Uncover the staggering wealth of Pablo Escobar, the infamous drug lord, as HOW.EDU.VN explores the complexities of his financial empire and its impact. Seeking expert advice on financial matters? Our team of PhDs is ready to assist. Dive into the details of his financial operations, asset management, and the true extent of his illicit fortune, along with the challenges of laundering such sums and how that money impacted the world.

1. The Rise of a Drug Lord: Pablo Escobar’s Early Wealth Accumulation

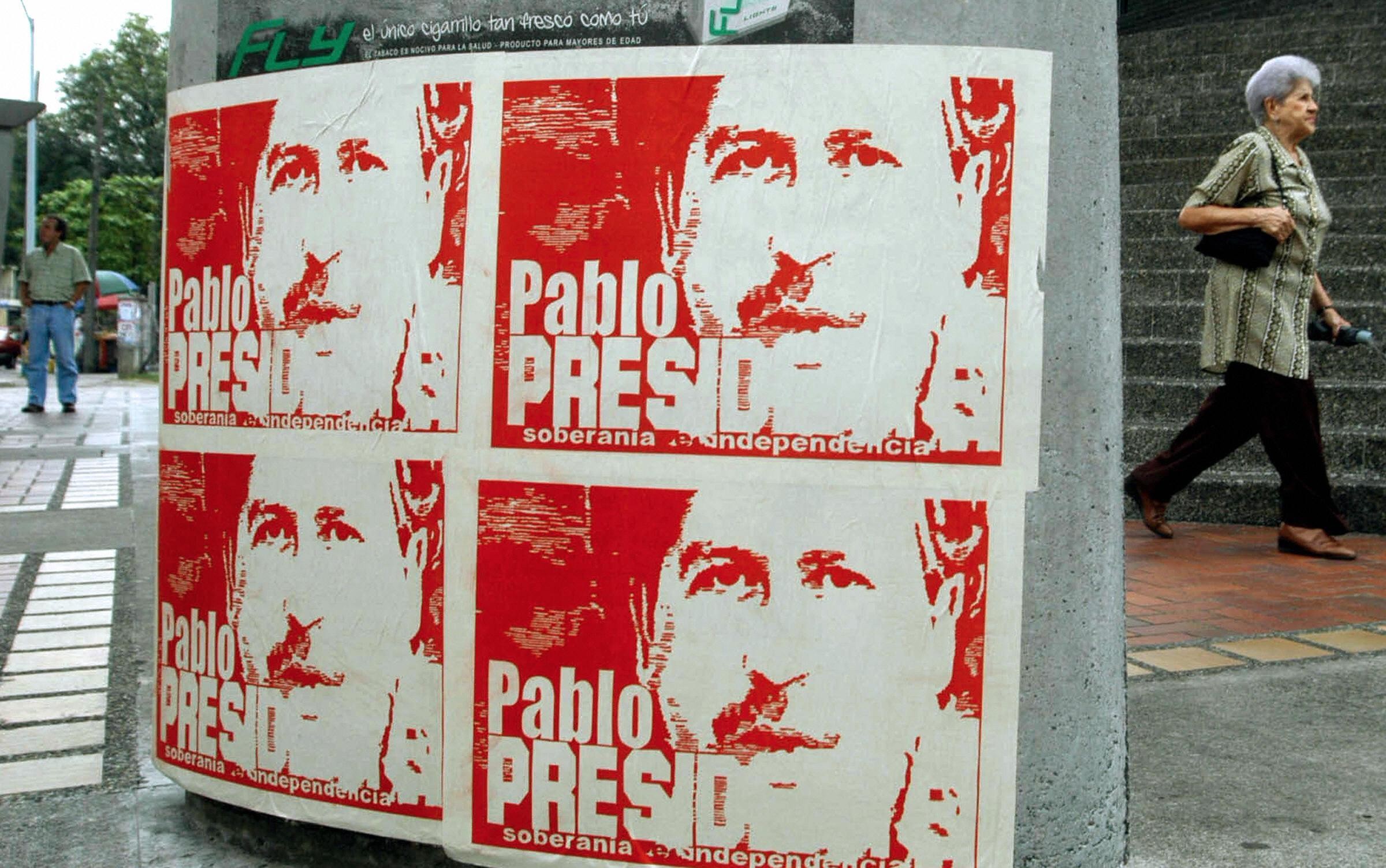

Pablo Escobar, often dubbed the “King of Cocaine,” amassed a fortune that remains legendary and almost incomprehensible. His journey from a humble background to one of the wealthiest men in the world is a stark illustration of the immense profits generated by the drug trade. Understanding how much money Pablo Escobar had involves delving into the operations of the Medellín Cartel and the sheer scale of its cocaine empire.

1.1 The Medellín Cartel: The Engine of Escobar’s Wealth

The Medellín Cartel, led by Escobar, controlled approximately 80% of the global cocaine market by the late 1980s. This dominance translated into staggering revenues, making Escobar one of the wealthiest individuals in history.

1.2 Weekly and Annual Revenue Estimates

Estimates suggest that in the mid-1980s, Escobar’s cartel brought in about $420 million each week. This amounts to nearly $22 billion per year. These figures highlight the colossal scale of Escobar’s financial operations and why he consistently appeared on Forbes’ list of international billionaires.

1.3 Forbes Recognition: A Billionaire Several Times Over

Escobar was featured on Forbes’ list of international billionaires for seven consecutive years, from 1987 to 1993. In 1989, he was ranked as the seventh-richest man in the world. This recognition from a reputable financial publication underscores the enormous scale of Escobar’s wealth.

2. The Mechanics of Escobar’s Operations: Cocaine Smuggling and Distribution

Escobar’s wealth was primarily derived from the production, smuggling, and distribution of cocaine. The mechanics of these operations were sophisticated and ruthlessly efficient, enabling the cartel to move massive quantities of drugs and generate immense profits.

2.1 The Scale of Smuggling Operations

Escobar’s cartel smuggled approximately 15 tons of cocaine into the United States every day. The primary route was via the Florida coast, a 900-mile stretch from the north coast of Colombia, which was largely uncontrolled during that time.

2.2 Distribution Networks and Market Dominance

The Medellín Cartel’s efficient distribution networks ensured that their cocaine reached a significant portion of the American market. It is estimated that four out of five Americans who used cocaine were consuming lines supplied by Escobar’s organization.

2.3 The Financial Impact of Market Control

Controlling such a large portion of the cocaine market meant that Escobar had a significant influence on drug prices and profits. This market dominance allowed him to dictate terms and amass even greater wealth.

3. The Challenges of Immense Wealth: Money Laundering and Asset Management

Managing and laundering such vast sums of money presented significant challenges for Escobar and his organization. The cartel had to devise elaborate methods to hide, move, and legitimize their illicit wealth.

3.1 The Scale of Losses Due to Poor Storage

One of the most incredible aspects of Escobar’s wealth was the amount of money lost due to inadequate storage. According to Roberto Escobar, the cartel’s chief accountant and Escobar’s brother, approximately 10% of the money was written off annually because it was eaten by rats, damaged by water, or simply lost. This amounted to about $2.1 billion per year.

3.2 Expenditure on Basic Necessities for Handling Cash

The Medellín Cartel spent approximately $2,500 each month on rubber bands simply to bundle stacks of banknotes. This expense illustrates the sheer volume of cash that the cartel was handling daily.

3.3 Creative Methods of Hiding Money

Escobar resorted to stashing money in various locations, including Colombian farming fields, dilapidated warehouses, and within the walls of cartel members’ homes. This was necessary because traditional banking systems could not handle the volume of cash the cartel generated.

4. Escobar’s Philanthropy: “Robin Hood” or Calculated Strategy?

Escobar gained notoriety for his philanthropic activities, earning him the nickname “Robin Hood.” However, these acts of charity may have also served strategic purposes.

4.1 Investment in Community Projects

Escobar invested heavily in community projects, including building housing for the homeless, constructing 70 community soccer fields, and establishing a zoo. These projects were aimed at gaining the support of the local population.

4.2 Distribution of Cash to the Poor

Escobar was known for handing out cash to the poor, further enhancing his image as a benefactor. This helped him cultivate a loyal following, which provided a degree of protection against law enforcement.

4.3 Strategic Implications of Philanthropy

While Escobar’s philanthropy may have been motivated by genuine concern for the poor, it also served to bolster his reputation and create a support base that would protect his interests.

5. Imprisonment and Continued Control: La Catedral

In 1991, Escobar negotiated a deal with the Colombian government that allowed him to be imprisoned in a luxurious, self-designed prison called “La Catedral.” This arrangement allowed him to maintain control over his operations while ostensibly serving time.

5.1 Terms of the Agreement with the Colombian Government

Under the terms of the agreement, Escobar was allowed to select his fellow prisoners and the staff at La Catedral. He was also permitted to continue running his cartel business and receive visitors.

5.2 Amenities and Control within La Catedral

La Catedral was equipped with a soccer field, barbecue pit, and patios. The Colombian authorities were prohibited from coming within three miles of the prison, effectively giving Escobar free rein.

5.3 Continued Criminal Activity from Prison

Despite being imprisoned, Escobar continued to manage his drug operations and maintain his opulent lifestyle. This situation highlighted the extent of his influence and the corruption within the Colombian government.

6. The Downfall: Escobar’s Death and the Dissolution of His Empire

Escobar’s reign eventually came to an end with his death in 1993. The circumstances surrounding his death are still debated, but his demise marked the beginning of the end for the Medellín Cartel.

6.1 Circumstances of Escobar’s Death

Escobar was killed by Colombian National Police in Medellín on December 2, 1993. The official version of events states that he was shot while trying to escape, but some believe he may have been deliberately killed.

6.2 The Impact on the Medellín Cartel

Following Escobar’s death, the Medellín Cartel began to disintegrate. Rival cartels and law enforcement agencies moved in to fill the power vacuum, leading to a period of intense violence and instability.

6.3 The Legacy of Escobar’s Wealth

Despite his death, the legacy of Escobar’s wealth continues to fascinate. The exact amount of money he accumulated remains unknown, but it is clear that he was one of the wealthiest and most powerful criminals in history.

7. The Tangible Assets: What Did Escobar’s Money Buy?

Escobar’s vast wealth was manifested in numerous tangible assets, reflecting his extravagant lifestyle and business interests.

7.1 Real Estate Holdings

Escobar owned numerous properties, including luxurious estates, apartments, and ranches. These properties were often lavishly decorated and equipped with amenities such as private zoos and swimming pools.

7.2 Transportation Fleet

Escobar maintained a fleet of vehicles, including cars, motorcycles, and airplanes. These were used for both personal transportation and for smuggling operations.

7.3 Personal Luxuries

Escobar indulged in various personal luxuries, including designer clothing, jewelry, and artwork. These items were symbols of his wealth and power.

8. The Intangible Impact: Corruption and Social Disruption

Escobar’s wealth had a significant intangible impact, fueling corruption and disrupting social structures.

8.1 Corruption of Government Officials

Escobar used his wealth to bribe government officials, law enforcement officers, and judges. This corruption allowed him to operate with impunity and avoid prosecution for many years.

8.2 Social Disruption and Violence

The drug trade fueled by Escobar’s wealth led to widespread violence and social disruption. The competition between cartels and the government’s efforts to combat drug trafficking resulted in countless deaths and a climate of fear.

8.3 The Normalization of Drug Culture

Escobar’s success contributed to the normalization of drug culture in Colombia. Many people saw him as a role model and aspired to emulate his wealth and power.

9. Verifying Escobar’s Wealth: The Impossibility of Precision

Verifying the exact amount of Escobar’s wealth is virtually impossible due to the nature of drug money and the clandestine nature of his operations.

9.1 The Challenges of Tracking Illicit Funds

Illicit funds are typically moved through informal channels, making them difficult to trace. Escobar’s money was no exception, and much of it remains unaccounted for.

9.2 Reliance on Estimates and Historical Records

Estimates of Escobar’s wealth are based on historical records, financial reports, and accounts from individuals who were involved in his operations. However, these sources are often incomplete or unreliable.

9.3 The Ongoing Mystery of Escobar’s Fortune

The exact amount of Escobar’s fortune remains a mystery. While estimates range as high as $30 billion, the true figure may never be known.

10. Expert Consultation: Navigating Complex Financial Matters with HOW.EDU.VN

Understanding the financial complexities of someone like Pablo Escobar can be fascinating, but it also highlights the importance of sound financial advice. Whether you are dealing with complex investments, business strategies, or personal finances, having access to expert consultation can make a significant difference.

10.1. Access to Top PhDs and Professionals

HOW.EDU.VN connects you with over 100 distinguished PhDs and experts across various fields, ready to provide tailored advice.

10.2. Personalized Solutions for Unique Challenges

We understand that every individual and business faces unique challenges. Our experts offer personalized solutions designed to meet your specific needs.

10.3. Confidential and Reliable Advice

Your privacy and trust are our top priorities. We ensure that all consultations are confidential and that you receive reliable, fact-based advice.

11. Who Sought Escobar’s Financial Insight?

While it may seem counter-intuitive, individuals from various walks of life sought Pablo Escobar’s financial insight, albeit indirectly. Here are some examples:

- Local Business Owners: Many small business owners in Medellín benefited from Escobar’s investments in the community, which stimulated the local economy.

- Construction Workers: Escobar’s construction of houses and soccer fields provided employment opportunities for many local workers.

- Politicians: Some politicians accepted bribes from Escobar in exchange for political favors, benefiting financially from their association with him.

- Cartel Members: Of course, the members of the Medellín Cartel were the primary beneficiaries of Escobar’s financial empire, earning large sums of money from the drug trade.

- Accountants and Lawyers: Some accountants and lawyers were employed by Escobar to help manage and launder his vast wealth, profiting from their involvement in his criminal enterprise.

These examples highlight the complex and often paradoxical nature of Escobar’s financial influence, which extended far beyond the realm of drug trafficking.

12. The Importance of Ethical Financial Management

Escobar’s story serves as a cautionary tale about the dangers of illicit wealth and the importance of ethical financial management. Building a sustainable financial future requires integrity, transparency, and compliance with the law.

12.1 Avoiding Illicit Activities

Engaging in illicit activities, such as drug trafficking or money laundering, carries significant legal and ethical risks. These activities can lead to severe penalties, including imprisonment and asset forfeiture.

12.2 Building a Sustainable Financial Future

A sustainable financial future is built on sound financial principles, such as budgeting, saving, and investing. These principles can help you achieve your financial goals and secure your long-term well-being.

12.3 Seeking Professional Guidance

Seeking professional guidance from financial advisors can help you make informed decisions and avoid costly mistakes. A qualified advisor can provide tailored advice based on your individual circumstances and financial goals.

13. Modern Parallels: Understanding Financial Crime Today

While Pablo Escobar’s era may seem distant, financial crime remains a significant problem today. Understanding modern financial crime can help you protect yourself and your assets.

13.1 Cybercrime and Fraud

Cybercrime and fraud are increasingly common, with criminals using sophisticated techniques to steal money and personal information.

13.2 Money Laundering and Tax Evasion

Money laundering and tax evasion continue to be major concerns, with individuals and organizations using complex schemes to hide their wealth and avoid paying taxes.

13.3 The Role of Regulatory Agencies

Regulatory agencies, such as the Financial Crimes Enforcement Network (FinCEN), play a crucial role in combating financial crime. These agencies work to detect and prevent illicit financial activity.

14. Case Studies: Learning from Real-World Examples

Examining real-world case studies can provide valuable insights into financial crime and the importance of ethical financial management.

14.1. The Bernie Madoff Scandal

The Bernie Madoff scandal is a classic example of a Ponzi scheme, where investors were defrauded of billions of dollars. This case highlights the importance of due diligence and skepticism when evaluating investment opportunities.

14.2. The Panama Papers Leak

The Panama Papers leak revealed the use of offshore accounts to hide wealth and evade taxes. This case underscores the need for transparency and international cooperation in combating financial crime.

14.3. Corporate Accounting Scandals

Corporate accounting scandals, such as Enron and WorldCom, demonstrate the dangers of fraudulent accounting practices. These cases highlight the importance of ethical leadership and strong internal controls.

15. Current Financial Experts: Providing Guidance Today

In today’s complex financial landscape, having access to reliable and knowledgeable experts is essential.

15.1. Financial Advisors

Financial advisors can provide guidance on investments, retirement planning, and other financial matters. They can help you develop a personalized financial plan and make informed decisions.

15.2. Accountants

Accountants can help you manage your finances, prepare taxes, and comply with financial regulations. They can also provide valuable advice on business accounting and financial planning.

15.3. Legal Professionals

Legal professionals can provide guidance on legal matters related to finance, such as contracts, estate planning, and business law. They can help you protect your assets and navigate complex legal issues.

16. Ethical Considerations: Guiding Principles for Financial Decisions

Ethical considerations should guide all financial decisions. Acting with integrity and transparency is essential for building trust and maintaining a positive reputation.

16.1. Transparency and Honesty

Transparency and honesty are fundamental to ethical financial management. Being open and honest with clients, employees, and stakeholders builds trust and fosters long-term relationships.

16.2. Fairness and Equity

Fairness and equity should guide all financial transactions. Treating everyone with respect and ensuring that they receive a fair deal is essential for maintaining ethical standards.

16.3. Social Responsibility

Social responsibility involves considering the impact of your financial decisions on society and the environment. Supporting sustainable businesses and contributing to charitable causes are ways to promote social responsibility.

17. Key Financial Skills for Success

Developing key financial skills can empower you to make informed decisions and achieve your financial goals.

17.1. Budgeting and Saving

Budgeting and saving are essential for managing your finances effectively. Creating a budget can help you track your income and expenses, identify areas where you can save money, and achieve your financial goals.

17.2. Investing

Investing can help you grow your wealth over time. Learning about different investment options and developing a diversified portfolio can help you achieve your long-term financial goals.

17.3. Financial Planning

Financial planning involves setting financial goals and developing a plan to achieve them. This includes considering your income, expenses, assets, and liabilities, as well as your risk tolerance and time horizon.

18. The Role of Education in Financial Literacy

Education plays a crucial role in promoting financial literacy. Understanding basic financial concepts can empower individuals to make informed decisions and manage their finances effectively.

18.1. Schools and Universities

Schools and universities can incorporate financial literacy into their curriculum, teaching students about budgeting, saving, investing, and other essential financial concepts.

18.2. Community Programs

Community programs can provide financial education to adults, helping them improve their financial skills and achieve their financial goals.

18.3. Online Resources

Online resources, such as websites and online courses, can provide valuable information and tools for improving financial literacy.

19. Technological Advances in Financial Management

Technological advances are transforming financial management, making it easier to track expenses, manage investments, and access financial information.

19.1. Mobile Banking Apps

Mobile banking apps allow you to manage your bank accounts, pay bills, and transfer funds from your smartphone or tablet.

19.2. Online Investment Platforms

Online investment platforms provide access to a wide range of investment options, including stocks, bonds, and mutual funds.

19.3. Financial Management Software

Financial management software can help you track your income and expenses, create budgets, and manage your investments.

20. Future Trends in Finance

Understanding future trends in finance can help you prepare for the challenges and opportunities ahead.

20.1. Cryptocurrency and Blockchain

Cryptocurrency and blockchain technology have the potential to revolutionize the financial industry, offering new ways to transfer money and manage assets.

20.2. Artificial Intelligence

Artificial intelligence is being used to automate financial tasks, such as fraud detection and investment management.

20.3. Sustainable Investing

Sustainable investing is growing in popularity, with investors seeking to align their investments with their values and support companies that are environmentally and socially responsible.

21. Connect with the Experts at HOW.EDU.VN

Ready to take control of your financial future? HOW.EDU.VN is here to help. Our team of experienced PhDs and professionals are ready to provide personalized guidance and support.

21.1. Schedule a Consultation

Schedule a consultation with one of our experts to discuss your financial goals and develop a plan to achieve them.

21.2. Ask a Question

Have a specific question about finance? Ask our experts and receive a detailed, personalized answer.

21.3. Join Our Community

Join our community to connect with other individuals who are passionate about finance and learn from their experiences.

FAQ: Understanding Pablo Escobar’s Wealth and Modern Financial Consultation

Q1: How Much Money Did Pablo Escobar Have at his peak?

Estimates range up to $30 billion, making him one of the wealthiest criminals in history.

Q2: What were the main sources of Escobar’s wealth?

Cocaine production, smuggling, and distribution were the primary sources of his vast fortune.

Q3: How did Escobar manage and launder his money?

He used creative methods, including stashing cash in various locations and writing off losses due to poor storage.

Q4: What were some of Escobar’s philanthropic activities?

He invested in community projects, built housing for the homeless, and distributed cash to the poor.

Q5: How did Escobar’s wealth impact Colombian society?

It fueled corruption, disrupted social structures, and contributed to the normalization of drug culture.

Q6: Why is it difficult to verify the exact amount of Escobar’s wealth?

Due to the nature of drug money and the clandestine nature of his operations, tracking illicit funds is challenging.

Q7: What can we learn from Escobar’s story about ethical financial management?

His story highlights the importance of integrity, transparency, and compliance with the law.

Q8: How can HOW.EDU.VN help with modern financial challenges?

We connect you with top PhDs and experts across various fields, providing tailored advice and personalized solutions.

Q9: What types of financial services does HOW.EDU.VN offer?

We offer personalized financial consultations, expert guidance on investments, and support for business strategies.

Q10: How can I schedule a consultation with a financial expert at HOW.EDU.VN?

Visit our website or contact us directly to schedule a consultation with one of our experienced professionals.

Ready to connect with top PhDs and professionals for tailored financial advice? Contact HOW.EDU.VN today at 456 Expertise Plaza, Consult City, CA 90210, United States. Reach us via WhatsApp at +1 (310) 555-1212 or visit our website how.edu.vn.