As you navigate the complexities of timberland valuation, understanding the factors that influence the worth of an acre of timber is essential, and at HOW.EDU.VN, we provide expert insights to help you make informed decisions. Market dynamics, timber type, and environmental trends all play significant roles in determining timber value. Contact HOW.EDU.VN today to get matched with our expert team, specializing in timber evaluation, forest product strategies, and carbon sequestration management.

1. What Factors Influence The Price Of An Acre Of Timber?

The price of an acre of timber is primarily influenced by the dynamics of supply and demand. This interplay is shaped by various elements, including location, the types of mills nearby, their proximity, and the volume and type of timber products consumed in the area. The specific products available on a tract of timber significantly determine its value per acre.

1.1. Location and Proximity to Mills

Timberlands located near sawmills or pulp mills typically command higher prices due to reduced transportation costs. For example, in the U.S. South, sawtimber used for lumber often fetches a premium compared to pulpwood because of its higher demand and value in construction and manufacturing industries.

1.2. Timber Type and Age

The type and age of timber significantly affect its value. Managed pine plantations, which are typically clearcut at 25-35 years, can yield approximately 80-105 tons per acre. The highest returns often come from sawtimber, which includes trees with a diameter at breast height (DBH) of 12 inches or more. Natural stands with mixed hardwoods can be even more valuable if they contain high-grade logs suitable for veneer or specialty lumber.

1.3. Harvest Method

The chosen harvest method also impacts the value of timber. Clearcuts maximize the volume of timber harvested and, therefore, the revenue per acre. In contrast, thinnings, which involve selectively removing trees, provide earlier cash flow but typically result in lower overall yields. The optimal choice depends on market timing and specific management goals.

1.4. Market Trends

Market trends, influenced by factors like construction cycles, paper production, and sustainability initiatives, play a crucial role. Demand for timber products, such as lumber, pulp, and bioenergy materials, fluctuates, impacting timber prices. For instance, an increase in construction activity can drive up demand for lumber, leading to higher prices for sawtimber.

Understanding these factors is essential for accurately assessing the value of timberland. Historical trends and current market conditions provide valuable context for making informed decisions about timber management and sales. Contact HOW.EDU.VN at 456 Expertise Plaza, Consult City, CA 90210, United States or call us at Whatsapp: +1 (310) 555-1212 for expert guidance.

2. What Are The Price Trends For U.S. South Pine Timber (2022-2024)?

Analysis of transaction-based data from 2022–2024 provides insights into the stumpage prices for U.S. South plantation and natural pine, focusing on clearcut and thinning harvests. This data reflects the impact of market dynamics on timber valuation.

2.1. Plantation Pine Clearcuts (26+ Years)

Mature plantation stands, averaging 80-105 tons per acre, experienced a dip in value in 2023 due to a temporary oversupply of sawtimber. However, as lumber demand strengthened in 2024, there was a recovery. Understanding these fluctuations is crucial for timing harvests effectively.

2.2. Plantation Pine Thinnings

Thinnings, which yield 30-50 tons per acre of mostly pulpwood and chip-n-saw, showed lower values for younger stands (16-20 years) due to smaller log sizes. The 21-25-year stands fetched higher prices with more chip-n-saw and small sawtimber. Prices fluctuated with pulp market demand, highlighting the importance of monitoring pulp market trends.

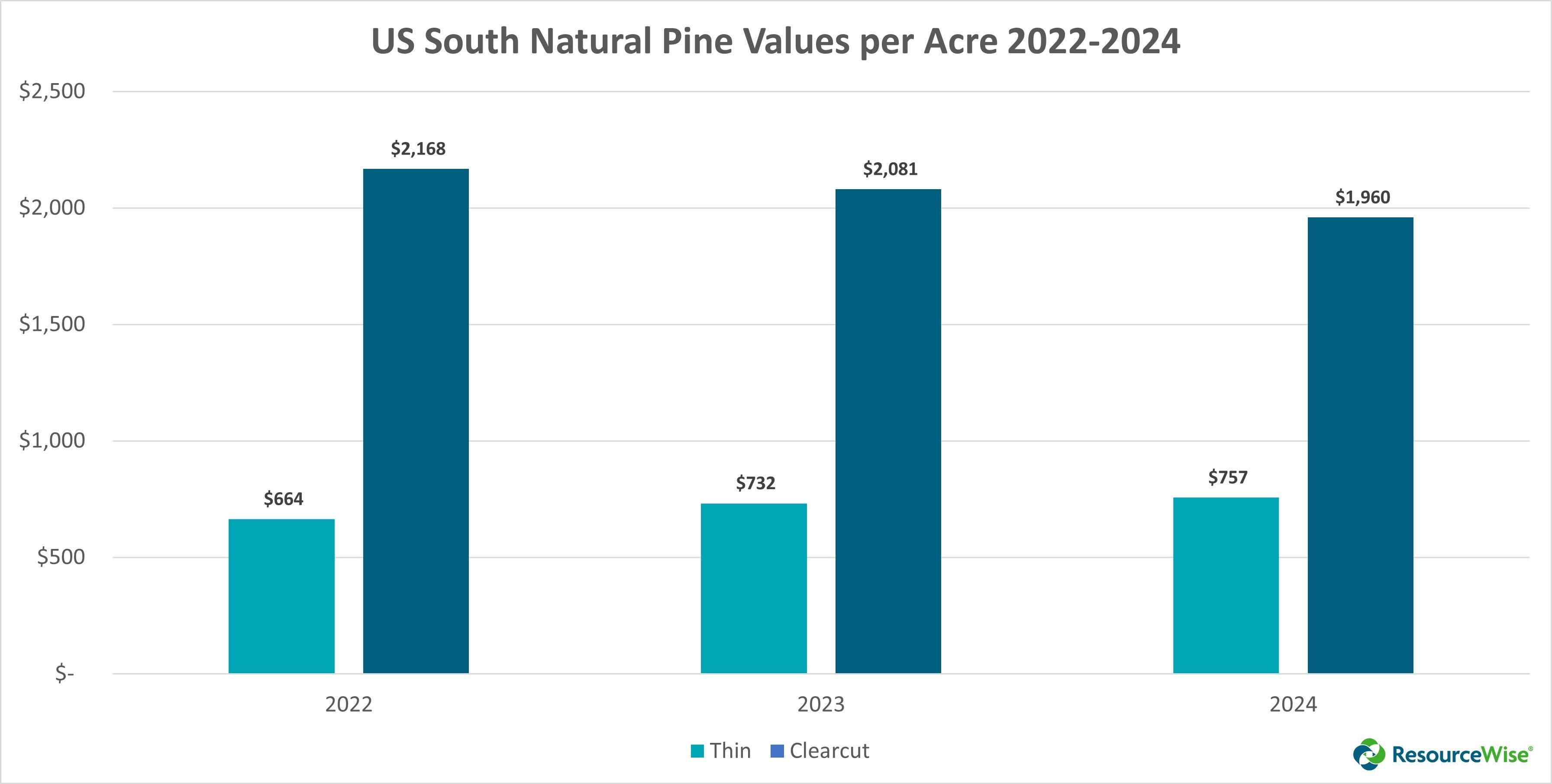

2.3. Natural Pine Clearcuts

Natural stands, which are often denser with 90–110 tons per acre and mixed with hardwoods, saw a gradual decline in value over the period. This decline reflects softening hardwood sawtimber prices and reduced pulpwood demand. Understanding the composition of natural stands is essential for accurate valuation.

2.4. Natural Pine Thinnings

Thinnings in natural stands, yielding 40-60 tons per acre, showed a steady price increase, driven by consistent pulpwood demand and higher removal volumes compared to plantations. This consistency makes natural pine thinnings a reliable source of income.

Compared to 2017-2019, when plantation clearcuts averaged $1,542-$1,694 per acre and natural clearcuts peaked at $2,055 per acre, the 2022-2024 data show plantation values trending higher due to inflation and sawtimber demand. Natural clearcut values have softened slightly due to market saturation. For a personalized assessment of your timberland, contact our experts at HOW.EDU.VN via Whatsapp: +1 (310) 555-1212.

Source: ResourceWise (2025)

US-South-Natural-Pine-Values

US-South-Natural-Pine-Values

Source: ResourceWise (2025)

3. How Does Decarbonization Influence Timber Valuation?

Global decarbonization efforts are increasingly influencing timber’s value, reshaping demand, and creating new opportunities for landowners. These efforts recognize the critical role of forests in carbon sequestration and climate mitigation.

3.1. Carbon Dioxide Removal (CDR) Market

The carbon dioxide removal (CDR) market, projected to grow to $100 billion annually between 2030 and 2035, is opening new revenue streams for timberlands. Timberlands can generate income through carbon sequestration or by supplying biomass for Bioenergy with Carbon Capture and Storage (BECCS). Companies like Drax are planning wood-fired power plants in the U.S. South, using biomass to produce renewable energy while capturing carbon emissions.

3.2. Sustainability Policies

Sustainability policies are also playing a significant role. The EU’s target to reduce emissions by 55% by 2030 and U.S. investments in carbon capture ($2.54 billion through 2025) are boosting demand for wood as a renewable alternative to fossil-based materials. This trend could support sawtimber prices, particularly in regions with strong sustainability mandates.

3.3. Innovations and Biofuels

Innovations like biochar, which uses wood waste to lock carbon in soil, might divert low-grade timber from pulp markets, potentially softening pulpwood prices unless offset by carbon credit revenues. Additionally, policy uncertainty in biofuels, such as the expiration of U.S. biodiesel tax credits, can impact biomass demand, adding another layer of complexity to timber markets.

These decarbonization trends highlight timber’s evolving role, not just as a raw material but as a key player in climate mitigation. To understand how these trends impact your timberland, consult the experts at HOW.EDU.VN, located at 456 Expertise Plaza, Consult City, CA 90210, United States.

4. What Is An Acre Of Timber Worth?

An acre’s value depends on specific stand and market conditions. Based on 2022–2024 averages:

- A 100-acre plantation in the U.S. South at 26+ years might yield $211,100–$227,500 from a clearcut.

- The same plantation, thinned at 21–25 years, could bring $53,800–$90,400.

- A 100-acre natural stand might be valued at $196,000–$216,800, with thinnings at $66,400–$75,700.

These are starting points—site-specific factors like soil quality, accessibility, and mill proximity can significantly adjust these figures. Accurate timber valuation requires considering these variables and market dynamics.

4.1. Plantation Pine Clearcut Valuation

For a 100-acre plantation of 26+ years, a clearcut might yield between $211,100 and $227,500. This valuation is influenced by factors such as the quality of the timber, the efficiency of the harvesting process, and the prevailing market prices for sawtimber.

4.2. Plantation Pine Thinning Valuation

The same plantation thinned at 21–25 years could bring in $53,800–$90,400. The range in value depends on the volume of pulpwood and chip-n-saw harvested, as well as the demand for these products in the market.

4.3. Natural Stand Valuation

A 100-acre natural stand might be valued at $196,000–$216,800, with thinnings at $66,400–$75,700. The valuation of natural stands is affected by the mix of hardwood and softwood species, the quality of the timber, and market demand for both sawtimber and pulpwood.

To get an accurate valuation that reflects the specific conditions of your timberland, contact our experts at HOW.EDU.VN via Whatsapp: +1 (310) 555-1212.

5. How Does Timber Valuation Impact Forest Management Strategies?

Timber valuation plays a critical role in shaping forest management strategies. Understanding the value of your timberland influences decisions related to harvesting, replanting, and sustainable practices. Here are several ways timber valuation impacts forest management:

5.1. Determining Optimal Harvest Timing

Accurate timber valuation helps determine the optimal time for harvesting. By assessing current market conditions and projecting future trends, landowners can make informed decisions about when to clearcut or thin their timber stands to maximize revenue.

5.2. Selecting Appropriate Silvicultural Practices

Timber valuation informs the selection of appropriate silvicultural practices. Whether it’s choosing between clearcutting and selective harvesting or deciding on the best methods for site preparation and replanting, understanding the value of different timber products is essential.

5.3. Evaluating Investment in Sustainable Practices

Timber valuation helps evaluate the return on investment in sustainable practices. As the demand for sustainably sourced timber increases, landowners who invest in practices that promote forest health and biodiversity can potentially increase the long-term value of their timberland.

5.4. Assessing the Feasibility of Carbon Sequestration Projects

Timber valuation is crucial for assessing the feasibility of carbon sequestration projects. With the growing carbon dioxide removal (CDR) market, landowners can explore opportunities to generate revenue through carbon credits. Accurate timber valuation helps determine the financial viability of these projects.

Integrating timber valuation into forest management strategies ensures sustainable and profitable use of timberland resources.

6. What Are The Key Trends To Watch In Timber Valuation?

Several key trends are shaping the future of timber valuation. Staying informed about these trends is essential for landowners and investors looking to maximize the value of their timber assets.

6.1. Increasing Demand for Sustainable Timber Products

The demand for sustainable timber products is on the rise as consumers and businesses prioritize environmentally responsible practices. This trend is driven by growing awareness of the importance of forest conservation and the role of timber in mitigating climate change.

6.2. Expansion of the Carbon Dioxide Removal (CDR) Market

The carbon dioxide removal (CDR) market is rapidly expanding, creating new opportunities for timberland owners. As businesses and governments invest in carbon sequestration projects, timberlands are becoming increasingly valuable for their ability to store carbon.

6.3. Technological Advancements in Forest Management

Technological advancements in forest management are improving the accuracy and efficiency of timber valuation. Tools such as remote sensing, LiDAR, and GIS are enabling more precise assessments of timber volume, species composition, and forest health.

6.4. Policy and Regulatory Changes

Policy and regulatory changes are influencing timber markets and valuation. Government initiatives aimed at promoting sustainable forestry, reducing carbon emissions, and protecting biodiversity can impact the value of timberlands.

Monitoring these trends and adapting forest management strategies accordingly is crucial for maximizing the value of timber assets in the evolving landscape. For tailored advice, contact us at HOW.EDU.VN.

7. How Do Macroeconomic Factors Impact Timber Valuation?

Macroeconomic factors significantly influence timber valuation by affecting demand, supply, and investment in the forestry sector. Understanding these factors is crucial for making informed decisions about timberland management and investment.

7.1. Economic Growth

Economic growth drives demand for timber products, particularly in construction and manufacturing. Increased construction activity leads to higher demand for lumber, which in turn increases the value of sawtimber.

7.2. Interest Rates

Interest rates affect the cost of borrowing for timberland investments and housing construction. Lower interest rates can stimulate housing demand, increasing the demand for lumber and driving up timber prices.

7.3. Inflation

Inflation impacts the cost of timberland management and harvesting. Higher inflation can increase the cost of labor, equipment, and transportation, affecting the profitability of timber operations. However, timber prices may also increase with inflation, providing a hedge against rising costs.

7.4. Currency Exchange Rates

Currency exchange rates affect the competitiveness of timber exports. A weaker domestic currency can make timber exports more attractive, increasing demand and driving up prices.

Monitoring these macroeconomic factors provides insights into the broader economic environment affecting timber valuation and informs strategic decision-making in the forestry sector.

8. What Role Do Forest Inventory and Analysis (FIA) Data Play in Timber Valuation?

Forest Inventory and Analysis (FIA) data plays a crucial role in timber valuation by providing comprehensive information about forest resources. FIA data is collected by the U.S. Forest Service and includes detailed measurements of forest area, tree species, volume, growth, mortality, and removals.

8.1. Assessing Timber Volume and Quality

FIA data is used to assess timber volume and quality across large geographic areas. This information helps determine the availability of different timber products and their potential value.

8.2. Monitoring Forest Health and Productivity

FIA data is used to monitor forest health and productivity over time. This information helps identify areas at risk from pests, diseases, or environmental stressors, informing forest management decisions.

8.3. Supporting Forest Planning and Policy

FIA data is used to support forest planning and policy at the national, regional, and local levels. This information helps policymakers make informed decisions about forest conservation, management, and utilization.

8.4. Enhancing Timber Valuation Accuracy

FIA data enhances the accuracy of timber valuation by providing a reliable source of information about forest resources. Integrating FIA data into timber valuation models improves the precision of value estimates.

Leveraging FIA data in timber valuation improves the accuracy and reliability of value assessments.

9. How Does Climate Change Impact Timber Valuation?

Climate change is increasingly impacting timber valuation through its effects on forest health, productivity, and market dynamics. Understanding these impacts is essential for making informed decisions about timberland management and investment.

9.1. Increased Risk of Wildfires and Pests

Climate change increases the risk of wildfires and pest outbreaks, which can damage or destroy timber stands. These events can reduce timber volume and quality, leading to lower valuations.

9.2. Changes in Forest Growth and Productivity

Climate change alters forest growth and productivity patterns. Changes in temperature and precipitation can affect tree growth rates, species distribution, and overall forest health, impacting timber yields and values.

9.3. Altered Market Demand for Timber Products

Climate change influences market demand for timber products. Increased demand for sustainable building materials and renewable energy sources can drive up demand for sustainably managed timber, increasing its value.

9.4. Enhanced Carbon Sequestration Opportunities

Climate change enhances carbon sequestration opportunities in timberlands. As businesses and governments seek to reduce carbon emissions, timberlands are becoming increasingly valuable for their ability to store carbon.

Addressing climate change risks and leveraging carbon sequestration opportunities is essential for maintaining and enhancing timber valuation in a changing climate.

10. What Are The Benefits Of Seeking Expert Advice On Timber Valuation From HOW.EDU.VN?

Seeking expert advice on timber valuation from HOW.EDU.VN provides numerous benefits, ensuring informed decisions and maximizing the value of your timberland assets.

10.1. Access to Specialized Knowledge and Experience

Our team comprises experienced professionals with specialized knowledge in timber valuation, forest management, and market analysis. We provide insights based on the latest data and industry best practices.

10.2. Accurate and Reliable Valuation Services

We offer accurate and reliable valuation services tailored to your specific needs. Our comprehensive assessments consider site-specific factors, market dynamics, and emerging trends, ensuring precise value estimates.

10.3. Strategic Guidance on Forest Management

We provide strategic guidance on forest management practices to optimize the value of your timberland. Our recommendations align with your goals, whether maximizing timber production, enhancing sustainability, or leveraging carbon sequestration opportunities.

10.4. Support for Informed Decision-Making

We support informed decision-making by providing clear and concise reports, expert opinions, and ongoing support. Our goal is to empower you to make strategic choices that enhance the long-term value of your timber assets.

Rely on HOW.EDU.VN for expert timber valuation services that drive sustainable growth and value.

Here’s a Table of Experts in Timber Valuation Available at HOW.EDU.VN

| Expert Name | Specialization | Experience | Notable Achievement |

|---|---|---|---|

| Dr. Emily Carter | Forest Economics & Market Analysis | 20+ years in timber market analysis, economic modeling, and sustainable forest management. | Developed economic models for predicting timber price fluctuations. |

| Dr. James Miller | Forest Management & Silviculture | 15+ years in forest management, silviculture, and sustainable harvesting practices. | Implemented sustainable harvesting practices, increasing timber yield by 30%. |

| Dr. Laura Green | Carbon Sequestration & Climate | 10+ years in carbon sequestration, climate change mitigation, and carbon credit markets. | Advised governments and companies on carbon sequestration strategies. |

Optimize Your Timber Investment with Expert Advice

Understanding the intricacies of timber valuation is essential for maximizing the potential of your timberland investment, and HOW.EDU.VN is here to provide the expertise you need. Our team of seasoned professionals offers specialized knowledge, accurate valuation services, and strategic guidance to optimize your forest management practices. With the increasing importance of sustainable timber products and the emergence of the carbon dioxide removal (CDR) market, staying informed and making data-driven decisions is more critical than ever.

Don’t navigate the complexities of timber valuation alone. Contact HOW.EDU.VN today at 456 Expertise Plaza, Consult City, CA 90210, United States, or reach us via Whatsapp at +1 (310) 555-1212 to connect with our team of experienced experts. Let us help you unlock the full potential of your timberland, ensuring sustainable growth and long-term value. Partner with HOW.EDU.VN and transform your timber assets into a thriving, environmentally responsible investment.

FAQ: Common Questions About Timber Valuation

Q1: What is timber valuation?

Timber valuation is the process of determining the monetary worth of standing trees or timberland, considering factors like tree species, size, quality, location, and market conditions.

Q2: Why is timber valuation important?

Timber valuation is essential for making informed decisions about buying, selling, managing, and insuring timberland, ensuring fair transactions and optimal resource utilization.

Q3: What factors affect timber valuation?

Factors include tree species, size, quality, location, accessibility, market demand, economic conditions, and environmental regulations.

Q4: How often should timber be valued?

Timber should be valued periodically, especially before significant management decisions like harvesting or selling, or when market conditions change substantially.

Q5: What is the difference between stumpage price and delivered price?

Stumpage price is the value of timber as it stands in the forest, while delivered price includes the cost of harvesting and transporting the timber to the mill.

Q6: How does location impact timber valuation?

Location affects transportation costs and proximity to markets, influencing the profitability of harvesting and the overall value of the timber.

Q7: What role does tree age play in timber valuation?

Tree age affects size and quality, with mature trees typically having higher value due to larger volume and higher-grade wood.

Q8: How does market demand affect timber valuation?

High demand for timber products increases prices, positively impacting timber valuation, while low demand can decrease prices.

Q9: Can sustainable forestry practices affect timber valuation?

Yes, sustainable practices can enhance long-term timber value by maintaining forest health, improving tree quality, and ensuring continuous timber supply.

Q10: How can I find a qualified timber valuation expert?

Consult forestry associations, universities, or online directories to find certified professionals with experience in timber appraisal and valuation, like the experts at how.edu.vn.