Determining how much you should pay for a car is crucial for maintaining financial stability and making informed purchasing decisions. At HOW.EDU.VN, we help you navigate this complex process by offering expert insights on budgeting, financing, and understanding the true cost of vehicle ownership. By considering factors like your income, expenses, and credit score, you can confidently determine a car payment you can comfortably afford. Securing a manageable car loan, smart vehicle financing, and finding affordable car options will allow you to make the right decision.

1. Assess Your Financial Situation to Determine Car Affordability

Before stepping onto a car lot, it’s essential to conduct a thorough self-assessment of your financial standing. This involves evaluating your income, expenses, and credit score to establish a realistic budget for your vehicle purchase. This detailed preparation helps to avoid future financial strain and ensures you can comfortably manage car-related costs.

1.1 Calculate Your Monthly Take-Home Pay

Start by calculating your monthly take-home pay, which is the amount you receive after taxes and other deductions. This figure provides a realistic view of your available funds.

According to a study by the Bureau of Labor Statistics in 2023, average monthly net pay varies significantly across different professions, emphasizing the importance of using individual net pay for budgeting.

1.2 Track Your Monthly Expenses

List all your monthly expenses, including rent or mortgage payments, utilities, groceries, insurance, debt repayments, and other regular bills. This will give you a clear picture of your fixed financial obligations.

1.3 Evaluate Your Credit Score

Check your credit score, as it significantly impacts the interest rate you’ll receive on a car loan. A higher credit score typically results in a lower interest rate, saving you money over the life of the loan.

1.4 Determine Your Down Payment Amount

Decide on the amount you can afford for a down payment. A larger down payment reduces the loan amount and potentially lowers your monthly payments.

1.5 Consider Your Desired Loan Term

Think about your preferred loan term, which is the length of time you’ll be making payments. Shorter loan terms result in higher monthly payments but lower overall interest paid, while longer terms offer lower monthly payments but increase the total interest.

1.6 Choose Your Desired Vehicle Type

Determine whether you want to buy a new, used, or leased vehicle. Each option has different cost implications, including depreciation, maintenance, and insurance rates.

2. Establish a Monthly Car Payment Budget

Once you have a clear understanding of your finances, you can establish a monthly car payment budget. This involves calculating the maximum amount you can comfortably allocate to car payments without jeopardizing your financial stability.

2.1 Use the 20% Rule for Car Expenses

As a general guideline, aim to keep your total car-related expenses, including loan payments, insurance, fuel, and maintenance, below 20% of your monthly take-home pay. This ensures that you have enough funds for other essential expenses and savings goals.

2.2 Avoid Maxing Out Your Budget

It’s crucial to avoid maxing out your budget, as unexpected expenses or financial setbacks can occur. Leaving some buffer in your budget provides financial flexibility and peace of mind.

2.3 Consider the Impact of Loan Term Length

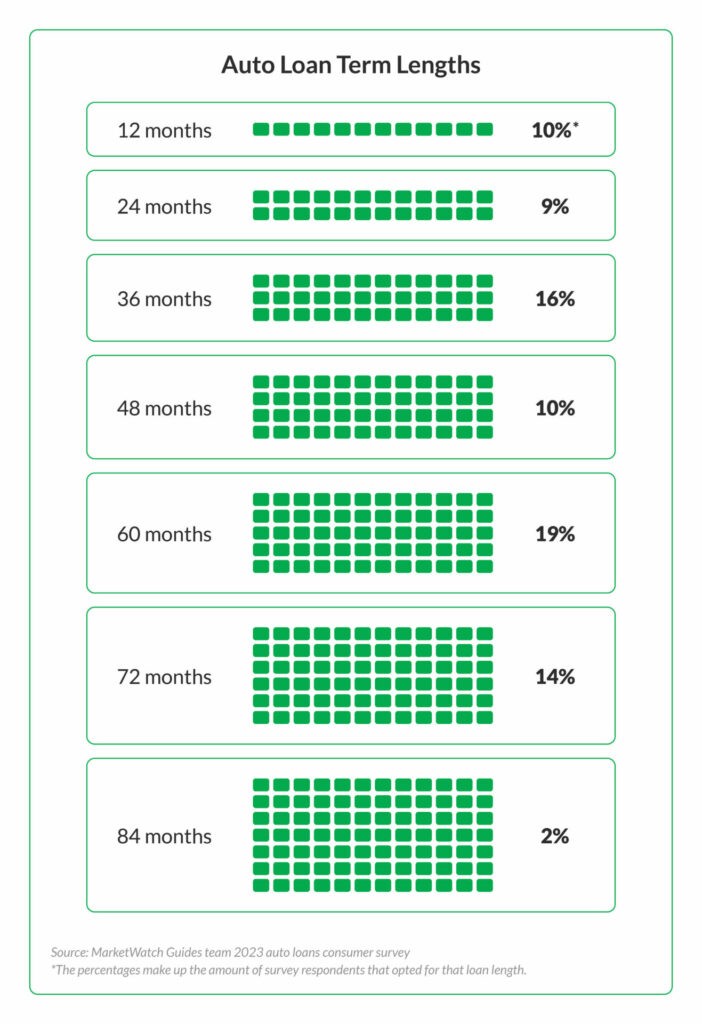

Be realistic about the length of time you want to make monthly payments. Most loan companies offer terms between 24 and 84 months for used and new cars. Longer loan terms can result in lower monthly payments, but you’ll pay more overall due to the additional interest that accumulates.

According to a 2022 report by Experian, the average loan term for new cars is approximately 69 months, while for used cars, it’s around 65 months. This data highlights the increasing trend of longer loan terms to make car payments more affordable.

2.4 Understand the Risk of Being Upside-Down on Your Loan

Longer loan terms increase your risk of going upside-down on your loan, which happens when you owe more on the loan than the vehicle is worth. Since a vehicle’s value decreases over time, weigh your options carefully before choosing which vehicle to purchase.

Illustration showing auto loan term lengths and their popularity

Illustration showing auto loan term lengths and their popularity

3. Determine Fuel and Insurance Costs

In addition to car payments, fuel and insurance costs are significant factors to consider when determining the overall affordability of a vehicle. These costs can vary widely depending on factors such as location, driving history, and vehicle type.

3.1 Research Fuel Economy Ratings

Before purchasing a vehicle, research its fuel economy ratings to estimate your monthly fuel expenses. The U.S. Department of Energy provides a detailed list of fuel economy figures and a comparison tool that allows you to check different vehicles’ annual fuel cost estimates.

3.2 Obtain Auto Insurance Quotes

Reach out to your insurance agent or insurance companies to get quotes for auto insurance. Compare car insurance quotes from different companies to get a sense of what you’ll pay.

3.3 Shop for the Best Car Insurance Rates

Consider recommendations for the best car insurance companies to find the most competitive rates. Factors like your driving record, age, and location can impact your insurance premiums.

3.4 Include Fuel and Insurance in Your Budget

When calculating your monthly car payment and related expenses, try to keep your total costs to less than 20% of your monthly take-home pay. This ensures that you have sufficient funds for other essential expenses and savings goals.

4. Calculate Loan Amount and Term Length

Once you’ve calculated your affordable monthly payment, you can determine how much you can borrow. The amount a lender will let you borrow depends on several factors.

4.1 New vs. Used Car Loans

New car loans tend to have lower annual percentage rates (APRs) than used cars. This is because new cars are considered less risky investments by lenders.

4.2 Credit Score Impact on APR

Your credit score will affect the APR on the loan and how much the bank is willing to lend you. A higher credit score typically results in a lower APR, saving you money over the life of the loan.

4.3 Loan Term Considerations

Consider your loan term, which is how many months you’ll have to pay your auto loan off. Shorter loan terms result in higher monthly payments but lower overall interest paid, while longer terms offer lower monthly payments but increase the total interest.

5. Set a Purchase Price and Negotiate

The total loan amount you calculated for your car may not be the price you pay. When shopping for a car, pay attention to details other than the sticker price. In most states, you’ll have to pay sales tax and fees whether you buy a new or used car.

5.1 Factor in Sales Tax and Fees

In most states, you’ll have to pay sales tax and fees whether you buy a new or used car. These costs can add a significant amount to the overall price.

5.2 Consider Registration and Documentation Fees

Registration fees typically range from $50 to $300, although some states can be much more expensive. Documentation fees are generally between $100 and $500, depending on your state.

5.3 Utilize a Down Payment or Trade-In

Making a down payment or trading your old car in can help you borrow less money when purchasing a vehicle. This can significantly reduce your monthly payments and overall interest paid.

6. Understanding Car Affordability Calculators

An auto loan calculator can help you determine the monthly payment and total cost of an auto loan you may qualify for. It uses factors such as your loan term, down payment, and interest rate. Some calculators may also incorporate sales tax, fees, and your current vehicle’s trade-in value.

6.1 Input Accurate Information

To get the most accurate results, input precise information such as the loan amount, term, interest rate, and any applicable fees or taxes.

6.2 Compare Different Scenarios

Experiment with different scenarios, such as varying the loan term or down payment amount, to see how they impact your monthly payments and total cost.

6.3 Use Calculators as a Planning Tool

Auto loan calculators are valuable tools for planning your car purchase and determining the best financing options for your budget.

7. Key Factors Influencing Car Affordability

Several key factors influence how much you should pay for a car. Understanding these factors can help you make a more informed decision.

7.1 Income and Expenses

Your income and expenses are fundamental determinants of car affordability. Calculate your monthly take-home pay and subtract your expenses to determine how much you can allocate to car payments.

7.2 Credit Score

Your credit score significantly impacts the interest rate you’ll receive on a car loan. A higher credit score typically results in a lower interest rate, saving you money over the life of the loan.

7.3 Loan Terms and Interest Rates

The loan term and interest rate affect your monthly payments and the total cost of the loan. Longer loan terms result in lower monthly payments but higher overall interest paid, while shorter terms offer the opposite.

7.4 Vehicle Type and Condition

The type and condition of the vehicle impact its price, insurance rates, and maintenance costs. New cars typically have higher purchase prices but lower maintenance costs initially, while used cars are more affordable but may require more maintenance.

7.5 Insurance and Fuel Costs

Insurance and fuel costs can significantly add to the overall cost of car ownership. Research insurance rates and fuel economy ratings before making a purchase.

8. Navigating the Car Buying Process

Navigating the car buying process can be complex, but with preparation and knowledge, you can make informed decisions.

8.1 Research Vehicle Options

Research different vehicle options to find one that meets your needs and budget. Consider factors such as fuel efficiency, safety features, and reliability.

8.2 Shop Around for Financing

Shop around for financing options from different lenders to find the best interest rate and loan terms. Banks, credit unions, and online lenders may offer competitive rates.

8.3 Negotiate the Price

Negotiate the price of the vehicle with the dealer to get the best possible deal. Be prepared to walk away if the dealer doesn’t meet your offer.

8.4 Review the Contract Carefully

Review the contract carefully before signing to ensure that all terms and conditions are accurate and fair.

9. Financial Risks of Overspending on a Car

Overspending on a car can lead to significant financial risks, including debt accumulation, financial strain, and limited financial flexibility.

9.1 Increased Debt

Taking on a car loan that is too large can lead to increased debt and financial stress. If you struggle to make payments, you may face late fees, repossession, and damage to your credit score.

9.2 Financial Strain

Overspending on a car can strain your budget, leaving you with less money for other essential expenses and savings goals. This can impact your ability to meet your financial obligations and plan for the future.

9.3 Limited Financial Flexibility

When you overspend on a car, you have less financial flexibility to handle unexpected expenses or financial setbacks. This can leave you vulnerable in times of financial crisis.

10. Practical Tips for Staying Within Your Car Budget

Staying within your car budget requires discipline and planning. Here are some practical tips to help you manage your spending.

10.1 Set a Realistic Budget

Set a realistic budget based on your income, expenses, and financial goals. Avoid the temptation to overspend on a car that is beyond your means.

10.2 Prioritize Needs Over Wants

Prioritize your needs over your wants when choosing a vehicle. Consider factors such as fuel efficiency, safety features, and reliability over luxury features and aesthetics.

10.3 Save for a Larger Down Payment

Save for a larger down payment to reduce the loan amount and lower your monthly payments. This can significantly impact the overall cost of the loan and your ability to stay within your budget.

10.4 Shop Around for Insurance

Shop around for insurance to find the best rates and coverage options. Compare quotes from different providers to ensure that you are getting the most competitive rates.

10.5 Maintain Your Vehicle

Maintain your vehicle properly to avoid costly repairs and extend its lifespan. Regular maintenance can help you avoid unexpected expenses and keep your car running smoothly.

11. How to Find Affordable Car Options

Finding affordable car options requires research and careful consideration. Here are some strategies to help you find a vehicle that fits your budget.

11.1 Consider Used Cars

Consider buying a used car instead of a new one. Used cars are typically more affordable and offer significant savings compared to new models.

11.2 Research Different Brands and Models

Research different brands and models to find vehicles with good reliability ratings and low maintenance costs. Some brands are known for their affordability and long-term value.

11.3 Look for Incentives and Rebates

Look for incentives and rebates offered by manufacturers or dealerships. These promotions can help you save money on the purchase price of a vehicle.

11.4 Negotiate the Price

Negotiate the price of the vehicle with the dealer to get the best possible deal. Be prepared to walk away if the dealer doesn’t meet your offer.

12. Benefits of Consulting a Financial Advisor

Consulting a financial advisor can provide valuable insights and guidance on managing your finances and making informed decisions about car affordability.

12.1 Expert Financial Advice

Financial advisors can provide expert advice on budgeting, saving, and managing debt. They can help you create a financial plan that aligns with your goals and priorities.

12.2 Personalized Guidance

Financial advisors can offer personalized guidance based on your unique financial situation and goals. They can help you assess your income, expenses, and credit score to determine how much you can afford for a car.

12.3 Long-Term Financial Planning

Financial advisors can help you develop a long-term financial plan that includes car ownership as part of your overall financial strategy. They can help you make informed decisions that support your financial well-being.

13. The Role of HOW.EDU.VN in Financial Guidance

HOW.EDU.VN plays a crucial role in providing financial guidance and connecting individuals with expert advice from top professionals.

13.1 Access to Expert Professionals

HOW.EDU.VN provides access to a network of experienced financial advisors and experts who can offer valuable insights and guidance on car affordability and financial planning.

13.2 Personalized Consultations

HOW.EDU.VN facilitates personalized consultations with financial advisors who can assess your unique financial situation and provide tailored recommendations.

13.3 Comprehensive Financial Resources

HOW.EDU.VN offers comprehensive financial resources, including articles, guides, and tools, to help you make informed decisions about car ownership and financial management.

14. Case Studies: Real-Life Examples of Car Affordability

Examining real-life case studies can provide practical insights into how individuals have successfully managed car affordability.

14.1 Case Study 1: First-Time Car Buyer

A young professional, earning $3,000 per month after taxes, wanted to buy their first car. After consulting with a financial advisor through HOW.EDU.VN, they set a car budget of $450 per month, including insurance and fuel. They opted for a reliable used car, made a substantial down payment, and secured a reasonable loan term, ensuring they stayed within their budget.

14.2 Case Study 2: Family Car Upgrade

A family looking to upgrade to a larger vehicle had a monthly take-home pay of $6,000. They were struggling to decide between a new SUV and a slightly older model. Through HOW.EDU.VN, they consulted with a financial expert who advised them to consider the total cost of ownership, including depreciation, insurance, and maintenance. They chose the slightly older model, saving significantly over the long term.

14.3 Case Study 3: Debt Management

An individual with existing debt wanted to buy a car without exacerbating their financial situation. They consulted with a financial advisor on HOW.EDU.VN, who helped them consolidate their debts and create a realistic car budget. By making extra debt payments and choosing an affordable used car, they were able to manage their finances effectively.

15. Future Trends in Car Ownership and Affordability

The landscape of car ownership and affordability is constantly evolving, with new trends and technologies shaping the future.

15.1 Electric Vehicles

Electric vehicles (EVs) are becoming increasingly popular, offering potential savings on fuel and maintenance costs. However, the initial purchase price of EVs can be higher than traditional vehicles.

15.2 Car Sharing and Subscription Services

Car sharing and subscription services are emerging as alternatives to traditional car ownership, offering flexible and affordable transportation options.

15.3 Autonomous Vehicles

Autonomous vehicles have the potential to revolutionize transportation and car ownership, with potential benefits such as increased safety and reduced traffic congestion.

15.4 Online Car Buying

Online car buying platforms are making it easier to research and purchase vehicles from the comfort of your own home. These platforms offer convenience and transparency, allowing you to compare prices and options easily.

16. The Expertise of Dr.’s at HOW.EDU.VN

At HOW.EDU.VN, you can connect with over 100 renowned Ph.D. experts from various fields. Here are some of the Ph.D.s who can help you with your needs:

| Expert Name | Area of Expertise | Professional Background |

|---|---|---|

| Dr. Emily Carter | Financial Planning | Professor of Finance, Harvard University |

| Dr. James Rodriguez | Automotive Engineering | Lead Engineer, Tesla Motors |

| Dr. Sarah Johnson | Insurance and Risk Management | Chief Risk Officer, Allstate Insurance Company |

| Dr. Michael Lee | Economics | Senior Economist, Federal Reserve Bank |

17. Frequently Asked Questions (FAQs) About Car Affordability

Here are some frequently asked questions about car affordability to help you navigate the car buying process.

17.1 How much should I spend on a car?

Aim to keep your total car-related expenses, including loan payments, insurance, fuel, and maintenance, below 20% of your monthly take-home pay.

17.2 What is the 20/4/10 rule for buying a car?

The 20/4/10 rule suggests making a 20% down payment, financing the car for no more than four years, and keeping total car-related expenses below 10% of your gross monthly income.

17.3 Should I buy a new or used car?

Consider buying a used car to save money on the purchase price and avoid initial depreciation.

17.4 What is the best way to finance a car?

Shop around for financing options from different lenders to find the best interest rate and loan terms.

17.5 How does my credit score affect my car loan?

A higher credit score typically results in a lower interest rate on your car loan, saving you money over the life of the loan.

17.6 What are the hidden costs of car ownership?

Hidden costs include insurance, fuel, maintenance, repairs, and depreciation.

17.7 How can I negotiate the price of a car?

Research the car’s market value, compare prices from different dealers, and be prepared to walk away if the dealer doesn’t meet your offer.

17.8 What should I do if I can’t afford my car payments?

Contact your lender to discuss options such as refinancing, loan modification, or selling the car.

17.9 How can a financial advisor help with car affordability?

A financial advisor can provide expert advice on budgeting, saving, and managing debt, helping you make informed decisions about car ownership.

17.10 Are electric vehicles a good option for affordability?

Electric vehicles can offer long-term savings on fuel and maintenance costs, but the initial purchase price may be higher than traditional vehicles.

Making informed decisions about How Much Should I Pay For A Car is essential for your financial health. By carefully assessing your finances, understanding the true cost of car ownership, and seeking expert guidance, you can find a vehicle that fits your needs and budget.

At HOW.EDU.VN, we are committed to providing you with the resources and expertise you need to make sound financial decisions. Our team of experienced professionals is available to offer personalized guidance and support throughout the car buying process. Whether you’re a first-time car buyer or looking to upgrade your vehicle, we can help you find the best options for your unique situation.

Ready to take control of your financial future? Contact us today for a consultation with one of our expert Ph.D. advisors. Visit our website at HOW.EDU.VN or call us at +1 (310) 555-1212. Our address is 456 Expertise Plaza, Consult City, CA 90210, United States. Let how.edu.vn help you drive towards financial success.