How Much Is 2000 Square Feet? Understanding the pricing and implications of a 2000 square foot property is crucial for making informed decisions, and exploring the true cost of a 2000 square foot space involves considering various factors beyond just the initial price tag. Seeking expert advice can provide invaluable insights into property valuation and investment strategies. Discover expert financial guidance at HOW.EDU.VN.

1. Understanding the Basics: What is 2000 Square Feet?

Before diving into the costs, let’s visualize what 2000 square feet actually means.

1.1. Visualizing the Size

Two thousand square feet offers a comfortable living space for families and individuals alike. To put it into perspective, consider these comparisons:

- Tennis Court Analogy: A standard tennis court’s playable area is about 2,800 square feet. Imagine removing a portion of this court, and you’re close to visualizing 2,000 square feet.

- Two-Car Garages: A typical two-car garage is around 400 square feet. Therefore, five such garages combined would equal approximately 2,000 square feet.

1.2. Common Layouts

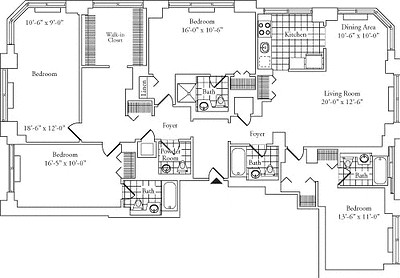

A 2000 square foot apartment or house usually includes:

- Three to four bedrooms

- A spacious living area

- A fully-equipped kitchen

- Multiple bathrooms

- Walk-in closets

2. Key Factors Influencing the Cost of 2000 Square Feet

Several elements can affect the price of a 2000 square foot space. Understanding these factors is essential for accurate budgeting and planning.

2.1. Location, Location, Location

The geographical location significantly impacts the cost. Prime urban areas will command higher prices than suburban or rural locations.

- Urban Centers: Expect premium prices in cities like New York, San Francisco, or London.

- Suburban Areas: Costs are generally lower, offering more space for your money.

- Rural Regions: These areas offer the most affordable options but may come with additional transportation costs.

2.2. Property Type

The type of property—apartment, house, or commercial space—also plays a crucial role.

- Apartments: Often cheaper than houses due to shared amenities and smaller land allocation.

- Houses: Provide more privacy and land but come with higher maintenance costs.

- Commercial Spaces: Pricing varies widely based on industry, foot traffic, and zoning regulations.

2.3. Condition and Age

The property’s condition and age are significant cost drivers. Newer properties usually require less immediate maintenance, while older ones may need renovations.

- New Constructions: Typically priced higher but come with modern amenities and fewer initial repairs.

- Well-Maintained Older Properties: Can offer a balance of charm and reasonable costs.

- Properties Needing Renovation: While cheaper upfront, factor in renovation expenses, which can be substantial.

2.4. Market Conditions

Real estate market dynamics, such as supply and demand, interest rates, and economic conditions, influence property values.

- Buyer’s Market: More properties are available, potentially driving prices down.

- Seller’s Market: Limited availability can inflate prices, making it more competitive for buyers.

2.5. Materials and Finishes

The cost of materials and finishes significantly impacts the overall expense, especially in construction or renovation projects.

- High-End Finishes: Premium materials like marble countertops, hardwood flooring, and designer fixtures substantially increase costs.

- Standard Finishes: Using more economical options such as laminate countertops, carpet, and standard appliances can help manage the budget.

- Sustainability: Opting for eco-friendly and sustainable materials, such as bamboo flooring, recycled glass tiles, and energy-efficient appliances, can also affect the price. While some sustainable options may have a higher upfront cost, they often lead to long-term savings through reduced energy and water consumption.

2.6. Labor Costs

Labor costs vary widely depending on the location, the complexity of the project, and the expertise required.

- Geographical Differences: Labor rates are typically higher in metropolitan areas and regions with a high cost of living.

- Specialized Work: Projects requiring specialized skills, such as custom carpentry, electrical work, or plumbing, can increase labor costs.

- Contractor Selection: Hiring licensed and insured contractors is essential for ensuring quality work and compliance with local building codes. While their rates may be higher, the investment protects against potential liabilities and ensures professional results.

2.7. Permits and Fees

Obtaining the necessary permits and paying associated fees is a critical component of any construction or renovation project.

- Building Permits: Required for most construction, renovation, and remodeling projects to ensure compliance with local building codes and safety standards.

- Inspection Fees: Local authorities often conduct inspections at various stages of the project to verify adherence to regulations, which may incur additional fees.

- Impact Fees: Some municipalities charge impact fees to help fund public infrastructure improvements needed to support new developments.

2.8. Energy Efficiency

Energy-efficient features can affect the initial cost and long-term savings of a 2000 square foot space.

- Insulation: Proper insulation reduces energy consumption by maintaining consistent indoor temperatures, leading to lower heating and cooling costs.

- Windows and Doors: Energy-efficient windows and doors minimize heat transfer, improving overall energy efficiency.

- HVAC Systems: High-efficiency heating, ventilation, and air conditioning (HVAC) systems consume less energy, resulting in lower utility bills.

- Renewable Energy: Installing solar panels or other renewable energy systems can significantly reduce energy costs and environmental impact, although the upfront investment may be substantial.

2.9. Local Zoning Laws

Local zoning laws and regulations play a significant role in determining the permissible uses and development standards for a 2000 square foot space.

- Land Use Restrictions: Zoning ordinances specify how land can be used, including residential, commercial, industrial, or mixed-use, affecting the potential value and development options.

- Building Codes: These codes dictate the minimum standards for construction, renovation, and safety, influencing the cost of materials, labor, and compliance.

- Density Regulations: Zoning laws often regulate the density of development, such as maximum building height, lot coverage, and minimum setback requirements, which can impact the overall design and usability of the space.

Consulting with local zoning officials and real estate professionals can provide valuable insights into how these regulations affect the feasibility and cost of projects.

3. Estimating the Cost: A Breakdown

To provide a clearer picture, let’s break down the costs associated with acquiring or renting a 2000 square foot space.

3.1. Purchasing a 2000 Square Foot Home

- Average Cost: National averages can range from $200,000 to over $1 million, depending on location and property features.

- Down Payment: Typically 5% to 20% of the purchase price.

- Closing Costs: Approximately 2% to 5% of the loan amount.

- Property Taxes: Vary by location but average around 1% to 2% of the property’s assessed value annually.

- Homeowner’s Insurance: Averages $1,000 to $2,000 per year.

- Maintenance: Budget 1% to 3% of the home’s value annually for repairs and upkeep.

3.2. Renting a 2000 Square Foot Apartment

- Average Rent: Ranges from $1,500 to $5,000 per month, influenced by location and amenities.

- Security Deposit: Usually one to two months’ rent.

- Utilities: Expect to pay $200 to $500 per month for electricity, water, gas, and internet.

- Renter’s Insurance: Typically $10 to $30 per month.

3.3. Building a 2000 Square Foot Home

- Construction Costs: On average, $100 to $400 per square foot, totaling $200,000 to $800,000 for a new build.

- Land Costs: Highly variable, depending on location.

- Permits and Fees: Can range from $5,000 to $20,000.

- Architectural and Design Fees: Typically 5% to 15% of the total construction cost.

3.4. Remodeling a 2000 Square Foot Home

- Minor Renovations: Such as painting and replacing fixtures, can cost $5,000 to $20,000.

- Major Renovations: Including kitchen or bathroom remodels, can range from $20,000 to $100,000 or more.

- Structural Changes: Altering the layout or adding square footage can significantly increase costs.

4. Additional Costs to Consider

Beyond the initial purchase or rental price, several ongoing and potential costs should be factored into your budget.

4.1. Utilities and Services

- Electricity: Varies based on usage but averages $100 to $300 per month.

- Water and Sewer: $50 to $100 per month.

- Gas: $50 to $200 per month, especially in colder climates.

- Internet and Cable: $100 to $200 per month.

- Trash and Recycling: $20 to $50 per month.

4.2. Property Taxes and Insurance

- Property Taxes: As mentioned, these vary widely by location.

- Homeowner’s or Renter’s Insurance: Essential for protecting your property and belongings.

4.3. Maintenance and Repairs

- Routine Maintenance: Includes lawn care, cleaning, and minor repairs.

- Emergency Repairs: Unexpected costs for plumbing, electrical, or HVAC issues.

- Appliance Repairs: Budget for potential appliance breakdowns and replacements.

4.4. HOA Fees

- Monthly or Annual Fees: If the property is part of a homeowner’s association, factor in these fees, which cover common area maintenance and amenities.

4.5. Furnishing and Decorating

- Initial Costs: Can range from a few thousand dollars to tens of thousands, depending on your taste and budget.

- Ongoing Expenses: Include replacing worn-out items and updating décor.

4.6. Landscaping and Outdoor Maintenance

- Lawn Care: Mowing, fertilizing, and pest control.

- Gardening: Planting, weeding, and maintaining flower beds.

- Snow Removal: In colder climates, factor in the cost of plowing or shoveling snow.

4.7. Security Systems

- Installation Costs: Vary based on the complexity of the system.

- Monitoring Fees: Monthly fees for professional monitoring services.

4.8. Property Appreciation

Property appreciation is a critical factor in determining the long-term financial benefits of owning a 2000 square foot home.

- Historical Trends: Analyzing historical data on property values in the area provides insights into long-term appreciation trends.

- Market Analysis: Current market conditions, including supply and demand, interest rates, and economic growth, influence property values.

- Future Developments: Planned infrastructure projects, new businesses, and community improvements can positively impact property values.

Considering these factors can help property owners make informed decisions about when to buy, sell, or invest in renovations to maximize their return on investment.

4.9. Financing Options

Financing options significantly affect the overall cost of a 2000 square foot property.

- Mortgage Rates: Interest rates on mortgages can vary widely depending on the lender, credit score, and economic conditions, affecting monthly payments and total interest paid over the loan term.

- Loan Types: Different loan types, such as fixed-rate, adjustable-rate, FHA, and VA loans, offer various terms and eligibility requirements that influence affordability.

- Refinancing: Refinancing an existing mortgage can lower interest rates, reduce monthly payments, and shorten the loan term, but it involves additional costs and fees.

Evaluating these options carefully can help buyers secure the most favorable terms and minimize the long-term cost of financing their property.

4.10. Insurance Implications

Insurance implications are an essential consideration when evaluating the cost of a 2000 square foot property.

- Coverage Types: Homeowners insurance typically covers damages from fire, wind, hail, water, and other covered perils, as well as liability protection for injuries on the property.

- Policy Limits: Adequate coverage limits ensure that the policy can cover the cost of repairing or replacing the property in the event of a covered loss.

- Premiums: Insurance premiums vary based on factors such as location, coverage limits, deductible, and the property’s characteristics, affecting the overall cost of ownership.

Understanding these insurance implications can help homeowners protect their investment and mitigate potential financial risks.

Apartment Floor Plan

Apartment Floor Plan

5. Tips for Managing Costs

Whether you are buying, renting, or building, here are some practical tips to manage the costs associated with a 2000 square foot space.

5.1. Set a Realistic Budget

- Assess Your Finances: Understand your income, expenses, and savings to determine what you can afford.

- Factor in All Costs: Include not just the purchase or rental price, but also ongoing expenses like utilities, taxes, and maintenance.

- Get Pre-Approved: If buying, get pre-approved for a mortgage to understand your borrowing power.

5.2. Shop Around and Compare

- Get Multiple Quotes: Compare prices from different contractors, insurance companies, and service providers.

- Negotiate: Don’t be afraid to negotiate prices, whether buying a property or hiring a contractor.

5.3. Prioritize Needs vs. Wants

- Focus on Essentials: Prioritize essential features and amenities over non-essential ones.

- DIY When Possible: Tackle smaller projects yourself to save on labor costs.

5.4. Plan Ahead and Be Prepared

- Anticipate Unexpected Costs: Set aside a contingency fund for unexpected repairs and expenses.

- Research: Thoroughly research properties, neighborhoods, and contractors before making any decisions.

5.5. Consider Energy-Efficient Upgrades

- Insulation: Proper insulation can significantly reduce heating and cooling costs.

- Energy-Efficient Appliances: Invest in appliances with high energy-efficiency ratings.

- Smart Home Technology: Install smart thermostats and lighting systems to optimize energy usage.

5.6. Maximize Space Utilization

- Multi-Functional Furniture: Invest in furniture that serves multiple purposes, such as sofa beds and storage ottomans.

- Vertical Storage: Utilize vertical space with shelving units and wall-mounted storage solutions.

- Declutter Regularly: Keep your space organized and clutter-free to maximize usability.

5.7. Regular Maintenance

- Preventative Measures: Regularly inspect and maintain your property to prevent costly repairs.

- Address Issues Promptly: Fix minor issues before they escalate into major problems.

5.8. Smart Financing

- Shop Around for Loans: Compare mortgage rates and terms from different lenders to find the best deal.

- Consider Government Programs: Explore government programs and incentives for first-time homebuyers or energy-efficient upgrades.

5.9. Consult Professionals

- Real Estate Agents: Work with a knowledgeable real estate agent to find properties that fit your budget and needs.

- Financial Advisors: Seek advice from a financial advisor to plan your finances and make informed decisions.

6. Case Studies: Real-Life Examples

To illustrate the cost variations, let’s look at a few case studies in different locations.

6.1. New York City Apartment

- Location: Manhattan, New York

- Type: Luxury Apartment

- Size: 2000 Square Feet

- Cost:

- Purchase Price: $3,500,000

- Monthly Rent: $12,000

- Annual Property Taxes: $30,000

- Monthly HOA Fees: $2,000

6.2. Suburban Home in Texas

- Location: Austin, Texas

- Type: Single-Family Home

- Size: 2000 Square Feet

- Cost:

- Purchase Price: $450,000

- Monthly Mortgage: $2,500

- Annual Property Taxes: $9,000

- Monthly Utilities: $300

6.3. Rural Property in Montana

- Location: Bozeman, Montana

- Type: Ranch-Style House

- Size: 2000 Square Feet

- Cost:

- Purchase Price: $600,000

- Monthly Mortgage: $3,000

- Annual Property Taxes: $6,000

- Monthly Utilities: $400

7. The Expertise of HOW.EDU.VN

Navigating the complexities of property valuation and investment requires expert guidance. At HOW.EDU.VN, we connect you with top PhDs and specialists ready to provide tailored advice. Our team offers:

- Personalized Consultations: Receive advice that aligns with your specific financial goals and situation.

- Comprehensive Analysis: Gain insights into market trends, property values, and investment strategies.

- Real-Time Support: Get your questions answered promptly and accurately.

Seeking advice from our seasoned professionals can save you time and money. Don’t leave your property investment to chance; consult with the best at HOW.EDU.VN.

8. Benefits of Seeking Expert Advice

Consulting with experts from HOW.EDU.VN offers several distinct advantages:

- Informed Decision-Making: Understand all aspects of your property investment with data-driven insights.

- Risk Mitigation: Identify potential pitfalls and develop strategies to minimize risk.

- Financial Planning: Create a budget that aligns with your long-term financial goals.

8.1. Case Study: Success with Expert Guidance

Consider the story of Sarah, a first-time homebuyer who sought advice from HOW.EDU.VN. Sarah initially considered purchasing a fixer-upper to save money but was unsure about the potential renovation costs. Our experts provided a detailed analysis of the property, including estimated repair expenses and potential resale value after renovations.

Armed with this information, Sarah decided to invest in a slightly more expensive but move-in-ready home. This decision saved her from unexpected renovation costs and provided peace of mind. Sarah’s experience underscores the value of seeking expert advice to make informed decisions.

9. Call to Action

Ready to make informed decisions about your property investments? Contact HOW.EDU.VN today for personalized consultations with our team of PhDs and experts.

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Don’t navigate the complexities of property investment alone. Let HOW.EDU.VN guide you toward financial success.

10. Conclusion

Understanding how much a 2000 square foot space truly costs involves a comprehensive analysis of various factors, including location, property type, condition, and market conditions. By setting a realistic budget, comparing options, and seeking expert advice from HOW.EDU.VN, you can make informed decisions that align with your financial goals and lifestyle.

Frequently Asked Questions (FAQs)

1. How can I accurately measure the square footage of a property?

To accurately measure the square footage of a property, use a 100-foot tape measure and sketch the shape of each room. Measure the length and width of each room in inches, round up to the nearest inch, and record the measurements on your sketch. Convert each measurement to feet by dividing by 12. Multiply the length by the width to get the square footage of each room. Add up the square footage of all rooms to get the total square footage of the property.

2. What are the key factors that influence the cost of renting or buying a 2000 square foot space?

Key factors that influence the cost include location, property type (apartment, house, commercial space), condition and age of the property, market conditions (buyer’s vs. seller’s market), materials and finishes, labor costs, permits and fees, and energy efficiency.

3. How much should I budget for maintenance and repairs when owning a 2000 square foot home?

It is generally recommended to budget 1% to 3% of the home’s value annually for maintenance and repairs. This should cover routine maintenance, emergency repairs, and appliance repairs.

4. What are some strategies for managing the costs associated with a 2000 square foot space?

Strategies include setting a realistic budget, shopping around and comparing prices, prioritizing needs over wants, planning ahead and being prepared for unexpected costs, considering energy-efficient upgrades, maximizing space utilization, and seeking professional advice from real estate agents and financial advisors.

5. How can energy-efficient upgrades impact the overall cost of owning a 2000 square foot property?

Energy-efficient upgrades, such as proper insulation, energy-efficient appliances, and smart home technology, can reduce energy consumption and lower utility bills, leading to long-term savings that offset the initial investment.

6. What are the typical costs associated with building a 2000 square foot home?

Construction costs range from $100 to $400 per square foot, totaling $200,000 to $800,000 for a new build. Additional costs include land costs, permits and fees ($5,000 to $20,000), and architectural and design fees (5% to 15% of the total construction cost).

7. How do HOA fees impact the cost of owning a property, and what do they typically cover?

HOA fees cover common area maintenance, amenities, and services within a community. These fees should be factored into your budget and can vary widely depending on the location and included amenities.

8. What are the insurance implications I need to know of when evaluating the cost of a 2000 square foot property?

Homeowners insurance provides coverage for damages from fire, wind, hail, water, and other perils, as well as liability protection. Adequate coverage limits are essential to protect your investment. Premiums vary based on location, coverage, deductible, and property characteristics.

9. Can you provide some real-life examples of the cost of a 2000 square foot space in different locations?

- New York City Apartment: Purchase Price: $3,500,000, Monthly Rent: $12,000, Annual Property Taxes: $30,000

- Suburban Home in Texas: Purchase Price: $450,000, Monthly Mortgage: $2,500, Annual Property Taxes: $9,000

- Rural Property in Montana: Purchase Price: $600,000, Monthly Mortgage: $3,000, Annual Property Taxes: $6,000

10. What are the benefits of consulting with experts from HOW.EDU.VN when evaluating the cost of a 2000 square foot space?

Consulting with experts from how.edu.vn offers informed decision-making, risk mitigation, and financial planning assistance. You can receive personalized advice that aligns with your financial goals, gain insights into market trends, and minimize risk with data-driven strategies.