Determining how much a silver coin is worth involves understanding several factors, primarily the coin’s silver content and the current silver market price. While the face value of a coin is fixed, its intrinsic value, based on the silver it contains, fluctuates with market conditions. This guide provides an in-depth look at how to calculate the melt value of U.S. silver coins, factors affecting their worth, and why numismatic value can significantly exceed melt value.

Understanding Silver Coin Melt Value

The melt value of a silver coin refers to the intrinsic value of the silver it contains, calculated based on the current spot price of silver. This value represents how much the coin would be worth if it were melted down for its silver content.

Key Factors Influencing Melt Value:

- Silver Content: The percentage of silver in a coin directly affects its melt value. U.S. silver coins typically contain 90% silver, but some may have different compositions.

- Weight: The total weight of the coin is crucial, as it determines the amount of silver present.

- Spot Price of Silver: The current market price of silver, usually quoted per ounce, is the most dynamic factor.

Calculating the Melt Value of a Silver Coin

To calculate the melt value, you need to know the coin’s silver weight (ASW) in troy ounces and the current spot price of silver. The formula is:

Melt Value = (ASW) x (Spot Price of Silver)

For example, if a coin contains 0.723 troy ounces of silver and the spot price is $34.13 per ounce, the melt value would be:

- 723 x $34.13 = $24.67

Melt Values of Common U.S. Silver Coins

Here’s a table illustrating the melt values of various U.S. silver coins, updated as of March 28, 2025, with a spot price of silver at $34.13 per ounce:

| Coin | Composition | Weight (g) | ASW (oz.) | Melt Value |

|---|---|---|---|---|

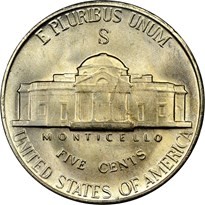

| Jefferson Nickel, Wartime Silver Alloy (1942-1945) | 56% Copper, 35% Silver, 9% Manganese | 5 | 0.0563 | $1.92 |

| Barber Dime (1892-1916) | 90% Silver | 2.5 | 0.0723 | $2.47 |

| Mercury Dime (1916-1945) | 90% Silver | 2.5 | 0.0723 | $2.47 |

| Roosevelt Dime (1946-1964) | 90% Silver | 2.5 | 0.0723 | $2.47 |

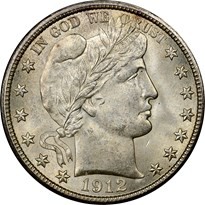

| Barber Quarter (1892-1916) | 90% Silver | 6.25 | 0.1808 | $6.17 |

| Standing Liberty Quarter (1916-1930) | 90% Silver | 6.25 | 0.1808 | $6.17 |

| Washington Quarter (1932-1964) | 90% Silver | 6.25 | 0.1808 | $6.17 |

| Barber Half Dollar (1892-1915) | 90% Silver | 12.5 | 0.36169 | $12.34 |

| Walking Liberty Half Dollar (1916-1947) | 90% Silver | 12.5 | 0.36169 | $12.34 |

| Franklin Half Dollar (1948-1963) | 90% Silver | 12.5 | 0.36169 | $12.34 |

| Kennedy Half Dollar (1964) | 90% Silver | 12.5 | 0.36169 | $12.34 |

| Kennedy Half Dollar (1965-1970) | 60% Copper, 40% Silver | 11.5 | 0.1479 | $5.05 |

| Morgan Dollar (1878-1921) | 90% Silver | 26.73 | 0.7734 | $26.40 |

| Peace Dollar (1921-1935) | 90% Silver | 26.73 | 0.7734 | $26.40 |

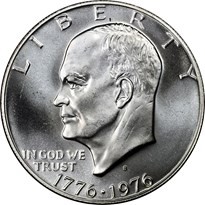

| Eisenhower, Silver (1971-1976) | 60% Copper, 40% Silver | 24.59 | 0.3161 | $10.79 |

| American Silver Eagle $1 (1986-Date) | 99.93% Silver | 31.101 | 1 | $34.13 |

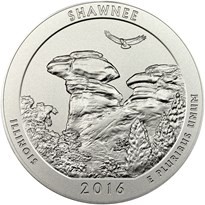

| America the Beautiful 5 Ounce Silver (2010-Date) | 99.93% Silver | 155.55 | 5 | $170.65 |

Note: These melt values are approximate and fluctuate with the spot price of silver.

Beyond Melt Value: Numismatic Value

While melt value provides a baseline, the numismatic value, or collector’s value, can significantly exceed it. Factors influencing numismatic value include:

- Rarity: Scarce coins are highly sought after by collectors.

- Condition: Well-preserved coins command higher prices.

- Historical Significance: Coins with historical importance or unique stories are more valuable.

- Mint Marks and Errors: Certain mint marks or minting errors can increase a coin’s value.

Where to Find the Current Spot Price of Silver

The spot price of silver is readily available from various sources:

- Financial Websites: Major financial websites like Bloomberg, MarketWatch, and Yahoo Finance provide real-time silver prices.

- Coin Dealers: Many reputable coin dealers display current silver prices on their websites.

- Precious Metals Exchanges: Websites of precious metals exchanges offer up-to-date market information.

Disclaimer

The prices listed are compiled from third-party sources and are averages, not specific prices for individual coins. These prices do not reflect short-term pricing trends and are designed to serve merely as one of many measures and factors that coin buyers and sellers can use in determining coin values. Conduct due diligence and seek expert consultation when entering into a coin transaction.

Conclusion

Determining how much a silver coin is worth requires considering both its melt value and numismatic value. While melt value provides a baseline based on silver content and spot price, numismatic value can significantly increase a coin’s worth due to rarity, condition, and historical significance. By understanding these factors, you can accurately assess the value of your silver coins.