Venmo has become a ubiquitous platform for peer-to-peer transactions, boasting over 78 million users as of 2023. Its ease of use and integration into the PayPal ecosystem have made it a favorite for splitting bills, sending gifts, and even conducting small business transactions. However, like any financial service, Venmo charges fees for certain transactions. Understanding these fees, especially those associated with instant transfers, is crucial for managing your finances effectively. This guide breaks down Venmo’s fee structure, focusing on instant transfers, and provides strategies to minimize these costs.

Understanding Venmo Transfer Fees

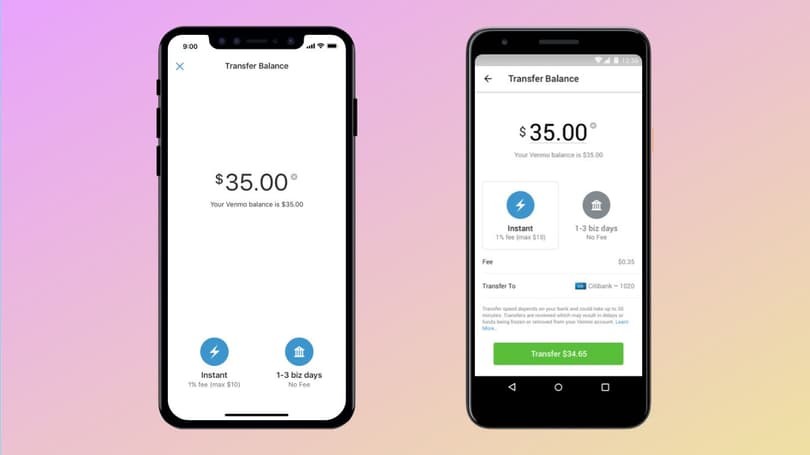

Venmo allows users to send and receive money using various methods, including their Venmo balance, linked bank accounts, debit cards, and credit cards. While some transactions are free, others incur fees. Here’s a breakdown of the most common Venmo fees:

- Instant Transfers: 1.75% of the transfer amount, with a minimum fee of $0.25 and a maximum fee of $25.

- Credit Card Transfers: A 3% fee applies when sending money to another user using a credit card.

- Standard Transfers: Free when transferring funds from your Venmo balance, bank account, or debit card. These transfers typically take 1-3 business days.

- Cryptocurrency Transactions: Fees vary based on the transaction amount, ranging from $0.49 for transactions between $1 and $4.99 to 1.80% for transactions between $200.01 and $1,000. Transactions exceeding $1,000 incur a 1.50% fee.

Venmo is committed to transparency, ensuring users are aware of any applicable fees before completing a transaction. The platform levies no charges on basic transactions like sending and receiving money from your bank account or debit card.

Calculating Venmo Instant Transfer Fees

Several Venmo fee calculators are available online to simplify the process of determining the cost of instant transfers. These calculators allow you to quickly estimate the fees associated with your transaction, helping you make informed decisions.

To use a Venmo fee calculator, simply enter the following information:

- Transaction Type: Specify that you are calculating the fee for an instant transfer.

- Transfer Amount: Enter the total amount you wish to transfer.

The calculator will then provide an accurate estimate of the fee you will be charged for the instant transfer. This tool is particularly useful for frequent Venmo users who want to avoid manual calculations and ensure they are aware of all associated costs.

Strategies to Minimize Venmo Instant Transfer Fees

While instant transfers offer convenience, the associated fees can add up over time. Here are some strategies to minimize these costs:

Avoid Using a Credit Card for Transfers

Venmo charges a 3% fee for transactions made using a credit card. To avoid this fee, opt to transfer money from your Venmo balance, linked bank account, or debit card.

Use Standard Transfers When Possible

Instant transfers come with a 1.75% fee, while standard electronic transfers are free. If you don’t need the money immediately, choose the standard transfer option, which typically takes 1-3 business days. This can save you a significant amount in fees over time.

Cash Checks with the “In 10 Days” Option

If you need to cash a check through Venmo, you have two options: instant deposit (which incurs a fee) or deposit within 10 days (which is free). Unless you require immediate access to the funds, selecting the “in 10 days” option can help you avoid unnecessary fees.

Conclusion

Venmo is a valuable tool for managing finances and conducting peer-to-peer transactions. Understanding the platform’s fee structure, particularly the fees associated with instant transfers, is essential for making informed decisions and minimizing costs. While instant transfers offer convenience, opting for standard transfers, avoiding credit card transactions, and utilizing the “in 10 days” check cashing option can help you save money on Venmo fees. By implementing these strategies, you can maximize the benefits of Venmo while keeping your transaction costs to a minimum.