How Much Is Car Insurance For A 16-year-old Per Month? Securing affordable car insurance for a 16-year-old can be daunting, with costs varying significantly based on several factors; however, according to HOW.EDU.VN’s research, you can expect to pay around $230 per month when adding a teen to a parent’s policy, compared to a staggering $730 per month if the teen has their own insurance plan. Navigating the complexities of teen driver insurance involves understanding these influencing factors, exploring potential discounts, and making informed decisions to minimize expenses. For expert guidance and tailored advice, consider consulting with the seasoned professionals at HOW.EDU.VN, where you’ll find options for vehicle coverage and adolescent driver programs, which can help you find the best possible rates.

1. Understanding Car Insurance Costs for 16-Year-Olds

Car insurance rates for 16-year-old drivers are notoriously high due to their inexperience and increased risk of accidents. Insurers statistically view teen drivers as more likely to be involved in incidents, leading to higher premiums to offset potential claims. Several factors contribute to these elevated costs.

1.1. Factors Influencing Car Insurance Premiums for Teen Drivers

Several elements influence the car insurance premiums for 16-year-old drivers, including age, gender, location, and the type of vehicle driven.

- Age: Younger drivers, particularly those aged 16, are statistically more prone to accidents due to their limited driving experience. This inexperience translates to higher insurance rates as insurers perceive them as higher-risk individuals.

- Gender: Statistically, young male drivers tend to engage in riskier driving behaviors, leading to a higher incidence of accidents and traffic violations. As a result, insurance companies often charge higher premiums for young male drivers compared to their female counterparts.

- Location: Urban areas with high traffic density and accident rates typically experience higher insurance premiums than rural areas with lower traffic volume. Additionally, states with more stringent insurance regulations or higher rates of uninsured drivers may also have higher premiums.

- Type of Vehicle: Insuring a sports car or luxury vehicle will generally result in higher premiums than insuring a standard sedan or minivan. Additionally, the age and safety features of the vehicle can also influence insurance costs.

1.2. Statistical Overview of Car Insurance Rates for 16-Year-Olds

According to Forbes Advisor’s analysis, the average annual cost to add a 16-year-old to a parent’s car insurance policy is approximately $2,735, which translates to about $230 per month. However, the average car insurance cost for a 16-year-old driver with their own policy is significantly higher, averaging around $8,765 per year or $730 per month.

2. Strategies for Lowering Car Insurance Costs

While car insurance for 16-year-olds can be expensive, several strategies can help lower premiums.

2.1. Adding a Teen to a Parent’s Policy vs. Standalone Policy

One of the most effective ways to save on car insurance for a 16-year-old is to add them to a parent’s existing policy rather than purchasing a separate policy. Insurance companies generally offer lower rates for drivers added to a parent’s policy because they are considered less risky than those with their own policies. According to a study by the Insurance Institute for Highway Safety (IIHS) in April 2024, adding a teen to a parent’s policy can reduce insurance costs by as much as 60%.

2.2. Exploring Available Discounts

Many car insurance companies offer discounts that can significantly reduce premiums for teen drivers. Some common discounts include:

- Good Student Discount: Most insurers provide discounts for students who maintain a B average or higher.

- Driver’s Education Discount: Completing a driver’s education course can often qualify a teen driver for a discount.

- Multi-Policy Discount: Bundling car insurance with other insurance policies, such as homeowners or renters insurance, can result in savings.

- Safe Driver Discount: Maintaining a clean driving record free of accidents and traffic violations can lead to lower premiums.

2.3. Increasing Deductibles

Choosing a higher deductible can lower monthly premiums. However, it’s essential to consider the financial implications of paying a higher deductible in the event of an accident.

2.4. Choosing an Affordable Car

The type of car a teen drives can significantly impact insurance costs. Opting for a safer, less expensive vehicle with good safety ratings can result in lower premiums.

2.5. Comparing Car Insurance Quotes

It’s crucial to compare quotes from multiple car insurance companies to find the best rates. Rates can vary significantly between insurers, so shopping around can save you hundreds of dollars per year.

3. The Cheapest Car Insurance Companies for 16-Year-Olds

Several car insurance companies consistently offer competitive rates for 16-year-old drivers. Here’s a look at some of the cheapest options available:

3.1. Top Insurers for Adding a Teen to a Parent’s Policy

When adding a 16-year-old to a parent’s policy, Erie, Nationwide, and Geico are consistently ranked among the cheapest options.

| Car insurance company | Average cost per year to add 16-year-old to a parent’s car insurance policy |

|---|---|

| Erie | $1,803 |

| Nationwide | $2,098 |

| Geico | $2,168 |

| USAA* | $2,232 |

| Progressive | $2,402 |

| American Family | $2,474 |

| State Farm | $2,563 |

| Auto-Owners | $2,594 |

| Overall average | $2,735 |

*USAA is available only to members of the military, veterans, and their immediate families.

3.2. Top Insurers for Parents Plus a 16-Year-Old Driver

For parents looking for a new policy that covers both themselves and their 16-year-old, Erie, USAA, and Geico offer the most affordable options.

| Car insurance company | Average annual car insurance cost of parent policy with 16-year-old driver included |

|---|---|

| Erie | $4,267 |

| USAA* | $4,373 |

| Geico | $4,688 |

| Nationwide | $4,896 |

| Progressive | $5,266 |

| Travelers | $5,326 |

| State Farm | $5,473 |

| Auto-Owners | $5,629 |

| Overall average | $5,697 |

*USAA is available only to members of the military, veterans, and their immediate families.

3.3. Top Insurers for 16-Year-Olds on Their Own Policy

If a 16-year-old needs their own car insurance policy, Auto-Owners, Geico, and Erie generally offer the most competitive rates.

| Car insurance company | Average car insurance cost per year for 16-year-old on their own policy |

|---|---|

| Auto-Owners | $5,383 |

| Geico | $5,890 |

| Erie | $6,043 |

| Nationwide | $6,071 |

| American Family | $6,342 |

| USAA* | $6,420 |

| State Farm | $7,065 |

| Overall average | $8,765 |

*USAA is available only to members of the military, veterans, and their immediate families.

4. Factors Affecting the Cost of Car Insurance for 16-Year-Olds

Several factors beyond age influence the cost of car insurance for 16-year-olds. Understanding these factors can help you make informed decisions to potentially lower premiums.

4.1. Age

As mentioned earlier, age is a primary factor in determining car insurance rates for teen drivers. Insurers view younger drivers as higher-risk individuals due to their inexperience and increased likelihood of accidents.

4.2. Gender

Gender can also play a role in car insurance rates, particularly for young drivers. Statistically, young male drivers tend to engage in riskier driving behaviors, leading to higher accident rates. As a result, insurers may charge higher premiums for young male drivers compared to their female counterparts. The difference in rates based on gender can vary depending on the insurance company and the state in which you reside.

4.3. Location

The location where you live can significantly impact your car insurance rates. Urban areas with high traffic density and accident rates typically experience higher premiums than rural areas with lower traffic volume. Additionally, states with more stringent insurance regulations or higher rates of uninsured drivers may also have higher premiums.

4.4. Type of Car

The type of car a 16-year-old drives can significantly affect insurance costs. Insuring a sports car or luxury vehicle will generally result in higher premiums than insuring a standard sedan or minivan. Additionally, the age and safety features of the vehicle can also influence insurance costs.

5. Discounts Available for 16-Year-Olds

Car insurance companies offer various discounts to help lower premiums for teen drivers. Taking advantage of these discounts can significantly reduce the overall cost of insurance.

5.1. Good Student Discount

One of the most common and valuable discounts available to 16-year-olds is the good student discount. Most insurers offer this discount to students who maintain a B average or higher. To qualify, students typically need to provide proof of their academic standing, such as a report card or transcript. The amount of the discount can vary depending on the insurance company, but it can often result in savings of up to 25%. According to a study by the National Safety Council in June 2023, students who maintain a B average are less likely to be involved in accidents, making them safer drivers.

5.2. Driver Training Class Discount

Another discount that may be available to 16-year-olds is the driver training class discount. Completing an approved driver training program can often qualify a teen driver for a discount on their car insurance premiums. These programs provide comprehensive instruction on safe driving practices, traffic laws, and defensive driving techniques. By completing a driver training course, teen drivers can demonstrate their commitment to safe driving, which can lead to lower insurance rates.

5.3. Other Potential Discounts

In addition to the good student discount and driver training class discount, several other discounts may be available to 16-year-olds. These include:

- Multi-Policy Discount: If a family has multiple insurance policies with the same company, such as car insurance, homeowners insurance, or renters insurance, they may be eligible for a multi-policy discount.

- Multi-Car Discount: If a family insures multiple vehicles with the same company, they may be eligible for a multi-car discount.

- Safe Driver Discount: Maintaining a clean driving record free of accidents and traffic violations can lead to lower premiums.

6. Navigating Car Insurance as a 16-Year-Old

Securing affordable car insurance as a 16-year-old can be a complex process, but with the right knowledge and strategies, it’s possible to find coverage that fits your needs and budget.

6.1. Can a 16-Year-Old Get Their Own Insurance Policy?

While it’s possible for a 16-year-old to get their own car insurance policy, it’s generally much more expensive than being added to a parent’s policy. Insurance companies view 16-year-olds as high-risk drivers, so they charge higher premiums to offset the increased risk. According to data from the Insurance Information Institute, the average annual cost for a 16-year-old to have their own car insurance policy is significantly higher than the cost of adding them to a parent’s policy.

6.2. Tips for Finding the Cheapest Insurance at Age 16

To find the cheapest car insurance at age 16, it’s essential to shop around and compare quotes from multiple insurance companies. Rates can vary significantly between insurers, so it’s crucial to get quotes from several different companies to find the best deal. In addition to comparing rates, it’s also important to explore available discounts and consider increasing your deductible to lower your monthly premiums.

6.3. Drive an Affordable Car

The type of car a 16-year-old drives can significantly impact insurance costs. Insuring a sports car or luxury vehicle will generally result in higher premiums than insuring a standard sedan or minivan. Opting for a safer, less expensive vehicle with good safety ratings can result in lower premiums.

6.4. Increase Your Deductibles

Choosing a higher deductible can lower monthly premiums. However, it’s essential to consider the financial implications of paying a higher deductible in the event of an accident.

6.5. Coverage Amounts

When choosing car insurance coverage, it’s essential to strike a balance between affordability and adequate protection. While it may be tempting to reduce coverage to save money, it’s crucial to ensure that you have sufficient coverage to protect yourself financially in the event of an accident.

7. State-by-State Comparison of Car Insurance Costs for 16-Year-Olds

Car insurance costs for 16-year-olds can vary significantly depending on the state in which they reside. Factors such as population density, accident rates, and state insurance regulations can all influence premiums.

7.1. Average Cost by State for Adding Driver Age 16 to Parent Policy vs. Own Policy

The following table compares the average annual cost of adding a 16-year-old to a parent’s car insurance policy versus the average annual cost of a 16-year-old having their own car insurance policy in each state:

| State | Average annual cost to add a 16-year-old to a parent’s car insurance policy | Average annual car insurance cost for a 16-year-old on their own car insurance policy |

|---|---|---|

| Alabama | $3,073 | $5,134 |

| Alaska | $3,280 | $5,146 |

| Arizona | $3,219 | $5,324 |

| Arkansas | $2,649 | $4,777 |

| California | $3,222 | $6,496 |

| Colorado | $2,938 | $6,449 |

| Connecticut | $2,962 | $5,319 |

| Delaware | $3,002 | $6,735 |

| Florida | $4,046 | $11,376 |

| Georgia | $3,165 | $6,529 |

| Hawaii | $641 | $1,521 |

| Idaho | $2,040 | $3,951 |

| Illinois | $2,470 | $8,357 |

| Indiana | $2,146 | $5,174 |

| Iowa | $1,760 | $3,897 |

| Kansas | $2,503 | $5,932 |

| Kentucky | $3,273 | $5,095 |

| Louisiana | $4,719 | $8,716 |

| Maine | $2,080 | $4,540 |

| Maryland | $3,025 | $8,163 |

| Massachusetts | $2,499 | $6,995 |

| Michigan | $2,361 | $6,743 |

| Minnesota | $2,705 | $6,838 |

| Mississippi | $2,644 | $5,830 |

| Missouri | $3,206 | $5,684 |

| Montana | $1,908 | $5,001 |

| Nebraska | $2,328 | $4,233 |

| Nevada | $4,036 | $8,142 |

| New Hampshire | $1,729 | $3,989 |

| New Jersey | $2,912 | $7,263 |

| New Mexico | $2,679 | $5,144 |

| New York | $3,569 | $9,750 |

| North Carolina | $1,738 | $3,548 |

| North Dakota | $1,903 | $4,213 |

| Ohio | $2,192 | $3,831 |

| Oklahoma | $2,614 | $7,424 |

| Oregon | $2,450 | $4,940 |

| Pennsylvania | $3,196 | $9,756 |

| Rhode Island | $3,181 | $6,354 |

| South Carolina | $2,907 | $6,153 |

| South Dakota | $1,840 | $4,929 |

| Tennessee | $2,702 | $5,461 |

| Texas | $2,969 | $6,313 |

| Utah | $3,230 | $5,956 |

| Vermont | $1,348 | $3,488 |

| Virginia | $2,255 | $4,494 |

| Washington | $2,614 | $5,368 |

| West Virginia | $2,338 | $5,350 |

| Wisconsin | $1,975 | $5,059 |

| Wyoming | $1,831 | $3,309 |

7.2. Factors Contributing to State-by-State Variations

Several factors contribute to the state-by-state variations in car insurance costs for 16-year-olds. These include:

- Population Density: States with higher population densities tend to have higher car insurance rates due to the increased risk of accidents.

- Accident Rates: States with higher accident rates also tend to have higher car insurance rates.

- State Insurance Regulations: Each state has its own insurance regulations, which can impact car insurance rates.

- Minimum Coverage Requirements: States with higher minimum coverage requirements tend to have higher car insurance rates.

- Uninsured Motorist Rates: States with higher rates of uninsured motorists also tend to have higher car insurance rates.

8. Gender Differences in Car Insurance Costs for 16-Year-Olds

Gender can also play a significant role in determining car insurance costs for 16-year-olds. Statistically, young male drivers tend to engage in riskier driving behaviors, leading to higher accident rates. As a result, insurers may charge higher premiums for young male drivers compared to their female counterparts.

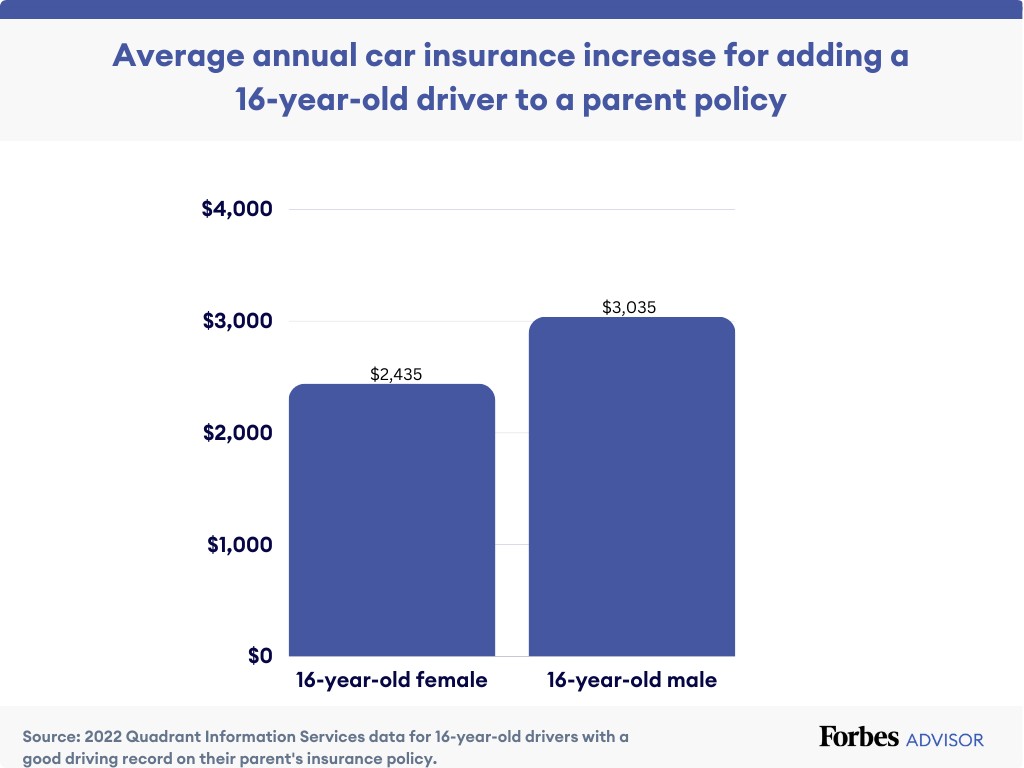

8.1. Average Car Insurance Cost by Gender for Drivers Age 16 on Parent Policy

The following table compares the average annual cost of adding a 16-year-old female to a parent’s policy versus the average annual cost of adding a 16-year-old male to a parent’s policy:

| Average annual cost to add 16-year-old female to parent policy | Average annual cost to add 16-year-old male to parent policy | Average $ increase for males vs. females, age 16 | Average % increase for males vs. females, age 16 |

|---|---|---|---|

| $2,435 | $3,035 | $600 | 25% |

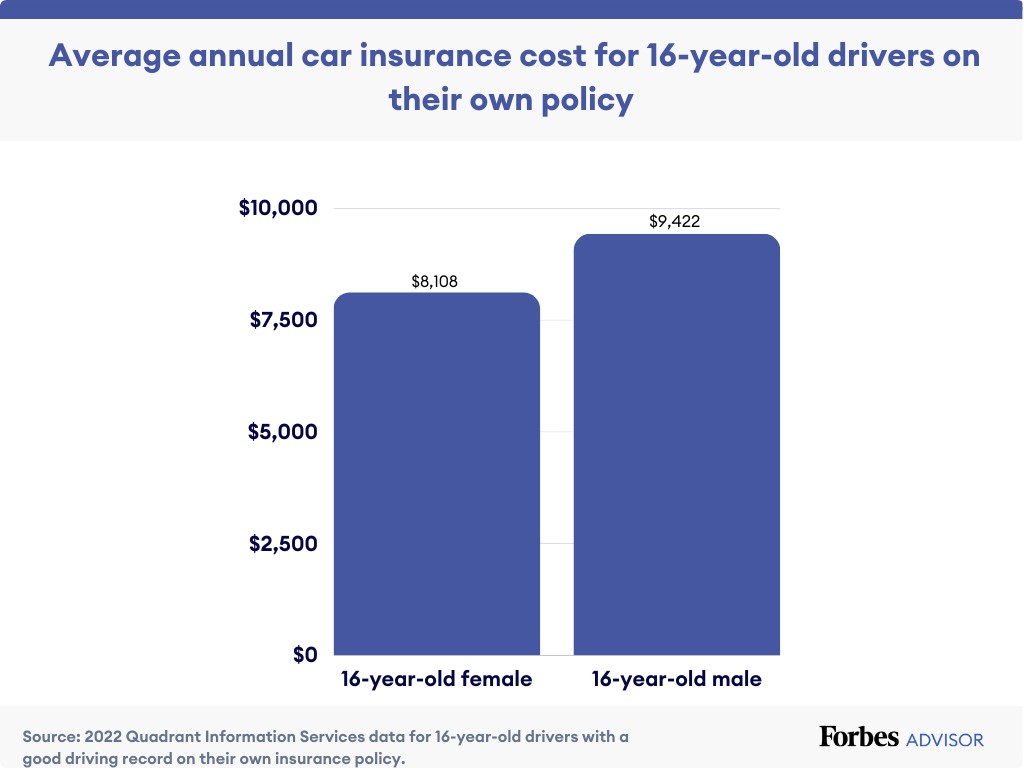

8.2. Average Car Insurance Cost by Gender for 16-Year-Olds on Their Own Policy

The following table compares the average annual cost of a 16-year-old female on their own policy versus the average annual cost of a 16-year-old male on their own policy:

| Annual average cost of 16-year-old female on own policy | Annual average cost of 16-year-old male on own policy | Average $ increase for males vs. females, age 16 | Average % increase for males vs. females, age16 |

|---|---|---|---|

| $8,108 | $9,422 | $1,314 | 16% |

9. Expert Tips on Saving Money on Car Insurance for Teenagers

Navigating the world of car insurance for teenagers can be tricky. Here are some expert tips to guide you:

9.1. Get Multiple Quotes

Once a 16-year-old is added to an auto policy, the insurer that was cheap for parents before may no longer have competitive rates. I recommend shopping around with at least three companies to find the lowest rates. Adding a new driver is a terrific time to compare car insurance quotes to see where the better deals are.

9.2. Explore Discount Opportunities

I know parents of 16-year-olds will see expensive rates compared to what they were paying, but you can look for ways to bring down the final price. Focus on good student discounts and price breaks for completing a driver’s education class. Don’t be afraid to ask your agent what other discounts might apply for families with a 16-year-old driver.

9.3. Drive an Affordable Car

Collision and comprehensive insurance will cost less if your vehicle is cheaper to repair or replace. You want a solid, safe vehicle for a teen driver, so I would avoid luxury cars and definitely avoid a sports car if you want to keep your cost for car insurance for teens in check.

9.4. Increase Your Deductibles

Collision and comprehensive insurance come with a car insurance deductible. You can usually save money by choosing a higher deductible—such as $1,000 instead of $500.

I’d advise you to ask your agent for quotes with various levels of deductibles. Decide if the savings are worth raising the deductible to a higher amount, but keep in mind that 16-year-old drivers are more likely than adults to crash into something.

9.5. Coverage Amounts

You may be toying with the idea of reducing coverage to save money. If you have a 16-year-old driver, I don’t think you want to skimp on auto insurance coverage. Teens are more likely to be involved in car accidents, so your chances of needing good insurance due to claims are higher.

10. Cheap Car Insurance for 16-Year-Olds Frequently Asked Questions (FAQs)

Here are some frequently asked questions about cheap car insurance for 16-year-olds:

10.1. Why is car insurance so expensive for 16-year-olds?

The cost of insuring a 16-year-old driver is expensive because they lack driving experience, which increases their likelihood of accidents. Car insurance companies usually charge high-risk drivers more than safe, experienced drivers. The risk of being in car crashes, especially fatal crashes, is the highest at ages 16 and 17, according to the Insurance Institute for Highway Safety.

Because car insurance costs for 16-year-olds are so high, it’s essential to compare car insurance quotes to find the car insurance company with the best rates. Also, keeping a clean driving record will help the 16-year-old find better prices now and in the future.

10.2. Can you add a 16-year-old to an existing policy?

Yes, you can add a 16-year-old driver to an existing car insurance policy. Adding teen drivers to your policy is usually a much cheaper option than the teen buying their own policy.

When it’s time to add your 16-year-old to your car insurance, shop around to find the lowest rates possible. The cost to add your teen driver can vary significantly among insurance companies. Inquire about the best car insurance for teens and discounts your teen may be eligible for.

10.3. At what age will car insurance rates start to go down?

Car insurance rates continually decline as teens get older, and by age 21, the cost of being added to a parent policy is significantly cheaper than the cost of adding a 16-year-old. For instance, it costs $2,735 per year on average to add a 16-year-old to a parent policy. That dips to $2,360 per year for 17-year-olds. For 21-year-old drivers, it drops to $1,110.

Put another way: The average yearly cost for drivers age 16 with their own policy is $8,765. For drivers age 21, it’s $3,459, or about $5,000 cheaper. To find cheaper car insurance for your teen, shop around each year to see if switching car insurance companies will help you save even more.

10.4. Will safe driving influence the cost of car insurance for a 16-year-old driver?

Yes, safe driving influences the cost of car insurance for a 16-year-old driver. Your driving record is one of the key factors taken into account by insurance companies when pricing policies. Typically, the safer you drive, the lower your rate; if all else is equal

Accidents and moving violations can hike car insurance costs, regardless of the driver’s age. For example, car insurance rates after a speeding ticket increase by 24%, on average, based on Forbes Advisor’s analysis. If you’re already paying a lot for car insurance as a newly licensed driver, adding an increase for a violation or accident is likely to significantly increase your rates.

10.5. What is a good student discount, and how does it affect car insurance rates for teens?

A good student discount is a common offering from car insurance companies to incentivize academic achievement among young drivers. Generally, if a teen maintains a B average or higher in school, they can qualify for this discount, which can significantly lower their insurance premiums. Insurers often view good students as more responsible and less likely to engage in risky driving behaviors.

10.6. How does the type of car a 16-year-old drives impact insurance costs?

The type of vehicle a 16-year-old drives has a substantial impact on insurance costs. Sports cars and luxury vehicles typically come with higher premiums due to their increased value and potential for higher repair costs. Conversely, opting for a safer, more practical vehicle with good safety ratings can lead to lower insurance rates.

10.7. What steps can parents take to minimize the financial burden of insuring a teen driver?

Parents can take several steps to minimize the financial burden of insuring a teen driver. These include:

- Adding the teen to the parent’s existing policy rather than purchasing a separate policy

- Exploring available discounts, such as good student discounts and driver’s education discounts

- Increasing the deductible on the policy

- Choosing a safer, more affordable vehicle for the teen to drive

- Shopping around and comparing quotes from multiple insurance companies

10.8. Are there any long-term strategies for reducing car insurance costs as a teen driver gains experience?

As a teen driver gains experience and maintains a clean driving record, their car insurance rates will gradually decrease over time. Additionally, completing defensive driving courses and continuing to excel academically can further reduce premiums. Encouraging responsible driving habits and maintaining a safe driving record are essential for long-term cost savings.

10.9. How often should families reassess their car insurance coverage for a 16-year-old driver?

Families should reassess their car insurance coverage for a 16-year-old driver at least once a year or whenever there are significant changes in circumstances, such as a change in vehicle, a change in driving record, or a change in academic standing. Regular reassessment ensures that the coverage remains adequate and that the family is taking advantage of all available discounts.

10.10. What role does state legislation play in determining car insurance rates for 16-year-olds?

State legislation plays a significant role in determining car insurance rates for 16-year-olds. Each state has its own insurance regulations, which can impact the types of coverage required, the minimum coverage amounts, and the factors that insurers can consider when setting rates. States with more stringent insurance regulations or higher minimum coverage requirements tend to have higher car insurance rates.

Navigating the world of car insurance for 16-year-olds can be challenging, but understanding the factors that influence rates and exploring available discounts can help you find affordable coverage. For personalized guidance and expert advice, consider consulting with the experienced professionals at HOW.EDU.VN. We can help you assess your needs, compare quotes, and make informed decisions to protect yourself and your teen driver.

Are you finding it difficult to navigate the complexities of car insurance for your 16-year-old? Do you feel overwhelmed by the high costs and the multitude of options available? You’re not alone. Many parents and teens struggle with the same challenges.

At HOW.EDU.VN, we understand the unique difficulties you face when seeking affordable and comprehensive car insurance for young drivers. Our team of over 100 experienced Ph.D. experts is dedicated to providing personalized guidance and tailored solutions to help you make informed decisions and secure the best possible coverage at the most competitive rates.

Don’t let the complexities of car insurance overwhelm you. Contact HOW.EDU.VN today for a free consultation and let our experts guide you toward the perfect solution for your needs.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States

WhatsApp: +1 (310) 555-1212

Website: HOW.EDU.VN

Let how.edu.vn be your trusted partner in navigating the world of car insurance and ensuring the safety and security of your teen driver.

Disclaimer: Car insurance rates and discounts mentioned in this article are based on averages and may vary depending on individual circumstances and location. It is essential to obtain personalized quotes from multiple insurance companies to determine the most accurate and affordable coverage options.