Figuring out How Much Of Your Income Should Go To Mortgage is a critical financial decision. Many financial experts at HOW.EDU.VN agree that it’s wise to approach this strategically to ensure financial stability and prevent overextending yourself. By carefully considering your income and debt, you can determine an amount that allows you to comfortably manage mortgage costs while also achieving your financial goals, providing long-term financial well-being and security.

Navigating the complexities of homeownership involves understanding income allocation, affordable housing, and financial health, vital for sustainable budgeting.

1. Understanding Mortgage Payments

A mortgage payment is what you pay your lender each month for your home loan. This amount typically includes the principal (the original loan amount) and the interest. Depending on the terms of your mortgage, it might also include property taxes and homeowners insurance, which are often collected in an escrow account.

Mortgage payments are usually made monthly, but some lenders may offer options for bi-weekly or semi-monthly payments. Understanding what your mortgage payment covers is crucial for budgeting and financial planning.

2. Common Mortgage-to-Income Ratio Rules

Determining the right percentage of your income for a mortgage requires understanding your income, financial goals, and current debts. Several rules of thumb can help you get started.

2.1. The 28% Rule

The 28% rule suggests that no more than 28% of your gross monthly income should be allocated to your mortgage payment, including principal, interest, taxes, and insurance (PITI). This rule helps ensure that housing costs remain manageable relative to your income.

To calculate the maximum affordable mortgage payment using the 28% rule, multiply your gross monthly income by 0.28. For instance, if your gross monthly income is $8,000, the calculation would be:

$8,000 x 0.28 = $2,240

This means your total monthly mortgage payment should not exceed $2,240.

2.2. The 28/36 Rule

The 28/36 rule expands on the 28% rule by also considering your total debt-to-income (DTI) ratio. This rule suggests limiting your mortgage costs to 28% of your gross monthly income while ensuring that your total debt payments, including mortgage, car loans, student loans, credit card debt, and other debts, stay below 36% of your gross monthly income.

The 28/36 rule provides a more comprehensive view of your financial situation, helping to prevent overextension with new debt obligations.

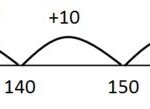

2.3. The 35/45 Rule

With the 35/45 rule, your total monthly debt, including the mortgage payment, shouldn’t exceed 35% of your pre-tax income or 45% of your after-tax income. This provides a range to determine affordability.

To estimate your affordable range, multiply your gross income before taxes by 0.35 and your net income after taxes by 0.45. For example, if your monthly income is $8,000 before taxes and $6,500 after taxes:

- $8,000 x 0.35 = $2,800

- $6,500 x 0.45 = $2,925

According to the 35/45 rule, you could potentially afford between $2,800 and $2,925 per month.

2.4. The 25% Post-Tax Rule

The 25% post-tax rule is a conservative approach, suggesting that your total monthly debt should be at or below 25% of your post-tax income. To calculate the affordable mortgage payment, multiply your post-tax monthly income by 0.25.

For example, if you earn $6,500 after taxes, your maximum affordable mortgage payment would be:

$6,500 x 0.25 = $1,625

This rule is generally considered more conservative than other models, providing a larger buffer for unexpected expenses.

While these rules of thumb are useful starting points, it’s important to consider your personal financial situation and goals. Consulting with a qualified home lending advisor can provide tailored guidance on suitable mortgage options.

3. Factors Lenders Consider for Affordability

Mortgage lenders evaluate your qualifications based on several factors, including your gross income, debt-to-income (DTI) ratio, and credit score.

3.1. Gross Income

Gross income is the total amount of money you earn before taxes and other deductions. Lenders use gross income to evaluate your ability to make monthly mortgage payments. Higher gross income generally indicates a greater capacity to afford a more expensive home.

3.2. Debt-to-Income (DTI) Ratio

Your DTI ratio compares your monthly debt payments to your gross monthly income. To calculate your DTI ratio, divide your total monthly debt (including mortgage payments, car loans, student loans, and credit card balances) by your gross monthly income, then multiply by 100.

For example, if your total monthly debt is $2,000 and your gross monthly income is $8,000:

($2,000 / $8,000) x 100 = 25%

A lower DTI ratio suggests that you have more disposable income available for mortgage payments, improving your mortgage application. Lenders often prefer a DTI ratio below 43%.

3.3. Credit Score

Your credit score reflects your creditworthiness based on factors such as payment history, credit utilization, and the length of your credit history. A higher credit score indicates lower risk to lenders, improving your chances of qualifying for a mortgage and securing favorable terms. Minimum credit score requirements vary, so it’s best to consult with your lender for more information. Generally, a credit score of 700 or higher is considered good.

4. Strategies to Lower Monthly Mortgage Payments

Lowering your monthly mortgage payment is a common goal. Here are some strategies to achieve that:

4.1. Increase Your Credit Score

To improve your credit score, it’s recommended to pay bills on time, reduce existing debt, and avoid opening new credit accounts unless necessary. Be aware that closing unused credit accounts may negatively affect your credit score by increasing your credit utilization ratio.

4.2. Extend Your Loan Term

Choosing a longer loan term, such as a 30-year mortgage instead of a 15-year mortgage, can reduce monthly payments by spreading the cost of your loan over a longer period. However, this generally means paying more interest over the life of the loan.

4.3. Make a Larger Down Payment

Making a down payment of at least 20% can help you avoid private mortgage insurance (PMI), typically required for borrowers with lower down payments. Eliminating PMI can reduce your monthly mortgage expenses. Additionally, a larger down payment means you’ll need to borrow less money, further reducing your monthly payments.

4.4. Request a Home Tax Reassessment

If you already own a home or it’s in escrow, consider filing for a reassessment with your county and requesting a hearing with the State Board of Equalization. A reassessment may lower your property taxes, potentially decreasing your monthly mortgage payment. However, be aware that a reassessment could also result in a higher property valuation, increasing your property taxes. Research ahead of time and consult a qualified tax professional before seeking a reassessment.

4.5. Refinance Your Mortgage

If interest rates have decreased since you obtained your original mortgage, consider refinancing. Refinancing to a lower rate can reduce your monthly payments. Consider the costs associated with refinancing and whether the long-term savings outweigh these expenses. Improving your credit score before seeking a mortgage refinance is recommended.

5. The Importance of Professional Financial Advice

Navigating the complexities of mortgage affordability can be challenging. Seeking professional advice ensures you make informed decisions tailored to your unique financial situation.

5.1. Benefits of Consulting a Home Lending Advisor

A home lending advisor can provide personalized guidance based on your specific financial circumstances, helping you determine the appropriate mortgage options. They can assess your income, debts, credit score, and financial goals to recommend a mortgage plan that aligns with your needs.

5.2. Tailored Financial Planning

Financial advisors offer comprehensive planning services beyond just mortgage advice. They can help you create a budget, manage debt, plan for retirement, and set financial goals, ensuring long-term financial stability.

5.3. Avoiding Common Pitfalls

With expert advice, you can avoid common pitfalls such as overextending your budget, choosing unsuitable loan terms, and neglecting long-term financial implications. Advisors can provide insights into the fine print and potential risks associated with different mortgage products.

6. How HOW.EDU.VN Can Help You Make Informed Decisions

At HOW.EDU.VN, we understand the complexities of financial planning and homeownership. Our team of over 100 distinguished PhDs and experts worldwide is dedicated to providing you with the guidance you need to make informed decisions.

6.1. Access to Expert Advice

We offer direct access to top-tier experts who can provide personalized advice tailored to your financial situation. Whether you need help determining how much of your income should go to your mortgage or require comprehensive financial planning, our experts are here to assist.

6.2. Personalized Consultation Services

Our consultation services are designed to address your specific needs. By understanding your financial goals and challenges, we can offer customized solutions that help you achieve your objectives.

6.3. Comprehensive Financial Resources

HOW.EDU.VN provides a wealth of resources, including articles, guides, and tools, to help you navigate the complexities of financial planning. Our resources cover a wide range of topics, from mortgage affordability to retirement planning, ensuring you have the knowledge you need to make sound financial decisions.

6.4. Expert Insights on Mortgage Affordability

Our experts offer in-depth insights into mortgage affordability, helping you understand the factors that influence your ability to qualify for a mortgage and providing strategies to improve your financial position. We can help you assess your income, debts, and credit score to determine the appropriate mortgage options for your needs.

6.5. Real-World Examples and Case Studies

To illustrate the benefits of seeking expert advice, we offer real-world examples and case studies that demonstrate how our experts have helped individuals achieve their financial goals. These examples showcase the value of personalized guidance and the positive impact it can have on your financial well-being.

Consider the story of Sarah, a 32-year-old professional who was struggling to determine how much of her income should go to her mortgage. By consulting with one of our financial experts, Sarah was able to develop a budget that allowed her to comfortably afford her mortgage payments while still saving for retirement and other financial goals.

7. Mortgage-to-Income Ratio FAQs

7.1. Do mortgage lenders use gross or net income?

Mortgage lenders typically use your gross income when determining how much you can afford to borrow. Gross income is your total earnings before any taxes or deductions. Lenders use this figure to evaluate key financial metrics, such as your debt-to-income ratio, to assess your ability to repay the loan.

7.2. Does mortgage interest reduce taxable income?

Yes, mortgage interest can potentially be used to reduce taxable income. Homeowners who itemize their deductions on their federal tax return may be able to deduct the interest paid on a mortgage. This deduction may apply to mortgages on a primary residence and, in some cases, a second home. However, there are limits and eligibility criteria, so it’s generally recommended to consult with a tax professional for specific guidance.

7.3. Does the length of the home loan term impact the mortgage-to-income ratio?

Yes, the length of the home loan term does impact the mortgage-to-income ratio. Longer loan terms, like a 30-year mortgage, typically have lower monthly payments, which can result in a lower mortgage-to-income ratio. Conversely, shorter loan terms, like a 15-year mortgage, often have higher monthly payments, leading to a higher mortgage-to-income ratio.

7.4. What other factors should I consider when determining how much my mortgage should be?

To help determine an appropriate amount for your routine mortgage payments, you’ll generally want to consider factors like your current debts, overarching financial goals, your total savings, expected income changes and current living expenses. A qualified home lending advisor can provide more personalized guidance to help you find a mortgage that fits.

7.5. What are the risks of allocating too much income to mortgage?

Allocating too much income to a mortgage often causes financial strain, limits flexibility, and may lead to new debt. This over allocation of income toward a mortgage is sometimes called “house poor.” Higher payments leave less for other expenses and emergencies, potentially resulting in further borrowing and additional stress.

7.6. How can I improve my chances of getting a mortgage with favorable terms?

Improving your chances of getting a mortgage with favorable terms involves several steps. First, focus on increasing your credit score by paying bills on time, reducing debt, and avoiding new credit applications. Second, save for a larger down payment to reduce the loan amount and potentially avoid private mortgage insurance (PMI). Third, lower your debt-to-income (DTI) ratio by paying off outstanding debts. Finally, compare offers from multiple lenders to find the best interest rates and terms.

7.7. What are the different types of mortgages available?

Several types of mortgages are available to suit different needs and financial situations. Fixed-rate mortgages offer a consistent interest rate throughout the loan term, providing predictable monthly payments. Adjustable-rate mortgages (ARMs) have interest rates that can change periodically based on market conditions. FHA loans are insured by the Federal Housing Administration and are designed for borrowers with limited savings or lower credit scores. VA loans are guaranteed by the Department of Veterans Affairs and are available to eligible veterans and active-duty service members.

7.8. How does private mortgage insurance (PMI) affect my monthly mortgage payment?

Private mortgage insurance (PMI) is typically required when you make a down payment of less than 20% of the home’s purchase price. PMI protects the lender in case you default on the loan. The cost of PMI is added to your monthly mortgage payment and can range from 0.5% to 1% of the original loan amount per year. Once you have built up enough equity in your home (typically 20%), you can request to have PMI removed.

7.9. What is the role of property taxes and homeowners insurance in my mortgage payment?

Property taxes and homeowners insurance are often included in your monthly mortgage payment. Lenders collect these funds and hold them in an escrow account to ensure that property taxes and insurance premiums are paid on time. Property taxes are assessed by local governments and are based on the value of your home. Homeowners insurance protects your home against damage from events such as fire, storms, and theft.

7.10. Where can I find reliable resources for learning more about mortgages?

You can find reliable resources for learning more about mortgages from various sources. Government agencies like the Consumer Financial Protection Bureau (CFPB) and the Department of Housing and Urban Development (HUD) offer educational materials and resources for homebuyers. Non-profit organizations such as the National Foundation for Credit Counseling (NFCC) provide financial education and counseling services. Additionally, reputable financial websites and publications offer articles and guides on mortgage-related topics.

8. Take Action with HOW.EDU.VN

Don’t let the complexities of mortgage affordability overwhelm you. Connect with our team of distinguished PhDs at HOW.EDU.VN and gain the expert guidance you need to make informed decisions. Whether you’re looking to determine how much of your income should go to your mortgage or need comprehensive financial planning, we’re here to help.

8.1. Why Choose HOW.EDU.VN?

At HOW.EDU.VN, we pride ourselves on providing personalized, expert advice tailored to your unique financial situation. Our team of over 100 distinguished PhDs and experts worldwide is dedicated to helping you achieve your financial goals. We offer a range of services, including personalized consultations, comprehensive financial resources, and access to top-tier experts.

8.2. Call to Action

Ready to take control of your financial future? Contact us today to schedule a consultation with one of our expert financial advisors. We’ll work with you to assess your income, debts, credit score, and financial goals to develop a customized mortgage plan that aligns with your needs.

Don’t navigate the complexities of mortgage affordability alone. Let HOW.EDU.VN be your trusted partner in achieving financial stability and homeownership success.

Contact Information:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: how.edu.vn

By seeking guidance from our experts, you can gain the confidence and knowledge you need to make sound financial decisions and achieve your homeownership dreams.