How Much Did The National Debt Increase Under Trump? Discover the truth behind the numbers and understand the factors that contributed to this significant rise, plus, discover how HOW.EDU.VN can guide you through complex economic issues with expert insights. Explore economic policies and their impact.

1. Understanding the National Debt Under Trump’s Presidency

During Donald Trump’s presidency, the national debt became a significant topic of discussion and debate. While in office, Trump implemented various economic policies, including tax cuts and increased government spending, which had a substantial impact on the nation’s financial standing. Understanding the specifics of how much the national debt increased under his leadership requires a detailed analysis of economic factors and policy decisions.

The national debt is the total amount of money the United States federal government owes to creditors. This includes debt held by the public (such as Treasury securities) and debt held by government accounts. Increases in the national debt can be attributed to various factors, including government spending exceeding revenue, economic recessions, and policy changes.

2. The Numbers: Quantifying the Increase in National Debt

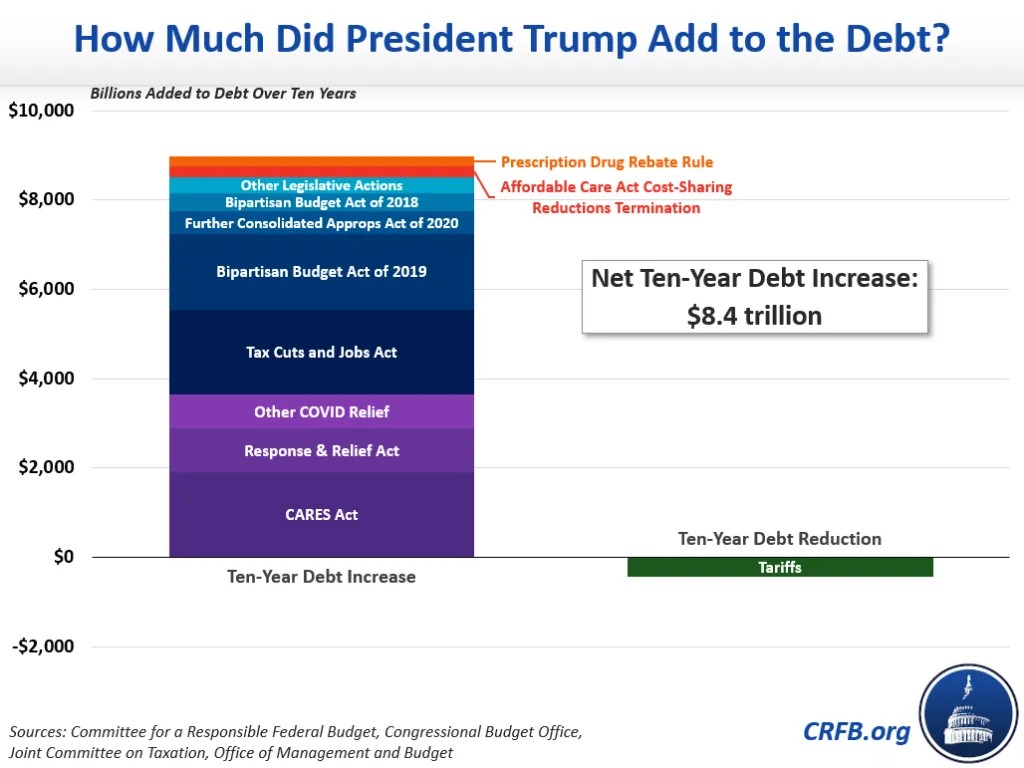

Quantifying the increase in the national debt under President Trump involves looking at specific figures and comparing them over time. During his four years in office, the gross national debt increased substantially, raising concerns among economists and policymakers alike. It’s essential to examine these numbers in context to understand the full scope of the financial changes.

According to data from the U.S. Department of the Treasury, the gross national debt increased from $19.95 trillion to $27.75 trillion during President Trump’s term. This represents a $7.8 trillion increase over four years. The debt held by the public, which is considered a more economically meaningful measure, grew by $7.2 trillion during the same period. These figures highlight the magnitude of the debt accumulation under the Trump administration.

However, attributing the entire $7.8 trillion increase solely to President Trump’s policies would be an oversimplification. Several factors contributed to this rise, including pre-existing fiscal trends, the economic impact of the COVID-19 pandemic, and specific legislative actions taken during his tenure.

3. Factors Contributing to the Debt Increase

Several key factors contributed to the increase in the national debt during President Trump’s presidency. These include tax cuts, increased government spending, and the economic fallout from the COVID-19 pandemic. Each of these factors played a significant role in shaping the nation’s financial landscape.

3.1. Tax Cuts and Jobs Act of 2017

One of the most significant pieces of legislation enacted during President Trump’s term was the Tax Cuts and Jobs Act of 2017 (TCJA). This law significantly reduced corporate and individual income tax rates, leading to lower government revenue. While proponents argued that the tax cuts would stimulate economic growth, critics warned that they would exacerbate the national debt.

The TCJA reduced the corporate tax rate from 35% to 21% and made various changes to individual income tax brackets. According to the Congressional Budget Office (CBO), the TCJA is projected to add approximately $1.9 trillion to the national debt over ten years. This substantial increase is primarily due to the decrease in government revenue resulting from lower tax rates.

3.2. Increased Government Spending

In addition to tax cuts, increased government spending also contributed to the rise in the national debt. During President Trump’s term, there were bipartisan agreements to increase discretionary spending, particularly on defense and domestic programs. These spending increases added to the overall budget deficit and, consequently, the national debt.

The Bipartisan Budget Acts of 2018 and 2019 significantly increased discretionary spending. These acts raised budget caps and allocated additional funds to various government agencies and programs. The CBO estimated that these acts would add approximately $2.1 trillion to the national debt over ten years.

3.3. COVID-19 Pandemic and Economic Relief Measures

The COVID-19 pandemic had a profound impact on the U.S. economy and government finances. The economic downturn caused by the pandemic led to decreased tax revenue, while the government implemented massive relief measures to support individuals, businesses, and state and local governments. These relief measures significantly increased government spending and, consequently, the national debt.

The CARES Act, enacted in March 2020, was one of the largest economic relief packages in U.S. history. It provided direct payments to individuals, expanded unemployment benefits, and offered loans and grants to businesses. The CBO estimated that the CARES Act would add approximately $1.9 trillion to the national debt. Additional COVID-19 relief measures, such as the Response and Relief Act, further contributed to the debt increase.

Donald Trump discussing economic policy

Donald Trump discussing economic policy

4. Executive Actions and Their Fiscal Impact

President Trump also took several executive actions that had fiscal implications. While some of these actions increased the debt, others aimed to reduce it. Understanding the net impact of these actions requires a careful assessment of their costs and savings.

4.1. Tariffs

One of President Trump’s signature policies was the imposition of tariffs on imported goods from various countries, particularly China. While the primary goal of these tariffs was to protect domestic industries and encourage foreign countries to change their trade practices, they also had an impact on government revenue.

The tariffs increased government revenue by collecting duties on imported goods. According to estimates, the tariffs raised about $445 billion over ten years. However, the economic effects of the tariffs, such as higher prices for consumers and reduced trade, could have offset some of these gains.

4.2. Affordable Care Act (ACA) Cost-Sharing Reductions Termination

President Trump took executive action to terminate the Affordable Care Act’s (ACA) cost-sharing reductions (CSR) funding. These payments were designed to help low-income individuals afford health insurance coverage. Terminating these payments was intended to reduce government spending.

The termination of ACA cost-sharing reductions was estimated to save approximately $250 billion over ten years. However, it also led to higher premiums and reduced access to healthcare for some individuals.

4.3. Prescription Drug Rebate Rule

Another executive action taken by President Trump was the implementation of a prescription drug rebate rule. This rule aimed to lower drug prices by eliminating kickbacks to middlemen. However, the rule was ultimately repealed.

The prescription drug rebate rule was estimated to increase the debt by $205 billion over ten years. The repeal of the rule effectively negated these costs.

5. Comparing Trump’s Debt Increase to Previous Administrations

To provide context, it’s helpful to compare the increase in the national debt under President Trump to that of previous administrations. Each president faces unique economic circumstances and policy challenges, making direct comparisons complex. However, examining debt levels under different administrations can offer valuable insights into long-term fiscal trends.

5.1. Debt Under President Obama

During President Barack Obama’s two terms in office (2009-2017), the national debt also increased significantly. The debt held by the public nearly doubled, rising from $6.3 trillion to $14.8 trillion. This increase was largely attributed to the Great Recession, the implementation of economic stimulus measures, and ongoing wars in Iraq and Afghanistan.

5.2. Debt Under President George W. Bush

President George W. Bush also oversaw a substantial increase in the national debt during his two terms (2001-2009). The debt held by the public more than doubled, rising from $3.3 trillion to $7.5 trillion. This increase was primarily due to tax cuts, increased military spending (particularly on the wars in Iraq and Afghanistan), and the onset of the Great Recession.

5.3. Analysis of Debt Increases

While the increase in the national debt under President Trump was substantial, it is important to consider the specific circumstances and policy decisions that contributed to it. Each administration faces different economic challenges and makes different policy choices that affect the national debt. Factors such as economic recessions, wars, and legislative changes all play a role in shaping the nation’s fiscal trajectory.

| President | Years in Office | Debt Increase (Debt Held by Public) | Major Contributing Factors |

|---|---|---|---|

| George W. Bush | 2001-2009 | $4.2 trillion | Tax cuts, wars in Iraq and Afghanistan, Great Recession |

| Barack Obama | 2009-2017 | $8.5 trillion | Great Recession, economic stimulus, ongoing wars |

| Donald Trump | 2017-2021 | $7.2 trillion | Tax Cuts and Jobs Act, increased spending, COVID-19 pandemic |

6. The Broader Economic Context

Understanding the increase in the national debt under President Trump requires considering the broader economic context. Factors such as economic growth, inflation, and interest rates all play a role in shaping the fiscal landscape.

6.1. Economic Growth

Economic growth can help offset the impact of increased debt by increasing government revenue. During President Trump’s term, the U.S. economy experienced moderate growth, although it was disrupted by the COVID-19 pandemic. Prior to the pandemic, the economy was growing at a steady pace, which helped to mitigate some of the negative effects of increased debt.

6.2. Inflation

Inflation can also affect the national debt by eroding the real value of outstanding debt. Higher inflation rates can reduce the burden of debt over time, as the debt is repaid with dollars that are worth less. During President Trump’s term, inflation rates remained relatively low, which meant that the real value of the debt was not significantly eroded.

6.3. Interest Rates

Interest rates play a crucial role in determining the cost of servicing the national debt. Lower interest rates reduce the cost of borrowing, while higher interest rates increase it. During President Trump’s term, interest rates remained relatively low, which helped to keep the cost of servicing the debt manageable. However, rising interest rates in the future could significantly increase the cost of servicing the debt.

7. Expert Opinions and Analysis

Economists and policy experts have offered various perspectives on the increase in the national debt under President Trump. Some argue that the tax cuts and increased spending were necessary to stimulate economic growth, while others warn that they have created unsustainable fiscal imbalances.

7.1. Perspectives on Tax Cuts

Proponents of the Tax Cuts and Jobs Act of 2017 argued that it would boost economic growth by incentivizing businesses to invest and create jobs. They believed that the resulting increase in economic activity would generate enough additional tax revenue to offset the cost of the tax cuts. However, critics argued that the tax cuts were poorly targeted and disproportionately benefited wealthy individuals and corporations.

7.2. Perspectives on Increased Spending

Some experts supported increased government spending on defense and domestic programs, arguing that it was necessary to address critical needs and priorities. They believed that these investments would yield long-term benefits, such as improved infrastructure, enhanced national security, and increased economic opportunity. However, others cautioned that increased spending would lead to higher deficits and debt, potentially crowding out private investment and hindering long-term economic growth.

8. The Future of the National Debt

The future of the national debt is a topic of ongoing debate and concern. Without significant policy changes, the debt is projected to continue rising in the coming years, posing potential risks to the U.S. economy.

8.1. Long-Term Projections

The Congressional Budget Office (CBO) regularly publishes long-term budget projections that provide insights into the future trajectory of the national debt. These projections typically show that, under current law, the debt is projected to continue rising as a share of GDP. This is due to factors such as rising healthcare costs, an aging population, and the accumulation of interest on the debt.

8.2. Potential Risks

A high and rising national debt can pose several risks to the U.S. economy. These include:

- Increased interest rates: As the government borrows more money, it could put upward pressure on interest rates, making it more expensive for businesses and individuals to borrow and invest.

- Crowding out private investment: High levels of government borrowing could crowd out private investment, reducing the economy’s long-term growth potential.

- Fiscal instability: A high and rising national debt could make the U.S. more vulnerable to economic shocks and financial crises.

- Reduced fiscal flexibility: A large national debt could limit the government’s ability to respond to future economic challenges, such as recessions or pandemics.

8.3. Policy Options

Addressing the national debt will likely require a combination of policy changes, such as tax increases, spending cuts, and entitlement reforms. Finding a politically feasible and economically sound path forward will be a major challenge for policymakers in the years ahead.

9. How HOW.EDU.VN Can Help You Understand Complex Economic Issues

Navigating complex economic issues like the national debt can be challenging. HOW.EDU.VN provides expert insights and resources to help you understand these issues and make informed decisions. Our team of experienced professionals offers in-depth analysis, clear explanations, and personalized guidance to address your specific questions and concerns.

At HOW.EDU.VN, we understand that everyone’s financial situation is unique. That’s why we offer personalized consultations to help you develop a financial strategy tailored to your individual needs and goals. Whether you’re planning for retirement, saving for college, or simply trying to get a better handle on your finances, our experts are here to help.

9.1. Access to Expert Analysis

HOW.EDU.VN provides access to expert analysis and insights on a wide range of economic and financial topics. Our team of experienced economists and financial professionals stays up-to-date on the latest developments and trends, providing you with the information you need to make informed decisions.

9.2. Clear and Concise Explanations

We understand that economic issues can be complex and confusing. That’s why we strive to provide clear and concise explanations that are easy to understand. Whether you’re a seasoned investor or just starting to learn about finance, we can help you make sense of the complex world of economics.

9.3. Personalized Guidance

At HOW.EDU.VN, we offer personalized guidance to help you address your specific questions and concerns. Our experts are available to answer your questions, provide advice, and help you develop a financial strategy that meets your individual needs and goals.

10. Call to Action: Get Expert Guidance from HOW.EDU.VN

Understanding the complexities of the national debt and its implications requires expert guidance. Don’t navigate these challenges alone. Contact HOW.EDU.VN today and connect with our team of over 100 experienced Ph.D. experts who can provide the insights and advice you need.

Whether you’re seeking clarity on economic policies, financial planning assistance, or strategies for addressing specific financial challenges, HOW.EDU.VN is your trusted resource. Our experts are committed to providing you with the knowledge and support you need to make informed decisions and achieve your financial goals.

Contact us today to schedule a consultation and experience the benefits of working with leading experts in their fields.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: HOW.EDU.VN

Let HOW.EDU.VN empower you with the knowledge and expertise you need to navigate the complex world of economics and finance with confidence.

FAQ: Understanding the National Debt and Expert Consultation

1. What is the national debt?

The national debt is the total amount of money the U.S. federal government owes to creditors, including debt held by the public and debt held by government accounts.

2. How did the national debt change during President Trump’s term?

During President Trump’s term, the gross national debt increased from $19.95 trillion to $27.75 trillion, a $7.8 trillion increase.

3. What factors contributed to the increase in the national debt under Trump?

Key factors include the Tax Cuts and Jobs Act of 2017, increased government spending, and the economic impact of the COVID-19 pandemic.

4. How does the debt increase under Trump compare to previous administrations?

The debt increase under Trump was significant but comparable to increases under Presidents Obama and George W. Bush, each influenced by unique economic circumstances and policy decisions.

5. What are the potential risks of a high national debt?

Potential risks include increased interest rates, crowding out private investment, fiscal instability, and reduced fiscal flexibility.

6. How can HOW.EDU.VN help me understand economic issues?

HOW.EDU.VN offers expert analysis, clear explanations, and personalized guidance to help you understand complex economic issues and make informed decisions.

7. What types of consultations does HOW.EDU.VN offer?

HOW.EDU.VN offers consultations on various economic and financial topics, including economic policies, financial planning, and strategies for addressing specific financial challenges.

8. Who are the experts at HOW.EDU.VN?

HOW.EDU.VN has a team of over 100 experienced Ph.D. experts in various fields who provide insights and advice based on their extensive knowledge and expertise.

9. How do I schedule a consultation with HOW.EDU.VN?

You can schedule a consultation by contacting us via phone, WhatsApp, or through our website. Our team will help you find the right expert for your needs.

10. Why should I choose HOW.EDU.VN for expert consultation?

HOW.EDU.VN provides access to top-tier experts, personalized guidance, and clear explanations, empowering you to navigate complex economic and financial issues with confidence. We prioritize your unique needs and offer tailored solutions to help you achieve your financial goals. Trust how.edu.vn for reliable, expert advice.