At Lemonade, you can find pet insurance for your dog or cat starting as low as $10 per month. Our affordable pet health insurance is also recognized and trusted by authorities like Money.com.

However, it’s important to understand that the actual cost of pet insurance can vary significantly. Several factors come into play, influencing how much you’ll pay for coverage. These include the specific type and amount of coverage you choose, the breed and age of your beloved pet, and even your geographical location. While it’s an added monthly expense, think of pet insurance as a worthwhile investment, a small price to ensure you’re financially prepared for unexpected veterinary bills.

Let’s cut through the confusing insurance jargon and delve into the real question: how much does pet insurance truly cost?

Decoding the Average Cost of Pet Insurance

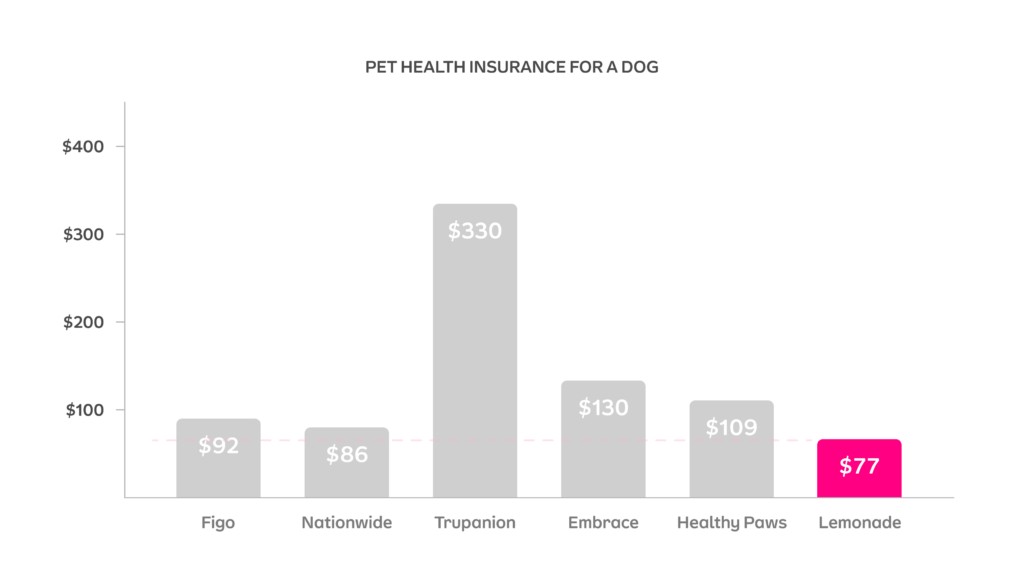

Pet insurance plan prices are not one-size-fits-all. They fluctuate based on a variety of elements. To give you a clearer picture, we’ve researched and compared rates from six different insurance providers for both a typical cat and a typical dog.

Breaking Down Dog Insurance Costs

Consider this example: Imagine you own a 4-year-old Golden Retriever residing in Chicago. If you were to enroll this dog in a pet insurance plan with an 80% co-insurance, the highest available annual limit, and a $250 annual deductible, you would be looking at an average monthly cost of $37.

| Insurance Provider | Average Monthly Cost |

|---|---|

| Figo | $92 |

| Nationwide | $86 |

| Trupanion | $330 |

| Embrace | $130 |

| Healthy Paws | $109 |

| Lemonade | $77 |

Based on rates for a 4-year-old Golden Retriever in Chicago

On average, across various dog breeds, ages, and locations, Lemonade pet parents spend approximately $47 per month to ensure their canine companions are protected.

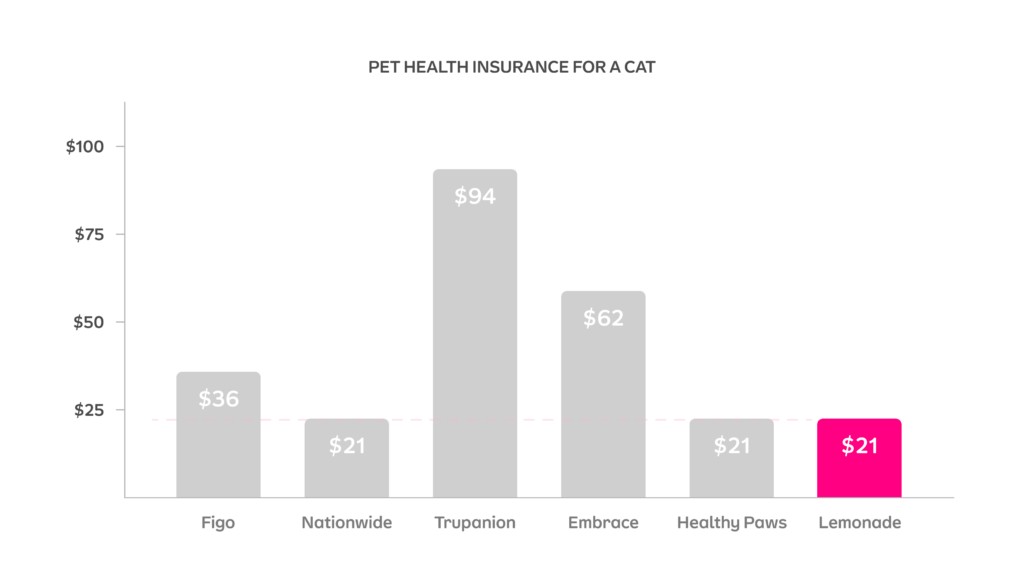

Understanding Cat Insurance Costs

Let’s examine a couple of scenarios for cat insurance. First, we obtained a pet insurance quote for a 2-year-old, short-haired cat living in Brooklyn, New York. We selected the basic policy offered by six different pet insurance companies. We then standardized the coverage options as much as possible, aiming for a $250 deductible, 80% co-insurance, and the maximum annual limit available, without including any add-ons or discounts. For this particular cat and policy configuration, the average monthly premium comes out to around $42.

For comparison, if we consider a 5-year-old, short-haired cat also in New York City, the average monthly cost rises to approximately $67. This is also based on an 80% co-insurance, the maximum annual limit, and a $250 annual deductible.

It’s important to note that while we aimed to make these quotes as comparable as possible, some minor coverage differences exist between providers. For instance, Healthy Paws only offered 80% co-insurance with no annual limit, while Trupanion’s lowest co-insurance option was 90%. We standardized the offerings to the best of our ability for this comparison.

| Insurance Provider | Average Monthly Cost |

|---|---|

| Figo | $36 |

| Nationwide | $21 |

| Trupanion | $94 |

| Embrace | $62 |

| Healthy Paws | $21 |

| Lemonade | $21 |

Based on rates for a 2-year-old short-haired cat in Brooklyn

On average, when considering different cat breeds, ages, and locations, Lemonade customers typically pay around $28 per month to ensure their feline friends have pet insurance coverage.

Key Factors Influencing Your Pet Insurance Premiums

Several elements are at play when determining your individual pet insurance quote:

Dog vs. Cat: Species Matters

Generally, insuring cats is less expensive than insuring dogs. This is primarily because veterinary care costs tend to be lower for cats. While both species require routine care like vaccinations and check-ups, cats often experience fewer health issues throughout their lives compared to dogs. Furthermore, many cats are indoor pets, reducing their exposure to external risks that can lead to accidents or illnesses, risks that dogs, who are often more active outdoors, face more frequently. Dogs are also more susceptible to certain hereditary conditions, such as hip dysplasia and cruciate ligament problems, which can increase insurance costs.

Age of Your Pet

Similar to human health insurance, the age of your pet is a significant factor. Older pets, just like older humans, are statistically more likely to require more frequent and intensive healthcare. Consequently, your pet’s age at the time you purchase a pet insurance policy will directly impact your monthly premium. Insurance for older pets will typically be more expensive than for younger ones.

Breed-Specific Considerations

Certain dog and cat breeds are inherently more prone to specific health issues and may require more specialized or frequent veterinary care. If you are aware that your pet’s breed has a predisposition to certain hereditary conditions, such as asthma in Siamese cats, it’s wise to consider pet insurance early. While these conditions might not be apparent at birth or in the early years, waiting until symptoms develop to obtain insurance could mean the condition is classified as pre-existing and therefore not covered. Enrolling your pet in insurance while they are young and healthy can be a proactive step. Pet insurance can then help cover the costs of managing chronic conditions that may arise later in life, potentially saving you significant expenses in the long run.

Geographical Location

Your location also plays a role in determining your pet insurance rate. Veterinary care costs vary across different states. For instance, veterinary expenses in states like California are generally higher compared to states like Tennessee. This regional difference in healthcare costs can influence insurance premiums. Additionally, even if your monthly premium remains consistent, higher local vet costs could mean you reach your policy’s annual limit more quickly. Therefore, it’s essential to customize your pet health insurance policy to ensure it adequately meets your needs and provides sufficient coverage in your specific location.

Calculating Potential Savings with Pet Insurance

Are you wondering if pet insurance is truly a worthwhile investment? Consider the potential financial protection it offers. Pet insurance can help pet owners significantly reduce their out-of-pocket expenses for unexpected veterinary bills, providing peace of mind and ensuring your pet can receive the necessary care without straining your finances.

Strategies to Lower Your Pet Insurance Premium

If you’re looking for ways to make pet insurance more affordable, you have options to adjust your policy’s co-insurance, deductible, and annual limit. In most states, you can modify your coverage levels, such as increasing your deductible or decreasing your co-insurance, at any point during your policy term. Let’s clarify what these terms mean and how adjusting them can affect your premium.

Co-insurance Explained

Co-insurance is the percentage of covered veterinary costs that your insurance company will pay after you’ve met your deductible. It’s important to distinguish co-insurance from a co-pay, which is a fixed dollar amount you pay for each visit. For example, if you choose an 80% co-insurance, your insurance provider will cover 80% of eligible expenses when your pet requires veterinary care, and you will be responsible for the remaining 20%. This percentage applies to each claim you file. Lemonade pet health insurance, for instance, offers co-insurance options of 70%, 80%, or 90%. Opting for a lower co-insurance percentage, such as 70%, will typically result in a lower monthly premium, but you’ll pay a higher percentage of the vet bill when you file a claim.

Deductible Options

The deductible is another way you share in the cost of your pet’s healthcare. This is the amount you must pay out-of-pocket each policy year before your co-insurance kicks in and your insurance company starts covering eligible expenses. With Lemonade, you can select from annual deductible amounts of $100, $250, $500, and $750. Choosing a higher deductible will lower your monthly premium because you’re agreeing to pay more out-of-pocket before your insurance coverage begins. Before selecting a deductible, consider your financial comfort level and ask yourself: How much of my pet’s medical expenses can I comfortably handle myself before needing financial assistance from my insurance company? Your pet insurance policy’s annual deductible resets each year. You can meet it through one large claim or accumulate it over multiple smaller claims throughout the year.

Annual Coverage Limits

Most pet insurance providers set a limit on the total amount they will pay out in claims within a policy year. However, the good news is that you often have the flexibility to choose your annual coverage limit. Lemonade, for example, allows you to select an annual limit ranging from $5,000 to $100,000. Veterinary bills can accumulate rapidly, especially in cases of serious accidents or illnesses. Therefore, it’s crucial to select an annual coverage limit that adequately balances your budget and your pet’s potential healthcare needs. Choosing a lower annual limit might reduce your monthly premium, but it also means you’ll have less financial protection if your pet incurs significant medical expenses within a year.

While adjusting these coverage elements—co-insurance, deductible, and annual limit—can potentially reduce your monthly premium by 10% to 15%, remember that lower monthly payments mean you’ll have less comprehensive coverage when a substantial vet bill arises.

To explore your personalized coverage options and find a plan that suits your pet and your budget, you can contact Lemonade’s customer service team. They are available to answer your questions and guide you through the process of customizing your pet insurance policy.

*Coverage downgrades may not be available in New Hampshire or California.

Understanding How Pet Insurance Claims Work

Still unclear about the claims process? Let’s walk through a detailed example to illustrate how it works.

- Suppose your dog, Mogley, requires knee surgery—poor Mogley!

- The total cost of the procedure is $6,000. You file a claim for this amount with your pet insurance company.

- Your policy includes 80% co-insurance and a $250 annual deductible.

Here’s how your claim payment would be calculated:

($6,000 x 80%) – $250 = $4,550

In this scenario, your insurance company would reimburse $4,550 towards the $6,000 surgery cost. You would be responsible for the remaining $1,450, which includes your $250 deductible and the 20% co-insurance portion.

Now, imagine a few months later, Mogley, in his typical adventurous spirit, swallows a mysterious object, requiring another procedure. This subsequent procedure costs $1,500. Since you’ve already met your annual deductible with the knee surgery claim, the deductible is no longer applied. Here’s the claim calculation for this second incident:

($1,500 x 80%) – $0 = $1,200

For this second claim, your insurance company would contribute $1,200, and you would only need to pay $300 out-of-pocket. This same claims process would continue for any further covered incidents throughout the remainder of your policy year, until you reach your policy’s annual coverage limit.

Vet Acceptance and Pet Insurance

Lemonade Pet insurance operates on a reimbursement model, offering you the flexibility to take your pet to any licensed veterinarian in the United States. You are not restricted to a network of specific vets.

You pay your vet directly at the time of service and then submit the invoice or receipt to Lemonade through their mobile app for reimbursement. Lemonade’s claims team will review your submission to ensure the treatment is covered under your policy terms and then reimburse you for the eligible amount based on your co-insurance and deductible.

How Pet Insurance Can Significantly Reduce Your Vet Costs

Anyone who has received a vet bill knows that unexpected veterinary care can quickly become very expensive, potentially reaching tens of thousands of dollars for serious conditions or emergencies. Pet health insurance provides a financial safety net, enabling you to make decisions about your pet’s care based on their needs, not solely on your immediate financial constraints. With pet insurance, you can avoid the difficult situation of having to choose between your pet’s health and your financial stability.

So, what exactly does your monthly premium provide? A standard pet health insurance policy is designed to help cover the costs associated with diagnostics, procedures, and medications necessary to treat your dog or cat for eligible accidents and illnesses.

This means that if your pet suffers a broken leg, is injured in an accident, or develops an illness like a stomach bug, a basic policy can provide coverage. Whether it’s an injury, vomiting, diarrhea, infections, or more serious conditions like cancer, a fundamental pet insurance policy typically helps cover the expenses for:

- Diagnostics: Including blood tests, x-rays, MRIs, CT scans, and laboratory work.

- Procedures: Covering outpatient care, specialist treatments, emergency care, hospitalization, and surgeries.

- Medications: Including injectable medications and prescription drugs.

While a basic policy offers broad coverage for many pet health-related expenses, it doesn’t encompass everything. This is why pet insurance companies offer optional add-ons to expand your coverage.

Exploring Pet Insurance Add-ons

To maximize your pet insurance coverage and tailor it to your pet’s specific needs and lifestyle, Lemonade provides a range of optional preventative care packages and add-ons. These allow you to customize your policy beyond the core accident and illness coverage.

Lemonade offers preventative care packages, including a basic Preventative Package, a Preventative+ Package, and a Puppy/Kitten Preventative Package specifically designed for younger pets.

Lemonade’s basic Preventative package is designed to cover routine wellness care that you likely already budget for, such as your pet’s annual wellness exam, heartworm or FeLV/FIV tests, up to three vaccinations, parasite or fecal tests, and blood tests.

The Preventative+ package expands on this routine care, additionally covering services like dental cleaning and heartworm medication. For pets under two years old, the Puppy/Kitten Preventative package is available, which includes coverage for spaying/neutering, microchipping, and preventative medications for heartworm and fleas.

In addition to preventative care packages, Lemonade Pet Insurance offers five optional add-ons that you can choose to include in your policy:

- Vet visit fees: Covers the fees that veterinary clinics often charge simply for an office visit when you bring your pet in due to an accident or illness.

- Physical therapy: Provides coverage for physical therapy, acupuncture, and hydrotherapy treatments that can aid your pet’s recovery from injuries or surgeries.

- Dental illness: Extends coverage to include procedures like tooth extractions and root canals, as well as treatments for dental conditions such as gingivitis and periodontal disease.

- Behavioral conditions: Covers vet-recommended therapy and medications for behavioral issues like anxiety and aggression, helping you address your pet’s mental and emotional well-being.

- End of life and remembrance: Offers coverage for vet-recommended euthanasia, as well as cremation services and commemorative items to honor your pet’s memory when the time comes.

What Pet Insurance Typically Does Not Cover

While pet insurance provides extensive coverage, it’s important to be aware of typical exclusions. Generally, pet insurance policies will not cover:

- Pre-existing conditions: Any health condition that your pet has been diagnosed with, shown symptoms of, or received treatment for prior to your policy’s start date or during the policy’s waiting period is typically considered a pre-existing condition and will not be covered.

- Preventable situations and neglect: Pet insurance is not intended to cover health issues that arise from neglect or a failure to provide a safe environment and reasonable preventative care for your pet. If a health problem is deemed to be a result of neglect, it’s unlikely to be covered.

- Certain non-medical or elective procedures: Routine or elective procedures that are not related to accidents or illnesses are generally not covered. This can include grooming, cosmetic procedures like breed-specific haircuts, obedience training, and boarding or travel-related expenses.

It’s true that pet insurance is an ongoing expense. However, the potential cost of unexpected veterinary care can be significantly higher.

If you are uncertain whether pet insurance is the right choice for you, consider the potential “worst-case scenario” – a serious accident or illness requiring extensive and expensive treatment. Would you be financially prepared to cover those costs out-of-pocket?

Lemonade pet insurance policies are designed to be customizable. If a comprehensive policy with a high co-insurance level doesn’t fit your current budget, you can adjust your coverage options to find a monthly premium that is more manageable for you.

In an unpredictable world, protecting your loved ones, including your pets, is paramount. Pet insurance offers a way to safeguard your pet’s health and your financial well-being, so you don’t have to face heart-wrenching decisions when your pet needs medical care.

Get pet insurance quote from Lemonade

Read Lemonade customer reviews on Trustpilot

Frequently Asked Questions About Pet Insurance Costs

How Much Should I Budget for Pet Insurance?

When selecting a pet insurance plan, it’s crucial to consider both your pet’s potential healthcare needs and your financial capacity.

If you want to reduce your pet insurance expenses, adjusting your coverage options to lower your premium is possible. However, remember that while this may save money in the short term, reduced coverage could lead to significant out-of-pocket expenses if your pet experiences a major accident or illness. Choosing the right policy involves finding a balance between affordability and comprehensive protection.

What Percentage of Vet Bills Does Pet Insurance Cover?

The percentage of your vet bills covered by pet insurance depends on the co-insurance level you choose in your policy. A common co-insurance option is 80%, meaning your insurance provider pays 80% of covered expenses, and you are responsible for the remaining 20%. However, the ideal co-insurance percentage for you depends on your ability to pay out-of-pocket at the time of a claim and the monthly premium you are comfortable paying.

Keep in mind that co-insurance payments are applied after you’ve met your annual deductible and are subject to your policy’s annual coverage limit. Your deductible is an annual amount that can be met through a single large claim or accumulated over multiple claims throughout the policy year. Co-insurance will only apply to claim amounts that fall within your annual coverage limit.

Does Pet Insurance Cost Increase as My Pet Gets Older?

Yes, it’s typical for pet insurance premiums to increase as your pet ages. Older pets are statistically more likely to develop age-related health issues and chronic conditions, resulting in higher average veterinary costs. To ensure that your pet continues to receive the same level of comprehensive coverage as they age and their healthcare needs potentially increase, insurance providers may adjust premium prices over time. It’s important to note that filing claims with Lemonade Pet Insurance will not result in a rate change to your policy. Rate adjustments are based on broader factors, such as pet’s age and overall changes in veterinary costs.

Is Pet Insurance a Worthwhile Investment?

The value of pet insurance is often dependent on your pet’s individual circumstances and your personal financial situation. Pet insurance can provide significant financial protection against unexpected accidents and illnesses, offering peace of mind and helping you manage potentially high veterinary costs.

However, it’s also important to acknowledge that pet insurance does not cover all situations. For instance, pre-existing conditions that your pet had before enrolling in a policy will generally not be covered by any pet insurance provider.

When deciding whether pet insurance is right for you, carefully consider your ability to handle unexpected veterinary expenses out-of-pocket. If facing a large vet bill would create a significant financial burden, pet insurance can be a valuable tool for protecting both your pet’s health and your financial well-being.

In Which States Does Lemonade Offer Pet Insurance?

Lemonade Pet Insurance is currently available in a wide range of states across the US, including: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C., and Wisconsin.

Disclaimer: This information is for general informational purposes only and does not alter the terms, conditions, exclusions, or limitations of Lemonade insurance policies, which may vary by state. Consult with professional advisors for personalized advice. Third-party views are not endorsed by Lemonade. Coverage and discounts may not be available in all states.