Are you wondering how much checks cost and where to find the best deals? The cost of checks can vary significantly depending on where you order them, but HOW.EDU.VN is here to help you navigate the options and find affordable solutions. By comparing prices from different vendors, understanding the types of checks available, and considering security features, you can save money while ensuring the safety of your financial information. Explore options for ordering personal checks, business checks, and secure check printing with us.

1. Understanding the Cost of Checks

The price of checks can vary widely based on where you purchase them. Banks, online retailers, and third-party check printers all offer different pricing structures. Understanding these differences can help you make an informed decision and save money.

1.1. Factors Influencing Check Costs

Several factors influence the cost of checks:

- Type of Check: Single checks are generally cheaper than duplicate checks.

- Quantity: Ordering in bulk often reduces the per-check cost.

- Design and Security Features: Basic designs are more affordable, while custom designs and enhanced security features increase the price.

- Vendor: Banks tend to be more expensive than online retailers.

- Shipping Costs: Expedited shipping can add to the overall cost.

1.2. Average Costs of Single Checks

Single checks are the standard type of check. Here’s a comparison of costs from various vendors:

| Company | Number of Checks in One Box | Cost, 2 Boxes | Cost Per Check |

|---|---|---|---|

| Sam’s Club | 240 | $17.38 | $0.04 |

| Checks.com | 80 | $11.90 | $0.07 |

| Costco | 125 | $20.22 | $0.08 |

| Promise Checks | 100 | $15.90 | $0.08 |

| Walmart | 240 | $19.62 | $0.08 |

| Vistaprint | 150 | $24.00 | $0.08 |

| Checks in the Mail | 100 | $38.25 | $0.19 |

| Checks Unlimited | 80 | $29.98 | $0.19 |

| Chase Bank | 80 | $40.00 | $0.25 |

1.3. Average Costs of Duplicate Checks

Duplicate checks create a carbon copy as you write them, providing a record of each transaction. Here’s a cost comparison:

| Company | Number of Checks in One Box | Cost, 2 Boxes | Cost Per Check |

|---|---|---|---|

| Sam’s Club | 165 | $18.85 | $0.06 |

| Checks.com | 80 | $13.90 | $0.09 |

| Walmart | 120 | $22.56 | $0.09 |

| Costco | 100 | $20.70 | $0.10 |

| Vistaprint | 150 | $30.00 | $0.10 |

| Promise Checks | 80 | $21.90 | $0.14 |

| Checks in the Mail | 100 | $44.65 | $0.22 |

| Checks Unlimited | 80 | $39.98 | $0.25 |

| Chase Bank | 80 | $48.00 | $0.30 |

1.4. Banks vs. Third-Party Check Printers

Banks often source their checks from third-party printers like Deluxe or Harland Clarke. Ordering directly from these printers or other online retailers can be significantly cheaper than ordering through your bank. You’re essentially cutting out the middleman.

2. Where to Buy Checks: Options and Considerations

When ordering checks, you have several options. Each has its own advantages and disadvantages, so it’s important to consider what best suits your needs.

2.1. Ordering Checks Through Your Bank

Ordering checks directly through your bank is convenient, but it’s often the most expensive option. Banks typically mark up the price of checks to generate additional revenue.

Pros:

- Convenience: Easy to order through your existing banking relationship.

- Familiarity: No need to research new vendors.

Cons:

- Higher Cost: Typically more expensive than other options.

- Limited Customization: Fewer design choices compared to online printers.

2.2. Online Check Printers

Online check printers offer a wide variety of designs and competitive prices. These companies often provide discounts and promotional codes, making them an attractive option.

Pros:

- Lower Cost: Generally cheaper than ordering through your bank.

- Wide Selection: Extensive range of designs and customization options.

- Promotional Offers: Frequent discounts and free shipping deals.

Cons:

- Security Concerns: Requires sharing sensitive banking information with a third party.

- Shipping Times: May take longer to receive your checks compared to ordering through your bank.

2.3. Retailers and Buying Clubs

Retailers like Walmart and buying clubs like Sam’s Club also offer check printing services. These options can be among the most affordable, especially if you’re already a member.

Pros:

- Very Low Cost: Often the cheapest option available.

- Convenience: Can be ordered while shopping for other items.

Cons:

- Limited Selection: Fewer design options compared to online printers.

- Membership Required: Buying clubs require a membership fee.

3. How to Find Cheap Personal Checks

Finding cheap personal checks involves a bit of research and comparison shopping. Here are some strategies to help you save money.

3.1. Check if Your Bank Offers Free Checks

Some banks offer free standard checks to account holders, especially for premium accounts or as a promotional offer. Ally Bank and Navy Federal Credit Union are examples of institutions that sometimes provide free checks.

3.2. Look Online for Deals and Promo Codes

Websites like CouponCabin and RetailMeNot often list deals and promo codes for online check printers. Searching for these discounts can significantly reduce the cost of your order.

3.3. Order Checks in Bulk

The price per check is usually lower when you order a larger quantity. Consider ordering a two-year supply to take advantage of bulk discounts.

3.4. Choose Basic Designs

Basic, standard designs are typically cheaper than multicolored or custom designs. Opting for a simple design can save you money without sacrificing functionality.

3.5. Select Economy Shipping

If you don’t need your checks urgently, choose the slowest shipping option. Expedited shipping can add a significant amount to your total cost.

4. Security Features to Consider

While saving money is important, security should be your top priority when ordering checks. Checks are vulnerable to fraud, so it’s essential to choose checks with adequate security features.

4.1. Microprint Signature Line

A microprint signature line makes it difficult for fraudsters to photocopy or alter the check. The fine print is often illegible to the naked eye but becomes visible upon close inspection.

4.2. Security Warning Border

A security warning border alerts recipients to the security features of the check, deterring potential fraudsters.

4.3. Chemical Protection Paper

Chemical protection paper prevents alteration by chemical means. If someone tries to alter the check using chemicals, the paper will stain or change color.

4.4. Watermarks

Watermarks are visible when the check is held up to the light and cannot be easily duplicated. They add an extra layer of security against counterfeiting.

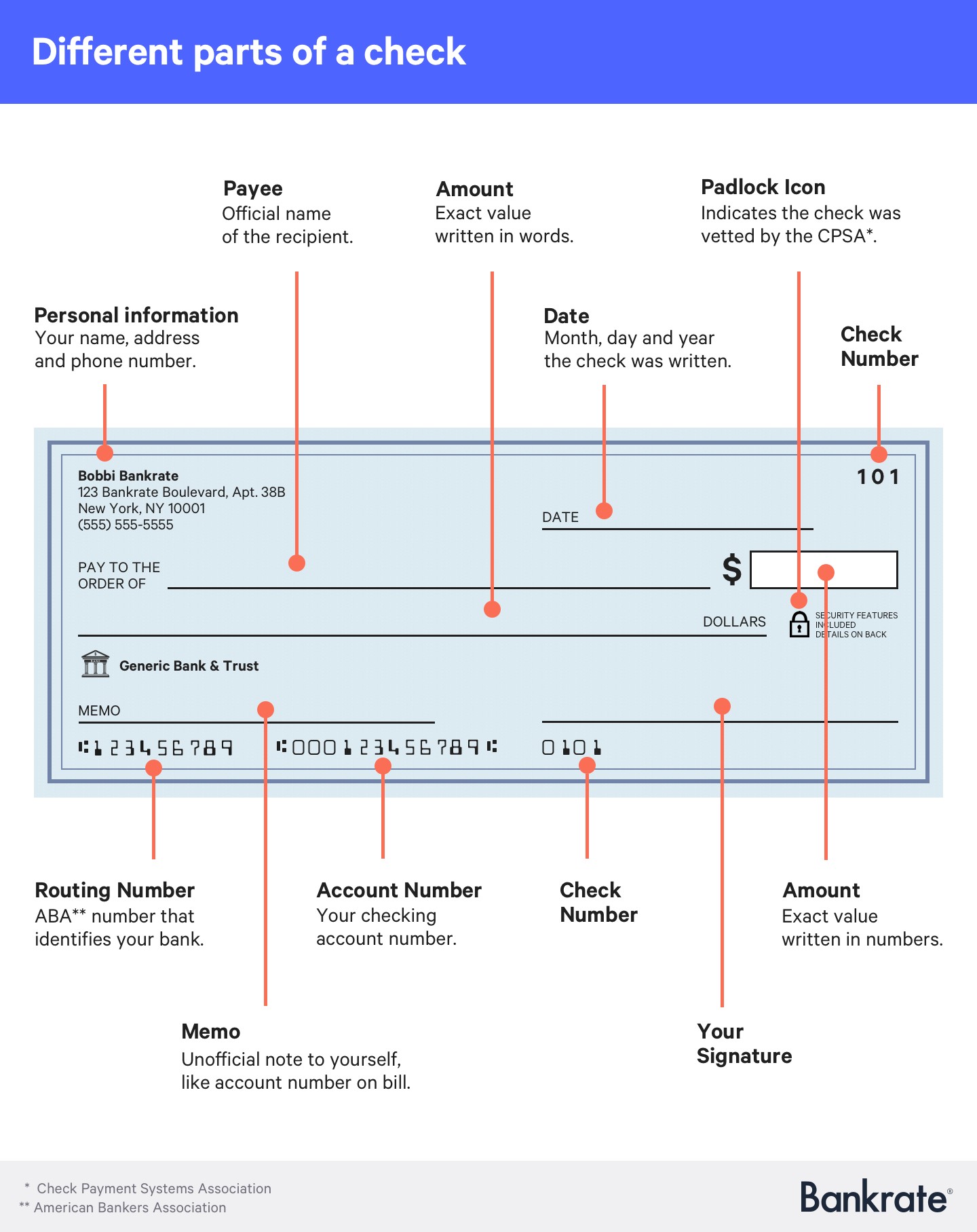

4.5. Padlock Icon

The padlock icon indicates that the check and the printer have been vetted by the Check Payment Systems Association (CPSA). This ensures that the checks meet minimum security standards.

4.6. Check Payment Systems Association (CPSA)

The CPSA is a nonprofit trade association that promotes check security. Their website provides a list of authorized printers who meet their security standards.

5. What You Need to Order Checks

To order checks, you’ll need the following information:

- Checking Account Number: This is the unique identifier for your bank account.

- Bank Routing Number: This number identifies your bank.

- Check Number: This indicates the starting number for your new checks.

- Personal Information: Your name and address.

You can find this information on one of your old checks or by contacting your bank.

6. Understanding Check Fraud

Check fraud is a serious issue, and it’s essential to take precautions to protect yourself. Here are some common types of check fraud:

- Check Washing: Altering the payee or amount on a check.

- Counterfeiting: Creating fake checks using your account information.

- Forgery: Signing someone else’s name on a check.

6.1. How to Protect Yourself from Check Fraud

- Use Secure Checks: Choose checks with security features like microprint, watermarks, and chemical protection paper.

- Monitor Your Accounts: Regularly review your bank statements for unauthorized transactions.

- Shred Voided Checks: Properly dispose of voided checks to prevent them from being used fraudulently.

- Report Suspicious Activity: Immediately report any suspicious activity to your bank.

7. Alternatives to Paper Checks

As technology evolves, there are several alternatives to traditional paper checks. These options offer greater convenience and security.

7.1. Online Bill Payment

Online bill payment allows you to pay your bills electronically through your bank’s website or mobile app. This eliminates the need to write and mail checks.

7.2. Mobile Wallets

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay allow you to make payments using your smartphone. These services use encryption and tokenization to protect your financial information.

7.3. Electronic Funds Transfers (EFTs)

EFTs are electronic transfers of money from one bank account to another. They are commonly used for recurring payments like rent and utilities.

8. Business Checks vs. Personal Checks

Business checks and personal checks serve different purposes and have distinct features. Understanding the differences can help you choose the right type of check for your needs.

8.1. Key Differences

- Purpose: Business checks are used for business transactions, while personal checks are used for personal expenses.

- Information: Business checks often include the company name, logo, and address.

- Security: Business checks may have additional security features to protect against fraud.

- Size and Format: Business checks come in different sizes and formats than personal checks.

8.2. Types of Business Checks

- Standard Business Checks: Used for general business transactions.

- Payroll Checks: Used to pay employees.

- Accounts Payable Checks: Used to pay vendors and suppliers.

9. The Future of Checks

While the use of paper checks has declined in recent years, they still play a role in the financial system. As technology continues to advance, checks may evolve further.

9.1. Remote Deposit Capture (RDC)

RDC allows you to deposit checks remotely by scanning them with a smartphone or scanner. This technology makes it easier and more convenient to deposit checks.

9.2. Image Replacement Documents (IRDs)

IRDs are digital images of checks that can be used in place of the original paper checks. This technology streamlines the check clearing process.

10. Seeking Expert Financial Advice

Navigating the world of personal finance can be complex. Seeking advice from financial experts can help you make informed decisions about your money.

10.1. Benefits of Consulting Financial Experts

- Personalized Advice: Tailored guidance based on your specific financial situation.

- Expert Knowledge: Access to in-depth knowledge of financial products and strategies.

- Objective Perspective: Unbiased advice to help you achieve your financial goals.

- Financial Planning: Assistance with budgeting, saving, and investing.

10.2. How HOW.EDU.VN Can Help

At HOW.EDU.VN, we connect you with leading experts in various fields, including finance. Our team of experienced financial advisors can provide personalized guidance to help you manage your money effectively. Whether you need help with budgeting, investing, or financial planning, we’re here to support you.

11. Understanding Check Terminology

Familiarizing yourself with common check-related terms can help you better understand the process and avoid potential issues.

11.1. Key Terms

- Account Number: The unique number that identifies your bank account.

- Routing Number: The nine-digit number that identifies your bank.

- Payee: The person or entity to whom the check is made payable.

- Payer: The person or entity who is writing the check.

- MICR Line: The Magnetic Ink Character Recognition line at the bottom of the check that contains the account number, routing number, and check number.

- Void: To invalidate a check by writing “VOID” across it.

12. Ordering Checks Online: A Step-by-Step Guide

Ordering checks online can be a straightforward process if you follow these steps:

12.1. Research and Compare Vendors

Start by researching different online check printers. Compare prices, designs, security features, and customer reviews.

12.2. Choose a Design

Select a design that meets your needs and preferences. Consider basic designs for cost savings or custom designs for a more personalized touch.

12.3. Enter Your Account Information

Provide your checking account number, bank routing number, and starting check number. Double-check this information for accuracy.

12.4. Review Security Features

Select the security features you want to include on your checks, such as microprint, watermarks, and chemical protection paper.

12.5. Place Your Order

Review your order carefully and place it. Choose your preferred shipping method and payment option.

12.6. Confirm Your Order

You will typically receive an email confirmation with your order details and estimated delivery date.

13. The Impact of Technology on Check Usage

Technology has significantly impacted the use of paper checks, with more consumers and businesses opting for electronic payment methods.

13.1. Decline in Check Usage

The use of paper checks has been declining steadily over the past few decades as electronic payment methods have become more popular.

13.2. Rise of Electronic Payments

Electronic payment methods such as credit cards, debit cards, online bill payment, and mobile wallets have become increasingly popular due to their convenience and security.

13.3. Future Trends

As technology continues to evolve, the use of paper checks may continue to decline. However, checks are likely to remain a viable payment option for certain situations.

14. Addressing Common Concerns About Check Security

Many people have concerns about the security of paper checks. Addressing these concerns can help you make informed decisions about using checks.

14.1. Common Concerns

- Check Fraud: The risk of someone altering or counterfeiting your checks.

- Identity Theft: The risk of someone stealing your personal information from your checks.

- Lost or Stolen Checks: The risk of your checks being lost or stolen in the mail.

14.2. How to Mitigate Risks

- Use Secure Checks: Choose checks with security features to deter fraud.

- Monitor Your Accounts: Regularly review your bank statements for suspicious activity.

- Protect Your Personal Information: Keep your checks in a safe place and avoid sharing your account information.

- Report Lost or Stolen Checks: Immediately report any lost or stolen checks to your bank.

15. Comparing Check Prices: A Real-World Example

Let’s look at a real-world example to illustrate the cost differences between ordering checks through your bank and ordering them online.

15.1. Scenario

John needs to order 200 single checks. He checks with his bank, which offers checks for $0.25 each, totaling $50. He then researches online check printers and finds a vendor offering checks for $0.08 each, totaling $16.

15.2. Cost Savings

By ordering checks online, John saves $34 compared to ordering through his bank. This example highlights the potential cost savings of shopping around for the best deals.

16. How to Void a Check Properly

Voiding a check properly is essential to prevent it from being used fraudulently. Here’s how to do it:

16.1. Steps to Void a Check

- Write “VOID” in large letters across the front of the check.

- Use a pen with permanent ink to prevent alteration.

- Make sure the word “VOID” covers the payee, amount, date, and signature line.

- Keep the voided check for your records.

16.2. Why Voiding is Important

Voiding a check prevents it from being used for payment. This is important when you need to cancel a check or provide a sample check for direct deposit.

17. Conclusion: Making Informed Decisions About Check Costs

Understanding the cost of checks and the factors that influence pricing can help you make informed decisions and save money. By comparing prices, choosing basic designs, and taking advantage of discounts, you can find affordable checks that meet your needs. Remember to prioritize security and take precautions to protect yourself from check fraud.

At HOW.EDU.VN, we are committed to providing you with expert guidance and resources to help you manage your finances effectively. Whether you need advice on ordering checks, budgeting, or investing, our team of experienced professionals is here to support you.

18. Call to Action

Do you have questions about managing your finances or finding the best deals on checks? Contact our team of expert advisors at HOW.EDU.VN today for personalized guidance. We can help you navigate the complexities of personal finance and achieve your financial goals.

Contact Information:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Let HOW.EDU.VN connect you with the expertise you need to make informed decisions and secure your financial future. Our team of over 100 distinguished PhDs is ready to assist you with personalized advice and solutions.

19. Frequently Asked Questions (FAQs)

19.1. How much does it cost to order checks from my bank?

The cost of ordering checks from your bank can vary widely, but it is typically more expensive than ordering from online check printers or retailers. Prices can range from $0.25 to $0.50 per check.

19.2. Where can I find the cheapest checks online?

Retailers like Walmart and buying clubs like Sam’s Club often offer the cheapest checks online. Additionally, online check printers frequently have promotional deals and discounts.

19.3. What information do I need to order checks?

To order checks, you will need your checking account number, bank routing number, and starting check number. You will also need to provide your name and address.

19.4. Are online check printers safe?

Most online check printers are safe, but it’s important to do your research and choose a reputable company. Look for security features like the padlock icon and check the company’s reputation with the Better Business Bureau (BBB).

19.5. What are the different types of checks I can order?

You can order single checks, duplicate checks, business checks, and personal checks. Single checks are the standard type, while duplicate checks create a carbon copy as you write them.

19.6. What security features should I look for when ordering checks?

Security features to look for include microprint signature lines, security warning borders, chemical protection paper, watermarks, and the padlock icon.

19.7. Can I get free checks from my bank?

Some banks offer free standard checks to account holders, especially for premium accounts or as a promotional offer. Check with your bank to see if they offer free checks.

19.8. How can I protect myself from check fraud?

To protect yourself from check fraud, use secure checks, monitor your accounts regularly, shred voided checks, and report any suspicious activity to your bank immediately.

19.9. What are the alternatives to paper checks?

Alternatives to paper checks include online bill payment, mobile wallets, and electronic funds transfers (EFTs).

19.10. How do I void a check properly?

To void a check properly, write “VOID” in large letters across the front of the check, covering the payee, amount, date, and signature line. Use a pen with permanent ink to prevent alteration.

Disclaimer: This article provides general information about the cost of checks and related topics. For personalized financial advice, consult with a qualified financial advisor at how.edu.vn.