How Much Do Bankers Make is a common question, and at HOW.EDU.VN, we provide a comprehensive guide to banker compensation, including base salary, bonuses, and benefits. Understanding the earning potential in banking can help you make informed career decisions, and we offer expert insights to guide you. Explore banking salaries and compensation packages with us.

1. Understanding Banker Compensation: An Overview

Banker compensation is a multifaceted topic, covering various roles and levels of seniority. A banker’s earnings typically consist of a base salary, bonuses (including signing, stub, and end-of-year bonuses), and employee benefits. The specific amount can vary significantly based on factors such as the type of bank, location, experience, and individual performance. Let’s delve into each component to provide a clearer picture.

1.1. Base Salary: The Foundation of Banker Income

The base salary is the fixed amount a banker receives, regardless of performance. This forms the foundation of their earnings. For entry-level positions, such as analysts, the base salary is relatively standard across mid- to large-sized banks. However, as bankers progress in their careers, the base salary increases significantly.

1.2. Bonuses: Enhancing Overall Compensation

Bonuses represent a substantial part of a banker’s compensation. There are several types of bonuses, each serving a different purpose:

- End-of-Year Bonus: This is a percentage of the base salary, dependent on performance, deal flow, and overall contribution to the bank.

- Stub Bonus: New hires who join mid-year often receive a stub bonus to compensate for the partial year of work.

- Signing Bonus: A one-time bonus offered to attract new talent, especially at the entry-level.

1.3. Employee Benefits: Additional Perks and Advantages

Beyond salary and bonuses, bankers also receive employee benefits, including:

- 401(k) Plans: Retirement savings plans with potential employer matching.

- Health Insurance: Coverage for medical, dental, and vision care.

- Vacation Days: Paid time off for leisure and personal matters.

2. Entry-Level Banker Salaries: What to Expect

Entry-level positions in banking, such as financial analyst roles, are often the starting point for many aspiring finance professionals. Understanding the compensation structure at this level is crucial for setting realistic expectations. Here’s a detailed look at what entry-level bankers can expect.

2.1. Analyst Salaries: The Starting Point

First-year analysts typically earn a base salary in the range of $85,000 to $95,000. This range can fluctuate based on the size and type of the bank. Boutique firms, for instance, may offer higher or lower base salaries compared to larger, more established banks.

2.2. Bonuses for Analysts: Boosting Initial Earnings

Bonuses significantly impact the total compensation for analysts. First-year analysts can expect to receive:

- Signing Bonus: Ranging from $5,000 to $15,000.

- Stub Bonus: Around $20,000 to $30,000 for those hired mid-year.

- End-of-Year Bonus: Typically 70% to 100% of their base salary, based on performance.

2.3. Total Compensation for Entry-Level Bankers

Considering the base salary and potential bonuses, a first-year analyst can earn a total compensation package of $150,000 to $200,000. This figure underscores the lucrative nature of entry-level banking positions.

Entry-Level Banker

Entry-Level Banker

3. Mid-Career Banker Salaries: Associate and Vice President Levels

As bankers gain experience and move up the corporate ladder, their compensation increases substantially. The roles of Associate and Vice President (VP) are pivotal mid-career positions with significantly higher earning potential. Let’s examine what these roles entail and the corresponding salary ranges.

3.1. Associate Salaries: A Significant Step Up

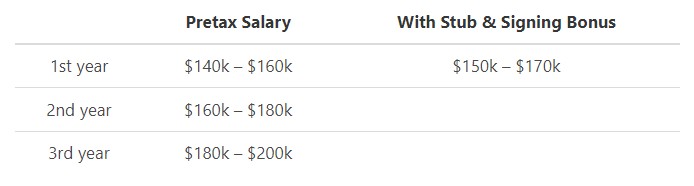

Associates typically have several years of experience and often an MBA or other advanced degree. Their responsibilities include managing analyst teams, conducting financial analysis, and assisting in deal execution. The base salary for an associate ranges from $140,000 to $180,000, depending on the bank and location. With bonuses, total compensation can range from $250,000 to $400,000.

3.2. Vice President Salaries: Leadership and Management

Vice Presidents play a critical role in business development, client management, and leading deal teams. Their base salary typically ranges from $200,000 to $300,000. Bonuses can range from 120% to 150% of their base salary, resulting in total compensation of $450,000 to $700,000.

3.3. Factors Influencing Mid-Career Compensation

Several factors influence compensation at the Associate and VP levels:

- Performance: Individual performance and contribution to successful deals.

- Location: Compensation varies based on geographic location and cost of living.

- Bank Type: Bulge bracket banks generally offer higher compensation compared to smaller firms.

4. Senior-Level Banker Salaries: Managing Director and Beyond

Reaching the Managing Director (MD) level represents the pinnacle of a banking career. This position involves significant responsibilities, including leading large deal teams, managing client relationships, and driving revenue for the bank. The compensation at this level reflects the importance and impact of the role.

4.1. Managing Director Salaries: Top-Tier Earnings

Managing Directors earn the highest salaries in the banking industry, with base salaries ranging from $400,000 to $600,000 or higher. Bonuses can vary significantly, ranging from close to nothing to several million dollars, depending on the MD’s performance and the bank’s overall profitability. Total compensation can easily exceed $1 million annually.

4.2. Compensation Structure for Senior Bankers

A significant portion of senior banker compensation comes in the form of stock options and deferred compensation. These incentives are designed to align the banker’s interests with the long-term success of the firm. Deferred compensation typically vests over a period of 3 to 5 years, encouraging bankers to remain with the firm.

4.3. Impact of Deal Size and Commission

Senior bankers’ bonuses are closely tied to individual performance and the fees they generate for the bank. Commission structures vary, but they are generally higher for smaller deals and scale down for larger transactions. For example, deals worth less than $1 billion might come with a 1% commission, while larger deals may have a commission of around 0.1%. Even a 0.1% commission on a $50 billion deal amounts to $50 million.

5. Factors Influencing Banker Salaries: A Comprehensive Analysis

Several factors influence banker salaries, ranging from the type of bank to individual performance. Understanding these factors can provide a clearer picture of the earning potential in the banking industry.

5.1. Type of Bank: Bulge Bracket vs. Boutique

The type of bank significantly impacts compensation. Bulge bracket banks, which are large, multinational investment banks, typically offer higher salaries and bonuses compared to boutique firms. Boutique banks, however, may offer unique opportunities for specialized experience and faster career advancement.

5.2. Location: Geographic Variations in Pay

Geographic location plays a crucial role in determining banker salaries. Major financial centers such as New York, London, and Hong Kong tend to offer higher compensation due to the higher cost of living and greater demand for talent. Smaller financial hubs may offer lower salaries but also provide a lower cost of living.

5.3. Performance: Individual Contribution and Impact

Individual performance is a key factor in determining bonuses and overall compensation. Bankers who consistently exceed expectations, generate significant revenue, and contribute to successful deals are rewarded with higher bonuses. Performance metrics include deal execution, client relationship management, and business development.

5.4. Specialization: M&A vs. Capital Markets

The specific area of specialization within banking also influences compensation. Mergers and Acquisitions (M&A) groups tend to offer higher remuneration compared to capital markets groups. M&A roles involve advising companies on buying, selling, or merging with other companies, which often leads to higher fees for the bank.

6. The Reality of Banking Hours: Is the Salary Worth It?

While the compensation in banking can be substantial, it’s essential to consider the demanding work hours and lifestyle associated with the profession. The high salaries often come with long hours and significant stress.

6.1. Long Hours and Intense Pressure

Bankers typically work long hours, often exceeding 60-80 hours per week. This can lead to burnout and impact work-life balance. The intense pressure to perform and meet deadlines can also take a toll on mental and physical health.

6.2. Alternatives to Banking: Exploring Other High-Paying Careers

If work-life balance is a priority, there are other high-paying careers that may offer a better lifestyle. For example, tech companies often pay competitive salaries with more reasonable working hours. Software engineers at companies like Google or Facebook can earn upwards of $200,000 annually with more relaxed schedules.

6.3. Banking as a Stepping Stone: Private Equity and Beyond

Many individuals enter banking as a stepping stone to other lucrative careers, such as private equity (PE). Private equity firms offer the potential for even higher compensation, as employees can reap the rewards when an asset increases in value. Banking experience is often a prerequisite for entering the private equity world.

7. Salary Expectations Across Various Banking Roles

To provide a clearer picture of the diverse career paths within banking, here’s a table outlining the salary expectations for various roles.

| Role | Base Salary Range | Bonus Range (Percentage of Base Salary) | Total Compensation Range |

|---|---|---|---|

| Financial Analyst | $85,000 – $95,000 | 70% – 100% | $150,000 – $200,000 |

| Associate | $140,000 – $180,000 | 80% – 120% | $250,000 – $400,000 |

| Vice President | $200,000 – $300,000 | 120% – 150% | $450,000 – $700,000 |

| Managing Director | $400,000 – $600,000+ | Highly Variable | $1,000,000+ |

| Portfolio Manager | $150,000 – $250,000 | 50% – 100% | $225,000 – $500,000 |

| Loan Officer | $60,000 – $120,000 | 20% – 50% | $72,000 – $180,000 |

| Compliance Officer | $70,000 – $140,000 | 10% – 30% | $77,000 – $182,000 |

| Investment Banker | $90,000 – $600,000+ | Highly Variable | $153,000 – $1,000,000+ |

| Bank Manager | $75,000 – $150,000 | 15% – 40% | $86,250 – $210,000 |

| Risk Manager | $80,000 – $160,000 | 20% – 50% | $96,000 – $240,000 |

| Branch Manager | $65,000 – $130,000 | 10% – 30% | $71,500 – $169,000 |

| Quantitative Analyst | $95,000 – $180,000 | 25% – 60% | $118,750 – $288,000 |

| Financial Advisor | $50,000 – $100,000 | 30% – 70% | $65,000 – $170,000 |

8. Strategies to Maximize Your Banking Salary

Maximizing your banking salary requires strategic planning and continuous effort. Here are several strategies to help you increase your earning potential.

8.1. Continuous Skill Development and Education

Investing in your skills and education is crucial for career advancement. Pursue advanced degrees, certifications, and training programs to enhance your expertise. Relevant certifications include the Chartered Financial Analyst (CFA) and Financial Risk Manager (FRM) designations.

8.2. Networking and Building Relationships

Networking is essential for career growth in banking. Attend industry events, join professional organizations, and build relationships with colleagues and senior leaders. Networking can lead to new opportunities and higher-paying positions.

8.3. Performance Excellence and Visibility

Consistently exceed expectations in your role and seek opportunities to showcase your achievements. Volunteer for high-profile projects, present your work to senior management, and actively contribute to team success. Increased visibility can lead to promotions and higher bonuses.

8.4. Negotiating Compensation Packages

Be prepared to negotiate your compensation package when accepting a new job or receiving a promotion. Research industry standards, understand your value, and confidently articulate your expectations. Don’t hesitate to negotiate for a higher base salary, bonus, or benefits.

9. The Future of Banker Salaries: Trends and Predictions

The banking industry is constantly evolving, and salaries are influenced by various trends and market conditions. Staying informed about these trends can help you make informed career decisions.

9.1. Impact of Technology and Automation

Technology and automation are transforming the banking industry, leading to changes in job roles and salary structures. Some roles may be automated, while others will require new skills. Focus on developing skills that complement technology, such as data analysis, strategic thinking, and client relationship management.

9.2. Regulatory Changes and Compliance

Regulatory changes and compliance requirements are increasing, leading to greater demand for compliance professionals. These roles offer competitive salaries and opportunities for career advancement. Develop expertise in regulatory compliance to capitalize on this trend.

9.3. Globalization and International Opportunities

Globalization continues to impact the banking industry, creating opportunities for international assignments and cross-border deals. Develop international experience and cultural sensitivity to enhance your career prospects. Fluency in multiple languages is also a valuable asset.

10. Expert Insights on Banker Salaries from HOW.EDU.VN

At HOW.EDU.VN, we understand the complexities of banker compensation and provide expert insights to guide you. Our team of experienced financial professionals offers personalized advice and resources to help you navigate your career path.

10.1. Connecting with Leading Experts

We connect you directly with leading experts and PhDs who can provide tailored advice and solutions to your specific challenges. Our experts offer insights into compensation trends, negotiation strategies, and career advancement opportunities.

10.2. Personalized Guidance for Career Advancement

Whether you’re just starting your career or seeking to advance to a senior-level position, our personalized guidance can help you achieve your goals. We offer career coaching, resume reviews, and interview preparation services.

10.3. Confidential and Reliable Advice

We ensure the confidentiality and reliability of our advice, providing a safe and trusted environment for you to discuss your career aspirations and compensation concerns. Our experts adhere to the highest ethical standards and provide unbiased guidance.

Navigating the complexities of banker compensation can be challenging, but with the right information and guidance, you can make informed decisions and maximize your earning potential. Contact HOW.EDU.VN today to connect with our team of experts and take your banking career to the next level. Our team of over 100 PhDs are ready to provide consultation and answer any questions you may have. Reach us at 456 Expertise Plaza, Consult City, CA 90210, United States or via WhatsApp at +1 (310) 555-1212. Visit our website at HOW.EDU.VN for more information.

FAQs: Understanding Banker Compensation

1. What is an investment banker?

An investment banker is a financial professional who helps companies and governments raise capital by underwriting and selling securities. They also advise on mergers, acquisitions, and other corporate transactions.

2. How much do investment bankers earn?

Investment Banking Vice Presidents through to Senior VPs typically earn a base salary between $200,000 and $300,000. Their bonuses can range from 120% to 150% of their base salary, leading to total compensation of $450,000 to $700,000. Managing Directors can earn upwards of $1 million annually, with base salaries in the $400,000 to $600,000 range and highly variable bonuses.

3. Can you become a millionaire as a banker?

Yes, it is possible to become a millionaire as a banker, particularly in senior-level positions such as Managing Director. However, it requires consistent savings and strategic investments over many years.

4. Why are bankers paid so much?

Bankers are highly compensated due to their specialized skills and the critical role they play in the financial markets. They help companies raise capital, facilitate economic growth, and manage complex financial transactions.

5. What exactly does a banker do?

A banker performs a variety of functions, including advising companies on financial strategies, underwriting securities, managing client relationships, and executing financial transactions. Their specific responsibilities vary based on their role and specialization within the banking industry.

6. How does location impact banker salaries?

Location significantly impacts banker salaries, with major financial centers like New York, London, and Hong Kong offering higher compensation due to the higher cost of living and greater demand for talent.

7. What are the common benefits for bankers?

Common benefits for bankers include health insurance, retirement plans (such as 401(k)s), paid time off, and employee stock options.

8. How important is performance in determining a banker’s bonus?

Performance is a critical factor in determining a banker’s bonus. Those who consistently exceed expectations and generate significant revenue for the bank are rewarded with higher bonuses.

9. What is deferred compensation, and why is it used?

Deferred compensation is a portion of a banker’s bonus that is paid out over a period of several years. It is used to incentivize bankers to remain with the firm and align their interests with the long-term success of the bank.

10. What skills are essential for success in the banking industry?

Essential skills for success in the banking industry include financial analysis, communication, networking, problem-solving, and leadership. Continuous skill development and education are also crucial for career advancement.

Are you seeking expert guidance on your banking career? Contact HOW.EDU.VN today to connect with our team of experienced financial professionals and PhDs. We can provide personalized advice and resources to help you achieve your career goals. Reach us at 456 Expertise Plaza, Consult City, CA 90210, United States or via WhatsApp at +1 (310) 555-1212. Visit our website at how.edu.vn for more information.