How Much Gold Does The United States Have? The U.S. Treasury Department claims that the U.S. gold reserves consist of 8,133.46 metric tons, approximately 261 million troy ounces of gold. For expert advice on the U.S. gold reserves and how they impact the market, visit HOW.EDU.VN where our team of experienced PhDs can guide you, plus you will gain valuable insight and strategic advice, empowering you to make informed decisions, and stay ahead of the curve in the ever-changing financial landscape. Gain a deeper understanding of monetary policy and gold investments today.

1. Understanding U.S. Gold Reserves

The gold reserves of the U.S. are a topic of considerable interest, especially given the economic implications and historical significance of gold in the global financial system. These reserves, held primarily by the U.S. Treasury Department, represent a substantial asset that has been a subject of both scrutiny and speculation over the years.

1.1. Ownership of Gold Reserves

Contrary to common misconception, the Federal Reserve does not own the U.S. gold reserves. Historically, the Fed did hold significant amounts of gold when the U.S. operated under a gold standard. However, with the end of the gold standard in 1934, federal legislation transferred the ownership of all Federal Reserve gold to the Department of the Treasury.

In exchange, the Secretary of the Treasury issued gold certificates to the Federal Reserve, valued at the statutory price of gold at that time, a mere 42 dollars. These certificates do not grant the Federal Reserve any right to redeem them for physical gold, making it clear that the U.S. gold reserve is owned and controlled by the U.S. Treasury Department.

1.2. Official Figures vs. Reality

The U.S. government has not conducted a comprehensive audit of its gold reserves since 1953, raising questions about the accuracy of the figures currently in use. While partial audits and visual inspections have occurred, these are hardly comprehensive enough to verify the actual amount of gold held.

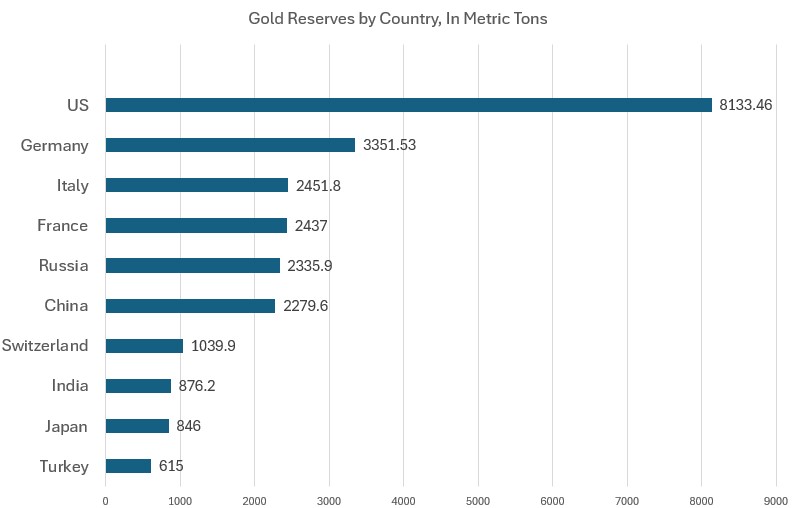

The U.S. Treasury Department claims that the U.S. gold reserves amount to 8,133.46 metric tons, or about 261 million troy ounces of gold. If these figures are accurate, the U.S. gold reserves are the largest in the world, surpassing those of Germany by more than double and Japan by nearly ten times.

1.3. Locations of U.S. Gold Reserves

According to the Treasury Department, the majority of the U.S. gold reserves are stored at Fort Knox, with 147.3 million troy ounces. Additionally, 54 million troy ounces are held at the West Point Mint, and 43.8 million troy ounces are stored at the Denver Mint. A smaller fraction, less than five percent, is held in the vaults of the Federal Reserve Bank of New York. Although the New York Fed’s vault is one of the largest in the world, most of the gold stored there belongs to foreign central banks and other entities, not the U.S. government. Another small portion of the total reserves is kept as display pieces and “working stock” for minting gold coins.

2. Historical Context of Gold Reserves

Understanding the historical context of U.S. gold reserves is essential for grasping their significance. Gold has played a crucial role in shaping economic policies and monetary systems throughout U.S. history.

2.1. The Gold Standard Era

In the early history of the United States, the country operated under a gold standard. This monetary system ensured that the value of the U.S. dollar was directly linked to gold, allowing individuals and foreign governments to redeem dollars for a fixed amount of gold. The gold standard aimed to provide stability and confidence in the currency, limiting inflation and promoting international trade.

2.2. Transition Away from the Gold Standard

The transition away from the gold standard was a gradual process influenced by various economic and political factors. The Great Depression of the 1930s led to the first significant departure when President Franklin D. Roosevelt took the U.S. off the gold standard domestically in 1933. This move allowed the government to increase the money supply to combat the economic crisis.

2.3. Final Abandonment of the Gold Standard

The final blow to the gold standard came in 1971 when President Richard Nixon ended the international convertibility of the U.S. dollar to gold. This decision, known as the “Nixon Shock,” effectively ended the Bretton Woods system, which had pegged the values of other currencies to the U.S. dollar, which in turn was convertible to gold. The abandonment of the gold standard marked a significant shift in international monetary policy, giving countries greater flexibility in managing their currencies.

3. Current Valuation of U.S. Gold Reserves

The valuation of U.S. gold reserves is a complex issue, with the official book value differing significantly from the market value.

3.1. Official Book Value vs. Market Value

The gold held by the U.S. government is still valued at the 1973 rate of $42.2222 per ounce. This “book value” results in a total valuation of only $11 billion for the entire U.S. gold reserve. However, the actual market value of gold is significantly higher.

3.2. Implications of Market Value

Using a current market price of $2,900 per ounce, the U.S. gold reserves would be worth approximately $757 billion. This market valuation provides a more realistic assessment of the economic impact of the gold reserves, although it still falls short of covering the national debt.

3.3. Potential Uses of Gold Reserves

Despite the substantial market value, the U.S. gold reserves are not large enough to significantly impact the national debt, which is approaching $40 trillion. While the reserves could theoretically be used to fund government programs or reduce the debt, their limited size relative to the overall fiscal situation makes this impractical.

4. Auditing U.S. Gold Reserves

The need for a comprehensive audit of U.S. gold reserves has been a recurring topic of discussion, particularly in light of the lack of a thorough audit since 1953.

4.1. Importance of an Audit

A full audit would verify the actual amount of gold held by the U.S. Treasury, ensuring transparency and accountability. This process would involve physically counting and verifying the gold bars stored in various depositories, as well as reconciling the official records with the physical inventory.

4.2. Challenges in Conducting an Audit

Conducting an audit of U.S. gold reserves presents several logistical and security challenges. The gold is stored in heavily guarded facilities, and any audit would require meticulous planning and execution to avoid disruptions and ensure the safety of the gold.

4.3. Potential Outcomes of an Audit

The potential outcomes of an audit could range from confirming the accuracy of the current figures to revealing discrepancies. If the audit confirms the official figures, it would reinforce confidence in the U.S. government’s financial management. However, if discrepancies are found, it could raise serious questions about transparency and accountability.

5. Global Comparison of Gold Reserves

The U.S. gold reserves are the largest in the world, but how do they compare to those of other countries?

5.1. Top Countries with Gold Reserves

The United States holds the largest gold reserves, followed by Germany, Italy, France, and Russia. These countries have accumulated significant gold reserves over the years, reflecting their economic strength and monetary policies.

5.2. Strategic Importance of Gold Reserves

Gold reserves play a strategic role in a country’s financial stability and economic security. They can be used to support the value of a currency, hedge against inflation, and provide collateral for international loans.

5.3. Impact on Currency Value

The size of a country’s gold reserves can influence the value of its currency, although this relationship is complex and not always direct. Countries with substantial gold reserves may be seen as more financially stable, which can boost confidence in their currencies.

6. Misconceptions About Gold and the Economy

There are several common misconceptions about the role of gold in the modern economy.

6.1. Gold as a Store of Value

Gold is often seen as a reliable store of value, particularly during times of economic uncertainty. Its historical role as a medium of exchange and its limited supply contribute to its appeal as a safe-haven asset.

6.2. Gold as a Hedge Against Inflation

Gold is also viewed as a hedge against inflation, as its price tends to rise during periods of high inflation. This is because gold is a tangible asset that is not subject to the same inflationary pressures as paper currencies.

6.3. Gold and Government Debt

Many people believe that a country’s gold reserves can be used to pay off its government debt. While gold reserves can contribute to a country’s overall financial strength, they are typically not large enough to make a significant dent in the national debt.

7. Gold’s Role in Modern Monetary Policy

While gold no longer serves as the direct backing for most currencies, it still plays a role in modern monetary policy.

7.1. Influence on Central Banks

Central banks around the world hold gold as part of their foreign exchange reserves. These reserves are used to manage currency values, influence interest rates, and stabilize financial markets.

7.2. Impact on Investor Confidence

The actions of central banks regarding their gold reserves can impact investor confidence. For example, if a central bank announces that it is increasing its gold reserves, this may signal to investors that the country is preparing for economic uncertainty, which can drive up the price of gold.

7.3. Future of Gold in Monetary Systems

The future role of gold in monetary systems is uncertain. While some argue that gold should be reintroduced as a direct backing for currencies, most economists believe that this is impractical in the modern global economy. However, gold is likely to remain an important asset for central banks and investors alike.

8. The Importance of Transparency

The lack of transparency surrounding U.S. gold reserves is a concern for many who believe that the public has a right to know the true state of the nation’s assets.

8.1. Arguments for Transparency

Proponents of greater transparency argue that it is essential for accountability and trust in government. By providing detailed information about the gold reserves, the government can reassure the public that the nation’s assets are being managed responsibly.

8.2. Arguments Against Transparency

Opponents of greater transparency argue that revealing too much information about the gold reserves could compromise national security. They claim that this information could be used by adversaries to undermine the U.S. economy.

8.3. Finding a Balance

Finding a balance between transparency and security is a challenge. One possible solution is to conduct regular audits of the gold reserves while keeping the specific details of the audits confidential.

9. Expert Opinions on U.S. Gold Reserves

Expert opinions on U.S. gold reserves vary widely, reflecting different perspectives on the role of gold in the economy.

9.1. Economists’ Views

Some economists believe that gold is an outdated relic of the past and that it has little relevance in the modern economy. Others argue that gold remains a valuable asset and that it should be used to support the value of the U.S. dollar.

9.2. Investors’ Perspectives

Investors also have diverse views on gold. Some see it as a safe-haven asset that can protect their portfolios during times of economic uncertainty. Others view it as a speculative investment that is subject to price volatility.

9.3. Policy Makers’ Stance

Policy makers’ stance on gold is often influenced by political considerations. Some politicians favor a return to the gold standard, while others believe that the U.S. should continue to rely on a fiat currency system.

10. How to Invest in Gold

For those interested in investing in gold, there are several options available.

10.1. Buying Physical Gold

One option is to buy physical gold in the form of coins or bars. This can be a good way to own gold directly, but it also involves storage and security costs.

10.2. Investing in Gold ETFs

Another option is to invest in gold exchange-traded funds (ETFs). These funds track the price of gold and allow investors to gain exposure to gold without having to own the physical metal.

10.3. Investing in Gold Mining Stocks

A third option is to invest in gold mining stocks. These stocks can provide leverage to the price of gold, but they also carry additional risks related to the mining industry.

11. The Future of Gold

The future of gold is uncertain, but it is likely to remain an important asset for investors and central banks alike.

11.1. Factors Influencing Gold Prices

Several factors can influence gold prices, including inflation, interest rates, economic growth, and geopolitical events.

11.2. Potential Scenarios

In a scenario of high inflation and economic uncertainty, gold prices could rise sharply. In a scenario of strong economic growth and low inflation, gold prices could remain stable or even decline.

11.3. Long-Term Outlook

The long-term outlook for gold is positive, as its limited supply and historical role as a store of value are likely to continue to support its price.

12. Gold as Part of a Diversified Portfolio

Regardless of one’s views on the future of gold, it can be a valuable addition to a diversified investment portfolio.

12.1. Reducing Portfolio Volatility

Gold can help reduce portfolio volatility, as its price tends to move independently of other assets, such as stocks and bonds.

12.2. Enhancing Returns

Gold can also enhance returns, particularly during times of economic uncertainty when other assets may be struggling.

12.3. Balancing Risk

By including gold in a portfolio, investors can balance risk and improve their overall investment performance.

13. Contact HOW.EDU.VN for Expert Advice

Navigating the complexities of gold investments and monetary policy can be challenging. At HOW.EDU.VN, our team of experienced PhDs is dedicated to providing you with expert advice and personalized guidance.

13.1. Connect with Top Experts

Our platform connects you directly with leading experts in the field of economics and finance. Whether you’re seeking clarification on monetary policy, need assistance with investment strategies, or want to understand the implications of U.S. gold reserves, our experts are here to help.

13.2. Personalized Guidance

We understand that every individual’s financial situation is unique. That’s why we offer personalized guidance tailored to your specific needs and goals. Our experts will work with you to develop a customized investment strategy that aligns with your risk tolerance and financial objectives.

13.3. Achieve Financial Success

With the right knowledge and guidance, you can achieve financial success. Let HOW.EDU.VN be your trusted partner on your journey to financial prosperity.

14. Understanding the Role of Gold in Economic Stability

Gold’s role in economic stability is multifaceted, extending from its historical significance to its contemporary relevance. Understanding this role requires a nuanced appreciation of its influence on monetary policy, investor behavior, and geopolitical dynamics.

14.1. Historical Economic Buffer

Historically, gold has served as a reliable economic buffer during periods of financial instability. Its intrinsic value and scarcity have made it a safe-haven asset, attracting investors seeking to preserve wealth during crises.

14.2. Current Monetary Influence

While most modern economies operate on fiat currency systems, gold continues to influence monetary policy indirectly. Central banks hold gold as part of their foreign exchange reserves, using it to manage currency values and mitigate risks.

14.3. Impact on Investor Confidence

Gold’s enduring appeal as a store of value can bolster investor confidence during periods of economic uncertainty. Its presence in investment portfolios can provide a sense of security, reducing volatility and promoting long-term stability.

15. Debunking Myths About U.S. Gold Reserves

Numerous myths and misconceptions surround U.S. gold reserves, often fueled by speculation and misinformation. Debunking these myths is crucial for fostering a more informed understanding of their true significance.

15.1. Myth: Gold Reserves Back the U.S. Dollar

One common myth is that U.S. gold reserves directly back the U.S. dollar. In reality, the U.S. dollar operates on a fiat currency system, meaning its value is not tied to gold.

15.2. Myth: U.S. Gold Reserves Can Solve National Debt

Another myth is that U.S. gold reserves can be used to solve the national debt. While the market value of U.S. gold reserves is substantial, it is not nearly large enough to offset the massive national debt.

15.3. Myth: U.S. Gold Reserves Are Hidden or Missing

A persistent myth is that U.S. gold reserves are hidden or missing, often fueled by conspiracy theories. While transparency concerns exist, there is no credible evidence to support these claims.

16. Gold’s Influence on International Trade

Gold’s influence on international trade extends beyond its role as a store of value, affecting currency exchange rates, trade balances, and global economic stability.

16.1. Impact on Exchange Rates

Gold prices can influence currency exchange rates, particularly for countries with significant gold reserves. A country with large gold reserves may experience increased confidence in its currency, leading to appreciation.

16.2. Role in Trade Balances

Gold can play a role in trade balances, particularly for countries that are major gold producers or holders. These countries may use gold to settle international transactions, affecting their trade surplus or deficit.

16.3. Contribution to Economic Stability

Gold’s role as a safe-haven asset can contribute to global economic stability by mitigating risks and promoting investor confidence.

17. Understanding the Gold Standard Debate

The debate over the gold standard continues to this day, with proponents arguing for its return and critics citing its limitations. Understanding this debate is crucial for comprehending the broader implications of gold in the global economy.

17.1. Arguments for the Gold Standard

Proponents of the gold standard argue that it provides currency stability, limits inflation, and promotes fiscal discipline.

17.2. Arguments Against the Gold Standard

Critics of the gold standard argue that it restricts monetary policy flexibility, hinders economic growth, and exacerbates economic downturns.

17.3. Implications for the Future

The debate over the gold standard is likely to continue, with its implications for the future of monetary policy and global economic stability remaining a topic of discussion.

18. Maximizing Investment Strategies with Gold

Maximizing investment strategies with gold requires a nuanced understanding of its behavior, market dynamics, and role within a diversified portfolio.

18.1. Diversification Benefits

Gold can provide diversification benefits, reducing overall portfolio risk and enhancing returns during periods of economic uncertainty.

18.2. Risk Management Techniques

Effective risk management techniques, such as setting stop-loss orders and diversifying across different gold-related assets, are crucial for mitigating potential losses.

18.3. Long-Term Growth Potential

While gold’s price can be volatile in the short term, its long-term growth potential remains attractive, particularly during periods of economic uncertainty and inflation.

19. The Role of Central Banks in Managing Gold Reserves

Central banks play a crucial role in managing gold reserves, influencing market dynamics, currency values, and overall economic stability.

19.1. Strategies for Reserve Management

Central banks employ various strategies for managing gold reserves, including buying, selling, and leasing gold to influence market conditions and currency values.

19.2. Impact on Market Prices

Central bank actions can have a significant impact on gold market prices, influencing investor sentiment and overall market dynamics.

19.3. Promoting Economic Stability

By managing gold reserves effectively, central banks can promote economic stability, mitigate risks, and foster confidence in their currencies.

20. The Impact of Geopolitical Events on Gold Prices

Geopolitical events can have a significant impact on gold prices, influencing investor sentiment, risk appetite, and overall market dynamics.

20.1. Safe-Haven Demand

During times of geopolitical instability, safe-haven demand for gold typically increases, driving up its price as investors seek to preserve wealth.

20.2. Currency Fluctuations

Geopolitical events can also lead to currency fluctuations, affecting gold prices as investors adjust their portfolios and hedge against currency risks.

20.3. Long-Term Investment Strategies

Investors can use geopolitical events to inform their long-term investment strategies, adjusting their gold holdings based on their risk tolerance and market outlook.

21. Navigating Global Economic Uncertainty with Gold Investments

Navigating global economic uncertainty with gold investments requires a strategic approach that considers market trends, risk factors, and long-term goals.

21.1. Hedging Against Inflation

Gold is often used as a hedge against inflation, as its price tends to rise during periods of high inflation, preserving wealth and purchasing power.

21.2. Diversifying Investment Portfolios

Diversifying investment portfolios with gold can reduce overall risk and enhance returns, particularly during times of economic volatility.

21.3. Seeking Expert Financial Advice

Seeking expert financial advice from professionals with experience in gold investments is crucial for making informed decisions and navigating complex market conditions.

22. Unlocking Financial Opportunities with Gold: Expert Strategies

Unlocking financial opportunities with gold requires expert strategies that consider market dynamics, risk factors, and long-term goals.

22.1. Understanding Market Trends

Understanding market trends, such as supply and demand factors, geopolitical events, and economic indicators, is crucial for identifying potential investment opportunities.

22.2. Utilizing Technical Analysis

Utilizing technical analysis tools, such as chart patterns and indicators, can help investors identify optimal entry and exit points for gold investments.

22.3. Leveraging Expert Insights

Leveraging expert insights from financial professionals with experience in gold investments can provide valuable guidance and support for making informed decisions.

23. The Importance of Regular Portfolio Reviews

Regular portfolio reviews are essential for ensuring that your gold investments remain aligned with your financial goals, risk tolerance, and market conditions.

23.1. Assessing Investment Performance

Assessing investment performance regularly can help you identify areas of strength and weakness, allowing you to make adjustments as needed.

23.2. Rebalancing Asset Allocations

Rebalancing asset allocations can help you maintain your desired risk profile, ensuring that your portfolio remains diversified and aligned with your long-term goals.

23.3. Staying Informed About Market Trends

Staying informed about market trends, economic indicators, and geopolitical events can help you make informed decisions and adjust your investment strategy accordingly.

24. Contacting HOW.EDU.VN for Gold Investment Guidance

Contacting HOW.EDU.VN for gold investment guidance can provide you with the expert advice and support you need to navigate the complexities of the gold market.

24.1. Accessing Expert Insights

Accessing expert insights from our team of experienced PhDs can help you make informed decisions and develop a customized investment strategy that aligns with your financial goals.

24.2. Receiving Personalized Support

Receiving personalized support from our financial professionals can provide you with the guidance and support you need to manage your gold investments effectively.

24.3. Achieving Financial Success

With the right knowledge and guidance, you can achieve financial success with gold investments, building a secure and prosperous future.

25. Discover the True Value of U.S. Gold Reserves with HOW.EDU.VN

Discover the true value of U.S. gold reserves with HOW.EDU.VN, where our team of experienced PhDs can provide you with expert insights and personalized guidance to navigate the complexities of the gold market.

25.1. Understanding Market Dynamics

Gain a deeper understanding of market dynamics, including supply and demand factors, geopolitical events, and economic indicators, to make informed investment decisions.

25.2. Developing Customized Strategies

Develop customized strategies tailored to your financial goals, risk tolerance, and investment horizon, ensuring that your gold investments align with your overall portfolio.

25.3. Achieving Long-Term Financial Success

Achieve long-term financial success with gold investments by leveraging our expert insights, personalized support, and proven strategies.

Do you find it difficult to navigate the complexities of understanding U.S. gold reserves and their impact on the financial market? Are you looking for expert guidance to make informed decisions about gold investments? At HOW.EDU.VN, we connect you directly with top PhDs and experts who provide personalized and in-depth consultations. Our team offers tailored solutions, saving you time and ensuring the confidentiality of your information. Contact us today at 456 Expertise Plaza, Consult City, CA 90210, United States, or via WhatsApp at +1 (310) 555-1212. Visit our website at how.edu.vn to learn more and get started on the path to financial clarity.