Are you curious about the real value of those coveted Olympic gold medals? While they symbolize ultimate achievement, the actual worth might surprise you. At HOW.EDU.VN, we break down the composition and estimated value of Olympic medals, revealing the factors that contribute to their worth. Discover how commodity prices and historical significance play a role in determining the value of these iconic awards and how you can get expert insights on similar topics.

1. What Are Olympic Gold Medals Made Of?

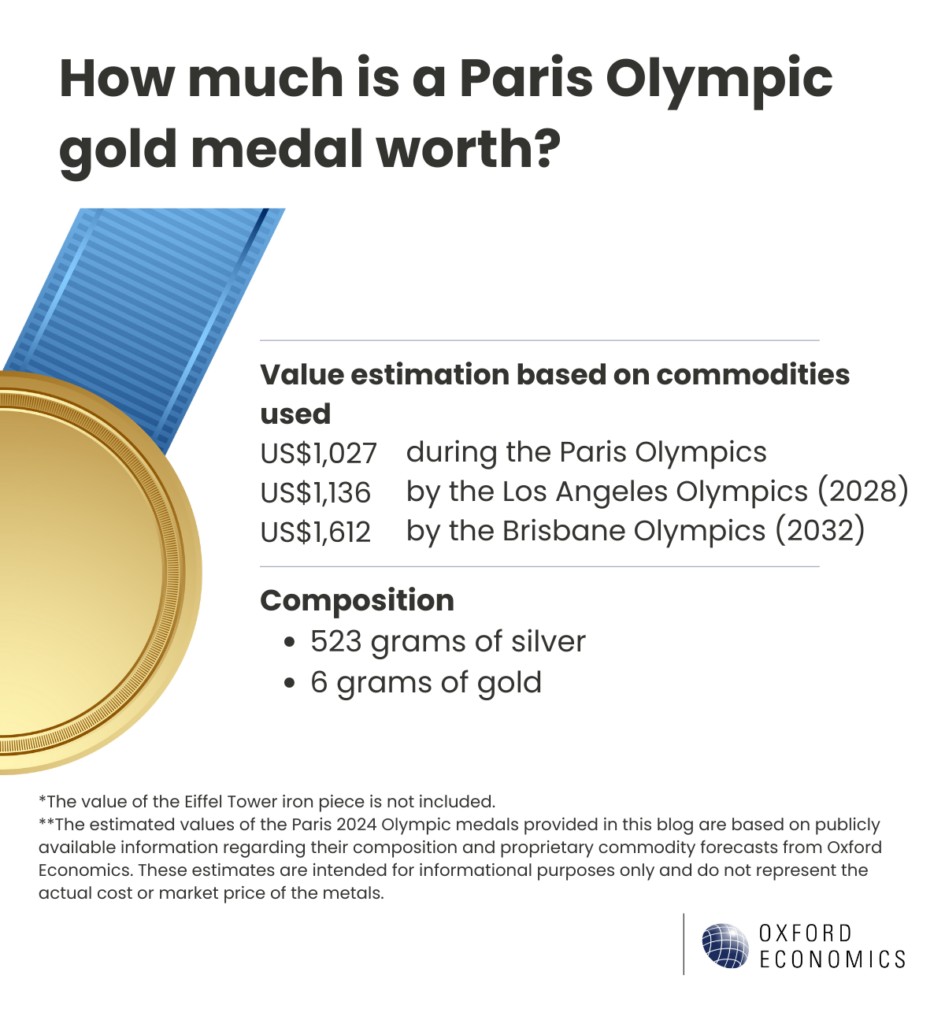

Olympic gold medals aren’t pure gold. Instead, they consist primarily of silver and are coated with a layer of gold. For example, the gold medals at the Paris Olympics contained 523 grams of silver coated with 6 grams of gold. Silver medals are made of pure silver, while bronze medals consist of copper, tin, and zinc. This composition affects their intrinsic value, making it different from their symbolic worth.

- Gold Medals: 523 grams of silver, 6 grams of gold

- Silver Medals: 525 grams of pure silver

- Bronze Medals: 455 grams of copper, tin, and zinc

Paris Olympic gold medal made of silver coated in gold

Paris Olympic gold medal made of silver coated in gold

2. How Much Are The 2024 Paris Olympics Medals Worth?

The commodity value of the 2024 Paris Olympics gold medal is estimated to be around $1,027 USD. This calculation considers the amounts of silver and gold used. Silver medals are worth approximately $535, and bronze medals around $4.60 based on current metal prices. These figures do not account for the historical or collectible value, which can significantly increase their worth.

3. What Adds Value To Olympic Medals Beyond Their Material Components?

Beyond their physical composition, Olympic medals gain value from several intangible factors:

- Historical Significance: Each medal represents a moment in Olympic history, adding to its collectibility.

- Athlete Achievement: The story behind the win, the athlete’s journey, and the national pride associated with the victory significantly enhance the medal’s worth.

- Rarity: Some medals are more valuable due to the limited number awarded in specific games or events.

- Collectible Value: Collectors often seek Olympic medals, driving up prices based on demand and the medal’s condition.

4. How Did The Paris Olympics Medals Differ From Traditional Medals?

The 2024 Paris Olympics medals included a unique element: a piece of iron from the Eiffel Tower. This addition set them apart from previous medals, blending the sporting achievement with a symbol of French heritage. The inclusion of Eiffel Tower iron makes the medals historically significant and adds sentimental and monetary value.

5. How Do Precious And Industrial Metals Markets Influence Medal Values?

The value of Olympic medals is closely linked to the market prices of precious and industrial metals:

- Gold: Gold’s price is influenced by central bank demand, economic stability, and investor behavior.

- Silver: Silver’s price is affected by industrial demand and expectations of Federal Reserve (FED) rate cuts.

- Copper: Copper prices are affected by industrial production, electric vehicle (EV) manufacturing, and renewable energy projects.

- Zinc: Zinc prices are tied to steel and construction activity.

- Tin: Tin prices are driven by disruptions in supply from major producers like Indonesia and Myanmar, as well as demand from the electronics sector.

Fluctuations in these markets can significantly impact the intrinsic value of the medals.

6. What Are The Price Forecasts For Metals Used In Olympic Medals?

According to forecasts from Oxford Economics’ Global Commodity Forecast Service, the prices of metals used in Olympic medals are expected to increase over the coming years:

- Gold: Anticipated to trade above US$2,640/oz by 2028 and US$2,865/oz by 2032, driven by demand from central banks and Chinese consumers.

- Silver: Expected to appreciate to US$31.27/oz by 2028 and US$32.83/oz by 2032, influenced by global industrial production recovery.

- Copper: Projected to reach US$11,051/tonne in 2028 and US$12,898/tonne by 2032, boosted by EV and renewable energy production.

- Zinc: Forecasted to average US$2,863 in 2028, linked to improvements in steel and construction activity.

- Tin: Prices expected to remain high due to continued supply disruptions and rising demand from the electronics sector, averaging US$33,834 per ton this year.

These forecasts suggest that the material value of Olympic medals will likely increase in the future.

7. How Will Rising Metal Prices Affect The Value Of Future Olympic Medals?

Rising metal prices will increase the commodity value of Olympic medals in future games. For instance, gold medals at the 2028 Los Angeles Olympics are projected to be worth US$1,136, while those at the 2032 Brisbane Olympics could reach US$1,612. This increase is primarily due to the rising costs of gold, silver, copper, and other metals used in their production.

| Olympics Year | Gold Medal Value (USD) | Silver Medal Value (USD) | Bronze Medal Value (USD) |

|---|---|---|---|

| 2024 (Paris) | 1,027 | 535 | 4.6 |

| 2028 (LA) | 1,136 | 579 | 5.2 |

| 2032 (Brisbane) | 1,612 | 608 | 6 |

8. What Is The Role Of Gold In Global Finance And Its Impact On Olympic Medals?

Gold plays a significant role in global finance due to its stability and perceived safety. Central banks hold gold as a reserve asset, and investors turn to gold during economic uncertainty. High demand from these entities supports gold prices. According to a report by the World Gold Council, central banks globally increased their gold reserves by 650 tons in 2023, signaling strong confidence in gold as a stable asset.

The demand for gold also comes from consumers, particularly in markets like China and India, where gold is a traditional store of value and is used in jewelry. The People’s Bank of China has been a consistent buyer of gold, further supporting its price. These factors contribute to the metal’s sustained high value and, consequently, the worth of gold medals.

9. How Does Silver’s Industrial Use Impact Its Value In Olympic Medals?

Silver has extensive industrial applications, making its market dynamics different from gold. It is used in electronics, solar panels, and medical applications, influencing its demand and price. An increase in industrial activity can lead to higher silver prices, directly impacting the value of silver medals.

According to the Silver Institute, approximately 50% of silver demand comes from industrial applications. Growth in sectors such as electric vehicles and renewable energy boosts silver consumption. For example, silver is used in the production of solar panels, and the increasing adoption of solar energy worldwide drives up the demand for silver. This industrial demand, combined with investment interest, supports silver’s price and its value in Olympic medals.

10. What Role Does Copper Play In The Global Economy And In Olympic Medals?

Copper is essential in many industries, including construction, manufacturing, and transportation. Its demand is closely tied to global economic growth, especially in emerging markets. The metal is also critical in the transition to renewable energy, as it is used extensively in electric vehicles, wind turbines, and solar power systems.

The International Copper Study Group (ICSG) forecasts that demand for copper will continue to grow, driven by the expansion of renewable energy infrastructure and the increasing production of electric vehicles. While new mine capacity is expected to grow, the overall supply outlook remains challenging, which could lead to higher prices. This increased demand and potential supply constraints support copper prices, enhancing the value of bronze medals.

11. How Do Geopolitical Tensions Affect The Prices Of Metals Used In Olympic Medals?

Geopolitical tensions significantly affect the prices of metals used in Olympic medals. Uncertainty in global affairs can disrupt supply chains, increase demand for safe-haven assets like gold, and impact industrial production, thus influencing the prices of silver, copper, zinc, and tin.

For example, political instability in regions that produce significant amounts of these metals can lead to supply disruptions. Trade tensions between major economies can also affect demand and prices. In times of uncertainty, investors often turn to gold as a safe haven, increasing its demand and price. Understanding these geopolitical factors is crucial for forecasting metal prices and, consequently, the value of Olympic medals.

12. What Are Some Notable Examples Of Olympic Medals Sold At High Prices?

Several Olympic medals have been sold for substantial amounts at auctions, highlighting their collectible value and historical significance:

- Jesse Owens’ 1936 Gold Medal: Sold for nearly $1.5 million in 2013, reflecting the historical importance of Owens’ achievements during the Nazi Olympics.

- Mark Wells’ 1980 “Miracle on Ice” Gold Medal: Part of the collection was sold for $310,700 in 2010, symbolizing a significant moment in sports history.

- Anthony Ervin’s 2000 Gold Medal: Auctioned for $17,100, with proceeds donated to tsunami relief efforts, illustrating the medal’s charitable value.

These examples demonstrate that the auction prices of Olympic medals often exceed their intrinsic material value due to their historical and sentimental importance.

13. How Do Macroeconomic Factors Like Interest Rates Influence Metal Prices?

Macroeconomic factors, such as interest rates, significantly influence metal prices. Lower interest rates tend to weaken the U.S. dollar, making dollar-denominated commodities like gold and silver more attractive to international buyers. This increased demand can drive up prices. Additionally, low interest rates can stimulate economic growth, boosting industrial demand for metals like copper, zinc, and tin.

Conversely, higher interest rates can strengthen the dollar and dampen economic activity, potentially leading to lower metal prices. Expectations about future interest rate movements by central banks like the Federal Reserve can also influence investor sentiment and metal prices. Monitoring these macroeconomic trends is essential for understanding the dynamics of metal markets.

14. How Does Demand From Emerging Markets Impact The Value Of Metals In Olympic Medals?

Demand from emerging markets, particularly China and India, has a significant impact on the value of metals used in Olympic medals. These countries are major consumers of gold, silver, and copper, driven by economic growth, industrialization, and increasing consumer wealth.

China’s demand for gold, both from its central bank and consumers, supports global gold prices. India’s appetite for gold jewelry also contributes significantly to the metal’s demand. Additionally, the rapid industrialization and infrastructure development in these countries boost demand for copper, zinc, and tin. Understanding the economic trends and consumption patterns in emerging markets is vital for forecasting metal prices and the future value of Olympic medals.

15. What Role Do Exchange-Traded Funds (ETFs) Play In The Market For Metals Used In Olympic Medals?

Exchange-Traded Funds (ETFs) play a significant role in the market for metals used in Olympic medals by providing investors with easy access to these commodities. ETFs that hold physical gold, silver, copper, zinc, or tin can influence demand and prices. When investors buy shares of these ETFs, the fund must purchase the underlying metal, increasing demand and potentially driving up prices.

The trading activity in these ETFs reflects investor sentiment about the future direction of metal prices. Large inflows into metal ETFs can signal bullish sentiment, while outflows can indicate bearish sentiment. Monitoring the flows and holdings of metal ETFs is essential for understanding market dynamics and predicting price movements.

16. How Does Supply Chain Disruption Affect The Value Of Metals Used In Olympic Medals?

Supply chain disruptions can significantly affect the value of metals used in Olympic medals by creating scarcity and uncertainty in the market. Events such as strikes, natural disasters, and geopolitical tensions can disrupt the mining, processing, and transportation of these metals.

For example, disruptions in the supply of tin from major producers like Indonesia and Myanmar have led to higher prices. Similarly, labor disputes in copper-producing countries can reduce the availability of copper and increase its price. These supply chain disruptions can cause price volatility and increase the value of metals used in Olympic medals. Companies and investors closely monitor these disruptions to anticipate price movements and manage risk.

17. How Do Technological Advancements Impact Demand For Metals Used In Olympic Medals?

Technological advancements significantly impact the demand for metals used in Olympic medals. Innovations in electronics, renewable energy, and electric vehicles drive increased demand for specific metals, influencing their prices.

For example, the development of more efficient solar panels increases the demand for silver, while the growth of the electric vehicle market boosts demand for copper and lithium. Advances in battery technology also influence demand for various metals. These technological trends create long-term demand drivers that support metal prices and affect the value of Olympic medals.

18. What Is The Historical Significance Of Gold, Silver, And Bronze In Awarding Medals?

The tradition of awarding gold, silver, and bronze medals dates back to ancient Greece, where these metals symbolized different levels of achievement. Gold, being the most precious, represented the highest honor, followed by silver and then bronze.

This tradition was revived during the modern Olympic Games, starting in 1896, and has continued to this day. The use of these metals provides a universally recognized hierarchy of achievement and adds historical and cultural significance to the medals. The symbolic value of gold, silver, and bronze is deeply embedded in the Olympic tradition and continues to inspire athletes worldwide.

19. What Are The Psychological And Cultural Values Associated With Olympic Medals?

Olympic medals carry immense psychological and cultural value, representing the pinnacle of athletic achievement and national pride. Winning an Olympic medal is often the culmination of years of intense training and dedication, making it a symbol of perseverance and excellence.

The medals also hold significant cultural value, representing a nation’s sporting prowess and contributing to its identity. The pride and recognition associated with winning a medal can inspire future generations of athletes and unite a country in celebration. The psychological and cultural values of Olympic medals far exceed their material worth, making them priceless symbols of human achievement.

20. What Expert Insights Can HOW.EDU.VN Provide On The Value Of Olympic Medals And Commodities?

At HOW.EDU.VN, we offer expert insights on the value of Olympic medals and commodities, providing detailed analysis and forecasts to help you understand the complex factors that influence their worth. Our team of experienced economists and industry experts provides comprehensive reports, data-driven analysis, and actionable insights on precious and industrial metals markets.

We also offer personalized consulting services to help you navigate the complexities of commodity markets and make informed decisions. Whether you’re an investor, a business professional, or simply curious about the value of Olympic medals, HOW.EDU.VN is your trusted source for expert insights and analysis.

Why Choose HOW.EDU.VN?

- Expert Team: Our team includes leading economists and industry experts.

- Comprehensive Analysis: We offer detailed reports and data-driven analysis.

- Personalized Consulting: We provide customized consulting services to meet your needs.

Ready to unlock the power of expert insights? Contact HOW.EDU.VN today!

FAQ: Olympic Medals Worth

1. Are Olympic gold medals made of pure gold?

No, Olympic gold medals are primarily made of silver and coated with a layer of gold.

2. How much is a 2024 Paris Olympics gold medal worth in terms of its materials?

The material value of a 2024 Paris Olympics gold medal is estimated to be around $1,027 USD.

3. What makes Olympic medals valuable besides their material components?

Olympic medals gain value from their historical significance, the athlete’s achievement, rarity, and collectible demand.

4. How did the Paris Olympics medals differ from traditional medals?

The 2024 Paris Olympics medals included a piece of iron from the Eiffel Tower.

5. What are the price forecasts for gold and silver in the coming years?

Gold is anticipated to trade above US$2,640/oz by 2028, and silver is expected to appreciate to US$31.27/oz by 2028.

6. How do geopolitical tensions affect the prices of metals used in Olympic medals?

Geopolitical tensions can disrupt supply chains and increase demand for safe-haven assets like gold, influencing metal prices.

7. What are some notable examples of Olympic medals sold at high prices?

Jesse Owens’ 1936 gold medal sold for nearly $1.5 million, and Mark Wells’ 1980 “Miracle on Ice” gold medal part sold for $310,700.

8. How do macroeconomic factors like interest rates influence metal prices?

Lower interest rates can weaken the U.S. dollar, making dollar-denominated commodities more attractive to international buyers.

9. What is the historical significance of awarding gold, silver, and bronze medals?

The tradition dates back to ancient Greece, with gold representing the highest honor, followed by silver and bronze.

10. What psychological and cultural values are associated with Olympic medals?

Olympic medals represent the pinnacle of athletic achievement, national pride, and the psychological value of perseverance and excellence.

Seeking clarity on complex issues and expert guidance is essential in today’s rapidly changing world. At HOW.EDU.VN, we connect you with over 100 world-renowned PhDs ready to provide tailored solutions.

Take the Next Step with HOW.EDU.VN

- Connect with Experts: Gain access to over 100 world-renowned PhDs.

- Personalized Solutions: Receive tailored advice for your unique challenges.

- Stay Informed: Get insights on commodities, economics, and more.

Don’t navigate complex challenges alone. Contact HOW.EDU.VN today for expert guidance. Visit our website at HOW.EDU.VN, call us at +1 (310) 555-1212, or visit our office at 456 Expertise Plaza, Consult City, CA 90210, United States. Let how.edu.vn be your partner in achieving clarity and success.