Deciding How Much Should I Contribute To 401k is a crucial step towards securing your financial future. There’s no universal answer, as the optimal contribution amount depends on individual circumstances and goals. At how.edu.vn, we aim to provide clarity and guidance to help you navigate your retirement savings journey.

Whether you’re just starting or already have a 401(k), understanding the factors that influence your contribution strategy is essential. Remember that consulting a financial advisor or tax professional can provide personalized advice.

Let’s delve into the details of 401(k) contributions, including:

- Contribution limits

- Employer matching

- Key factors to consider when determining your contribution amount

Understanding Contribution Limits

The IRS sets annual limits on 401(k) contributions to ensure fair tax advantages. These limits are subject to change each year.

What Are the Maximum 401(k) Contribution Limits?

In 2025, the individual contribution limit (also known as the 402(g) limit) is $23,500 for combined traditional and Roth 401(k) accounts. For those aged 50 or older, a catch-up contribution of an additional $7,500 is permitted, bringing the total to $31,000. Beginning in 2025, individuals aged 60-63 can contribute an additional $11,250 (for a total of $34,750 in 2025).

These limits are reviewed and potentially adjusted annually by the IRS to account for cost-of-living changes.

Does the Limit Include Employer Contributions?

The individual contribution limits apply only to what you, as the employee, contribute. Employer contributions are separate. The total contribution limit, encompassing both employee and employer contributions (known as the 415(c) limit), is $70,000 in 2025. This increases to $77,500 for those 50 or older, and $81,250 for those aged 60-63 and eligible for the extended catch-up. Importantly, your total 401(k) contributions cannot exceed 100% of your taxable income.

The 415(c) limit is also reevaluated annually, often increasing alongside the 402(g) limit.

Multiple 401(k) Plans and Contribution Limits

The deferral limits are individual, meaning they apply to your total contributions across all 401(k) plans in a given tax year. If you change jobs mid-year, the limit does not reset. It’s crucial to inform your new 401(k) provider of any contributions you’ve already made to avoid over-contributing.

Consider these examples:

- A 39-year-old works for Company A from January to September, contributing $10,000 to their 401(k). From October to December, they work for Company B, which also offers a 401(k). They must inform Company B’s provider of the $10,000 contribution to avoid exceeding the $23,500 limit.

- A 53-year-old has two full-time jobs and a part-time seasonal role, each offering a 401(k). If they plan to contribute $23,500 to their primary 401(k)s, they can only contribute an additional $7,500 to the part-time employer’s plan (based on the catch-up contribution limit for those 50+ in 2025).

Do Rollovers Affect My Contribution Limit?

Rollovers from previous 401(k) plans generally don’t count toward your annual contribution limit, provided the original contributions were made in a prior tax year. However, if you’re rolling over funds that include contributions made within the current tax year, those contributions will count towards your limit.

For instance, contributions made to a 401(k) from April 2023 to December 31, 2023, will not count towards your 2024 limit, even if you roll those funds into a new 401(k) in 2024.

Consequences of Exceeding Contribution Limits

Contributing more than the IRS-allowed amount can lead to double taxation. The IRS imposes tax consequences when individuals exceed the limit. This often happens when individuals don’t inform their 401(k) provider about previous contributions in the same tax year.

Many providers monitor contributions and will notify you if you exceed the limit.

Maximizing Employer Matching

Employer matching is a significant benefit that can accelerate your retirement savings.

What Is an Employer Match?

An employer match is when your employer contributes to your 401(k) based on your contributions. This is essentially “free money” that boosts your retirement savings.

Employer matches come in different forms:

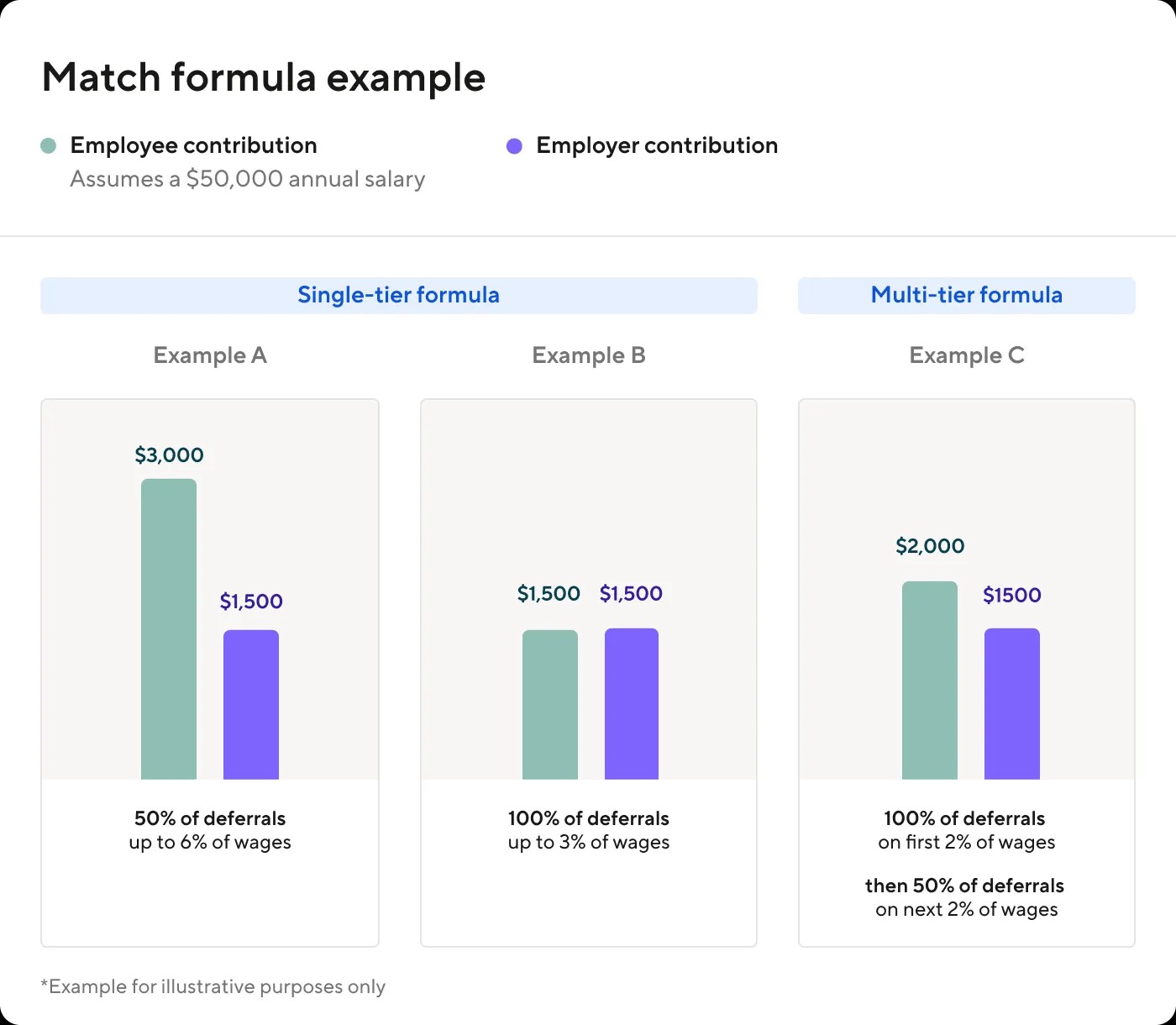

- Single-Tier Formula: The employer matches a percentage of your contributions up to a certain percentage of your income. For example, matching 50% of the first 6% of your contributions.

- Multi-Tier Formula: The employer’s match has different tiers with varying match rates. For example, matching 100% on the first 2% and 50% on the next 2%.

Match formula example

Match formula example

Why Meeting the Match Matters

Consider your employer’s contribution as part of your total compensation. Contributing enough to receive the full employer match is critical. Failing to do so means leaving money on the table. If your income is $50,000 and your employer matches 3% of your income, not contributing enough could cost you $1,500 per year.

Contributing Beyond the Match

You can contribute more than what’s required to receive the employer match. While you won’t receive any additional matching funds on these extra contributions, you’ll save more and take greater advantage of tax-advantaged growth.

Vesting Schedules

Vesting determines when you have full ownership of your employer’s matching contributions. There are three common types:

- Immediate Vesting: You own the employer’s match immediately.

- Cliff Vesting: You gain full ownership of the employer’s match after a specific period of time (e.g., two years).

- Graded Vesting: You gradually gain ownership of the employer’s match over time.

Even if your employer’s match hasn’t fully vested when you leave the company, your own contributions always belong to you.

Determining Your “Just Right” Contribution

There’s no one-size-fits-all answer to the question of how much should I contribute to 401k. Here are some questions to guide your decision:

1. Are You Meeting Your Match?

Prioritize contributing enough to receive the full employer match. This is a crucial first step.

2. Can You Contribute More Than Your Match?

If you’re comfortable, consider contributing more than the match. Maxing out your 401(k) contributions may not be feasible for everyone, but even small increases can significantly impact your long-term savings.

When determining how much more you can contribute, consider:

- Expenses: Calculate your average monthly expenses, including housing, utilities, food, debt payments, and entertainment.

- Goals: Consider retirement alongside other financial milestones, such as buying a home or funding education.

- Options: Explore other savings and investment options to diversify your portfolio.

Also, keep in mind factors such as:

- Overall risk tolerance

- Investment objectives

- Overall financial situation

- Outside investment and retirement accounts

- Prior investment experience

- Tax bracket

- Time horizon

3. Are You Maxing Out Your 401(k) Contributions?

If you’re already contributing the maximum amount ($23,500 in 2025, $31,000 if 50+, $34,750 if 60-63), and you have an employer match, avoid maxing out too early in the year. Doing so can prevent you from receiving the full employer match. Most 401(k) providers will alert you if your contribution rate will cause you to max out too early.

If you’re maxing out your 401(k) and want to save more for retirement, consider contributing to an IRA. In 2025, you can contribute an additional $7,000 to an IRA (or $8,000 if you are 50 or older).

Key Takeaways:

- Meet your match: Don’t leave free money on the table.

- Optimize your max: Avoid maxing out too early if you have an employer match.

- Don’t exceed the max: Be aware of the annual contribution limits.

- Strike the right balance: Consider your overall financial situation and adjust your contributions as needed. You can change your contribution amount at any time.

By carefully considering these factors, you can make informed decisions about how much should I contribute to 401k and work towards a secure financial future.