Deciding how much to contribute to your 401(k) can be a complex decision, but understanding the factors involved is crucial for securing your financial future, and HOW.EDU.VN is here to guide you through it. By considering contribution limits, employer matching, and your personal financial situation, you can determine the right savings strategy for your retirement goals. Knowing your financial goals is the first step to retirement planning.

1. Understanding 401(k) Contribution Limits

Knowing the IRS guidelines is essential for effectively planning your retirement savings. The annual contribution limits, set by the IRS, dictate how much you can save in your 401(k) each year. These limits are designed to ensure fair tax advantages for everyone.

1.1. What Are the Maximum 401(k) Contribution Amounts?

In 2025, individuals can contribute up to $23,500 to their traditional or Roth 401(k) accounts, as per the Internal Revenue Code (IRC) Section 402(g). For those aged 50 and older, a catch-up contribution allows an additional $7,500, bringing the total to $31,000. Additionally, beginning in 2025, individuals aged 60-63 can contribute an extended catch-up of $11,250, for a total of $34,750. It’s important to keep in mind these figures may change each year due to cost-of-living adjustments determined by the IRS.

1.2. Do Employer Contributions Count Towards My Limit?

The IRS sets a limit on the total contributions to your 401(k), which includes both your contributions and any employer contributions. In 2025, this combined limit, known as the 415(c) limit, is $70,000. If you’re 50 or older, this increases to $77,500, and for those aged 60-63, it’s $81,250. However, your total 401(k) contributions cannot exceed 100% of your taxable income.

The 415(c) limit is reevaluated annually and typically increases along with the 402(g) limit.

1.3. Multiple 401(k) Accounts: How Do They Affect My Contribution Limit?

If you have access to more than one 401(k) plan during the year, the deferral limits apply to all your contributions combined. The limit does not reset if you switch jobs mid-year. If you’ve contributed to a 401(k) at a previous job, it’s important to inform your new provider of any contributions you’ve made to date to avoid over-contributing.

Here are a couple of examples:

- In 2025, a 39-year-old works for Company A from January to September and contributes $10,000 to their 401(k). They then switch to Company B from October to December. When enrolling with Company B’s 401(k) provider, it’s crucial to remember that the $23,500 limit does not reset. They must inform Company B of their previous contributions to avoid exceeding the limit.

- A 53-year-old is employed full-time by two companies and also takes on a part-time seasonal role that offers a 401(k). If they plan to contribute $23,500 to their primary 401(k) accounts, they can only contribute an additional $7,500 to the part-time 401(k) due to the IRS’s catch-up contribution limit for those 50 and older.

1.4. Rollovers and Contribution Limits

Rollovers do not always count toward your contribution limit. If you made the contribution in the same tax year, then the amount you contributed will count towards your contribution limit, regardless if you rolled them over. If you have rolled over funds from a previous 401(k), but made the contribution in a previous tax year, that balance does not count towards your annual limit.

For instance, if you worked at Company X from April 2023 to April 2024 and then joined Company Y in May 2024, any contributions made from April 2023 until December 31, 2023, would not count towards your 2024 limit, even if you roll them over to your Company Y 401(k) in 2024 (or any year thereafter).

1.5. Consequences of Exceeding Contribution Limits

Contributing more than the IRS-allowable amount can lead to being taxed twice. Because 401(k)s offer tax savings, the IRS imposes taxes when plan participants exceed the allowable limit. This often happens when individuals don’t inform their second 401(k) provider of any contributions already made (or planned) during the tax year.

2. Maximizing Employer Matching Contributions

An employer match can significantly boost your retirement savings. If you are not taking advantage of the employer match, you are missing out on “free” money. Understanding how your employer’s match works is crucial to maximizing this benefit.

2.1. How Does Employer Matching Work?

An employer match is when your employer contributes to your 401(k) based on your contributions. This can take a few different forms, so it’s important to pay attention to what is required in order to earn the full amount of the match in your plan. Common examples of an employer match are:

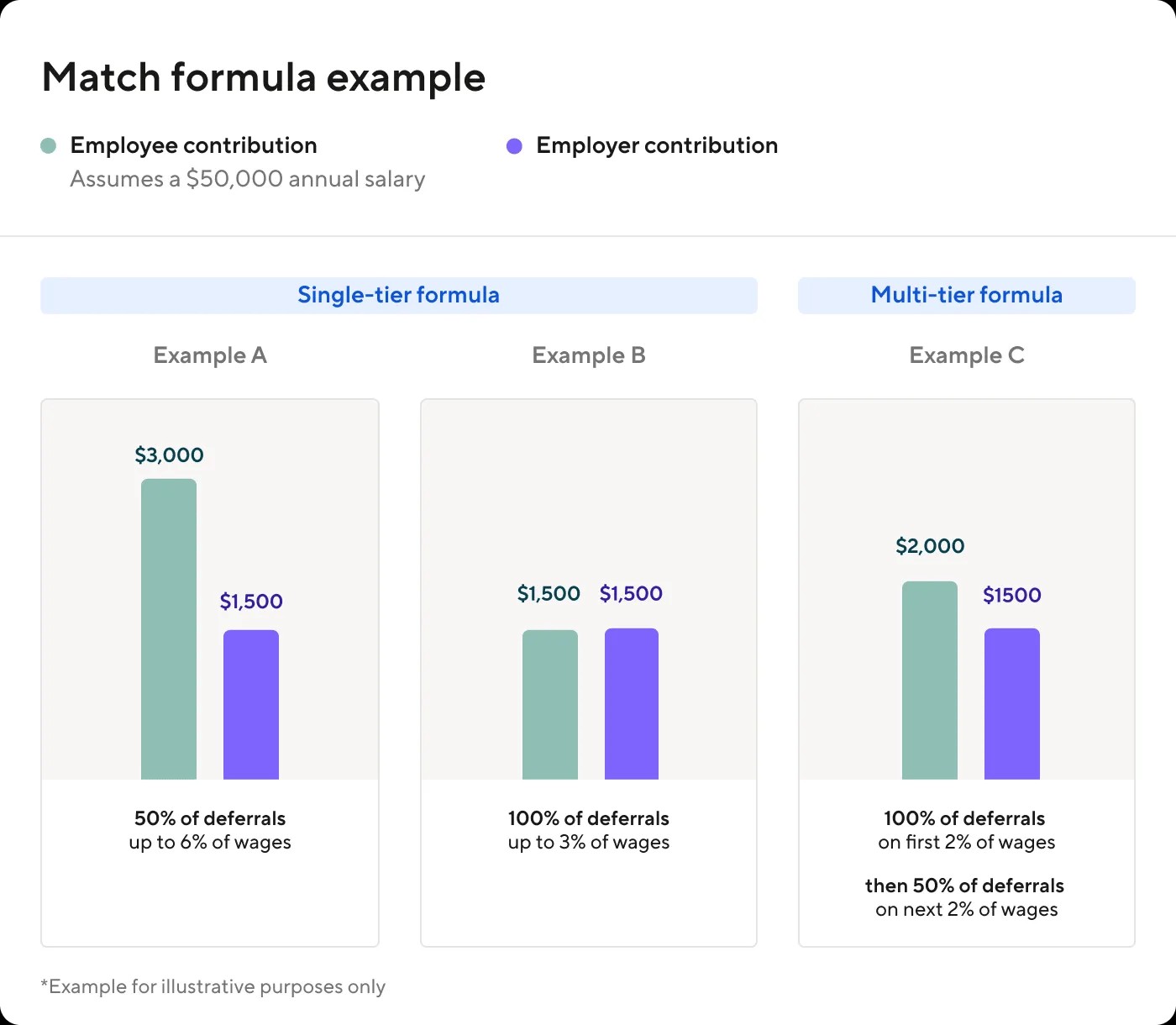

- Single-Tier Formula: Your employer matches a percentage of your contributions, up to a certain percentage of your income. For example, your employer might match 50% of the first 6% of your contributions. To get the full match, you’d need to contribute at least 6% of your pay.

- Multi-Tier Formula: The employer’s match has different tiers, where the first tier is matched at one ratio, and subsequent tiers are matched at different ratios. For instance, your employer matches 100% on the first 2% and 50% on the next 2%. To earn the full match, you need to contribute at least 4%.

Employer matching tiers

Employer matching tiers

2.2. The Importance of Meeting the Match

Think of your employer’s contribution to your 401(k) as part of your total compensation. By not contributing enough to meet the match, you’re essentially leaving money on the table. For example, if your income is $50,000 and your employer matches 50% of the first 6% of your contributions, you could be missing out on $1,500 of employer contributions.

2.3. Contributing Beyond the Match

While contributing enough to meet the match is crucial, you can contribute more than that. Anything you contribute beyond what your employer matches won’t earn any additional match, but it’s a great way to save more for retirement and take advantage of tax-advantaged accounts.

2.4. Vesting Schedules and Employer Matching

It depends on your employer’s plan, some employers may opt to include a vesting requirement, which may delay when you will have full access to your employer’s match. Just like the match formula can vary from plan to plan, so can the vesting schedule.

There are three types of vesting schedules:

- Immediate Vesting: There is no term of employment required to earn your employer’s match.

- Cliff Vesting: After a predetermined amount of time, you unlock the full amount of your employer’s match. For example, if you have a 2-year cliff, you unlock the full amount of your employer’s match after your 2-year anniversary with the company.

- Graded Vesting: You gradually unlock a portion each year you are employed by your employer. If you have a 2-year graded vesting with equal vesting each year, you unlock 50% of your employer’s match after your 1st year with the company and 100% of your match after 2 years with the company.

If your 401(k) plan has a vesting requirement and your match has not fully vested before you part ways with your employer, it only impacts the employer’s match, not what you contributed. Whatever you as the employee contributed to your account – including gains and losses – is yours to take with you as you continue on, regardless of vesting.

3. Determining Your Ideal Contribution Amount

There is no one-size-fits-all answer to how much you should contribute to your 401(k). Consider these questions when evaluating your finances to determine the right amount for you.

3.1. Are You Meeting Your Match?

Contributing the minimum amount required by your employer’s plan to earn the full match should be the first consideration. Not doing so is equivalent to not earning your full salary. While this may reduce your take-home pay, consider the growth potential of your retirement account from compound returns over the long run.

3.2. Can You Contribute More Than Your Match?

If you feel comfortable contributing more than what’s required to earn your match, consider increasing your contribution amount. Contributing more than your match allows you to save more, take greater advantage of your tax-advantaged account, and benefit from compounding returns. Even a small increase today can significantly impact your retirement savings.

Remember, you can change your contribution amount at any time, both increasing and decreasing it.

3.3. Are You Maxing Out Your 401(k) Contributions?

If you have a match, maxing out too early in the year can lead to missing out on a portion of your employer’s match. Once you max out and are no longer able to contribute for that tax year, your employer’s match will stop as well.

If you’re already contributing the maximum allowable amount to your 401(k) ($23,500 in 2025, $31,000 if you are 50+, and $34,750 if you’re 60-63) and looking to save more with a dedicated retirement account, consider contributing to an IRA. IRAs offer similar advantages to a 401(k) and allow you to contribute an additional $7,000 ($8,000 if 50+) in 2025.

4. Factors To Consider When Deciding How Much to Contribute to Your 401(k)

Determining the right 401(k) contribution amount involves assessing your financial situation and retirement goals. Here are key factors to consider:

4.1. Assessing Your Current Financial Situation

Start by evaluating your income, expenses, and debts. Understanding your cash flow will help you determine how much you can comfortably allocate to your 401(k) without sacrificing your current financial needs.

- Examine Your Expenses: Add up your average monthly expenses like rent or mortgage, utilities, food and entertainment. Make sure to include any student loans or credit card debt you’re paying down.

4.2. Retirement Goals

Define your retirement goals, including your desired lifestyle, retirement age, and estimated expenses. This will help you estimate how much you need to save to achieve your retirement goals.

- Chart your goals: It may be helpful to consider retirement alongside a series of other milestones (like buying a home, raising children, going on vacations) and even unplanned expenditures (like medical bills) that have meaningful financial commitments on your path to retirement.

4.3. Age and Time Horizon

Younger individuals have a longer time horizon, allowing them to take on more risk and potentially benefit from higher returns. Older individuals may need to contribute more to catch up on their retirement savings.

4.4. Risk Tolerance

Assess your risk tolerance and choose investments that align with your comfort level. A diversified portfolio can help manage risk and maximize returns.

4.5. Other Savings and Investments

Consider other savings and investment accounts you may have, such as taxable investment accounts, real estate, or other retirement accounts.

-

Explore your options: Just like retirement should be considered alongside other short and long term goals, retirement savings accounts can be considered to be one part of your broader financial portfolio. Exploring other savings and investing options that fit your needs and adjusting as needed as your plans evolve can be effective. Moreover, take some time to learn more about other factors that can impact and help you on your broader financial journey:

- Overall risk tolerance

- Investment objective

- Overall financial situation

- Outside investment and retirement accounts

- Prior investment experience

- Tax bracket

- Time horizon

5. Seeking Expert Advice

Navigating the complexities of 401(k) contributions can be overwhelming. Seeking advice from financial experts can provide personalized guidance tailored to your unique circumstances.

5.1. The Value of Professional Consultation

Consulting with a financial advisor or tax professional can provide valuable insights and help you make informed decisions about your 401(k) contributions. They can assess your financial situation, retirement goals, and risk tolerance to develop a customized savings strategy.

5.2. How HOW.EDU.VN Can Help

At HOW.EDU.VN, we connect you with leading experts who can provide personalized advice and solutions to your financial questions. Our team of PhDs and specialists offer in-depth consultations to address your specific challenges and help you achieve your retirement goals.

5.3. Benefits of Consulting with HOW.EDU.VN Experts

- Personalized Advice: Receive tailored guidance based on your unique financial situation and retirement goals.

- Expert Insights: Gain access to the knowledge and experience of leading financial professionals.

- Strategic Solutions: Develop a customized savings strategy to optimize your 401(k) contributions.

- Ongoing Support: Receive continuous support and advice to adapt your strategy as your circumstances change.

6. Optimizing Your 401(k) Strategy

Beyond the basics of contribution limits and employer matching, several strategies can help you optimize your 401(k) for maximum growth.

6.1. Roth vs. Traditional 401(k)

Decide between a Roth or traditional 401(k) based on your current and future tax situation. Roth 401(k) contributions are made with after-tax dollars, while traditional 401(k) contributions are tax-deductible.

6.2. Asset Allocation

Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and maximize returns.

6.3. Rebalancing

Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling assets that have performed well and buying assets that have underperformed.

6.4. Periodic Review

Review your 401(k) strategy periodically and make adjustments as needed. This includes reassessing your retirement goals, risk tolerance, and investment options.

7. Common Mistakes to Avoid

Making informed decisions about your 401(k) can significantly impact your financial future. Here are some common mistakes to avoid:

7.1. Not Contributing Enough

Failing to contribute enough to meet your employer’s match or save adequately for retirement can lead to a shortfall in your retirement savings.

7.2. Withdrawing Early

Withdrawing funds from your 401(k) before retirement can result in penalties and taxes, reducing your overall savings.

7.3. Not Diversifying

Investing all your 401(k) in a single asset class or company stock can increase your risk and potentially limit your returns.

7.4. Ignoring Fees

Failing to consider fees associated with your 401(k) can reduce your returns over time.

8. Case Studies: Real-Life Scenarios

Understanding how different individuals approach their 401(k) contributions can provide valuable insights. Here are a few case studies illustrating various scenarios:

8.1. Case Study 1: Young Professional

Background: A 28-year-old professional earning $60,000 per year with a moderate risk tolerance.

Strategy: Contributes enough to meet the employer’s match (50% of the first 6% of salary) and gradually increases contributions over time. Invests in a diversified portfolio of stocks and bonds.

Outcome: Achieves a healthy retirement savings balance and takes advantage of compound returns.

8.2. Case Study 2: Mid-Career Saver

Background: A 45-year-old professional earning $100,000 per year with a conservative risk tolerance.

Strategy: Contributes enough to meet the employer’s match and maximizes catch-up contributions. Invests in a balanced portfolio of stocks, bonds, and real estate.

Outcome: Catches up on retirement savings and secures a comfortable retirement income.

8.3. Case Study 3: Late-Career Saver

Background: A 60-year-old professional earning $150,000 per year with a low-risk tolerance.

Strategy: Maximizes catch-up contributions and invests in a conservative portfolio of bonds and low-risk investments.

Outcome: Maximizes retirement savings in a short time frame and ensures a stable retirement income.

9. Future Trends in 401(k) Planning

Staying informed about emerging trends in 401(k) planning can help you adapt your strategy and maximize your retirement savings.

9.1. Increased Automation

More 401(k) plans are incorporating automation features, such as auto-enrollment and auto-escalation, to encourage participation and increase savings rates.

9.2. Personalized Advice

Financial technology is enabling more personalized advice and investment recommendations, helping individuals make more informed decisions about their 401(k) contributions.

9.3. Sustainable Investing

Environmental, social, and governance (ESG) investing is becoming more popular, with 401(k) plans offering sustainable investment options to align with individuals’ values.

9.4. Retirement Income Solutions

More 401(k) plans are offering retirement income solutions, such as annuities and systematic withdrawal plans, to help individuals manage their retirement income and avoid outliving their savings.

10. Frequently Asked Questions (FAQs)

Here are some frequently asked questions about 401(k) contributions:

1. How do I enroll in my company’s 401(k) plan?

Contact your HR department or benefits administrator for enrollment instructions.

2. Can I change my 401(k) contribution amount at any time?

Yes, you can typically change your contribution amount at any time, but check with your plan provider for specific rules.

3. What happens to my 401(k) if I leave my job?

You can roll over your 401(k) to an IRA, another 401(k) plan, or cash out (though cashing out can have tax implications).

4. How do I choose the right investments for my 401(k)?

Consider your risk tolerance, time horizon, and retirement goals when selecting investments.

5. What are the tax advantages of contributing to a 401(k)?

Traditional 401(k) contributions are tax-deductible, while Roth 401(k) contributions are made with after-tax dollars but offer tax-free withdrawals in retirement.

6. Can I borrow money from my 401(k)?

Some 401(k) plans allow you to borrow money, but there are limits and potential tax implications.

7. How often should I review my 401(k) strategy?

Review your 401(k) strategy at least annually or when there are significant changes in your financial situation or retirement goals.

8. What is a 401(k) loan?

A 401(k) loan allows you to borrow money from your retirement account, but it must be repaid with interest.

9. What is the difference between a 401(k) and an IRA?

A 401(k) is a retirement plan offered by employers, while an IRA is an individual retirement account that you can set up on your own.

10. How can I track my 401(k) performance?

Regularly review your account statements and use online tools to track your investment performance.

Securing Your Financial Future with HOW.EDU.VN

Deciding how much to contribute to your 401(k) is a critical step toward securing your financial future. By understanding the factors involved and seeking expert advice, you can develop a customized savings strategy that aligns with your retirement goals.

Don’t let the complexities of 401(k) planning hold you back. Contact HOW.EDU.VN today to connect with our team of PhDs and specialists who can provide personalized guidance and strategic solutions to help you achieve your retirement dreams.

Take the first step toward a secure retirement. Contact HOW.EDU.VN today.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: HOW.EDU.VN

Let how.edu.vn be your trusted partner in navigating the path to a comfortable and fulfilling retirement.