How Much Does A Lawyer Charge To Transfer A Deed? It’s a common question, and at HOW.EDU.VN, we understand the importance of transparency in legal costs. Legal fees for deed transfers can vary, but understanding the factors involved can help you budget effectively and avoid costly mistakes. Find expert advice and connect with top-rated attorneys for deed preparation, property conveyance, and title transfer assistance.

1. Understanding Property Deed Transfers

Property deed transfers are fundamental to real estate transactions, acting as the official record of ownership changes. In Pennsylvania, a deed transfer is essential for documenting the transfer of property rights and ensuring all legal requirements are met. A deed is a legal instrument that, when correctly executed, gives a new owner the title to real estate, transferring all rights, titles, and interests from the seller to the buyer. This process legally binds the owner to the property, making it necessary to understand and execute the procedure correctly.

2. Types of Deeds Relevant in Pennsylvania

Pennsylvania uses various types of deeds to transfer property, each with different purposes and levels of warranty:

- General Warranty Deed: Offers the highest level of buyer protection, with a full warranty of clear title against all claims.

- Special Warranty Deed: Provides a limited warranty, covering only the period during which the seller owned the property.

- Quitclaim Deed: Offers no warranties, transferring only the seller’s interest at the time of transfer.

Understanding these differences is crucial for buyers and sellers to protect their rights. According to a study by the Pennsylvania Bar Association, selecting the wrong type of deed can lead to significant legal complications and financial losses.

3. The Deed Transfer Process Explained

The deed transfer process in Pennsylvania involves several critical steps:

- Preparing the deed accurately.

- Ensuring all parties sign correctly.

- Paying transfer taxes and fees.

- Recording the deed with the county recorder.

This process requires attention to detail and adherence to legal standards. Errors in the deed transfer process can lead to disputes and legal challenges. According to a report by the American Land Title Association, proper execution and recording of the deed are essential for a valid transfer.

4. Factors Influencing the Cost of Deed Transfers

Several factors affect the cost of transferring a deed in Pennsylvania:

- Recording Fees: Fees charged by county offices to file the deed, varying by location.

- Transfer Taxes: Pennsylvania imposes a state transfer tax, with potential local taxes.

- Additional Costs: Including title searches and title insurance.

Title searches are vital for confirming the property’s clear title, and title insurance protects against future claims. These costs contribute significantly to the overall financial implications of transferring a property deed. A survey by the National Association of Realtors found that unexpected fees and taxes are a common source of frustration for both buyers and sellers.

5. Typical Attorney Fees for Deed Transfers

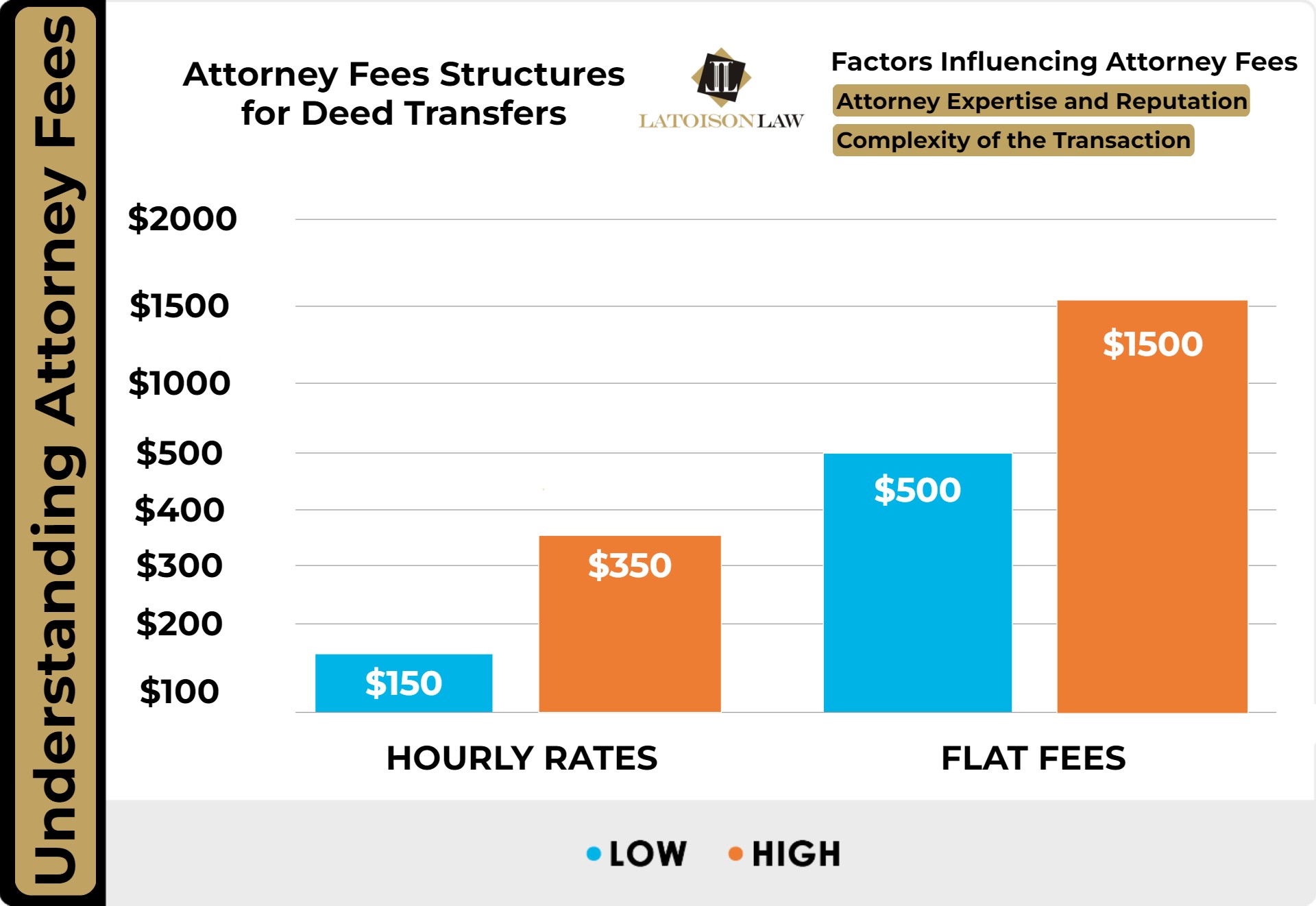

When determining “how much does a lawyer charge to transfer a deed,” the answer varies based on the transaction’s complexity, the deed type, and the attorney’s expertise. Generally, attorney fees can be structured in a few ways:

- Flat Fees: For standard transfers, attorneys may offer flat fees ranging from $500 to $1,500.

- Hourly Rates: For complex transactions, hourly rates can range from $150 to $350 per hour.

- Additional Costs: These can include title searches, title insurance, and filing fees, which are essential to the transaction.

A comparison chart illustrating flat rate vs hourly fees for deed transfers

A comparison chart illustrating flat rate vs hourly fees for deed transfers

6. Flat Rate vs. Hourly Rate: Which is Best for You?

Choosing between flat rate and hourly billing is crucial when hiring a lawyer for a deed transfer. Each has its advantages and considerations:

6.1. Flat Rate Prices: Predictability and Simplicity

Advantages:

- Predictability: Flat rates offer a clear, upfront cost, making budgeting straightforward.

- Simplicity: Used for straightforward transactions, simplifying the billing process.

- Efficiency: Incentivizes attorneys to work efficiently.

Considerations:

- Scope of Work: Understand what services are included; complex matters may incur additional charges.

- Cost-Effectiveness: For very simple transactions, a flat rate might be higher than hourly.

6.2. Hourly Rates: Flexibility and Transparency

Advantages:

- Flexibility: Adapts to the unpredictable nature of complex transactions.

- Transparency: Clients receive detailed billing statements.

Considerations:

- Uncertainty in Costs: Difficult to estimate total costs upfront.

- Monitoring Costs: Clients may need to actively manage legal expenses.

According to a survey by the American Bar Association, clients who understand the fee structure are more satisfied with their legal representation.

7. Why Legal Guidance is Essential for Deed Transfers

Professional legal guidance is invaluable when navigating property deed transfers. An experienced attorney can minimize costs, ensure compliance with regulations, and address legal issues. Law firms offer the expertise needed to ensure clients understand their obligations and options.

Engaging a knowledgeable attorney early in the process can provide peace of mind and protect the interests of all parties involved. According to a report by the National Consumer Law Center, legal representation can significantly reduce the risk of errors and disputes in property transactions.

8. Avoiding Costly Mistakes in Deed Transfers

Mistakes in deed transfers can be more than just costly; they can derail the entire transaction. Experienced attorneys prioritize accuracy, thoroughness, and legal compliance in every transaction. Here’s how to avoid common pitfalls:

- Inaccurate Legal Descriptions: Ensure the property’s legal description is accurate to avoid future boundary disputes.

- Improper Signatures: All parties must sign the deed correctly to ensure its validity.

- Failure to Record the Deed: Recording the deed makes the transfer public record and protects the new owner’s rights.

According to a study by the American Title Insurance Association, many title disputes arise from errors in the original deed or transfer process.

9. Working with a Real Estate Attorney

A real estate attorney is indispensable for property transactions. They provide legal advice, draft and review documents, negotiate terms, and represent your interests. Here are some benefits:

- Legal Expertise: Attorneys understand real estate law and can guide you through the process.

- Document Preparation: They ensure all documents are prepared accurately and legally compliant.

- Negotiation Skills: Attorneys can negotiate terms to protect your interests.

According to a survey by the National Association of Real Estate Attorneys, clients who work with a real estate attorney are more likely to have a smooth and successful transaction.

10. DIY vs. Hiring an Attorney for Deed Transfers

Deciding whether to handle a deed transfer yourself or hire an attorney depends on your comfort level and the transaction’s complexity.

DIY Deed Transfers:

- Pros: Cost savings on attorney fees.

- Cons: Risk of errors, lack of legal expertise, potential for future disputes.

Hiring an Attorney:

- Pros: Legal expertise, accurate document preparation, reduced risk of errors.

- Cons: Higher upfront costs.

For straightforward transfers between family members, a DIY approach might be feasible. However, for complex transactions or when significant assets are involved, hiring an attorney is highly recommended.

11. How to Find a Reputable Real Estate Attorney

Finding a reputable real estate attorney is crucial for a smooth property transfer. Here are some tips:

- Seek Recommendations: Ask friends, family, or colleagues for recommendations.

- Check Online Reviews: Look for attorneys with positive reviews and ratings.

- Verify Credentials: Ensure the attorney is licensed and in good standing with the state bar.

It’s also helpful to schedule consultations with multiple attorneys to find one who is a good fit for your needs. According to the Martindale-Hubbell Law Directory, attorneys with high ratings are more likely to provide excellent service.

12. Questions to Ask Before Hiring a Real Estate Attorney

Before hiring a real estate attorney, ask these questions to ensure they are the right fit:

- What is your experience with deed transfers?

- What are your fees and how are they structured?

- What services are included in your fees?

- What is your communication style?

These questions will help you understand the attorney’s expertise and ensure they meet your needs.

13. The Role of Title Insurance in Deed Transfers

Title insurance protects against defects in the title, such as outstanding liens or conflicting ownership claims. It provides coverage for legal fees and losses if a title issue arises.

Benefits of Title Insurance:

- Protects against financial loss.

- Covers legal fees to defend against title claims.

- Provides peace of mind.

According to the American Land Title Association, title insurance is a critical safeguard for property owners, protecting them from unforeseen title issues.

14. Understanding Pennsylvania Real Estate Transfer Taxes

Pennsylvania imposes a state transfer tax on property transactions, with the possibility of additional local taxes. Understanding these taxes is essential for budgeting and avoiding surprises.

Key Points about Transfer Taxes:

- The tax rate can vary by location.

- Certain transactions may qualify for exemptions.

- It’s crucial to consult with a professional to understand your obligations.

A study by the Pennsylvania Department of Revenue found that many property owners are unaware of potential exemptions and overpay their transfer taxes.

15. Steps to Take After a Deed Transfer

After a deed transfer, take these steps to protect your rights and ensure a smooth transition:

- Record the deed with the county recorder.

- Update property insurance policies.

- Notify relevant parties, such as utilities and homeowners’ associations.

These steps will help you establish your ownership and avoid future complications.

16. Common Legal Issues in Deed Transfers

Several legal issues can arise during deed transfers, including:

- Title defects

- Boundary disputes

- Fraudulent transfers

Addressing these issues requires legal expertise and can be costly if not handled properly.

17. How to Handle Disputes in Deed Transfers

Disputes in deed transfers can be resolved through negotiation, mediation, or litigation.

- Negotiation: Attempt to resolve the issue directly with the other party.

- Mediation: Use a neutral third party to facilitate a resolution.

- Litigation: File a lawsuit to resolve the dispute in court.

According to the American Arbitration Association, mediation is often a cost-effective way to resolve real estate disputes.

18. The Impact of Estate Planning on Deed Transfers

Estate planning can significantly impact deed transfers, particularly when transferring property to heirs.

Key Considerations for Estate Planning:

- Wills and trusts

- Gift taxes

- Inheritance taxes

Consult with an estate planning attorney to ensure your property is transferred according to your wishes and in compliance with the law.

19. Using Quitclaim Deeds for Property Transfers

Quitclaim deeds are often used for transferring property between family members or to clear up title issues.

Advantages of Quitclaim Deeds:

- Simple and quick to prepare.

- Can be used to transfer property without a title search.

Disadvantages of Quitclaim Deeds:

- Offers no warranties regarding the title.

- May not be suitable for complex transactions.

According to the American Bar Association, quitclaim deeds should be used with caution, as they provide limited protection to the buyer.

20. Protecting Yourself in Property Transfers

Protecting yourself in property transfers involves several key steps:

- Conduct thorough due diligence.

- Obtain title insurance.

- Work with experienced professionals.

These measures will help you avoid costly mistakes and ensure a smooth transaction.

21. Key Takeaways for a Smooth Deed Transfer

For a smooth deed transfer, remember these key points:

- Understand the different types of deeds.

- Work with a real estate attorney.

- Obtain title insurance.

- Be aware of transfer taxes.

By following these guidelines, you can ensure a successful property transfer.

22. Common Misconceptions About Deed Transfers

Several misconceptions exist about deed transfers:

- Myth: You don’t need an attorney for a simple transfer.

- Fact: Even simple transfers can have legal implications.

- Myth: Title insurance is unnecessary.

- Fact: Title insurance protects against hidden title defects.

- Myth: All deeds are the same.

- Fact: Different deeds offer different levels of protection.

Understanding these facts can help you make informed decisions.

23. Resources for Pennsylvania Property Owners

Pennsylvania property owners can access various resources for assistance with deed transfers:

- County Recorder’s Office

- Pennsylvania Bar Association

- Real Estate Attorneys

These resources can provide valuable information and support.

24. The Future of Deed Transfers

The future of deed transfers may involve increased use of technology, such as electronic recording and online platforms. These innovations could streamline the process and reduce costs. However, it’s essential to stay informed about legal requirements and potential risks.

25. Maximizing Value in Property Transactions

Maximizing value in property transactions involves:

- Understanding market conditions

- Negotiating effectively

- Working with experienced professionals

These strategies can help you achieve your financial goals.

Navigating property deed transfers in Pennsylvania requires understanding various factors, from deed types to legal fees. Whether you choose a flat rate or hourly billing, seeking professional legal guidance can ensure a smooth and legally sound transaction. Don’t let uncertainty cloud your real estate endeavors—partner with seasoned experts who prioritize accuracy, compliance, and your peace of mind.

26. Call to Action

Are you facing a property deed transfer in Pennsylvania? At HOW.EDU.VN, our team of over 100 experienced Ph.D. experts is ready to provide the expert guidance you need. We understand the complexities of property law and can help you navigate every step of the process. Whether you have questions about fees, need assistance with document preparation, or want to ensure a smooth transaction, our experts are here to help.

Contact us today for personalized assistance and expert advice. Reach out to us at 456 Expertise Plaza, Consult City, CA 90210, United States. Whatsapp: +1 (310) 555-1212. Visit our website at how.edu.vn to learn more and get started. Don’t navigate this complex process alone—let our Ph.D. experts guide you to success.

FAQ: Common Questions About Deed Transfers

1. What is a property deed?

A property deed is a legal document that transfers ownership of real estate from one party to another.

2. What are the different types of deeds in Pennsylvania?

The main types are General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds.

3. How much does a lawyer charge to transfer a deed?

Attorney fees vary; flat fees range from $500 to $1,500, while hourly rates range from $150 to $350 per hour.

4. What are recording fees?

Recording fees are charged by local county offices to file the deed and make the transfer public record.

5. What is title insurance?

Title insurance protects against defects in the title, such as outstanding liens or conflicting ownership claims.

6. Do I need a lawyer for a deed transfer?

While not always required, hiring a lawyer is highly recommended for complex transactions.

7. What is a quitclaim deed?

A quitclaim deed transfers only the seller’s interest at the time of transfer, without any warranties.

8. What are Pennsylvania real estate transfer taxes?

Pennsylvania imposes a state transfer tax on property transactions, with possible local taxes.

9. How do I find a reputable real estate attorney?

Seek recommendations, check online reviews, and verify credentials with the state bar.

10. What should I do after a deed transfer?

Record the deed, update property insurance, and notify relevant parties.