Unlock the secrets to understanding Square’s costs and optimizing your business finances with insights from HOW.EDU.VN. Learn about transaction fees, hardware investments, and software subscriptions to effectively manage your expenses and maximize profitability. Discover cost-saving strategies for your business and connect with expert financial advisors at HOW.EDU.VN for personalized guidance.

1. Understanding Square’s Monthly Costs

Square’s cost structure is not as simple as a single monthly fee. Instead, it depends on the specific services and products you leverage for your business operations. It is important to understand the different cost components and optimize usage to save money. The main factors determining your monthly expenses are:

- Transaction Fees: Charges applied per transaction, contingent on the transaction type.

- Hardware Costs: One-time expenses for Square’s hardware solutions.

- Software Fees: Subscription costs for Square’s software solutions.

- Additional Fees: Potential charges under particular conditions.

Let’s explore these elements in greater detail to provide you with a clear picture of Square’s cost implications.

2. Detailed Breakdown of Square Fees and Costs

To accurately assess Square’s cost-effectiveness for your business, it’s crucial to deeply understand the various fees and costs involved. This includes transaction fees, hardware expenses, software subscriptions, and other potential charges that may arise.

2.1. Transaction Fees: The Cost of Processing Payments

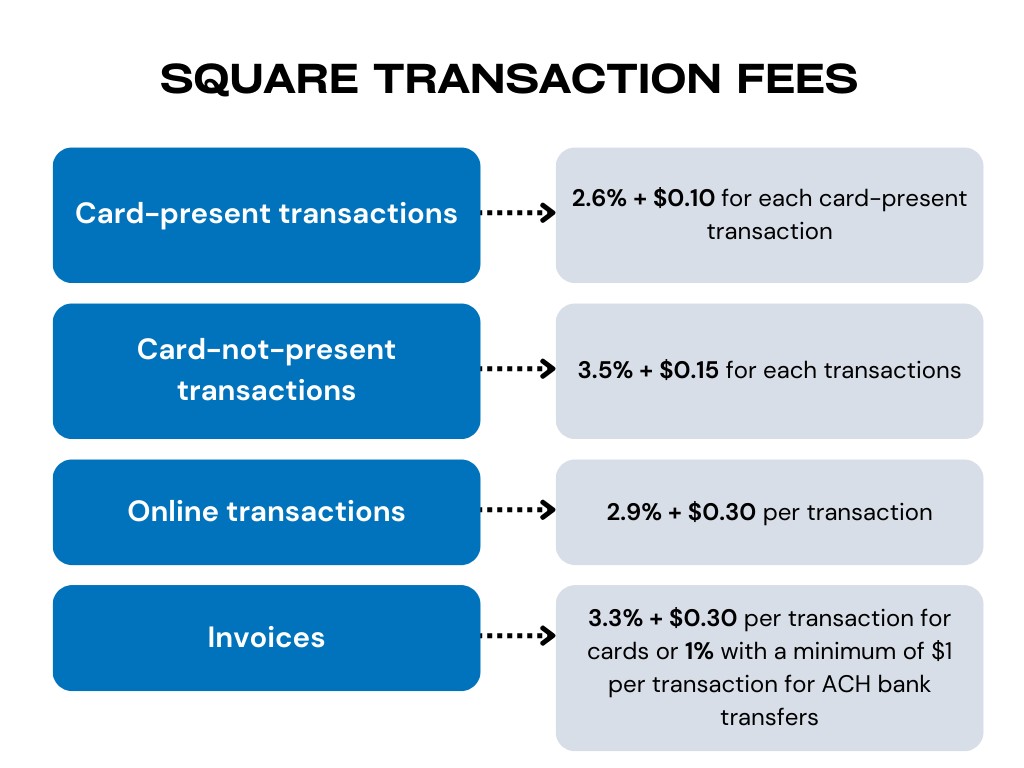

Transaction fees are an essential aspect of accepting electronic payments. Square, like other payment processors, levies these fees to offset the costs associated with facilitating transactions. The fee structure differs based on how the transaction is conducted:

- Card-Present Transactions: For transactions where the customer’s card is physically present and read by a Square device (chip, swipe, or tap), the fee is generally lower. Square charges 2.6% + $0.10 for each card-present transaction. The lower fee reflects the reduced risk of fraud due to the cardholder’s physical presence.

- Card-Not-Present Transactions: When the customer’s card is not physically present, such as with manually entered card details or phone orders, the transaction is considered higher risk. Square charges 3.5% + $0.15 for each of these transactions.

- Online Transactions: For transactions conducted through Square’s Online Store or using online payment APIs, Square charges 2.9% + $0.30 per transaction.

- Invoices: If you utilize Square’s invoicing features, the fee is 3.3% + $0.30 per transaction for cards or 1% (minimum $1) for ACH bank transfers.

These fees are automatically deducted from the transaction amount before the funds are deposited into your bank account. It’s important to factor these fees into your pricing strategy to maintain profitability.

2.2. Hardware Costs: Investing in Payment Processing Tools

Square provides a variety of hardware products to facilitate payment processing. These products entail a one-time upfront cost. Here are some of the hardware options available:

- Square Reader for Magstripe: The most basic option, which plugs into a smartphone or tablet to swipe magnetic stripe cards. The cost is $10.

- Square Reader for Contactless and Chip: Accepts chip cards and contactless payments (Apple Pay, Google Pay). The cost is $59.

- Square Terminal: An all-in-one card processing terminal that accepts all types of card payments and prints receipts. Priced at $299.

- Square Register: A fully integrated point-of-sale system with a customer display. Accepts all forms of card payments. At the time of writing, the Register was priced at $799.

For more information, read about [How Square Point Of Sale works](https://synder.com/blog/how-does-square-point-of-sale-work-a-guide-to-the-basics/) and [How to set up Afterpay On Square](https://synder.com/blog/how-to-set-up-afterpay-on-square-a-step-by-step-guide/).

2.3. Software Fees: Subscriptions for Advanced Features

Square offers a variety of software solutions designed to enhance your business operations. These solutions come with monthly subscription fees that vary depending on the product and plan you choose:

- Square for Retail: Tailored for retail businesses, offering features like multi-location inventory management and detailed sales reports. It has a free version (Square for Retail Free) and a more advanced version (Square for Retail Plus), costing $60 per location per month.

- Square for Restaurants: A POS software specifically designed for the restaurant industry, offering features like table mapping and order management. There is a free version (Square for Restaurants Free), a more advanced version (Square for Restaurants Plus) at $60 per location per month, and a premium version for businesses processing over $250k annually.

- Square Appointments: Ideal for service-based businesses, providing online booking, calendar management, and reminders. The cost depends on the plan: Free for a single location, Plus is $29 per month per location, and Premium is $69 per month per location.

2.4. Additional Fees: Potential One-Off Costs

In addition to the core fees, Square may charge additional fees under specific circumstances:

- Refund Fees: Square does not charge a fee to process refunds. However, the original transaction fees from the initial sale are not returned.

- Instant Transfer Fees: While Square typically transfers funds to your bank account on a set schedule, you can opt for instant transfers for a 1.75% fee per transfer.

For further details, refer to [Square fee rates](https://squareup.com/help/us/en/article/5068-what-are-square-s-fees).

3. Strategies to Minimize Square Fees

While Square’s processing fees are generally fixed, several strategies can help mitigate their impact on your business’s bottom line.

3.1. Encourage Cash or Debit Card Payments

Since Square charges fees for credit card transactions, incentivizing customers to pay with cash or debit cards can reduce your overall costs. Consider offering discounts for cash payments or clearly communicating the benefits of using debit cards.

3.2. Increase Your Average Transaction Value

Each transaction includes a fixed fee in addition to the percentage rate. Increasing your average transaction value can make your fees more cost-effective. Tactics such as bundling products or services, upselling, or setting a minimum transaction amount for card payments can help achieve this.

3.3. Utilize Square’s POS System for In-Person Transactions

Using Square’s POS system for in-person transactions results in lower fees than manually entered or online transactions. Prioritize in-person card transactions whenever feasible to take advantage of these lower rates.

3.4. Select the Right Square Software for Your Business Needs

Square offers a range of software options, some free and others with monthly fees. Assess your business needs carefully and choose the software that provides the features you require without paying for unnecessary extras.

3.5. Negotiate Your Fees (For High-Volume Businesses)

If your business processes a substantial volume of transactions, you may be able to negotiate lower rates with Square. Contact Square’s customer service to discuss the possibility of customized pricing.

Before implementing these strategies, carefully consider their potential effects on your business and customer experience. Strategies aimed at reducing fees should not negatively impact sales or customer satisfaction.

4. Generating Reports on Square Fees

Tracking your Square fees is crucial for effective financial management. Square provides reporting features through its dashboard, allowing you to monitor your expenses.

4.1. Accessing Reports Through Square’s Dashboard

Follow these steps to access detailed reports on your Square fees:

- Log into your Square dashboard. Access your Dashboard from a web browser using your Square account credentials.

- Navigate to the Reports section. Locate the “Reports” section in the main menu on the left side of the screen.

- Access the Transaction report. Select the “Transaction” report for detailed information on your Square fees.

- Customize the report. Specify a date range and select the information you want to include in the report. Make sure to include “Fees” to view your Square fee expenses.

- Export or print the report. Export the report as a CSV file or print it directly from the Dashboard to maintain a digital or hard copy of your Square fee records.

4.2. Utilizing Third-Party Solutions

Consider implementing a third-party solution to streamline your bookkeeping and accounting processes. Solutions like Synder Sync can synchronize data between Square and your accounting software (QuickBooks Online/Desktop or Xero).

Synder allows you to synchronize real-time data and track various Square transactions, including processing fees, payments, refunds, and settlements. Choose between per-transaction sync for detailed data or daily summary sync for high-level information. Once the data is synchronized, you can generate comprehensive P&L reports that include Square fees and other income and expense records.

Synder also enables you to connect multiple business units to your accounting software, allowing you to track performance across all channels. With Synder and QuickBooks Online, you can create and schedule invoices and automatically close them once payments are received.

Connect your Square to Synder by [creating a free account](https://go.synder.com/auth#/signup?product=SYNC/?sync) or [book a seat at our webinar](https://synder.com/demo/) to get acquainted with all the features in more detail and ask any questions about the workflow, which will be answered by Synder specialists.

5. Charging Customers a Processing Fee on Square

Square does not offer a built-in feature to directly add a processing fee to a transaction. However, some businesses choose to incorporate the cost of processing fees into their prices or add a general service charge to orders.

5.1. Options for Incorporating Processing Fees

- Adjusting Prices: Calculate your average processing cost and adjust your product or service prices accordingly. This way, the listed prices already include the processing fee.

- Adding a Service Charge: Add a service charge to an entire sale or individual items through the Square POS app.

To add a service charge to a sale, go to your Square POS app → “Current Sale” →”Discounts” → “Add a Discount” or select an existing one → enter the name and amount of the service charge → “Save“.

To add a service charge to individual items, create a new item representing the service charge and add it to the sale along with the other items the customer is purchasing.

5.2. Legal and Ethical Considerations

Before implementing these strategies, be aware of local laws and regulations. Some jurisdictions prohibit or restrict charging customers an additional fee for using a credit card. Be transparent with your customers about any added charges and ensure your business remains compliant with all relevant laws and regulations. Consult with a legal advisor or reach out to Square’s customer support for up-to-date information.

6. Determining if Square is Worth the Cost

Square fees are an important consideration, but they must be evaluated in the context of the comprehensive benefits that Square provides. For many businesses, the convenience, simplicity, and value offered by Square’s integrated payment processing, hardware, and software solutions outweigh the cost implications. Evaluate your business’s needs and carefully consider the implications of Square fees to make an informed decision.

7. Expert Financial Advice at HOW.EDU.VN

Navigating the complexities of business finances, including understanding and managing Square fees, can be challenging. At HOW.EDU.VN, we connect you with a network of over 100 experienced PhDs and experts across various fields. Whether you need help with financial planning, operational optimization, or strategic decision-making, our experts can provide personalized guidance tailored to your unique needs.

7.1. Benefits of Consulting with Our Experts

- Expertise: Our experts possess advanced degrees and extensive experience in their respective fields, ensuring you receive knowledgeable and reliable advice.

- Personalized Solutions: We understand that every business is different. Our experts take the time to understand your specific challenges and goals to develop customized solutions.

- Strategic Insights: Gain valuable insights into industry trends, best practices, and emerging opportunities to help you make informed decisions and stay ahead of the competition.

- Objective Perspective: Our experts provide an unbiased perspective, helping you identify blind spots and make strategic adjustments to improve your business performance.

- Comprehensive Support: From initial consultation to ongoing support, we are committed to providing you with the resources and guidance you need to succeed.

7.2. How to Connect with Our Experts

Connecting with our experts is easy. Simply visit HOW.EDU.VN and browse our directory of experts. You can search by expertise, industry, or specific skills. Once you find an expert who matches your needs, you can request a consultation or submit your questions directly through our platform.

7.3. Case Studies: Real-World Success Stories

To illustrate the value of consulting with our experts, consider these anonymized case studies:

- Retail Business: A small retail business struggled with inventory management and profitability. After consulting with one of our experts, they implemented a new inventory tracking system and adjusted their pricing strategy, resulting in a 20% increase in profits within six months.

- Restaurant Owner: A restaurant owner faced challenges with rising food costs and labor expenses. Our expert helped them optimize their menu, streamline operations, and negotiate better deals with suppliers, leading to a 15% reduction in expenses.

- Service Provider: A service-based business wanted to expand its reach and attract new clients. Our expert assisted them in developing a comprehensive marketing plan, including social media strategies and online advertising campaigns, resulting in a 30% increase in new clients.

These are just a few examples of how our experts have helped businesses overcome challenges and achieve their goals. At HOW.EDU.VN, we are committed to empowering you with the knowledge and guidance you need to thrive.

8. FAQs About Square Costs

Here are some frequently asked questions about Square costs:

- What is the standard transaction fee for card-present transactions?

- The standard fee is 2.6% + $0.10 per transaction.

- What is the transaction fee for online sales through Square?

- The fee is 2.9% + $0.30 per transaction.

- Does Square charge a monthly fee?

- Square does not charge a standard monthly fee. However, certain software subscriptions have monthly fees.

- Are there any hidden fees with Square?

- Square is transparent about its fees. Additional fees may apply for instant transfers or specific services.

- Can I negotiate Square’s processing fees?

- High-volume businesses may be able to negotiate lower rates.

- What happens to the transaction fee if I issue a refund?

- The original transaction fee is not returned when you issue a refund.

- How can I track my Square fees?

- Track your fees through Square’s dashboard or by using third-party accounting solutions.

- Does Square offer discounts for non-profits?

- Contact Square directly to inquire about potential discounts for non-profit organizations.

- What hardware do I need to start using Square?

- You can start with the Square Reader for Magstripe ($10) or the Square Reader for Contactless and Chip ($59).

- Can I charge customers a fee for using a credit card?

- This may be restricted by local laws. Be transparent and compliant with regulations.

9. Get Personalized Advice Today

Understanding the nuances of Square costs is just the first step. For personalized advice and solutions tailored to your specific business needs, contact the experts at HOW.EDU.VN. We provide the insights and guidance you need to make informed decisions, optimize your operations, and achieve your financial goals.

Contact us today:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Let how.edu.vn empower you with the expertise to thrive in today’s competitive business landscape. Our team of over 100 PhDs is ready to address your unique challenges and guide you toward lasting success.