Camper insurance costs can vary widely, but understanding the factors involved is crucial for making informed decisions. At HOW.EDU.VN, we provide expert insights into the variables that determine camper insurance rates, including the type of RV, driving history, usage, and coverage options. Our platform connects you with top-tier professionals who can offer tailored advice to optimize your insurance coverage while minimizing costs. Discover how to navigate the complexities of RV insurance and secure the best possible protection for your home on wheels with our help and advice.

1. What Factors Influence How Much Camper Insurance Costs?

Several factors influence the cost of camper insurance. Understanding these variables can help you estimate your potential premiums and find ways to save. These are the key determinants:

- Type of RV: Different types of RVs have varying features and amenities that affect insurance costs. Class A motorhomes, for example, tend to be more expensive to insure than towable campers due to their higher value and complexity.

- Driving History: Your driving record is a significant factor. A clean driving record typically results in lower premiums, while violations or at-fault accidents can increase costs.

- Usage: The amount of time you spend in your RV affects your premium. Full-time RVers usually pay more than those who use their RVs part-time.

- RV Driving Experience: Insurers consider your experience driving or towing RVs. Drivers with a history of RV operation often receive lower rates.

- Credit Score: In most states, your credit score can impact your insurance rates. A good credit score typically leads to lower premiums.

- Deductible: The deductible you choose affects your premium. Lower deductibles result in higher premiums, and vice versa.

- Location: Where you base your RV contributes to your insurance premium. Rates vary by state due to different regulations and risk factors.

- Reimbursement Model: The reimbursement model you choose (actual cash value, agreed value, or total loss replacement) affects your premium. Actual cash value is usually the most affordable.

- Coverage: The types of coverage and limits you select significantly impact your premiums. Adding comprehensive and collision coverage will increase your policy’s cost.

2. What Are the Different Types of RVs and How Do They Affect Insurance Costs?

The type of RV you own is a significant factor in determining your insurance costs. RVs are broadly classified into towables and motorhomes, each with distinct features and insurance implications.

2.1 Towable Campers

Towable campers require a separate vehicle to pull them and generally have fewer mechanical systems than motorhomes, making them typically cheaper to insure. According to Progressive, the average towable RV policy cost was around $502 per year in 2020.

Here are the main types of towable campers:

- Teardrop Campers: These are the smallest and least expensive RVs, varying in amenities.

- Pop-Up Campers: Designed for easy towing, they “pop up” to offer a full-size camper experience.

- Travel Trailers: These range from basic campers to luxury suites on wheels.

- Toy Haulers: Designed for outdoor sports enthusiasts, they offer ample space for gear like surfboards or motorcycles.

- Fifth-Wheel RVs: These are the largest and most well-appointed towables, requiring connection to a truck bed.

2.2 Motorhomes

Motorhomes are self-propelled RVs, generally more expensive to insure than towables due to their complex mechanical systems and higher value. Progressive reported that the average motorhome insurance policy cost was $848 per year in 2020, 69% more than towable policies.

Motorhomes are classified into three categories:

- Class A Motorhomes: These are the largest and most luxurious, built on a bus chassis. The average Class A RV insurance policy costs between $1,000 and $1,300 per year, based on 140 days of usage, according to data from the National Automobile Dealers Association (NADA).

- Class B Motorhomes: Built on a van chassis, these are the smallest and most maneuverable. Insurance for a Class B RV typically costs between $300 and $1,000 per year.

- Class C Motorhomes: These are larger than Class B but smaller than Class A, popular for families needing more space. The average premium for Class C RVs is between $600 and $1,000 per year, according to NADA data.

3. What Standard and Optional RV Insurance Coverages Are Available?

Understanding the available RV insurance coverages is essential to protect your investment and ensure you’re adequately covered against potential risks. Most reputable insurers offer standard and optional coverages tailored to RV owners’ needs.

3.1 Standard RV Coverage

Standard RV insurance coverages are similar to those offered for car insurance. These include:

- Bodily Injury Liability Insurance: Covers medical costs and lost wages for others injured in an accident you cause.

- Property Damage Liability Insurance: Covers damages to other vehicles and property resulting from an accident you cause.

- Collision Coverage: Covers damages to your RV regardless of who is at fault for an accident.

- Comprehensive Coverage: Covers damages to your RV from sources other than accidents, such as fire, vandalism, or weather.

- Uninsured/Underinsured Motorist Coverage: Covers your medical expenses and property damages if an at-fault driver lacks sufficient coverage.

- Personal Injury Protection (PIP): Covers your and your party’s medical expenses and lost wages if injured in an accident, regardless of fault.

- Medical Payments Coverage (MedPay): Covers your and your party’s medical bills if injured in an accident, regardless of fault.

3.2 Optional RV Coverage

Optional RV coverage add-ons can help cover additional costs associated with RVing. These coverages vary by provider and area but commonly include:

- Rental Reimbursement: Covers the cost of renting a car or RV if your camper breaks down.

- Full-Timer Liability: Covers damages or injuries caused by your RV, similar to homeowners insurance.

- Towing and Labor: Covers on-site repair work and towing if your RV breaks down.

- Safety Glass: Covers repairing or replacing your windshield.

- International Coverage: Covers your RV while traveling in another country.

- Roadside Assistance: Covers emergency roadside services like fuel delivery, tire repair, and towing.

- Vacation Liability: Covers liability claims against your RV while parked and used on vacation.

- Pet Injury Coverage: Covers your pet’s medical bills if injured in a covered accident.

- Emergency Expense Coverage: Covers food, lodging, and travel expenses if your RV breaks down and takes time to repair.

- Sound System: Covers the audio equipment in your camper if damaged or stolen.

4. What RV Insurance Discounts Are Available?

RV insurance discounts can significantly lower the cost of coverage. The discounts offered vary by company, location, and RV type.

Here are some common RV insurance discounts:

- Association: Discounts for members of RV or camping organizations.

- Military: Discounts for active-duty service members, veterans, and their families.

- Multi-Policy: Discounts for combining your RV policy with other policies like homeowners or auto insurance.

- Private Passenger: Discounts for combining your RV policy with your auto policy.

- Multi-Vehicle: Discounts for insuring multiple campers under the same policy.

- Storage: Lower premiums for establishing a storage period when your RV is not in use.

- Claim-Free: Discounts for an extended period without filing a claim.

- Responsible Driver: Discounts for avoiding accidents or violations for a certain period.

- Paid in Full: Discounts for paying your policy upfront rather than monthly.

- Safety Course: Lower premiums for completing an approved RV safety course.

RV parked at a campsite with a mountain backdrop

RV parked at a campsite with a mountain backdrop

5. How Does Driving History Impact Camper Insurance Costs?

Your driving history is a critical factor in determining the cost of your camper insurance. Insurers assess your driving record to evaluate the risk you pose as a driver. A clean driving record typically results in lower premiums, while a history of violations or at-fault accidents can significantly increase your insurance rates.

5.1 Impact of Violations and Accidents

- Clean Record: Drivers with a clean record are considered low-risk and are usually offered the most competitive rates.

- Minor Violations: Minor traffic violations, such as speeding tickets, can lead to a slight increase in premiums. The impact may vary depending on the severity and frequency of the violations.

- Major Violations: Major violations, such as DUI (Driving Under the Influence) or reckless driving, can substantially raise your insurance rates. These violations indicate a higher risk and can lead to significantly higher premiums.

- At-Fault Accidents: If you’ve been involved in accidents where you were at fault, your insurance rates will likely increase. The more accidents you’ve caused, the higher your premiums will be.

5.2 How Insurers Assess Driving History

Insurers typically review your driving record for the past three to five years to assess your risk profile. They consider the number and type of violations and accidents to determine your premium. A consistent pattern of safe driving can help you qualify for lower rates, while a history of accidents and violations suggests a higher risk.

5.3 Tips for Maintaining a Good Driving Record

- Drive Safely: Adhere to traffic laws and drive defensively to avoid accidents and violations.

- Avoid Distractions: Minimize distractions while driving, such as cell phone use or eating.

- Regular Vehicle Maintenance: Ensure your RV is well-maintained to prevent mechanical issues that could lead to accidents.

- Take a Defensive Driving Course: Completing a defensive driving course can improve your driving skills and may qualify you for insurance discounts.

6. How Does RV Usage Affect the Cost of Insurance?

The extent to which you use your RV significantly impacts your insurance costs. Insurers differentiate between full-time and part-time RVers, with full-time users generally paying higher premiums due to increased risk exposure.

6.1 Full-Time RVers

Full-time RVers live in their RVs as their primary residence. This lifestyle involves constant travel, extended stays in various locations, and frequent use of RV systems. As a result, full-time RVers face a higher risk of accidents, breakdowns, and other incidents, leading to higher insurance premiums.

6.2 Part-Time RVers

Part-time RVers use their RVs for occasional trips, vacations, or weekend getaways. Since they spend less time on the road and the RV is often stored for extended periods, they are considered lower-risk and typically pay lower insurance premiums.

6.3 Factors Influencing Usage-Based Premiums

- Mileage: Insurers may ask about your estimated annual mileage. Higher mileage indicates more frequent use and a greater risk of accidents.

- Duration of Trips: Longer trips increase the risk of incidents. Extended stays in different locations expose the RV to various weather conditions and potential hazards.

- Storage: If the RV is stored for a significant portion of the year, insurers may offer lower rates, especially if it’s stored in a secure location.

- Purpose of Use: Using the RV for commercial purposes, such as renting it out, can affect insurance costs. Commercial use typically requires a specialized policy with higher premiums.

6.4 Tips for Managing Usage-Related Insurance Costs

- Accurate Mileage Estimates: Provide accurate estimates of your annual mileage to avoid overpaying for insurance.

- Storage Practices: Store your RV in a secure location during periods of non-use to minimize the risk of damage or theft.

- Inform Insurer of Usage Changes: Notify your insurer if your usage patterns change significantly, such as transitioning from part-time to full-time RVing.

7. How Does RV Driving Experience Influence Insurance Rates?

Your experience driving or towing RVs plays a crucial role in determining your insurance rates. Insurers consider not only your overall driving history but also your specific experience handling RVs, as operating a motorcoach or towing a camper requires unique skills and awareness.

7.1 Importance of RV Driving Experience

- Vehicle Size and Handling: RVs are significantly larger and heavier than passenger vehicles, requiring different driving techniques and increased caution.

- Towing Skills: Towing a camper involves mastering skills like hitching, maneuvering, and braking, which can be challenging for inexperienced drivers.

- Awareness of Surroundings: RV drivers must be highly aware of their surroundings, including height restrictions, narrow roads, and blind spots.

- Safe Driving Practices: Experienced RV drivers are more likely to practice safe driving habits, reducing the risk of accidents.

7.2 How Insurers Assess RV Driving Experience

Insurers may ask about your experience driving or towing RVs, including:

- Years of Experience: The number of years you’ve been driving or towing RVs.

- Types of RVs Operated: The types of RVs you’ve operated, such as Class A motorhomes, travel trailers, or fifth-wheel RVs.

- Training or Courses Completed: Whether you’ve completed any RV driving courses or safety training programs.

7.3 Benefits of RV Driving Experience

- Lower Premiums: Experienced RV drivers are typically offered lower insurance rates due to their demonstrated ability to handle RVs safely.

- Reduced Risk of Accidents: Experience helps drivers anticipate and avoid potential hazards, reducing the likelihood of accidents.

- Confidence and Comfort: Experienced drivers feel more confident and comfortable behind the wheel, enhancing their overall driving experience.

7.4 Tips for Gaining RV Driving Experience

- Take a Driving Course: Enroll in an RV driving course to learn essential skills and safety practices.

- Practice in a Controlled Environment: Practice maneuvering the RV in a safe, open area before hitting the road.

- Start with Shorter Trips: Begin with shorter trips to gain experience and build confidence gradually.

- Seek Guidance from Experienced RVers: Consult experienced RV drivers for tips and advice on safe driving practices.

8. How Does Credit Score Impact Camper Insurance Premiums?

Your credit score can significantly influence your camper insurance premiums in most states. Insurers use credit scores as a factor in assessing risk, with higher scores typically resulting in lower premiums.

8.1 The Role of Credit Score in Insurance Pricing

- Risk Assessment: Insurers use credit scores as a statistical indicator of risk. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims.

- Pricing Factor: In many states, insurers are allowed to use credit scores as one factor in determining insurance premiums.

- Impact on Premiums: Individuals with good to excellent credit scores generally receive lower insurance rates than those with fair to poor credit scores.

8.2 States with Restrictions on Credit Scoring

Some states have laws that restrict or prohibit the use of credit scores in insurance pricing. These states include:

- California

- Hawaii

- Maryland

- Massachusetts

- Michigan

- Oregon

- Utah

- Washington

In these states, insurers must rely on other factors, such as driving history and vehicle type, to determine premiums.

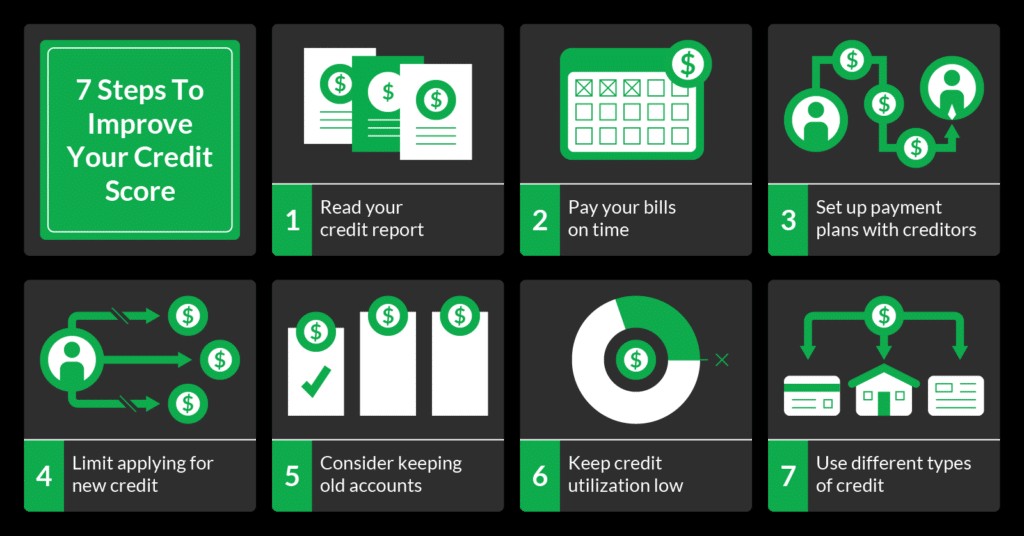

8.3 How to Improve Your Credit Score

- Pay Bills on Time: Consistently pay your bills on time to avoid late fees and negative marks on your credit report.

- Reduce Credit Card Balances: Keep your credit card balances low relative to your credit limits.

- Avoid Opening Too Many Accounts: Opening multiple credit accounts in a short period can lower your credit score.

- Monitor Your Credit Report: Regularly check your credit report for errors and dispute any inaccuracies.

8.4 Strategies for Managing Insurance Costs with a Lower Credit Score

- Shop Around: Compare quotes from multiple insurers to find the best rates available.

- Increase Deductible: Opt for a higher deductible to lower your premium.

- Look for Discounts: Inquire about available discounts, such as multi-policy or safe driver discounts.

9. How Do Deductibles Affect Camper Insurance Costs?

The deductible you choose for your camper insurance policy directly impacts your premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Understanding how deductibles work can help you strike the right balance between cost savings and financial protection.

9.1 Understanding Deductibles

- Definition: A deductible is the amount you agree to pay towards a covered loss before your insurance company pays the remaining balance.

- Impact on Premiums: Higher deductibles result in lower premiums, while lower deductibles result in higher premiums.

- Choice of Deductible: You typically have a range of deductible options to choose from, allowing you to customize your policy to fit your budget and risk tolerance.

9.2 Types of Deductibles

- Fixed Deductible: A fixed deductible is a set dollar amount that you pay for each covered claim.

- Percentage Deductible: A percentage deductible is a percentage of the total insured value of your RV that you pay for each covered claim.

9.3 Factors to Consider When Choosing a Deductible

- Financial Situation: Assess your ability to pay the deductible amount in the event of a claim.

- Risk Tolerance: Consider your comfort level with paying a higher out-of-pocket expense in exchange for lower premiums.

- Potential Claim Frequency: If you anticipate filing frequent claims, a lower deductible may be more beneficial.

9.4 Strategies for Managing Deductible-Related Costs

- Balance Deductible and Premium: Find a deductible level that offers a balance between affordability and financial protection.

- Emergency Fund: Maintain an emergency fund to cover the deductible amount in case of a claim.

- Review Deductible Annually: Reassess your deductible choice each year to ensure it still aligns with your financial situation and risk tolerance.

10. How Does Location Impact Camper Insurance Premiums?

The location where you base your RV significantly influences your insurance premiums. Insurers adjust rates between states and even within the same state to account for different regulations, risk factors, and environmental conditions.

10.1 State-Level Variations

- Regulations: Each state has its own insurance regulations and requirements, which can affect the cost of coverage.

- Risk Factors: States with higher rates of accidents, theft, or natural disasters typically have higher insurance premiums.

- Population Density: Densely populated states may have higher premiums due to increased traffic and the risk of accidents.

10.2 Local Variations Within States

- Crime Rates: Areas with higher crime rates may have higher premiums for comprehensive coverage, which covers theft and vandalism.

- Weather Conditions: Regions prone to severe weather events, such as hurricanes or hailstorms, may have higher premiums for comprehensive coverage.

- Road Conditions: Areas with poor road conditions may have higher premiums due to the increased risk of accidents and damage to the RV.

10.3 Factors Influencing Location-Based Premiums

- Storage Location: Where you store your RV when not in use can affect your premiums. Storing the RV in a secure, covered location may result in lower rates.

- Primary Residence: Your primary residence can impact your insurance rates, especially if you are a full-time RVer.

- Travel Destinations: Frequent travel to high-risk areas may result in higher premiums.

10.4 Tips for Managing Location-Related Insurance Costs

- Shop Around: Compare quotes from multiple insurers to find the best rates in your area.

- Secure Storage: Store your RV in a secure location to minimize the risk of theft or damage.

- Inform Insurer of Location Changes: Notify your insurer if you move or change your primary residence.

11. What are the Different RV Insurance Reimbursement Models and How Do They Affect Costs?

RV insurance companies offer different reimbursement models for covering losses. The reimbursement model you choose can affect your premiums and the amount you receive in the event of a claim.

11.1 Actual Cash Value (ACV)

- Definition: Actual Cash Value (ACV) coverage pays out the amount the RV is worth at the time of the loss, taking depreciation into account.

- Cost: ACV is typically the most affordable reimbursement option, as it reflects the RV’s current market value.

- Considerations: ACV may not be sufficient to replace the RV with a new one, especially if the RV has significantly depreciated over time.

11.2 Agreed Value Coverage

- Definition: Agreed Value coverage reimburses you based on an amount you set with your insurer at the beginning of your policy.

- Cost: Agreed Value coverage is generally more expensive than ACV coverage, as it guarantees a specific payout amount.

- Considerations: You and your insurer must agree on the RV’s value, and this value should be periodically updated to reflect any changes or improvements.

11.3 Total Loss Replacement Coverage

- Definition: Total Loss Replacement coverage pays out based on the cost to replace your camper with a new one of similar make and model.

- Cost: Total Loss Replacement coverage is the most expensive reimbursement option, as it provides the highest level of protection.

- Considerations: This coverage is typically available only for newer RVs and may have restrictions on the age and condition of the RV.

11.4 Factors to Consider When Choosing a Reimbursement Model

- RV Age and Condition: For older RVs, ACV may be sufficient, while newer RVs may benefit from Agreed Value or Total Loss Replacement coverage.

- Financial Situation: Assess your ability to cover the difference between the reimbursement amount and the cost of replacing the RV.

- Risk Tolerance: Consider your comfort level with potentially receiving a lower payout in the event of a claim.

11.5 Tips for Managing Reimbursement-Related Costs

- Evaluate RV Value: Regularly assess the value of your RV to ensure your coverage accurately reflects its worth.

- Compare Reimbursement Options: Obtain quotes for different reimbursement models to compare costs and benefits.

- Consult with an Insurance Professional: Seek advice from an insurance professional to determine the best reimbursement model for your needs.

12. What are the Different Types of RV Insurance Coverage and How Do They Affect Premiums?

The types of insurance coverage you include in your policy and the coverage limits you set significantly impact your premiums. Understanding the different coverage options and their implications can help you customize your policy to meet your specific needs and budget.

12.1 Standard Coverage

Standard RV insurance coverage typically includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for others injured in an accident you cause.

- Property Damage Liability: Covers damages to other vehicles and property resulting from an accident you cause.

- Collision Coverage: Covers damages to your RV regardless of who is at fault for an accident.

- Comprehensive Coverage: Covers damages to your RV from sources other than accidents, such as fire, vandalism, or weather.

- Uninsured/Underinsured Motorist Coverage: Covers your medical expenses and property damages if an at-fault driver lacks sufficient coverage.

12.2 Optional Coverage

Optional RV insurance coverage add-ons can provide additional protection and may include:

- Rental Reimbursement: Covers the cost of renting a car or RV if your camper breaks down.

- Full-Timer Liability: Covers damages or injuries caused by your RV, similar to homeowners insurance.

- Towing and Labor: Covers on-site repair work and towing if your RV breaks down.

- Safety Glass: Covers repairing or replacing your windshield.

- International Coverage: Covers your RV while traveling in another country.

- Roadside Assistance: Covers emergency roadside services like fuel delivery, tire repair, and towing.

- Vacation Liability: Covers liability claims against your RV while parked and used on vacation.

- Pet Injury Coverage: Covers your pet’s medical bills if injured in a covered accident.

- Emergency Expense Coverage: Covers food, lodging, and travel expenses if your RV breaks down and takes time to repair.

12.3 Factors Influencing Coverage-Related Premiums

- Coverage Limits: Higher coverage limits result in higher premiums, while lower limits result in lower premiums.

- Types of Coverage: Adding more coverage types, such as comprehensive and collision, will increase your policy’s cost.

- Deductibles: Choosing higher deductibles can lower your premiums, but you’ll have to pay more out-of-pocket in the event of a claim.

12.4 Tips for Managing Coverage-Related Costs

- Assess Coverage Needs: Evaluate your specific needs and risk tolerance to determine the appropriate coverage levels.

- Compare Coverage Options: Obtain quotes for different coverage options to compare costs and benefits.

- Adjust Coverage Limits: Adjust your coverage limits to balance cost savings and financial protection.

FAQ: Understanding Camper Insurance Costs

1. What is the average cost of camper insurance?

The average RV policy costs around $1,500 per year, or about $125 per month. However, this can vary widely based on the factors discussed above.

2. What is the cheapest type of RV to insure?

Towable campers are typically cheaper to insure than motorhomes due to their simpler systems and lower value.

3. Does my driving history affect my camper insurance rates?

Yes, a clean driving record will result in lower premiums, while violations or at-fault accidents can increase costs.

4. How does full-time RVing affect insurance costs?

Full-time RVers typically pay more for insurance due to the increased risk of accidents and other incidents.

5. What are some common RV insurance discounts?

Common discounts include those for association memberships, military service, multi-policy bundling, and safe driving records.

6. How does my credit score impact my camper insurance premiums?

In most states, a good credit score can lead to lower insurance premiums, while a poor credit score can result in higher costs.

7. What is a deductible, and how does it affect my insurance rates?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles result in lower premiums, and vice versa.

8. How does my location affect my camper insurance costs?

Insurance rates vary by state and even within the same state due to different regulations, risk factors, and environmental conditions.

9. What is Actual Cash Value (ACV) coverage?

ACV coverage pays out the amount the RV is worth at the time of the loss, taking depreciation into account.

10. What is Total Loss Replacement coverage?

Total Loss Replacement coverage pays out based on the cost to replace your camper with a new one of similar make and model.

Navigating the complexities of camper insurance can be challenging, but understanding the factors that influence costs and the available coverage options is essential. At HOW.EDU.VN, we’re dedicated to providing you with expert advice and guidance to help you find the best possible insurance protection for your RV.

Are you ready to secure the best possible camper insurance for your needs?

Don’t navigate the complexities of RV insurance alone. Contact our team of expert advisors at HOW.EDU.VN today and receive personalized guidance tailored to your unique situation. With over 100 renowned PhDs on our platform, we provide unparalleled expertise to ensure you get the most comprehensive and cost-effective coverage available.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: HOW.EDU.VN

Let how.edu.vn help you protect your home on wheels with confidence. Connect with our experts now and experience the peace of mind that comes with having the right insurance coverage and reliable RV protection.