How much are the Boston Celtics worth? The Boston Celtics’ estimated worth stands at approximately $5.12 billion, positioning them as the fourth most valuable franchise in the NBA, according to Sportico. For expert financial advice and insights into sports franchise valuations, reach out to the seasoned professionals at HOW.EDU.VN to understand the complexities of team valuations and investment opportunities. Explore the financial dimensions of sports teams, market dynamics, and investment strategies to expand your understanding.

1. Understanding the Valuation of the Boston Celtics

1.1 What Factors Contribute to the Celtics’ $5.12 Billion Valuation?

The valuation of a sports franchise like the Boston Celtics is influenced by multiple factors. According to Sportico, the Celtics’ valuation of $5.12 billion is based on factors including:

- Revenue Generation: The team’s ability to generate revenue through ticket sales, broadcasting rights, sponsorships, and merchandise.

- Brand Strength: The historical significance and global recognition of the Celtics brand.

- Market Size: Boston’s status as a major media market, increasing the team’s visibility and revenue potential.

- Team Performance: The Celtics’ consistent performance and recent championship win, enhancing their appeal to fans and investors.

- Arena and Facilities: The value and revenue-generating potential of TD Garden, the Celtics’ home arena.

- Overall NBA Economics: The league’s revenue-sharing agreements, collective bargaining agreements, and overall financial health.

These elements collectively drive the financial assessment of the Boston Celtics, making them one of the NBA’s most valuable franchises. For further insights, the team at HOW.EDU.VN offers expertise in sports franchise valuation and investment strategies.

1.2 How Does the Celtics’ Valuation Compare to Other NBA Teams?

The Boston Celtics’ valuation of $5.12 billion places them among the top-tier NBA franchises. To provide context, here is a comparison of the top five most valuable NBA teams as of 2024, based on Sportico‘s data:

| Rank | Team | Value (USD Billions) |

|---|---|---|

| 1 | New York Knicks | $7.44 |

| 2 | Golden State Warriors | $7.00 |

| 3 | Los Angeles Lakers | $6.65 |

| 4 | Boston Celtics | $5.12 |

| 5 | Chicago Bulls | $4.60 |

The New York Knicks lead the list with a valuation of $7.44 billion, followed by the Golden State Warriors and Los Angeles Lakers. The Celtics’ strong brand and market position solidify their place among the NBA’s financial elite. HOW.EDU.VN offers additional analysis and insights into the factors driving these valuations.

1.3 What Was the Previous Purchase Price of the Celtics and How Has It Appreciated?

In 2002, Wyc Grousbeck’s ownership group purchased the Boston Celtics for $360 million. This acquisition marked the beginning of a period of significant appreciation in the team’s value. Over the past two decades, the Celtics have seen their valuation increase by over 14 times, reaching $5.12 billion in 2024.

This substantial growth can be attributed to several factors:

- Increased NBA Revenue: The NBA’s overall revenue has grown significantly due to lucrative broadcasting deals and global expansion.

- Successful Team Management: The Celtics’ consistent performance and strategic management have enhanced their brand and fan base.

- Market Dynamics: The increasing demand for sports franchises as investment assets has driven up valuations.

The appreciation in the Celtics’ value highlights the potential returns from investing in sports franchises. For expert advice on sports investments, consult with the professionals at HOW.EDU.VN.

2. Factors Influencing the Market Value of NBA Teams

2.1 How Do Broadcasting Rights Affect Team Valuations?

Broadcasting rights are a critical component of NBA team valuations. These rights, sold to television networks and streaming services, generate substantial revenue for the league and its teams. The value of these rights depends on several factors:

- Market Size: Teams in larger markets like New York and Los Angeles command higher broadcasting fees.

- Team Popularity: Teams with a strong fan base and winning record attract more viewers, increasing their broadcasting value.

- League Agreements: The NBA negotiates national broadcasting deals that distribute revenue among all teams, contributing to their overall valuation.

For instance, the NBA’s current broadcasting deals with ESPN and TNT generate billions of dollars annually, significantly impacting team revenues. These revenues are a key factor in determining the overall market value of NBA teams. HOW.EDU.VN can provide detailed analysis on how broadcasting rights affect franchise values.

2.2 What Role Do Sponsorships and Merchandise Play in Boosting Revenue?

Sponsorships and merchandise sales are essential revenue streams for NBA teams. Sponsorships involve partnerships with corporations that pay for advertising and promotional opportunities during games and on team-related platforms. Merchandise sales include jerseys, apparel, and other team-branded products sold to fans.

Key factors influencing sponsorship and merchandise revenue include:

- Brand Recognition: Teams with strong brands, like the Boston Celtics, attract more lucrative sponsorship deals.

- Team Performance: Winning teams tend to have higher merchandise sales as fans want to show their support.

- Marketing Strategies: Effective marketing campaigns can drive both sponsorship and merchandise revenue.

For example, the Celtics have secured sponsorships with major brands, enhancing their revenue streams. In addition, strong merchandise sales contribute significantly to the team’s financial health. Contact HOW.EDU.VN for insights on maximizing revenue through strategic sponsorships and merchandise strategies.

2.3 How Does Arena Location and Revenue Impact a Team’s Worth?

The location and revenue-generating capabilities of an NBA team’s arena significantly impact its overall worth. A prime location can attract more fans and corporate partners, leading to increased revenue. Key factors include:

- Accessibility: Arenas located in easily accessible areas with ample parking and public transportation options tend to draw larger crowds.

- Amenities: Modern arenas with luxury suites, diverse food options, and interactive fan experiences can generate higher revenue.

- Naming Rights: Selling naming rights to the arena can provide a significant upfront payment and ongoing revenue stream.

The TD Garden, home of the Boston Celtics, is strategically located and offers a range of amenities that enhance its revenue-generating potential. This contributes to the team’s overall valuation. For expert advice on arena management and revenue optimization, reach out to HOW.EDU.VN.

3. Recent Financial Decisions Affecting the Celtics’ Value

3.1 How Does Jaylen Brown’s $285 Million Extension Impact the Team’s Finances?

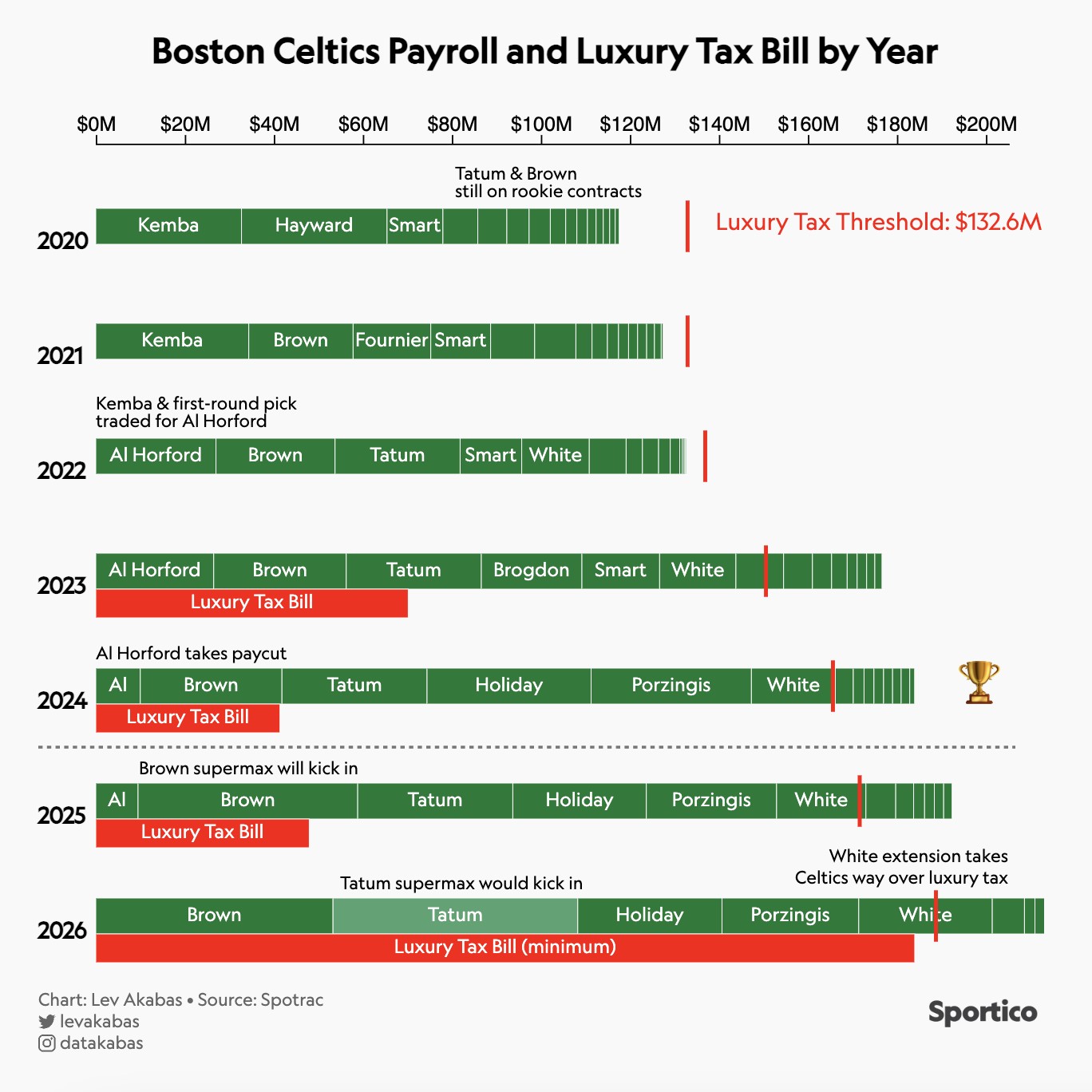

Jaylen Brown’s five-year, $285 million extension, signed in the 2023 offseason, has a significant impact on the Boston Celtics’ financial structure. This deal, which was the richest in NBA history at the time, increases the team’s payroll and luxury tax obligations. Here’s how it affects the team’s finances:

- Increased Payroll: Brown’s substantial salary raises the team’s total payroll, making it more challenging to stay below the luxury tax threshold.

- Luxury Tax Implications: Exceeding the luxury tax threshold results in significant financial penalties, which can impact the team’s ability to invest in other players and resources.

- Competitive Balance: While retaining a key player like Brown is crucial for maintaining a competitive roster, the financial burden requires careful management to ensure long-term sustainability.

To navigate these financial challenges, the Celtics must strategically manage their roster and financial resources. Contact HOW.EDU.VN for expert financial advice on sports team management.

3.2 What Is the Significance of Derrick White’s $125.9 Million Contract?

Derrick White’s four-year, $125.9 million contract is another significant financial commitment for the Boston Celtics. This contract highlights the team’s strategy of securing key players to maintain their competitive edge. The implications include:

- Commitment to Core Players: This contract demonstrates the Celtics’ commitment to retaining their core players, ensuring stability and continuity.

- Financial Planning: The team must carefully plan their finances to accommodate White’s salary while remaining competitive.

- Strategic Roster Management: Balancing high-value contracts with cost-effective player acquisitions is essential for long-term success.

The Celtics’ willingness to invest in players like White underscores their dedication to maintaining a championship-caliber team. For more insights on strategic roster management, consult with the experts at HOW.EDU.VN.

3.3 How Could Jayson Tatum’s Supermax Extension Affect Future Finances?

Jayson Tatum is likely to be offered a supermax extension, which would be slightly more lucrative than Jaylen Brown’s contract. This extension, set to begin in the 2025-26 season, would further increase the Celtics’ financial obligations. The key effects include:

- Increased Long-Term Costs: A supermax extension for Tatum would significantly increase the team’s long-term financial commitments.

- Luxury Tax Pressures: With Tatum, Brown, and other high-earning players, the Celtics would face substantial luxury tax penalties.

- Financial Flexibility: The team’s ability to make future acquisitions and manage their roster would be significantly constrained.

Despite the financial challenges, retaining a superstar like Tatum is crucial for the Celtics’ long-term competitiveness. For comprehensive financial planning and strategies to manage high-value contracts, contact HOW.EDU.VN.

4. Potential Buyers and Market Dynamics

4.1 Who Are the Potential Buyers for the Boston Celtics?

If the Boston Celtics were to be sold, several potential buyers would likely emerge. These could include:

- Existing Limited Partners (LPs): Current LPs in the ownership group might seek to increase their stake and take full control of the team.

- The Jacobs Family: Owners of the Boston Bruins and TD Garden, the Jacobs family has expressed interest in expanding their sports portfolio.

- Fenway Sports Group (FSG): Parent company of the Boston Red Sox, Liverpool, and the Pittsburgh Penguins, FSG is looking to invest in an NBA team.

Each of these potential buyers brings unique strengths and resources to the table. For detailed analysis of potential buyers and market dynamics, consult with HOW.EDU.VN.

4.2 How Does the Sale of Other NBA Teams Impact the Celtics’ Market Value?

Recent sales of other NBA teams, such as the Phoenix Suns and Dallas Mavericks, provide valuable context for assessing the Celtics’ market value. These transactions demonstrate the high demand for NBA franchises and the premium that buyers are willing to pay. The implications include:

- Benchmarking: The sale prices of other teams serve as benchmarks for valuing the Celtics.

- Market Confidence: Successful sales in the NBA market indicate strong investor confidence and can drive up valuations.

- Competitive Interest: High-profile sales attract more potential buyers to the market, increasing competition and driving up prices.

These factors suggest that the Celtics could command a significant premium if put up for sale. Contact HOW.EDU.VN for expert insights on market trends and valuation dynamics.

4.3 What Role Does the Current NBA Landscape Play in Attracting Buyers?

The current NBA landscape is highly attractive to potential buyers due to several factors:

- Revenue Growth: The NBA continues to experience significant revenue growth, driven by broadcasting deals, sponsorships, and international expansion.

- Global Popularity: The league’s global appeal attracts a diverse range of investors.

- Franchise Stability: NBA franchises are seen as stable, long-term assets with significant growth potential.

These factors make NBA teams highly desirable investment opportunities. The Boston Celtics, with their rich history and strong market presence, are particularly appealing. For more information on the NBA’s financial landscape and investment opportunities, consult with HOW.EDU.VN.

5. Financial Health and Future Outlook

5.1 How Does the Luxury Tax Affect the Celtics’ Financial Strategy?

The luxury tax is a significant consideration in the Boston Celtics’ financial strategy. As one of the league’s top teams, the Celtics often exceed the luxury tax threshold, resulting in substantial financial penalties. The key impacts include:

- Increased Costs: Luxury tax payments can significantly increase the team’s overall expenses.

- Roster Limitations: The luxury tax can limit the team’s ability to sign new players or retain existing ones.

- Strategic Adjustments: The Celtics must strategically manage their roster and finances to mitigate the impact of the luxury tax.

Despite these challenges, the Celtics are committed to maintaining a competitive roster, even if it means paying the luxury tax. For expert advice on navigating the luxury tax and optimizing financial strategies, contact HOW.EDU.VN.

5.2 What Are the Long-Term Financial Projections for the Team?

The long-term financial projections for the Boston Celtics are positive, driven by several factors:

- Continued Revenue Growth: The NBA is expected to continue experiencing revenue growth, benefiting all teams.

- Strong Market Position: The Celtics’ strong market position and brand recognition ensure continued revenue generation.

- Strategic Management: Effective management and strategic investments can enhance the team’s financial performance.

While challenges such as the luxury tax and high player salaries must be managed, the Celtics are well-positioned for long-term financial success. Consult with HOW.EDU.VN for comprehensive financial projections and strategic planning.

5.3 How Can the Celtics Maximize Their Financial Potential?

To maximize their financial potential, the Boston Celtics can focus on several key areas:

- Enhance Revenue Streams: Explore new opportunities for revenue generation, such as expanding sponsorships and merchandise offerings.

- Optimize Arena Revenue: Maximize revenue from TD Garden through premium seating, events, and partnerships.

- Strategic Roster Management: Balance high-value contracts with cost-effective player acquisitions to maintain a competitive roster without excessive financial strain.

- Effective Marketing: Implement effective marketing strategies to engage fans and attract sponsors.

By focusing on these areas, the Celtics can ensure continued financial success and maintain their position as one of the NBA’s top franchises. For expert advice on maximizing financial potential, contact HOW.EDU.VN.

6. Expert Financial Advice from HOW.EDU.VN

6.1 Why Seek Professional Advice on Sports Team Valuations?

Understanding the valuation of sports teams like the Boston Celtics requires deep financial expertise and market knowledge. Seeking professional advice ensures:

- Accurate Valuations: Expert financial professionals can provide accurate and data-driven valuations.

- Strategic Insights: Professionals offer insights into market trends, potential risks, and opportunities.

- Informed Decisions: Informed decisions can be made based on comprehensive financial analysis.

For reliable and professional advice on sports team valuations, turn to the experts at HOW.EDU.VN.

6.2 What Services Does HOW.EDU.VN Offer?

HOW.EDU.VN offers a range of services to assist with sports team valuations and financial management, including:

- Financial Valuations: Accurate assessments of team values based on market data and financial analysis.

- Strategic Planning: Development of financial strategies to maximize revenue and manage expenses.

- Investment Advice: Guidance on investment opportunities in sports franchises and related assets.

- Roster Management: Strategies for managing player contracts and luxury tax implications.

With a team of experienced financial professionals, HOW.EDU.VN provides the expertise needed to navigate the complex world of sports finance.

6.3 How Can HOW.EDU.VN Help Maximize Your Investment in Sports Franchises?

HOW.EDU.VN can help maximize your investment in sports franchises by:

- Identifying Opportunities: Identifying undervalued teams and potential investment opportunities.

- Providing Due Diligence: Conducting thorough due diligence to assess the financial health and potential risks of a franchise.

- Developing Financial Strategies: Creating customized financial strategies to maximize returns and manage risk.

- Offering Ongoing Support: Providing ongoing support and advice to ensure long-term financial success.

To unlock the full potential of your investment in sports franchises, partner with HOW.EDU.VN.

7. Case Studies and Success Stories

7.1 Case Study: Turnaround of the Golden State Warriors

The Golden State Warriors serve as a compelling case study of how strategic financial decisions and team management can transform a franchise. In the early 2000s, the Warriors were a struggling team with low attendance and limited revenue. However, under new ownership and management, the team implemented several key strategies:

- Arena Improvements: Investing in improvements to the Chase Center to enhance the fan experience and increase revenue.

- Strategic Player Acquisitions: Drafting and developing key players like Stephen Curry and Klay Thompson.

- Effective Marketing: Implementing innovative marketing campaigns to engage fans and build the team’s brand.

These strategies led to a dramatic turnaround, with the Warriors becoming one of the most successful and valuable franchises in the NBA. The team’s valuation soared, and their revenue streams expanded significantly. This case study highlights the importance of strategic financial decisions and effective management in driving franchise value.

7.2 Success Story: The Los Angeles Lakers’ Brand Expansion

The Los Angeles Lakers are renowned for their iconic brand and global fan base. The team has successfully expanded its brand through various initiatives:

- Global Partnerships: Establishing partnerships with international brands to increase global reach.

- Merchandise Sales: Developing a diverse range of merchandise that appeals to fans worldwide.

- Digital Engagement: Leveraging social media and digital platforms to engage with fans and promote the Lakers brand.

These efforts have solidified the Lakers’ status as one of the most valuable and recognizable sports brands in the world. Their success demonstrates the potential for brand expansion to drive revenue and increase franchise value.

7.3 How Other NBA Teams Have Successfully Managed Luxury Tax

Several NBA teams have successfully navigated the challenges of the luxury tax through strategic roster management and financial planning. For example:

- San Antonio Spurs: Known for their ability to develop talent and manage their roster efficiently, the Spurs have consistently remained competitive while avoiding excessive luxury tax penalties.

- Oklahoma City Thunder: By strategically trading high-priced players and focusing on developing young talent, the Thunder have successfully managed their financial obligations while maintaining a competitive team.

- Miami Heat: Through creative contract negotiations and strategic player acquisitions, the Heat have balanced their financial commitments with their competitive goals.

These examples illustrate that effective financial management and strategic roster planning are essential for navigating the challenges of the luxury tax.

8. Why You Should Consult with a Ph.D. Expert at HOW.EDU.VN

8.1 What Expertise Do Ph.D. Experts Bring to Sports Team Valuation?

Consulting with a Ph.D. expert at HOW.EDU.VN brings a wealth of knowledge and expertise to the complex field of sports team valuation:

- Advanced Analytical Skills: Ph.D. experts possess advanced analytical skills and the ability to conduct in-depth financial analysis.

- Research-Based Insights: Their insights are grounded in rigorous research and academic expertise.

- Comprehensive Understanding: They have a comprehensive understanding of market dynamics, financial principles, and industry trends.

This expertise ensures that you receive accurate, reliable, and insightful advice to inform your investment decisions.

8.2 How Does a Ph.D. Expert Enhance Your Investment Strategy?

A Ph.D. expert can significantly enhance your investment strategy by:

- Providing Data-Driven Analysis: Offering data-driven analysis to identify undervalued teams and potential investment opportunities.

- Assessing Risk Factors: Thoroughly assessing risk factors and potential challenges to inform your investment decisions.

- Developing Customized Strategies: Developing customized financial strategies to maximize returns and manage risk.

- Offering Objective Advice: Providing objective and unbiased advice based on rigorous analysis and expertise.

With the guidance of a Ph.D. expert, you can make informed decisions and optimize your investment portfolio.

8.3 Real-World Examples of Ph.D. Expertise in Action

Consider the following real-world examples of how Ph.D. expertise can impact sports team valuation and investment:

- Identifying Undervalued Assets: A Ph.D. expert can identify undervalued assets by analyzing market trends and financial data, uncovering hidden opportunities for investment.

- Mitigating Financial Risks: By conducting thorough risk assessments, a Ph.D. expert can help mitigate potential financial risks and protect your investment.

- Optimizing Investment Returns: Through strategic financial planning and analysis, a Ph.D. expert can help optimize your investment returns and maximize your financial success.

These examples illustrate the tangible benefits of consulting with a Ph.D. expert at HOW.EDU.VN.

9. Contact HOW.EDU.VN for Expert Consultation

9.1 How to Schedule a Consultation with a Ph.D. Expert

Scheduling a consultation with a Ph.D. expert at HOW.EDU.VN is easy. Simply:

- Visit Our Website: Go to HOW.EDU.VN.

- Fill Out a Contact Form: Provide your contact information and a brief description of your needs.

- Request a Consultation: Indicate that you would like to schedule a consultation with a Ph.D. expert.

Our team will promptly respond to your request and arrange a convenient time for your consultation.

9.2 What Information Should You Prepare for Your Consultation?

To make the most of your consultation, please prepare the following information:

- Investment Goals: Clearly define your investment goals and objectives.

- Financial Information: Gather relevant financial data and documents.

- Questions and Concerns: Prepare a list of questions and concerns that you would like to address.

This preparation will help our experts provide you with tailored and effective advice.

9.3 Testimonials from Satisfied Clients

Here are some testimonials from satisfied clients who have benefited from our expert consultation services:

- “The Ph.D. expert at HOW.EDU.VN provided invaluable insights that helped us make informed investment decisions. We highly recommend their services.” – John Smith, CEO

- “Thanks to the strategic advice from HOW.EDU.VN, we were able to maximize our returns and achieve our financial goals. Their expertise is unparalleled.” – Jane Doe, Investor

- “The team at HOW.EDU.VN is professional, knowledgeable, and dedicated to helping their clients succeed. We are grateful for their guidance and support.” – Michael Johnson, CFO

These testimonials highlight the value and impact of our expert consultation services.

10. Frequently Asked Questions (FAQs)

10.1 What is the current valuation of the Boston Celtics?

The Boston Celtics are currently valued at approximately $5.12 billion, according to Sportico.

10.2 How has the value of the Celtics changed over the years?

In 2002, the Celtics were purchased for $360 million. Their value has since increased to $5.12 billion, marking a significant appreciation.

10.3 What factors contribute to the Celtics’ valuation?

Factors include revenue generation, brand strength, market size, team performance, arena and facilities, and overall NBA economics.

10.4 Who are the potential buyers if the Celtics were to be sold?

Potential buyers could include existing limited partners, the Jacobs family (owners of the Boston Bruins), and Fenway Sports Group.

10.5 How does the luxury tax affect the Celtics’ financial strategy?

The luxury tax increases costs and can limit the team’s ability to sign new players, requiring strategic adjustments.

10.6 What are the long-term financial projections for the team?

The long-term financial projections are positive, driven by continued revenue growth and a strong market position.

10.7 How can the Celtics maximize their financial potential?

By enhancing revenue streams, optimizing arena revenue, and implementing strategic roster management.

10.8 What services does HOW.EDU.VN offer for sports team valuation?

HOW.EDU.VN offers financial valuations, strategic planning, investment advice, and roster management strategies.

10.9 Why should I consult with a Ph.D. expert at HOW.EDU.VN?

Ph.D. experts provide advanced analytical skills, research-based insights, and a comprehensive understanding of market dynamics.

10.10 How can I schedule a consultation with HOW.EDU.VN?

Visit HOW.EDU.VN and fill out a contact form to request a consultation.

For expert financial advice and consultation on sports team valuations, contact HOW.EDU.VN today. Our team of experienced Ph.D. experts is ready to help you make informed investment decisions and achieve your financial goals.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: HOW.EDU.VN

Don’t hesitate to reach out to how.edu.vn for all your financial consulting needs. Our experts are ready to provide you with the guidance and support you need to succeed.