Are you wondering, How Much Does A Semester Of College Cost? Understanding the expenses associated with higher education is crucial for financial planning. At HOW.EDU.VN, we provide expert guidance to navigate these costs and make informed decisions about college financing, including exploring tuition fees and student expenses. Connect with our team of over 100 renowned PhDs for personalized insights that can help you manage costs effectively.

1. What is the Average Cost of a Semester of College?

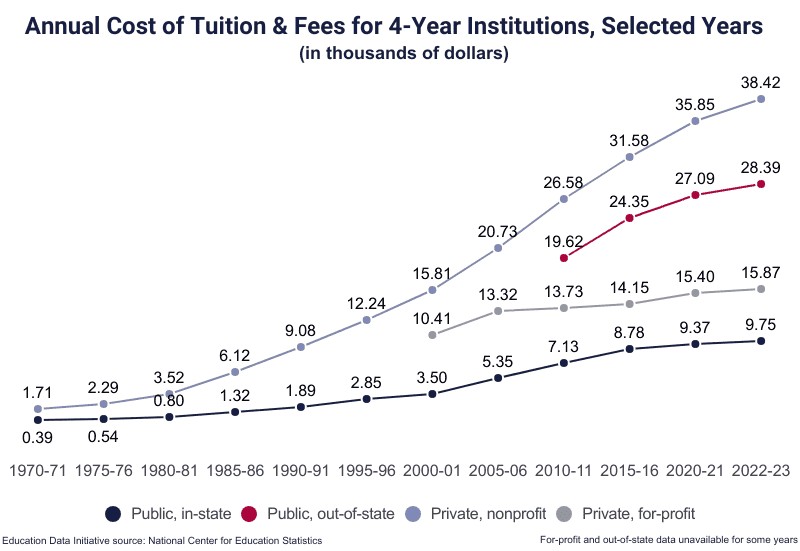

The average cost of a semester of college can vary widely based on several factors, but let’s break it down. For a starting point, consider that the average annual cost of college in the United States is approximately $38,270, which includes tuition, fees, books, supplies, and living expenses. Therefore, a semester, typically half of an academic year, could cost around $19,135. However, this figure is just an average and can change significantly depending on the type of institution and your residency status.

To better understand, let’s look at the specific costs at different types of colleges:

- Public 4-Year Institutions (In-State): These are generally the most affordable options for students who are residents of the state. The annual cost averages around $27,146, making a semester roughly $13,573.

- Public 4-Year Institutions (Out-of-State): If you’re attending a public college outside of your state of residency, expect to pay more. The average annual cost is about $45,708, so a semester would be approximately $22,854.

- Private Nonprofit Universities: These tend to be the most expensive, with an average annual cost of $58,628. A semester here could cost around $29,314.

Keep in mind these estimates do not include additional costs such as transportation, personal expenses, and potential lost income from not working full-time. For detailed personalized advice, consider consulting with the experts at HOW.EDU.VN. We can provide tailored strategies to manage and potentially reduce your college expenses.

2. What Factors Influence the Cost of a College Semester?

Several factors can significantly impact the cost of a college semester. Understanding these can help you plan your finances more effectively and potentially find ways to reduce expenses.

- Type of Institution: As mentioned earlier, public vs. private and in-state vs. out-of-state distinctions are major determinants. Public colleges usually offer lower tuition rates to state residents due to state funding.

- Tuition and Fees: This is typically the largest portion of your college expenses. Tuition covers the cost of instruction, while fees can include charges for technology, student activities, and other services.

- Room and Board: Where you live while attending college can greatly affect costs. On-campus housing is often more expensive than off-campus options, but it includes amenities and can save on transportation costs.

- Books and Supplies: Textbooks, lab equipment, and other course materials can add up quickly. Explore options such as renting textbooks or buying used ones to save money.

- Personal Expenses: These include everything from transportation and clothing to entertainment and healthcare. These costs can vary widely depending on your lifestyle and location.

- Financial Aid: Grants, scholarships, and loans can help offset the cost of college. Be sure to apply for financial aid early and explore all available options.

To gain a clearer picture of how these factors apply to your unique situation, consider reaching out to the experienced PhDs at HOW.EDU.VN. We offer personalized consultations to help you navigate the complexities of college financing.

3. How Much Does Tuition Cost Per Semester?

Understanding the breakdown of tuition costs is essential when planning for college expenses. Tuition typically makes up a significant portion of the total cost of attendance. Let’s explore the average tuition costs per semester for different types of institutions:

- Public 4-Year Institutions (In-State): The average annual in-state tuition is $9,750, which translates to approximately $4,875 per semester. This is often the most affordable tuition option for students residing in the state.

- Public 4-Year Institutions (Out-of-State): For students attending a public college outside their state of residency, the average annual tuition is $28,386, making the cost per semester around $14,193. This higher tuition reflects the lack of state subsidies for non-residents.

- Private Nonprofit Universities: These institutions generally have the highest tuition rates. The average annual tuition is $38,421, resulting in a cost of approximately $19,210.50 per semester.

These figures are averages, and the actual tuition costs can vary significantly based on the specific college and program. Factors like the college’s prestige, location, and the demand for specific programs can influence tuition rates.

For a detailed, tailored analysis of tuition costs based on your specific college choices and financial circumstances, consider consulting with the expert team at HOW.EDU.VN. Our PhDs can provide insights into potential financial aid opportunities and strategies to manage these expenses effectively.

4. What Are the Additional Costs Beyond Tuition?

While tuition is a major expense, it’s essential to consider the additional costs associated with attending college. These expenses can significantly impact your overall budget and should be accounted for when planning your finances. Here are some key additional costs:

- Room and Board: Housing and meal plans can be a substantial expense. On-campus housing typically costs around $12,302 annually at public 4-year institutions and $13,842 at private nonprofit institutions. Off-campus living expenses vary based on location and lifestyle.

- Books and Supplies: Textbooks and other course materials can cost between $1,215 and $1,467 annually, depending on the institution and program.

- Transportation: Whether you’re commuting to campus or traveling home for breaks, transportation costs can add up. This includes expenses for gas, public transportation, and car maintenance.

- Personal Expenses: These include a wide range of costs, such as clothing, entertainment, healthcare, and personal care items. The average student spends around $3,790 annually on these expenses while living on campus.

- Health Insurance: Many colleges require students to have health insurance. If you’re not covered under your parents’ plan, you’ll need to factor in the cost of student health insurance.

- Technology Fees: Some colleges charge technology fees to cover the cost of providing internet access and other tech-related services.

To fully understand the financial implications of these additional costs and how they apply to your specific situation, consult with the experienced team at HOW.EDU.VN. Our PhDs can provide personalized advice and strategies to manage these expenses effectively, ensuring you’re well-prepared for the financial demands of college life.

5. How Does the Cost of a Semester Compare Between Community College and a 4-Year University?

Choosing between a community college and a 4-year university can significantly impact your college expenses. Community colleges are generally more affordable, making them an attractive option for students looking to save money. Here’s a comparison of the costs:

- Community College: The average annual tuition at a public 2-year institution (community college) is around $3,598 for in-district students. This translates to approximately $1,799 per semester. Including other expenses like books, supplies, and personal costs, the total cost of attendance can be around $17,439 annually, or $8,719.50 per semester.

- 4-Year University: As discussed earlier, the average annual in-state tuition at a public 4-year university is $9,750, or $4,875 per semester. The total cost of attendance, including room and board, books, and other expenses, averages around $27,146 annually, or $13,573 per semester.

The cost difference is substantial. Attending a community college for the first two years and then transferring to a 4-year university can save you a significant amount of money. It’s also worth noting that community colleges often have lower fees and may offer more affordable housing options.

For personalized guidance on making the best choice for your educational and financial goals, consider consulting with the experts at HOW.EDU.VN. Our team of PhDs can provide insights into the long-term financial implications of different educational paths, helping you make an informed decision.

6. How Can I Estimate My Specific College Semester Costs?

Estimating your specific college semester costs involves a detailed assessment of various factors. Here’s a step-by-step guide to help you create a realistic budget:

-

Tuition and Fees:

- Visit the college’s website and find the most recent tuition and fee schedule.

- Note whether the listed rates are per semester or per year.

- Factor in any potential increases in tuition.

-

Room and Board:

- If you plan to live on campus, check the college’s housing rates for different types of rooms and meal plans.

- If you plan to live off-campus, research average rental costs in the area, as well as utility expenses.

-

Books and Supplies:

- Create a list of required textbooks and supplies for your courses.

- Compare prices at the college bookstore, online retailers, and used book sellers.

-

Transportation:

- Calculate the cost of commuting to campus, including gas, parking, and public transportation.

- Factor in the cost of traveling home for breaks.

-

Personal Expenses:

- Estimate your monthly expenses for items like clothing, entertainment, and personal care.

- Include any healthcare costs, such as insurance premiums and co-pays.

-

Financial Aid:

- Determine the amount of financial aid you’re eligible for, including grants, scholarships, and loans.

- Subtract this amount from your total estimated costs to determine your out-of-pocket expenses.

For a more precise and personalized estimate, consider consulting with the expert team at HOW.EDU.VN. Our PhDs can help you navigate the complexities of college budgeting, offering insights into potential cost-saving strategies and financial aid opportunities tailored to your unique circumstances.

7. What Are Some Strategies to Reduce the Cost of a College Semester?

Reducing the cost of a college semester requires a proactive approach. Here are several strategies you can implement to lower your expenses:

-

Apply for Financial Aid:

- Fill out the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal grants, loans, and work-study programs.

- Research and apply for scholarships from colleges, private organizations, and community groups.

-

Choose an Affordable Institution:

- Consider attending a public college in your state to take advantage of lower in-state tuition rates.

- Explore community colleges for the first two years before transferring to a 4-year university.

-

Live Strategically:

- If possible, live at home to save on room and board expenses.

- If living on campus, opt for a less expensive dorm room or consider being a resident advisor (RA) for free housing.

-

Minimize Book Costs:

- Rent textbooks instead of buying them.

- Purchase used textbooks from online retailers or upperclassmen.

- Look for digital versions of textbooks, which are often cheaper.

-

Control Personal Spending:

- Create a budget and track your expenses.

- Avoid unnecessary spending on entertainment, dining out, and other non-essential items.

-

Take Advantage of College Resources:

- Utilize free tutoring services, libraries, and other resources offered by the college.

- Participate in student activities and clubs to enrich your college experience without spending a lot of money.

-

Consider Dual Enrollment:

- If you are in high school, taking college courses can help reduce the overall cost of your degree.

For personalized advice on implementing these strategies and identifying additional cost-saving opportunities, consult with the expert team at HOW.EDU.VN. Our PhDs can provide tailored guidance based on your individual circumstances, helping you navigate the financial challenges of college and achieve your educational goals.

8. How Do Student Loans Impact the Overall Cost of a College Semester?

Student loans can significantly impact the overall cost of a college semester, often adding substantial long-term financial burden. Here’s how:

-

Principal and Interest:

- When you take out a student loan, you’re not just borrowing the cost of tuition and fees. You also have to repay the principal amount plus interest. The interest can add thousands of dollars to the total cost of your education.

-

Loan Origination Fees:

- Some federal and private student loans come with origination fees, which are charged as a percentage of the loan amount. These fees are deducted from the loan before you receive the funds, increasing the overall cost.

-

Accrued Interest:

- For some types of loans, interest accrues while you’re still in school. This means that by the time you graduate, you may owe more than you initially borrowed.

-

Repayment Terms:

- The length of your loan repayment term can also impact the total cost. Longer repayment terms mean lower monthly payments, but you’ll pay more in interest over time.

-

Defaulting on Loans:

- If you default on your student loans, you may face serious consequences, including wage garnishment, tax refund offset, and damage to your credit score. This can further increase the overall cost of your education.

To make informed decisions about student loans and minimize their impact on your college expenses, consult with the expert team at HOW.EDU.VN. Our PhDs can provide personalized guidance on loan options, repayment strategies, and financial planning, helping you navigate the complexities of student debt and achieve your financial goals.

9. What is the Return on Investment (ROI) of a College Education?

Evaluating the return on investment (ROI) of a college education involves assessing the long-term financial benefits relative to the costs incurred. While college can be expensive, it often leads to increased earning potential and career opportunities. Here’s how to assess the ROI:

-

Increased Earning Potential:

- College graduates typically earn more than individuals with only a high school diploma. According to the Bureau of Labor Statistics, the median weekly earnings for those with a bachelor’s degree are significantly higher than those with a high school diploma.

-

Career Advancement:

- A college degree can open doors to more advanced and specialized career paths. Many employers require a college degree for certain positions, increasing your job prospects.

-

Lower Unemployment Rates:

- College graduates generally experience lower unemployment rates compared to those with less education. This can provide greater job security and financial stability.

-

Long-Term Financial Benefits:

- Over the course of a career, the increased earnings from a college degree can far outweigh the initial costs of tuition and fees. This makes a college education a worthwhile investment for many individuals.

-

Personal and Professional Growth:

- Beyond financial benefits, college can lead to personal and professional growth, including critical thinking, communication skills, and networking opportunities.

To gain a comprehensive understanding of the ROI of a college education and how it applies to your specific field of study and career goals, consult with the expert team at HOW.EDU.VN. Our PhDs can provide insights into labor market trends, salary expectations, and the long-term financial benefits of different educational paths, helping you make an informed decision about your future.

10. How Can HOW.EDU.VN Help Me Plan for College Costs?

Planning for college costs can be overwhelming, but HOW.EDU.VN is here to provide expert guidance and support. Our team of over 100 renowned PhDs offers personalized consultations to help you navigate the complexities of college financing. Here’s how we can assist you:

-

Personalized Financial Planning:

- We’ll work with you to create a customized financial plan based on your unique circumstances, goals, and preferences.

- Our experts will help you assess your financial resources, estimate your college expenses, and identify strategies to manage costs effectively.

-

Scholarship and Grant Assistance:

- We’ll help you research and apply for scholarships and grants from colleges, private organizations, and community groups.

- Our team can provide guidance on writing compelling essays and preparing strong applications.

-

Student Loan Counseling:

- We’ll provide comprehensive counseling on student loan options, including federal and private loans.

- Our experts can help you understand the terms and conditions of different loan products and choose the best option for your needs.

-

Cost-Saving Strategies:

- We’ll offer practical tips and strategies to reduce your college expenses, such as living at home, renting textbooks, and controlling personal spending.

-

Career Guidance:

- We’ll provide insights into labor market trends, salary expectations, and the long-term financial benefits of different career paths.

- Our experts can help you align your educational goals with your career aspirations.

Don’t let the cost of college be a barrier to your dreams. Contact HOW.EDU.VN today to schedule a personalized consultation with our expert team. We’re here to help you navigate the financial challenges of college and achieve your educational goals.

FAQ: Frequently Asked Questions About College Semester Costs

- What is the average cost of tuition per semester at a public university?

The average cost of tuition per semester at a public university ranges from $4,875 for in-state students to $14,193 for out-of-state students. - How much does a semester at a private college typically cost?

A semester at a private college typically costs around $19,210.50 for tuition alone, with total costs often exceeding $29,314 when including other expenses. - What are the main factors that influence the cost of a college semester?

The main factors include the type of institution (public vs. private), tuition and fees, room and board, books and supplies, and personal expenses. - Are there ways to reduce the cost of a college semester?

Yes, strategies include applying for financial aid, choosing an affordable institution, living strategically, minimizing book costs, and controlling personal spending. - How do student loans affect the overall cost of a college semester?

Student loans add to the overall cost due to interest and fees, potentially leading to significant long-term financial burden. - What is the difference in cost between a community college and a 4-year university?

Community colleges are generally more affordable, with semester costs around $8,719.50, compared to $13,573 at a 4-year university. - Can I use financial aid to cover the full cost of a college semester?

Financial aid can significantly offset costs, but it may not cover the full amount. It depends on eligibility and the amount of aid received. - What are some often-overlooked expenses when planning for a college semester?

Often overlooked expenses include transportation, health insurance, technology fees, and personal expenses like clothing and entertainment. - How can I estimate my specific college semester costs accurately?

Visit the college’s website for tuition and fee schedules, research housing rates, estimate personal expenses, and factor in potential financial aid. - Is a college education worth the investment considering the costs?

Yes, a college education often leads to increased earning potential, career advancement, and lower unemployment rates, making it a worthwhile investment.

Ready to take control of your college financing? Contact HOW.EDU.VN today for a personalized consultation with our team of over 100 renowned PhDs. We can help you navigate the complexities of college costs and achieve your educational goals.

Contact us:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Don’t let financial challenges stand in the way of your dreams. Reach out to how.edu.vn, where expert guidance meets your aspirations.