Are you wondering How Much Do Community Colleges Cost and how to finance your education? At HOW.EDU.VN, we provide expert guidance to navigate the financial aspects of community college, offering solutions for budget-conscious students. Discover the average cost of community college, tuition fees, financial aid options, and cost-saving strategies, ensuring you make informed decisions about your academic future with valuable insights. Let HOW.EDU.VN’s team of over 100 PhDs assist you with the total cost of attendance, in-state tuition, and out-of-state tuition.

1. Understanding the Basics: What is the Cost of Community College?

The cost of community college varies depending on several factors. It’s important to break down the different elements to get a clear picture of what you can expect to pay.

1.1. Average Tuition Fees

What is the average cost of community college tuition? Nationally, the average cost of community college tuition is around $3,780 per year for in-district students. However, this number can vary significantly from state to state. For example, California has some of the lowest community college tuition rates, while other states may have much higher costs.

1.2. In-State vs. Out-of-State Tuition

What is the difference between in-state and out-of-state tuition for community colleges? A major factor affecting the cost is whether you are an in-state or out-of-state student. Out-of-state tuition is generally much higher, averaging around $8,990 per year. This difference can make a significant impact on your overall expenses.

1.3. Additional Fees and Expenses

What other expenses should you consider when calculating the cost of community college? Tuition isn’t the only expense. You also need to factor in fees, books, supplies, and living expenses. These additional costs can add up quickly, so it’s essential to create a detailed budget.

2. Factors Influencing Community College Costs

The cost of community college can be influenced by a variety of factors, from location to the type of program you choose.

2.1. Location, Location, Location

How does location affect the cost of community college? The state in which you attend community college plays a significant role in determining tuition costs. States with higher costs of living tend to have higher tuition rates.

2.2. Program of Study

Do different programs of study affect community college costs? Some programs, especially those in fields like healthcare or technology, may have additional fees for specialized equipment or materials. Always check the specific costs associated with your chosen program.

2.3. Full-Time vs. Part-Time Enrollment

How does enrollment status impact the cost of community college? Whether you attend full-time or part-time can also affect your costs. Full-time students may pay a flat tuition rate, while part-time students are often charged per credit hour.

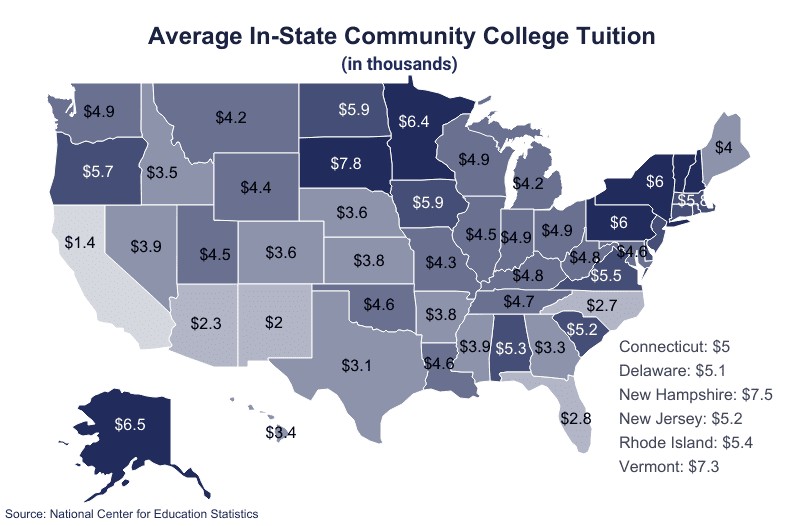

3. Breaking Down Community College Costs by State

Understanding the costs in your specific state is crucial. Let’s look at some examples to illustrate the variations.

3.1. States with Low Tuition Costs

Which states offer the most affordable community college tuition? California is known for its low community college tuition, with an average cost of around $1,350 per year for in-state students. Other states like New Mexico and Arizona also offer relatively affordable options.

3.2. States with High Tuition Costs

Which states have the highest community college tuition rates? On the other end of the spectrum, states like Vermont and New Hampshire have some of the highest community college tuition rates, often exceeding $7,000 per year.

3.3. Comparing Regional Differences

How do community college costs vary by region? Regional differences can be significant. For instance, community colleges in the South and Midwest tend to be more affordable than those in the Northeast and West Coast.

4. A Detailed Look at Community College Expenses

To fully understand the financial commitment, let’s delve into the different types of expenses you might encounter.

4.1. Tuition and Mandatory Fees

What do tuition and mandatory fees cover at community colleges? Tuition covers the cost of instruction, while mandatory fees may include charges for technology, student activities, and campus services.

4.2. Books and Supplies

How much should you budget for books and supplies at community college? Books and supplies can be a significant expense, often costing several hundred dollars per semester. Consider buying used textbooks or renting them to save money.

4.3. Room and Board

What are the housing options and costs for community college students? Some community colleges offer on-campus housing, while others primarily serve commuter students. If you live on campus, factor in room and board costs. If you live off-campus, consider rent, utilities, and transportation.

4.4. Transportation Costs

How do transportation costs affect the overall cost of community college? Transportation costs can vary widely depending on whether you drive, take public transportation, or live close enough to walk or bike to campus.

5. Financial Aid Options for Community College Students

Navigating financial aid can be overwhelming, but there are numerous resources available to help you finance your education.

5.1. Federal Student Aid (FAFSA)

What is FAFSA and how does it help community college students? The Free Application for Federal Student Aid (FAFSA) is the first step in applying for federal financial aid, including grants, loans, and work-study opportunities.

5.2. Pell Grants

Who is eligible for Pell Grants and how can they help with community college costs? Pell Grants are need-based grants that do not need to be repaid. They are a significant source of funding for many community college students.

5.3. State Grants and Scholarships

What types of state-level financial aid are available for community college students? Many states offer grants and scholarships to help students afford community college. Check with your state’s higher education agency for more information.

5.4. Institutional Aid

Do community colleges offer their own financial aid programs? Some community colleges offer their own grants and scholarships. Check with the financial aid office at your school for details.

5.5. Scholarships from Private Organizations

What private scholarships are available for community college students? Numerous private organizations offer scholarships to community college students. Websites like Scholarship America and Sallie Mae can help you find opportunities.

6. Strategies to Save Money on Community College

There are several strategies you can use to reduce the cost of community college.

6.1. Dual Enrollment Programs

What are dual enrollment programs and how can they lower community college costs? Dual enrollment programs allow high school students to take college courses for credit, often at a reduced cost or even for free.

6.2. CLEP Exams

How can CLEP exams help you save money on community college tuition? CLEP (College-Level Examination Program) exams allow you to earn college credit by demonstrating knowledge in certain subjects, potentially reducing the number of courses you need to take.

6.3. Open Educational Resources (OER)

What are OER and how can they help reduce the cost of textbooks? Open Educational Resources (OER) are free, openly licensed educational materials that can replace expensive textbooks.

6.4. Living at Home

How does living at home affect the cost of community college? Living at home can significantly reduce your expenses by eliminating room and board costs.

6.5. Working Part-Time

How can working part-time help offset the cost of community college? Working part-time can help you cover some of your expenses, but be sure to balance work with your studies.

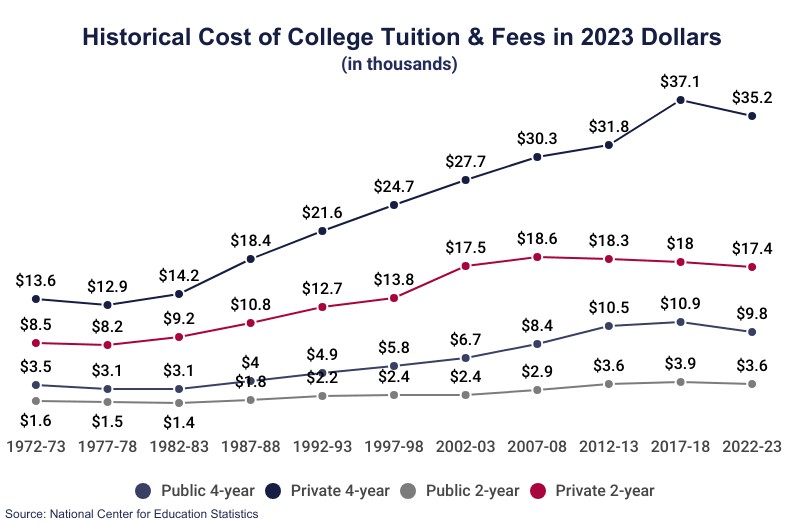

7. Community College vs. Four-Year University: A Cost Comparison

Understanding the cost differences between community colleges and four-year universities can help you make an informed decision.

7.1. Tuition Comparison

How does community college tuition compare to the cost of a four-year university? Community colleges typically have much lower tuition rates than four-year universities.

7.2. Overall Cost of Attendance

What is the total cost difference between attending a community college and a four-year university? The overall cost of attendance, including tuition, fees, room and board, and other expenses, is generally much lower at community colleges.

7.3. Long-Term Financial Benefits

What are the potential long-term financial benefits of starting at a community college? Starting at a community college can save you money on tuition and allow you to explore different academic paths before committing to a four-year university.

8. The Value of Community College Education

Despite the lower cost, community colleges offer significant value.

8.1. Career Training Programs

What types of career training programs are offered at community colleges? Community colleges offer a variety of career training programs that can prepare you for immediate employment in fields like healthcare, technology, and skilled trades.

8.2. Transfer Opportunities

What are the transfer opportunities available to community college students? Many community colleges have transfer agreements with four-year universities, making it easier to transfer credits and continue your education.

8.3. Smaller Class Sizes

How do smaller class sizes at community colleges benefit students? Community colleges often have smaller class sizes, allowing for more personalized attention from instructors.

8.4. Flexible Scheduling

What flexible scheduling options are available at community colleges? Community colleges often offer flexible scheduling options, including evening and weekend classes, to accommodate students with work or family responsibilities.

9. Case Studies: Real-Life Examples of Community College Costs

Let’s look at some real-life examples to illustrate the financial impact of attending community college.

9.1. Student A: In-State Student Living at Home

How much does it cost for an in-state student to attend community college while living at home? Student A attends a community college in California and lives at home with their parents. Their tuition is $1,350 per year, and they spend about $500 on books and supplies. Their total cost of attendance is $1,850 per year.

9.2. Student B: Out-of-State Student Living on Campus

What are the costs for an out-of-state student living on campus at a community college? Student B attends a community college in Vermont and lives on campus. Their tuition is $14,320 per year, and their room and board cost $10,000. They also spend $800 on books and supplies. Their total cost of attendance is $25,120 per year.

9.3. Student C: In-State Student Working Part-Time

How does working part-time affect the cost of community college for an in-state student? Student C attends a community college in Texas and works part-time to help cover expenses. Their tuition is $3,080 per year, and they earn $5,000 from their part-time job. After deducting their earnings, their net cost of attendance is significantly reduced.

10. Planning for the Future: Long-Term Financial Implications

Consider the long-term financial implications of your education choices.

10.1. Earning Potential with an Associate’s Degree

What is the earning potential with an associate’s degree from a community college? An associate’s degree can increase your earning potential compared to a high school diploma.

10.2. Return on Investment (ROI) of Community College Education

What is the ROI of investing in a community college education? The Return on Investment (ROI) of community college education is often high, especially when considering the lower cost compared to a four-year university.

10.3. Impact on Future Career Opportunities

How does a community college education impact future career opportunities? A community college education can open doors to a variety of career opportunities, especially in fields with high demand for skilled workers.

11. State-Specific Community College Costs: A Comprehensive Table

To give you a clearer picture, here’s a table detailing in-state and out-of-state tuition costs for community colleges across the United States.

| State | In-State Tuition | Out-of-State Tuition |

|---|---|---|

| Alabama | $5,290 | $9,910 |

| Alaska | $6,490 | $6,490 |

| Arizona | $2,270 | $7,820 |

| Arkansas | $3,840 | $5,410 |

| California | $1,350 | $9,810 |

| Colorado | $3,600 | $7,900 |

| Connecticut | $5,000 | $14,890 |

| Delaware | $5,122 | $9,479 |

| Florida | $2,800 | $10,180 |

| Georgia | $3,290 | $8,670 |

| Hawaii | $3,390 | $8,820 |

| Idaho | $3,530 | $8,660 |

| Illinois | $4,460 | $12,280 |

| Indiana | $4,870 | $9,380 |

| Iowa | $5,860 | $7,240 |

| Kansas | $3,830 | $5,070 |

| Kentucky | $4,820 | $16,280 |

| Louisiana | $4,590 | $5,340 |

| Maine | $3,970 | $6,990 |

| Maryland | $4,630 | $10,370 |

| Massachusetts | $5,840 | $11,170 |

| Michigan | $4,160 | $7,870 |

| Minnesota | $6,350 | $7,130 |

| Mississippi | $3,870 | $6,550 |

| Missouri | $4,280 | $8,000 |

| Montana | $4,150 | $10,210 |

| Nebraska | $3,580 | $4,520 |

| Nevada | $3,898 | $12,489 |

| New Hampshire | $7,460 | $16,120 |

| New Jersey | $5,230 | $8,990 |

| New Mexico | $2,020 | $6,940 |

| New York | $6,040 | $9,600 |

| North Carolina | $2,650 | $8,950 |

| North Dakota | $5,890 | $6,980 |

| Ohio | $4,860 | $8,710 |

| Oklahoma | $4,630 | $10,420 |

| Oregon | $5,650 | $9,610 |

| Pennsylvania | $6,000 | $13,840 |

| Rhode Island | $5,350 | $14,230 |

| South Carolina | $5,240 | $11,020 |

| South Dakota | $7,780 | $7,620 |

| Tennessee | $4,660 | $18,120 |

| Texas | $3,080 | $8,260 |

| Utah | $4,470 | $14,390 |

| Vermont | $7,270 | $14,320 |

| Virginia | $5,480 | $12,090 |

| Washington | $4,860 | $8,710 |

| West Virginia | $4,830 | $11,320 |

| Wisconsin | $4,890 | $7,020 |

| Wyoming | $4,400 | $10,490 |

12. Student Financial Aid: A Deep Dive

Understanding the different types of financial aid can help you make informed decisions about how to finance your community college education.

12.1. Government Programs

What government programs are available to help community college students? Government programs such as Pell Grants, federal student loans, and state-level grants can provide significant financial assistance.

12.2. Institutional Programs

How do institutional financial aid programs work at community colleges? Many community colleges offer their own financial aid programs, including grants, scholarships, and work-study opportunities.

12.3. Private Organizations

What types of financial aid do private organizations offer to community college students? Private organizations such as foundations, corporations, and non-profits offer scholarships and grants to community college students.

13. Community College Tuition by State: A Closer Examination

Let’s take a closer look at community college tuition by state, highlighting some key differences and trends.

13.1. States with the Lowest Community College Tuition

Which states offer the most affordable community college education? California, New Mexico, and Arizona consistently rank among the states with the lowest community college tuition rates.

13.2. States with the Highest Community College Tuition

Which states have the highest community college tuition rates? Vermont, New Hampshire, and South Dakota typically have the highest community college tuition rates.

13.3. Factors Influencing Tuition Costs

What factors contribute to the differences in community college tuition costs across states? Factors such as state funding, cost of living, and demand for higher education can influence tuition costs.

14. Navigating the Financial Aid Process: A Step-by-Step Guide

Navigating the financial aid process can be challenging, but with the right guidance, you can successfully secure funding for your community college education.

14.1. Completing the FAFSA

How do you complete the FAFSA form and what information do you need? The FAFSA (Free Application for Federal Student Aid) is the first step in applying for federal financial aid. You will need your Social Security number, tax information, and bank statements.

14.2. Applying for Scholarships

What are the best strategies for applying for scholarships to fund community college? Research scholarships that you are eligible for, and submit well-written applications that highlight your achievements and goals.

14.3. Understanding Student Loan Options

What types of student loans are available and what are the terms and conditions? Federal student loans are generally the best option, as they offer lower interest rates and more flexible repayment options.

14.4. Managing Student Loan Debt

How can you manage student loan debt after graduating from community college? Create a budget, explore income-driven repayment plans, and consider loan consolidation or refinancing options.

15. Maximizing Your Financial Aid: Tips and Tricks

To maximize your financial aid, consider these tips and tricks.

15.1. Applying Early

Why is it important to apply for financial aid as early as possible? Applying early can increase your chances of receiving financial aid, as funding is often limited.

15.2. Understanding Eligibility Requirements

How can you ensure that you meet the eligibility requirements for financial aid programs? Review the eligibility requirements for each financial aid program to ensure that you meet the criteria.

15.3. Appealing Financial Aid Decisions

What steps can you take if you disagree with a financial aid decision? If you disagree with a financial aid decision, you can appeal to the financial aid office and provide additional information to support your case.

16. Student Loan Debt Statistics: Understanding the Trends

It’s important to be aware of student loan debt statistics to make informed decisions about borrowing.

16.1. Average Student Loan Debt for Community College Graduates

What is the average student loan debt for community college graduates? The average student loan debt for community college graduates is generally lower than that of four-year university graduates.

16.2. Default Rates Among Community College Students

What are the default rates among community college students and what factors contribute to these rates? Default rates among community college students can be higher than those of four-year university graduates due to factors such as lower income levels and lack of financial literacy.

16.3. Strategies to Avoid Student Loan Debt

How can you minimize or avoid student loan debt while attending community college? Consider working part-time, living at home, and applying for scholarships and grants to minimize your reliance on student loans.

17. Financial Planning Resources for Community College Students

Numerous financial planning resources are available to help community college students manage their finances.

17.1. Online Budgeting Tools

What are some online budgeting tools that can help community college students manage their finances? Online budgeting tools such as Mint, YNAB (You Need A Budget), and Personal Capital can help you track your income and expenses.

17.2. Financial Literacy Workshops

Do community colleges offer financial literacy workshops for students? Many community colleges offer financial literacy workshops to help students learn about budgeting, saving, and debt management.

17.3. Credit Counseling Services

Where can community college students find credit counseling services? Non-profit credit counseling agencies can provide free or low-cost credit counseling services to help you manage your debt and improve your credit score.

18. Community College Promise Programs: Tuition-Free Options

Community College Promise programs offer tuition-free community college education to eligible students.

18.1. State-Level Promise Programs

Which states offer tuition-free community college through Promise programs? States such as California, New York, and Tennessee offer tuition-free community college through Promise programs.

18.2. Eligibility Requirements for Promise Programs

What are the eligibility requirements for participating in a Community College Promise program? Eligibility requirements vary by state, but typically include residency requirements, GPA requirements, and enrollment status.

18.3. Benefits and Limitations of Promise Programs

What are the benefits and limitations of participating in a Community College Promise program? Benefits include tuition-free education and access to support services, while limitations may include restrictions on course selection and enrollment status.

19. Advanced Strategies for Managing Community College Costs

Explore these advanced strategies to further reduce the financial burden of community college.

19.1. Tax Credits for Education

What tax credits are available for education expenses and how can you claim them? Tax credits such as the American Opportunity Tax Credit and the Lifetime Learning Credit can help reduce your tax liability.

19.2. Employer Tuition Assistance Programs

Does your employer offer tuition assistance programs for community college courses? Many employers offer tuition assistance programs to help employees pay for college courses.

19.3. Negotiating Tuition Costs

Is it possible to negotiate tuition costs with community colleges? While it is rare to negotiate tuition costs directly, you can appeal for additional financial aid if you have extenuating circumstances.

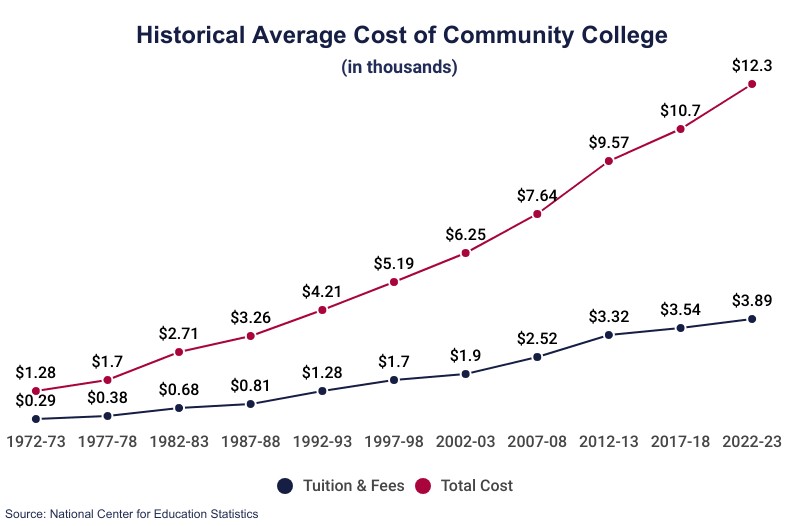

20. Future Trends in Community College Affordability

Stay informed about the future trends in community college affordability.

20.1. Increasing Tuition Costs

Are community college tuition costs expected to increase in the future? Tuition costs are expected to continue to increase in the future, although the rate of increase may vary by state.

20.2. Expanding Access to Financial Aid

Are there efforts to expand access to financial aid for community college students? There are ongoing efforts to expand access to financial aid through initiatives such as increasing Pell Grant funding and expanding Community College Promise programs.

20.3. Innovative Financing Models

Are there any innovative financing models being explored to make community college more affordable? Innovative financing models such as income-share agreements and social impact bonds are being explored to make community college more affordable.

21. Making an Informed Decision: Evaluating Your Options

Evaluate all your options before making a decision about attending community college.

21.1. Assessing Your Financial Situation

How can you assess your financial situation to determine whether you can afford community college? Create a budget, review your income and expenses, and assess your eligibility for financial aid.

21.2. Comparing Different Community Colleges

What factors should you consider when comparing different community colleges? Consider factors such as tuition costs, program offerings, location, and student support services.

21.3. Creating a Long-Term Financial Plan

How can you create a long-term financial plan to ensure that you can afford community college and achieve your educational goals? Set financial goals, create a budget, and explore financial aid options.

22. Community College Success Stories: Inspiration and Motivation

Get inspired by these community college success stories.

22.1. From Community College to a Four-Year University

How have community college graduates successfully transferred to four-year universities? Many community college graduates have successfully transferred to four-year universities and gone on to achieve great success in their careers.

22.2. Career Success After Community College

What are some examples of career success stories after graduating from community college? Community college graduates have achieved success in a variety of fields, including healthcare, technology, and business.

22.3. Overcoming Financial Challenges

How have students overcome financial challenges to achieve their community college goals? Many students have overcome financial challenges by working part-time, living at home, and applying for scholarships and grants.

23. Expert Advice: Insights from Financial Aid Professionals

Get expert advice from financial aid professionals.

23.1. Common Mistakes to Avoid

What are some common mistakes to avoid when applying for financial aid? Common mistakes include missing deadlines, providing inaccurate information, and failing to read the fine print.

23.2. Tips for Success

What are some tips for successfully navigating the financial aid process? Apply early, understand eligibility requirements, and seek help from financial aid professionals.

23.3. Future Trends in Financial Aid

What are some future trends to watch in the world of financial aid? Future trends include expanding access to financial aid, increasing Pell Grant funding, and exploring innovative financing models.

24. Resources for Community College Students

Take advantage of these resources to support your community college education.

24.1. Websites and Online Tools

What are some useful websites and online tools for community college students? Useful websites include FAFSA, Sallie Mae, and Scholarship America.

24.2. Support Services at Community Colleges

What support services are available at community colleges? Support services include academic advising, tutoring, career counseling, and financial aid assistance.

24.3. Connecting with Alumni

How can you connect with community college alumni for advice and support? Many community colleges have alumni networks that can provide valuable advice and support.

25. The Role of Community Colleges in Workforce Development

Understand the role of community colleges in workforce development.

25.1. Preparing Students for In-Demand Jobs

How do community colleges prepare students for in-demand jobs? Community colleges offer career training programs that align with the needs of local employers.

25.2. Partnerships with Local Businesses

What types of partnerships do community colleges have with local businesses? Community colleges partner with local businesses to provide internships, apprenticeships, and job placement services.

25.3. Addressing Skills Gaps

How do community colleges address skills gaps in the workforce? Community colleges offer training programs that address skills gaps in the workforce and prepare students for high-demand jobs.

26. Comparing Community Colleges: A Comprehensive Checklist

Use this checklist to compare different community colleges.

26.1. Tuition and Fees

What are the tuition and fees for each community college? Compare the tuition and fees for different community colleges to determine which is the most affordable.

26.2. Program Offerings

What programs are offered at each community college? Ensure that the community college offers the programs that you are interested in.

26.3. Location and Accessibility

How convenient is the location of each community college? Consider the location and accessibility of each community college, especially if you plan to commute.

26.4. Student Support Services

What student support services are available at each community college? Look for community colleges that offer comprehensive student support services, such as academic advising, tutoring, and career counseling.

27. Community College Myths vs. Realities

Dispel common myths about community colleges.

27.1. Myth: Community Colleges Are Not as Good as Four-Year Universities

What is the reality? Community colleges offer high-quality education and can be a great starting point for students who plan to transfer to a four-year university.

27.2. Myth: Community Colleges Are Only for Students Who Can’t Get Into Four-Year Universities

What is the reality? Community colleges serve a diverse range of students, including those who are seeking career training, exploring different academic paths, or saving money on tuition.

27.3. Myth: Community College Credits Don’t Transfer

What is the reality? Many community colleges have transfer agreements with four-year universities, making it easier to transfer credits and continue your education.

28. The Impact of COVID-19 on Community College Costs

Understand the impact of COVID-19 on community college costs.

28.1. Shift to Online Learning

How has the shift to online learning affected community college costs? The shift to online learning may have reduced some costs, such as transportation and on-campus housing, but may have also increased other costs, such as technology and internet access.

28.2. Financial Aid Changes

Have there been any changes to financial aid programs as a result of COVID-19? Some financial aid programs have been expanded to provide additional support to students during the pandemic.

28.3. Long-Term Implications

What are the long-term implications of COVID-19 on community college affordability? The long-term implications of COVID-19 on community college affordability are still unfolding, but it is likely that there will be increased demand for financial aid and support services.

29. FAQs: Your Questions About Community College Costs Answered

Get answers to your frequently asked questions about community college costs.

29.1. What is the average cost of a community college per semester?

The average cost of a community college per semester is approximately $1,890.

29.2. How much does it cost to attend community college for two years?

Attending community college for two years typically costs around $7,560.

29.3. What are the main factors that affect community college tuition?

The main factors that affect community college tuition include residency status (in-state vs. out-of-state), location, and program of study.

29.4. Are there any states with free community college tuition?

Yes, some states offer tuition-free community college through Promise programs, such as California, New York, and Tennessee.

29.5. How can I reduce the cost of attending community college?

You can reduce the cost of attending community college by applying for financial aid, working part-time, living at home, and taking advantage of dual enrollment programs and CLEP exams.

29.6. What types of financial aid are available for community college students?

Financial aid options for community college students include Pell Grants, federal student loans, state grants and scholarships, and institutional aid.

29.7. Is it worth attending community college before transferring to a four-year university?

Yes, attending community college before transferring to a four-year university can save you money on tuition and allow you to explore different academic paths.

29.8. What is the difference between in-state and out-of-state tuition at community colleges?

In-state tuition is typically much lower than out-of-state tuition, as it is subsidized by state tax dollars.

29.9. How does the cost of community college compare to the cost of a four-year university?

The cost of community college is generally much lower than the cost of a four-year university.

29.10. What resources are available to help me plan for community college expenses?

Resources available to help you plan for community college expenses include online budgeting tools, financial literacy workshops, and credit counseling services.

30. Call to Action: Get Expert Advice from HOW.EDU.VN

Navigating the financial aspects of community college can be complex. At HOW.EDU.VN, our team of over 100 PhDs is dedicated to providing expert guidance and personalized advice to help you make informed decisions about your education. Whether you need assistance with financial aid, budgeting, or career planning, we are here to support you every step of the way.

Don’t let financial concerns hold you back from pursuing your educational goals. Contact us today for a consultation and discover how we can help you achieve your dreams.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: HOW.EDU.VN

Let how.edu.vn be your partner in achieving academic and financial success.