How Much Student Loan Debt Is There? Analyzing student debt statistics reveals the magnitude of educational borrowing and repayment trends and highlights the crucial need for expert financial advice. At HOW.EDU.VN, our team of experienced PhDs provides tailored guidance to help you navigate student loan management, offering strategies for debt consolidation, repayment plans, and financial planning for a secure future. Take charge of your financial future by exploring options for student loan management, minimizing the burden of student debt repayment, and optimizing your financial wellness.

1. Understanding the Landscape of Student Loan Debt

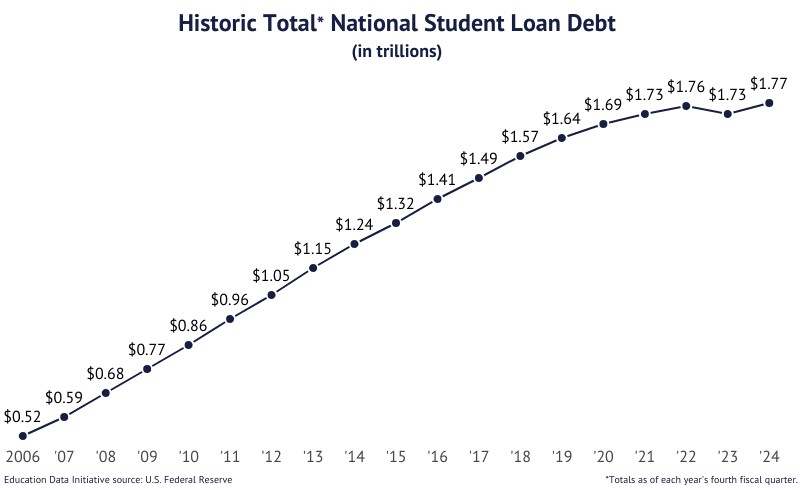

Student loan debt has become a significant financial challenge for millions of Americans. Understanding the magnitude of this debt is the first step towards finding effective solutions. The total student loan debt in the United States has reached a staggering $1.777 trillion. This figure represents a substantial burden on individuals and the economy as a whole. The trend indicates the persistent need for borrowing to finance higher education.

1.1. The Breakdown of Student Loan Debt

Breaking down the student loan debt reveals that federal student loans make up the majority. As of recent data, federal student loan debt accounts for $1.693 trillion. This colossal amount affects over 42.7 million student borrowers who are navigating the complexities of repayment. Understanding the nuances of federal loan programs is vital for borrowers seeking manageable repayment options.

1.2. Private vs. Federal Student Loan Debt

While federal loans dominate the student debt landscape, private student loans also play a significant role. Private student loans represent a notable portion, approximately 7.79% of the total student loan debt. This includes around $29.3 billion in refinance loans. Borrowers should be aware of the different terms and conditions associated with private loans compared to federal loans. Private loans often come with variable interest rates and fewer borrower protections.

1.3. The Average Student Loan Debt Balance

The average student loan debt balance provides a clearer picture of individual financial burdens. The average federal student loan debt balance is approximately $38,375. When private loan debt is included, the total average balance can climb as high as $41,618. These figures highlight the considerable financial strain on graduates as they start their careers. Financial planning is essential to manage this debt effectively.

2. Key Statistics and Trends in 2024

Analyzing the latest statistics and trends offers insights into the current state of student loan debt. These figures help borrowers, policymakers, and financial advisors understand the challenges and opportunities in managing student loans.

2.1. Default Rates on Student Loans

Default rates are a critical indicator of the health of student loan repayment. As of 2024’s fourth financial quarter, 4.86% of federal student loan dollars were in default. Private student loans had a default rate of 1.61% as of 2024 Q1. These rates underscore the need for strategies to help borrowers avoid default and maintain good financial standing. Expert advice is invaluable in navigating repayment options and avoiding default.

2.2. Borrowing for a Bachelor’s Degree

The cost of a bachelor’s degree often requires students to borrow significant amounts. The average public university student borrows around $31,960 to attain a bachelor’s degree. This debt can impact their financial decisions for years to come. Planning and budgeting are critical skills for managing this level of debt.

2.3. Recent Changes in Student Loan Debt

Examining recent changes in total student loan debt reveals important trends. Total student loan debt increased 2.77% year-over-year in Q4 of 2024. Federal student loan debt also saw an increase of 2.27%. Monitoring these changes can provide a better understanding of the economic factors influencing student debt.

3. Factors Influencing Student Loan Debt

Several factors contribute to the growing student loan debt crisis. These include rising tuition costs, changes in federal loan policies, and the increasing need for higher education in today’s job market.

3.1. The Rising Cost of Tuition

One of the primary drivers of student loan debt is the increasing cost of tuition. As tuition rates continue to rise, more students are forced to borrow larger amounts to finance their education. This trend necessitates exploring alternative funding options, such as scholarships, grants, and employer tuition assistance programs.

3.2. Federal Loan Policies and Their Impact

Federal loan policies can significantly impact the amount of student loan debt. Changes in interest rates, loan limits, and eligibility criteria can affect how much students borrow and how easily they can repay their loans. Staying informed about these policies is essential for effective financial planning.

3.3. The Value of Higher Education in the Job Market

Despite the cost, a higher education often remains a valuable asset in the job market. Many jobs require a bachelor’s degree or higher, making education a necessary investment. However, balancing the cost of education with potential career earnings is crucial for making informed financial decisions.

4. Student Loan Debt Relief and Forgiveness Programs

Various student loan debt relief and forgiveness programs aim to alleviate the burden of student loans. Understanding these programs can help eligible borrowers find pathways to reduce or eliminate their debt.

4.1. Federal Student Loan Forgiveness Programs

Federal student loan forgiveness programs offer opportunities for borrowers to have their loans forgiven after meeting specific criteria. Programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness provide debt relief for those working in eligible public service or teaching positions. Navigating these programs requires careful attention to eligibility requirements and application procedures.

4.2. Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more affordable by basing them on a borrower’s income and family size. These plans can significantly lower monthly payments and offer loan forgiveness after a set period, typically 20 to 25 years. Understanding the various IDR options and choosing the right one is crucial for effective debt management.

4.3. State-Sponsored Loan Forgiveness Programs

Some states offer their own loan forgiveness programs to attract professionals to specific fields or geographic areas. These programs can provide additional opportunities for debt relief beyond federal options. Researching state-specific programs is a valuable step for borrowers seeking to minimize their student loan burden.

5. The Impact of Student Loan Debt on Borrowers

Student loan debt can have a profound impact on borrowers’ financial lives, affecting their ability to save, invest, and achieve long-term financial goals.

5.1. Effects on Financial Decisions

High student loan debt can delay or prevent borrowers from making major financial decisions, such as buying a home, starting a family, or investing in retirement. The monthly loan payments can strain their budgets and limit their financial flexibility. Seeking strategies to manage and reduce debt is essential for regaining financial control.

5.2. Psychological and Emotional Toll

The burden of student loan debt can also take a psychological and emotional toll on borrowers. The constant pressure of repayment can lead to stress, anxiety, and feelings of hopelessness. Finding resources and support to cope with these challenges is crucial for maintaining mental and emotional well-being.

5.3. Long-Term Financial Health

The long-term financial health of borrowers can be significantly impacted by student loan debt. The interest that accrues over time can substantially increase the total amount repaid, making it harder to achieve financial security. Developing a comprehensive financial plan that includes debt management strategies is vital for building a strong financial future.

6. Navigating Student Loan Repayment

Effectively navigating student loan repayment requires understanding the available options and creating a personalized strategy that aligns with individual financial goals.

6.1. Understanding Your Repayment Options

Borrowers have several repayment options to choose from, including standard, graduated, extended, and income-driven plans. Each plan has its own advantages and disadvantages, depending on a borrower’s income, debt level, and financial priorities. Comparing and understanding these options is the first step toward successful repayment.

6.2. Creating a Budget and Financial Plan

Creating a budget and financial plan is essential for managing student loan debt effectively. This involves tracking income and expenses, setting financial goals, and allocating funds for loan payments, savings, and investments. A well-structured budget can provide clarity and control over one’s financial situation.

6.3. Strategies for Accelerating Repayment

Accelerating student loan repayment can save borrowers money on interest and shorten the time it takes to become debt-free. Strategies such as making extra payments, refinancing to a lower interest rate, and using windfalls to pay down debt can significantly speed up the repayment process. Expert guidance can help identify the most effective strategies for individual circumstances.

7. The Role of Financial Advisors in Managing Student Loan Debt

Financial advisors play a crucial role in helping borrowers navigate the complexities of student loan debt and develop personalized strategies for managing it.

7.1. Personalized Financial Advice

Financial advisors provide personalized advice tailored to each borrower’s unique financial situation and goals. They can assess their income, debt level, and risk tolerance to recommend the most suitable repayment options and strategies. This personalized approach can significantly improve the chances of successful debt management.

7.2. Assessing Repayment Options

Financial advisors can help borrowers evaluate the various repayment options available to them, including federal and private loan plans, income-driven repayment, and loan forgiveness programs. They can analyze the pros and cons of each option and help borrowers choose the one that best fits their needs.

7.3. Developing Long-Term Financial Strategies

Beyond managing student loan debt, financial advisors can help borrowers develop long-term financial strategies that include savings, investments, and retirement planning. By integrating debt management into a comprehensive financial plan, borrowers can achieve their financial goals and secure their future.

8. Expert Insights from HOW.EDU.VN’s Team of PhDs

At HOW.EDU.VN, our team of experienced PhDs is dedicated to providing expert insights and guidance on managing student loan debt. We understand the complexities of student loans and offer tailored solutions to help you achieve financial freedom.

8.1. Comprehensive Financial Assessments

Our team conducts comprehensive financial assessments to understand your unique financial situation. We analyze your income, expenses, assets, and debts to develop a clear picture of your financial health. This assessment forms the foundation for our personalized recommendations.

8.2. Tailored Solutions for Debt Management

Based on our assessment, we provide tailored solutions for managing your student loan debt. We help you explore repayment options, evaluate loan forgiveness programs, and develop strategies for accelerating repayment. Our goal is to empower you to take control of your debt and achieve your financial goals.

8.3. Ongoing Support and Guidance

We offer ongoing support and guidance to help you stay on track with your debt management plan. Our team is available to answer your questions, provide updates on policy changes, and adjust your strategy as needed. We are committed to your long-term financial success.

9. Strategies for Minimizing Future Student Loan Debt

While managing existing student loan debt is crucial, it’s equally important to minimize future borrowing. Implementing proactive strategies can help students and families reduce the need for loans and make higher education more affordable.

9.1. Exploring Scholarship and Grant Opportunities

Scholarships and grants are a valuable source of free money for college. Students should research and apply for as many scholarships and grants as possible to reduce their reliance on loans. Websites like the College Board and Fastweb offer extensive databases of scholarship opportunities.

9.2. Considering Community College Options

Starting at a community college can be a cost-effective way to earn college credits before transferring to a four-year university. Community colleges typically have lower tuition rates than four-year institutions, allowing students to save money on their first two years of education.

9.3. Saving Early for College Expenses

Starting to save for college early can significantly reduce the amount of debt needed to finance higher education. Investing in a 529 plan or other college savings account can help families accumulate funds over time. The earlier you start saving, the more time your money has to grow.

10. Student Loan Debt and the Economy

The vast amount of student loan debt in the United States has broader implications for the economy, affecting consumer spending, housing markets, and economic growth.

10.1. Impact on Consumer Spending

High student loan debt can limit borrowers’ ability to spend money on other goods and services, impacting consumer spending and economic activity. As a significant portion of their income goes towards loan payments, they have less to spend on housing, transportation, and entertainment.

10.2. Effects on Housing Markets

Student loan debt can also affect housing markets by delaying or preventing borrowers from buying homes. The added financial burden can make it difficult to save for a down payment and qualify for a mortgage. This can slow down the growth of the housing market and limit homeownership opportunities.

10.3. Implications for Economic Growth

The overall economic growth can be affected by student loan debt. When a large segment of the population is burdened with debt, it can hinder innovation, entrepreneurship, and investment. Addressing the student loan crisis is essential for fostering a healthy and vibrant economy.

11. Common Misconceptions About Student Loan Debt

Several misconceptions surround student loan debt, which can lead to confusion and poor decision-making. Clarifying these misconceptions is essential for borrowers to make informed choices about their education and finances.

11.1. Myth: Student Loan Debt Is Always Bad

While student loan debt can be a burden, it’s not always a negative thing. It can be a necessary investment in education, which can lead to higher earning potential and career opportunities. The key is to manage the debt responsibly and ensure that the investment pays off in the long run.

11.2. Myth: All Loan Forgiveness Programs Are the Same

Loan forgiveness programs vary widely in their eligibility requirements, terms, and conditions. Some programs offer forgiveness after a set period of employment in a specific field, while others are based on income and family size. Understanding the differences between these programs is crucial for choosing the right one.

11.3. Myth: Refinancing Always Saves Money

Refinancing student loans can potentially save money by lowering the interest rate, but it’s not always the best option. Refinancing federal loans into private loans can result in the loss of valuable borrower protections and repayment options. Carefully weighing the pros and cons is essential before making a decision.

12. The Future of Student Loan Debt

The future of student loan debt remains uncertain, with ongoing debates about loan forgiveness, policy changes, and the rising cost of education. Staying informed about these developments is essential for borrowers and policymakers alike.

12.1. Potential Policy Changes

Potential policy changes, such as broader loan forgiveness initiatives and reforms to repayment programs, could significantly impact the student loan landscape. Monitoring these changes and understanding their implications is crucial for making informed financial decisions.

12.2. The Evolving Cost of Education

The evolving cost of education will continue to shape the future of student loan debt. Efforts to control tuition rates, increase funding for scholarships and grants, and promote alternative education pathways will be essential for making higher education more accessible and affordable.

12.3. Preparing for the Unknown

Preparing for the unknown involves staying flexible, adaptable, and informed. Developing a solid financial plan, seeking expert advice, and continuously evaluating repayment options can help borrowers navigate the challenges and opportunities ahead.

13. How HOW.EDU.VN Can Help You

At HOW.EDU.VN, we understand the complexities of student loan debt and are committed to helping you navigate the process with confidence. Our team of PhDs offers expert guidance, personalized solutions, and ongoing support to help you achieve financial freedom.

13.1. Expert Financial Guidance

Our team provides expert financial guidance tailored to your unique situation. We analyze your financial health, assess your repayment options, and develop a personalized plan to manage your student loan debt effectively.

13.2. Personalized Solutions

We offer personalized solutions designed to help you achieve your financial goals. Whether you’re looking to explore loan forgiveness programs, refinance your loans, or accelerate your repayment, we can help you find the strategies that work best for you.

13.3. Ongoing Support

We provide ongoing support to help you stay on track with your debt management plan. Our team is available to answer your questions, provide updates on policy changes, and adjust your strategy as needed.

14. FAQs About Student Loan Debt

Understanding the nuances of student loan debt can be challenging. Here are some frequently asked questions to help clarify common concerns.

14.1. What is the current total student loan debt in the U.S.?

As of recent data, the total student loan debt in the United States is approximately $1.777 trillion.

14.2. What is the average student loan debt balance?

The average federal student loan debt balance is about $38,375, while the total average balance, including private loans, can reach $41,618.

14.3. What are the options for student loan repayment?

Options include standard, graduated, extended, and income-driven repayment plans.

14.4. What are income-driven repayment plans?

Income-driven repayment plans base your monthly loan payments on your income and family size, potentially lowering your payments.

14.5. What is Public Service Loan Forgiveness (PSLF)?

PSLF is a program that forgives the remaining balance on your federal student loans after you’ve made 120 qualifying payments while working full-time for a qualifying employer.

14.6. How can I lower my student loan interest rate?

You can lower your interest rate by refinancing your student loans, but be cautious about refinancing federal loans into private loans.

14.7. What is the difference between federal and private student loans?

Federal student loans are issued by the government and offer more flexible repayment options, while private student loans are issued by private lenders and typically have less flexible terms.

14.8. How can I avoid student loan default?

To avoid default, stay in communication with your loan servicer, explore income-driven repayment plans, and consider deferment or forbearance if you’re facing temporary financial hardship.

14.9. Can student loans be discharged in bankruptcy?

It is difficult but possible to discharge student loans in bankruptcy, requiring you to prove “undue hardship.”

14.10. Where can I find reliable information about student loan debt?

Reliable sources include the U.S. Department of Education, the Consumer Financial Protection Bureau, and reputable financial advisory services like HOW.EDU.VN.

15. Take Control of Your Financial Future with HOW.EDU.VN

Don’t let student loan debt hold you back from achieving your financial goals. Contact HOW.EDU.VN today to connect with our team of experienced PhDs and start developing a personalized strategy for managing your student loans.

At HOW.EDU.VN, we understand the challenges you face and are committed to providing the expert guidance and support you need to achieve financial freedom. Our comprehensive financial assessments, tailored solutions, and ongoing support will empower you to take control of your debt and build a secure financial future.

Contact us today:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Take the first step towards financial freedom. Contact how.edu.vn and let our team of PhDs help you navigate the complexities of student loan debt and achieve your financial goals. Get expert financial advice and personalized support to manage your debt effectively. Minimize the burden of student debt repayment and optimize your financial wellness with our tailored solutions. We eagerly await to embark on this transformative journey with you, guiding you towards a brighter, more secure financial tomorrow.