How much savings does the average American have? The answer varies significantly based on factors like age, race, education, and homeownership. According to data, the average American family holds $62,410 in transaction accounts. If you’re seeking expert financial advice tailored to your specific situation, HOW.EDU.VN offers consultations with top financial experts. Understanding these averages can help you benchmark your own savings and plan for a more secure financial future.

1. Key Factors Influencing American Savings

Several factors impact how much the average American saves. Let’s break down some key takeaways:

- Average Savings: The average American family has $62,410 in savings, though this number varies across different demographics.

- Age: Older Americans (65-74) tend to have the highest savings, peaking at $100,250 before declining post-retirement.

- Homeownership: Homeowners ($85,430) generally save more than renters ($16,930), reflecting the financial stability and wealth-building advantages of owning a home.

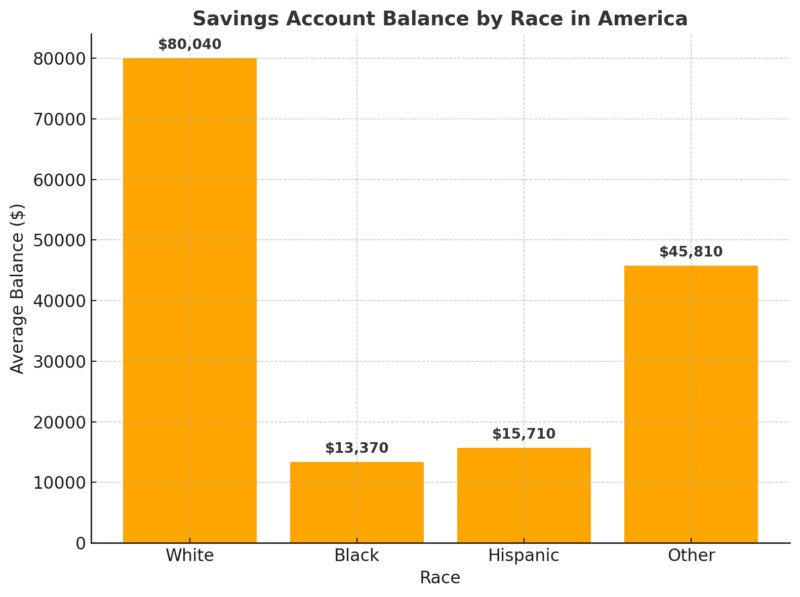

- Race: Racial disparities persist, with White households averaging $80,040, while Black households average $13,370.

- Education: Education level significantly impacts savings, with college graduates ($116,010) saving considerably more than high school graduates ($23,380).

- Financial Security: A substantial 59% of Americans feel uneasy about their emergency savings, and 27% have no emergency funds at all, signaling financial insecurity.

These statistics underscore the importance of understanding how different factors can affect one’s savings.

2. What is the Average Savings Account Balance by Age?

Savings account balances typically increase with age, as older individuals generally accumulate more wealth. According to Federal Reserve data, individuals between 45 and 54 years old have, on average, $50,590 more in savings compared to those under 35. However, balances tend to decrease after age 70 as retirees start using their savings.

These trends highlight the lifecycle of savings, typically peaking between 65 and 74 before decreasing in later years. According to the Bureau of Labor Statistics’ 2022 Consumer Expenditure Survey, individuals aged 45 to 54 also have the highest annual expenses on average. When it comes to financial preparedness, only 31% of Gen Z report having enough savings to cover a $1,000 unexpected expense, compared to 43% of Millennials, 36% of Gen Xers, and 59% of Baby Boomers.

For personalized advice on optimizing your savings at any age, consider consulting the expert financial advisors at HOW.EDU.VN.

3. How Does Race Impact Savings Account Balances?

A notable racial wealth gap exists in America, influencing not just income and household wealth but also savings balances.

Data from Business Insider shows that White households have the highest average savings, while Black and Hispanic households have significantly lower balances. On average, White individuals have $80,040 in savings, compared to $13,370 for Black individuals and $15,710 for Hispanic individuals. Other racial groups have an average savings balance of $45,810.

These figures illustrate ongoing racial wealth disparities, likely resulting from historical inequalities, income levels, employment opportunities, and access to financial resources. Lower savings balances can limit economic mobility, making it harder for some racial groups to build wealth.

Understanding these disparities is crucial for addressing systemic inequalities. If you’re looking to improve your financial situation, HOW.EDU.VN can connect you with advisors who understand diverse financial backgrounds.

4. How Does Homeownership Affect Savings Account Balances?

Homeownership is often seen as a key indicator of financial stability. Homeowners generally have higher savings balances than renters. According to Federal Reserve data, homeowners have an average savings balance of $85,430, significantly more than renters, who have an average of $16,930.

This disparity highlights the wealth-building advantages of homeownership, as homeowners often have higher incomes and greater financial resources. This reflects the broader wealth gap between homeowners and renters, emphasizing the importance of property ownership as a pathway to financial growth.

If you’re considering homeownership and want to understand its impact on your overall financial health, HOW.EDU.VN provides expert consultations.

5. What’s the Link Between Household Size and Savings?

Household structure significantly impacts savings balances. Couples without children tend to have the highest average savings, while single-parent households typically have the lowest balances. Federal data shows that single individuals under 55 have $19,320 in savings, while single parents with children have an even lower balance of $16,800.

In contrast, couples without children hold the most savings, averaging $103,140, likely due to dual-income potential and fewer financial dependents. These figures highlight how life stages, financial responsibilities, and income structures impact household savings. Approximately 30% of the middle class struggles with emergency savings, making it crucial to plan accordingly.

Couples without children tend to have more financial flexibility, while single-parent households face greater financial constraints that limit their ability to save. If you’re managing a household and need personalized financial advice, HOW.EDU.VN offers consultations tailored to your specific family situation.

6. How Does Education Level Affect Savings Account Balances?

Education plays a crucial role in financial stability, with higher education levels strongly correlating with higher savings balances.

According to the 2022 Survey of Consumer Finances, individuals with a college degree have an average savings balance of $116,010, which is nearly five times that of someone with only a high school diploma ($23,380). Similarly, individuals with some college experience have an average balance of $33,410, while those without a high school diploma hold the lowest savings, averaging $9,130.

These figures emphasize the financial benefits of higher education, as individuals with college degrees tend to earn higher incomes, leading to greater savings potential and long-term financial security. If you’re looking to maximize your financial potential through education and strategic savings plans, HOW.EDU.VN can provide expert guidance.

7. Key Savings Statistics to Keep in Mind

Here are some key savings statistics to consider:

- High-Yield Savings Accounts: These offer better interest rates than traditional savings accounts, helping funds grow more efficiently.

- Financial Security: Only 25% of Americans consider themselves completely financially secure, down from 28% in 2023, according to the Financial Freedom Survey.

- Emergency Savings: Nearly 59% of U.S. adults feel uncomfortable with their level of emergency savings.

- No Emergency Savings: 27% of Americans have no emergency savings at all, leaving them financially vulnerable in case of unexpected expenses.

- Credit Card Debt: 36% of adults had more credit card debt than emergency savings in both 2023 and 2024, highlighting financial strain.

- Retirement Savings: 57% of working Americans (full-time, part-time, or temporarily unemployed) fell behind on their retirement savings, according to the latest Retirement Savings Survey.

Understanding these statistics can highlight areas where you may need to improve your financial planning. For tailored advice, HOW.EDU.VN connects you with financial experts who can help you navigate these challenges.

8. Strategies to Improve Your Savings

Improving your savings involves a combination of budgeting, strategic planning, and financial discipline. Here are some effective strategies:

- Create a Budget: Start by tracking your income and expenses to identify areas where you can cut back.

- Set Financial Goals: Define clear, achievable savings goals, whether it’s for retirement, a down payment on a home, or an emergency fund.

- Automate Savings: Set up automatic transfers from your checking account to your savings account each month.

- Reduce Debt: Prioritize paying off high-interest debt, such as credit card balances, to free up more funds for savings.

- Increase Income: Explore opportunities to increase your income through side hustles, freelancing, or career advancement.

- Take Advantage of Employer Benefits: Maximize contributions to employer-sponsored retirement plans, especially if there’s an employer match.

- Consider a High-Yield Savings Account: These accounts offer higher interest rates, helping your savings grow faster.

- Regularly Review and Adjust: Periodically review your budget and savings plan to ensure they still align with your financial goals.

Implementing these strategies can significantly improve your savings rate. For personalized guidance and expert advice, HOW.EDU.VN offers consultations with top financial advisors.

9. The Importance of Emergency Savings

Having an emergency fund is crucial for financial security. It provides a safety net to cover unexpected expenses such as medical bills, car repairs, or job loss.

Financial experts generally recommend having three to six months’ worth of living expenses in an emergency fund. This can help you avoid going into debt or depleting your long-term savings when unexpected events occur. Building an emergency fund requires discipline and consistent savings habits. Start by setting a savings goal and making regular contributions, no matter how small.

Automating your savings can make it easier to build your emergency fund over time. For personalized advice on building and managing your emergency savings, HOW.EDU.VN can connect you with financial experts who understand your specific needs.

10. Retirement Savings: Are You on Track?

Retirement savings are a critical component of long-term financial planning. Many Americans are falling behind on their retirement savings goals, making it essential to take proactive steps to ensure a comfortable retirement.

Assess your current retirement savings and determine how much more you need to save to meet your retirement goals. Consider factors such as your desired retirement age, estimated expenses, and potential sources of income, such as Social Security and pensions.

Maximize contributions to employer-sponsored retirement plans, such as 401(k)s, and consider opening an individual retirement account (IRA) to supplement your retirement savings. Diversify your investments to reduce risk and increase potential returns. For personalized retirement planning advice, HOW.EDU.VN offers consultations with experienced financial advisors.

11. How to Overcome Financial Insecurity

Financial insecurity is a common concern for many Americans. Taking proactive steps to improve your financial literacy, manage your debt, and build your savings can help alleviate financial stress and improve your overall financial well-being.

Start by educating yourself about personal finance topics such as budgeting, investing, and debt management. There are numerous online resources, books, and courses available to help you improve your financial knowledge.

Develop a comprehensive financial plan that includes clear goals, a detailed budget, and a savings strategy. Regularly review and adjust your plan as needed to ensure it still aligns with your financial goals.

Seek professional advice from a financial advisor who can provide personalized guidance and support. HOW.EDU.VN offers consultations with top financial experts who can help you navigate complex financial issues and develop a plan to achieve financial security.

12. Expert Financial Advice from HOW.EDU.VN

Navigating the complexities of personal finance can be challenging, but you don’t have to do it alone. HOW.EDU.VN connects you with experienced financial advisors who can provide personalized guidance and support to help you achieve your financial goals.

Our team of experts includes professionals with diverse backgrounds and areas of expertise, ensuring that you can find an advisor who understands your unique needs and circumstances. Whether you need help with budgeting, saving, investing, retirement planning, or debt management, our advisors can provide the insights and strategies you need to succeed.

Consulting with a financial advisor can provide numerous benefits, including:

- Personalized Guidance: Receive tailored advice based on your specific financial situation and goals.

- Expert Insights: Gain access to the knowledge and experience of seasoned financial professionals.

- Objective Advice: Benefit from unbiased recommendations that prioritize your best interests.

- Comprehensive Planning: Develop a holistic financial plan that addresses all aspects of your financial life.

- Ongoing Support: Receive ongoing support and guidance to help you stay on track and achieve your goals.

Don’t let financial insecurity hold you back. Contact HOW.EDU.VN today to schedule a consultation with one of our expert financial advisors.

13. Making the Most of High-Yield Savings Accounts

High-yield savings accounts are a valuable tool for maximizing your savings potential. These accounts typically offer higher interest rates than traditional savings accounts, allowing your money to grow faster.

To make the most of high-yield savings accounts:

- Shop Around: Compare interest rates and fees from different banks and credit unions to find the best deal.

- Meet Minimum Balance Requirements: Some accounts may require a minimum balance to earn the highest interest rate.

- Avoid Excessive Withdrawals: Excessive withdrawals can reduce your interest earnings or incur fees.

- Take Advantage of Compounding Interest: The more frequently interest is compounded, the faster your savings will grow.

- Consider Tax Implications: Interest earned on savings accounts is typically taxable, so factor this into your financial planning.

High-yield savings accounts are a great option for short-term savings goals, such as building an emergency fund or saving for a down payment. For personalized advice on maximizing your savings potential, HOW.EDU.VN offers consultations with top financial advisors.

14. Understanding the Impact of Debt on Savings

Debt can significantly impact your ability to save and achieve your financial goals. High-interest debt, such as credit card balances, can quickly erode your savings and make it more difficult to build wealth.

Prioritize paying off high-interest debt to free up more funds for savings. Consider strategies such as the debt snowball method (paying off the smallest balances first) or the debt avalanche method (paying off the highest interest rates first).

Avoid taking on new debt whenever possible, and be mindful of your spending habits. For personalized advice on managing your debt and improving your savings, HOW.EDU.VN can connect you with financial experts who understand your specific needs.

15. Building a Strong Financial Foundation

Building a strong financial foundation requires a combination of smart financial habits, strategic planning, and disciplined execution.

Focus on the following key areas:

- Budgeting: Create a detailed budget to track your income and expenses.

- Savings: Set clear savings goals and automate your savings contributions.

- Debt Management: Prioritize paying off high-interest debt and avoid taking on new debt.

- Investing: Diversify your investments to reduce risk and increase potential returns.

- Insurance: Protect yourself against unexpected events with adequate insurance coverage.

- Retirement Planning: Plan for your retirement by maximizing contributions to retirement accounts.

Building a strong financial foundation can provide you with financial security and peace of mind. For personalized guidance and support, HOW.EDU.VN offers consultations with top financial experts who can help you achieve your financial goals.

Ready to take control of your financial future? Contact HOW.EDU.VN today and connect with our team of experienced financial advisors. We can help you develop a personalized financial plan to achieve your savings goals and build a secure financial future.

Contact us:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Don’t wait, start building your financial security today!

FAQ: Common Questions About American Savings

What is considered a good amount of savings for my age?

A good amount of savings varies depending on your age, income, and financial goals. A general guideline is to have at least one year’s salary saved by age 30, three times your salary by age 40, and so on. However, this is just a benchmark. For personalized advice, consult a financial advisor at HOW.EDU.VN.

How can I start saving more money each month?

Start by creating a budget to track your income and expenses. Identify areas where you can cut back, and set up automatic transfers to a savings account. Consider increasing your income through side hustles or freelancing. The experts at HOW.EDU.VN can provide tailored strategies to boost your savings.

What are the best types of savings accounts to consider?

High-yield savings accounts offer better interest rates than traditional accounts. Also, consider money market accounts or certificates of deposit (CDs) for different savings goals. A financial advisor at HOW.EDU.VN can help you choose the best options for your needs.

How important is it to have an emergency fund?

Having an emergency fund is crucial for financial security. It provides a safety net for unexpected expenses and can prevent you from going into debt. Aim to save three to six months’ worth of living expenses. Get personalized advice on emergency fund planning from the experts at HOW.EDU.VN.

What steps should I take to reduce my debt?

Prioritize paying off high-interest debt, such as credit card balances. Consider strategies like the debt snowball or debt avalanche method. Avoid taking on new debt and review your spending habits. HOW.EDU.VN offers debt management consultations to help you get on track.

How can I improve my credit score?

Pay your bills on time, keep your credit utilization low, and check your credit report regularly for errors. A higher credit score can help you secure better interest rates on loans and credit cards. The advisors at HOW.EDU.VN can provide guidance on improving your credit score.

What are the tax implications of savings accounts?

Interest earned on savings accounts is typically taxable. Be sure to report any interest income on your tax return. Consider tax-advantaged savings accounts, such as IRAs, for retirement savings. Consult with the financial experts at HOW.EDU.VN for tax-efficient savings strategies.

How often should I review my savings plan?

You should review your savings plan at least once a year, or more frequently if you experience significant life changes, such as a job loss or marriage. Regularly assess your progress and adjust your plan as needed. The advisors at HOW.EDU.VN can help you stay on track with ongoing support and guidance.

What are the biggest mistakes to avoid when saving money?

Common mistakes include not having a budget, failing to set financial goals, neglecting emergency savings, and taking on too much debt. Avoid these pitfalls by creating a comprehensive financial plan and seeking expert advice from HOW.EDU.VN.

How can a financial advisor help me with my savings?

A financial advisor can provide personalized guidance, develop a tailored savings plan, offer objective advice, and help you stay on track to achieve your financial goals. how.edu.vn connects you with top financial experts who can provide the support you need to succeed.