How Much Is A Billion Dollars? It’s a question that often boggles the mind. At HOW.EDU.VN, we’ll break down this massive number into relatable terms and explore its significance, helping you grasp the true scale of a billion dollars. Understanding large sums like this can be useful for finance management and investment strategies.

1. What Is A Billion Dollars?

A billion dollars is a substantial sum of money, equivalent to one thousand million. Written numerically, it is 1,000,000,000. The scale of a billion dollars can be difficult to comprehend, and it’s often used to measure significant financial assets, government budgets, and the net worth of the wealthiest individuals. Visualizing such a large number requires breaking it down into more relatable concepts and benchmarks.

1.1. Million vs. Billion vs. Trillion

Understanding the difference between a million, a billion, and a trillion can provide a clearer perspective.

- Million: 1,000 x 1,000 = 1,000,000 (one followed by six zeros)

- Billion: 1,000,000 x 1,000 = 1,000,000,000 (one followed by nine zeros)

- Trillion: 1,000,000,000 x 1,000 = 1,000,000,000,000 (one followed by twelve zeros)

Scientists often use scientific notation to simplify these large numbers. For example, 1 billion is 10^9, and 1 trillion is 10^12. This notation is useful in fields like astronomy and advanced physics.

1.2. Why Is It Hard to Visualize Large Numbers?

The human brain struggles with very large numbers because our everyday experiences rarely involve quantities of that magnitude. Mathematician Spencer Greenberg noted that while we can easily visualize five things, or even roughly visualize around 100 things, our ability to visualize completely fails when we talk about millions. People develop an intuition that 10 is much bigger than one and that 100 is a drastic increase over 10, but this intuition doesn’t extend to billions or trillions.

To better comprehend these large numbers, Greenberg suggests converting them into alternate units of measurement. This can help reduce the numbers to more comprehensible amounts.

2. How to Visualize a Billion Dollars

Visualizing a billion dollars requires breaking it down into smaller, more relatable amounts. Here are a few ways to comprehend this massive number:

2.1. Time

One way to understand the value of a billion is to measure it in terms of time. One million seconds is approximately 11.57 days. One billion seconds is approximately 31.71 years. One trillion seconds would equate to 31,710 years. This comparison helps to illustrate the vast difference between these amounts.

2.2. Population

If $1 billion was divided among the current total U.S. population of approximately 341.1 million people, each person would receive about $3. In contrast, if $1 trillion were split between the same population, each person would get approximately $2,932. These figures provide a tangible sense of scale.

2.3. Distance

Imagine walking one billion steps. Assuming the average person’s footstep approximates a 2-foot stride, then a 1 billion-step journey would cover 2 billion feet. Since 1 mile equals 5,280 feet, this equates to 378,788 miles. The distance around the Earth’s equator is roughly 24,793 miles, so 1 billion steps would take you around the equator more than 15 times.

Calculation:

- 2,000,000,000 ft. / 5,280 ft. per mile = 378,788 total miles

- 378,788 miles / 24,793 miles = Approximately 15 times around the equator

2.4. Food

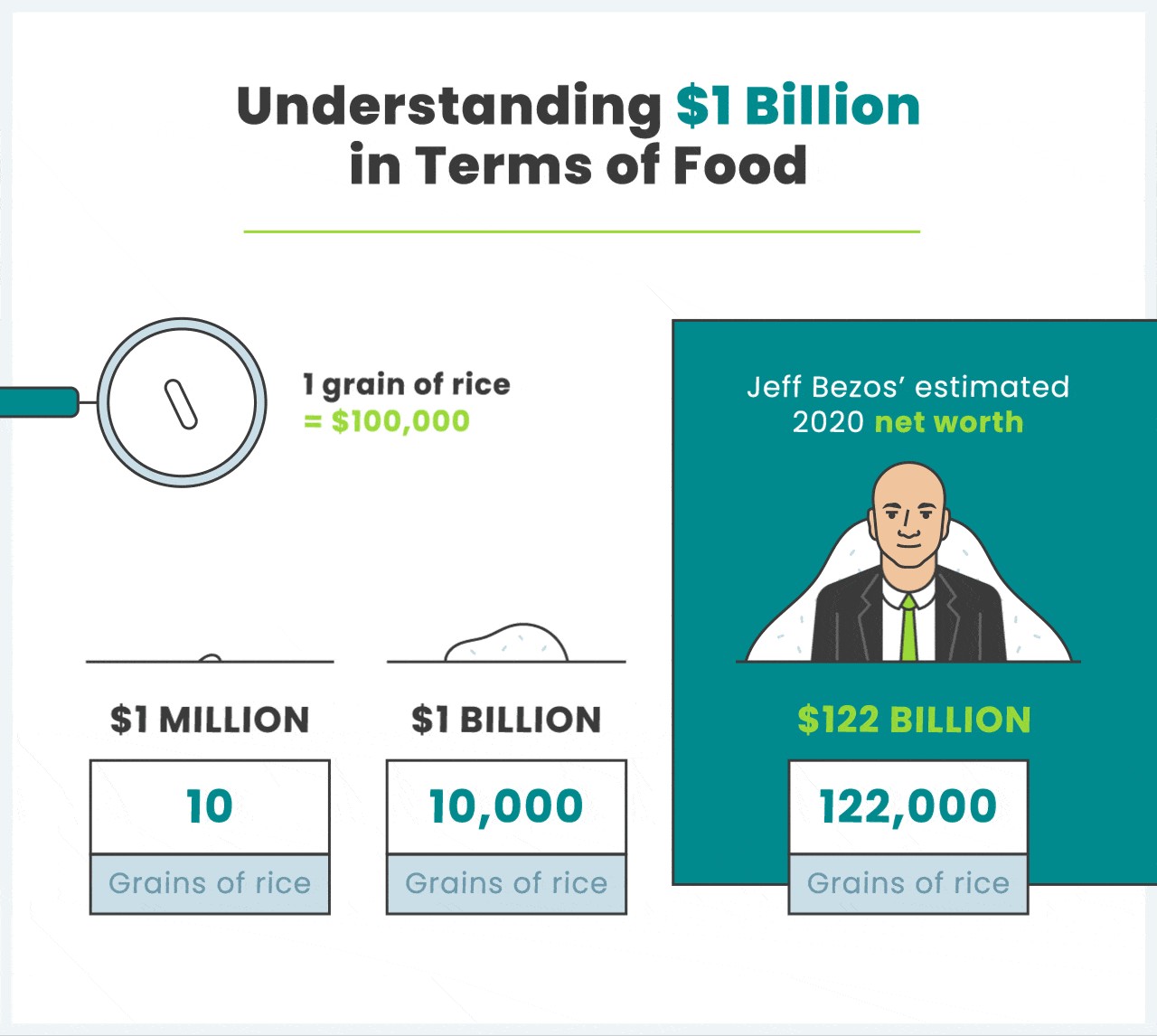

Visualizing Food Quantities Representing a Billion Dollars

Visualizing Food Quantities Representing a Billion Dollars

In 2020, a TikTok star used grains of rice to illustrate the differences between large dollar amounts. Each grain represented $100,000. A single grain represented $100,000, 10 grains represented $1 million, and 10,000 grains represented $1 billion. He then visualized Jeff Bezos’ estimated net worth at the time, which was $122 billion, using 58 pounds of rice.

3. Where Does a Billion Dollars Come From?

Understanding how individuals or entities accumulate a billion dollars can provide a broader perspective on wealth generation.

3.1. Entrepreneurship

Many billionaires create their wealth through entrepreneurship, starting and scaling successful businesses. Entrepreneurs identify market needs, develop innovative solutions, and build organizations that generate significant revenue and profits.

Examples of Industries That Can Generate Billions:

- Technology: Tech companies like Apple, Microsoft, and Amazon have created enormous wealth for their founders and shareholders.

- Finance: Financial institutions, investment firms, and hedge funds can generate billions through strategic investments and financial services.

- Retail: Retail giants like Walmart and Amazon have built empires by dominating the consumer market.

- Real Estate: Developing and managing large-scale real estate projects can lead to substantial wealth accumulation.

3.2. Investments

Strategic investments in stocks, bonds, real estate, and other assets can lead to significant wealth accumulation over time. Successful investors identify undervalued assets, make informed decisions, and hold investments for the long term.

3.3. Inheritance

Some individuals inherit substantial wealth, providing them with a significant head start in accumulating a billion dollars. Inheritance can come in the form of cash, stocks, real estate, or other assets.

Alice Walton, the daughter of Walmart founder Sam Walton, is one of the wealthiest women in the world due to her inheritance. As of November 28, 2023, her estimated assets totaled $61.6 billion.

3.4. Lottery

While statistically unlikely, winning the lottery can instantly provide a person with a billion dollars. Lottery prizes over the $1 billion mark have been awarded only a handful of times in the United States. The odds of winning a Powerball jackpot are 1 in 292,201,338. Three lucky winners split a $1.58 billion jackpot in 2016, with each ticket worth $528.8 million.

3.5. Real Estate Investments

Real estate accounts for two-thirds of the net worth of the world’s wealthiest people, largely thanks to the relatively consistent income and capital appreciation these investments offer, according to a McKinsey report on global wealth. Many wealthy investors believe that real estate investments should grow their wealth, not simply protect it.

Business magnate Mukesh Ambani acquired the first-ever billion-dollar private residence. Known as Antilia, it is located in Mumbai, India, spans 400,000 square feet, and has a current market value of nearly $2 billion.

4. Financial Goals and Retirement Savings

While accumulating a billion dollars may not be a realistic goal for most people, focusing on managing expenses and investing wisely within one’s risk tolerance is essential. Setting short-term goals for retirement savings can be motivating, especially for younger investors.

4.1. Saving for Retirement

Retirement statistics indicate that the median household retirement savings for American workers is only about $93,000, and that 44% of retirees regret not saving and investing for retirement sooner. Saving as early as possible and implementing effective investment strategies are important aspects of planning for retirement.

4.2. The Unrealistic Goal of Saving $1 Billion

According to the U.S. Census Bureau, the 2023 median family income in the United States was $78,538. If a family deposited every penny of their salary directly into savings, with no taxes levied or living expenses incurred, and remained untouched, they would still face a very long wait to accumulate $1 billion.

Calculation:

$1,000,000,000 ÷ $78,538 = Approximately 12,732 years

Real-life economic conditions entail taxes, living expenses, and interest earned on savings and investments. Depending on your annual income earned and the three aforementioned variables, the odds of attaining $1 billion can increase or decrease. Nevertheless, it is a very unrealistic target for the vast majority of people.

4.3. Alternative Financial Goals

Instead of focusing solely on accumulating a specific dollar amount, consider setting goals related to financial independence, early retirement, or achieving specific lifestyle goals. These goals can be more attainable and provide a greater sense of fulfillment.

5. The Impact of a Billion Dollars

A billion dollars can have a significant impact on individuals, organizations, and society as a whole.

5.1. Personal Impact

For an individual, having a billion dollars provides financial security, freedom, and the ability to pursue personal passions. It also comes with the responsibility of managing such a large sum of money wisely and ethically.

5.2. Organizational Impact

For a company, a billion-dollar valuation signifies success, market dominance, and the potential for further growth. It can attract investors, talent, and strategic partnerships.

5.3. Societal Impact

Billionaires and large corporations have the resources to make significant contributions to society through philanthropy, investments in innovation, and job creation. However, wealth inequality remains a concern, and the impact of wealth on political influence is often debated.

6. What Can You Buy With a Billion Dollars?

To further put the value of a billion dollars into perspective, here are some examples of what you could purchase with that amount:

6.1. Real Estate

You could buy several luxury homes, apartment buildings, or commercial properties. For example, you could purchase multiple units in some of the most expensive residential buildings in New York City or London.

6.2. Sports Teams

While some of the most valuable sports teams in the world are worth more than a billion dollars, you could still purchase a smaller team in a major league or a significant stake in a larger franchise.

6.3. Art and Collectibles

The art market often sees individual pieces sell for tens or hundreds of millions of dollars. With a billion dollars, you could assemble an impressive collection of art, antiques, and other collectibles.

6.4. Start-Up Investments

You could fund numerous start-up companies, providing them with the capital they need to grow and innovate. This could involve investments in technology, healthcare, or other sectors.

6.5. Charitable Contributions

You could make a substantial impact on society by donating to various charitable causes. This could include funding research, supporting education, or addressing poverty and inequality.

7. Case Studies: Billion-Dollar Success Stories

Examining real-life examples of individuals and companies that have achieved billion-dollar success can provide valuable insights and inspiration.

7.1. Jeff Bezos and Amazon

Jeff Bezos founded Amazon in 1994 as an online bookstore. Through innovation, customer focus, and strategic expansion, Amazon has grown into a global e-commerce giant with a market capitalization of over $1 trillion. Bezos’ net worth has fluctuated but has often been over $100 billion, making him one of the wealthiest people in the world.

7.2. Bill Gates and Microsoft

Bill Gates co-founded Microsoft in 1975, revolutionizing the personal computer industry with its Windows operating system. Microsoft’s success has made Gates one of the wealthiest individuals globally, with a net worth often exceeding $100 billion. He has since focused on philanthropy through the Bill & Melinda Gates Foundation.

7.3. Warren Buffett and Berkshire Hathaway

Warren Buffett is a legendary investor and the CEO of Berkshire Hathaway. Through strategic investments in various companies and industries, Buffett has built a massive fortune and is known for his value investing approach. His net worth is typically around $100 billion, and he has pledged to donate most of his wealth to charitable causes.

8. Common Misconceptions About Billionaires

There are several common misconceptions about billionaires that are worth addressing.

8.1. Billionaires Are Always Happy

Having a billion dollars does not guarantee happiness or fulfillment. Many billionaires face challenges related to managing their wealth, maintaining relationships, and finding purpose in life.

8.2. Billionaires Are All Self-Made

While many billionaires have built their wealth through entrepreneurship and hard work, some have inherited significant wealth, providing them with a head start.

8.3. Billionaires Don’t Pay Taxes

Billionaires are subject to various taxes, including income tax, capital gains tax, and estate tax. However, they often employ sophisticated tax strategies to minimize their tax liabilities.

8.4. Billionaires Are All Greedy

While some billionaires may be perceived as greedy or self-centered, many are actively involved in philanthropy and use their wealth to address social and environmental issues.

9. How HOW.EDU.VN Can Help You Achieve Your Financial Goals

At HOW.EDU.VN, we connect you directly with leading experts, including Ph.D.s, to provide personalized and in-depth financial guidance. Whether you’re looking to understand investment strategies, plan for retirement, or manage your wealth more effectively, our team is here to help. We offer expert consultations that save you time and money, ensuring your financial decisions are both informed and secure.

9.1. Benefits of Consulting with Our Experts

- Direct Access to Experts: Connect with Ph.D.s and top professionals in various fields.

- Personalized Advice: Receive custom solutions tailored to your unique financial situation.

- Save Time and Money: Avoid costly mistakes by getting expert guidance upfront.

- Secure and Reliable: Ensure the confidentiality and trustworthiness of your consultations.

9.2. Our Team of Experts

Our team includes financial analysts, investment strategists, retirement planners, and wealth management experts. Each expert brings years of experience and a deep understanding of the financial landscape to help you achieve your goals.

Table of Financial Experts at HOW.EDU.VN

| Expert Name | Area of Expertise | Credentials |

|---|---|---|

| Dr. Emily Carter | Investment Strategies | Ph.D. in Finance, CFA |

| Dr. James Maxwell | Retirement Planning | Ph.D. in Economics, CFP |

| Dr. Sophia Rodriguez | Wealth Management | Ph.D. in Business Administration, CPA |

9.3. Get Started Today

Don’t let financial complexities hold you back. Contact HOW.EDU.VN today to connect with our team of experts and start building a secure and prosperous future. We are dedicated to providing the insights and solutions you need to navigate the financial world with confidence.

10. Frequently Asked Questions (FAQ)

10.1. What is the difference between net worth and income?

Net worth is the value of your assets minus your liabilities, providing a snapshot of your overall financial position. Income is the money you receive regularly, such as from a salary or investments.

10.2. How can I start saving for retirement early?

Start by setting clear financial goals, creating a budget, and automating your savings. Consider contributing to tax-advantaged retirement accounts like 401(k)s or IRAs.

10.3. What are the key factors to consider when investing?

Consider your risk tolerance, investment timeline, and financial goals. Diversify your portfolio and seek professional advice if needed.

10.4. How do I create a budget?

Track your income and expenses, categorize your spending, and identify areas where you can cut back. Use budgeting tools or apps to help you stay organized.

10.5. What are the benefits of working with a financial advisor?

A financial advisor can provide personalized advice, help you develop a financial plan, and manage your investments. They can also help you navigate complex financial decisions.

10.6. What is financial independence, and how can I achieve it?

Financial independence is having enough income to cover your living expenses without needing to work. Achieve it by increasing your savings, reducing your debt, and investing wisely.

10.7. How can I reduce my tax liabilities?

Take advantage of tax deductions and credits, contribute to tax-advantaged accounts, and consult with a tax professional for personalized advice.

10.8. What are the most common investment mistakes to avoid?

Avoid emotional investing, neglecting diversification, and failing to rebalance your portfolio. Stay informed and seek professional guidance.

10.9. How can I improve my credit score?

Pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts.

10.10. What resources does HOW.EDU.VN offer for financial planning?

HOW.EDU.VN offers direct access to financial experts, personalized advice, and comprehensive resources to help you achieve your financial goals.

Understanding the magnitude and impact of a billion dollars is crucial for grasping financial concepts and setting realistic goals. Whether you aim to manage your investments more effectively, plan for retirement, or simply understand the complexities of wealth, HOW.EDU.VN is here to provide expert guidance and support.

Ready to take control of your financial future? Contact us today at 456 Expertise Plaza, Consult City, CA 90210, United States, or reach out via WhatsApp at +1 (310) 555-1212. Visit our website at HOW.EDU.VN to learn more and connect with our team of leading Ph.D.s. Let how.edu.vn be your trusted partner in achieving financial success.