Investment banking salaries and bonuses are topics of great interest, and at HOW.EDU.VN, we provide expert insights to help you understand the compensation landscape. While there was anticipation for substantial increases, total compensation only rose by 10-15% across most levels despite a global investment banking revenue increase of nearly 30%. Our team of financial experts offers in-depth analysis and personalized advice, providing clarity and strategic guidance to navigate this dynamic industry. Explore detailed breakdowns, regional variances, and future trends in investment banking compensation, and connect with our experienced advisors for customized solutions.

1. Understanding Investment Banker Compensation in 2025

The year 2024 brought much anticipation for a “return to form” in investment banking compensation, with optimistic expectations fueled by significant revenue increases. However, the reality was more tempered. While base salaries remained stable, and bonuses saw notable growth, the overall increase in total compensation was only about 10-15% across most positions. This was despite a global investment banking revenue increase of nearly 30%, and a 37% increase in the U.S. Here’s a detailed look at the typical compensation ranges for various roles in investment banking:

| Position Title | Typical Age Range | Base Salary (USD) | Total Compensation (USD) | Timeframe for Promotion |

|---|---|---|---|---|

| Analyst | 22-27 | $100-$125K | $160-$210K | 2-3 years |

| Associate | 25-35 | $175-$225K | $275-$475K | 3-4 years |

| Vice President (VP) | 28-40 | $250-$300K | $500-$700K | 3-4 years |

| Director / Senior Vice President (SVP) | 32-45 | $300-$350K | $600-$800K | 2-3 years |

| Managing Director (MD) | 35-50 | $400-$600K | $800-$1600K+ | N/A |

NOTE: These figures are pre-tax for front-office roles based in New York and include base salaries and year-end bonuses, but exclude signing/relocation bonuses and benefits. The ranges represent approximately the 25th to 75th percentile across large banks.

To truly understand the nuances of investment banking compensation and how it applies to your career goals, connect with the seasoned financial experts at HOW.EDU.VN. Our advisors provide tailored insights that can help you optimize your career path and financial planning in the investment banking sector. Reach out today to gain the clarity and strategic direction you need.

1.1. Factors Influencing Compensation Shortfall

Several factors contributed to why total compensation didn’t align with the higher revenue growth:

- Higher Base Salaries: Increased base salaries for Analysts and Associates, implemented in 2021-2022, meant that bonus increases had a smaller overall impact on total compensation.

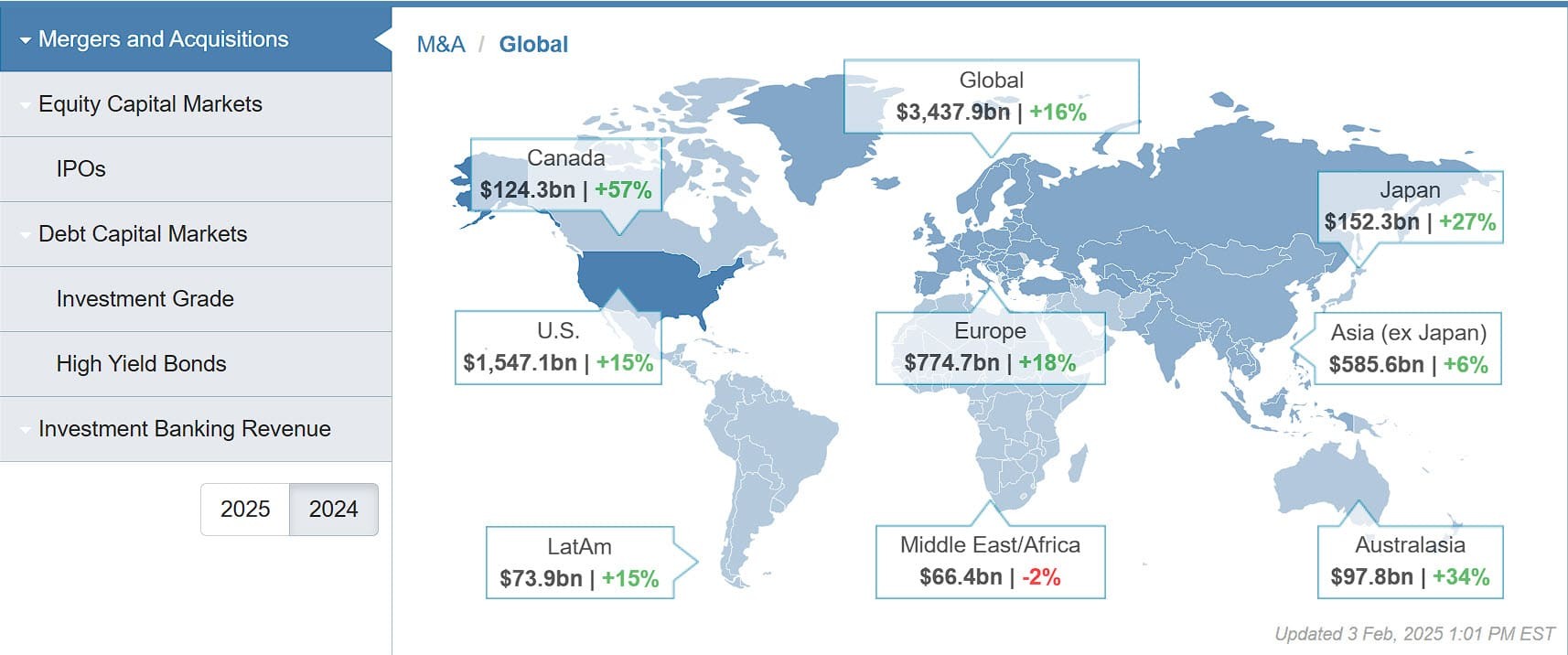

- Total IB vs. M&A Fees: While total investment banking revenue increased, M&A advisory revenue saw more modest growth. Capital markets activities, though helpful, typically have lower profit margins.

- Post-COVID Caution: After significant hiring and compensation boosts in 2020-2021, followed by market corrections, banks remained cautious about making drastic compensation changes.

- Limited Job Market Options: The competitive landscape in other sectors, such as Big Tech, changed, making it harder for finance professionals to find comparable high-paying jobs.

- Uncertainty Over Deal Activity: Despite optimism, lingering concerns about trade wars, antitrust scrutiny, and interest rate cuts added uncertainty.

These elements combined to create a complex compensation environment, underscoring the need for expert guidance to navigate the intricacies of the investment banking industry. At HOW.EDU.VN, our team of financial experts can provide the insights and advice you need to understand these trends and make informed decisions about your career.

M&A Advisory Revenue – 2025

M&A Advisory Revenue – 2025

1.2. The Revenue Composition Impacting Investment Banker Bonuses

The revenue composition significantly impacts investment banker bonuses. While total investment banking revenue saw a substantial increase, the distribution among different activities plays a crucial role in determining compensation. M&A advisory revenue, which typically commands higher margins, grew at a slower pace compared to equity capital markets (ECM) and debt capital markets (DCM). The increase in ECM and DCM activity is beneficial, but these areas generally have lower profitability due to higher overhead and fee-sharing among multiple groups. According to a study by Deloitte, firms that prioritize high-margin advisory services tend to offer higher bonuses compared to those heavily reliant on capital market transactions. Therefore, the specific mix of revenue streams influences the overall bonus pool available for distribution among investment banking professionals.

2. Salary and Bonus Trends in Investment Banking

The investment banking landscape is becoming increasingly diverse, with significant variations in compensation even among firms in the same category. This section explores specific trends and disparities in salary and bonus structures across different types of banks.

2.1. Variations Among Banks

In the past, elite boutiques typically offered higher bonuses and compensation ceilings, particularly for senior bankers. However, in 2025, there are significant differences in pay even among firms within the same category. For example, Lazard appears to pay less than other elite boutique banks but remains at or above the level of bulge bracket banks. A Year 1 Associate at Lazard might earn just over $300K in total compensation, comparable to some bulge bracket banks like Goldman Sachs and JP Morgan, but higher than Morgan Stanley and Bank of America.

Conversely, firms like PJT Partners offer total compensation that can reach as high as $400K for top-ranked Year 1 Associates. While most Associates won’t reach this top tier, many will earn significantly more than their counterparts at bulge bracket banks. Additionally, some Canadian banks, such as TD Cowen, are offering substantial bonuses to attract new talent, although the sustainability of this practice is uncertain.

According to a recent survey by Heidrick & Struggles, compensation disparities are driven by factors such as firm performance, deal size, and individual contributions, highlighting the importance of strategic career planning to maximize earning potential. Understanding these nuances is crucial for professionals looking to optimize their compensation. At HOW.EDU.VN, our experts provide detailed compensation benchmarking and personalized advice to help you navigate these variations and make informed career decisions.

2.2. The Rise of Deferred Compensation

Another notable trend is the increasing use of stock and deferred compensation. This can be concerning, particularly in light of events such as the UBS acquisition of Credit Suisse. The shift towards deferred compensation affects how and when bankers receive their earnings, adding an element of risk. Furthermore, there are inconsistencies in base salaries, with some firms like UBS paying slightly less to Analysts post-acquisition (e.g., $115K instead of $125K for Year 2 Analysts). Elite boutiques also appear to offer approximately $25K higher base salaries to Associates.

To better understand how deferred compensation affects your financial future and to develop strategies to mitigate potential risks, consult with the financial experts at HOW.EDU.VN. Our advisors offer comprehensive financial planning services tailored to the unique challenges and opportunities in the investment banking industry.

2.3. Compensation Components Breakdown

Understanding the components of investment banker compensation is essential for navigating your career and financial planning. Here’s a breakdown of the main elements:

- Base Salary: A fixed amount paid bi-weekly or monthly, providing a stable income. Base salaries are typically adjusted periodically, especially at the Analyst and Associate levels.

- Stub Bonus: Given to Associates who start mid-year after graduating from MBA programs, covering their initial months of employment. These bonuses tend to be consistent across banks and regions, typically around $35-$45K.

- End-of-Year Bonus: Earned after a full year of work, usually paid in cash for Analysts. As you advance, a percentage shifts to stock and deferred compensation (e.g., 10-20% deferred for Associates, 20-30% for VPs, and 30-50% for MDs).

- Signing/Relocation Bonus: Offered to Analysts and Associates upon accepting full-time positions, usually a small percentage of the base salary.

- Benefits: Include health insurance, vacation days, and participation in retirement plans such as 401(k). In Europe, more vacation days are common due to government-funded healthcare.

| Compensation Component | Description | Example |

|---|---|---|

| Base Salary | Fixed income paid regularly. | Analyst: $100K – $125K annually |

| Stub Bonus | Bonus for partial year employment. | Associate starting mid-year: $35K – $45K |

| End-of-Year Bonus | Annual performance-based bonus. | Analyst: 100% cash; Associate: 80% cash, 20% deferred; VP: 70% cash, 30% deferred; MD: 50% cash, 50% deferred |

| Signing/Relocation Bonus | One-time bonus for new hires. | Typically a small percentage of base salary. |

| Benefits | Health insurance, vacation, retirement plans. | Comprehensive health coverage, 20 days vacation, 401(k) matching. |

For personalized insights into how these compensation components apply to your specific situation and career level, connect with the expert advisors at HOW.EDU.VN. Our tailored guidance helps you understand and optimize your compensation package. Contact us today to learn more.

3. Investment Banker Salaries and Bonuses Across Different Levels

Compensation in investment banking varies significantly across different levels. This section provides a detailed overview of what Analysts, Associates, Vice Presidents, Directors, and Managing Directors can typically expect to earn.

3.1. Analyst Compensation

For Analysts starting in mid-2024, total compensation ranged from $160K to $210K. Second-year Analysts at elite boutiques likely earned above this range. Third-year Analyst compensation is similar to that of first-year Associates, as most banks now promote Analysts after two years. Taking $185K as the midpoint of the $160K – $210K range, this represents roughly a 12% increase over the previous year, aligning with the 10-20% increase in M&A fees.

3.2. Associate Compensation

Associate compensation varies widely, with significant disparities between firms. Bonuses at this level typically range from 65-80% of base salaries. The compensation becomes more dependent on deal activity as you progress from 1st to 3rd year.

3.3. Vice President (VP) Compensation

Data on VP-level compensation is less readily available and more variable. Some firms pay VPs similarly to Associates, while others, like PJT, offer higher compensation, such as $750K for 2nd year VPs.

3.4. Director Compensation

Director-level compensation also lacks comprehensive data, but it’s reasonable to assume approximately a 10% increase in total compensation, resulting in a range of $600K – $800K. Directors at elite boutiques may earn above this range, potentially reaching $1M or more.

3.5. Managing Director (MD) Compensation

Managing Directors (MDs) have the highest sensitivity to deal activity. When deal activity and fees increase, they benefit the most; conversely, they face the most significant impact when activity declines. In challenging years, some MDs may receive $0 bonuses. Junior MDs typically earn around $1M in total compensation, with higher compensation for more senior MDs, such as Group Heads. A significant portion (30%+) of MD bonuses is often deferred or paid in stock.

To gain a deeper understanding of the compensation expectations at your career level and to strategically plan for advancement, consult with the expert advisors at HOW.EDU.VN. Our personalized guidance can help you navigate the complexities of investment banking compensation.

4. Investment Banker Regional Salary Variations: London

Regional differences significantly impact investment banker salaries. While New York is often the benchmark, London presents a different landscape.

4.1. London Compensation Overview

Recent reports indicate that base salaries for Analysts in London range from £70K to £90K GBP, with a median bonus of £40K GBP. This translates to a total compensation range of approximately $135K to $160K USD, which seems low compared to New York standards. However, these figures may understate the bonus amounts. A more realistic estimate for total compensation in London is between $135K and $180K USD, representing a 15% discount compared to New York. This discount typically persists as you move up the career ladder.

According to a study by McLellan Financial Recruitment, London-based investment bankers often face higher living costs, which can offset some of the compensation advantages. Therefore, understanding the regional nuances is essential for making informed career decisions.

4.2. Factors Affecting London Pay

The compensation discount in London is influenced by several factors:

- Cost of Living: London has a high cost of living, though this can fluctuate.

- Taxation: The UK has different tax laws compared to the U.S., which can affect net income.

- Market Conditions: The competitiveness and health of the London financial market can impact compensation levels.

- Currency Exchange Rates: Fluctuations in exchange rates between the GBP and USD can affect the perceived value of compensation.

| Factor | Impact on London Compensation |

|---|---|

| Cost of Living | Higher living costs can reduce the real value of compensation. |

| Taxation | Different tax laws affect net income. |

| Market Conditions | A strong market can increase compensation, while a weak market can decrease it. |

| Currency Exchange Rates | Fluctuations between GBP and USD can change the perceived value of compensation. |

For a detailed analysis of how these regional factors may impact your earning potential, consult with the financial experts at HOW.EDU.VN. Our advisors provide personalized insights that can help you make informed decisions about your career and financial planning in different regions. Contact us today to learn more.

5. Future of Investment Banker Salaries and Bonuses

Predicting the future of investment banker salaries and bonuses involves considering numerous economic and market factors.

5.1. Market Predictions

Last year, there was a prediction of increased deal activity and a 10-15% increase in bonuses. While bonuses did increase by more than that, total compensation only rose by 10-15% across most levels. This year, predictions are more conservative due to uncertainties surrounding trade, interest rates, inflation, and geopolitical events. Total compensation could vary by +10% to -10%, but the direction is unclear.

5.2. Long-Term Career Considerations

Elite boutiques are becoming increasingly attractive compared to bulge bracket banks. Earning potential is higher, the work is more interesting, and exit opportunities remain strong. While starting as an Analyst at a bulge bracket bank may offer advantages in terms of brand recognition and networking, elite boutiques are more compelling at the Associate level and above. Building a client base at an elite boutique can be challenging for those aiming to become Managing Directors, but job mobility is common at the MD level.

A report by Johnson Associates suggests that firms that adapt to changing market conditions and prioritize employee development are more likely to sustain high compensation levels. Therefore, choosing the right firm and continuously developing your skills are crucial for long-term career success.

5.3. A Word of Caution

It’s important to have realistic expectations about an investment banking career. Even at the MD level, the job is demanding, and “coasting” is unlikely unless you are exceptionally talented, lucky, or very senior. MDs face constant pressure to generate fees, resulting in high turnover. Career longevity can also be an issue; if a junior MD can bring in the same deal volume for less, the bank may opt for the more cost-effective option.

While some bankers remain in the role for decades and become wealthy, others experience burnout or transition to corporate roles. Lifestyle creep can exacerbate these challenges. Unless bonus structures from 2021 return or banks accelerate promotion schedules, these trends are likely to persist.

To prepare for the challenges and opportunities in your investment banking career, connect with the expert advisors at HOW.EDU.VN. Our personalized guidance helps you navigate the industry, make informed decisions, and achieve your long-term career and financial goals.

6. How HOW.EDU.VN Can Help You

Navigating the complex world of investment banking compensation requires expert guidance and personalized advice. HOW.EDU.VN offers a unique platform connecting you with seasoned PhD-level experts who can provide the insights you need to make informed career and financial decisions.

6.1. Benefits of Consulting with Our Experts

- Expertise: Gain access to PhD-level consultants with years of experience in finance and investment banking.

- Personalized Advice: Receive tailored guidance based on your specific career level, goals, and financial situation.

- Comprehensive Analysis: Understand the nuances of compensation structures, regional variations, and future market trends.

- Strategic Planning: Develop strategies to maximize your earning potential and navigate the challenges of the industry.

| Benefit | Description |

|---|---|

| PhD-Level Expertise | Consultants with advanced degrees and extensive industry experience. |

| Tailored Guidance | Personalized advice based on your unique career and financial situation. |

| In-Depth Analysis | Comprehensive understanding of compensation structures, regional variations, and market trends. |

| Strategic Career Plan | Actionable strategies to maximize earning potential and navigate industry challenges. |

6.2. How to Get Started

- Visit HOW.EDU.VN: Explore our website to learn more about our services and expert consultants.

- Connect with an Expert: Choose a consultant whose expertise aligns with your specific needs.

- Schedule a Consultation: Discuss your career goals, financial situation, and compensation concerns.

- Receive Personalized Advice: Gain actionable insights and strategies to optimize your investment banking career.

Don’t navigate the complexities of investment banking compensation alone. Contact HOW.EDU.VN today and unlock the expertise you need to succeed.

Are you struggling to find expert advice tailored to your unique challenges? Are you tired of spending endless hours searching for reliable information? At HOW.EDU.VN, we connect you directly with world-class PhDs ready to provide personalized solutions.

7. FAQs: Understanding Investment Banker Compensation

7.1. What is the typical starting salary for an investment banking analyst?

The typical starting salary for an investment banking analyst ranges from $100,000 to $125,000, with total compensation (including bonuses) ranging from $160,000 to $210,000.

7.2. How much do investment banking associates earn?

Investment banking associates can earn base salaries ranging from $175,000 to $225,000, with total compensation ranging from $275,000 to $475,000, depending on the firm and performance.

7.3. What factors influence investment banker bonuses?

Investment banker bonuses are influenced by firm performance, deal activity, individual contributions, and the overall economic climate.

7.4. Are there significant regional differences in investment banking salaries?

Yes, there are regional differences. For example, London-based analysts may earn 15% less than their New York counterparts.

7.5. How does deferred compensation affect investment banker earnings?

Deferred compensation, paid in stock or other forms, can impact the timing and security of earnings, particularly in the event of firm acquisitions or market downturns.

7.6. What are the key components of an investment banker’s compensation package?

The key components include base salary, stub bonus, end-of-year bonus, signing/relocation bonus, and benefits (health insurance, retirement plans).

7.7. How do elite boutique banks compare to bulge bracket banks in terms of compensation?

Elite boutique banks often offer higher earning potential, particularly at the associate level and above, with more interesting work and strong exit opportunities.

7.8. What is the role of a managing director, and how does their compensation differ?

Managing directors are responsible for generating fees and face high-pressure environments. Their compensation is highly sensitive to deal activity and can fluctuate significantly.

7.9. Is investment banking a stable career with long-term earning potential?

While investment banking can offer high earning potential, it is also a demanding career with high turnover and potential for burnout.

7.10. How can I maximize my earning potential in investment banking?

To maximize earning potential, focus on continuous skill development, strategic career planning, and choosing the right firm that aligns with your goals.

Ready to take your career to the next level? Contact HOW.EDU.VN today for expert guidance and personalized solutions.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

Whatsapp: +1 (310) 555-1212

Website: HOW.EDU.VN

Don’t let your challenges hold you back. Connect with our team of PhDs at how.edu.vn and unlock the expertise you need to thrive.