The world of investment banking is often associated with high-pressure environments and demanding work hours, but also with significant financial rewards. Understanding how much a banker earns involves analyzing various compensation components and factors influencing pay scales.

Before diving into the specifics, it’s crucial to note that all figures discussed below are pre-tax values applicable to front-office roles based in New York. These figures account for base salaries and year-end bonuses but exclude signing/relocation bonuses, stub bonuses, and benefits. The ranges provided generally represent the 25th to 75th percentile among large banks, excluding smaller boutique firms.

| Position Title | Typical Age Range | Base Salary (USD) | Total Compensation (USD) | Timeframe for Promotion |

|---|---|---|---|---|

| Analyst | 22-27 | $100-$125K | $160-$210K | 2-3 years |

| Associate | 25-35 | $175-$225K | $275-$475K | 3-4 years |

| Vice President (VP) | 28-40 | $250-$300K | $500-$700K | 3-4 years |

| Director / Senior Vice President (SVP) | 32-45 | $300-$350K | $600-$800K | 2-3 years |

| Managing Director (MD) | 35-50 | $400-$600K | $800-$1600K+ | N/A |

Factors Influencing Investment Banker Salaries and Bonuses

Several factors affect the compensation packages offered to investment bankers, including the bank’s overall revenue, specific deal activity, and the performance of individual teams.

Recent Trends in Investment Banking Revenue

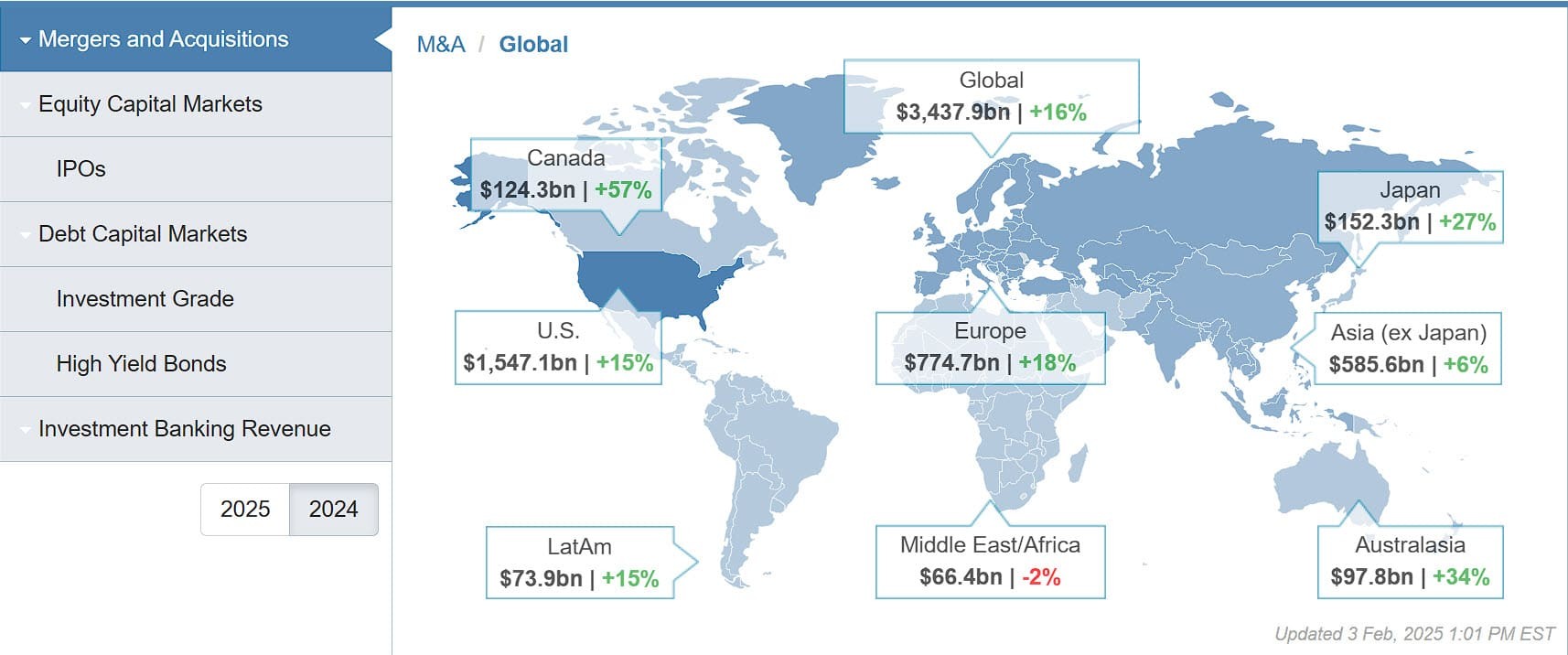

While total investment banking revenue saw increases, the impact on bonuses was not as substantial as anticipated. M&A advisory revenue experienced more modest growth compared to equity and debt capital markets, which often have lower profit margins due to higher overhead and fee-splitting among various groups.

M&A Advisory Revenue Trends

M&A Advisory Revenue Trends

Components of Investment Banker Compensation

Understanding the components that make up an investment banker’s compensation is crucial. Here’s a breakdown:

- Base Salary: A fixed amount paid regularly (bi-weekly). Analyst and Associate levels often see adjustments every few years, with the last significant changes occurring in 2021-2022.

- Stub Bonus: Given to Associates joining mid-year after completing MBA programs, covering the initial months of employment.

- End-of-Year Bonus: Awarded after a full year of work, this bonus shifts from 100% cash for Analysts to include stock and deferred compensation at higher levels like Associates, VPs, and MDs.

- Signing/Relocation Bonus: Offered to Analysts and Associates accepting full-time positions, usually a small percentage of the base salary.

- Benefits: Include health insurance, vacation days, and participation in retirement plans.

Investment Banker Salary and Bonus Levels: A Detailed Look

Understanding specific salary and bonus ranges for various positions is essential for anyone considering a career in investment banking.

Analyst Compensation

Entry-level analysts can anticipate a substantial starting package. Second-year analysts at top-tier firms might see earnings exceeding this range.

Associate Compensation

There can be a considerable compensation gap between firms. Bonuses often range from 65% to 80% of base salaries, with variations based on individual and firm performance. As Associates advance, their compensation becomes increasingly linked to deal activity.

Vice President (VP) Compensation

VP-level compensation can vary widely across firms. Total compensation packages can differ significantly, making it essential for VPs to understand their firm’s compensation structure.

Director Compensation

Directors typically see a rise in total compensation, influenced by deal successes and overall firm profitability.

Managing Director (MD) Compensation

MDs have the most variable compensation. MDs benefit significantly from increased deal activity but also face considerable risk during downturns. A significant portion of their compensation is often deferred or paid in stock.

Regional Differences in Compensation

Compensation can vary significantly by region. London, for instance, typically offers a discount compared to New York salaries.

Future Outlook for Investment Banker Salaries and Bonuses

Predicting future trends is challenging due to various economic uncertainties, including trade tensions, interest rate fluctuations, and geopolitical events. While some anticipate a potential increase or decrease in total compensation, the outlook remains cautiously optimistic.

The Shift Towards Elite Boutique Banks

Elite boutique banks are increasingly becoming attractive options compared to bulge bracket firms. These boutiques often offer higher compensation, more engaging work, and excellent career advancement prospects. While bulge brackets may still be a solid starting point for Analysts, elite boutiques appear more compelling for those at the Associate level and above.

A Word of Caution

While the financial rewards of investment banking can be substantial, it’s important to acknowledge the demanding nature of the profession. Even at the MD level, the role requires constant pressure to generate fees, leading to high turnover. Long-term career success in investment banking demands exceptional talent, luck, and dedication. Individuals should carefully consider these factors before pursuing a career in this competitive field.