How much gold is in a gold medal? While Olympic gold medals aren’t solid gold, understanding their composition reveals fascinating insights. HOW.EDU.VN provides expert insight into the real value and composition of Olympic medals. Gold content in medals, precious metal values, and Olympic investment opportunities are explained.

1. Composition of Olympic Gold Medals: A Detailed Breakdown

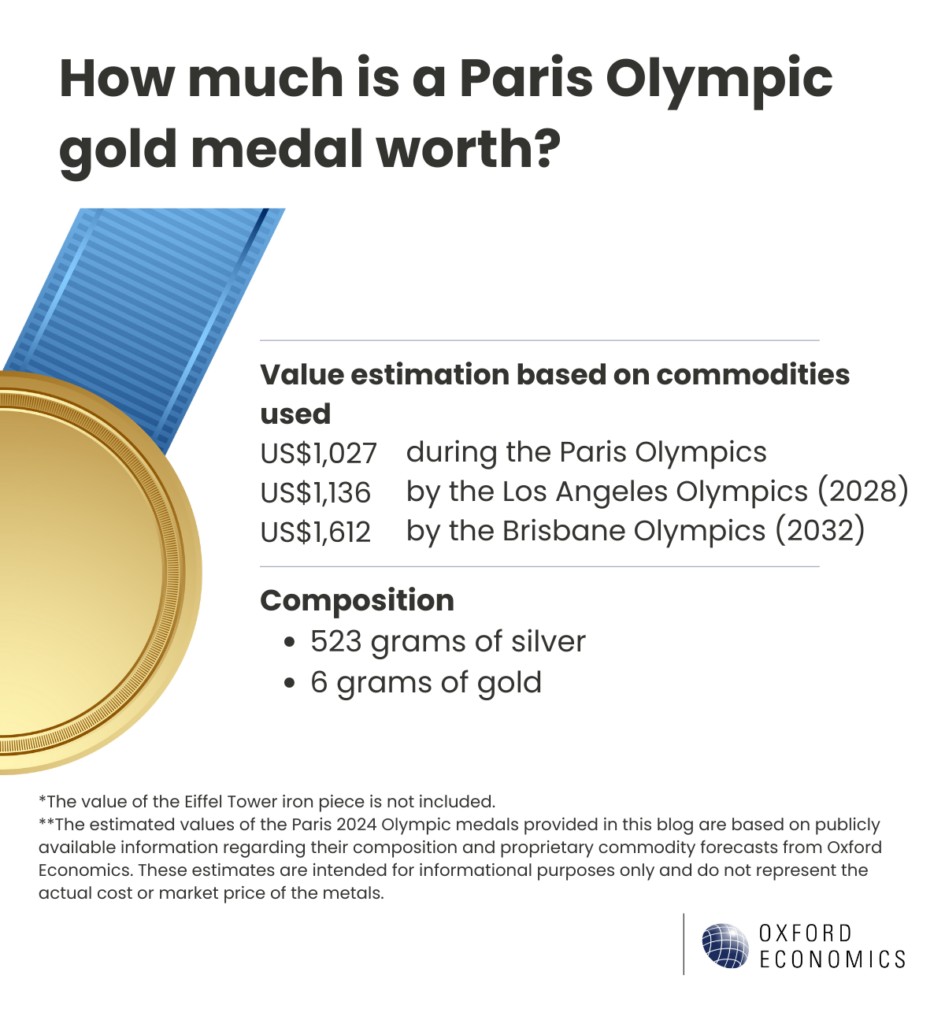

Olympic gold medals, despite their prestigious name, are not made entirely of gold. The composition of these medals is carefully regulated to balance cost, durability, and symbolic value. Let’s delve into the specific materials used in a gold medal at the Paris Olympics and their respective quantities:

- Silver: The primary component of the gold medal is silver. For the 2024 Paris Olympics, each gold medal contains 523 grams of silver. This substantial amount provides the structural integrity of the medal.

- Gold Coating: The silver base is coated with a layer of gold to give the medal its iconic golden appearance. This gold coating is relatively thin, with each medal containing 6 grams of gold.

- Other Materials: In a departure from historical tradition, the Paris Olympic medals include an iron piece from the Eiffel Tower. This addition does not affect the precious metal content but adds significant historical and cultural value to the medals.

This composition ensures that the medals are both visually impressive and economically feasible. The use of silver as the primary material reduces the overall cost while still allowing the medal to retain its symbolic value as a “gold” medal. The thin layer of gold provides the necessary aesthetic appeal without requiring an excessive amount of this precious metal.

2. The Intrinsic Value of Olympic Medals: What Are They Worth?

Beyond the glory and prestige, Olympic medals hold intrinsic value based on their material composition. Understanding this value involves assessing the market prices of the metals used, primarily silver and gold. Here’s a breakdown of the estimated worth of the medals for the 2024 Paris Olympics, excluding the value of the Eiffel Tower iron piece:

Estimated Value of Olympic Medals

| Medal Type | Silver (grams) | Gold (grams) | Other Materials | Estimated Value (USD) |

|---|---|---|---|---|

| Gold | 523 | 6 | Eiffel Tower Iron | 1,027 |

| Silver | 525 | 0 | None | 535 |

| Bronze | N/A | 0 | Copper, Tin, Zinc | 4.6 |

The value of the gold medal is significantly influenced by the price of silver, given its substantial quantity in the medal. The thin gold coating adds a premium, but silver remains the primary driver of the medal’s material worth.

Factors Influencing Medal Value

- Precious Metals Market: The fluctuating prices of gold and silver on the global market directly impact the medal’s value. Economic conditions, geopolitical events, and market sentiment can cause these prices to vary.

- Historical Significance: The inclusion of a piece from the Eiffel Tower in the Paris Olympic medals adds immeasurable historical and cultural value, though this is difficult to quantify in monetary terms.

- Collector’s Value: Over time, Olympic medals can become valuable collectibles. Their worth can increase significantly based on the historical importance of the games, the athlete who won the medal, and the rarity of the medal itself.

Future Value Projections

Oxford Economics estimates that the value of Olympic medals will increase in the coming years due to rising precious and industrial metal prices.

- 2028 Los Angeles Olympics: Gold medals are projected to be worth US$1,136, silver medals US$579, and bronze medals US$5.2.

- 2032 Brisbane Olympics: The value is expected to rise further, with gold medals reaching US$1,612, silver medals US$608, and bronze medals US$6.

Winning an Olympic medal represents both immediate glory and a potentially valuable investment for the future.

3. The Historical Significance of Gold in Olympic Medals

The use of gold in Olympic medals is deeply rooted in historical symbolism and tradition. Although the composition has evolved over time, the presence of gold continues to signify excellence, achievement, and the highest honor in sports.

Evolution of Gold Medal Composition

- Early Olympics: In the early Olympic Games, gold medals were often made of solid gold. The 1904 Olympics, for example, awarded gold medals made of nearly pure gold.

- World Wars and Economic Pressures: The practice of using solid gold medals was phased out due to economic pressures, particularly during and after World War I. The shift to gold-plated silver became more common to reduce costs while maintaining the aesthetic appeal of a gold medal.

- Modern Olympics: Today, Olympic gold medals consist primarily of silver with a gold coating. This composition balances the symbolic importance of gold with practical economic considerations.

Symbolic Value of Gold

- Wealth and Prosperity: Gold has long been associated with wealth, prosperity, and royalty. Its use in Olympic medals symbolizes the immense value and prestige of winning an Olympic event.

- Purity and Excellence: Gold is often seen as a pure and unadulterated metal, representing the dedication, hard work, and excellence required to achieve Olympic success.

- Recognition and Honor: Receiving a gold medal is the ultimate recognition of an athlete’s achievements. It represents the culmination of years of training and sacrifice, making it one of the most coveted awards in the world.

Cultural Significance

- Global Symbol of Success: The gold medal is universally recognized as a symbol of success. It transcends cultural and linguistic barriers, representing the pinnacle of athletic achievement across the globe.

- Inspiration and Aspiration: Gold medals inspire athletes and aspiring sports enthusiasts worldwide. They serve as a tangible representation of what can be achieved through hard work, dedication, and perseverance.

- National Pride: Winning a gold medal often brings immense pride to an athlete’s home country. It can unite a nation in celebration and serve as a source of inspiration for future generations.

4. Factors Driving the Value of Precious Metals: A Comprehensive Analysis

The value of precious metals such as gold and silver, which constitute the bulk of Olympic medals, is influenced by a variety of factors. Understanding these factors is crucial for appreciating the intrinsic worth and potential future value of these medals.

Gold Market Drivers

- Central Bank Demand: Central banks, particularly those in emerging markets, play a significant role in driving gold prices. Increased gold reserves signal economic stability and diversification, leading to higher demand.

- Chinese Consumer Demand: China is one of the largest consumers of gold. Rising income levels and cultural preferences for gold jewelry and investments contribute to sustained demand.

- Inflation and Economic Uncertainty: Gold is often seen as a hedge against inflation and economic uncertainty. During periods of high inflation or economic instability, investors tend to flock to gold, driving up its price.

- Interest Rates: Interest rates can impact gold prices. Lower interest rates reduce the opportunity cost of holding gold (as it doesn’t provide a yield), making it more attractive to investors.

Silver Market Drivers

- Industrial Production: Silver has extensive industrial applications, particularly in electronics, solar panels, and medical equipment. The health of global industrial production significantly influences silver demand and prices.

- Investment Demand: Like gold, silver is also used as an investment vehicle. Investor sentiment, influenced by economic forecasts and market trends, can drive silver prices up or down.

- Green Energy Initiatives: The growing focus on renewable energy, especially solar power, increases the demand for silver due to its use in photovoltaic cells.

Copper Market Drivers

- Electric Vehicle (EV) Production: Copper is a key component in EVs and their charging infrastructure. The increasing adoption of EVs drives significant demand for copper.

- Renewable Energy Projects: Copper is used extensively in wind turbines, solar farms, and other renewable energy projects. The growth of these sectors boosts copper demand.

- Infrastructure Development: Infrastructure projects, such as building construction, power grids, and transportation systems, require substantial amounts of copper. Infrastructure spending in developing and developed countries alike contributes to copper demand.

Zinc and Tin Market Drivers

- Zinc: Zinc demand is closely tied to the steel and construction industries. The health of these sectors, influenced by economic growth and infrastructure spending, impacts zinc prices.

- Tin: Tin is primarily used in electronics, particularly in soldering. The growth of the electronics industry, driven by consumer demand for smartphones, computers, and other devices, supports tin prices.

5. The Allure of Winning: Beyond the Medal

The true value of an Olympic medal extends far beyond its material composition and monetary worth. The achievement of winning an Olympic medal carries immense personal, social, and national significance.

Personal Significance

- Culmination of Years of Hard Work: Winning an Olympic medal represents the culmination of years, often decades, of intense training, dedication, and sacrifice. It is the realization of a lifelong dream for many athletes.

- Sense of Achievement: The feeling of standing on the podium, receiving a medal, and hearing the national anthem is an unparalleled sense of achievement. It is a moment of pride, joy, and validation for the athlete.

- Personal Growth: The journey to becoming an Olympic medalist fosters personal growth, resilience, and mental fortitude. Athletes develop valuable life skills, such as discipline, perseverance, and teamwork, that extend beyond their sporting careers.

Social Significance

- Role Model: Olympic medalists become role models for aspiring athletes and young people. Their success inspires others to pursue their dreams and overcome challenges.

- Community Pride: An athlete’s success often brings pride to their local community. It unites people in celebration and serves as a source of inspiration for future generations.

- Promoting Sports and Healthy Lifestyles: Olympic medalists can play a key role in promoting sports and healthy lifestyles. Their stories and achievements encourage people to get involved in physical activity and embrace a healthy lifestyle.

National Significance

- National Pride and Unity: Winning an Olympic medal often brings immense pride to an athlete’s home country. It can unite a nation in celebration and foster a sense of national identity.

- Enhancing International Reputation: An Olympic medal can enhance a country’s international reputation. It showcases the nation’s sporting prowess and contributes to its overall image on the global stage.

- Economic Benefits: Hosting the Olympics and winning medals can bring economic benefits to a country, including increased tourism, investment, and infrastructure development.

6. How to Secure Expert Advice on Investment in Precious Metals

Investing in precious metals can be a lucrative but complex endeavor. Securing expert advice is crucial to making informed decisions and maximizing returns. HOW.EDU.VN offers a unique platform to connect with leading experts who can provide personalized guidance on precious metal investments.

Benefits of Consulting Experts on HOW.EDU.VN

- Access to Top Professionals: HOW.EDU.VN provides access to a network of over 100 renowned PhDs and experts from various fields, including finance and economics.

- Personalized Advice: Experts offer personalized advice tailored to your specific investment goals, risk tolerance, and financial situation.

- In-Depth Analysis: Experts provide in-depth analysis of market trends, economic indicators, and geopolitical factors that can impact precious metal prices.

- Risk Management Strategies: Experts help you develop effective risk management strategies to protect your investments from market volatility and potential losses.

- Timely Updates: Experts provide timely updates on market developments, regulatory changes, and emerging opportunities in the precious metals market.

How to Engage with Experts on HOW.EDU.VN

- Visit the HOW.EDU.VN Website: Navigate to HOW.EDU.VN to explore the platform’s features and services.

- Browse Expert Profiles: Browse the profiles of PhDs and experts specializing in finance and economics to find the right advisor for your needs.

- Submit Your Query: Submit your specific questions or investment goals through the platform’s secure messaging system.

- Receive Expert Consultation: Receive personalized consultation from your chosen expert, including detailed analysis, recommendations, and risk management strategies.

- Implement Investment Strategies: Implement the recommended investment strategies with confidence, knowing that you have expert guidance every step of the way.

By leveraging the expertise available on HOW.EDU.VN, you can make informed decisions, manage risks effectively, and optimize your returns in the precious metals market.

7. Precious Metals and the Global Economy

Precious metals play a pivotal role in the global economy, serving not only as valuable commodities but also as key indicators of economic health and stability. Their significance extends from industrial applications to investment havens, influencing financial markets and economic policies worldwide.

Role of Gold

- Safe Haven Asset: Gold is widely regarded as a safe haven asset, particularly during times of economic uncertainty and geopolitical instability. Investors often turn to gold to preserve wealth and protect against inflation.

- Monetary Policy: Central banks hold gold reserves as part of their monetary policy. These reserves provide a buffer against economic shocks and enhance a country’s financial credibility.

- Jewelry and Manufacturing: Gold has significant demand in the jewelry industry and various manufacturing processes. Countries with strong jewelry markets, such as India and China, contribute to global gold demand.

Role of Silver

- Industrial Applications: Silver is extensively used in industrial applications, including electronics, solar panels, and medical equipment. Its unique properties make it essential for many technological advancements.

- Investment Demand: Silver is also a popular investment option, offering diversification and potential returns. Investor sentiment and market trends influence silver prices significantly.

- Green Energy Initiatives: The growing focus on renewable energy, especially solar power, increases the demand for silver due to its use in photovoltaic cells.

Impact on Financial Markets

- Commodity Trading: Precious metals are actively traded on commodity exchanges worldwide. Their price fluctuations can impact financial markets and investor portfolios.

- Exchange Rates: The value of a country’s currency can be influenced by its gold reserves and commodity exports. Countries with significant precious metal resources may experience stronger exchange rates.

- Inflation Hedging: Precious metals are often used as a hedge against inflation. Investors may allocate a portion of their portfolio to precious metals to protect against rising prices.

Geopolitical Factors

- Political Instability: Geopolitical tensions and political instability can drive up demand for safe haven assets like gold. Investors seek refuge in gold during uncertain times, leading to price increases.

- Trade Policies: Trade policies and tariffs can impact the supply and demand of precious metals. Trade disputes between major economies can disrupt global supply chains and influence commodity prices.

- Sanctions: Economic sanctions imposed on countries with significant precious metal resources can disrupt supply and impact global markets.

8. Success Stories: Expert Advice in Action

The value of expert advice is best illustrated through real-world success stories. HOW.EDU.VN has facilitated numerous consultations that have led to significant financial gains and improved decision-making for its users. Here are a few examples of how expert advice has made a difference:

Case Study 1: Investment Portfolio Diversification

- Client: A young professional seeking to diversify their investment portfolio.

- Challenge: Limited knowledge of precious metals and concerns about market volatility.

- Expert: A finance expert on HOW.EDU.VN specializing in portfolio management.

- Solution: The expert provided a detailed analysis of the client’s financial situation, risk tolerance, and investment goals. They recommended allocating a portion of the portfolio to gold and silver exchange-traded funds (ETFs).

- Outcome: The client diversified their portfolio, reduced overall risk, and achieved a higher return on investment compared to their previous strategy.

Case Study 2: Navigating Market Uncertainty

- Client: An experienced investor concerned about potential market downturns.

- Challenge: Uncertainty about the impact of geopolitical events on precious metal prices.

- Expert: An economist on HOW.EDU.VN specializing in commodity markets.

- Solution: The economist provided regular updates on market developments, analyzed the potential impact of geopolitical events, and recommended adjusting the client’s investment strategy accordingly.

- Outcome: The client successfully navigated market uncertainty, preserved their capital, and even profited from strategic investments in precious metals.

Case Study 3: Informed Decision-Making

- Client: A business owner considering investing in a gold mining company.

- Challenge: Limited knowledge of the mining industry and concerns about potential risks.

- Expert: A mining industry expert on HOW.EDU.VN specializing in investment analysis.

- Solution: The expert conducted a thorough analysis of the gold mining company, assessed its financial health, and provided a detailed risk assessment.

- Outcome: The client made an informed decision based on the expert’s analysis, avoiding a potentially risky investment and preserving their capital.

Expertise Pays Off

These success stories demonstrate the tangible benefits of seeking expert advice on HOW.EDU.VN. By connecting with leading professionals, users can make informed decisions, manage risks effectively, and achieve their investment goals.

9. The Future of Olympic Medals: Innovations and Sustainability

As the Olympic Games continue to evolve, so too does the composition and production of Olympic medals. Innovations in materials science and a growing emphasis on sustainability are shaping the future of these iconic symbols of achievement.

Material Innovations

- Advanced Alloys: Researchers are exploring the use of advanced alloys that are both lightweight and durable. These alloys could reduce the overall weight of the medals while maintaining their structural integrity.

- Recycled Materials: There is a growing trend towards using recycled materials in Olympic medals. This includes recycled metals, plastics, and other sustainable materials.

- 3D Printing: 3D printing technology is being used to create intricate and customized medal designs. This allows for greater flexibility in medal production and the inclusion of unique elements.

Sustainability Initiatives

- Ethical Sourcing: Olympic organizers are increasingly focused on ethical sourcing of materials. This includes ensuring that metals are mined responsibly and that labor practices are fair and sustainable.

- Carbon Footprint Reduction: Efforts are being made to reduce the carbon footprint of medal production. This includes using renewable energy, minimizing waste, and optimizing transportation logistics.

- Environmental Impact Assessment: Olympic organizers conduct thorough environmental impact assessments to identify and mitigate potential environmental risks associated with medal production.

Design Trends

- Cultural Integration: Medals are increasingly incorporating elements of the host country’s culture and heritage. This adds a unique and meaningful touch to the medals, reflecting the spirit of the host nation.

- Interactive Elements: Some medals are being designed with interactive elements, such as QR codes that link to information about the athlete, the event, or the host city.

- Customization: There is a growing trend towards customizing medals for specific events or athletes. This allows for greater personalization and recognition of individual achievements.

HOW.EDU.VN Supporting Sustainable Practices

HOW.EDU.VN supports sustainable practices by connecting users with experts who can provide guidance on ethical sourcing, environmental impact assessment, and sustainable investment strategies. By promoting responsible business practices, HOW.EDU.VN contributes to a more sustainable future for the Olympic Games and the global economy.

10. FAQs About Gold in Olympic Medals

1. Are Olympic gold medals made of solid gold?

No, Olympic gold medals are not made of solid gold. They are primarily made of silver with a gold coating.

2. How much gold is in a gold medal?

A gold medal typically contains about 6 grams of gold, which is used as a coating over a silver base.

3. Why are gold medals not made of solid gold?

Using solid gold would be prohibitively expensive. The current composition balances cost-effectiveness with the symbolic value of gold.

4. What is the estimated value of a gold medal?

The estimated value of a gold medal from the 2024 Paris Olympics is around US$1,027, based on the market prices of silver and gold.

5. Do silver and bronze medals contain any gold?

No, silver and bronze medals do not contain any gold. Silver medals are made of pure silver, while bronze medals are made of copper, tin, and zinc.

6. Will the value of Olympic medals increase in the future?

Yes, experts predict that the value of Olympic medals will increase due to rising precious and industrial metal prices.

7. What factors influence the value of precious metals?

The value of precious metals is influenced by factors such as central bank demand, industrial production, inflation, and geopolitical events.

8. How can I invest in precious metals?

You can invest in precious metals through various means, including buying physical gold or silver, investing in exchange-traded funds (ETFs), or purchasing stocks in mining companies.

9. Where can I get expert advice on investing in precious metals?

HOW.EDU.VN offers a platform to connect with leading experts who can provide personalized guidance on precious metal investments.

10. What is the historical significance of gold in Olympic medals?

The use of gold in Olympic medals symbolizes wealth, prosperity, purity, and excellence, representing the highest honor in sports.

For expert advice and personalized guidance on investing in precious metals, contact HOW.EDU.VN today. Our team of over 100 renowned PhDs and experts is ready to help you achieve your investment goals.

Contact Information:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Don’t navigate the complexities of precious metal investments alone. Reach out to how.edu.vn and unlock the expertise you need to succeed.