Grandview Homes’ compensation policies can be a significant factor when considering selling your property, and understanding how they determine their offers is critical. At HOW.EDU.VN, we provide insights into the process and the factors that influence Grandview Homes’ payouts, helping you make informed decisions. This guide breaks down the factors that influence Grandview Homes’ offers, alternative selling strategies, and how you can maximize your returns. Consider consulting with the expert Doctors at how.edu.vn for personalized advice.

1. Understanding Grandview Homes’ Business Model

Grandview Homes operates as a cash buyer, specializing in acquiring properties quickly, often in distressed conditions. Their business model relies on purchasing homes at a discount, making necessary repairs or renovations, and then reselling them for a profit. This approach offers convenience and speed for sellers but typically results in a lower sale price compared to traditional methods.

1.1. The House-Flipping Approach

Grandview Homes, like many cash buyers, utilizes a house-flipping model. They aim to buy properties below market value, enhance their condition, and resell them at a higher price. This model allows them to generate revenue through the difference between the acquisition cost and the resale value.

1.2. Benefits of Selling to a Cash Buyer

Selling to a cash buyer like Grandview Homes offers several advantages, including:

- Speed: Transactions can close in as little as 10 days.

- Convenience: Sellers avoid the need for repairs or renovations.

- Certainty: Cash offers reduce the risk of deals falling through due to financing issues.

However, these benefits often come with a trade-off in terms of the final sale price.

2. Factors Influencing Grandview Homes’ Offers

Several factors influence the amount Grandview Homes is willing to pay for a property. These include market conditions, property condition, and their profit expectations. Understanding these elements can help sellers anticipate the potential offer range.

2.1. Market Conditions and Location

Local market trends significantly impact property values. Grandview Homes assesses recent sale prices of comparable homes in the area to determine a baseline value. Factors such as neighborhood desirability, school district ratings, and proximity to amenities play crucial roles.

2.2. Property Condition and Repair Costs

The condition of the property is a major determinant of the offer price. Homes requiring significant repairs or renovations will receive lower offers to account for the costs of bringing the property up to market standards. This includes assessing structural issues, cosmetic damages, and necessary updates to plumbing, electrical, and HVAC systems.

2.3. Profit Margin and Business Expenses

Grandview Homes, as a business, aims to generate a profit. Their offers reflect their desired profit margin, which covers their operational costs, repair expenses, and potential risks associated with the property. This means that the initial offer will always be less than the anticipated resale value after renovations.

3. How Much Does Grandview Homes Typically Pay?

Industry standards and market analyses suggest that Grandview Homes typically offers between 50% and 70% of a home’s fair market value (FMV). This range is consistent with other cash buyers, reflecting the discounted rate they require to account for the speed and convenience they offer.

3.1. Understanding the Fair Market Value (FMV)

The fair market value (FMV) represents the price a willing buyer would pay to a willing seller in an open market. This valuation considers current market conditions, comparable sales, and the unique attributes of the property. Determining the FMV is crucial for understanding the potential discount offered by Grandview Homes.

3.2. Example Scenario

For instance, if a home has a fair market value of $300,000, Grandview Homes might offer between $150,000 and $210,000. This range illustrates the potential financial trade-off sellers must consider when opting for a quick, all-cash sale.

3.3. Factors Affecting the Offer Range

The specific offer within this range is based on a variety of factors, including:

- Recent sale prices of similar homes: Analyzing comparable sales provides a baseline for valuation.

- Local market data: Assessing current market trends and economic indicators.

- Detailed property research: Investigating the property’s history, zoning regulations, and potential issues.

- Home inspection: Evaluating the condition of the property and estimating repair costs.

4. Grandview Homes LLC Reviews: What Customers Are Saying

Customer reviews provide valuable insights into the experiences of those who have worked with Grandview Homes. While many customers praise the company for its smooth and efficient process, others express concerns about low offers and potential delays.

4.1. Praises: Smooth Selling Experience

Some customers, like Diane Malzahn, have appreciated the smooth selling experience with Grandview Homes, noting the fair offer and flexibility in extending the closing date.

4.2. Complaints: Lowball Offers

Conversely, some customers, such as Frank R, have been frustrated with offers significantly below market value, feeling the offers were unfair given the condition of their homes.

4.3. Mixed Experiences

Other customers, like Mark Mal, couldn’t reach an agreement with Grandview Homes and were glad they didn’t sell, later finding a local investor who offered a better price.

4.4. Analyzing the Reviews

Analyzing these reviews reveals a common theme: while Grandview Homes offers a convenient and quick selling process, the offers may not always reflect the true market value of the property. Potential sellers should carefully weigh the pros and cons before proceeding.

Grandview Homes Reviews Coverage

Grandview Homes Reviews Coverage

5. Alternatives to Selling to Grandview Homes

While Grandview Homes offers a convenient option for a quick sale, exploring alternative methods can potentially yield a higher return on your property. These alternatives include listing on the MLS, working with a real estate agent, or considering other iBuyers.

5.1. Listing on the MLS (Multiple Listing Service)

Listing your home on the MLS exposes it to a broad network of potential buyers, increasing the chances of receiving multiple offers and securing a higher sale price. Platforms like Houzeo streamline the MLS listing process, allowing sellers to manage offers and negotiate terms effectively.

5.2. Working with a Real Estate Agent

A real estate agent can provide expert guidance on pricing, marketing, and negotiation. Agents understand local market dynamics and can help you navigate the complexities of the selling process, potentially resulting in a higher sale price.

5.3. Considering Other iBuyers

iBuyers (instant buyers) offer similar services to Grandview Homes but may provide different offers based on their valuation models. Comparing offers from multiple iBuyers can help you find the most competitive price for your property.

6. Grandview Homes Pros and Cons: A Detailed Overview

To make an informed decision, it’s essential to weigh the advantages and disadvantages of selling to Grandview Homes. This overview provides a balanced perspective to help you assess whether their services align with your needs.

6.1. Pros of Selling to Grandview Homes

- Quick Closing: Properties can close in as little as 10 days, offering a fast solution for sellers needing immediate funds.

- Flexible Timeline: Sellers can choose a closing date that accommodates their schedule.

- Hassle-Free Process: No need for repairs, renovations, or staging.

- No Closing and Agent Fees: Sellers avoid traditional real estate commissions and closing costs, reducing overall expenses.

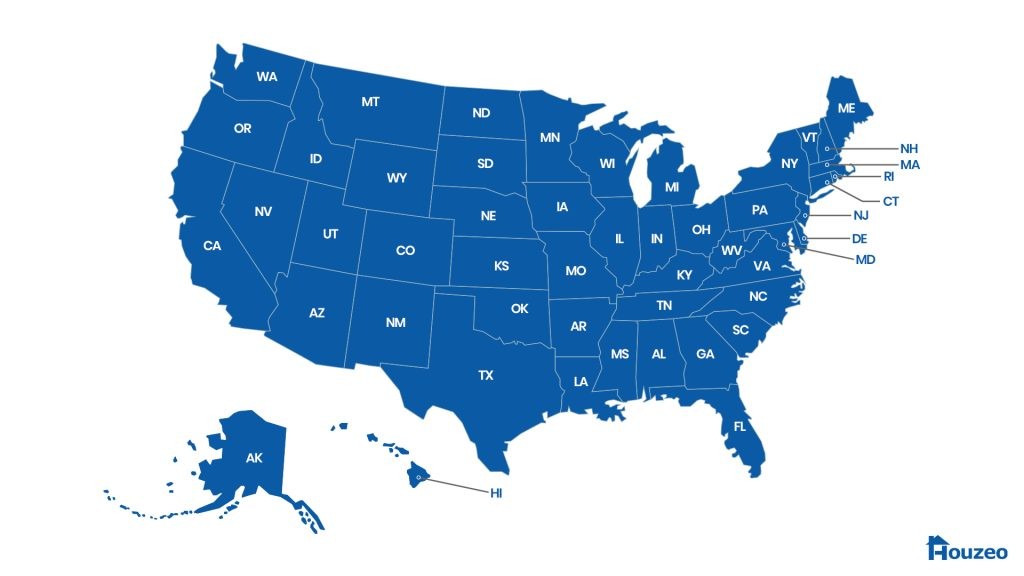

- Nationwide Coverage: Services available in all 50 states and Washington, D.C.

6.2. Cons of Selling to Grandview Homes

- Lowball Offers: Some customers report receiving offers significantly below market value.

- No Scope of Negotiation: Limited or no opportunity to negotiate for a better price.

- Additional Fees: Attorney fees of around $500 may apply at closing.

7. Competitor Analysis: Grandview Homes vs. Other Options

Comparing Grandview Homes to its competitors provides a broader understanding of the available options and their respective benefits. This analysis focuses on Houzeo, HomeVestors, and Offerpad.

7.1. Grandview Homes vs. Houzeo

Houzeo offers a tech-centric platform that allows sellers to list their homes on the MLS, manage multiple offers, and negotiate terms effectively. Unlike Grandview Homes, Houzeo aims to maximize the seller’s return by exposing the property to a wide range of potential buyers.

| Feature | Grandview Homes | Houzeo |

|---|---|---|

| Sale Price | 50% to 70% of FMV | Up to 100% of FMV |

| Customer Rating | 4.2 stars (145 reviews) | 4.9 stars (10,000+ reviews) |

| Closing Timeline | 10 to 30 days | 2 to 60 days |

| Fees | Attorney fees | $199 onwards |

| Scope for Negotiation | No | Yes |

| Compare Offers | No | Yes |

| Highest and Best Offer | No | Yes |

7.2. Grandview Homes vs. HomeVestors

HomeVestors operates similarly to Grandview Homes, purchasing properties quickly for cash. However, HomeVestors sometimes refers sellers to third-party brokers, potentially leading to inconsistent experiences.

7.3. Grandview Homes vs. Offerpad

Offerpad, an iBuyer, typically offers a higher percentage of the home’s value compared to Grandview Homes, often around 70% to 80%. However, Offerpad has stricter criteria for the properties they purchase.

8. Maximizing Your Offer: Tips and Strategies

If you decide to pursue an offer from Grandview Homes, there are strategies you can use to potentially increase the amount they are willing to pay. These include gathering multiple offers, making strategic repairs, and understanding your home’s true value.

8.1. Obtain Multiple Offers

Contacting several cash buyers and iBuyers can provide you with a range of offers. This competitive environment may encourage Grandview Homes to increase their initial offer to secure your property.

8.2. Make Strategic Repairs

Addressing critical repairs before contacting Grandview Homes can improve your property’s appeal and potentially increase the offer. Focus on issues that significantly impact the home’s value, such as structural problems, roof repairs, or essential system upgrades.

8.3. Know Your Home’s Value

Conducting a thorough market analysis to determine your home’s fair market value is essential. This knowledge equips you with a strong negotiating position and helps you assess whether Grandview Homes’ offer is reasonable.

9. Understanding the Legal and Financial Implications

Selling a home involves legal and financial considerations that should be carefully evaluated. Consulting with professionals can help you navigate these complexities and protect your interests.

9.1. Consult with a Real Estate Attorney

A real estate attorney can review the sales contract, explain your rights and obligations, and ensure that the transaction complies with all applicable laws.

9.2. Seek Financial Advice

A financial advisor can help you understand the tax implications of selling your home and develop a strategy for managing the proceeds. This includes considering capital gains taxes, reinvestment options, and potential tax-saving strategies.

9.3. Review the Sales Contract

Carefully review the sales contract to understand the terms and conditions of the sale. Pay attention to details such as the closing date, contingencies, and any potential fees or charges.

10. Real-Life Case Studies: Lessons Learned

Examining real-life case studies can provide valuable insights into the potential outcomes of selling to Grandview Homes. These examples highlight the importance of thorough research, negotiation, and understanding the market.

10.1. Case Study 1: Maximizing Value Through MLS Listing

A homeowner in Chicago received a low offer from Grandview Homes for their distressed property. Instead of accepting the offer, they listed the property on the MLS through Houzeo. This attracted multiple cash buyers, resulting in a final sale price that was significantly higher than Grandview Homes’ initial offer.

10.2. Case Study 2: Strategic Repairs and Negotiation

A seller in Atlanta contacted Grandview Homes for an offer on their home, which required some repairs. After obtaining an initial offer, they invested in strategic repairs to address the most critical issues. They then renegotiated with Grandview Homes, resulting in a higher offer that better reflected the property’s value.

10.3. Case Study 3: Understanding Market Value and Walking Away

A homeowner in Phoenix received an offer from Grandview Homes that was significantly below market value. After conducting thorough research and consulting with a real estate agent, they determined that the offer was unacceptable. They decided to list the property on the open market, ultimately securing a sale price that was much higher than Grandview Homes’ offer.

11. Navigating the Selling Process with Grandview Homes

If you decide to sell to Grandview Homes, understanding their process can help you navigate the transaction smoothly. This includes scheduling a visit, undergoing a home inspection, and receiving an offer.

11.1. Schedule a Visit

The first step is to fill out a form with your property details and contact information on Grandview Homes’ website. This initiates the process of requesting a fair cash offer.

11.2. Home Inspection

An agent from Grandview Homes will visit your property at the scheduled time to conduct an inspection. This assessment helps them evaluate the condition of the property and estimate repair costs.

11.3. Receive an Offer

Grandview Homes typically extends an offer within 24 hours of the visit. If you choose to accept the offer, they will send you a contract on the same day.

11.4. Closing the Deal

Upon acceptance of the offer, you may receive a portion of the funds upfront. The closing process can be completed within 10 days or on a date that is convenient for you.

12. Alternative “We Buy Houses for Cash” Companies

Exploring other companies that buy houses for cash can provide you with additional options and potentially more competitive offers. These companies operate in various regions and may have different criteria for the properties they purchase.

| Region | States/Cities | Companies That Buy Houses For Cash Near Me