Determining How Much Federal Taxes Should Be Withheld from your paycheck can be a complex yet critical aspect of financial planning. Many taxpayers find themselves either receiving a larger-than-expected tax refund or facing an unexpected tax bill at the end of the year. This often stems from inaccuracies in paycheck withholdings, highlighting the importance of understanding and adjusting your Form W-4. At HOW.EDU.VN, we connect you with seasoned tax experts and financial advisors who can provide personalized guidance, ensuring that your withholding aligns with your financial situation and avoids surprises during tax season. Proper federal tax withholding, accurate W-4 form, and expert tax advice are key to financial stability.

1. Understanding Paycheck Withholdings for Federal Taxes

Paycheck withholdings are the amounts deducted from your earnings to pay for federal income taxes. When you start a new job, you fill out Form W-4, which guides your employer on how much to withhold from each paycheck. Completing this form accurately is crucial to avoid overpaying or underpaying your taxes throughout the year.

1.1. How Form W-4 Works

Form W-4 collects information about your filing status, dependents, other income, and deductions. This information helps your employer determine the correct amount of federal income tax to withhold from your pay. Answering the form properly ensures a good outcome, but many find the form confusing, according to JoAnn May, a CFP at Forest Asset Management. To better understand this process, HOW.EDU.VN offers expert consultations to navigate these complexities.

1.2. Adjusting Withholdings After Life Changes

Life changes like marriage, divorce, or having a child can significantly impact your tax obligations. When these events occur, you need to update your Form W-4 to reflect the changes. It’s also essential to double-check your paystubs to ensure that the changes have been correctly applied. Experts at HOW.EDU.VN can help you understand how these changes affect your withholding and guide you through the necessary adjustments.

Form W-4 guide for paycheck tax withholding

Form W-4 guide for paycheck tax withholding

1.3. Regular Review of Withholdings

To avoid significant tax bills or refunds, it’s wise to review your withholdings periodically. This practice ensures your tax payments are aligned with your current income and tax situation. HOW.EDU.VN provides tools and expert consultations to help you stay on top of your tax planning.

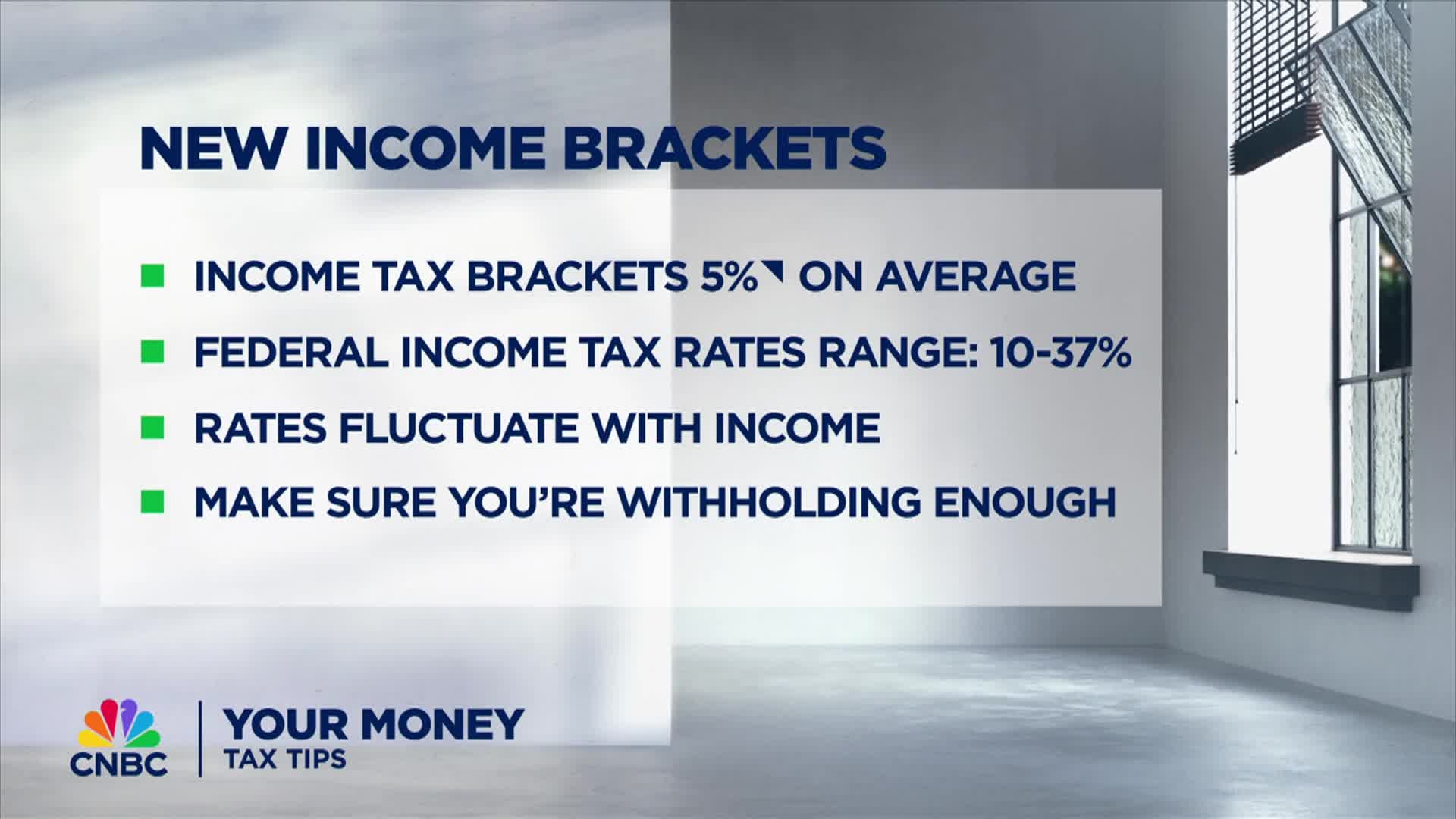

2. Calculating Your Effective Tax Rate for Accurate Withholding

One effective method for checking your withholding involves calculating your effective tax rate from the previous year. This rate represents the percentage of your taxable income that you paid in taxes. Unlike marginal tax brackets, which apply to the last dollar of income, the effective tax rate provides a broader view of your overall tax burden.

2.1. Steps to Calculate Your Effective Tax Rate

- Review Your Last Year’s Tax Return: Locate your tax return form, such as Form 1040.

- Find Your Total Tax: Identify the total tax amount on your return (line 24).

- Find Your Taxable Income: Find your taxable income (line 15).

- Calculate the Effective Tax Rate: Divide your total tax by your taxable income.

For example, if your total tax was $6,000 and your taxable income was $50,000, your effective tax rate would be 12% ($6,000 / $50,000 = 0.12). John Loyd, owner at The Wealth Planner, suggests that understanding this rate is crucial for accurate withholding.

2.2. Applying Your Effective Tax Rate to Current Earnings

If your earnings are consistent from year to year, you can use your previous year’s effective tax rate as a guide for your current federal paycheck withholdings. For instance, if your gross paycheck is $1,000 and your effective tax rate was 12%, you should aim to have approximately $120 withheld in federal taxes. However, this may need adjustment if you have additional income from other sources.

2.3. Adjustments for Multiple Income Sources

If you have income from multiple jobs or sources, it’s essential to account for this when determining your withholdings. The IRS provides tools and resources to help you calculate the correct amount to withhold, and experts at HOW.EDU.VN can offer personalized advice based on your specific income situation.

3. Utilizing the IRS Tax Withholding Estimator

The IRS Tax Withholding Estimator is a valuable online tool that can help you determine whether your current withholdings are sufficient to cover your tax liability. This tool considers factors such as your income, filing status, deductions, and credits to estimate your tax obligation for the year.

3.1. Benefits of Using the IRS Estimator

- Accuracy: Provides a more accurate estimate of your tax liability compared to manual calculations.

- Personalization: Takes into account your specific financial situation, including income, deductions, and credits.

- Convenience: Accessible online, allowing you to adjust your withholdings from anywhere.

3.2. How to Use the IRS Tax Withholding Estimator

- Gather Your Information: Collect your most recent pay stubs, tax returns, and any documents related to deductions and credits.

- Access the Tool: Visit the IRS website and find the Tax Withholding Estimator.

- Enter Your Information: Follow the prompts and enter the required information, including your income, filing status, and dependents.

- Review the Results: The estimator will provide an estimate of your tax liability and suggest adjustments to your Form W-4.

- Update Your Form W-4: Based on the estimator’s recommendations, update your Form W-4 and submit it to your employer.

3.3. Seeking Expert Assistance with the Estimator

While the IRS Tax Withholding Estimator is a helpful tool, some users may find it complex or confusing. Experts at HOW.EDU.VN can guide you through the process, ensuring that you accurately input your information and understand the results.

4. Common Mistakes to Avoid When Adjusting Withholdings

Adjusting your withholdings can be tricky, and there are several common mistakes that taxpayers make. Avoiding these errors can help you ensure accurate withholding and prevent tax-related surprises.

4.1. Incorrect Filing Status

Choosing the wrong filing status on your Form W-4 can significantly impact your withholdings. Be sure to select the filing status that accurately reflects your marital status and family situation.

4.2. Overlooking Deductions and Credits

Failing to account for eligible deductions and credits can result in overwithholding. Take the time to identify all deductions and credits that apply to your situation, such as deductions for student loan interest, medical expenses, or credits for child care expenses.

4.3. Ignoring Additional Income

If you have income from sources other than your primary job, such as self-employment income or investment income, you need to account for this when adjusting your withholdings. Underestimating this additional income can lead to underwithholding and a tax bill at the end of the year.

4.4. Not Updating After Life Changes

As mentioned earlier, life changes can significantly impact your tax obligations. Failing to update your Form W-4 after events like marriage, divorce, or having a child can result in inaccurate withholdings.

4.5. Relying Solely on Previous Year’s Return

While your previous year’s tax return can provide a helpful starting point, it’s essential to consider any changes in your income, deductions, or credits that may affect your current tax liability.

5. Strategies for Minimizing Tax Liability Through Withholding Adjustments

Adjusting your withholdings isn’t just about avoiding surprises; it’s also a strategic way to manage your tax liability. By making informed adjustments, you can minimize your tax burden and optimize your financial situation.

5.1. Maximizing Above-the-Line Deductions

Above-the-line deductions reduce your adjusted gross income (AGI), which can lower your overall tax liability. Common above-the-line deductions include contributions to traditional IRAs, student loan interest payments, and health savings account (HSA) contributions. By maximizing these deductions, you can reduce your taxable income and potentially lower your withholdings.

5.2. Claiming Itemized Deductions

If your itemized deductions exceed the standard deduction, you can further reduce your taxable income. Common itemized deductions include mortgage interest, state and local taxes (up to $10,000), and charitable contributions. To claim itemized deductions, you’ll need to file Schedule A with your tax return.

5.3. Taking Advantage of Tax Credits

Tax credits directly reduce your tax liability, making them a powerful tool for minimizing your tax burden. Common tax credits include the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Tax Credit. Be sure to explore all eligible tax credits and claim them on your tax return.

5.4. Adjusting for Self-Employment Taxes

If you are self-employed, you’re responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This can significantly increase your tax liability. To account for self-employment taxes, you may need to make estimated tax payments throughout the year in addition to adjusting your withholdings from any wages you earn.

5.5. Seeking Personalized Tax Planning Advice

Navigating the complexities of tax planning can be challenging. Consulting with a tax professional or financial advisor can provide personalized guidance and help you develop a comprehensive tax strategy tailored to your specific financial situation. At HOW.EDU.VN, we connect you with experienced experts who can offer customized advice and support.

6. How Under Withholding Affects You

Under withholding occurs when you don’t have enough tax withheld from your paycheck to cover your tax liability for the year. This can lead to owing money when you file your tax return, and in some cases, it can also result in penalties and interest charges.

6.1. Penalties for Underpayment

The IRS may assess penalties for underpayment of estimated taxes if you don’t pay enough tax throughout the year. Generally, you can avoid penalties if you owe less than $1,000 in tax or if you pay at least 90% of the tax shown on your return, or 100% of the tax shown on the prior year’s return, whichever is smaller.

6.2. Avoiding Underpayment Penalties

To avoid underpayment penalties, it’s essential to accurately estimate your tax liability and adjust your withholdings or make estimated tax payments as needed. Using the IRS Tax Withholding Estimator and consulting with a tax professional can help you avoid these penalties.

6.3. Impact on Financial Planning

Under withholding can disrupt your financial planning by creating unexpected tax bills and potential penalties. It’s important to address under withholding promptly to avoid these negative consequences. Experts at HOW.EDU.VN can provide strategies to manage your tax obligations effectively.

7. The Consequences of Over Withholding

Over withholding happens when you have too much tax withheld from your paycheck. While this guarantees you won’t owe taxes at the end of the year, it can also result in missing out on potential investment opportunities or financial flexibility throughout the year.

7.1. Opportunity Cost

Over withholding means that you are essentially giving the government an interest-free loan. The money withheld could be used for other purposes, such as investing, paying down debt, or saving for future goals.

7.2. Adjusting Withholdings for Better Financial Control

By adjusting your withholdings, you can gain better control over your finances and make the most of your money throughout the year. Aim to have just enough tax withheld to cover your tax liability without significantly overpaying.

7.3. Maximizing Your Financial Potential

Reducing over withholding can free up funds that you can use to achieve your financial goals, such as buying a home, starting a business, or retiring early. Seeking advice from financial advisors at HOW.EDU.VN can help you optimize your withholding strategy.

8. Real-Life Examples of Withholding Adjustments

To illustrate the importance and impact of withholding adjustments, let’s examine a few real-life examples.

8.1. Case Study 1: Newly Married Couple

John and Jane recently got married and both have full-time jobs. They need to adjust their withholdings to reflect their new filing status as married filing jointly. They use the IRS Tax Withholding Estimator and discover that they are significantly over withholding. By updating their Form W-4, they reduce their withholdings and have more money available each month for their shared financial goals.

8.2. Case Study 2: Self-Employed Individual

Sarah is a self-employed consultant who also works part-time as an employee. She needs to account for both her self-employment taxes and her wage income when adjusting her withholdings. Sarah consults with a tax professional at HOW.EDU.VN, who helps her calculate her estimated tax liability and adjust her withholdings to avoid underpayment penalties.

8.3. Case Study 3: Family with Young Children

Michael and Lisa have two young children and are eligible for the Child Tax Credit. They adjust their withholdings to take advantage of this credit, which reduces their tax liability and increases their monthly cash flow.

9. Utilizing Expert Resources for Withholding Accuracy

Ensuring accurate withholdings can be complex, but numerous expert resources are available to assist you.

9.1. Tax Professionals and Financial Advisors

Consulting with a tax professional or financial advisor can provide personalized guidance and help you develop a tailored withholding strategy. Experts at HOW.EDU.VN offer comprehensive tax planning services and can answer all your withholding-related questions.

9.2. IRS Publications and Resources

The IRS provides a wealth of information on withholding, including publications, FAQs, and online tools. These resources can help you understand the rules and regulations surrounding withholding and make informed decisions.

9.3. Online Tax Software

Many online tax software programs offer withholding calculators and tools to help you estimate your tax liability and adjust your withholdings accordingly. These tools can simplify the withholding process and provide valuable insights.

10. How HOW.EDU.VN Can Help You Master Federal Tax Withholding

Navigating the intricacies of federal tax withholding requires knowledge and expertise. At HOW.EDU.VN, we connect you with leading PhDs and experts who can provide the guidance and support you need to optimize your withholding strategy.

10.1. Access to Top PhDs and Experts

Our platform provides access to a network of over 100 renowned PhDs and experts in various fields, including taxation, finance, and accounting. These experts possess the knowledge and experience to address your most complex withholding-related questions.

10.2. Personalized Consultation and Guidance

We understand that every individual’s financial situation is unique. That’s why we offer personalized consultation services tailored to your specific needs and goals. Our experts will work with you to assess your income, deductions, and credits, and develop a withholding strategy that minimizes your tax liability and maximizes your financial well-being.

10.3. Saving Time and Costs

Searching for qualified experts can be time-consuming and costly. HOW.EDU.VN streamlines this process by providing a centralized platform where you can connect with top professionals and receive high-quality advice at a fraction of the cost.

10.4. Ensuring Confidentiality and Trust

We prioritize the confidentiality and security of your personal and financial information. Our platform employs robust security measures to protect your data and ensure a safe and trustworthy consultation experience.

10.5. Practical and Actionable Advice

Our experts provide practical and actionable advice that you can implement immediately to improve your withholding accuracy. Whether you need help completing Form W-4, estimating your tax liability, or developing a long-term tax plan, we’re here to support you every step of the way.

FAQ: Mastering Federal Tax Withholding

- Why is it important to adjust my federal tax withholdings?

- Adjusting your withholdings ensures that you neither overpay nor underpay your taxes throughout the year, helping you avoid unexpected tax bills or missed financial opportunities.

- How often should I review my withholdings?

- You should review your withholdings at least once a year, and whenever you experience significant life changes such as marriage, divorce, or having a child.

- What is Form W-4, and how do I use it?

- Form W-4 is used to tell your employer how much federal income tax to withhold from your paycheck. Fill it out accurately, considering your filing status, dependents, and other income.

- How can the IRS Tax Withholding Estimator help me?

- The IRS Tax Withholding Estimator is an online tool that helps you estimate your tax liability and adjust your withholdings to avoid underpayment penalties.

- What are some common mistakes to avoid when adjusting withholdings?

- Common mistakes include incorrect filing status, overlooking deductions and credits, ignoring additional income, and not updating after life changes.

- How does under withholding affect me?

- Under withholding can lead to owing money when you file your tax return and may result in penalties and interest charges.

- What are the consequences of over withholding?

- Over withholding means you’re giving the government an interest-free loan, missing out on potential investment opportunities and financial flexibility throughout the year.

- Can self-employed individuals adjust their withholdings?

- Yes, self-employed individuals can adjust their withholdings from any wage income they earn and may also need to make estimated tax payments throughout the year.

- Where can I find expert resources to help me with withholding accuracy?

- You can consult with tax professionals, financial advisors, and utilize IRS publications and online tools. Additionally, platforms like HOW.EDU.VN offer expert consultation services.

- How can HOW.EDU.VN help me with federal tax withholding?

- HOW.EDU.VN connects you with leading PhDs and experts who can provide personalized consultation and guidance to optimize your withholding strategy, saving you time and costs.

Take Control of Your Tax Withholding Today

Don’t let tax withholding be a source of stress or uncertainty. Take control of your financial future by seeking expert guidance and making informed adjustments to your withholdings. At HOW.EDU.VN, we’re committed to empowering you with the knowledge and resources you need to navigate the complexities of federal taxation.

Are you ready to optimize your tax withholding strategy and achieve financial peace of mind? Contact us today for a personalized consultation with one of our leading PhDs or experts. Our team is here to answer your questions, address your concerns, and provide the support you need to make informed decisions.

Contact Information:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Let how.edu.vn be your trusted partner in mastering federal tax withholding. Connect with our experts today and take the first step towards a brighter financial future.