Silver half dollars value is determined by silver spot prices and coin’s condition. At HOW.EDU.VN, we provide the most up-to-date information to help you understand the worth of these coins. By understanding the factors that influence their value, you can accurately assess your collection or make informed investment decisions. Let’s explore silver melt values, collector value, and market trends.

1. Understanding the Intrinsic Value of Silver Half Dollars

What determines the intrinsic worth of silver half dollars?

The intrinsic value of silver half dollars is primarily determined by their silver content and the current spot price of silver. This is often referred to as the melt value, representing the raw worth of the silver if the coin were melted down. However, it’s essential to consider that the actual market value can be higher due to factors like the coin’s condition, rarity, and historical significance.

1.1. Key Factors Influencing Melt Value

Several elements affect the melt value of silver half dollars:

- Silver Content: The percentage of silver in the coin directly impacts its intrinsic value. For instance, pre-1965 half dollars contain 90% silver, while those from 1965-1970 have 40% silver.

- Spot Price of Silver: This is the current market price of silver per ounce. As the spot price fluctuates, so does the melt value of the coin. According to recent data, the spot price of silver is around $33.13 per ounce as of May 6, 2025.

- Weight of the Coin: The total weight of the coin, measured in grams or ounces, is a critical factor. The actual silver weight (ASW) is the precise amount of silver contained in the coin.

1.2. Calculating Melt Value: A Step-by-Step Guide

To accurately calculate the melt value, follow these steps:

- Determine Silver Content: Identify the silver percentage. For example, a 90% silver coin has 0.90 silver content.

- Find the Coin’s Weight: Obtain the coin’s weight in troy ounces. A standard 90% silver half dollar weighs approximately 0.36169 troy ounces.

- Multiply Weight by Silver Content: Multiply the coin’s weight by its silver content to find the ASW.

0. 36169 ounces * 0.90 = 0.325521 ounces - Multiply ASW by Spot Price: Multiply the ASW by the current spot price of silver to get the melt value.

0. 325521 ounces * $33.13 = $10.78

Therefore, the melt value of a 90% silver half dollar, given a silver spot price of $33.13 per ounce, is approximately $10.78.

1.3. Examples of Melt Values for Different Silver Half Dollars

Here are examples of melt values for common U.S. silver half dollars, based on the current silver spot price:

| Coin Type | Silver Content | Weight (oz) | ASW (oz) | Melt Value |

|---|---|---|---|---|

| Barber Half Dollar (1892-1915) | 90% | 0.4019 | 0.36169 | $11.98 |

| Walking Liberty Half Dollar (1916-1947) | 90% | 0.4019 | 0.36169 | $11.98 |

| Franklin Half Dollar (1948-1963) | 90% | 0.4019 | 0.36169 | $11.98 |

| Kennedy Half Dollar (1964) | 90% | 0.4019 | 0.36169 | $11.98 |

| Kennedy Half Dollar (1965-1970) | 40% | 0.3692 | 0.1479 | $4.90 |

Note: Melt values are approximate and subject to change based on the current spot price of silver.

Understanding these calculations and factors can help you accurately assess the baseline value of your silver half dollars. For more precise evaluations and expert insights, consider consulting with the experts at HOW.EDU.VN.

2. Historical Significance and Collector’s Value

Why do collectors value certain silver half dollars more than others?

Beyond their melt value, silver half dollars hold significant historical and collector’s value. Factors such as rarity, condition, mint marks, and historical context can substantially increase a coin’s worth. Coins in excellent condition or those with unique historical backgrounds often command higher prices among collectors.

2.1. Key Historical Half Dollars and Their Stories

Certain half dollars are particularly prized due to their historical importance:

- Walking Liberty Half Dollar (1916-1947): Designed by Adolph A. Weinman, this coin is celebrated for its artistic beauty and patriotic imagery, symbolizing liberty and progress. Its historical significance during both World Wars makes it a favorite among collectors.

- Franklin Half Dollar (1948-1963): Featuring Benjamin Franklin, this coin is valued for its association with one of America’s founding fathers. It’s also notable for being replaced by the Kennedy Half Dollar shortly after President Kennedy’s assassination.

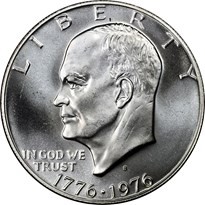

- Kennedy Half Dollar (1964): Minted shortly after President Kennedy’s death, the 1964 Kennedy Half Dollar holds a special place in American history. Its initial release saw a surge in demand as people sought to commemorate the late president.

2.2. Understanding Rarity and Mint Marks

Rarity and mint marks play a crucial role in determining a coin’s collector’s value:

- Rarity: Limited mintage numbers make a coin rarer and more valuable. Coins with low survival rates or those minted in specific years with lower production runs are highly sought after.

- Mint Marks: These indicate where a coin was produced. For example, “D” represents Denver, “S” represents San Francisco, and no mark usually signifies Philadelphia. Certain mint marks combined with specific years can significantly increase a coin’s value due to rarity.

2.3. Grading and Condition: How It Impacts Value

The condition of a coin, as determined by professional grading services, significantly influences its value:

- Uncirculated (MS-60 to MS-70): These coins show no signs of wear and retain their original luster. Higher grades (MS-65 to MS-70) are particularly valuable due to their pristine condition.

- About Uncirculated (AU-50 to AU-58): These coins have slight traces of wear on high points but still retain much of their original detail.

- Extremely Fine (EF-40 to EF-45): These coins exhibit light to moderate wear with clear details.

- Very Fine (VF-20 to VF-35): These coins show moderate wear but still have well-defined features.

- Fine (F-12 to F-15): These coins have considerable wear, but major design elements are still visible.

- Good (G-4 to G-6): Heavily worn coins with significant detail loss.

2.4. Key Dates and Varieties to Look For

Certain dates and varieties are especially valuable due to their rarity or unique characteristics:

- 1921 Walking Liberty Half Dollar: This year had a low mintage, making it a key date for collectors.

- 1938-D Walking Liberty Half Dollar: Another key date with a relatively low mintage from the Denver Mint.

- 1946-S Walking Liberty Half Dollar: The final year of the Walking Liberty series from the San Francisco Mint is also a valuable find.

- 1964 Special Mint Set (SMS) Kennedy Half Dollar: While not officially released to the public, some examples have surfaced, commanding high prices.

Understanding these historical aspects and grading factors can significantly enhance your ability to evaluate silver half dollars. For expert appraisals and detailed insights, consider reaching out to the experienced numismatists at HOW.EDU.VN.

3. Market Trends and Investment Potential

What are the current market trends for silver half dollars, and how can they inform investment decisions?

The market for silver half dollars is influenced by various factors, including silver prices, economic conditions, and collector demand. Understanding these trends is essential for both collectors and investors looking to maximize their returns.

3.1. Current Market Overview

The market for silver coins has seen considerable activity in recent years, driven by:

- Increased Investor Interest: As precious metals often act as a safe haven during economic uncertainty, silver has attracted significant investment.

- Growing Collector Demand: The appeal of historical coins and the desire to own tangible assets have boosted the demand for silver half dollars among collectors.

- Fluctuations in Silver Prices: The spot price of silver can significantly impact the market, affecting both melt values and collector interest.

3.2. Factors Affecting Silver Coin Values

Several factors can impact the value of silver coins:

- Economic Conditions: During economic downturns, investors often turn to precious metals, increasing demand and prices.

- Inflation Rates: Silver is often seen as a hedge against inflation, so rising inflation rates can increase its value.

- Interest Rates: Lower interest rates can make precious metals more attractive, as they offer a competitive alternative to bonds and other fixed-income investments.

- Geopolitical Stability: Political instability can drive investors towards safe-haven assets like silver.

3.3. Strategies for Investing in Silver Half Dollars

Consider these strategies when investing in silver half dollars:

- Diversify Your Portfolio: Allocate a portion of your investment portfolio to precious metals, including silver, to hedge against market volatility.

- Focus on Key Dates and Varieties: Invest in rare and key date coins that have the potential for significant appreciation.

- Buy Graded Coins: Purchase coins graded by reputable services like NGC (Numismatic Guaranty Corporation) or PCGS (Professional Coin Grading Service) to ensure authenticity and condition.

- Monitor Market Trends: Stay informed about the latest market trends and silver prices to make timely investment decisions.

- Consider Long-Term Potential: Silver coins can be a solid long-term investment, providing both intrinsic value and potential collector appreciation.

3.4. Risks and Considerations

Investing in silver half dollars also involves risks:

- Market Volatility: Silver prices can be volatile and subject to sharp fluctuations.

- Storage Costs: Storing physical silver requires secure storage, which can incur costs.

- Liquidity: Selling silver coins may take time, especially for rare or high-value items.

- Counterfeiting: Be aware of counterfeit coins and always buy from reputable dealers or grading services.

Staying informed and consulting with experts can help you navigate the silver coin market effectively. At HOW.EDU.VN, our team of numismatists and financial advisors can provide personalized guidance tailored to your investment goals.

4. Identifying Genuine Silver Half Dollars

How can you ensure that your silver half dollars are genuine and not counterfeit?

Ensuring the authenticity of silver half dollars is crucial to protect your investment. Counterfeit coins can significantly diminish the value of your collection, making it essential to know how to identify genuine pieces.

4.1. Key Indicators of Authenticity

Here are several indicators to help you determine if a silver half dollar is genuine:

- Weight and Dimensions: Genuine silver half dollars have specific weight and diameter measurements. Check these against standard specifications.

- Mint Marks and Dates: Verify the mint mark and date against known authentic combinations. Unusual or non-existent mint marks can be a red flag.

- Edge Lettering: Some silver half dollars have edge lettering or reeding. Check for correct patterns and spacing.

- Design Details: Closely examine the design details, including the sharpness of the images and the accuracy of the lettering.

- Sound Test: Genuine silver coins produce a distinct ringing sound when dropped on a hard surface. Counterfeit coins often sound dull.

4.2. Common Counterfeiting Techniques

Understanding common counterfeiting techniques can help you spot fakes:

- Base Metal Forgeries: These coins are made from non-precious metals and plated with silver. They often lack the correct weight and sound.

- Cast Copies: These are created using molds and often have a grainy surface and poor detail.

- Altered Dates: Counterfeiters may alter the date of a common coin to make it appear like a rare or key date.

4.3. Tools and Resources for Authentication

Utilize these tools and resources for verifying the authenticity of your coins:

- Digital Scales: Use a precise digital scale to verify the coin’s weight.

- Calipers: Calipers can accurately measure the diameter and thickness of the coin.

- Magnifying Glass or Loupe: A magnifying glass or loupe helps examine fine details and detect imperfections.

- Coin Reference Books: Consult reputable coin reference books for information on authentic coin specifications and varieties.

4.4. When to Seek Professional Appraisal

If you are unsure about the authenticity of a coin, seek professional appraisal from a reputable numismatist or grading service.

- Numismatists: Experienced coin dealers and appraisers can provide expert opinions on authenticity and value.

- Grading Services: NGC and PCGS are leading grading services that authenticate, grade, and encapsulate coins.

By staying vigilant and using the right tools, you can protect yourself from counterfeit coins and ensure the value of your silver half dollar collection. For professional authentication services and expert guidance, contact the team at HOW.EDU.VN.

5. Maintenance and Storage Tips for Silver Half Dollars

How should you properly maintain and store your silver half dollars to preserve their value?

Proper maintenance and storage are crucial for preserving the value and condition of your silver half dollars. By following best practices, you can prevent damage and maintain their aesthetic appeal for years to come.

5.1. Best Practices for Handling Silver Coins

Follow these guidelines when handling silver coins:

- Wash Your Hands: Always wash your hands thoroughly before handling coins to remove oils and dirt.

- Handle by the Edges: Hold coins by the edges to avoid touching the surfaces, which can cause fingerprints and damage.

- Use Cotton Gloves: Consider wearing cotton gloves to further protect coins from oils and contaminants.

- Work on a Clean Surface: Handle coins on a clean, soft surface to prevent scratches and damage.

5.2. Cleaning Silver Coins: What to Do and Avoid

Cleaning silver coins requires caution. Here’s what to do and what to avoid:

- Avoid Abrasive Cleaners: Never use abrasive cleaners, polishes, or cloths, as they can scratch the surface and reduce the coin’s value.

- Gentle Washing: If necessary, gently wash coins with mild soap and distilled water. Rinse thoroughly and pat dry with a soft cloth.

- Professional Cleaning: For valuable or delicate coins, consider professional cleaning by a numismatist.

5.3. Ideal Storage Conditions

Proper storage conditions are essential for preserving silver coins:

- Temperature and Humidity: Store coins in a cool, dry place with stable temperature and humidity.

- Acid-Free Materials: Use acid-free coin holders, albums, and storage boxes to prevent corrosion and toning.

- Individual Holders: Store coins in individual holders or capsules to protect them from scratches and contact with other coins.

5.4. Storage Options: Coin Holders, Albums, and Safes

Consider these storage options for your silver half dollars:

- Coin Holders: Individual coin holders or capsules provide excellent protection and allow for easy viewing.

- Coin Albums: Coin albums offer organized storage and protection for larger collections.

- Coin Storage Boxes: Acid-free coin storage boxes provide secure storage for multiple coins and albums.

- Safes: For valuable collections, consider storing coins in a secure safe to protect them from theft and environmental damage.

5.5. Preventing Tarnish and Corrosion

Silver coins are prone to tarnish and corrosion. Here’s how to prevent it:

- Air-Tight Storage: Store coins in air-tight holders or capsules to minimize exposure to air and moisture.

- Desiccants: Use desiccants in storage containers to absorb moisture and prevent corrosion.

- Regular Inspection: Periodically inspect your coins for signs of tarnish or corrosion and take appropriate action.

By following these maintenance and storage tips, you can ensure that your silver half dollars remain in excellent condition and retain their value for generations to come. For more detailed advice and personalized storage solutions, consult with the experts at HOW.EDU.VN.

6. The Impact of Silver Purity on Coin Value

How does the purity of silver in a half dollar affect its overall value and desirability?

The purity of silver in a half dollar significantly impacts its value, influencing both its intrinsic worth and its appeal to collectors and investors. Understanding the relationship between silver purity and coin value is essential for making informed decisions in the coin market.

6.1. Different Silver Purities in Half Dollars

U.S. half dollars have been minted with varying degrees of silver purity throughout history:

- 90% Silver (Pre-1965): Half dollars minted before 1965 are composed of 90% silver and 10% copper. These coins are highly valued for their substantial silver content and historical significance.

- 40% Silver (1965-1970): From 1965 to 1970, half dollars were made with a 40% silver clad composition. While still containing silver, their lower purity affects their melt value compared to pre-1965 coins.

- No Silver (Post-1970): After 1970, regular issue half dollars were made from copper-nickel clad, containing no silver. These coins have minimal intrinsic value.

6.2. How Silver Purity Affects Melt Value

The melt value of a silver half dollar is directly proportional to its silver purity:

- Higher Purity, Higher Value: Coins with higher silver content have a greater melt value because they contain more precious metal.

- Calculating Melt Value Based on Purity: The melt value is calculated by multiplying the coin’s weight, silver purity, and the current spot price of silver.

6.3. Collector Preference for High-Purity Coins

Collectors often prefer high-purity silver coins for several reasons:

- Historical Significance: Pre-1965 90% silver coins are considered more historically significant due to their role in the U.S. monetary system.

- Investment Value: High-purity silver coins are viewed as a more reliable store of value, especially during economic uncertainty.

- Aesthetic Appeal: Many collectors appreciate the luster and appearance of high-purity silver coins.

6.4. The Role of Silver Purity in Coin Grading

Silver purity can indirectly affect a coin’s grade and overall value:

- Tarnish Resistance: Higher purity silver coins may be more resistant to tarnish and corrosion, helping them maintain their condition and grade.

- Surface Quality: The quality of the silver can influence the coin’s surface appearance, affecting its grade and desirability.

6.5. Market Demand for Different Purity Levels

Market demand varies for silver half dollars with different purity levels:

- High Demand for 90% Silver Coins: Pre-1965 90% silver half dollars are consistently in high demand among collectors and investors.

- Moderate Demand for 40% Silver Coins: The 1965-1970 40% silver half dollars have moderate demand, primarily driven by their silver content and historical context.

- Low Demand for Non-Silver Coins: Post-1970 non-silver half dollars have limited collector or investment appeal, mainly valued at face value.

Understanding the impact of silver purity on coin value can help you make informed decisions when buying, selling, or collecting silver half dollars. For expert advice and detailed evaluations, consult with the knowledgeable team at HOW.EDU.VN.

7. Key Dates and Varieties of Silver Half Dollars

What are the key dates and varieties of silver half dollars that collectors should be aware of?

Identifying key dates and varieties of silver half dollars is crucial for collectors seeking to maximize the value of their collections. Certain years and mint marks are much rarer and more valuable than others, making them highly sought after by numismatists.

7.1. Walking Liberty Half Dollar (1916-1947)

The Walking Liberty Half Dollar series includes several key dates and varieties:

- 1916-D: This is one of the rarest and most valuable coins in the series due to its low mintage at the Denver Mint.

- 1919-D: Another key date with a relatively low mintage, making it a prized addition to any collection.

- 1921: This year had a significantly lower mintage compared to other years, increasing its value.

- 1938-D: The 1938-D is a key date due to a combination of lower mintage and high demand.

7.2. Franklin Half Dollar (1948-1963)

The Franklin Half Dollar series has a few notable varieties:

- 1949-S: The 1949-S is considered a semi-key date, with a lower mintage than other years in the series.

- 1955 “Bugs Bunny” Variety: This variety features a die clash that creates an image resembling Bugs Bunny’s teeth near Franklin’s mouth, adding to its collector appeal.

7.3. Kennedy Half Dollar (1964-1970)

The Kennedy Half Dollar series includes a few significant issues:

- 1964: The 1964 Kennedy Half Dollar, minted in 90% silver, is highly sought after as a memorial to President Kennedy.

- 1964-D: While less valuable than the 1964, the 1964-D from the Denver Mint is also a popular collectible.

- 1965-1970 (40% Silver): These coins, while containing 40% silver, are collected more for their historical context than their silver content.

7.4. Factors Contributing to Rarity

Several factors contribute to the rarity and value of these key dates and varieties:

- Low Mintage: Years with lower production numbers are generally rarer and more valuable.

- Wear and Survival Rates: Coins that saw heavy circulation or were melted down have lower survival rates, increasing their rarity.

- Mint Errors: Coins with mint errors or varieties are highly prized by collectors.

7.5. Resources for Identifying Key Dates and Varieties

Utilize these resources to identify key dates and varieties:

- Coin Guides: Reputable coin guides provide detailed information on mintage figures, varieties, and values.

- Numismatic Organizations: Organizations like the American Numismatic Association (ANA) offer resources and education for collectors.

- Online Forums: Online coin collecting forums can provide valuable insights and information from experienced collectors.

By understanding these key dates and varieties, collectors can make informed decisions and enhance their silver half dollar collections. For expert appraisal and guidance, reach out to the team at HOW.EDU.VN.

8. Grading Services and Their Role in Determining Value

How do professional grading services like NGC and PCGS influence the value of silver half dollars?

Professional grading services such as Numismatic Guaranty Corporation (NGC) and Professional Coin Grading Service (PCGS) play a pivotal role in determining the value of silver half dollars. These services provide expert authentication, grading, and encapsulation, giving collectors and investors confidence in their purchases.

8.1. Overview of NGC and PCGS

NGC and PCGS are the leading third-party grading services in the numismatic industry:

- NGC (Numismatic Guaranty Corporation): NGC is known for its accurate grading and secure encapsulation, providing a trusted assessment of a coin’s condition and authenticity.

- PCGS (Professional Coin Grading Service): PCGS is another highly respected grading service, recognized for its stringent grading standards and market influence.

8.2. The Grading Process

The grading process involves several steps:

- Submission: Coins are submitted to NGC or PCGS along with a submission form and payment.

- Authentication: Experts examine the coin to verify its authenticity and identify any alterations or counterfeiting.

- Grading: The coin is evaluated based on its condition, using a standardized grading scale ranging from Poor (PO-01) to Perfect Uncirculated (MS-70).

- Encapsulation: Once graded, the coin is sealed in a tamper-evident holder to protect it from environmental damage and handling.

8.3. Impact of Grading on Coin Value

Grading significantly impacts a coin’s value:

- Increased Confidence: A graded coin provides buyers with confidence in its authenticity and condition, reducing the risk of fraud.

- Higher Market Value: Graded coins, especially those in high grades, typically command higher prices than ungraded coins.

- Liquidity: Graded coins are easier to sell, as they are readily accepted by collectors and dealers.

8.4. Understanding the Grading Scale

The Sheldon scale, used by NGC and PCGS, is a numerical grading system:

- Poor (PO-01): Heavily worn with major details missing.

- Good (G-04 and G-06): Significant wear, but major design elements are visible.

- Very Good (VG-08 and VG-10): Moderate wear, but some details remain.

- Fine (F-12 and F-15): Moderate wear with clear details.

- Very Fine (VF-20, VF-25, VF-30, VF-35): Moderate wear but with well-defined features.

- Extremely Fine (EF-40 and EF-45): Light to moderate wear with sharp details.

- About Uncirculated (AU-50, AU-53, AU-55, AU-58): Slight traces of wear on high points, but retains much of its original detail.

- Mint State (MS-60 to MS-70): Uncirculated with no signs of wear. MS-70 is a perfect coin with no imperfections.

8.5. Choosing Between NGC and PCGS

Both NGC and PCGS are reputable grading services, and the choice often depends on personal preference:

- Market Acceptance: Both NGC and PCGS graded coins are widely accepted in the numismatic market.

- Grading Standards: While both services use the Sheldon scale, some collectors believe one service is more stringent than the other.

- Holder Design: The design of the encapsulation holder may also influence collectors’ preferences.

By understanding the role of grading services and the grading process, collectors and investors can make informed decisions and enhance the value of their silver half dollar collections. For expert guidance on grading and coin valuation, contact the specialists at HOW.EDU.VN.

9. Economic Factors and Silver Half Dollar Value

How do broader economic conditions influence the value of silver half dollars, both in terms of melt value and collector demand?

Broader economic conditions play a significant role in influencing the value of silver half dollars. These conditions can affect both the melt value, driven by the spot price of silver, and the collector demand, influenced by economic stability and investor sentiment.

9.1. Silver as a Safe-Haven Asset

Silver is often considered a safe-haven asset, especially during times of economic uncertainty:

- Economic Downturns: During economic recessions or market crashes, investors often flock to precious metals like silver, driving up demand and prices.

- Inflation Hedge: Silver is also seen as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines.

- Geopolitical Instability: Political instability and global crises can also increase demand for silver as investors seek safe and reliable stores of value.

9.2. Impact of Inflation and Interest Rates

Inflation and interest rates have a direct impact on silver prices and, consequently, on the value of silver half dollars:

- Inflation: Rising inflation rates can increase the demand for silver as investors seek to preserve their wealth.

- Interest Rates: Lower interest rates make precious metals more attractive, as they offer a competitive alternative to bonds and other fixed-income investments.

- Real Interest Rates: The real interest rate (nominal interest rate minus inflation) is a key factor. Negative real interest rates can be particularly bullish for silver.

9.3. Currency Fluctuations and Silver Value

Currency fluctuations can also affect the value of silver:

- Dollar Strength: A weaker U.S. dollar can make silver more attractive to international investors, increasing demand and prices.

- Exchange Rates: Fluctuations in exchange rates can impact the affordability of silver in different countries, influencing global demand.

9.4. Industrial Demand for Silver

In addition to its role as a store of value, silver has significant industrial applications:

- Electronics: Silver is used in numerous electronic components due to its high conductivity.

- Solar Panels: Silver is a key component in solar panels, and growing demand for renewable energy is driving increased industrial demand for silver.

- Medical Applications: Silver has antimicrobial properties and is used in medical devices and treatments.

9.5. Collector Market Dynamics

Economic conditions also influence the collector market for silver half dollars:

- Disposable Income: During economic prosperity, collectors may have more disposable income to invest in rare and valuable coins.

- Investor Sentiment: Positive investor sentiment can increase confidence in the coin market, driving up demand and prices for collectible coins.

- Market Speculation: Speculative buying can also influence coin values, especially for key dates and varieties.

Understanding these economic factors can help collectors and investors make informed decisions about buying, selling, and holding silver half dollars. For expert analysis and personalized investment strategies, consult with the team at HOW.EDU.VN.

10. Selling Silver Half Dollars: Best Practices and Options

What are the best practices and options for selling silver half dollars to maximize your returns?

Selling silver half dollars requires careful consideration to ensure you receive fair value and maximize your returns. Understanding the various selling options and implementing best practices can help you navigate the market effectively.

10.1. Determining the Value of Your Coins

Before selling, it’s crucial to determine the value of your coins:

- Melt Value: Calculate the melt value based on the silver content and current spot price of silver.

- Collector Value: Research the collector value of your coins, considering factors such as rarity, condition, and key dates.

- Professional Appraisal: Consider obtaining a professional appraisal from a reputable numismatist to accurately assess the value of your collection.

10.2. Selling Options

Several options are available for selling silver half dollars:

- Local Coin Dealers: Local coin dealers can provide quick evaluations and cash offers, but their prices may be lower than other options.

- Online Coin Dealers: Online coin dealers offer competitive prices and broader market access, but you’ll need to ship your coins and wait for payment.

- Auction Sites: Auction sites like eBay can provide access to a large pool of buyers, but you’ll need to manage the listing, shipping, and payment process.

- Coin Shows: Coin shows offer the opportunity to sell directly to collectors and dealers, but they require travel and booth fees.

- Pawn Shops: Pawn shops may offer quick cash, but their prices are typically much lower than other options.

10.3. Best Practices for Selling

Follow these best practices to maximize your returns:

- Clean and Organize Your Coins: Clean your coins gently (if necessary) and organize them by type, date, and condition.

- Take High-Quality Photos: If selling online, take clear, high-quality photos of your coins to showcase their details and condition.

- Write Accurate Descriptions: Provide accurate and detailed descriptions of your coins, including their condition, key dates, and any notable features.

- Set Competitive Prices: Research current market prices and set competitive prices to attract buyers.

- Offer Secure Shipping: Use secure shipping methods with tracking and insurance to protect your coins during transit.

10.4. Negotiating Tips

Negotiation is often part of the selling process:

- Know Your Bottom Line: Determine the minimum price you’re willing to accept before entering negotiations.

- Be Prepared to Walk Away: Don’t be afraid to walk away if you’re not offered a fair price.

- Highlight the Coin’s Value: Emphasize the coin’s unique features, rarity, and potential appreciation.

- Be Polite and Professional: Maintain a polite and professional demeanor throughout the negotiation process.

10.5. Tax Implications

Be aware of the tax implications of selling silver half dollars:

- Capital Gains Taxes: Profits from the sale of silver coins may be subject to capital gains taxes.

- Reporting Requirements: Report any gains from the sale of silver coins on your tax return.

- Consult a Tax Professional: Consult with a tax professional for guidance on reporting and minimizing your tax liabilities.

By following these best practices and considering your selling options, you can maximize your returns when selling silver half dollars. For expert advice and personalized selling strategies, contact the team at HOW.EDU.VN.

Navigating the world of silver half dollars involves understanding their intrinsic value, historical significance, market trends, and proper maintenance. By staying informed and seeking expert guidance, collectors and investors can make sound decisions and maximize the value of their collections.

Do you find it challenging to navigate the complexities of coin valuation? Are you looking for expert guidance to ensure you’re getting the best value for your collection or investment?

At how.edu.vn, we understand the difficulties in finding reliable and trustworthy expertise. That’s why we’ve gathered over 100 world-renowned Ph.D.s ready to provide you with personalized advice and solutions.