How Much Is The Oil? Navigating the complexities of oil pricing, market dynamics, and future trends can be daunting. HOW.EDU.VN offers expert guidance to demystify the oil industry and provide clarity on factors influencing price fluctuations. Consult with our seasoned professionals for in-depth analysis and strategic insights in petroleum economics, energy policy, and global market impacts.

1. Decoding Oil Prices: An Introductory Overview

Understanding “how much is the oil” requires a comprehensive grasp of the global energy market. Oil prices are not static; they fluctuate based on a multitude of factors ranging from geopolitical tensions to supply and demand imbalances. This section provides a foundational understanding of the key elements that drive oil pricing.

1.1. The Core Determinants of Oil Prices

Several factors influence the price of oil:

- Supply and Demand: The most fundamental driver. When demand exceeds supply, prices rise, and vice versa.

- Geopolitical Events: Political instability in oil-producing regions can disrupt supply and lead to price spikes.

- Economic Indicators: Global economic growth typically increases demand for oil, impacting prices.

- Currency Fluctuations: The U.S. dollar is the primary currency for oil trading; its strength or weakness affects oil prices.

- Inventory Levels: High inventory levels can indicate oversupply, potentially lowering prices.

- Weather Conditions: Extreme weather events can disrupt production and transportation, affecting prices.

- Speculation: Trading activities and future expectations can also drive price movements.

1.2. Benchmarks: WTI, Brent, and OPEC Basket

Oil prices are often quoted based on benchmark crudes:

- West Texas Intermediate (WTI): A light, sweet crude oil produced in the United States, used as a benchmark for North American oil prices.

- Brent Crude: A blend of crude oils from the North Sea, serving as a benchmark for international oil prices.

- OPEC Basket: A weighted average of crude oil prices from different OPEC member countries.

These benchmarks provide a reference point for pricing oil globally, with regional variations reflecting transportation costs and quality differences.

2. Exploring the Nuances of Crude Oil Pricing

“How much is the oil” depends greatly on the type of crude oil. Crude oil varies widely in quality, density, and sulfur content. These factors influence its refining complexity and, consequently, its market value.

2.1. Sweet vs. Sour Crude Oil

Crude oil is classified as either “sweet” or “sour” based on its sulfur content:

- Sweet Crude Oil: Contains less than 0.5% sulfur. It is easier and less costly to refine, making it more desirable and typically more expensive.

- Sour Crude Oil: Contains more than 0.5% sulfur. It requires more complex and expensive refining processes to remove the sulfur.

2.2. Light vs. Heavy Crude Oil

Crude oil is also categorized by its density, measured in API gravity:

- Light Crude Oil: Has a high API gravity (above 31.1°). It is easier to extract and refine, yielding a higher proportion of valuable products like gasoline and diesel.

- Heavy Crude Oil: Has a low API gravity (below 22.3°). It is more viscous and requires more energy-intensive refining processes.

2.3. The Price Differential: Quality Matters

The quality of crude oil significantly impacts its price. Light, sweet crude oil generally commands a premium due to its lower refining costs and higher yield of valuable products. Heavy, sour crude oil is typically priced lower because it requires more complex and costly refining.

3. Geopolitical Factors Influencing Oil Prices

Geopolitics plays a crucial role in determining “how much is the oil”. Political instability, conflicts, and international relations can disrupt oil supply and significantly impact prices.

3.1. OPEC’s Influence on Global Oil Supply

The Organization of the Petroleum Exporting Countries (OPEC) is a cartel of 13 oil-producing nations that collectively control a significant portion of the world’s oil supply. OPEC’s decisions on production quotas can have a profound impact on global oil prices.

- Production Quotas: OPEC sets production targets for its member countries, aiming to balance supply and demand.

- Market Intervention: OPEC can increase or decrease production to stabilize prices during periods of volatility.

- Geopolitical Considerations: OPEC’s decisions are often influenced by political and economic considerations, adding complexity to the market.

3.2. Political Instability and Supply Disruptions

Political instability in oil-producing regions can lead to supply disruptions and price spikes. Conflicts, sanctions, and political unrest can all impact oil production and export capacity.

- Middle East Tensions: The Middle East is a major oil-producing region, and political tensions there can have a significant impact on global oil prices.

- Sanctions: Sanctions imposed on oil-producing countries can restrict their ability to export oil, affecting global supply.

- Infrastructure Attacks: Attacks on oil infrastructure, such as pipelines and refineries, can disrupt supply and drive up prices.

3.3. International Relations and Trade Agreements

International relations and trade agreements also play a role in shaping oil prices. Trade agreements can facilitate or restrict the flow of oil between countries, affecting supply dynamics.

- Trade Wars: Trade disputes and tariffs can disrupt oil trade and impact prices.

- Energy Agreements: Agreements between countries on oil production and export can influence global supply.

- Geopolitical Alliances: Alliances between oil-producing countries can affect their collective bargaining power and influence on the market.

4. Economic Indicators and Their Impact on Oil Demand

Economic indicators are essential in understanding “how much is the oil”. Global economic growth, industrial production, and consumer spending all influence the demand for oil and, consequently, its price.

4.1. GDP Growth and Oil Demand

Gross Domestic Product (GDP) growth is a key indicator of economic activity. Higher GDP growth typically leads to increased demand for oil as businesses expand and consumers travel more.

- Developed Economies: Economic growth in developed countries like the United States, Europe, and Japan can drive up oil demand.

- Emerging Markets: Rapid economic growth in emerging markets like China and India has a significant impact on global oil demand.

- Industrial Activity: Increased industrial production requires more energy, boosting demand for oil.

4.2. Manufacturing and Transportation Sectors

The manufacturing and transportation sectors are major consumers of oil. Their performance directly impacts oil demand.

- Manufacturing Output: Higher manufacturing output requires more energy, including oil, to power factories and transport goods.

- Vehicle Sales: Increased vehicle sales, particularly of fuel-efficient vehicles, can impact gasoline demand.

- Aviation Industry: The aviation industry is heavily reliant on jet fuel, and its growth or decline affects oil demand.

4.3. Consumer Spending and Travel Patterns

Consumer spending and travel patterns also influence oil demand. Increased consumer spending often leads to more travel and higher gasoline consumption.

- Retail Sales: Higher retail sales indicate increased consumer activity, which can translate to more travel and higher gasoline demand.

- Tourism: Increased tourism and travel contribute to higher demand for transportation fuels like gasoline and jet fuel.

- Commuting Patterns: Commuting patterns, such as the number of people driving to work, can impact gasoline demand.

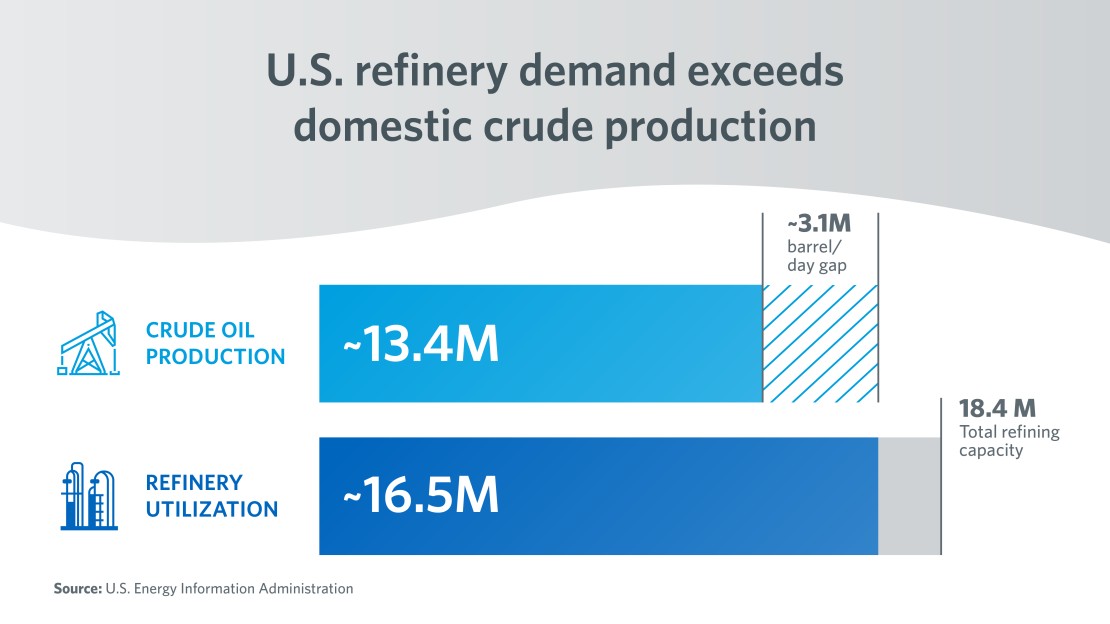

U.S. refinery demand exceeds domestic crude production

U.S. refinery demand exceeds domestic crude production

5. The Role of Currency Fluctuations in Oil Pricing

Currency fluctuations, particularly the value of the U.S. dollar, play a significant role in determining “how much is the oil”. Since oil is priced in U.S. dollars, changes in the dollar’s value can impact the purchasing power of countries using other currencies.

5.1. The U.S. Dollar as the Global Oil Currency

The U.S. dollar is the primary currency for international oil transactions. This means that most oil trades are conducted in U.S. dollars, regardless of the country of origin or destination.

- Pricing Mechanism: Oil prices are quoted in U.S. dollars per barrel, making the dollar’s value a key factor in determining the cost of oil for importing countries.

- Global Trade: The dominance of the U.S. dollar in oil trade reinforces its status as the world’s reserve currency.

5.2. Impact of Dollar Strength on Oil Prices

A stronger U.S. dollar can make oil more expensive for countries using other currencies. This can lead to reduced demand and potentially lower oil prices.

- Purchasing Power: When the U.S. dollar strengthens, countries using other currencies need to spend more to buy the same amount of oil.

- Demand Elasticity: Higher oil prices in local currencies can reduce demand, particularly in price-sensitive markets.

5.3. Hedging Strategies and Currency Risk Management

Companies involved in the oil trade often use hedging strategies to manage currency risk. These strategies help to protect against fluctuations in exchange rates.

- Forward Contracts: Companies can use forward contracts to lock in a specific exchange rate for future oil transactions.

- Currency Options: Currency options provide the right, but not the obligation, to buy or sell currency at a specific exchange rate.

- Natural Hedges: Companies with operations in multiple countries can use natural hedges to offset currency risk.

6. Inventory Levels and Storage Capacity

Inventory levels and storage capacity are vital considerations when evaluating “how much is the oil”. High inventory levels can indicate oversupply, potentially leading to lower prices, while low inventory levels can suggest undersupply and higher prices.

6.1. Commercial Crude Oil Inventories

Commercial crude oil inventories are the amount of crude oil held in storage by companies for future use. These inventories provide a buffer against supply disruptions and can influence market sentiment.

- Weekly Data: The U.S. Energy Information Administration (EIA) publishes weekly data on commercial crude oil inventories, providing insights into supply and demand dynamics.

- Storage Capacity: The availability of storage capacity can impact the ability to accumulate inventories, influencing price movements.

6.2. Strategic Petroleum Reserves (SPR)

Strategic Petroleum Reserves (SPR) are government-controlled stockpiles of crude oil held for emergency situations. These reserves can be released to the market to mitigate supply disruptions.

- Emergency Response: SPRs are intended to provide a buffer against significant supply disruptions caused by geopolitical events or natural disasters.

- Market Intervention: Governments can release oil from SPRs to stabilize prices during periods of volatility.

6.3. Impact of Inventory Data on Market Sentiment

Inventory data can have a significant impact on market sentiment. Higher-than-expected inventory levels can signal oversupply, leading to price declines, while lower-than-expected levels can indicate undersupply and higher prices.

7. Weather Conditions and Seasonal Demand

Weather conditions and seasonal demand are important factors when asking “how much is the oil”. Extreme weather events can disrupt oil production and transportation, while seasonal changes in demand influence consumption patterns.

7.1. Hurricane Season and Offshore Production

Hurricane season in the Gulf of Mexico can disrupt offshore oil production, leading to supply disruptions and price spikes.

- Production Shut-ins: Oil companies often shut down offshore production platforms in advance of hurricanes to protect their assets and personnel.

- Refinery Disruptions: Hurricanes can also disrupt refinery operations along the Gulf Coast, further impacting supply.

7.2. Winter Heating Demand and Natural Gas Prices

Winter heating demand can increase demand for natural gas, which is often used for heating homes and businesses. This can impact the demand for heating oil and, consequently, crude oil prices.

- Cold Weather: Prolonged periods of cold weather can significantly increase natural gas demand, putting upward pressure on prices.

- Inventory Levels: Low natural gas inventory levels can exacerbate price spikes during cold weather events.

7.3. Summer Driving Season and Gasoline Demand

Summer driving season typically sees increased demand for gasoline as people travel more for vacations and leisure activities. This can lead to higher gasoline prices and increased demand for crude oil.

- Travel Patterns: Increased travel during the summer months boosts gasoline consumption.

- Refinery Output: Refineries often increase gasoline production during the summer to meet higher demand.

8. Speculation and Financial Markets

Speculation and financial markets play a significant role in shaping “how much is the oil”. Trading activities, investment flows, and future expectations can all influence oil prices.

8.1. Oil Futures Contracts and Trading

Oil futures contracts are agreements to buy or sell oil at a specific price on a future date. These contracts are traded on exchanges and used by investors and companies to hedge risk or speculate on price movements.

- Price Discovery: Futures markets provide a mechanism for price discovery, reflecting the collective expectations of market participants.

- Hedging: Companies involved in the oil trade use futures contracts to hedge against price fluctuations.

- Speculation: Investors can use futures contracts to speculate on the direction of oil prices.

8.2. Investment Flows and Institutional Investors

Investment flows from institutional investors, such as hedge funds and pension funds, can impact oil prices. Large investment flows can amplify price movements.

- Long Positions: Investors who believe that oil prices will rise take long positions in futures contracts.

- Short Positions: Investors who believe that oil prices will fall take short positions in futures contracts.

8.3. Market Sentiment and Herd Behavior

Market sentiment and herd behavior can also influence oil prices. When investors become overly optimistic or pessimistic, they may act in a way that amplifies price movements.

- Fear and Greed: Fear of missing out (FOMO) and greed can drive speculative buying, while fear of losses can trigger panic selling.

- Momentum Trading: Momentum traders seek to profit from price trends, often exacerbating price movements.

9. Technological Advancements and Production Efficiency

Technological advancements and production efficiency are increasingly relevant to “how much is the oil”. Innovations in drilling, extraction, and refining can impact oil supply and costs.

9.1. Shale Oil Revolution and Fracking

The shale oil revolution, driven by advancements in hydraulic fracturing (fracking) and horizontal drilling, has significantly increased oil production in the United States.

- Increased Production: Fracking has unlocked vast reserves of shale oil, transforming the United States into a major oil producer.

- Reduced Costs: Technological advancements have reduced the cost of shale oil production, making it more competitive.

9.2. Enhanced Oil Recovery (EOR) Techniques

Enhanced Oil Recovery (EOR) techniques are used to extract more oil from existing oil fields. These techniques can help to increase production and extend the life of oil fields.

- Chemical Flooding: Injecting chemicals into oil fields to improve oil flow.

- Gas Injection: Injecting gases like carbon dioxide into oil fields to increase pressure and displace oil.

- Thermal Methods: Using heat to reduce the viscosity of heavy oil and improve its flow.

9.3. Refining Efficiency and Yield Optimization

Refining efficiency and yield optimization can impact the supply of refined products like gasoline and diesel. Improvements in refining technology can increase the output of valuable products.

- Catalytic Cracking: Using catalysts to break down large hydrocarbon molecules into smaller, more valuable ones.

- Hydrotreating: Removing impurities like sulfur from refined products.

10. Alternative Energy Sources and Long-Term Trends

Alternative energy sources and long-term trends are crucial when predicting “how much is the oil” in the future. The growth of renewable energy, electric vehicles, and energy efficiency measures can impact the long-term demand for oil.

10.1. Renewable Energy Growth and Oil Demand

The growth of renewable energy sources like solar, wind, and hydro power can displace oil demand in the electricity generation sector.

- Solar Power: Solar power is becoming increasingly competitive with fossil fuels for electricity generation.

- Wind Power: Wind power is another rapidly growing renewable energy source.

10.2. Electric Vehicles and Transportation Fuel Demand

Electric vehicles (EVs) are gaining market share and can reduce demand for gasoline and diesel in the transportation sector.

- EV Adoption: Increased adoption of EVs can significantly reduce demand for transportation fuels.

- Battery Technology: Advancements in battery technology are improving the range and performance of EVs.

10.3. Energy Efficiency and Conservation Measures

Energy efficiency and conservation measures can reduce overall energy consumption, including oil.

- Building Codes: Building codes that promote energy efficiency can reduce energy consumption in buildings.

- Fuel Efficiency Standards: Fuel efficiency standards for vehicles can reduce gasoline consumption.

Navigating the complexities of the oil market requires expertise and insight. At HOW.EDU.VN, we connect you with top PhDs and experts who can provide comprehensive analysis and strategic advice. Whether you’re looking to understand market trends, manage risk, or optimize your energy investments, our team is here to help.

Connect with our Experts Today:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

11. Understanding the Impact of Government Regulations on Oil Prices

Government regulations significantly impact “how much is the oil”. Environmental policies, fuel standards, and taxes influence both the supply and demand sides of the oil market.

11.1. Environmental Regulations and Production Costs

Environmental regulations aimed at reducing emissions and protecting the environment can increase the cost of oil production.

- Methane Regulations: Regulations aimed at reducing methane emissions from oil and gas operations can require companies to invest in new technologies and processes.

- Water Management: Regulations related to water usage and disposal in fracking operations can increase production costs.

11.2. Fuel Efficiency Standards and Gasoline Consumption

Fuel efficiency standards for vehicles can reduce gasoline consumption, impacting the demand for oil.

- Corporate Average Fuel Economy (CAFE) Standards: CAFE standards in the United States set minimum fuel efficiency requirements for vehicle fleets.

- Emission Standards: Regulations aimed at reducing vehicle emissions can also improve fuel efficiency.

11.3. Carbon Taxes and Climate Change Policies

Carbon taxes and other climate change policies can increase the cost of fossil fuels, including oil, and encourage the adoption of alternative energy sources.

- Carbon Pricing: Carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, put a price on carbon emissions.

- Renewable Energy Subsidies: Subsidies for renewable energy sources can make them more competitive with fossil fuels.

12. Case Studies: Historical Oil Price Shocks

Examining historical oil price shocks can provide valuable insights into the factors that drive oil price volatility. Let’s analyze a few notable examples:

12.1. The 1973 Oil Crisis

The 1973 oil crisis was triggered by an oil embargo imposed by OPEC in response to the Yom Kippur War. This led to a sharp increase in oil prices and significant economic disruption.

- Embargo: The OPEC embargo reduced oil supply, leading to higher prices.

- Economic Impact: The crisis caused inflation, recession, and energy shortages in many countries.

12.2. The 1979 Energy Crisis

The 1979 energy crisis was caused by the Iranian Revolution, which disrupted oil production and led to supply shortages.

- Iranian Revolution: The revolution led to a decline in Iranian oil production, impacting global supply.

- Price Spikes: Oil prices surged, causing economic instability.

12.3. The 2008 Financial Crisis

The 2008 financial crisis led to a sharp decline in oil demand and prices as the global economy slowed down.

- Economic Recession: The financial crisis caused a global recession, reducing oil demand.

- Price Collapse: Oil prices plummeted as demand declined.

These case studies illustrate the significant impact that geopolitical events and economic conditions can have on oil prices.

13. Expert Perspectives on Future Oil Price Trends

Understanding “how much is the oil” tomorrow requires insights from experts. Let’s consider perspectives on future oil price trends from leading energy analysts and economists:

13.1. Demand Growth in Emerging Markets

Many experts believe that demand growth in emerging markets like China and India will continue to drive oil demand in the coming years.

- Urbanization: Rapid urbanization in emerging markets is increasing demand for transportation fuels.

- Industrialization: Industrialization is boosting demand for energy, including oil.

13.2. Impact of Electric Vehicle Adoption

The increasing adoption of electric vehicles is expected to gradually reduce demand for gasoline and diesel, potentially putting downward pressure on oil prices in the long term.

- Policy Support: Government policies supporting EV adoption, such as subsidies and regulations, can accelerate the transition.

- Technological Advancements: Advancements in battery technology are improving the competitiveness of EVs.

13.3. Geopolitical Risks and Supply Disruptions

Geopolitical risks and potential supply disruptions in oil-producing regions remain a significant concern. These factors can lead to price spikes and increased volatility in the oil market.

- Middle East Tensions: Ongoing tensions in the Middle East pose a risk to oil supply.

- Cyberattacks: Cyberattacks on oil infrastructure could disrupt production and transportation.

14. Utilizing Oil Price Forecasting Models

Predicting “how much is the oil” involves sophisticated models. Oil price forecasting models are used to estimate future oil prices based on a variety of factors, including supply and demand, economic indicators, and geopolitical risks.

14.1. Econometric Models

Econometric models use statistical techniques to analyze historical data and identify relationships between oil prices and other variables.

- Regression Analysis: Regression analysis is used to estimate the impact of different factors on oil prices.

- Time Series Analysis: Time series analysis is used to identify trends and patterns in oil prices over time.

14.2. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) techniques are increasingly being used to improve oil price forecasting.

- Neural Networks: Neural networks can learn complex relationships between variables and improve forecasting accuracy.

- Machine Learning Algorithms: Machine learning algorithms can identify patterns in large datasets and make predictions about future oil prices.

14.3. Integrating Expert Opinions

Integrating expert opinions into forecasting models can improve their accuracy. Experts can provide insights into factors that may not be captured by statistical data.

- Delphi Method: The Delphi method involves surveying experts to gather their opinions and refine forecasts.

- Scenario Analysis: Scenario analysis involves developing different scenarios based on potential future events and estimating their impact on oil prices.

15. Risk Management Strategies for Oil Price Volatility

Managing risk is crucial given the fluctuations in “how much is the oil”. Companies and investors can use various risk management strategies to protect themselves against oil price volatility.

15.1. Hedging with Futures and Options

Hedging with futures and options contracts can help to protect against price fluctuations.

- Short Hedging: Producers can use short hedging to lock in a price for future oil production.

- Long Hedging: Consumers can use long hedging to protect against price increases.

15.2. Diversification of Energy Sources

Diversifying energy sources can reduce reliance on oil and mitigate the impact of oil price volatility.

- Renewable Energy Investments: Investing in renewable energy sources can reduce dependence on oil.

- Energy Efficiency Measures: Implementing energy efficiency measures can reduce overall energy consumption.

15.3. Scenario Planning and Stress Testing

Scenario planning and stress testing can help to prepare for potential oil price shocks.

- Worst-Case Scenarios: Developing worst-case scenarios and assessing their impact on business operations.

- Contingency Plans: Creating contingency plans to respond to oil price shocks.

16. The Impact of the Russia-Ukraine Conflict on Oil Prices

The Russia-Ukraine conflict has had a significant impact on global oil prices, adding to existing market volatility. The conflict has disrupted oil supply chains and increased geopolitical risk.

16.1. Supply Disruptions and Sanctions

The conflict has led to supply disruptions as some countries have imposed sanctions on Russian oil exports.

- Reduced Russian Exports: Sanctions have reduced the amount of oil that Russia can export.

- Increased Geopolitical Risk: The conflict has increased geopolitical risk in the region, leading to higher oil prices.

16.2. Impact on Global Oil Demand

The conflict has also impacted global oil demand, as economic uncertainty has increased.

- Slower Economic Growth: The conflict has contributed to slower economic growth in some regions, reducing oil demand.

- Inflationary Pressures: Higher oil prices have added to inflationary pressures, impacting consumer spending.

16.3. Responses from OPEC and Other Producers

OPEC and other oil-producing countries have responded to the conflict by increasing production to help stabilize prices.

- Increased Production: Some OPEC members have increased production to offset the loss of Russian oil.

- Strategic Petroleum Reserve Releases: Some countries have released oil from their strategic petroleum reserves to increase supply.

17. The Future of U.S. Oil Imports and Exports

The United States has become a major oil producer in recent years, thanks to the shale oil revolution. This has transformed the country’s role in the global oil market.

17.1. The Rise of U.S. Oil Production

The shale oil revolution has significantly increased U.S. oil production, making the country less reliant on imports.

- Fracking Boom: The fracking boom has unlocked vast reserves of shale oil.

- Increased Exports: The United States has become a major oil exporter.

17.2. Dependence on Canadian and Mexican Oil

Despite the increase in domestic production, the United States still relies on imports from Canada and Mexico to meet its refining needs.

- Heavy Crude Oil: Many U.S. refineries are designed to process heavy crude oil, which is primarily imported from Canada and Mexico.

- Supply Security: Imports from Canada and Mexico provide supply security for U.S. refineries.

17.3. The Role of Refineries in the U.S.

U.S. refineries play a crucial role in processing crude oil and producing refined products like gasoline, diesel, and jet fuel.

- Refining Capacity: The U.S. has the largest refining capacity in the world.

- Product Exports: The U.S. exports refined products to other countries.

18. Examining the Role of American Petroleum Institute

The American Petroleum Institute (API) plays a crucial role in shaping the oil and gas industry through its advocacy, standards, and research initiatives. Understanding its function provides insights into industry dynamics.

18.1 API Standards and Certifications

API develops and maintains technical standards for the oil and gas industry, ensuring safety, efficiency, and environmental protection.

- Equipment Standards: API standards cover a wide range of equipment used in the industry, from drilling rigs to pipelines.

- Certification Programs: API offers certification programs for equipment and personnel, ensuring compliance with industry standards.

18.2 Advocacy and Policy Influence

API advocates for policies that support the oil and gas industry, representing its members’ interests in legislative and regulatory matters.

- Lobbying Efforts: API engages in lobbying efforts to influence government policies related to energy and the environment.

- Public Awareness Campaigns: API conducts public awareness campaigns to promote the benefits of oil and gas.

18.3 Research and Data Analysis

API conducts research and data analysis to inform industry practices and policy decisions.

- Statistical Reports: API publishes statistical reports on oil and gas production, consumption, and inventories.

- Economic Studies: API conducts economic studies to assess the impact of policies on the oil and gas industry.

19. Analyzing the Impact of OPEC+ Decisions on Oil Market

OPEC+, which includes OPEC members and other major oil-producing countries like Russia, plays a significant role in influencing global oil supply and prices. Their decisions on production cuts or increases can have a substantial impact on the market.

19.1 Production Quotas and Market Stability

OPEC+ sets production quotas for its member countries, aiming to balance supply and demand and maintain market stability.

- Supply Management: OPEC+ uses production quotas to manage the supply of oil in the market.

- Price Targets: OPEC+ aims to keep oil prices within a target range.

19.2 Geopolitical Considerations and Alliances

Geopolitical considerations and alliances among OPEC+ members can influence their decisions on production quotas.

- Political Interests: OPEC+ members’ political interests can influence their decisions on oil policy.

- Cooperation and Conflict: Cooperation and conflict among OPEC+ members can impact their ability to manage the market.

19.3 Impact on Consumer Nations

OPEC+ decisions on oil production can have a significant impact on consumer nations, affecting gasoline prices and economic growth.

- Energy Costs: Higher oil prices can increase energy costs for consumers and businesses.

- Economic Growth: Higher energy costs can slow economic growth.

20. Frequently Asked Questions (FAQ) About Oil Prices

Here are some frequently asked questions about oil prices:

- What factors influence the price of oil?

- Supply and demand, geopolitical events, economic indicators, currency fluctuations, inventory levels, weather conditions, and speculation.

- What are the main benchmarks for oil prices?

- West Texas Intermediate (WTI), Brent Crude, and OPEC Basket.

- How does OPEC influence oil prices?

- By setting production quotas for its member countries and intervening in the market to stabilize prices.

- How do currency fluctuations affect oil prices?

- A stronger U.S. dollar can make oil more expensive for countries using other currencies.

- What is the Strategic Petroleum Reserve (SPR)?

- A government-controlled stockpile of crude oil held for emergency situations.

- How do weather conditions impact oil prices?

- Extreme weather events like hurricanes can disrupt oil production and transportation.

- What is the role of oil futures contracts?

- They are agreements to buy or sell oil at a specific price on a future date, used for hedging and speculation.

- How do alternative energy sources affect oil demand?

- The growth of renewable energy sources can displace oil demand in the electricity generation sector.

- What impact does the Russia-Ukraine conflict have on oil prices?

- It has disrupted oil supply chains and increased geopolitical risk, leading to higher prices.

- How can companies manage the risk of oil price volatility?

- By hedging with futures and options, diversifying energy sources, and implementing scenario planning.

Understanding “how much is the oil” requires expertise across economics, geopolitics, and technology. At HOW.EDU.VN, our PhD-level experts offer specialized insights tailored to your needs.

Contact us today:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Let how.edu.vn connect you with the knowledge and experts you need to navigate the complex world of oil pricing.