The world of investment banking is often associated with high stakes, complex deals, and, of course, substantial compensation. If you’re considering a career in this field, understanding the earning potential is crucial. But How Much Do Investment Bankers Earn? While 2024 saw significant revenue increases for investment banks, the reality of salary and bonus payouts was more nuanced than anticipated. Let’s delve into the details of investment banker salaries and bonuses, exploring the factors that influence compensation and providing a realistic outlook for aspiring and current professionals.

Investment Banker Salary and Bonus Overview

Despite the initial excitement surrounding a potential “return to form,” total compensation for investment bankers increased by only 10-15% across most levels in 2024. While global investment banking revenue saw a more substantial rise of around 30%, with a 37% increase in the U.S., several factors contributed to the somewhat restrained compensation growth.

Here’s a summary of typical compensation ranges for investment banking positions in New York, before taxes:

| Position Title | Typical Age Range | Base Salary (USD) | Total Compensation (USD) | Timeframe for Promotion |

|---|---|---|---|---|

| Analyst | 22-27 | $100-$125K | $160-$210K | 2-3 years |

| Associate | 25-35 | $175-$225K | $275-$475K | 3-4 years |

| Vice President (VP) | 28-40 | $250-$300K | $500-$700K | 3-4 years |

| Director / Senior Vice President (SVP) | 32-45 | $300-$350K | $600-$800K | 2-3 years |

| Managing Director (MD) | 35-50 | $400-$600K | $800-$1600K+ | N/A |

It’s important to remember that these figures represent the 25th to 75th percentile ranges across large banks and exclude signing/relocation bonuses, stub bonuses, and benefits. Elite boutiques often pay above these ranges.

Factors Affecting Investment Banker Salaries and Bonuses

Several key factors explain why total compensation didn’t mirror the more significant revenue increases:

-

Higher Base Salaries: The base salary increases implemented in 2021-2022 for Analysts and Associates mean that bonus increases now have a smaller impact on overall compensation. This reduces the sensitivity of total compensation to fee fluctuations.

-

Total IB vs. M&A Fees: While overall investment banking revenue increased, M&A advisory revenue, which tends to be more profitable for banks, saw a smaller increase. Equity and debt capital markets activity also increased, but these areas often have lower margins due to higher overhead and fee splitting.

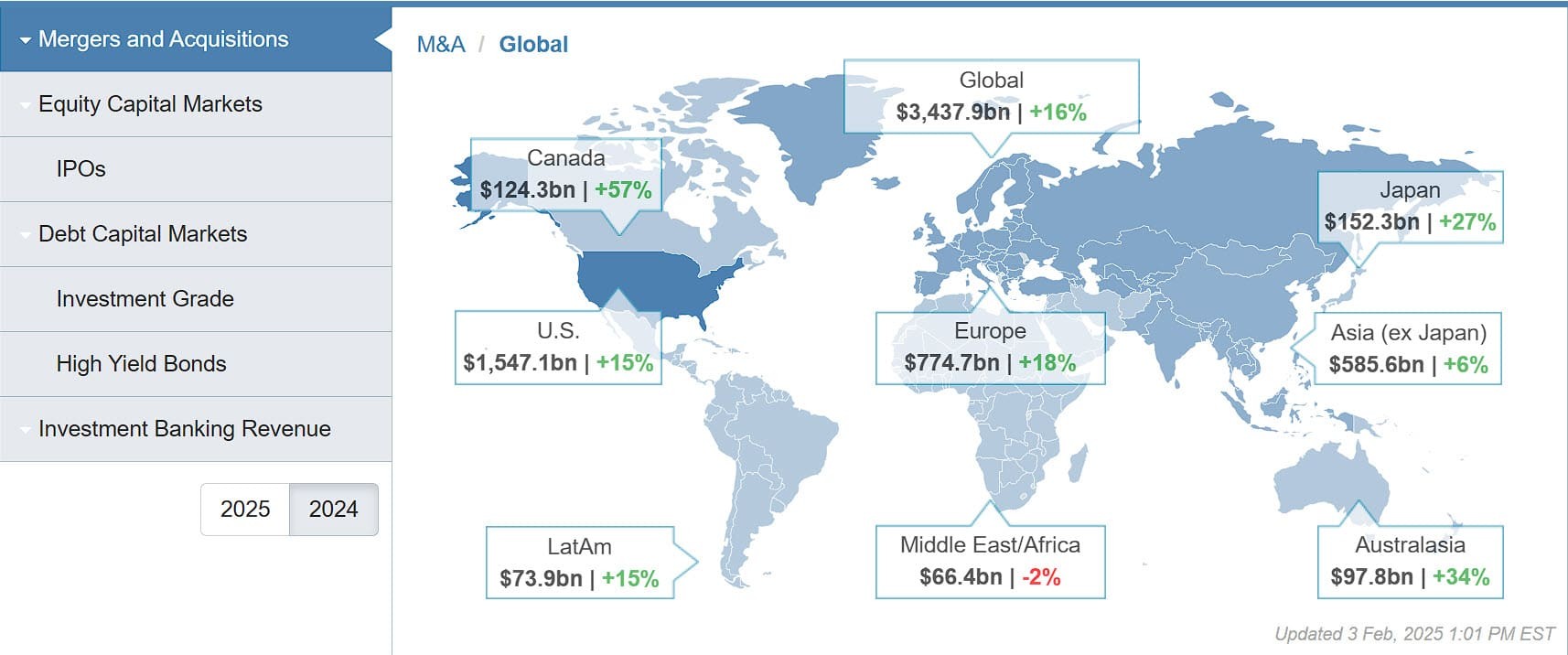

M&A Advisory Revenue – 2025

M&A Advisory Revenue – 2025M&A advisory revenue trends in 2025.

-

COVID Over-Extension and Bad Memories: Banks are still wary of making drastic compensation changes after over-hiring and overpaying during the 2020-2021 period and then having to scale back when the market declined.

-

Lack of Other Options in the Job Market: The competitive landscape has shifted, making it more challenging to secure lucrative positions at finance competitors like Big Tech companies.

-

Uncertainty Over Deal Activity: Despite optimism in 2024, concerns remained regarding potential trade wars, antitrust scrutiny, and fewer interest rate cuts than initially anticipated.

Trends in Investment Banker Compensation

The investment banking landscape is becoming increasingly complex, with significant compensation variations even among firms within the same category.

-

Elite Boutiques vs. Bulge Brackets: Historically, elite boutiques offered higher bonuses to Analysts and Associates and a higher compensation ceiling for senior bankers. However, as of 2025, pay disparities exist even among firms within the same category. For example, Lazard appears to pay less than other elite boutiques but still at or above the level of bulge bracket banks.

-

Firm-Specific Variations: Total compensation for Year 1 Associates can range from just above $300K at some bulge bracket banks (GS and JPM) to as high as $400K at firms like PJT Partners for top-ranked individuals.

-

Canadian Banks: Some Big 5 Canadian banks, such as TD Cowen, seem to be offering higher bonuses to attract talent, although the sustainability of this trend is uncertain.

-

Deferred Compensation: The proportion of compensation paid in stock and deferred forms appears to be increasing, which could be a concern in the event of another major financial institution restructuring.

-

Base Salary Anomalies: There have been reports of UBS paying slightly lower base salaries to some Analysts following the Credit Suisse acquisition, and elite boutiques seem to offer approximately $25K higher base salaries to Associates.

Components of Investment Banker Compensation

Understanding the various components of compensation is crucial for anyone considering a career in investment banking.

-

Base Salary: A fixed amount paid regularly (bi-weekly or monthly). Base salaries for Analysts and Associates are typically adjusted periodically.

-

Stub Bonus: A bonus paid to Associates who start mid-year after graduating from MBA programs, covering their first few months on the job.

-

End-of-Year Bonus: Paid after the first full year of work. Analyst bonuses are typically 100% cash, while a percentage shifts to stock and deferred compensation at higher levels.

-

Signing/Relocation Bonus: Paid to Analysts and Associates who accept full-time offers after graduation.

-

Benefits: Includes health insurance, vacation days, and participation in the firm’s retirement plans (e.g., 401(k)).

Investment Banker Salary and Bonus Levels: A Closer Look

Analysts

Total compensation for 2nd-year Analysts at elite boutiques likely exceeded $210K in mid-2024. With an estimated midpoint of $185K (based on a range of $160K-$210K), this represents roughly a 12% increase over the previous year, which aligns with the increase in M&A fees.

Associates

The spread in compensation is significant at the Associate level, with potential earnings varying by over $100K between firms like PJT Partners and bulge bracket banks. Bonuses at this level generally range from 65-80% of base salaries, with higher percentages as Associates progress from their first to third year.

Vice Presidents

Data on VP-level compensation is less readily available, but estimates suggest a total compensation range of $500K-$700K, with outliers at firms like PJT potentially earning significantly more.

Directors

Assuming a 10% increase in total compensation, Directors may earn between $600K and $800K, with the possibility of higher earnings at elite boutiques.

Managing Directors

Managing Directors experience the most significant fluctuations in compensation based on deal activity. While junior MDs likely earned around $1M in total compensation, more senior MDs, such as Group Heads, could earn significantly more. A significant portion of MD bonuses is often deferred or paid in stock.

Regional Differences: London

Data for London-based investment bankers is less readily available. However, a recent report suggests base salaries ranging from £70K to £90K GBP, with a median bonus of £40K. This translates to a total compensation range of approximately $135K to $160K USD. Adjusting for potential underestimation of bonus numbers, the upper end of the range could be closer to $180K USD, reflecting a 15-30% discount compared to New York compensation.

Future Outlook for Investment Banker Salaries and Bonuses

Predicting future compensation trends is challenging due to various uncertainties, including trade, interest rates, inflation, and geopolitical factors. A potential fluctuation of +10% to -10% in total compensation is possible, but the direction remains uncertain.

Long-term career prospects may favor elite boutiques over bulge bracket banks, offering higher earning potential, more interesting work, and strong exit opportunities. While starting at a bulge bracket bank may provide brand recognition and networking benefits, elite boutiques may be more compelling at the Associate level and above.

It’s essential to recognize that investment banking, even at the MD level, is not an easy job and requires sustained effort and performance. Turnover among MDs can be high due to constant pressure to generate fees. Career longevity can also be a concern as firms may prioritize younger MDs who can bring in the same deal volume for lower compensation.

While some investment bankers achieve long-term success and wealth, others experience burnout or transition to corporate or other roles.

In conclusion, understanding how much do investment bankers earn requires a comprehensive analysis of various factors, including position, firm type, market conditions, and individual performance. While the potential for high earnings exists, it’s crucial to have realistic expectations and be prepared for the demanding nature of the industry.