How Much Is Us In Jamaican Currency? At HOW.EDU.VN, we provide expert insights into currency exchange rates, helping you understand the fluctuations and factors that influence the value of the Jamaican dollar against the US dollar. Our team of experienced financial professionals is dedicated to providing accurate and up-to-date information, ensuring you have the knowledge to make informed decisions. Discover the latest exchange rates, historical trends, and expert analysis on currency conversions and foreign exchange markets.

1. Understanding the Jamaican Dollar (JMD)

The Jamaican Dollar (JMD) is the official currency of Jamaica. Understanding its value and how it fluctuates against other currencies, particularly the US dollar, is crucial for anyone involved in international trade, travel, or remittances. The history of the Jamaican dollar and its relationship with the US dollar is complex, marked by periods of stability and significant fluctuations.

1.1 Historical Context of the Jamaican Dollar

Following Jamaica’s independence from Britain, the country initially pegged its currency to the British pound. However, as the United States became Jamaica’s primary trading partner, the peg shifted to the US dollar. Initially, the Jamaican dollar was stronger than the US dollar. For example, in the early 1970s, the exchange rate was approximately J$0.909 to US$1. This advantageous position was maintained through borrowed reserves to meet the demand for foreign currency, leading to a need for policy adjustments.

1.2 Factors Influencing the JMD/USD Exchange Rate

Several factors influence the exchange rate between the Jamaican dollar and the US dollar. These include:

- Economic Performance: Jamaica’s economic growth, inflation rate, and unemployment levels all impact the value of its currency. Strong economic performance typically leads to a stronger currency.

- Trade Balance: A trade surplus (exporting more than importing) generally strengthens a country’s currency, while a trade deficit weakens it.

- Interest Rates: Higher interest rates can attract foreign investment, increasing demand for the local currency and strengthening it.

- Political Stability: Political stability and sound governance contribute to investor confidence, which can positively influence the currency’s value.

- Global Economic Conditions: Global events, such as economic recessions or geopolitical tensions, can also impact the JMD/USD exchange rate.

1.3 Key Economic Indicators in Jamaica

Monitoring key economic indicators is essential for understanding the Jamaican dollar’s performance. These indicators include:

- GDP Growth Rate: Reflects the overall health of the Jamaican economy.

- Inflation Rate: Measures the rate at which prices for goods and services are rising.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed.

- Current Account Balance: Shows the difference between Jamaica’s savings and investment.

- Fiscal Balance: Indicates the difference between government revenues and expenditures.

2. Current Exchange Rate: $1 USD to JMD

The exchange rate between the US dollar and the Jamaican dollar fluctuates constantly due to market forces. As of today, it’s crucial to consult reliable financial sources to get the most up-to-date information. You can find the current exchange rate on financial websites, currency converters, or through your bank.

2.1 Where to Find the Most Up-to-Date Exchange Rate

To find the most current exchange rate, consider the following resources:

- Financial Websites: Reputable financial websites like Google Finance, Yahoo Finance, and Bloomberg provide real-time exchange rates.

- Currency Converter Tools: Online currency converters such as XE.com and OANDA offer current exchange rates and historical data.

- Local Banks and Financial Institutions: Jamaican banks and financial institutions provide exchange rate information on their websites or through their customer service channels.

- Central Bank of Jamaica: The official website of the Central Bank of Jamaica may offer data and insights into currency exchange trends.

2.2 Factors Affecting Daily Fluctuations

Several factors can cause the JMD/USD exchange rate to fluctuate daily:

- Market Sentiment: News and events can influence market sentiment, leading to changes in demand for the Jamaican dollar.

- Trading Volumes: Higher trading volumes can result in greater volatility in the exchange rate.

- Economic Data Releases: Economic data releases, such as inflation reports or GDP figures, can trigger significant market reactions.

- Global Events: Global events, such as political developments or natural disasters, can also impact the exchange rate.

2.3 Historical Trends in the JMD/USD Exchange Rate

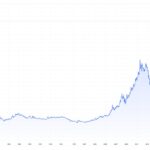

Over the years, the Jamaican dollar has experienced significant depreciation against the US dollar. From the early 1970s when the exchange rate was around J$0.909 to US$1, it has steadily increased. The liberalization of the financial sector in the early 1990s led to further depreciation. By 1992, the exchange rate had jumped to J$25.11 to US$1, and it has continued to depreciate since then. Today, the exchange rate hovers around J$150 to J$160 per US$1, reflecting the long-term economic challenges and policy changes Jamaica has faced.

3. Converting USD to JMD: A Practical Guide

Converting US dollars to Jamaican dollars can be straightforward if you follow the right steps and use the appropriate tools. Whether you are traveling to Jamaica, sending money to family, or conducting business, knowing how to convert currency is essential.

3.1 Step-by-Step Conversion Process

Here’s a step-by-step guide on how to convert USD to JMD:

-

Find the Current Exchange Rate: Use one of the reliable sources mentioned earlier (financial websites, currency converters, banks) to find the current JMD/USD exchange rate.

-

Determine the Amount: Decide how much USD you want to convert.

-

Calculate the Conversion: Multiply the amount of USD by the current exchange rate.

- Formula: JMD = USD amount x JMD/USD exchange rate

-

Example: If the current exchange rate is J$150 per US$1, and you want to convert US$100, the calculation would be:

- JMD = 100 x 150 = J$15,000

-

Consider Fees and Commissions: Be aware that banks and currency exchange services may charge fees or commissions, which can affect the final amount you receive.

3.2 Tools and Resources for Currency Conversion

Several tools and resources can help you with currency conversion:

- Online Currency Converters: Websites like XE.com, OANDA, and Google Currency Converter offer easy-to-use conversion tools.

- Mobile Apps: Many currency converter apps are available for smartphones, providing real-time exchange rates and offline access.

- Bank Websites: Most banks have currency conversion calculators on their websites.

3.3 Understanding Exchange Rate Markup and Fees

When converting currency, it’s important to understand the exchange rate markup and any associated fees. The markup is the difference between the mid-market exchange rate (the real exchange rate) and the rate offered by the bank or currency exchange service. Fees can include transaction fees, service charges, or commissions.

- Markup: The markup is how banks and exchange services make a profit. It’s usually a percentage of the total amount converted.

- Fees: Fees can be a flat fee or a percentage of the transaction.

To get the best deal, compare rates and fees from different providers before making a conversion.

4. Where to Exchange Currency: Best Options

Choosing the right place to exchange currency can significantly impact the amount of Jamaican dollars you receive. Different options offer varying exchange rates, fees, and convenience.

4.1 Banks and Credit Unions

- Pros:

- Trust and Security: Banks and credit unions are generally reliable and secure.

- Familiarity: Many people prefer using their bank for financial transactions.

- Cons:

- Lower Exchange Rates: Banks often offer less favorable exchange rates compared to other options.

- Fees: Banks may charge transaction fees or commissions.

- Convenience: Limited operating hours and potential wait times can be inconvenient.

4.2 Currency Exchange Services

- Pros:

- Better Exchange Rates: Currency exchange services often offer more competitive exchange rates than banks.

- Convenience: Many currency exchange services have convenient locations and extended hours.

- Cons:

- Fees: Exchange services may charge fees or commissions.

- Security: It’s important to choose reputable exchange services to avoid scams.

4.3 Airport Exchange Kiosks

- Pros:

- Convenience: Airport kiosks are convenient for last-minute currency exchange.

- Cons:

- High Fees: Airport kiosks typically offer the worst exchange rates and charge high fees.

- Limited Options: Limited competition can result in unfavorable terms.

4.4 Using ATMs in Jamaica

- Pros:

- Convenience: ATMs are widely available in Jamaica.

- Exchange Rate: ATMs often offer reasonable exchange rates.

- Cons:

- Fees: ATM fees and foreign transaction fees can add up.

- Security: Be cautious when using ATMs in unfamiliar areas.

4.5 Tips for Getting the Best Exchange Rate

To maximize the value of your money, consider these tips:

- Compare Rates: Compare exchange rates from different providers before making a conversion.

- Avoid Airport Kiosks: Airport kiosks typically offer the worst rates and highest fees.

- Use Local ATMs: If possible, use ATMs in Jamaica to withdraw Jamaican dollars at a reasonable exchange rate.

- Negotiate: If you are exchanging a large amount of currency, try to negotiate a better rate.

- Avoid Credit Card Advances: Credit card cash advances often come with high fees and interest rates.

5. Impact of Economic Policies on the JMD/USD Rate

Economic policies play a significant role in determining the exchange rate between the Jamaican dollar and the US dollar. Understanding these policies can provide insights into potential future movements in the currency market.

5.1 Monetary Policy and Interest Rates

Monetary policy, controlled by the Central Bank of Jamaica, influences interest rates, inflation, and overall economic stability.

- Interest Rates: Higher interest rates can attract foreign investment, increasing demand for the Jamaican dollar and strengthening its value.

- Inflation Control: Effective inflation control policies can help maintain the value of the Jamaican dollar.

- Currency Intervention: The Central Bank can intervene in the foreign exchange market to stabilize the currency or influence its value.

5.2 Fiscal Policy and Government Spending

Fiscal policy, which involves government spending and taxation, also impacts the exchange rate.

- Government Debt: High levels of government debt can weaken the currency, as investors may become concerned about the country’s ability to repay its obligations.

- Budget Deficits: Persistent budget deficits can lead to increased borrowing, which can put downward pressure on the currency.

- Economic Reforms: Economic reforms aimed at improving efficiency and competitiveness can strengthen investor confidence and support the currency.

5.3 Trade Policies and International Agreements

Trade policies and international agreements affect Jamaica’s trade balance, which in turn influences the exchange rate.

- Trade Agreements: Trade agreements can increase exports, leading to a stronger currency.

- Import Tariffs: High import tariffs can reduce imports, potentially strengthening the currency.

- Export Promotion: Policies aimed at promoting exports can improve the trade balance and support the currency.

5.4 Exchange Rate Regimes: Fixed vs. Floating

Jamaica has transitioned through different exchange rate regimes, each with its own impact on the currency.

- Fixed Exchange Rate: In a fixed exchange rate regime, the currency’s value is pegged to another currency or a basket of currencies. This provides stability but limits the country’s ability to respond to economic shocks.

- Floating Exchange Rate: In a floating exchange rate regime, the currency’s value is determined by market forces. This allows for greater flexibility but can lead to volatility.

Jamaica currently operates under a floating exchange rate system, which means the value of the Jamaican dollar is determined by supply and demand in the foreign exchange market.

6. Tips for Travelers: Managing Currency in Jamaica

Traveling to Jamaica requires careful planning, especially when it comes to managing your currency. Here are some tips to help you make the most of your money while enjoying your trip.

6.1 Best Practices for Using Cash

- Carry Small Denominations: Carry Jamaican dollars in small denominations to make it easier to pay for goods and services.

- Be Aware of Your Surroundings: Be cautious when handling cash in public places.

- Store Cash Securely: Keep your cash in a secure place, such as a money belt or a hidden pocket.

6.2 Credit and Debit Card Usage in Jamaica

- Inform Your Bank: Notify your bank of your travel plans to avoid having your card blocked.

- Check for Foreign Transaction Fees: Be aware of any foreign transaction fees your bank may charge.

- Use Credit Cards for Large Purchases: Use credit cards for larger purchases to take advantage of fraud protection and potential rewards.

- Be Cautious at ATMs: Use ATMs located in secure areas, such as banks or shopping malls.

6.3 Understanding Local Pricing and Tipping Customs

- Negotiate Prices: In some markets and informal settings, it may be possible to negotiate prices.

- Tipping: Tipping is customary in Jamaica for good service. A general guideline is to tip 10-15% at restaurants and for other services.

- Sales Tax: Be aware of sales tax, which is typically included in the price of goods and services.

6.4 Budgeting for Your Trip to Jamaica

- Estimate Daily Expenses: Estimate your daily expenses, including accommodation, food, transportation, and activities.

- Create a Budget: Create a budget and track your spending to stay within your financial limits.

- Set Aside Emergency Funds: Set aside emergency funds for unexpected expenses.

6.5 Currency Exchange Upon Arrival and Departure

- Exchange a Small Amount at the Airport: Exchange a small amount of currency at the airport upon arrival to cover immediate expenses.

- Use Local Banks or Exchange Services: Use local banks or reputable exchange services for better exchange rates.

- Convert Remaining Currency Before Departure: Convert any remaining Jamaican dollars back to your home currency before departing Jamaica.

7. Economic Outlook and Future Predictions for JMD/USD

Predicting the future exchange rate between the Jamaican dollar and the US dollar is challenging, but analyzing current economic trends and forecasts can provide some insights.

7.1 Expert Analysis and Forecasts

- Financial Institutions: Financial institutions and economic research firms regularly publish forecasts for the JMD/USD exchange rate.

- Economic Indicators: Monitoring key economic indicators, such as GDP growth, inflation, and unemployment, can help you assess the potential direction of the currency.

- Government Policies: Keep an eye on government policies that could impact the currency, such as monetary policy changes or fiscal reforms.

7.2 Potential Economic Shocks and Risks

- Global Economic Slowdown: A global economic slowdown could negatively impact Jamaica’s economy and weaken its currency.

- Commodity Price Fluctuations: Jamaica’s economy is sensitive to commodity price fluctuations, particularly in the bauxite and alumina sectors.

- Political Instability: Political instability could undermine investor confidence and put downward pressure on the currency.

7.3 Long-Term Trends and Considerations

- Economic Development: Long-term economic development and diversification can strengthen the Jamaican dollar.

- Debt Management: Effective debt management is crucial for maintaining the currency’s stability.

- Investment Climate: Improving the investment climate can attract foreign investment and support the currency.

7.4 Strategies for Mitigating Currency Risk

- Hedging: Businesses can use hedging strategies to protect against currency fluctuations.

- Diversification: Diversifying investments can reduce exposure to currency risk.

- Forward Contracts: Forward contracts allow you to lock in an exchange rate for a future transaction.

7.5 Resources for Staying Informed

- Financial News Outlets: Stay informed about economic developments by following reputable financial news outlets.

- Central Bank of Jamaica: The Central Bank of Jamaica’s website provides data and insights into the Jamaican economy.

- Economic Research Reports: Consult economic research reports from financial institutions and research firms.

8. The Role of HOW.EDU.VN in Financial Guidance

HOW.EDU.VN offers a platform for individuals and businesses seeking expert financial guidance. Our team of experienced professionals can provide insights and advice on currency exchange, investment strategies, and economic trends.

8.1 Expert Financial Advice Available at HOW.EDU.VN

- Currency Exchange Strategies: Our experts can help you develop strategies for managing currency risk and maximizing the value of your money.

- Investment Planning: We offer guidance on investment planning, including diversification and asset allocation.

- Economic Analysis: Our team provides economic analysis and forecasts to help you make informed financial decisions.

8.2 Benefits of Consulting with Financial Experts

- Personalized Advice: Our experts provide personalized advice tailored to your specific needs and goals.

- Informed Decisions: We help you make informed decisions based on accurate data and expert analysis.

- Risk Management: We can help you identify and manage financial risks.

8.3 Success Stories and Testimonials

- Case Studies: We have helped numerous clients navigate the complexities of currency exchange and investment planning.

- Testimonials: Our clients have praised our expertise, professionalism, and commitment to their financial success.

8.4 How to Connect with Experts on HOW.EDU.VN

- Visit Our Website: Visit HOW.EDU.VN to learn more about our services and connect with our experts.

- Contact Us: Contact us via phone, email, or online chat to schedule a consultation.

- Join Our Community: Join our online community to connect with other individuals and businesses interested in financial guidance.

8.5 Resources and Tools Offered by HOW.EDU.VN

- Financial Calculators: We offer a range of financial calculators to help you plan and manage your finances.

- Educational Articles: Our website features educational articles on a variety of financial topics.

- Webinars and Workshops: We host webinars and workshops to provide in-depth insights into financial planning and investment strategies.

9. Common Misconceptions About Currency Exchange

Many misconceptions exist regarding currency exchange that can lead to costly mistakes. It’s crucial to be informed to avoid these pitfalls.

9.1 Debunking Myths About Exchange Rates

-

Myth: Airport Exchange Kiosks Offer the Best Rates:

- Reality: Airport kiosks typically offer the worst exchange rates and charge high fees.

-

Myth: All Banks Offer the Same Exchange Rates:

- Reality: Exchange rates can vary significantly between banks.

-

Myth: Credit Card Cash Advances Are a Good Option:

- Reality: Credit card cash advances often come with high fees and interest rates.

-

Myth: You Should Exchange All Your Currency Before Traveling:

- Reality: It’s often better to exchange a small amount before traveling and then use local ATMs or exchange services for better rates.

9.2 Avoiding Common Currency Exchange Mistakes

- Failing to Compare Rates: Always compare exchange rates from different providers before making a conversion.

- Ignoring Fees: Be aware of any fees or commissions that may be charged.

- Using Unreliable Sources: Use reputable sources for exchange rate information.

- Carrying Large Amounts of Cash: Avoid carrying large amounts of cash, as it can be risky.

9.3 Understanding the Real Exchange Rate

- Mid-Market Rate: The mid-market rate is the real exchange rate, without any markup or fees.

- Markup: The markup is the difference between the mid-market rate and the rate offered by the bank or currency exchange service.

- Transparency: Look for providers that are transparent about their exchange rates and fees.

9.4 The Impact of Timing on Currency Exchange

- Market Fluctuations: Exchange rates can fluctuate throughout the day, so timing can impact the amount you receive.

- Economic News: Economic news releases can trigger significant market reactions, so be aware of upcoming events.

- Long-Term Trends: Consider long-term trends when making currency exchange decisions.

9.5 Practical Tips for Smart Currency Management

- Plan Ahead: Plan your currency exchange in advance to avoid last-minute decisions.

- Set a Budget: Set a budget and track your spending to stay within your financial limits.

- Be Informed: Stay informed about economic developments and currency trends.

10. FAQ: Frequently Asked Questions About USD to JMD

Here are some frequently asked questions about converting US dollars to Jamaican dollars:

10.1 What is the Current Exchange Rate for $1 USD to JMD?

The current exchange rate fluctuates, so check a reliable financial website like Google Finance or XE.com for the most up-to-date information.

10.2 Where Can I Exchange USD to JMD?

You can exchange currency at banks, credit unions, currency exchange services, and ATMs in Jamaica.

10.3 What is the Best Way to Get Jamaican Dollars?

The best way is to compare rates from different providers and use local ATMs for potentially better rates.

10.4 Are There Any Fees for Exchanging Currency?

Yes, banks and currency exchange services may charge fees or commissions.

10.5 Can I Use Credit Cards in Jamaica?

Yes, credit cards are widely accepted in Jamaica, but check for foreign transaction fees.

10.6 What Should I Do with Leftover Jamaican Dollars?

Convert them back to your home currency before departing Jamaica.

10.7 How Much Should I Tip in Jamaica?

Tipping 10-15% is customary for good service in Jamaica.

10.8 Is It Safe to Use ATMs in Jamaica?

Yes, but be cautious and use ATMs located in secure areas.

10.9 How Does the Jamaican Economy Affect the Exchange Rate?

The Jamaican economy’s performance, including GDP growth, inflation, and trade balance, affects the exchange rate.

10.10 How Can I Stay Updated on the JMD/USD Exchange Rate?

Follow reputable financial news outlets and the Central Bank of Jamaica’s website.

Navigating the complexities of currency exchange can be challenging. At HOW.EDU.VN, we are committed to providing you with the expert guidance you need to make informed financial decisions. Our team of experienced professionals is here to assist you with currency exchange strategies, investment planning, and economic analysis. Contact us today to schedule a consultation and take control of your financial future.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

Whatsapp: +1 (310) 555-1212

Website: how.edu.vn