Choosing the right payment platform is a crucial decision for any business that processes online transactions or accepts electronic payments. The platform you select significantly impacts the payment experience for both your customers and your internal operations. Crucially, it also determines the expenses your business incurs for accepting payments. Payment platform fees can have a substantial impact, potentially leading to noticeable differences in your net revenue. As your business expands, transaction volumes increase, amplifying the effect of these fees. This article provides a detailed breakdown of Stripe’s fees. However, keep in mind that these costs are subject to change, so it’s always wise to double-check the latest pricing information directly from Stripe and other providers during your research.

What is a Payment Platform?

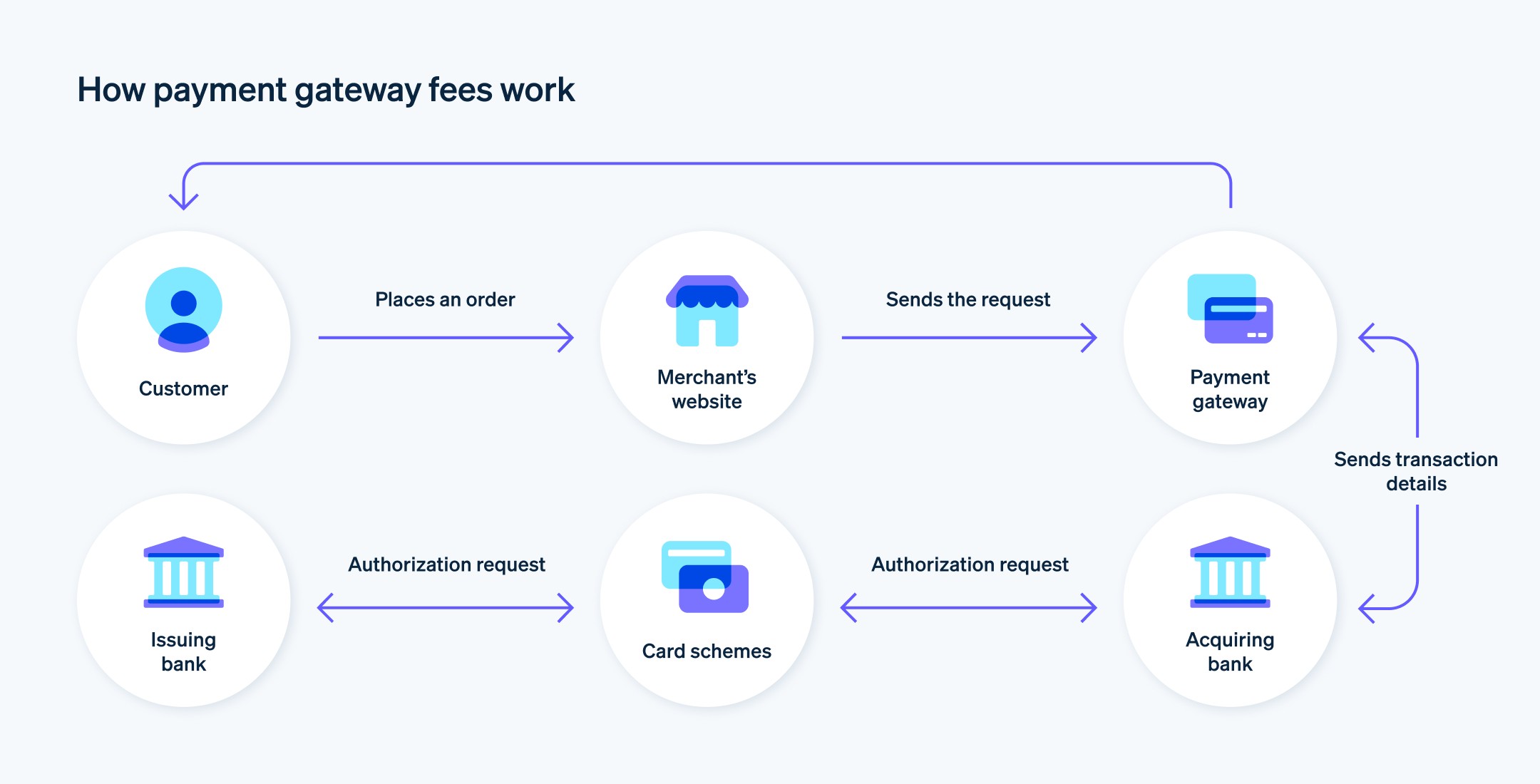

A payment platform is a service that processes credit card transactions for online and physical stores. Think of it as the digital equivalent of a point-of-sale (POS) terminal you’d find in a retail shop. When a customer makes a purchase, the payment platform encrypts sensitive payment information and securely transmits it between the cardholder’s issuing bank and the business’s bank, ensuring the transaction is valid. The payment platform acts as an intermediary, facilitating secure and efficient transactions.

Any online business that wants to accept credit cards or direct payments needs a payment platform. This technology secures customer information as it travels between the business and the payment processor, making it a vital part of the e-commerce transaction process. There’s a wide range of options available, each with features designed to meet the needs of different types of businesses. The global value of electronic payment transactions is projected to reach nearly $14.8 trillion by 2027, highlighting the growing need for reliable payment platforms.

Payment gateway fees explained for online businesses

Payment gateway fees explained for online businesses

Understanding Payment Platform Fees: How Much Does Stripe Charge?

Payment platform fees are the costs businesses incur when using a payment platform’s services, especially for processing credit card transactions. These fees fall into several categories:

- Setup Fees: This is a one-time cost a business pays when establishing an account with a payment platform. It covers the initial configuration and integration of the payment platform into the business’s sales system. Does Stripe charge setup fees? No, Stripe does not charge setup fees.

- Transaction Fees: These fees are charged by payment platforms each time a transaction is processed. They can be a fixed amount per transaction, a percentage of the sale amount, or sometimes a combination of both. These fees compensate the platform for processing the transaction. How much are Stripe’s transaction fees? Stripe’s standard transaction fees are typically around 2.9% + $0.30 per successful card charge.

- Monthly Fees: Some payment platforms charge businesses a recurring monthly fee to access their services, regardless of the number of transactions processed. Does Stripe charge monthly fees? Stripe doesn’t charge monthly fees for its standard pricing plan.

- Chargeback Fees: When a customer disputes a charge and the transaction is reversed, the business may incur a chargeback fee. This fee covers the administrative work involved in handling the dispute. How much are Stripe’s chargeback fees? Stripe’s chargeback fees vary by country but are typically around $15 per chargeback.

- Refund Fees: When a business issues a refund, some gateways may charge a fee to cover the cost of returning the funds to the customer. Does Stripe charge refund fees? Stripe does not refund transaction fees for refunded payments.

- PCI Compliance Fees: Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for businesses that process credit card transactions. Some platforms charge fees for maintaining this security standard. Does Stripe charge PCI compliance fees? Stripe handles PCI compliance for its users and does not charge separate PCI compliance fees.

- Termination Fees: If a business decides to terminate its account before the end of the contract, they may be subject to termination fees. This compensates the platform for the early termination of the service agreement. Does Stripe charge termination fees? Stripe does not charge termination fees.

- Miscellaneous Fees: Payment platforms may charge additional fees for services like international transactions, currency conversion, or access to premium services like fraud protection. These fees can vary depending on the payment platform. What other fees does Stripe charge? Stripe charges fees for services like currency conversion (typically 1%), instant payouts, and advanced fraud protection features.

Businesses typically choose a service based on how well these costs align with their sales volume and business model. Some payment platforms might have lower transaction fees but higher monthly fees, which is generally better for businesses with high transaction volumes. Others may not charge monthly fees but have higher transaction costs, which can be more advantageous for businesses with lower sales volumes.

It’s important to carefully evaluate these fees to determine the most cost-effective solution for your specific business needs.

Stripe Fees Breakdown: A Closer Look

Here’s a breakdown of Stripe fees for various payment processing services:

- Transaction Fees: As mentioned earlier, Stripe’s standard transaction fee is usually 2.9% + $0.30 per successful card charge. This covers the cost of processing the transaction and includes fraud protection.

- ACH Direct Debit: For processing payments via Automated Clearing House (ACH) direct debit, Stripe charges a lower fee, often around 0.8% per transaction, capped at a certain amount.

- Alternative Payment Methods: Stripe supports various alternative payment methods like Apple Pay, Google Pay, and others. Fees for these methods may vary, so it’s important to check Stripe’s pricing page for the latest information.

- 3D Secure Authentication: Stripe supports 3D Secure authentication to provide an extra layer of security for online transactions. There may be additional fees associated with using 3D Secure.

- Card Account Updater: For saved customer card details, Stripe automatically updates outdated or renewed card information for a fee. This helps reduce declined payments and improve customer experience.

- Machine Learning Models: Stripe incorporates machine learning models to achieve higher authorization rates for accounts with custom pricing.

- Instant Payouts: Stripe offers instant payouts for a fee, allowing businesses to access their funds faster than standard payout schedules.

- Dispute Fees: As previously noted, Stripe charges a fee for handling disputes (chargebacks).

Stripe prides itself on transparency, with no setup fees, no monthly fees for standard pricing, and no hidden costs.

For the most up-to-date and detailed information on Stripe’s pricing, it’s always best to visit the official Stripe Pricing page.

Disclaimer: The information provided in this article is for general informational and educational purposes only and does not constitute legal or tax advice. Stripe does not guarantee the accuracy, completeness, or timeliness of the information provided in this article. It is recommended to seek the advice of a licensed attorney or certified public accountant in the relevant jurisdiction(s) for advice tailored to your specific situation.