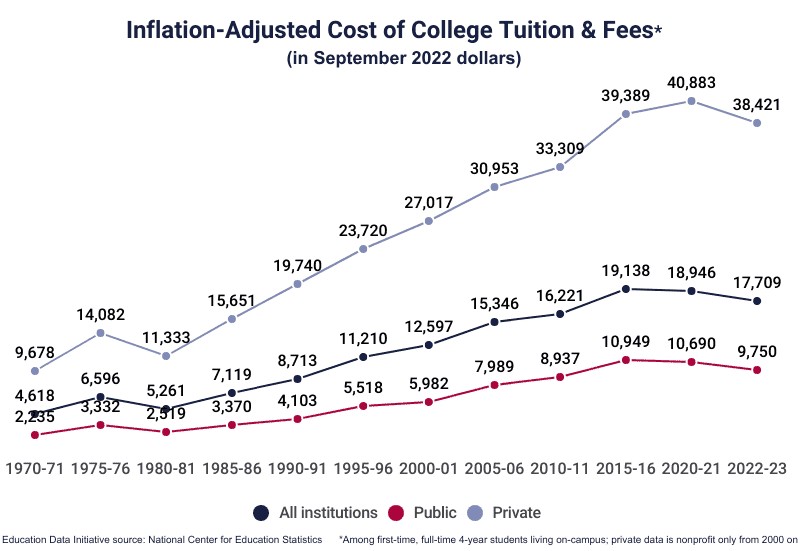

6. The Rising Cost of Tuition Over Time

The historical trend of tuition costs shows a significant increase over the decades. Understanding this trend can help families anticipate future expenses and plan accordingly.

How much has tuition increased over the years?

In 1963, the annual cost of tuition at a 4-year public college was $243, equivalent to $2,489 in November 2024. From 1963 to 2022, the cost increased at a CAGR of 2.34% after adjusting for inflation.

What were the tuition increases in recent years?

Between 2012-13 and 2022-23, the average tuition increased 25.6% at all 4-year colleges before adjusting for inflation. In-state tuition at public 4-year institutions increased 20.8%, while private, nonprofit 4-year institutions saw a 33.7% increase.

How does tuition inflation compare to wage inflation?

From 2000 to 2020, average postsecondary tuition inflation outpaced wage inflation by 111.4%. This highlights the growing challenge of affording higher education.

What were the historical costs of a 4-year degree?

In 1963, a 4-year degree from a public university cost $3,716. By 1989, the same degree cost $19,900. As of the 2022-23 academic year, the price of a bachelor’s degree is $89,556, illustrating the dramatic increase in costs over time.

7. Factoring in the Cost of Books & Supplies

Beyond tuition, the cost of books and supplies can add a significant financial burden. The expenses can vary widely depending on the program and institution.

How much do books and supplies cost at public institutions?

At public 4-year institutions, students spend an average of $1,220 annually on textbooks and supplies. Understanding this cost is crucial for budgeting.

What is the average cost at private institutions?

Books and supplies at private, non-profit institutions average $1,215, while private, for-profit institutions average $990. Public 2-year institutions average $1,467 per year, while private nonprofit institutions average $930 and private for-profit 2-year colleges average $1,501.

8. Understanding Room & Board Expenses

The cost of room and board is a significant factor in the overall expense of college. Whether a student lives on or off campus can greatly impact these costs.

What is the average cost of room and board?

At 4-year institutions, the cost of room and board averages $12,917. Public 4-year institutions charge on-campus students an average of $12,302 annually, while off-campus students pay $11,983.

How do room and board costs vary at private institutions?

Private, nonprofit institutions charge on-campus students an average of $13,842 per academic year, while off-campus students pay $10,876. Private, for-profit institutions charge $9,151 for on-campus and $9,564 for off-campus students.

What are the room and board costs at 2-year institutions?

At 2-year institutions, room and board costs $7,717. Public 2-year institutions charge on-campus students $7,420 and off-campus students $10,738. Private, nonprofit 2-year colleges charge on-campus students $12,732 and off-campus students $10,397. Private, for-profit institutions charge $7,920 for on-campus and $9,434 for off-campus students.

9. Additional Expenses to Consider

Beyond the main costs, additional expenses can add up quickly. Factoring these into your budget is essential for accurate financial planning.

What additional expenses should college students expect?

Additional expenses for a typical college student may exceed $5,000, including transportation, personal care, and entertainment.

How do additional expenses vary by living situation?

Students living on campus at a public 4-year institution pay an average of $3,790 in additional annual expenses. Students who live off campus may pay $4,720 if they do not live with family, and $4,654 if they live with family.

What are the additional expenses at private institutions?

At private, nonprofit 4-year institutions, students living on campus spend an average of $2,858 on additional expenses. Students at for-profit private colleges who live off campus spend an average of $5,276 if they do not live with family members and $4,654 if they do.

What are some hidden college costs?

Tallies of college costs often neglect to include the price of SAT prep courses, which can cost $5,000 or more. Being aware of these costs can help you avoid unexpected financial strain.

10. The Cost of Lost Income During College

One of the often-overlooked expenses is the potential income lost while studying instead of working full-time.

How much income is lost while attending college?

The median weekly income for a high school graduate is $899, or $46,748 per year. Over four years, the average worker with a high school diploma may earn $186,992.

What is the impact of unemployment rates?

The unemployment rate among high school graduates is 3.9%, which is 77.3% higher than the unemployment rate among bachelor’s degree holders. This highlights the long-term financial benefits of a college degree.

How does age affect unemployment rates?

18- and 19-year-olds have an average unemployment rate of 12.5%, while workers aged 20 to 24 years have an average unemployment rate of 7.8%.

11. The Financial Impact of Borrowing for College

Most students rely on loans to finance their education. Understanding the costs associated with borrowing is critical for responsible financial planning.

What is the average student loan debt?

The average federal student loan debt is $38,375. This highlights the significant financial burden many students face after graduation.

How much interest do students pay on loans?

Student borrowers pay an average of $2,636 in interest each year. The standard repayment plan for federal student loans lasts 10 years, with the longest plan extending to 30 years.

How long does it take to repay student loans?

The average student borrower spends closer to 20 years paying off their loans. Each year, 85.2% of new undergraduates borrow money to pay for college.

How much financial aid do students receive?

The average first-time, full-time student borrows more than $7,709 in federal loans to attend school and receives an average of $5,288 in grant and scholarship aid. Understanding these averages can help students explore all available funding options.

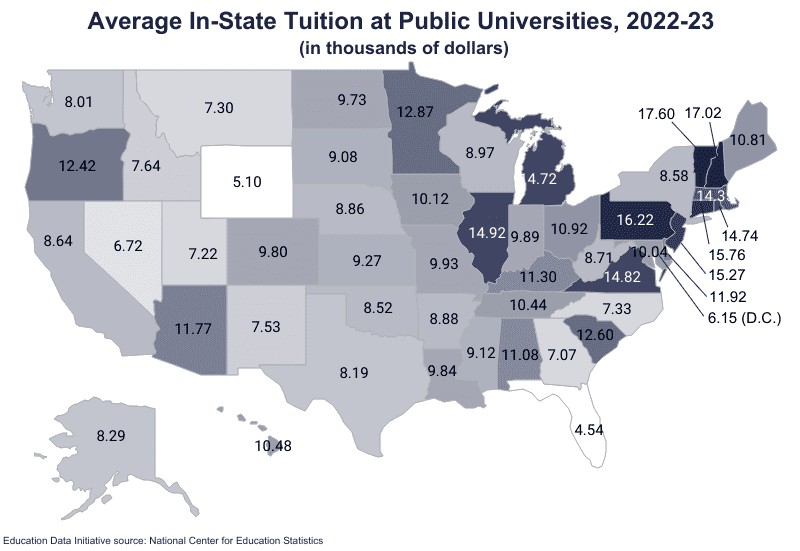

12. State-by-State Breakdown of College Costs

College costs vary significantly by state. This section provides an overview of the most and least expensive states for public universities.

Which states have the most expensive public universities?

The most expensive public schools are in the Northeast, traditionally called New England. The average tuition among the 10 most expensive states for public universities is $15,542.

Which states have the most affordable public universities?

The least expensive schools are in the South and Plains regions. The average tuition among the states with the most reasonably priced public universities is $6,660.

How much does in-state tuition vary by state?

The difference between the lowest and highest average in-state tuition is $13,060. Here’s a look at some of the most and least expensive states for in-state public universities in 2022-23:

Most Expensive In-State Public Universities, 2022-23

| State | Tuition & Fees | Tuition + Room & Board |

|---|---|---|

| Vermont | $17,600 | $50,094 |

| New Hampshire | $17,019 | $19,557 |

| Pennsylvania | $16,217 | $47,222 |

| Connecticut | $15,763 | $44,931 |

| New Jersey | $15,265 | $40,366 |

Least Expensive In-State Public Universities, 2022-23

| State | Tuition & Fees | Tuition + Room & Board |

|---|---|---|

| Florida | $4,540 | $30,928 |

| Wyoming | $5,100 | § |

| District of Columbia | $6,152 | $47,066 |

| Nevada | $6,723 | $24,246 |

| Georgia | $7,075 | $32,114 |

§No data for Wyoming.

13. Factors Influencing State College Costs

Understanding the factors that influence college costs at the state level can provide valuable insights for students and families.

How are public institutions funded?

Most public institutions receive funding from state and local governments, as well as federal funding through financial aid to students. Federal grants and contracts provide public postsecondary institutions 8.64% of their revenue.

What percentage of revenue comes from federal and state sources?

4-year public institutions receive 9.10% of their revenue from federal grants and contracts, while state governments fund an average of 2.23% of public postsecondary revenue.

How much revenue comes from tuition and fees?

17.57% of revenue comes from tuition and fees. These funding sources collectively determine the affordability of public education in each state.

14. Analyzing Room and Board Costs: On and Off Campus

Living expenses make up a significant portion of college costs. Deciding whether to live on or off campus can have a substantial impact on your budget.

What factors influence the cost of room and board?

Local rental markets significantly influence whether it is less expensive to live on or off campus. Colleges do not always accurately represent off-campus living costs, making assumptions regarding personal expenses like health insurance and food prices.

How do on-campus and off-campus costs compare in different regions?

Stanford University lists average local rent prices from 2018 on its student housing website. According to Stanford, one year in a shared 2-bedroom apartment within the San Francisco-San Jose urban sprawl would cost each student between $24,034 and $28,503 in November 2024 dollars. Meanwhile, room and board on campus costs between $15,784 and $20,264 for the 2024-25 academic year.

What are the cost estimates at UC Berkeley?

In Oakland, the University of California-Berkeley estimates that new students for 2024-25 pay up to 10.6% more living in an on-campus residence hall than they do living in a rented off-campus apartment, with apartment rental estimated at roughly $12,300.

What is the average rent in California?

According to a nonpartisan office of the California state legislature, the state-wide monthly rent for a 2-bedroom “typical property” was $2,748 in September 2024. In San Francisco, the average rent was $3,477; shared between two roommates, this is equivalent to $1,739 per month or $20,868 per year.

How can students manage living expenses?

Such discrepancies can make budgeting difficult. Groceries purchased in Iowa are much less expensive than groceries in Manhattan’s Lower East Side. Students may be able to temporarily reduce their cost of living using financial aid. Using student loans for living expenses, however, ultimately increases the student’s loan debt, including interest.

15. Navigating College Costs: Expert Advice from HOW.EDU.VN

Understanding the financial aspects of a bachelor’s degree can be overwhelming. At HOW.EDU.VN, we connect you with leading experts who can provide personalized guidance and advice.

What challenges do students face in managing college costs?

Students often struggle with finding affordable housing, managing their budgets, and understanding the complexities of financial aid and loan options.

How can HOW.EDU.VN help students navigate these challenges?

HOW.EDU.VN offers access to a network of experienced professionals who can provide insights into financial planning, scholarship opportunities, and effective budgeting strategies. Our experts can help you make informed decisions to minimize your financial burden.

What are the benefits of seeking expert advice?

By seeking advice from HOW.EDU.VN, you can:

- Develop a comprehensive financial plan tailored to your unique circumstances.

- Identify and apply for relevant scholarships and grants.

- Understand the terms and conditions of student loans.

- Create a realistic budget to manage expenses during college.

- Make informed decisions about housing and living arrangements.

With the support of our experts, you can confidently navigate the financial aspects of college and focus on achieving your academic goals.

FAQ: Understanding the Cost of a Bachelor’s Degree

1. What is the average cost of a bachelor’s degree in the United States?

The average cost of a bachelor’s degree in the United States is approximately $108,584 for in-state students at public 4-year institutions and $234,512 for students at private, nonprofit universities.

2. What factors influence the cost of a bachelor’s degree?

Factors that influence the cost include the type of institution (public or private), whether you are an in-state or out-of-state student, room and board expenses, and additional costs like books and supplies.

3. How can I reduce the cost of my bachelor’s degree?

You can reduce costs by attending a public in-state university, living off-campus, applying for scholarships and grants, and minimizing additional expenses.

4. Are there financial aid options available for college students?

Yes, there are various financial aid options, including federal and state grants, scholarships, and student loans. Fill out the Free Application for Federal Student Aid (FAFSA) to explore your eligibility.

5. How much can I expect to borrow in student loans?

The average federal student loan debt is $38,375. The amount you borrow will depend on your financial situation and the cost of your chosen institution.

6. What is the difference between tuition and the cost of attendance?

Tuition covers the cost of instruction, while the cost of attendance includes tuition, fees, room and board, books, supplies, and other living expenses.

7. How has the cost of college changed over time?

The cost of college has significantly increased over the past few decades. From 1963 to 2022, the cost of tuition at a 4-year public college increased at an average rate of 2.34% per year after adjusting for inflation.

8. Is it cheaper to live on or off campus?

Whether it is cheaper to live on or off campus depends on local rental markets. In some areas, off-campus housing may be more affordable, while in others, on-campus housing is more cost-effective.

9. What are some often-overlooked college expenses?

Some often-overlooked expenses include transportation, personal care items, entertainment, and SAT prep courses.

10. How can HOW.EDU.VN help me with college costs?

HOW.EDU.VN connects you with experienced financial experts who can provide personalized advice on managing college costs, identifying scholarship opportunities, and developing a financial plan.

Navigating the complexities of college costs requires careful planning and informed decision-making. By understanding the various factors that influence expenses and seeking expert advice, you can effectively manage your financial burden and achieve your academic goals. Contact HOW.EDU.VN today to connect with our team of experienced professionals and start planning for your future.

Are you ready to take control of your financial future and pursue your dream of a bachelor’s degree? Contact HOW.EDU.VN today to connect with our team of experienced professionals. We offer personalized advice and guidance to help you navigate the complexities of college costs and make informed decisions about your education. Let us help you develop a comprehensive financial plan, identify scholarship opportunities, and minimize your student loan debt. Reach out to us at 456 Expertise Plaza, Consult City, CA 90210, United States, Whatsapp: +1 (310) 555-1212, or visit our website at HOW.EDU.VN to get started. Don’t let financial concerns hold you back from achieving your academic aspirations—partner with how.edu.vn and pave the way for a brighter future.