How Much Do Investment Bankers Make is a question that sparks curiosity across various demographics, from aspiring professionals to seasoned experts. At HOW.EDU.VN, we provide clarity on this complex topic, offering expert insights into investment banker compensation structures and potential earnings. Learn about salary expectations and discover expert-backed career advice.

1. Understanding Investment Banker Compensation

Investment banking is a lucrative field, but understanding the intricacies of compensation is crucial. The total compensation for investment bankers is typically composed of a base salary, an end-of-year bonus, and sometimes, benefits such as health insurance and retirement plans. Compensation varies significantly based on the banker’s role, experience, and the firm’s performance.

1.1. Components of Investment Banker Pay

Breaking down the different parts of an investment banker’s earnings is essential for understanding the full picture. Each component plays a significant role in determining the total compensation package.

Base Salary: This is the fixed amount paid regularly, usually bi-weekly or monthly. Base salaries for investment bankers are competitive and tend to increase with experience.

Bonus: The bonus is a variable component tied to individual and firm performance. Bonuses can be a significant portion of an investment banker’s total earnings, especially in successful years.

Benefits: These include health insurance, retirement plans (such as 401(k)s), vacation time, and other perks offered by the firm.

Other Perks: Investment bankers may receive additional benefits such as signing bonuses, relocation assistance, and stock options, depending on the firm and their role.

1.2. Factors Affecting Investment Banker Salaries

Several factors can influence how much an investment banker makes. These factors range from individual performance to broader economic conditions.

| Factor | Description |

|---|---|

| Role/Position | Compensation varies significantly based on the banker’s role (Analyst, Associate, VP, Director, MD). |

| Experience Level | More experienced bankers typically command higher salaries and larger bonuses. |

| Firm Size/Type | Elite boutique firms and bulge bracket banks often pay differently. |

| Firm Performance | A firm’s overall financial performance directly impacts the size of bonuses awarded to its bankers. |

| Individual Performance | Bankers who consistently exceed expectations and bring in significant deals are rewarded with higher compensation. |

| Market Conditions | Economic conditions, such as deal volume and market volatility, can affect investment banking compensation. |

| Location | Salaries can vary based on location, with major financial centers like New York and London typically offering higher pay. |

1.3. Base Salary Trends

Base salaries in investment banking have seen adjustments over the years, particularly for Analysts and Associates. These adjustments often reflect the competitive nature of the industry and the need to attract and retain top talent. However, it’s important to note that higher base salaries can sometimes reduce the impact of bonus increases on total compensation.

2. Investment Banker Salary by Position

Investment banker salaries vary significantly based on the position held within the firm. From Analysts to Managing Directors, each role has its own compensation structure and earning potential.

2.1. Analyst Salaries

Analysts are typically recent graduates who support senior bankers in executing deals and providing financial analysis. Analyst compensation usually consists of a base salary and an end-of-year bonus.

Typical Age Range: 22-27

Base Salary (USD): $100,000 – $125,000

Total Compensation (USD): $160,000 – $210,000

Promotion Timeline: 2-3 years

2.2. Associate Salaries

Associates often come from MBA programs or have several years of experience in the field. They take on more responsibilities in deal execution and client management.

Typical Age Range: 25-35

Base Salary (USD): $175,000 – $225,000

Total Compensation (USD): $275,000 – $475,000

Promotion Timeline: 3-4 years

2.3. Vice President (VP) Salaries

Vice Presidents play a crucial role in leading deal teams and managing client relationships. They are responsible for overseeing the execution of transactions and mentoring junior bankers.

Typical Age Range: 28-40

Base Salary (USD): $250,000 – $300,000

Total Compensation (USD): $500,000 – $700,000

Promotion Timeline: 3-4 years

2.4. Director / Senior Vice President (SVP) Salaries

Directors or Senior Vice Presidents are responsible for generating new business and managing client relationships. They play a key role in the firm’s overall strategy and growth.

Typical Age Range: 32-45

Base Salary (USD): $300,000 – $350,000

Total Compensation (USD): $600,000 – $800,000

Promotion Timeline: 2-3 years

2.5. Managing Director (MD) Salaries

Managing Directors are the most senior bankers in the firm, responsible for leading teams, originating deals, and managing client relationships. Their compensation is highly variable and tied to the firm’s performance.

Typical Age Range: 35-50

Base Salary (USD): $400,000 – $600,000

Total Compensation (USD): $800,000 – $1,600,000+

Promotion Timeline: N/A

3. Investment Banker Salary by Firm Type

The type of firm an investment banker works for significantly impacts their compensation. There are notable differences between elite boutiques, bulge bracket banks, and regional firms.

3.1. Elite Boutique Banks

Elite boutique banks are known for their specialized focus and high-profile deals. They often offer higher compensation, especially for top-performing Analysts and Associates.

Compensation: Generally higher than bulge bracket banks, with potential for significant bonuses.

Culture: More entrepreneurial and deal-focused.

Examples: PJT Partners, Lazard.

3.2. Bulge Bracket Banks

Bulge bracket banks are large, full-service investment banks that offer a wide range of financial services. While their base salaries are competitive, bonuses may vary based on the firm’s overall performance.

Compensation: Competitive base salaries with bonuses that vary based on firm performance.

Culture: More structured and hierarchical.

Examples: Goldman Sachs, JP Morgan, Morgan Stanley, Bank of America.

3.3. Regional and Other Firms

Regional and smaller investment banks may offer lower compensation compared to elite boutiques and bulge bracket banks. However, they may provide opportunities for faster career advancement and a more personalized work environment.

Compensation: Generally lower base salaries and bonuses compared to larger firms.

Culture: More relaxed and personalized.

Examples: Local and regional investment banks.

3.4. Canadian Banks

Some Canadian banks, such as TD Cowen, have been known to offer outsized bonuses to attract new talent. While this may not be sustainable long-term, it can be an attractive option for those looking to maximize their earnings in the short term.

Compensation: May offer competitive or outsized bonuses to attract new talent.

Examples: TD Cowen.

4. Trends in Investment Banker Salaries and Bonuses

Staying informed about the latest trends in investment banker salaries and bonuses is crucial for those in the field. The market is constantly evolving, and understanding these trends can help bankers make informed career decisions.

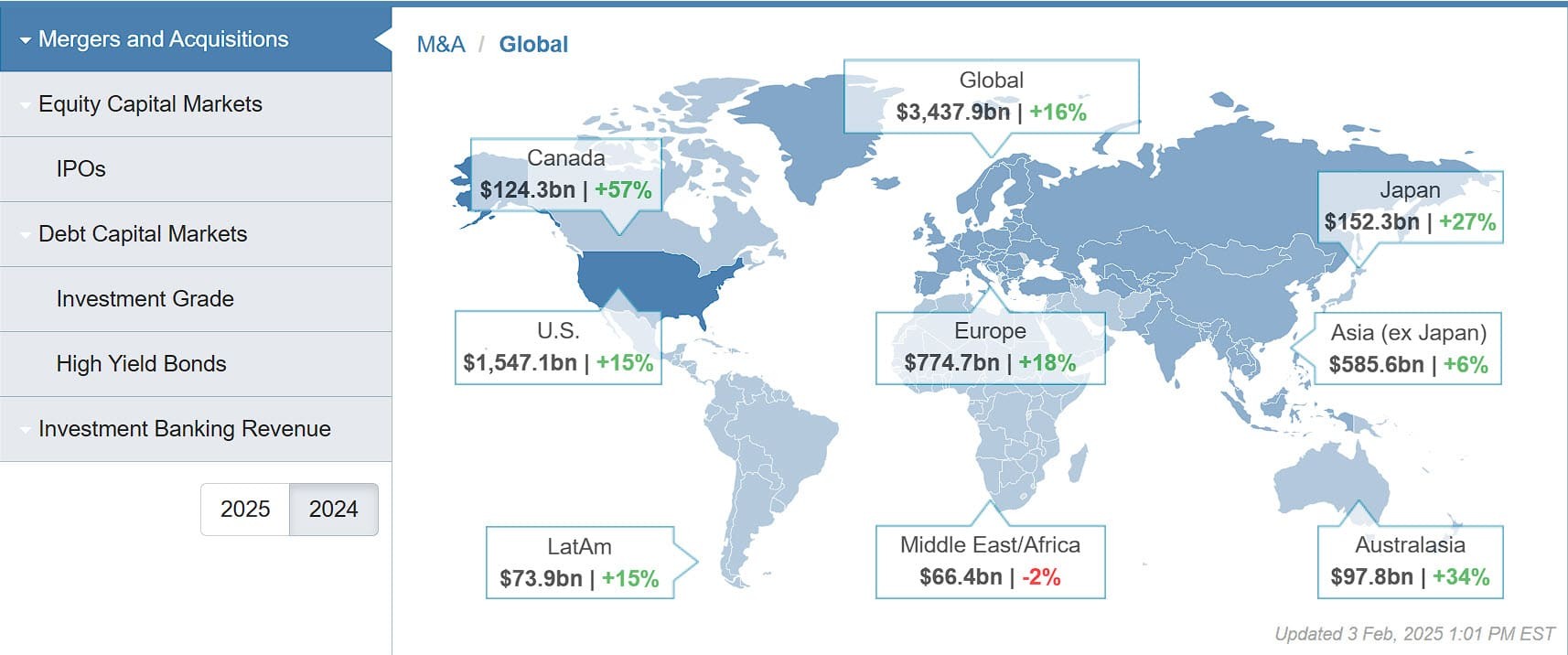

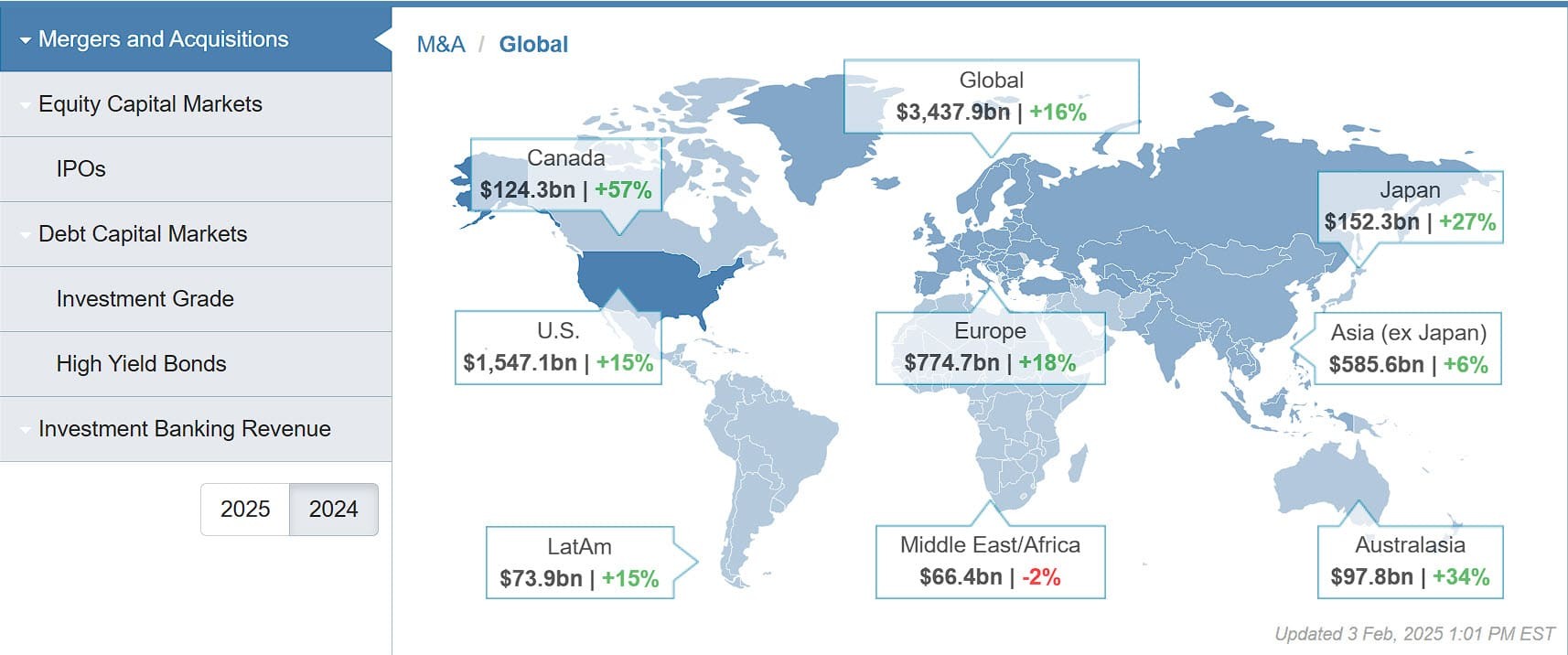

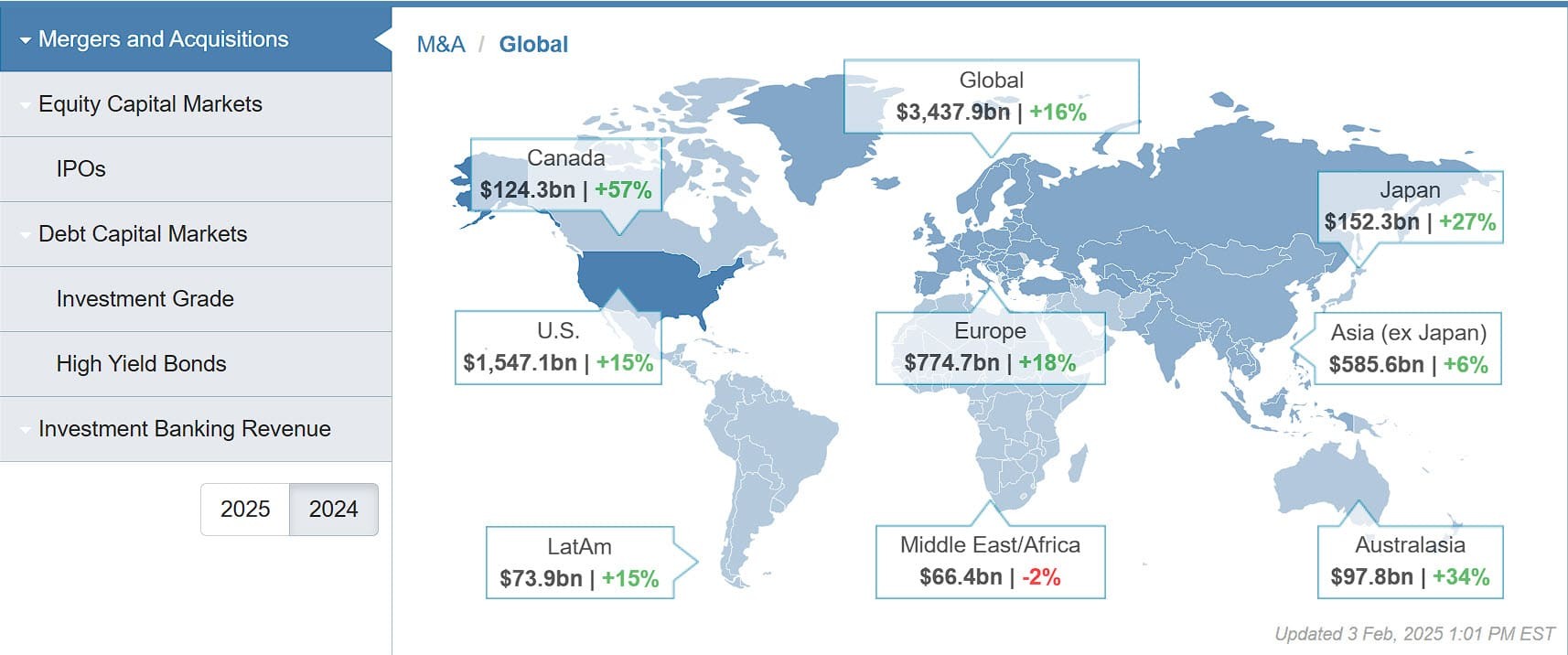

4.1. Impact of Market Conditions

Market conditions, such as deal volume, interest rates, and economic uncertainty, can significantly impact investment banker compensation. During periods of high deal activity, bonuses tend to be higher, while economic downturns may lead to lower compensation.

High Deal Activity: Increased bonuses and total compensation.

Economic Uncertainty: Potential decrease in bonuses and hiring freezes.

Interest Rate Changes: Impact on deal volume and overall market sentiment.

4.2. COVID-19 and Subsequent Adjustments

The COVID-19 pandemic and subsequent market volatility led to significant adjustments in investment banking compensation. While some firms boosted hiring and compensation during the initial recovery, they later pulled back as the market normalized.

Initial Recovery: Increased hiring and compensation.

Market Normalization: Pullback in compensation and cautious approach to hiring.

4.3. Deferred Compensation and Stock Components

An increasing trend in investment banking is the use of deferred compensation and stock components in bonus packages. This means that a portion of the bonus is paid out over time or in the form of company stock, which can be beneficial in the long run but also carries risks.

Deferred Compensation: Portion of bonus paid out over time.

Stock Components: Bonus paid in the form of company stock.

Risks: Potential loss of value due to market fluctuations or company performance.

5. Regional Differences in Investment Banking Salaries

Salaries in investment banking are not uniform across different regions. Major financial centers typically offer higher compensation due to the higher cost of living and greater demand for talent.

5.1. New York vs. London

New York and London are two of the world’s leading financial centers, but there are notable differences in investment banking salaries between the two cities. New York generally offers higher total compensation, while London may have a lower cost of living and different tax implications.

New York: Higher total compensation.

London: Lower cost of living, different tax implications.

5.2. Other Global Regions

Salaries in other global regions, such as Asia and Australia, may vary based on local market conditions and the presence of major financial institutions. Limited data is available for these regions, but compensation is generally lower compared to New York and London.

Asia: Varies based on local market conditions.

Australia: Generally lower compensation compared to New York and London.

6. Factors to Consider Beyond Salary

While salary is an important factor, it’s essential to consider other aspects of an investment banking career. Job satisfaction, work-life balance, and career growth opportunities can be just as important as the paycheck.

6.1. Work-Life Balance

Investment banking is known for its demanding hours and high-pressure environment. Maintaining a healthy work-life balance can be challenging but is crucial for long-term career satisfaction.

Demanding Hours: Long workdays and weekends.

High-Pressure Environment: Fast-paced and competitive.

Importance of Work-Life Balance: Crucial for long-term career satisfaction.

6.2. Career Growth and Exit Opportunities

Consider the career growth opportunities and potential exit options when evaluating an investment banking role. Many bankers use their experience to transition into other fields, such as private equity, hedge funds, or corporate finance.

Career Growth: Opportunities for advancement within the firm.

Exit Opportunities: Potential to transition into other fields.

6.3. Firm Culture

The culture of the firm can significantly impact your overall job satisfaction. Look for a firm that aligns with your values and provides a supportive and collaborative work environment.

Importance of Firm Culture: Impacts job satisfaction and overall well-being.

Values and Collaboration: Look for a firm that aligns with your values.

7. Maximizing Your Earning Potential

Maximizing your earning potential in investment banking requires a combination of skill, hard work, and strategic career planning.

7.1. Performance and Networking

Consistently exceeding expectations and building a strong network of contacts can significantly boost your earning potential.

Exceed Expectations: Go above and beyond in your role.

Build a Strong Network: Cultivate relationships with colleagues, clients, and industry professionals.

7.2. Negotiation Skills

Developing strong negotiation skills is essential for securing competitive compensation packages.

Negotiate Salary and Benefits: Be prepared to negotiate your salary and benefits during job offers and promotions.

Know Your Worth: Understand your value in the market and be confident in asking for what you deserve.

7.3. Staying Informed

Staying informed about market trends and industry developments can help you make informed career decisions and maximize your earning potential.

Read Industry Publications: Stay up-to-date on the latest news and trends.

Attend Industry Events: Network with industry professionals and learn about new opportunities.

8. The Role of Expert Guidance in Navigating Your Investment Banking Career

Navigating the complexities of an investment banking career can be challenging, but with the right guidance, you can make informed decisions and maximize your potential. At HOW.EDU.VN, we connect you with leading experts who can provide personalized advice and support.

8.1. Connecting with Expert Advisors

HOW.EDU.VN offers a unique platform where you can connect directly with top experts in the field. Our advisors can provide insights into compensation trends, career paths, and strategies for maximizing your earning potential.

8.2. Personalized Career Advice

Our experts offer personalized career advice tailored to your specific goals and circumstances. Whether you’re just starting out or looking to advance in your career, we can help you develop a strategic plan for success.

8.3. Overcoming Challenges with Expert Support

Investment banking can be a challenging field, but with the support of our expert advisors, you can overcome obstacles and achieve your goals. We provide guidance on everything from managing stress to negotiating compensation packages.

9. Future Outlook for Investment Banker Compensation

Predicting the future of investment banker compensation is challenging due to the many factors that can influence the market. However, by analyzing current trends and expert forecasts, we can get a sense of what to expect in the coming years.

9.1. Potential Growth Areas

Certain areas of investment banking, such as mergers and acquisitions (M&A) and technology, may offer higher growth potential in the future. Focusing on these areas can help you maximize your earning potential.

9.2. Impact of Technology

Technology is transforming the investment banking industry, and those who can adapt to new technologies and embrace innovation will be in high demand.

9.3. Long-Term Career Planning

Long-term career planning is essential for success in investment banking. By setting clear goals and developing a strategic plan, you can achieve your career aspirations and maximize your earning potential.

10. Addressing Common Concerns and Misconceptions

There are many common concerns and misconceptions about investment banking salaries and compensation. Let’s address some of the most frequently asked questions.

10.1. Is Investment Banking Worth It?

Whether investment banking is worth it depends on your personal goals and priorities. While the job can be demanding and stressful, it also offers the potential for high compensation and exciting career opportunities.

10.2. Can You “Coast” as an MD?

Even as a Managing Director, investment banking is not an easy job, and you will not be able to “coast” unless you are amazingly talented, lucky, or extremely senior. MDs are under constant pressure to generate fees, so turnover at this level is also quite high.

10.3. How Important is Work-Life Balance?

Work-life balance is crucial for long-term career satisfaction in investment banking. While the job can be demanding, finding ways to manage stress and maintain a healthy work-life balance is essential for your overall well-being.

FAQ: Investment Banking Compensation

1. What is the average starting salary for an investment banking analyst?

The average starting salary for an investment banking analyst ranges from $100,000 to $125,000, with total compensation ranging from $160,000 to $210,000.

2. How much do investment banking associates typically earn?

Investment banking associates typically earn a base salary between $175,000 and $225,000, with total compensation ranging from $275,000 to $475,000.

3. What factors influence the size of an investment banker’s bonus?

The size of an investment banker’s bonus is influenced by individual performance, the firm’s overall performance, and market conditions.

4. Do elite boutique banks pay more than bulge bracket banks?

Elite boutique banks often pay higher bonuses to Analysts and Associates, and senior bankers also have a higher compensation ceiling.

5. What is deferred compensation in investment banking?

Deferred compensation is a portion of the bonus that is paid out over time, often with stock components.

6. How do regional differences affect investment banking salaries?

Salaries can vary based on location, with major financial centers like New York and London typically offering higher pay.

7. Is it possible to negotiate a higher salary in investment banking?

Yes, it is possible to negotiate a higher salary, especially if you have strong qualifications and experience.

8. What are the benefits of working for a bulge bracket bank?

Bulge bracket banks offer competitive base salaries, a wide range of financial services, and structured career paths.

9. How important is networking in maximizing earning potential?

Networking is crucial for building relationships, finding new opportunities, and increasing your visibility in the industry.

10. What are some strategies for maximizing my earning potential in investment banking?

Strategies include consistently exceeding expectations, developing strong negotiation skills, and staying informed about market trends.

Navigating the world of investment banking compensation can be complex, but with the right information and guidance, you can make informed decisions and maximize your earning potential. At HOW.EDU.VN, we are committed to providing you with the expertise and support you need to succeed in your career.

Ready to take your investment banking career to the next level? Connect with our team of experienced Doctors and experts at HOW.EDU.VN today. We provide personalized advice, strategic guidance, and unparalleled support to help you achieve your professional goals. Don’t navigate the complexities of the industry alone. Let us help you succeed. Contact us now at 456 Expertise Plaza, Consult City, CA 90210, United States, or reach out via WhatsApp at +1 (310) 555-1212. Visit our website at how.edu.vn for more information.