Venmo’s popularity as a peer-to-peer payment platform is undeniable, offering a convenient way to send and receive money. However, understanding “How Much Does Venmo Cost” is crucial to avoid unexpected charges. HOW.EDU.VN provides a detailed breakdown of Venmo’s fee structure, covering various transaction types. By understanding these costs, users can optimize their usage and minimize expenses, allowing them to make savvy financial decisions and manage their online financial transactions more effectively.

1. Understanding Venmo’s Fee Structure

Venmo, a part of the PayPal ecosystem, is a popular platform for quick social payments, securing user data during transactions. Its user base significantly grew during the pandemic, indicating a shift toward online payments. Understanding “how much does Venmo cost” is vital, so let’s delve into Venmo’s fee structure to navigate your transactions effectively.

1.1. Types of Transactions and Associated Fees

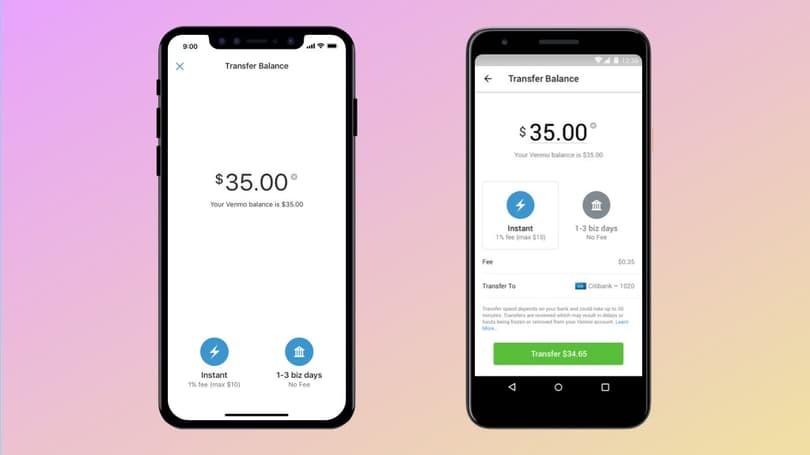

Venmo offers multiple ways to make payments, including using your bank account, Venmo balance, debit card, or credit card. Fees may apply when transferring funds between these sources. “How much does Venmo cost” depends on the type of transfer you choose.

- Instant Transfers: 1.75% of the transfer amount, with a minimum fee of $0.25 and a maximum of $25.

- Credit Card Transfers: A 3% fee is applied when sending money to another user using a credit card.

- Standard Transfers: These transfers are free.

- Instant Withdrawals: 1.75% of the withdrawal amount, with a minimum fee of $0.25 and a maximum of $25.

1.2. Cryptocurrency Transaction Fees

Venmo also allows you to transact in cryptocurrencies, and the fees vary based on the transaction amount. Understanding these fees helps answer “how much does Venmo cost” when dealing with crypto.

| Transaction Amount | Venmo Service Fee |

|---|---|

| $1–4.99 | $0.49 |

| $5–24.99 | $0.99 |

| $25–74.99 | $1.99 |

| $75–200 | $2.49 |

| $200.01–1,000 | 1.80% of the amount |

| >$1,000 | 1.50% of the amount |

1.3. Transparency in Fees

Venmo prides itself on transparency, ensuring no hidden fees. Basic transactions, like sending and receiving money from your bank account or debit card, are usually free. Clear details are provided upfront for any mandatory fees.

2. Calculating Venmo Transaction Fees

To answer “how much does Venmo cost,” calculating the fees for various transactions is essential. Several Venmo transaction fee calculators can help determine the cost of instant transfers.

2.1. Using a Venmo Fee Calculator

Venmo fee calculators help determine the cost of using Venmo for instant transfers. These tools save time by automating calculations.

To use a fee calculator:

- Enter Transaction Type: Select the type of transaction you plan to make.

- Input Transfer Amount: Enter the total amount you wish to transfer.

The calculator will provide an accurate estimate of the fees, helping you manage your finances effectively.

2.2. Manual Calculation Examples

Understanding how to manually calculate fees can also provide insights into “how much does Venmo cost.”

- Instant Transfer: If you send $100 via instant transfer, the fee is 1.75%, which equals $1.75.

- Credit Card Transfer: Sending $50 using a credit card incurs a 3% fee, which is $1.50.

2.3. Understanding Fee Caps and Minimums

Venmo’s fee structure includes minimum and maximum limits, affecting the overall cost. For instance, instant transfers have a minimum fee of $0.25 and a maximum of $25. Knowing these limits helps you understand “how much does Venmo cost” under different circumstances.

3. Strategies to Minimize Venmo Transfer Fees

Minimizing costs is key to getting the most out of Venmo. Several strategies can help you reduce fees and answer “how much does Venmo cost” in the long run.

3.1. Avoiding Credit Card Use

Venmo charges a 3% fee for credit card transactions. Transferring money from your Venmo balance, debit card, or bank account avoids this fee, making these options more cost-effective.

3.2. Using Standard Transfers

Instant transfers incur a fee of 1.75%. Opting for standard electronic transfers can save you money if you don’t need immediate access to the funds. Standard transfers typically take one to three business days.

3.3. Cashing Checks with the “In 10 Days” Option

When cashing checks through Venmo, choose the “deposit within 10 days” option to avoid fees. Instant deposits come with a fee, so planning can save you money.

3.4. Strategic Timing of Transfers

Timing your transfers can also impact fees. For instance, avoid making multiple small transfers that could incur minimum fees each time. Consolidating transactions can be more cost-effective.

3.5. Linking a Bank Account

Linking a bank account to Venmo can reduce fees. Using your bank account for transfers is often free, making it a smart choice for regular transactions.

4. Venmo Business Accounts and Fees

Venmo offers business accounts with unique fee structures, impacting “how much does Venmo cost” for businesses.

4.1. Overview of Venmo Business Accounts

Venmo business accounts cater to businesses by providing tools for managing transactions and engaging with customers. These accounts are designed for businesses looking to leverage Venmo’s user base.

4.2. Transaction Fees for Businesses

Business accounts have different fee structures compared to personal accounts. Typically, businesses pay a fee per transaction, which can vary. Understanding these fees is crucial for businesses using Venmo.

4.3. Benefits of Using a Business Account

Despite the fees, business accounts offer benefits such as enhanced transaction tracking, customer engagement features, and the ability to accept payments from a broader audience.

4.4. Comparing Personal vs. Business Account Fees

It’s important to compare the fee structures of personal and business accounts to determine the most cost-effective option. Businesses should evaluate their transaction volume and needs to make an informed decision.

5. Understanding Venmo’s Limits

Understanding Venmo limits is just as important as understanding its fees. These limits can impact how you use the platform and, indirectly, how much it costs you.

5.1. Sending Limits

Venmo imposes sending limits on accounts to prevent fraud and enhance security. Initially, unverified accounts have lower sending limits, which can be increased by verifying your identity.

5.2. Receiving Limits

There are also limits on how much money you can receive into your Venmo account. These limits are in place to comply with regulatory requirements and ensure the safety of transactions.

5.3. Withdrawal Limits

Withdrawal limits dictate how much money you can transfer from your Venmo account to your bank account. These limits can vary based on your account status and verification level.

5.4. How to Increase Limits

To increase your sending and receiving limits, Venmo typically requires you to verify your identity by providing additional information such as your Social Security number and linking a bank account.

5.5. Impact of Limits on Fees

Venmo limits can indirectly affect fees. For example, if you exceed your sending limit, you might need to make multiple transactions, potentially incurring more fees than a single larger transaction.

6. Venmo Alternatives

While Venmo is popular, other payment platforms offer different fee structures and benefits. Exploring these alternatives can help you find the most cost-effective solution.

6.1. Comparison with PayPal

PayPal, also owned by Venmo’s parent company, offers different services and fee structures. PayPal is often used for business transactions and international transfers, while Venmo is primarily for personal use.

6.2. Zelle

Zelle is a direct bank-to-bank transfer service that often has no fees. It’s a good alternative if you need to send money quickly and your bank supports Zelle.

6.3. Cash App

Cash App offers similar features to Venmo, including instant transfers and the ability to invest in stocks and Bitcoin. Its fee structure may be more favorable for certain types of transactions.

6.4. Google Pay

Google Pay allows you to send money to friends and family through your Google account. It often has no fees for basic transactions and integrates seamlessly with other Google services.

6.5. Apple Pay

Apple Pay is integrated into Apple devices and allows you to send and receive money through iMessage. It often has no fees for personal transfers and is convenient for Apple users.

7. Tips for Using Venmo Effectively

Using Venmo effectively involves understanding its features and optimizing your transactions.

7.1. Understanding Venmo’s Security Features

Venmo offers security features such as encryption and fraud monitoring. Understanding these features helps you protect your account and transactions.

7.2. Setting Up Two-Factor Authentication

Enabling two-factor authentication adds an extra layer of security to your account, protecting it from unauthorized access.

7.3. Monitoring Your Transactions Regularly

Regularly monitoring your transactions helps you identify and address any suspicious activity promptly.

7.4. Avoiding Scams and Fraud

Be cautious of scams and fraud attempts, such as phishing emails or requests for money from unknown sources.

7.5. Using Venmo for Budgeting

Venmo can be used as a budgeting tool by tracking your spending and setting limits for certain categories.

8. Future Trends in Venmo Fees and Services

The landscape of digital payments is constantly evolving, and Venmo is likely to introduce new features and fee structures in the future.

8.1. Potential Changes in Fee Structure

Keep an eye on any announcements from Venmo regarding changes to its fee structure. These changes could impact how much you pay for using the service.

8.2. New Services and Features

Venmo may introduce new services and features, such as expanded cryptocurrency support or integration with other financial platforms.

8.3. Impact of Regulations

Regulatory changes could also impact Venmo’s fees and services. Stay informed about any new regulations that could affect your use of the platform.

8.4. Competition from Other Platforms

Competition from other payment platforms could drive Venmo to offer more competitive fees and services to attract and retain users.

8.5. User Expectations

User expectations for low-cost and convenient payment options will likely influence Venmo’s future strategies.

9. Real-Life Examples of Venmo Fee Scenarios

Understanding how fees apply in real-life scenarios can help you make informed decisions.

9.1. Splitting a Dinner Bill

When splitting a $100 dinner bill with friends, using a credit card for the transaction would incur a $3 fee. Using a bank account or Venmo balance would avoid this fee.

9.2. Sending Rent Money

Sending $1,000 in rent money via instant transfer would incur a fee of $17.50. Planning ahead and using a standard transfer would avoid this fee.

9.3. Paying for a Service

Paying a local service provider $500 via Venmo business account would incur a fee that varies based on the account’s fee structure.

9.4. Receiving Money for a Sale

Receiving $200 from selling an item on Venmo would not incur fees if the sender uses a bank account or Venmo balance.

9.5. Withdrawing Funds Quickly

Withdrawing $500 instantly from your Venmo account would incur a fee of $8.75. Waiting for a standard transfer would avoid this fee.

10. Navigating Common Venmo Issues

Dealing with common Venmo issues effectively can prevent unnecessary fees and frustrations.

10.1. Resolving Transaction Errors

If you encounter a transaction error, promptly contact Venmo support to resolve the issue and avoid potential fees.

10.2. Dealing with Unauthorized Transactions

If you notice an unauthorized transaction, immediately report it to Venmo to prevent further charges.

10.3. Addressing Payment Disputes

If you have a payment dispute with another user, use Venmo’s dispute resolution process to seek a fair outcome.

10.4. Managing Account Holds

If your account is placed on hold, follow Venmo’s instructions to resolve the issue and regain access to your funds.

10.5. Understanding Refund Policies

Familiarize yourself with Venmo’s refund policies to understand how refunds are processed and whether any fees apply.

11. Expert Opinions on Venmo Fees

Getting insights from financial experts can provide a broader understanding of Venmo’s fees and how to manage them effectively.

11.1. Financial Advisors’ Perspectives

Financial advisors often recommend understanding Venmo’s fee structure to avoid unnecessary costs and make informed decisions.

11.2. Tech Experts’ Analysis

Tech experts analyze Venmo’s fees in the context of the broader digital payment landscape, comparing it to other platforms and evaluating its competitiveness.

11.3. Consumer Advocates’ Recommendations

Consumer advocates often advise users to be aware of Venmo’s fees and limits and to use the platform in a way that minimizes costs.

11.4. Industry Analysts’ Forecasts

Industry analysts provide forecasts on potential changes to Venmo’s fees and services, based on market trends and competitive pressures.

11.5. Academics’ Research

Academics conduct research on the impact of digital payment platforms like Venmo on consumer behavior and financial literacy.

12. FAQ: Frequently Asked Questions About Venmo Costs

12.1. Does Venmo Charge a Monthly Fee?

No, Venmo does not charge a monthly fee for personal accounts.

12.2. What Are the Fees for Sending Money?

Sending money from your Venmo balance, bank account, or debit card is usually free. However, sending money using a credit card incurs a 3% fee.

12.3. How Much Does Venmo Charge for Instant Transfers?

Venmo charges 1.75% for instant transfers, with a minimum fee of $0.25 and a maximum of $25.

12.4. Are There Fees for Receiving Money?

There are no fees for receiving money on Venmo for personal accounts.

12.5. How Can I Avoid Venmo Fees?

To avoid Venmo fees, use your Venmo balance, bank account, or debit card for transfers, and opt for standard transfers instead of instant transfers.

12.6. What Are the Fees for Venmo Business Accounts?

Venmo business accounts have different fee structures, typically charging a fee per transaction.

12.7. Does Venmo Charge Fees for Cryptocurrency Transactions?

Yes, Venmo charges fees for cryptocurrency transactions, which vary based on the transaction amount.

12.8. How Do I Calculate Venmo Fees?

You can use a Venmo fee calculator or manually calculate the fees based on the type and amount of the transaction.

12.9. What Happens If I Exceed My Venmo Limit?

If you exceed your Venmo limit, you may need to make multiple transactions, potentially incurring more fees.

12.10. How Do I Contact Venmo Support?

You can contact Venmo support through the app or website for assistance with any questions or issues.

By understanding these costs and the scenarios in which they apply, you can make informed decisions about when to use Venmo and when to explore alternative payment methods. Stay informed about the latest developments in the financial technology sector with HOW.EDU.VN.

Ready to make smarter financial decisions with Venmo? Contact our team of expert PhDs at HOW.EDU.VN for personalized advice and strategies to minimize fees and maximize your financial efficiency. Located at 456 Expertise Plaza, Consult City, CA 90210, United States, we’re here to help. Reach out via WhatsApp at +1 (310) 555-1212 or visit our website at how.edu.vn to get started today. Let us guide you to financial success with Venmo and beyond.