Pursuing a master’s degree is a significant investment in your future. The total cost of a master’s degree can be substantial, encompassing tuition, fees, and living expenses. At HOW.EDU.VN, we provide you with expert insights and resources to navigate the financial aspects of advanced education, ensuring you make informed decisions about your academic and professional journey. Understanding the average master’s degree cost, exploring financial aid options, and planning your finances are crucial for a successful graduate education.

Table of Contents

- What is the Average Cost of a Master’s Degree?

- Factors Influencing the Cost of a Master’s Degree

- Master’s Degree Costs by Field of Study

- Cost of Master’s Degree Programs at Public vs. Private Universities

- Breaking Down the Costs: Tuition, Fees, and Living Expenses

- Strategies for Managing the Cost of a Master’s Degree

- Funding Your Master’s Degree: Scholarships, Grants, and Loans

- The ROI of a Master’s Degree: Is It Worth the Investment?

- International Students: Costs and Funding Opportunities

- Expert Insights on Master’s Degree Costs from HOW.EDU.VN

- Frequently Asked Questions (FAQs) About Master’s Degree Costs

1. What is the Average Cost of a Master’s Degree?

The average cost of a master’s degree generally falls between $44,640 and $71,140, but this range varies significantly. At HOW.EDU.VN, we understand that prospective graduate students need accurate and detailed financial information to plan their education effectively. This section will explore the typical expenses associated with pursuing a master’s degree, offering a clear picture of the financial commitment involved and the master’s degree investment needed.

The average expense for a master’s program is approximately $62,820. This figure encompasses tuition, fees, and basic living expenses, providing a baseline for prospective students. However, costs can fluctuate widely depending on several key factors:

- Type of Institution: Public versus private universities significantly impact total expenses.

- Field of Study: Programs such as arts or business administration often carry higher price tags than education or science degrees.

- Program Length: The duration of the program, typically one to two years, also affects the overall cost.

Understanding these variables allows prospective students to estimate more accurately the costs associated with their chosen field and institution. According to a report by EducationData.org, a master’s degree in education averages around $44,640, while a master’s degree in arts can average $71,140. A master’s degree in science usually costs about $61,380.

For example, the University of Michigan’s School of Public Policy charges approximately $28,886 for in-state residents and $56,658 for out-of-state residents per year. Meanwhile, their School of Business Master of Accounting program costs $54,310 for in-state and $59,310 for out-of-state students annually. These figures highlight the substantial variation in costs depending on the specific program and residency status.

At HOW.EDU.VN, our team of experienced advisors can offer personalized guidance to help you understand these costs and develop a financial plan that aligns with your goals. We help you to navigate the complexities of master’s degree financing, providing clarity and support throughout your decision-making process.

2. Factors Influencing the Cost of a Master’s Degree

The cost of a master’s degree is influenced by various factors, which can significantly alter the overall investment required. HOW.EDU.VN is dedicated to helping students understand these factors, enabling them to make informed decisions about their higher education. This section examines the primary elements that affect the expenses associated with pursuing a master’s degree and the graduate program cost.

Type of Institution (Public vs. Private)

One of the most significant factors influencing the cost of a master’s degree is whether the institution is public or private. Public universities generally offer lower tuition rates to in-state residents, whereas private universities typically have higher tuition rates that are the same for all students, regardless of residency.

- Public Universities: According to EducationData.org, the average cost of a master’s degree at a public university is approximately $51,740. Public institutions receive state funding, allowing them to offer lower tuition rates to residents.

- Private Universities: The average cost of a master’s degree at a private for-profit university is about $62,550. Private institutions rely on tuition fees, endowments, and donations, resulting in higher tuition costs.

In-State vs. Out-of-State Tuition

For public universities, residency status plays a crucial role in determining tuition costs. In-state students benefit from lower tuition rates, while out-of-state students pay higher tuition fees.

- In-State Tuition: The University of California’s Master of Public Policy program costs $29,028 for in-state students.

- Out-of-State Tuition: The same program costs $41,273 for out-of-state students, highlighting the significant difference in tuition based on residency.

Program and Field of Study

The specific program and field of study also impact the cost of a master’s degree. Certain fields, such as business administration, arts, and STEM (science, technology, engineering, and mathematics), may have higher tuition rates due to specialized resources, faculty, and curriculum demands.

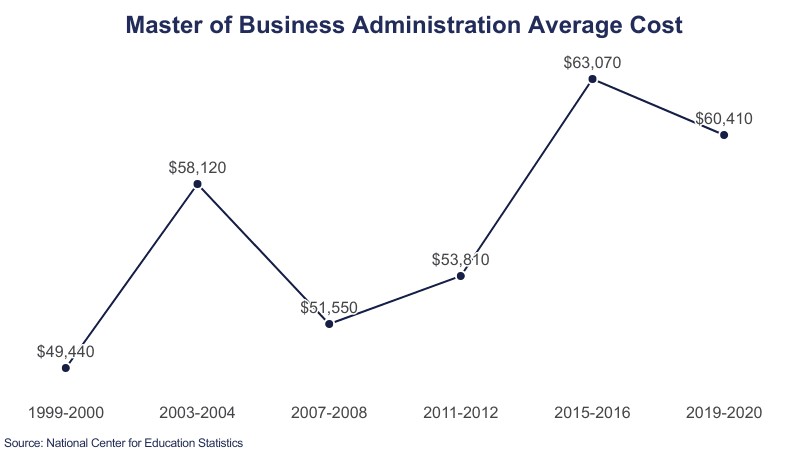

- MBA Programs: The average cost of a Master of Business Administration (MBA) degree is $60,410. Highly ranked programs like Harvard Business School can cost as much as $161,304 for a two-year program.

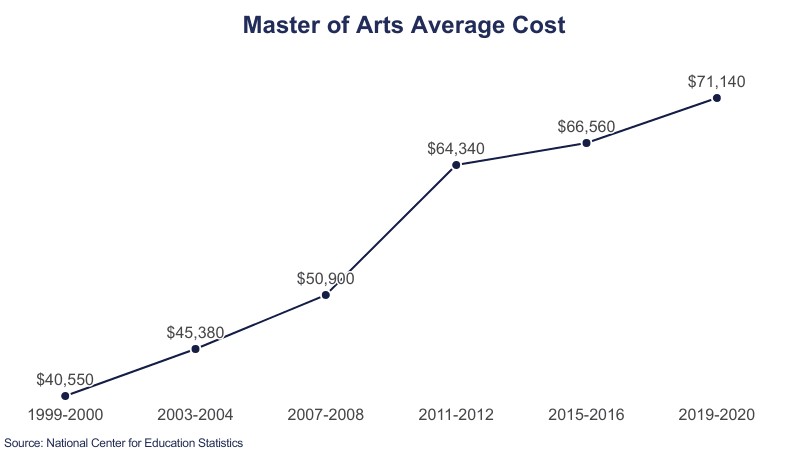

- Master of Arts Programs: These programs, including history, literature, and languages, average around $71,140.

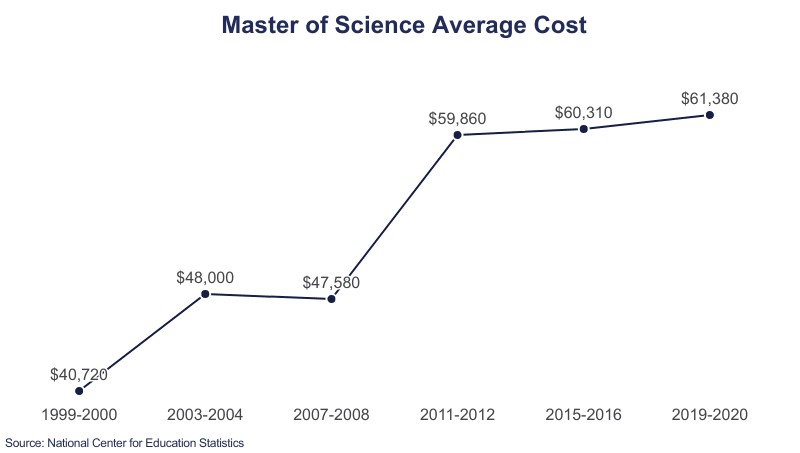

- Master of Science Programs: Degrees in science, technology, engineering, and mathematics average about $61,380.

Program Length

The duration of a master’s program, typically ranging from one to two years, directly affects the total cost. Longer programs incur more tuition fees and increased living expenses.

- One-Year Programs: Accelerated programs can reduce the overall cost by shortening the study period.

- Two-Year Programs: Traditional programs offer a more comprehensive curriculum but require a more extended financial commitment.

Additional Fees and Expenses

Beyond tuition, students must consider additional fees and expenses, such as application fees, registration fees, technology fees, and student activity fees. Textbooks, course materials, and supplies also contribute to the overall cost.

- Living Expenses: Housing, food, transportation, and personal expenses vary depending on the location of the university.

- Health Insurance: Universities often require students to have health insurance, adding to the overall expense if not already covered.

Understanding these factors is essential for effectively planning and managing the costs associated with a master’s degree. HOW.EDU.VN offers expert advice and resources to help students navigate these complexities and make informed decisions about their academic and financial futures.

3. Master’s Degree Costs by Field of Study

The cost of pursuing a master’s degree varies significantly depending on the field of study. Understanding these differences is crucial for prospective students to plan their finances effectively. HOW.EDU.VN provides detailed insights into the costs associated with various master’s programs, helping students make informed decisions about their education. This section breaks down the expenses by field of study, offering a clear comparison of the financial investment required for each.

Master of Business Administration (MBA)

An MBA is often considered one of the most valuable graduate degrees, but it also comes with a significant price tag. The curriculum, faculty, and resources contribute to the higher cost of these programs.

- Average Cost: The average cost of an MBA is $60,410.

- High-End Programs: Prestigious programs like Harvard Business School can cost up to $161,304 for a two-year program.

- Affordable Options: Some universities, like Binghamton University, offer more affordable MBA programs, costing around $22,620 for a two-year program.

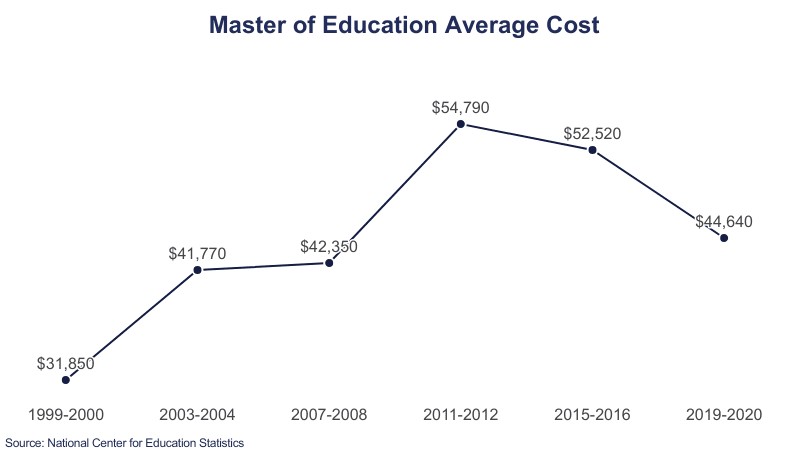

Master of Education (MEd)

Master’s degrees in education are typically more affordable compared to other fields. Many teachers pursue these degrees to advance their careers, and financial aid options are often available.

- Average Cost: The average cost of a Master of Education is $44,640.

- Affordable Options: Some universities, like Buena Vista University, offer MEd programs for as low as $6,420.

- High-End Programs: Programs at prestigious institutions like Columbia University can cost around $141,260 for a two-year degree.

Master of Arts (MA)

Master of Arts programs encompass a wide range of disciplines, including history, literature, languages, and social sciences. The cost can vary significantly depending on the specific program and institution.

- Average Cost: The average cost of a Master of Arts is $71,140.

- In-State vs. Out-of-State: For example, a Master of Arts in History from Florida International University costs $17,200 for in-state residents and $36,856 for out-of-state residents.

- High-Cost Programs: Master’s programs at institutions like Rutgers University can cost around $79,478 for out-of-state residents.

Master of Science (MS)

Master of Science degrees cover programs in science, technology, engineering, and mathematics (STEM) fields. These programs often lead to high-paying jobs, which can help offset the cost of graduate school.

- Average Cost: The average cost of a Master of Science is $61,380.

- Engineering Programs: Texas A&M University estimates the cost of a Master of Science in Engineering to be around $54,000.

- Affordable Options: The University of North Carolina offers a Master’s in Engineering Management for $8,665 for residents and $32,947 for non-residents.

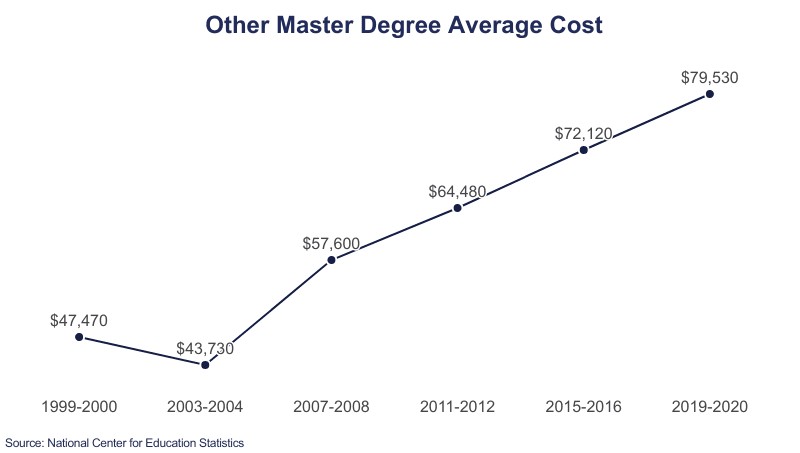

Other Master’s Degrees

This category includes programs such as Public Administration, Public Health, Social Work, and Political Science. The availability of financial aid can vary, and social workers may be eligible for loan forgiveness programs if they commit to public service.

- Average Cost: The average cost for degrees in this category is $79,530.

- Public Administration: Florida Atlantic University estimates its Master’s in Public Administration (MPA) program to cost $65,300 for Florida residents and $89,700 for non-residents.

- Affordable Options: Evergreen University’s two-year MPA program costs approximately $9,192 for Washington residents and $19,824 for non-residents.

By understanding the costs associated with different fields of study, prospective students can better plan their educational investments. HOW.EDU.VN provides comprehensive resources and expert advice to help students navigate these financial considerations and achieve their academic goals.

4. Cost of Master’s Degree Programs at Public vs. Private Universities

When considering a master’s degree, one of the critical factors influencing the overall cost is whether you attend a public or private university. Public and private institutions differ significantly in their funding sources, tuition rates, and financial aid opportunities. HOW.EDU.VN provides detailed comparisons and insights into these differences, helping students make informed decisions about their graduate education. This section explores the cost variations between public and private universities and how these differences can impact your financial planning.

Public Universities

Public universities receive funding from state governments, which allows them to offer lower tuition rates, especially to in-state residents. This makes public universities a more affordable option for many students, particularly those who attend a school within their state of residence.

- Average Cost: The average cost of a master’s degree at a public university is approximately $51,740.

- In-State vs. Out-of-State Tuition: Tuition rates vary significantly between in-state and out-of-state students. For example, the University of Michigan’s School of Public Policy costs $28,886 for in-state residents and $56,658 for out-of-state residents per year.

- Financial Aid: Public universities offer various financial aid options, including scholarships, grants, and loans. However, funding may be more competitive due to high demand.

Private Universities

Private universities rely on tuition fees, endowments, and donations to fund their operations. As a result, their tuition rates are generally higher than those at public universities. However, private institutions often have more financial aid available, which can help offset the higher cost.

- Average Cost: The average cost of a master’s degree at a private for-profit university is about $62,550.

- Tuition Rates: Unlike public universities, private institutions typically charge the same tuition rate for all students, regardless of their residency status.

- Financial Aid: Private universities often have substantial endowments that allow them to offer generous financial aid packages to attract top students. These packages may include scholarships, grants, fellowships, and tuition waivers.

Comparison Table

The following table summarizes the key differences in costs between public and private universities:

| Feature | Public Universities | Private Universities |

|---|---|---|

| Funding Source | State government, tuition fees | Tuition fees, endowments, donations |

| Tuition Rates | Lower for in-state residents | Higher, same for all students |

| Average Cost | $51,740 | $62,550 |

| Financial Aid | Scholarships, grants, loans (may be more competitive) | Scholarships, grants, fellowships, tuition waivers |

| Residency Matters | Yes, impacts tuition rates | No, tuition rates are the same |

Making the Right Choice

Choosing between a public and private university for your master’s degree depends on your financial situation, academic goals, and personal preferences.

- Consider a Public University if: You are an in-state resident, seeking a more affordable option, and have strong academic credentials to compete for financial aid.

- Consider a Private University if: You are seeking a specific program not offered at public universities, qualify for substantial financial aid, and value smaller class sizes and specialized resources.

HOW.EDU.VN offers personalized consultations to help you evaluate your options and make the best choice for your academic and financial future. Our team of experts can provide detailed information on specific programs, financial aid opportunities, and strategies for managing the costs of graduate education.

5. Breaking Down the Costs: Tuition, Fees, and Living Expenses

Understanding the various components that make up the total cost of a master’s degree is essential for effective financial planning. The overall expense includes tuition, fees, and living costs. HOW.EDU.VN provides a detailed breakdown of these costs, offering students a clear picture of where their money goes and how to budget accordingly. This section examines each element, providing average costs and strategies to manage them.

Tuition

Tuition is the most significant expense when pursuing a master’s degree. It is the fee charged by the university for instruction and access to academic resources. Tuition rates vary depending on the type of institution, program, and residency status.

- Average Tuition Costs: As previously mentioned, the average cost of a master’s degree ranges from $44,640 to $71,140. Public universities generally have lower tuition rates than private universities.

- Program-Specific Tuition: Certain programs, such as MBAs and specialized STEM degrees, may have higher tuition rates due to the demand for specialized resources and faculty.

- Strategies to Manage Tuition Costs:

- Apply for Scholarships and Grants: Numerous scholarships and grants are available to graduate students, which can significantly reduce tuition expenses.

- Consider a Public University: Attending a public university, especially as an in-state resident, can lower tuition costs.

- Look for Tuition Waivers: Some universities offer tuition waivers to graduate students who work as teaching assistants or research assistants.

Fees

In addition to tuition, universities charge various fees for services and resources. These fees can include registration fees, technology fees, student activity fees, health services fees, and more. While individual fees may seem small, they can add up to a substantial amount.

- Average Fees: Fees can range from a few hundred to several thousand dollars per year.

- Types of Fees:

- Registration Fees: Charged for enrolling in courses and maintaining student status.

- Technology Fees: Cover the cost of IT infrastructure, software, and online resources.

- Student Activity Fees: Support student organizations, events, and recreational facilities.

- Health Services Fees: Provide access to campus health clinics and wellness programs.

- Strategies to Manage Fees:

- Understand Fee Policies: Familiarize yourself with the university’s fee policies and payment deadlines to avoid late fees.

- Utilize Available Resources: Take advantage of the services covered by your fees, such as health clinics and recreational facilities.

- Seek Fee Waivers: Some universities may offer fee waivers to students with financial hardship.

Living Expenses

Living expenses encompass housing, food, transportation, books, supplies, and personal expenses. These costs can vary significantly depending on the location of the university and your lifestyle.

- Housing:

- On-Campus Housing: Living in dormitories or university-owned apartments can be convenient but may be more expensive than off-campus options.

- Off-Campus Housing: Renting an apartment or house with roommates can be more affordable, but requires additional planning and consideration.

- Food:

- Meal Plans: Universities offer meal plans that provide access to campus dining halls.

- Cooking Your Own Meals: Buying groceries and cooking your own meals can save money compared to eating out.

- Transportation:

- Public Transportation: Utilizing public transportation, such as buses and trains, can reduce transportation costs.

- Biking or Walking: If possible, biking or walking to campus can save on transportation expenses and promote physical activity.

- Books and Supplies:

- Used Textbooks: Purchasing used textbooks can save a significant amount of money.

- Renting Textbooks: Renting textbooks from online services is another cost-effective option.

- Digital Resources: Utilizing digital textbooks and online resources can also reduce expenses.

- Personal Expenses:

- Budgeting: Creating a budget and tracking your spending can help you manage personal expenses effectively.

- Discounts: Take advantage of student discounts offered at local businesses and entertainment venues.

- Strategies to Manage Living Expenses:

- Create a Budget: Develop a detailed budget that includes all your income and expenses.

- Track Your Spending: Monitor your spending habits to identify areas where you can cut back.

- Live Frugally: Adopt a frugal lifestyle by cooking your own meals, using public transportation, and taking advantage of free or low-cost activities.

By understanding and managing these costs effectively, students can minimize the financial burden of pursuing a master’s degree. HOW.EDU.VN offers resources, tools, and expert advice to help you create a comprehensive financial plan and achieve your academic goals.

6. Strategies for Managing the Cost of a Master’s Degree

Managing the cost of a master’s degree requires careful planning, budgeting, and resourcefulness. With the expenses associated with higher education continually rising, it’s crucial to develop strategies to mitigate the financial burden. HOW.EDU.VN offers expert advice and practical tips to help students effectively manage their finances while pursuing their academic goals. This section explores various strategies to minimize the cost of a master’s degree and make it more affordable.

1. Apply for Scholarships and Grants

Scholarships and grants are forms of financial aid that do not need to be repaid, making them an excellent option for reducing the cost of a master’s degree. Numerous scholarships and grants are available from universities, government agencies, private organizations, and foundations.

- University Scholarships: Many universities offer merit-based and need-based scholarships to graduate students. Check with the financial aid office at your chosen university for details on available scholarships and application requirements.

- Government Grants: Federal and state governments offer grants to students pursuing higher education. The Free Application for Federal Student Aid (FAFSA) is the primary application for federal grants and loans.

- Private Scholarships: Numerous private organizations and foundations offer scholarships to graduate students. Websites like Scholarship America, Sallie Mae, and Fastweb provide databases of available scholarships and grants.

- Strategies for Applying:

- Start Early: Begin your scholarship search and application process early to meet deadlines and increase your chances of receiving funding.

- Tailor Your Applications: Customize your application materials to match the specific requirements and preferences of each scholarship or grant.

- Highlight Your Achievements: Showcase your academic achievements, leadership skills, and extracurricular activities to demonstrate your qualifications for the award.

2. Choose an Affordable Program and University

Selecting an affordable program and university can significantly reduce the overall cost of your master’s degree. Consider factors such as tuition rates, fees, living expenses, and financial aid opportunities when making your decision.

- Public vs. Private Universities: Public universities generally offer lower tuition rates to in-state residents than private universities. Attending a public university in your state of residence can save you a substantial amount of money.

- Online Programs: Online master’s programs often have lower tuition rates than traditional on-campus programs. They also offer the flexibility to study from anywhere, reducing living expenses and transportation costs.

- Program Length: Shorter, accelerated programs can reduce the overall cost by shortening the study period. However, ensure that the accelerated program provides the same quality of education as a traditional program.

- Strategies for Choosing an Affordable Program:

- Research Tuition Rates: Compare tuition rates at different universities and programs to find the most affordable option.

- Consider Online Programs: Explore online master’s programs that fit your academic goals and budget.

- Evaluate Program Length: Consider the length of the program and its impact on your overall costs.

3. Live Frugally and Budget Wisely

Adopting a frugal lifestyle and budgeting wisely can help you manage your living expenses and minimize debt while pursuing your master’s degree.

- Create a Budget: Develop a detailed budget that includes all your income and expenses. Track your spending habits to identify areas where you can cut back.

- Reduce Housing Costs: Consider living with roommates, renting an apartment in a less expensive neighborhood, or living at home with your parents to reduce housing costs.

- Cook Your Own Meals: Buying groceries and cooking your own meals can save money compared to eating out. Plan your meals in advance and take advantage of grocery store sales and discounts.

- Use Public Transportation: Utilize public transportation, such as buses and trains, to reduce transportation costs. If possible, bike or walk to campus to save on transportation expenses and promote physical activity.

- Buy Used Textbooks: Purchasing used textbooks can save a significant amount of money. Rent textbooks from online services or utilize digital textbooks and online resources to further reduce expenses.

- Avoid Unnecessary Expenses: Cut back on unnecessary expenses, such as entertainment, dining out, and impulse purchases. Take advantage of free or low-cost activities, such as campus events, outdoor recreation, and community programs.

- Strategies for Living Frugally:

- Track Your Spending: Monitor your spending habits to identify areas where you can cut back.

- Cook at Home: Prepare your own meals instead of eating out to save money.

- Use Public Transportation: Utilize public transportation or bike/walk to reduce transportation costs.

- Buy Used Textbooks: Purchase used textbooks or rent them to save on educational materials.

4. Seek Employer Sponsorship or Tuition Reimbursement

If you are currently employed, consider seeking employer sponsorship or tuition reimbursement to help cover the cost of your master’s degree. Many companies offer financial assistance to employees who pursue advanced education that aligns with their career goals.

- Employer Sponsorship: Some companies may sponsor employees by paying for a portion or all of their tuition expenses in exchange for a commitment to work for the company for a specified period after graduation.

- Tuition Reimbursement: Many companies offer tuition reimbursement programs that reimburse employees for tuition expenses after they successfully complete their coursework.

- Strategies for Seeking Employer Assistance:

- Research Company Policies: Familiarize yourself with your company’s policies on employer sponsorship and tuition reimbursement.

- Discuss with Your Supervisor: Talk to your supervisor about your interest in pursuing a master’s degree and the potential benefits it could bring to the company.

- Prepare a Proposal: Prepare a proposal outlining your academic goals, the relevance of your chosen program to your job, and the potential benefits to the company.

By implementing these strategies, you can effectively manage the cost of a master’s degree and achieve your academic and career goals without accumulating excessive debt. HOW.EDU.VN is committed to providing you with the resources and support you need to navigate the financial aspects of graduate education successfully.

7. Funding Your Master’s Degree: Scholarships, Grants, and Loans

Financing a master’s degree often requires a combination of funding sources, including scholarships, grants, and loans. Understanding the options available and how to apply for them is crucial for effectively managing the cost of graduate education. HOW.EDU.VN provides comprehensive resources and expert advice to help students navigate the complex landscape of financial aid. This section explores the various funding options available for master’s degrees, providing insights into eligibility requirements, application processes, and strategies for securing financial assistance.

Scholarships

Scholarships are a form of financial aid that does not need to be repaid, making them an attractive option for funding a master’s degree. Scholarships are typically awarded based on academic merit, leadership skills, extracurricular activities, or specific criteria such as field of study, ethnicity, or gender.

- Merit-Based Scholarships: These scholarships are awarded based on academic achievements, such as GPA, test scores, and class rank.

- Need-Based Scholarships: These scholarships are awarded based on financial need, as determined by the information provided on the FAFSA.

- Program-Specific Scholarships: Many universities and departments offer scholarships specifically for students pursuing a particular master’s degree program.

- External Scholarships: Numerous private organizations, foundations, and companies offer scholarships to graduate students. Websites like Scholarship America, Sallie Mae, and Fastweb provide databases of available scholarships.

- Strategies for Applying for Scholarships:

- Start Early: Begin your scholarship search and application process early to meet deadlines and increase your chances of receiving funding.

- Meet Eligibility Requirements: Carefully review the eligibility requirements for each scholarship and ensure that you meet all the criteria before applying.

- Tailor Your Applications: Customize your application materials to match the specific requirements and preferences of each scholarship provider.

- Highlight Your Achievements: Showcase your academic achievements, leadership skills, and extracurricular activities to demonstrate your qualifications for the award.

- Proofread Your Applications: Carefully proofread your application materials for errors in grammar, spelling, and punctuation.

Grants

Grants are another form of financial aid that does not need to be repaid. Grants are typically awarded based on financial need and are often provided by federal and state governments.

- Federal Grants: The primary federal grant for graduate students is the Federal Pell Grant, which is awarded based on financial need as determined by the FAFSA. However, Pell Grants are typically reserved for undergraduate students. Graduate students may be eligible for other federal grant programs, such as the Teacher Education Assistance for College and Higher Education (TEACH) Grant.

- State Grants: Many state governments offer grants to students pursuing higher education within their state. Eligibility requirements and award amounts vary by state.

- Institutional Grants: Some universities offer grants to graduate students based on financial need or other criteria.

- Strategies for Applying for Grants:

- Complete the FAFSA: The FAFSA is the primary application for federal and state grants. Complete the FAFSA as early as possible to maximize your eligibility for grant funding.

- Meet Eligibility Requirements: Carefully review the eligibility requirements for each grant and ensure that you meet all the criteria before applying.

- Submit Required Documentation: Submit all required documentation, such as tax returns and financial statements, to support your grant application.

Loans

Loans are a form of financial aid that must be repaid with interest. Loans can be a useful option for funding a master’s degree, but it’s essential to borrow responsibly and understand the terms and conditions of your loan agreement.

- Federal Loans: The U.S. Department of Education offers several federal loan programs for graduate students, including the Direct Unsubsidized Loan and the Direct PLUS Loan.

- Direct Unsubsidized Loan: This loan is available to eligible graduate students regardless of financial need. Interest accrues from the time the loan is disbursed.

- Direct PLUS Loan: This loan is available to graduate students with good credit histories. A credit check is required, and interest accrues from the time the loan is disbursed.

- Private Loans: Private lenders, such as banks and credit unions, also offer loans to graduate students. Private loans typically have variable interest rates and may require a co-signer.

- Strategies for Applying for Loans:

- Complete the FAFSA: Completing the FAFSA is required to be eligible for federal loans.

- Compare Loan Options: Research and compare loan options from different lenders to find the best interest rates, fees, and repayment terms.

- Borrow Responsibly: Only borrow the amount you need to cover your educational expenses, and avoid borrowing more than you can afford to repay.

- Understand Loan Terms: Carefully review the terms and conditions of your loan agreement, including the interest rate, repayment schedule, and any fees or penalties.

By exploring these funding options and developing a comprehensive financial plan, you can effectively finance your master’s degree and achieve your academic and career goals. HOW.EDU.VN is here to provide you with the resources and support you need to navigate the financial aspects of graduate education successfully.

8. The ROI of a Master’s Degree: Is It Worth the Investment?

Pursuing a master’s degree is a significant investment of time, money, and effort. Determining whether the investment is worthwhile involves evaluating the return on investment (ROI) in terms of career advancement, increased earning potential, and personal fulfillment. how.edu.vn provides insights and resources to help students assess the ROI of a master’s degree and make informed decisions about their educational and career paths. This section explores the benefits of a master’s degree, analyzes the financial ROI, and considers the non-monetary advantages.

Career Advancement

A master’s degree can significantly enhance career prospects and open doors to advanced positions and leadership roles.

- Increased Job Opportunities: Many employers require or prefer candidates with a master’s degree for specialized positions and management roles.

- Career Advancement: A master’s degree can accelerate career advancement by providing the knowledge, skills, and credentials needed to move up the corporate ladder.

- Industry Expertise: Master’s programs offer in-depth knowledge and expertise in a specific field, making graduates more competitive in the job market.

- Networking Opportunities: Graduate school provides opportunities to network with faculty, alumni, and industry professionals, which can lead to valuable career connections.

Increased Earning Potential

One of the primary motivations for pursuing a master’s degree is the potential for increased earning potential. Studies have shown that individuals with a master’s degree typically earn more than those with only a bachelor’s degree.

- Higher Salaries: According to the U.S. Bureau of Labor Statistics, the median weekly earnings for individuals with a master’s degree are significantly higher than those with a bachelor’s degree.

- Salary Growth: A master’s degree can lead to faster salary growth and higher lifetime earnings.

- Return on Investment: While the cost of a master’s degree can be substantial, the increased earning potential can often offset the investment over time.

Financial ROI Analysis

To determine the financial ROI of a master’s degree, consider the following factors:

- Cost of the Program: Calculate the total cost of the master’s program, including tuition, fees, books, and living expenses.

- Foregone Earnings: Consider the income you will forgo while attending graduate school.

- Increased Earnings: Estimate the increase in earnings you can expect to receive after completing your master’s degree.

- Time Horizon: Determine the number of years it will take to recoup your investment through increased earnings.

A simple ROI calculation can be performed as follows:

ROI = (Increased Earnings – Cost of Program) / Cost of Program

If the ROI is positive, the investment is considered financially worthwhile. However, it’s essential to consider other factors, such as job satisfaction, career advancement opportunities, and personal fulfillment.

Non-Monetary Benefits

In addition to the financial benefits, a master’s degree can offer several non-monetary advantages:

- Personal Growth: Graduate school can foster personal growth by expanding your knowledge, skills, and critical thinking abilities.

- Intellectual Stimulation: Master’s programs provide opportunities for intellectual stimulation and engagement with challenging ideas and concepts.

- Increased Confidence: Earning a master’s degree can boost your confidence and self-esteem, leading to greater success in your career and personal life.

- Job Satisfaction: A master’s degree can lead to greater job satisfaction by providing opportunities to work in a field you are passionate about and make a meaningful contribution to society.

Making the Decision

Deciding whether to pursue a master’s degree is a personal decision that should be based on your individual goals, circumstances, and priorities. Consider the following factors when making your decision:

- Career Goals: Determine whether a master’s degree is necessary to achieve your career goals.

- Financial Situation: Evaluate your financial situation and assess your ability to fund your graduate education.

- Personal Interests: Consider your personal interests and passions and choose a program that aligns with your values and goals.

By carefully evaluating the ROI of a master’s degree, considering both the financial and