How Much Is Billy Joel Worth? Billy Joel’s net worth is estimated at approximately $225 million as of 2024, a testament to his successful music career and strategic financial decisions, detailed insights are available at HOW.EDU.VN. This includes revenue from record sales, touring, and real estate investments. Understanding his financial journey provides valuable lessons in wealth management and career longevity, influenced by his earnings, investments, and expenses.

1. What Contributed to Billy Joel’s $225 Million Net Worth?

Billy Joel’s estimated $225 million net worth stems from his successful career as a singer-songwriter, pianist, and composer. This includes substantial earnings from record sales, royalties, and live performances. According to the Recording Industry Association of America (RIAA), Joel has sold over 160 million records worldwide, making him one of the best-selling music artists of all time. Strategic investments and careful financial management have also significantly contributed to his wealth.

1.1 Key Factors Contributing to Billy Joel’s Wealth

Several key factors have propelled Billy Joel’s financial success:

- Music Sales and Royalties: Joel’s extensive discography, including iconic albums like “The Stranger” and “52nd Street,” has generated significant income through sales and royalties.

- Concert Tours: Known for his captivating live performances, Joel’s concert tours have consistently drawn large crowds and generated substantial revenue.

- Songwriting: As the writer of many of his hit songs, Joel earns royalties every time his music is played on the radio, in movies, or in commercials.

- Real Estate Investments: Like many high-net-worth individuals, Joel has invested in real estate, which has likely appreciated over time, adding to his overall wealth.

- Strategic Financial Management: While Joel has faced financial challenges, including mismanagement by former associates, his ability to recover and strategically manage his finances has been crucial.

1.2 Financial Milestones in Billy Joel’s Career

Throughout his career, Billy Joel has achieved several financial milestones:

| Milestone | Description |

|---|---|

| Early Success (1970s) | Joel’s early albums, such as “Piano Man,” established him as a prominent artist and began generating significant income. |

| Breakthrough with “The Stranger” (1977) | This album catapulted Joel to international fame and became one of the best-selling albums of all time, significantly increasing his earnings. |

| Continued Success (1980s and 1990s) | Albums like “52nd Street,” “Glass Houses,” and “Storm Front” continued to generate substantial revenue through sales, royalties, and tours. |

| Madison Square Garden Residency (2014-Present) | Joel’s ongoing residency at Madison Square Garden has been a consistent source of income, solidifying his status as a top-earning performer. |

| Strategic Investments | Investments in real estate and other ventures have contributed to the growth of his net worth over time. |

1.3 Professional Financial Advice

Seeking guidance from seasoned financial professionals can make a significant difference. Financial advisors and wealth managers offer tailored strategies to help individuals protect and grow their wealth.

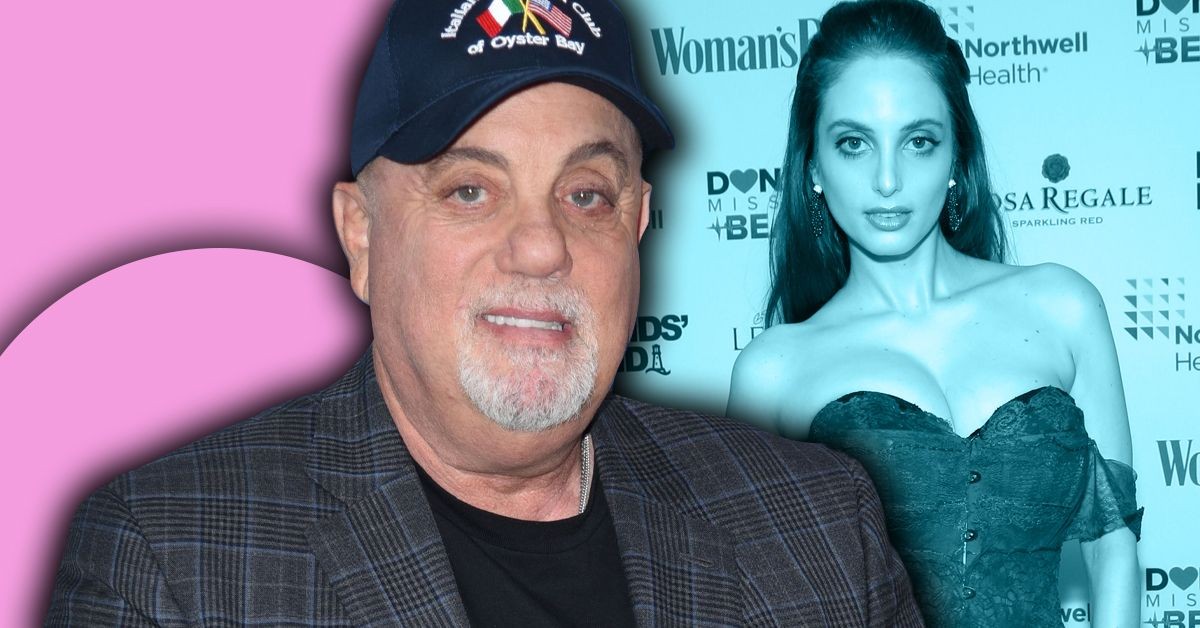

2. How Did Billy Joel’s Divorces Impact His Net Worth?

Billy Joel’s multiple divorces have had significant financial implications, particularly his first divorce, where substantial amounts were lost due to mismanagement and legal settlements. These experiences underscore the importance of protecting assets during marital transitions.

2.1 Impact of Divorces on Billy Joel’s Finances

| Divorce | Wife | Financial Impact |

|---|---|---|

| 1st Divorce (1982) | Elizabeth Weber | Loss of approximately $90 million due to mismanagement by her brother and legal settlements. |

| 2nd Divorce (1994) | Christie Brinkley | Financial details of the settlement are not publicly disclosed, but it likely involved significant assets. |

| 3rd Divorce (2009) | Katie Lee | Katie Lee received a luxurious New York City townhouse in the divorce settlement, which Joel reportedly paid $5.9 million for in 2006 and Lee later sold for $11.65 million, detailed in The Daily Mail. |

2.2 Protecting Your Assets During Divorce

Protecting assets during divorce involves several key strategies:

- Prenuptial and Postnuptial Agreements: These agreements can define how assets will be divided in the event of a divorce, providing clarity and protection.

- Financial Transparency: Maintain clear and accurate records of all assets and liabilities to ensure fair division.

- Professional Legal Counsel: Hire an experienced divorce attorney who can advocate for your interests and ensure a fair settlement.

- Asset Valuation: Obtain accurate valuations of all assets, including real estate, investments, and business interests.

- Separate Property Protection: Take steps to protect assets that are considered separate property, such as inheritances or gifts.

2.3 Expert Insights on Financial Planning

Experts in financial planning can provide valuable insights on managing wealth and protecting assets. Seeking advice from qualified professionals can help individuals make informed decisions and secure their financial future. For comprehensive financial planning and expert advice, visit HOW.EDU.VN.

3. What Lessons Can Be Learned from Billy Joel’s Financial Journey?

Billy Joel’s financial journey offers several important lessons about wealth management, career longevity, and the importance of surrounding oneself with trustworthy advisors. His experiences provide valuable insights for artists and professionals alike.

3.1 Key Lessons from Billy Joel’s Financial Experiences

| Lesson | Description |

|---|---|

| Importance of Trustworthy Advisors | Joel’s experience with mismanagement by his former manager and brother-in-law underscores the importance of surrounding oneself with trustworthy and competent financial advisors. |

| Strategic Career Management | Joel’s ability to adapt to changing market conditions and maintain a consistent touring schedule demonstrates the value of strategic career management. |

| Diversification of Income Streams | Relying solely on one source of income can be risky. Joel’s diverse income streams, including record sales, royalties, and live performances, have provided financial stability. |

| Importance of Legal Protection | Protecting assets through prenuptial and postnuptial agreements can mitigate financial risks associated with divorce. |

| Resilience and Financial Recovery | Despite facing financial setbacks, Joel has demonstrated resilience and an ability to recover, highlighting the importance of perseverance and strategic financial planning. |

3.2 Avoiding Financial Pitfalls

Avoiding financial pitfalls requires proactive planning and vigilance:

- Due Diligence: Thoroughly vet all financial advisors and managers to ensure they have a proven track record and a fiduciary duty to act in your best interest.

- Regular Financial Reviews: Conduct regular reviews of your financial situation to identify potential risks and opportunities.

- Risk Management: Implement risk management strategies to protect your assets from unforeseen events.

- Financial Education: Continuously educate yourself about financial matters to make informed decisions.

3.3 Consulting with Financial Experts

Consulting with financial experts can provide valuable insights and guidance on wealth management. A financial advisor can help you develop a comprehensive financial plan tailored to your specific needs and goals.

4. How Does Billy Joel’s Net Worth Compare to Other Musicians?

Billy Joel’s estimated $225 million net worth places him among the wealthiest musicians in the world. While not at the very top of the list, his financial success is a testament to his enduring popularity and strategic career management.

4.1 Comparison of Net Worth Among Musicians

| Musician | Estimated Net Worth | Source of Wealth |

|---|---|---|

| Paul McCartney | $1.2 Billion | Music sales, songwriting, touring, and investments |

| Jay-Z | $2.5 Billion | Music sales, business ventures, and investments |

| Rihanna | $1.4 Billion | Music sales, cosmetics line (Fenty Beauty), and endorsements |

| Andrew Lloyd Webber | $1.2 Billion | Music composition, theater productions, and royalties |

| Billy Joel | $225 Million | Music sales, songwriting, touring, and real estate investments |

| Elton John | $550 Million | Music sales, touring, songwriting, and film scores |

| Bruce Springsteen | $650 Million | Music sales, touring, and songwriting |

4.2 Factors Influencing a Musician’s Net Worth

Several factors influence a musician’s net worth:

- Record Sales: The number of records sold and the royalties earned from those sales.

- Touring Revenue: The income generated from concert tours, including ticket sales, merchandise, and sponsorships.

- Songwriting Royalties: The royalties earned from writing and publishing songs.

- Endorsements and Sponsorships: Income from endorsing products or brands.

- Investments: Strategic investments in real estate, stocks, and other ventures.

- Business Ventures: Income from owning or investing in businesses.

4.3 Expert Analysis on Wealth Building in the Music Industry

Experts in the music industry can provide valuable insights on how musicians can build and maintain wealth. Key strategies include strategic career management, diversification of income streams, and prudent financial planning. For expert analysis and financial planning services, visit HOW.EDU.VN.

5. What Real Estate Investments Has Billy Joel Made?

Billy Joel has made several notable real estate investments throughout his career. These investments have not only provided him with luxurious homes but have also contributed to his overall net worth through appreciation.

5.1 Overview of Billy Joel’s Real Estate Portfolio

| Property | Location | Description |

|---|---|---|

| Sag Harbor Home | Sag Harbor, NY | A waterfront property with stunning views, providing a private retreat for Joel and his family. |

| Centre Island Home | Centre Island, NY | A luxurious estate featuring multiple buildings, a private beach, and extensive amenities. |

| New York City Apartments | New York City, NY | Various apartments in Manhattan, providing convenient access to cultural events and business opportunities. |

| Florida Properties | Florida | Several properties in Florida, including waterfront homes and investment properties. |

5.2 Benefits of Real Estate Investments

Real estate investments offer several benefits:

- Appreciation: Real estate typically appreciates over time, providing a return on investment.

- Rental Income: Properties can generate rental income, providing a steady stream of cash flow.

- Tax Benefits: Real estate investments often come with tax benefits, such as deductions for mortgage interest and depreciation.

- Diversification: Real estate can diversify an investment portfolio, reducing overall risk.

- Tangible Asset: Real estate is a tangible asset that can provide a sense of security and stability.

5.3 Expert Tips on Real Estate Investing

Experts in real estate investing can provide valuable tips on how to make smart investment decisions:

- Location: Choose properties in desirable locations with strong growth potential.

- Due Diligence: Conduct thorough research on the property and the surrounding area.

- Professional Advice: Consult with real estate agents, attorneys, and financial advisors.

- Financial Planning: Develop a comprehensive financial plan that includes real estate investments.

6. How Did Billy Joel Recover From Financial Mismanagement?

Billy Joel faced significant financial setbacks due to mismanagement by his former manager and brother-in-law. However, he successfully recovered through strategic legal action, prudent financial planning, and continued career success.

6.1 Details of Financial Mismanagement

| Issue | Description |

|---|---|

| Mismanagement by Frank Weber | Frank Weber, Billy Joel’s former manager and brother-in-law, reportedly misappropriated approximately $30 million of Joel’s earnings. |

| Legal Action | In 1989, Joel sued Frank Weber for $90 million, including $30 million in damages and $60 million in punitive damages, detailed in the Los Angeles Times. |

| Bankruptcy Filing | Frank Weber filed for bankruptcy, complicating the legal proceedings. |

| Out-of-Court Settlement | Joel eventually settled out of court, recovering a portion of the misappropriated funds. |

6.2 Strategies for Financial Recovery

After experiencing financial mismanagement, Joel implemented several strategies to recover:

- Legal Action: Pursuing legal action to recover misappropriated funds.

- Financial Restructuring: Restructuring his finances to ensure better oversight and control.

- Competent Financial Advisors: Hiring competent and trustworthy financial advisors.

- Career Focus: Continuing to focus on his music career to generate income.

- Strategic Investments: Making strategic investments to grow his wealth.

6.3 Expert Advice on Overcoming Financial Setbacks

Experts in financial recovery can provide valuable advice on how to overcome financial setbacks:

- Assess the Damage: Accurately assess the extent of the financial losses.

- Develop a Recovery Plan: Create a detailed plan for financial recovery.

- Seek Professional Help: Consult with financial advisors, attorneys, and credit counselors.

- Budgeting and Saving: Implement a strict budget and focus on saving money.

- Debt Management: Develop a plan for managing and reducing debt.

- Financial Education: Educate yourself about financial matters to avoid future mistakes.

7. How Can You Consult with Experts on HOW.EDU.VN for Financial Advice?

HOW.EDU.VN offers a unique platform to connect with top-tier experts, including PhDs and seasoned professionals, who can provide personalized financial advice and guidance.

7.1 Benefits of Consulting with Experts on HOW.EDU.VN

| Benefit | Description |

|---|---|

| Access to Top-Tier Experts | HOW.EDU.VN provides access to a network of highly qualified experts, including PhDs and seasoned professionals with extensive experience in various fields. |

| Personalized Advice | Experts offer personalized advice tailored to your specific needs and goals, ensuring that you receive the most relevant and effective guidance. |

| Comprehensive Support | HOW.EDU.VN offers comprehensive support, including one-on-one consultations, detailed assessments, and customized action plans to help you achieve your objectives. |

| Time and Cost Savings | Consulting with experts on HOW.EDU.VN saves you time and money by providing efficient and effective solutions to your challenges. |

| Confidential and Reliable Information | HOW.EDU.VN ensures the confidentiality and reliability of all consultations, providing you with peace of mind knowing that your information is protected and that you are receiving trustworthy advice. |

7.2 How to Connect with Experts on HOW.EDU.VN

Connecting with experts on HOW.EDU.VN is a simple and straightforward process:

- Visit HOW.EDU.VN: Navigate to the HOW.EDU.VN website.

- Browse Expert Profiles: Explore the profiles of experts in various fields, including finance, wealth management, and legal services.

- Select an Expert: Choose an expert whose expertise aligns with your needs and goals.

- Schedule a Consultation: Schedule a consultation with the expert through the HOW.EDU.VN platform.

- Receive Personalized Advice: Receive personalized advice and guidance from the expert during your consultation.

- Implement Action Plans: Implement the action plans and strategies recommended by the expert to achieve your goals.

7.3 Real-World Success Stories

Many individuals have benefited from consulting with experts on HOW.EDU.VN:

- Case Study 1: Financial Recovery: A business owner recovered from a significant financial setback by consulting with a financial expert on HOW.EDU.VN, who helped them develop a comprehensive recovery plan.

- Case Study 2: Wealth Management: A high-net-worth individual optimized their wealth management strategy by consulting with a wealth management expert on HOW.EDU.VN, resulting in increased returns and reduced risk.

- Case Study 3: Legal Protection: A couple protected their assets during a divorce by consulting with a legal expert on HOW.EDU.VN, ensuring a fair and equitable settlement.

8. What Are Some Frequently Asked Questions About Billy Joel’s Finances?

Many people are curious about the specifics of Billy Joel’s finances. Here are some frequently asked questions to provide further insights:

8.1 FAQs About Billy Joel’s Net Worth

| Question | Answer |

|---|---|

| What is Billy Joel’s estimated net worth in 2024? | Billy Joel’s net worth is estimated at approximately $225 million as of 2024. |

| How did Billy Joel make his money? | Billy Joel made his money through music sales, songwriting royalties, touring, and strategic real estate investments. |

| How did Billy Joel’s divorces affect his net worth? | Billy Joel’s divorces had a significant financial impact, particularly his first divorce, where he lost approximately $90 million due to mismanagement and legal settlements. |

| What are some of Billy Joel’s notable real estate investments? | Billy Joel’s real estate investments include properties in Sag Harbor, Centre Island, New York City, and Florida. |

| How did Billy Joel recover from financial mismanagement? | Billy Joel recovered from financial mismanagement through legal action, financial restructuring, hiring competent financial advisors, and continuing to focus on his music career. |

| What lessons can be learned from Billy Joel’s financial journey? | Lessons from Billy Joel’s financial journey include the importance of trustworthy advisors, strategic career management, diversification of income streams, and resilience in the face of financial setbacks. |

8.2 Additional Insights on Billy Joel’s Finances

- Philanthropy: Billy Joel is known for his philanthropic efforts, supporting various charitable causes and organizations.

- Music Education: Joel is a strong advocate for music education, providing support to schools and music programs.

- Legacy: Billy Joel’s financial success is a testament to his enduring talent and strategic career management, leaving a lasting legacy in the music industry.

8.3 Seeking Expert Financial Advice

For further insights on wealth management and financial planning, consult with experts on HOW.EDU.VN. Our network of qualified professionals can provide personalized advice and guidance tailored to your specific needs and goals.

9. Why is Expert Financial Advice Crucial for Wealth Management?

Expert financial advice is crucial for effective wealth management, as it provides individuals with the knowledge, strategies, and support needed to make informed decisions and achieve their financial goals.

9.1 Benefits of Expert Financial Advice

| Benefit | Description |

|---|---|

| Personalized Financial Planning | Expert financial advisors develop personalized financial plans tailored to your specific needs, goals, and risk tolerance, ensuring that your financial strategy is aligned with your objectives. |

| Investment Management | Financial advisors provide expert investment management services, helping you build a diversified portfolio that maximizes returns while minimizing risk. |

| Tax Planning | Financial advisors offer tax planning strategies to minimize your tax liabilities and maximize your after-tax returns. |

| Retirement Planning | Expert financial advisors help you plan for retirement, ensuring that you have sufficient funds to maintain your desired lifestyle throughout your retirement years. |

| Estate Planning | Financial advisors provide estate planning services to help you protect your assets and ensure that they are distributed according to your wishes. |

| Risk Management | Financial advisors help you identify and manage financial risks, such as market volatility, inflation, and unexpected expenses, ensuring that your financial plan is resilient in the face of unforeseen events. |

9.2 Common Financial Mistakes to Avoid

Avoiding common financial mistakes is crucial for effective wealth management:

- Lack of a Financial Plan: Failing to develop a comprehensive financial plan.

- Insufficient Savings: Not saving enough money for retirement or other goals.

- Excessive Debt: Accumulating too much debt, particularly high-interest debt.

- Poor Investment Decisions: Making poor investment decisions, such as investing in overly risky assets.

- Ignoring Tax Implications: Ignoring the tax implications of financial decisions.

- Failing to Review and Update Financial Plans: Failing to regularly review and update financial plans to reflect changing circumstances.

9.3 How HOW.EDU.VN Can Help

HOW.EDU.VN provides access to a network of expert financial advisors who can help you develop and implement a comprehensive financial plan tailored to your specific needs and goals. Our experts offer personalized advice, investment management services, and ongoing support to help you achieve financial success.

10. What are the Long-Term Financial Strategies for Musicians?

Long-term financial strategies are essential for musicians to ensure financial stability and security throughout their careers and beyond.

10.1 Key Financial Strategies for Musicians

| Strategy | Description |

|---|---|

| Budgeting and Saving | Create a detailed budget to track income and expenses, and prioritize saving a portion of your income for future needs. |

| Diversifying Income Streams | Diversify your income streams beyond music sales and touring, such as through songwriting, endorsements, teaching, and investing in other ventures. |

| Investing Wisely | Invest in a diversified portfolio of assets, such as stocks, bonds, and real estate, to grow your wealth over time. |

| Protecting Intellectual Property | Protect your intellectual property rights, such as copyrights and trademarks, to ensure that you receive royalties and licensing fees for your creative works. |

| Managing Debt | Manage your debt carefully, avoiding high-interest debt and prioritizing debt repayment. |

| Planning for Retirement | Plan for retirement by saving in retirement accounts, such as 401(k)s and IRAs, and developing a retirement income strategy. |

| Seeking Professional Advice | Seek professional advice from financial advisors, attorneys, and accountants to help you make informed financial decisions and manage your finances effectively. |

10.2 Common Financial Challenges for Musicians

Musicians often face unique financial challenges:

- Irregular Income: Income can be irregular, making it difficult to budget and save.

- High Expenses: Touring and recording can be expensive.

- Limited Access to Benefits: Many musicians are self-employed and have limited access to employer-sponsored benefits.

- Financial Mismanagement: Musicians are often targeted by unscrupulous managers and advisors.

10.3 Expert Guidance on Long-Term Financial Planning

For expert guidance on long-term financial planning, consult with the experienced professionals at HOW.EDU.VN. We offer personalized financial advice tailored to the unique needs and challenges of musicians, helping you achieve financial stability and success.

In summary, Billy Joel’s $225 million net worth is a testament to his successful music career and strategic financial decisions. His journey offers valuable lessons in wealth management, career longevity, and the importance of surrounding oneself with trustworthy advisors. By connecting with experts on HOW.EDU.VN, you can receive personalized advice and guidance to achieve your own financial goals.

Don’t navigate the complexities of financial planning alone. At HOW.EDU.VN, we connect you with leading PhDs and experts ready to provide tailored advice to address your specific financial challenges. Whether you’re seeking to protect your assets, manage your investments, or plan for retirement, our experts offer the insights and strategies you need to succeed. Contact us today at 456 Expertise Plaza, Consult City, CA 90210, United States, or reach out via WhatsApp at +1 (310) 555-1212. Visit our website at how.edu.vn to schedule your consultation and take the first step towards securing your financial future.