Rocket Money: How much does it cost? Rocket Money is more than just a budgeting app; it’s a financial tool designed to help you take control of your spending, identify savings opportunities, and manage your subscriptions effectively. It assists users in monitoring income and expenses, setting financial goals, and tracking subscriptions, offering both free and premium versions. Discover how Rocket Money can revolutionize your financial management by connecting with financial experts at HOW.EDU.VN, ensuring you make informed decisions and achieve financial wellness. Unlock the secrets to financial empowerment and start saving today!

1. What is Rocket Money and How Can It Help Me?

Rocket Money is a personal finance app that helps you manage your money by tracking your spending, setting budgets, and identifying subscriptions you might not need. According to a 2024 CNET survey, almost half of respondents (48%) have forgotten to cancel a subscription, leading to an average of $91 per month spent on unwanted services. Rocket Money addresses this issue by providing a centralized platform to monitor and manage all your subscriptions, potentially saving you hundreds of dollars annually.

1.1 Key Features of Rocket Money

- Subscription Tracking: Automatically identifies and tracks all your subscriptions in one place.

- Budgeting Tools: Helps you create and maintain a budget based on your income and spending habits.

- Savings Goals: Allows you to set and track progress towards your financial goals.

- Bill Negotiation: Negotiates lower rates on your bills, such as internet and phone services.

- Cancellation Service: Cancels unwanted subscriptions on your behalf (available in the premium version).

2. Rocket Money Pricing: Free vs. Premium

Rocket Money offers both a free version and a premium version with additional features. Understanding the cost and benefits of each can help you decide which one is right for you.

2.1 Rocket Money Free Version

The free version of Rocket Money provides basic budgeting and subscription tracking features. It’s a great starting point for those who want to get a handle on their finances without paying a monthly fee.

- Features:

- Income and expense tracking

- Budget creation

- Subscription identification

- Cost: Free

- Limitations: Does not include subscription cancellation or bill negotiation services.

2.2 Rocket Money Premium Version

The premium version of Rocket Money unlocks additional features, including subscription cancellation, bill negotiation, and more advanced budgeting tools.

- Features:

- All free version features

- Subscription cancellation service

- Bill negotiation

- Advanced budgeting tools

- Net worth tracking

- Credit score monitoring

- Cost: $6 to $12 per month (you choose the amount)

2.3 Is Rocket Money Premium Worth It?

Deciding whether Rocket Money Premium is worth the cost depends on your individual needs and financial situation. Here are some factors to consider:

- Number of Subscriptions: If you have many subscriptions and struggle to keep track of them, the cancellation service can save you time and money.

- Bill Negotiation Potential: If you have high monthly bills, the bill negotiation service could potentially save you hundreds of dollars per year.

- Budgeting Needs: If you need advanced budgeting tools and features, the premium version offers more robust options.

To illustrate, consider a scenario where you identify and cancel $50 worth of unwanted subscriptions per month using Rocket Money Premium. Over a year, that’s $600 in savings. If you pay $12 per month for the premium version, your net savings would still be $456.

3. Step-by-Step Guide to Using Rocket Money

Whether you choose the free or premium version, here’s how to get started with Rocket Money:

3.1 Signing Up

- Download the App: Download the Rocket Money app from the App Store (iOS) or Google Play Store (Android).

- Create an Account: Open the app and follow the prompts to create an account. You’ll need to provide your email address and create a password.

- Link Your Accounts: Connect your bank and credit card accounts to Rocket Money. This allows the app to track your income and expenses automatically.

3.2 Tracking Subscriptions

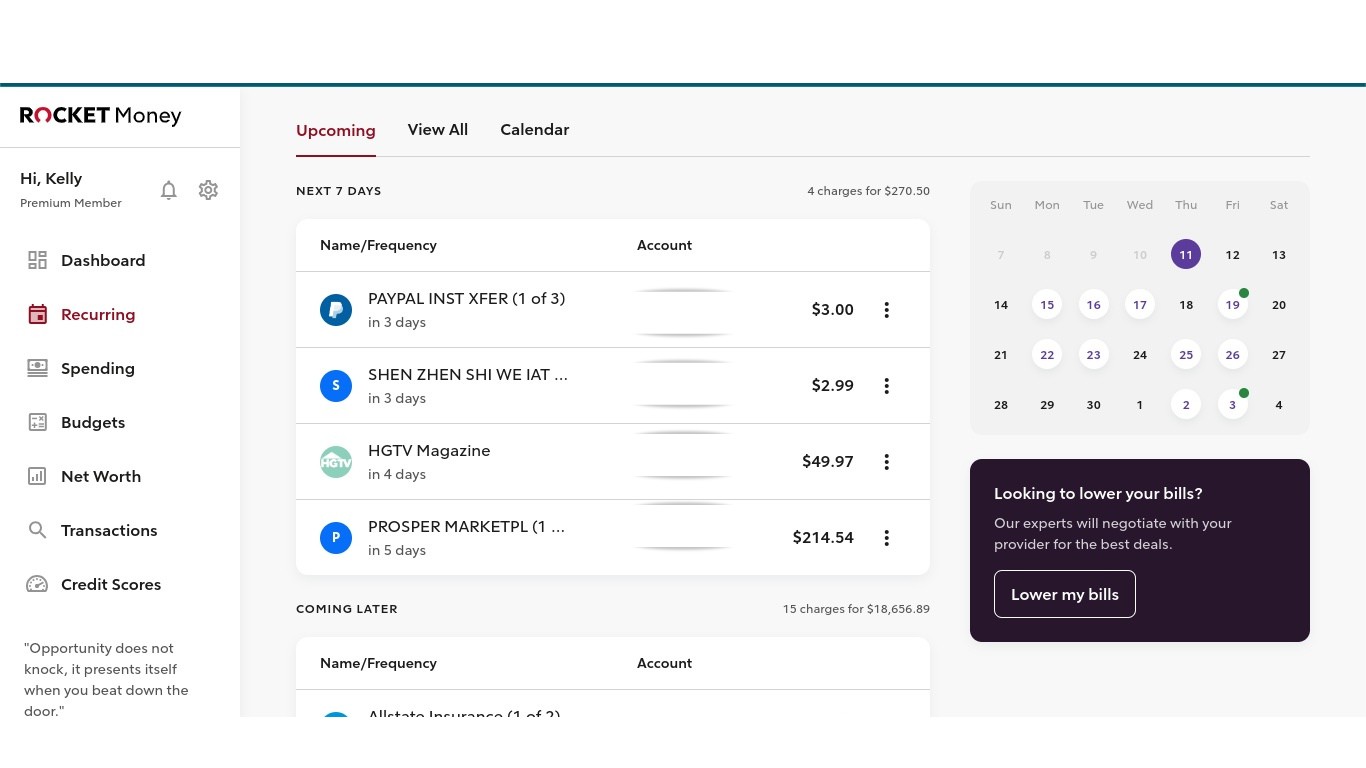

- Navigate to the Recurring Tab: In the app menu, find and select the “Recurring” tab.

- Review Your Subscriptions: Rocket Money will display a list of your recurring subscriptions, including the amount and due date.

- Identify Unwanted Subscriptions: Review the list and identify any subscriptions you no longer need or want.

3.3 Cancelling Subscriptions (Premium Version)

- Select the Subscription: Tap on the subscription you want to cancel.

- Choose Cancellation Method: Rocket Money will offer two options: cancel through the app or cancel yourself.

- Follow the Prompts: If you choose to cancel through the app, follow the prompts to provide the necessary information.

- Confirmation: Rocket Money will confirm that your cancellation request has been submitted and will notify you once the cancellation is complete.

3.4 Negotiating Bills (Premium Version)

- Select the Bill Negotiation Service: In the app menu, find and select the “Bill Negotiation” service.

- Provide Information: Provide information about the bill you want to negotiate, such as the provider and monthly amount.

- Submit Your Request: Rocket Money will submit your request to negotiate a lower rate on your behalf.

- Review the Results: Rocket Money will notify you of the results of the negotiation. If successful, you’ll pay a percentage of the first year’s savings as a fee.

4. How Rocket Money Saved Me $400 in 15 Minutes: A Personal Experience

Many users have reported significant savings by using Rocket Money. Here’s a personal account of how Rocket Money helped save over $400 in just 15 minutes.

4.1 Identifying Unwanted Subscriptions

After installing Rocket Money, the app quickly identified several subscriptions, some of which had been forgotten about over time.

- HGTV Magazine: $50 per year

- HP Instant Ink: $4.34 per month

- New York Times Digital: $4 per month

- Wall Street Journal: $4 per month

- Pandora: $10 per month

- Spotify: $10 per month

4.2 Cancelling Subscriptions

Using the premium version of Rocket Money, these subscriptions were cancelled quickly and easily. The process was straightforward, and the app provided timely updates on the cancellation status.

4.3 Total Savings

By cancelling these subscriptions, the total annual savings amounted to over $400. This was achieved in just 15 minutes of reviewing and cancelling the subscriptions through the app.

5. Alternatives to Rocket Money

While Rocket Money is a popular choice, there are several alternatives that offer similar features and benefits.

5.1 Mint

Mint is a free budgeting app that offers income and expense tracking, budget creation, and bill payment reminders. It’s a great option for those who want a comprehensive budgeting tool without paying a monthly fee.

- Features:

- Income and expense tracking

- Budget creation

- Bill payment reminders

- Credit score monitoring

- Cost: Free

5.2 Personal Capital

Personal Capital is a financial planning tool that offers investment tracking, retirement planning, and net worth tracking. It’s a good choice for those who want a more comprehensive view of their finances.

- Features:

- Investment tracking

- Retirement planning

- Net worth tracking

- Budgeting tools

- Cost: Free (with paid advisory services)

5.3 YNAB (You Need a Budget)

YNAB is a budgeting app that focuses on helping you gain control of your money by following four rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money.

- Features:

- Budgeting tools

- Goal setting

- Expense tracking

- Reporting

- Cost: $14.99 per month or $99 per year

5.4 Comparison Table

| Feature | Rocket Money (Premium) | Mint | Personal Capital | YNAB |

|---|---|---|---|---|

| Subscription Cancellation | Yes | No | No | No |

| Bill Negotiation | Yes | No | No | No |

| Income/Expense Tracking | Yes | Yes | Yes | Yes |

| Budgeting Tools | Yes | Yes | Yes | Yes |

| Investment Tracking | No | No | Yes | No |

| Retirement Planning | No | No | Yes | No |

| Credit Score Monitoring | Yes | Yes | No | No |

| Cost | $6-$12/month | Free | Free (advisory fees) | $14.99/month |

6. Maximizing Savings on Subscriptions Without an App

Even without using an app like Rocket Money, there are several strategies you can use to maximize your savings on subscriptions.

6.1 Review Your Budget Regularly

Make it a habit to review your budget weekly to spot any subscription charges that have already hit your account. Look at each transaction, even the minor ones, to evaluate if each expense is truly worth it.

6.2 Take Advantage of Complimentary Subscriptions

Some subscriptions offer free access to other services. For instance, Walmart+ members get a free Paramount+ subscription, and Amazon Prime membership comes with perks like a free Amazon Music subscription and a free year of Grubhub+.

6.3 Visit Your Local Library

Many library systems offer free access to newspapers, magazines, and movies and TV series on DVD. Check out your local library to see what you can enjoy for free.

6.4 Threaten to Cancel

Sometimes, you can score a discount by calling customer service and saying you’d like to cancel your subscription. It won’t always work, but it can’t hurt to try.

6.5 Leverage Free Trials and Introductory Offers

Many subscription services offer free trials or discounted introductory periods. Take advantage of these offers to test out services before committing to a full-price subscription. Just be sure to set a reminder to cancel before the trial period ends if you decide it’s not worth the money.

6.6 Bundle Services

Consider bundling multiple services from the same provider to save money. For example, many cable and internet companies offer discounts when you bundle your TV, internet, and phone services together. Similarly, some streaming services offer bundled packages that include multiple platforms at a reduced price.

Rocket Money Recurring Tab with Subscriptions

Rocket Money Recurring Tab with Subscriptions

7. Common Questions About Rocket Money

Here are some frequently asked questions about Rocket Money to help you make an informed decision.

7.1 Is Rocket Money Safe?

Rocket Money uses bank-level encryption to protect your financial data. They also use multi-factor authentication to prevent unauthorized access to your account.

7.2 Can Rocket Money Really Lower My Bills?

Yes, Rocket Money’s bill negotiation service can potentially lower your monthly bills by negotiating lower rates with your service providers. However, there is no guarantee of success, and you’ll pay a percentage of the first year’s savings as a fee.

7.3 How Does Rocket Money Make Money?

Rocket Money makes money through premium subscriptions and by taking a percentage of the savings they negotiate on your bills.

7.4 What Happens If Rocket Money Can’t Cancel a Subscription?

If Rocket Money is unable to cancel a subscription on your behalf, they will provide you with instructions on how to cancel it yourself.

7.5 Can I Cancel My Rocket Money Subscription?

Yes, you can cancel your Rocket Money subscription at any time. Simply log in to your account and follow the prompts to cancel.

7.6 How Accurate is Rocket Money’s Subscription Detection?

Rocket Money generally does a good job of identifying recurring subscriptions, but it may not catch everything. It’s always a good idea to manually review your bank and credit card statements to ensure that all subscriptions are accounted for.

7.7 Does Rocket Money Offer Customer Support?

Yes, Rocket Money offers customer support via email and in-app messaging. They strive to respond to inquiries in a timely manner and resolve any issues you may encounter.

7.8 Can Rocket Money Help Me Track My Net Worth?

Yes, Rocket Money Premium includes net worth tracking, which allows you to see a comprehensive view of your assets and liabilities. This can be helpful for monitoring your overall financial health and progress toward your financial goals.

7.9 Is Rocket Money Available Internationally?

Rocket Money is primarily available in the United States and Canada. Availability in other countries may be limited.

7.10 What Kind of Bills Can Rocket Money Negotiate?

Rocket Money can negotiate a variety of bills, including internet, phone, cable, and utilities. However, the availability of bill negotiation services may vary depending on your location and service provider.

8. Real-World Success Stories

To further illustrate the potential benefits of Rocket Money, here are a few real-world success stories:

- Sarah, 32: “I was shocked to see how many subscriptions I was paying for without even realizing it. Rocket Money helped me cancel over $70 per month in unwanted subscriptions, which has made a huge difference in my budget.”

- John, 45: “I was skeptical about the bill negotiation service, but Rocket Money was able to lower my internet bill by $30 per month. The savings more than paid for the premium subscription.”

- Emily, 28: “Rocket Money has helped me stay on track with my budget and savings goals. The app is easy to use, and I love being able to see all my finances in one place.”

9. Call to Action: Take Control of Your Finances Today

Are you tired of overspending on unwanted subscriptions and struggling to manage your budget? Rocket Money can help you take control of your finances and achieve your financial goals.

Ready to get started?

- Download the Rocket Money app from the App Store or Google Play Store.

- Sign up for a free account and link your bank and credit card accounts.

- Start tracking your subscriptions and managing your budget today.

For personalized financial advice and expert guidance, contact the team of experienced PhDs at HOW.EDU.VN. We can help you develop a comprehensive financial plan tailored to your individual needs and goals.

Contact us today:

- Address: 456 Expertise Plaza, Consult City, CA 90210, United States

- WhatsApp: +1 (310) 555-1212

- Website: HOW.EDU.VN

Don’t wait any longer to take control of your financial future. Let HOW.EDU.VN and Rocket Money help you achieve financial freedom and peace of mind.

By understanding the cost and benefits of Rocket Money, exploring alternatives, and implementing effective savings strategies, you can take control of your finances and achieve your financial goals. Remember, financial wellness is within reach with the right tools and guidance. Let how.edu.vn be your partner in achieving financial success.