Donald Trump received at least $413 million in today’s dollars from his father’s real estate empire, with much of it through tax dodges in the 1990s, according to a New York Times investigation. For expert financial advice and guidance, consider consulting the seasoned professionals at HOW.EDU.VN to navigate complex financial landscapes. These tax avoidance schemes and inheritance strategies underscore the importance of expertise in wealth management, estate planning, and tax compliance.

1. What Was Fred Trump’s Net Worth and How Did He Amass His Wealth?

Fred Trump was a prominent New York City real estate developer who amassed a substantial fortune through building and managing apartment complexes, primarily in Brooklyn and Queens. He was known for his efficient construction methods and leveraging government-backed loans to expand his real estate empire. This business acumen laid the foundation for his family’s wealth.

2. How Much Money Did Donald Trump Initially Receive From His Father?

Donald Trump’s initial financial support from his father included significant sums throughout his life. By the age of 3, he was earning $200,000 annually in today’s dollars from his father’s empire, and by 17, he had part ownership of a 52-unit apartment building. After graduating from college, he received the equivalent of $1 million a year from his father, increasing to over $5 million annually in his 40s and 50s. These transfers of wealth were pivotal in establishing Donald Trump’s early financial stability and business ventures.

3. What Were the Dubious Tax Schemes Used by the Trump Family to Transfer Wealth?

The Trump family employed several dubious tax schemes to transfer wealth, including:

- Sham Corporation: Setting up a sham corporation, All County Building Supply & Maintenance, to disguise millions of dollars in gifts from Fred Trump to his children.

- Improper Tax Deductions: Taking improper tax deductions worth millions more, aided by Donald Trump’s involvement.

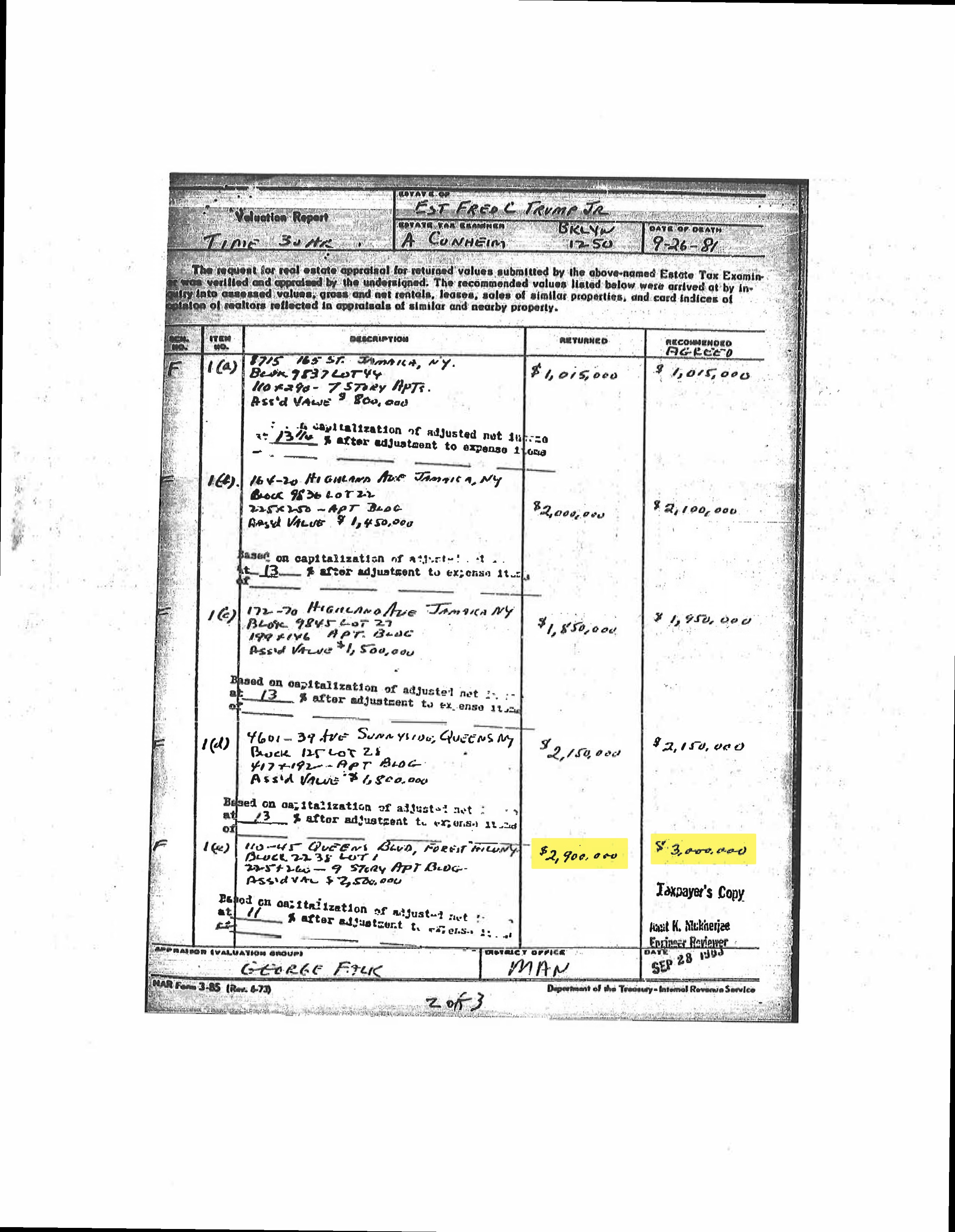

- Undervaluation of Real Estate Holdings: Formulating a strategy to undervalue real estate holdings by hundreds of millions of dollars on tax returns, reducing the tax bill when properties were transferred.

3.1 All County Building Supply & Maintenance

All County Building Supply & Maintenance was purportedly set up to be the purchasing agent for Fred Trump’s buildings, buying everything from boilers to cleaning supplies. However, it siphoned millions of dollars from Fred Trump’s empire by simply marking up purchases already made by his employees. These millions, effectively untaxed gifts, then flowed to All County’s owners — Donald Trump, his siblings, and a cousin.

3.2 Undervaluing Real Estate

One of the most significant financial events in Donald Trump’s life involved manipulating the value of real estate to evade taxes. In November 1997, Donald Trump and his siblings gained ownership of most of their father’s empire. Critical to this transaction was the value placed on the real estate. The lower the value, the lower the gift taxes. The Trumps dodged hundreds of millions in gift taxes by submitting tax returns that grossly undervalued the properties, claiming they were worth just $41.4 million.

4. How Did Fred Trump Help Donald Trump During Financial Difficulties?

Fred Trump repeatedly bailed out Donald Trump during his financial difficulties. In 1990, when Donald Trump’s businesses were failing, Fred Trump provided an emergency line of credit, using his stakes in the mini-empire and a high-rise for the elderly in East Orange as collateral to secure a $65 million loan. He also purchased $3.5 million in casino chips at Trump’s Castle casino to help his son avoid defaulting on his bonds, an action that resulted in a civil penalty for violating New Jersey gaming laws. These interventions were crucial in sustaining Donald Trump’s business ventures and preventing total financial collapse.

4.1 Actions Taken by Fred Trump to Bail Out Donald Trump:

| Action | Details |

|---|---|

| Emergency Line of Credit | Fred Trump provided an emergency line of credit to Donald Trump when his businesses were failing in 1990, using his stakes in the mini-empire and a high-rise for the elderly in East Orange as collateral to secure a $65 million loan. |

| Purchase of Casino Chips | Fred Trump purchased $3.5 million in casino chips at Trump’s Castle casino on December 17, 1990, to help Donald Trump avoid defaulting on his bonds. This action was an illegal loan under New Jersey gaming laws, resulting in a $65,000 civil penalty. |

| Increased Distributions from Family Partnerships and Companies | Between 1989 and 1992, family partnerships and companies created by Fred Trump dramatically increased distributions to Donald Trump and his siblings, paying Donald Trump the equivalent of $8.3 million in today’s dollars. |

| Income Increase | In 1990, Fred Trump’s income exploded to $49,638,928, several times what he paid himself in other years in that era. While the reasons for this increase are not explicitly stated, it is implied that this was to have cash on hand to bail out his son if need be. |

| Efforts to Rewrite Will | In December 1990, Donald Trump sent his father a document seeking significant changes to his will, which Fred Trump viewed as an attempt to gain total control over his affairs and potentially use his empire as collateral to rescue his failing businesses. This prompted Fred Trump to rewrite his will. |

5. What Was the Role of All County Building Supply & Maintenance in Dodging Gift Taxes?

All County Building Supply & Maintenance played a pivotal role in dodging gift taxes. Fred Trump used the company to make large cash gifts to his children, disguised as legitimate business transactions. All County systematically overcharged Fred Trump for maintenance and supplies, with the Trump siblings splitting the markup. This allowed Fred Trump to transfer wealth to his children without incurring the 55 percent gift tax.

5.1 Methods Employed by All County Building Supply & Maintenance:

| Method | Description |

|---|---|

| Overcharging for Maintenance and Supplies | All County systematically overcharged Fred Trump for maintenance and supplies. Invoices were padded with markups of 20 percent, 50 percent, or even more. |

| Negotiating Favorable Prices | Robert Trump claimed that All County saved Fred Trump money by negotiating better deals. However, examination of financial documents shows that costs shot up once All County entered the picture. |

| Profiting Off Mobile Boilers | All County charged Fred Trump rent on mobile boilers that a supplier was providing free of charge while new boilers were being installed, along with hookup fees, disconnection fees, and other fees. |

| Justifying Higher Rent Increases in Rent-Regulated Buildings | The padded All County invoices were used to justify higher rent increases in Fred Trump’s rent-regulated buildings. State records show that after All County’s creation, the Trumps got approval to raise rents on thousands of apartments. |

6. How Did the Trumps Manipulate the Value of Assets to Minimize Taxes?

The Trumps manipulated the value of assets to minimize taxes through various methods, including obtaining “friendly” appraisals and changing the ownership structure to make the empire appear less valuable. For instance, they claimed that properties, including 25 apartment complexes with 6,988 apartments, were worth just $41.4 million. By creating the fiction that Fred Trump was a minority owner, they further reduced the valuation, dodging hundreds of millions of dollars in gift taxes.

6.1 Key Techniques Used to Manipulate Asset Value:

| Technique | Description |

|---|---|

| Friendly Appraisals | The Trumps obtained appraisals from property appraiser Robert Von Ancken that understated the value of their assets. Comparable buildings sold for two to four times as much per square foot as Von Ancken’s appraisals, even when they were decades older and had fewer amenities. |

| Minority Ownership | To further reduce the empire’s valuation, the family created the appearance that Fred Trump held only 49.8% ownership in his companies. By splitting the ownership structure, they claimed that Fred and Mary Trump’s status as minority owners entitled them to lop 45% off Von Ancken’s $93.9 million valuation. |

| Strategic Timing | The Trumps split up the companies just before they set up grantor-retained annuity trusts (GRATs), a tax avoidance strategy. The timing of these maneuvers allowed them to claim minority ownership discounts and reduce the taxable value of the assets transferred into the GRATs. |

| Transferring Ownership | Fred and Mary Trump each ended up with 49.8% of the corporate entities that owned his buildings. The other 0.4% was split among their four children. This allowed them to claim a minority discount, reducing the taxable value of the assets transferred to the next generation. |

| GRATs (Grantor-Retained Annuity Trusts) | The Trumps placed half the properties into a GRAT in Fred Trump’s name and the other half into a GRAT in his wife’s name. By claiming a lower market value of Fred Trump’s empire, they reduced gift taxes. The I.R.S. requires families using GRATs to submit independent appraisals and threatens penalties for lowball valuations. |

7. How Did Donald Trump Try to Change His Father’s Will and What Were the Consequences?

In December 1990, Donald Trump attempted to change his ailing father’s will, seeking to gain more control over his father’s assets. Fred Trump viewed this as an attempt to undermine his wishes and potentially put his empire at risk. As a result, Fred Trump promptly rewrote his will, stripping Donald Trump of sole control over his estate and ensuring his assets were protected from Donald’s creditors. This episode highlighted the family’s complex dynamics and the lengths to which they would go to protect their wealth.

7.1 Key Aspects of Donald Trump’s Attempt to Change His Father’s Will:

| Aspect | Description |

|---|---|

| Proposed Codicil | Donald Trump sent his father, Fred Trump, a document drafted by one of his own lawyers seeking significant changes to Fred Trump’s will. Fred Trump had never seen the document before nor authorized its preparation. |

| Fred Trump’s Concerns | Fred Trump believed that the document potentially put his life’s work at risk. He confided to family members that he viewed the codicil as an attempt to go behind his back and give his son total control over his affairs. |

| Potential Implications | Fred Trump feared that the codicil could let Donald Trump denude his empire, even using it as collateral to rescue his failing businesses. This concern was heightened by the fact that Donald Trump was in precarious financial straits at the time. |

| Intervention of Maryanne Trump Barry | Fred Trump turned to his daughter Maryanne Trump Barry, then a federal judge, for advice. She read the codicil and reached the same conclusion, stating that Donald Trump was in precarious financial straits, and her father was concerned about preserving the family’s wealth. |

| Rewriting of the Will | Fred Trump took prompt action to thwart his son. He dispatched his daughter to find new estate lawyers. The lawyers drafted a new codicil stripping Donald Trump of sole control over his father’s estate, which Fred Trump signed immediately. |

| Family Reckoning | Donald Trump’s failed attempt to change his father’s will brought a family reckoning about Fred Trump’s declining health and his reluctance to relinquish ownership of his empire. This led to the formulation of a plan to minimize estate taxes. |

8. What Was the Outcome of Selling Fred Trump’s Real Estate Empire?

In 2004, Donald Trump and his siblings sold Fred Trump’s real estate empire for $737.9 million. Donald Trump’s cut was $177.3 million, equivalent to $236.2 million today. Despite the empire’s continued profitability, Donald Trump pushed for the sale, partly due to his own financial troubles. However, banks valued the empire at nearly $1 billion, suggesting that Donald Trump sold it for less than its actual worth.

8.1 Key Details of the Sale of Fred Trump’s Real Estate Empire:

| Detail | Description |

|---|---|

| Motivation for Sale | Donald Trump, facing financial troubles with his Atlantic City casinos, pushed for the sale of the empire despite its continued profitability and Fred Trump’s wish to keep his legacy in the family. |

| Amount of Sale | The empire, consisting of 37 apartment complexes and several shopping centers, was sold for a total sales price of $737.9 million. Donald Trump’s cut was $177.3 million, or $236.2 million in today’s dollars. |

| Buyers | Ruby Schron emerged as the favorite bidder and paid $705.6 million for most of the empire, including paying off the Trumps’ mortgages. A few remaining properties were sold to other buyers. |

| Sale Process | Donald Trump directed his brother Robert to solicit private bids, wanting the sale handled quickly and quietly. The sale received little news coverage. |

| Undervaluation | Banks financing Mr. Schron’s purchase valued Fred Trump’s empire at nearly $1 billion, implying that Donald Trump sold the empire for hundreds of millions less than its actual worth. |

| Subsequent Transactions by Donald Trump | Within a year of the sale, Donald Trump spent $149 million in cash on various transactions, including buying out his partner in the Trump International Hotel & Tower in Chicago, making peace with his casino creditors, and purchasing a mansion in Palm Beach, Fla. |

| Impact on Donald Trump’s Image | The sale coincided with the broadcast of the first season of “The Apprentice” in 2004, reinforcing the image of Donald Trump as a successful businessman, even as he was selling off his father’s empire. |

9. How Did the Trump Family’s Actions Evade Estate Taxes?

The Trump family evaded estate taxes through a combination of strategies, including undervaluing assets, creating sham corporations, and exploiting legal loopholes such as GRATs. These actions allowed them to transfer wealth from Fred Trump to his children while paying significantly less in taxes than they would have otherwise owed. The complexities of these tax schemes highlight the need for expert financial and legal advice in managing and transferring wealth.

9.1 Strategies Used by the Trump Family to Evade Estate Taxes:

| Strategy | Description |

|---|---|

| Undervaluing Assets | The Trumps grossly undervalued real estate assets in tax returns, claiming that properties were worth significantly less than their market value. This reduced the amount of gift and estate taxes owed. |

| Sham Corporations | Setting up companies like All County Building Supply & Maintenance to disguise gifts as legitimate business transactions. The company overcharged Fred Trump’s empire for goods and services, with the excess funds flowing to his children as untaxed gifts. |

| GRATs (Grantor-Retained Annuity Trusts) | Using GRATs to transfer wealth from one generation to the next without paying estate taxes. The Trumps put properties into GRATs, gave a portion to their children, and had the children make annuity payments to their parents. By undervaluing the assets placed in the GRATs, they further reduced the tax liability. |

| Exploiting Legal Loopholes | The Trumps exploited various legal loopholes, such as claiming minority ownership discounts, to reduce the taxable value of their assets. They restructured the ownership of Fred Trump’s empire to create the appearance that he was a minority owner, allowing them to claim significant discounts. |

| Manipulating Appraisals | Obtaining “friendly” appraisals from appraisers who were willing to undervalue the assets. These appraisals were used to support the lower valuations claimed in tax returns. |

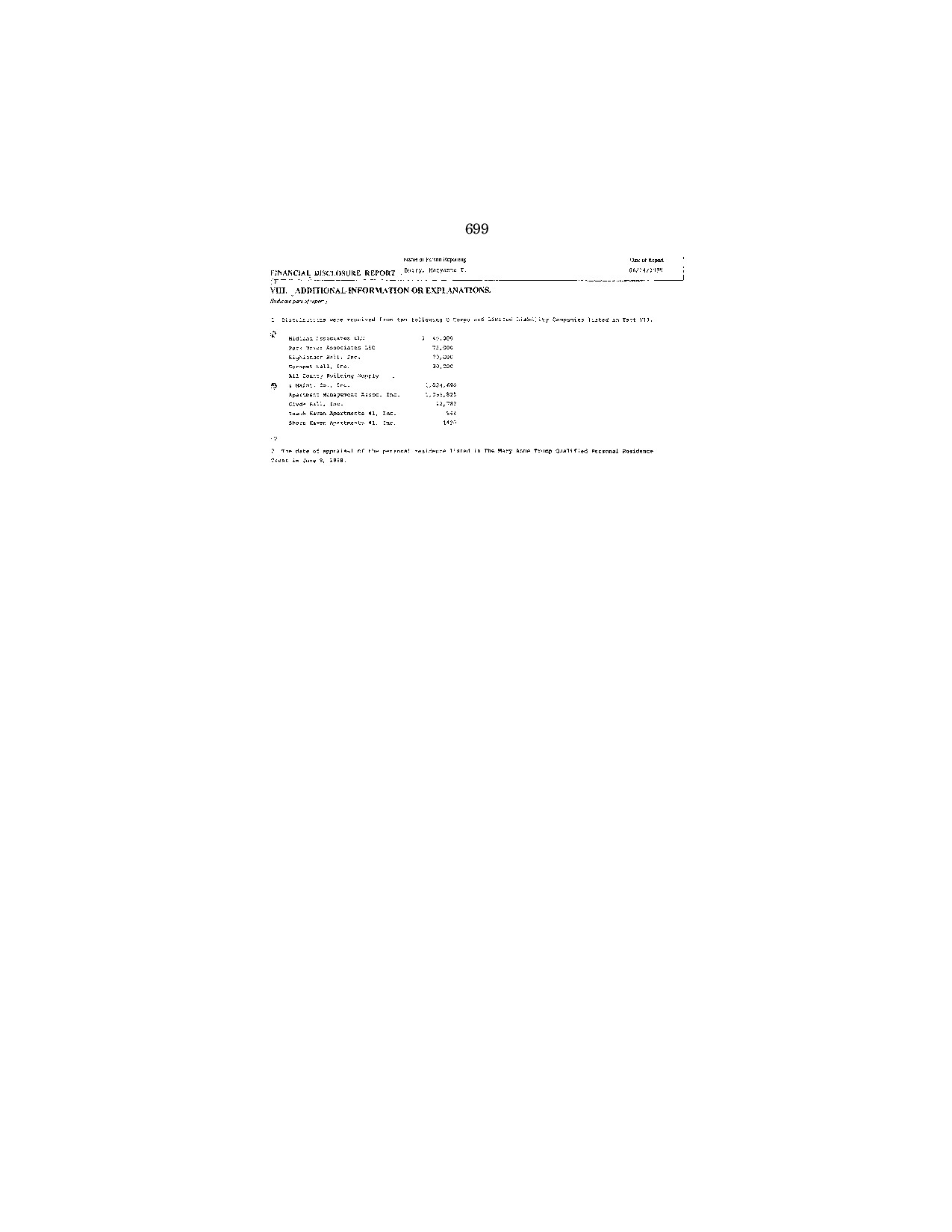

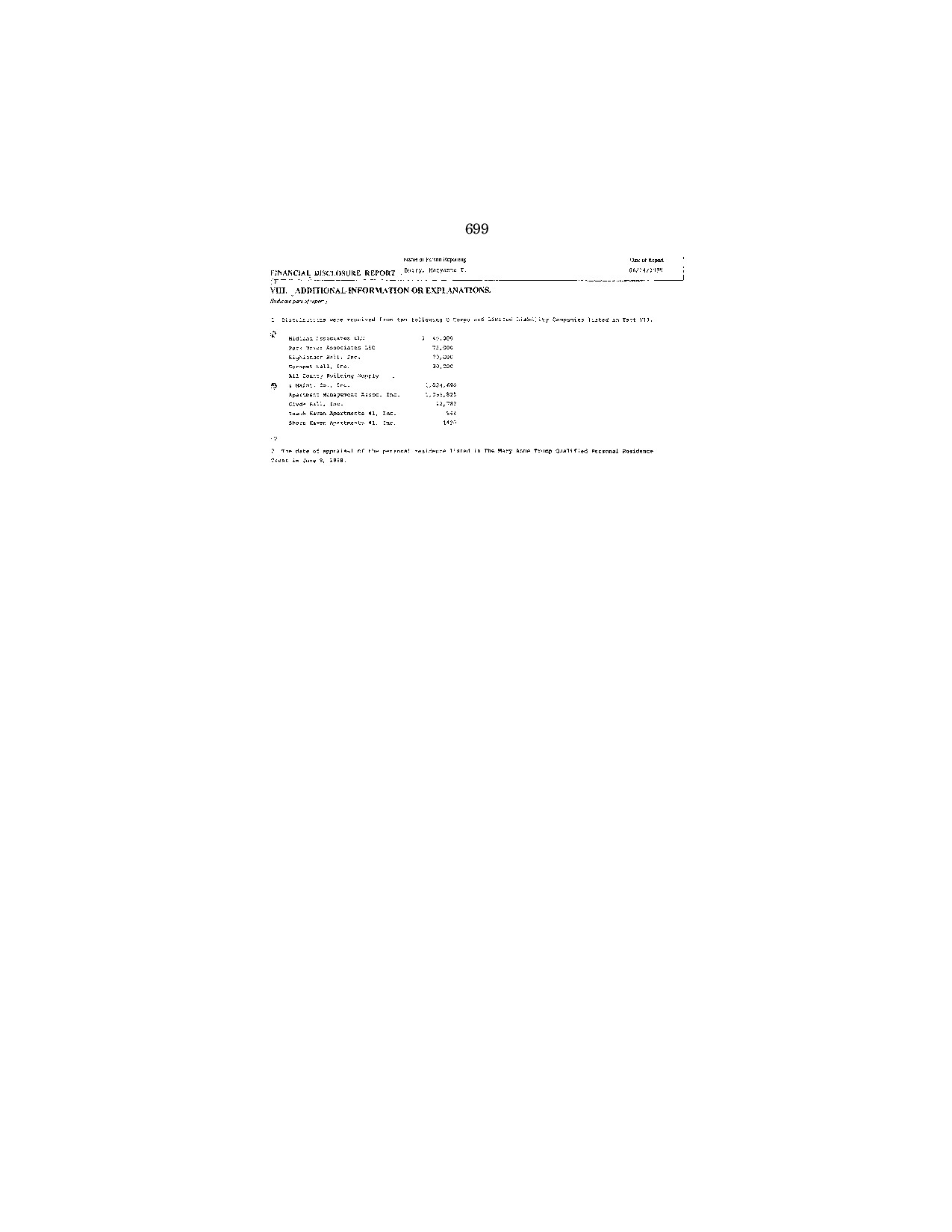

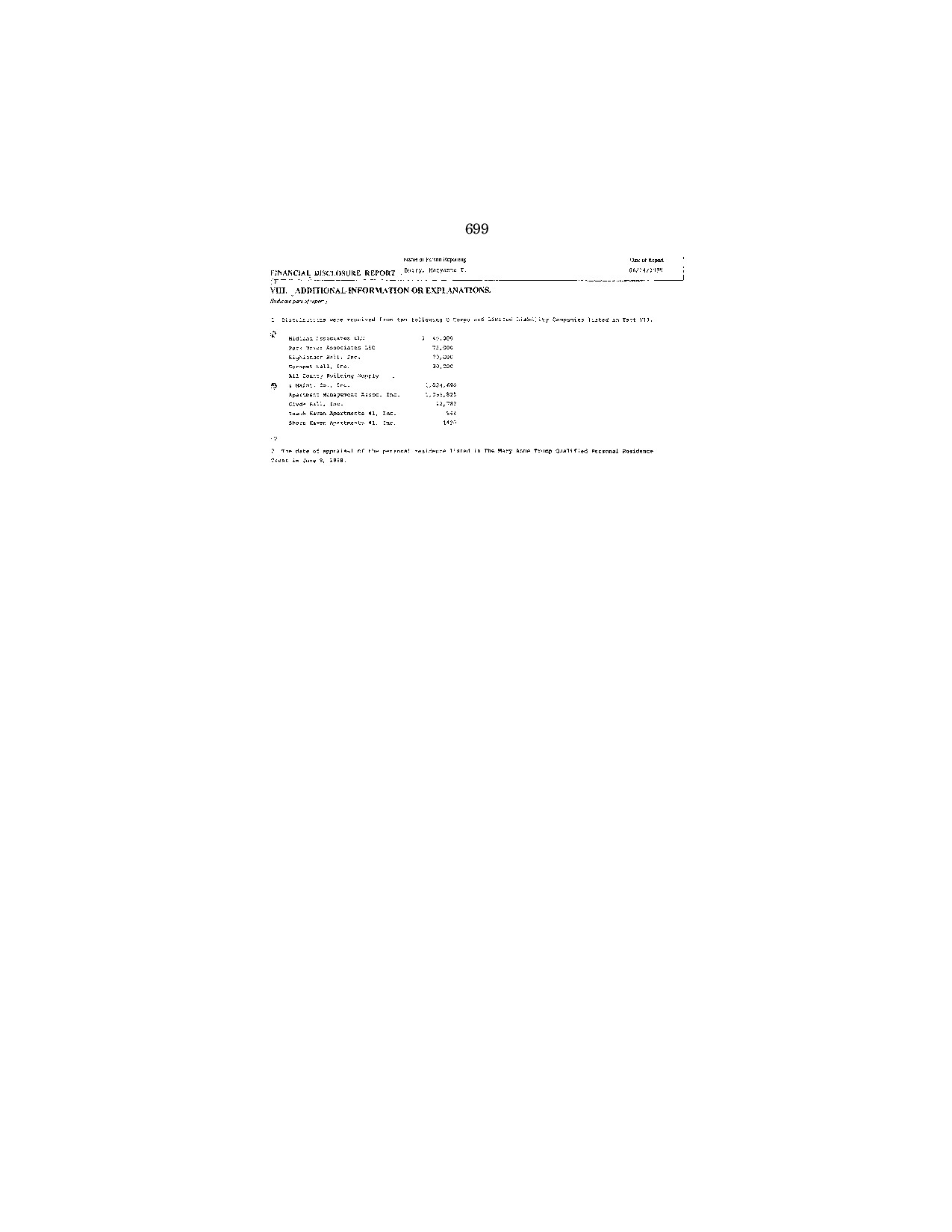

| Shifting Income Streams | Redirecting income streams from Fred Trump’s management company to companies owned by his children, such as Apartment Management Associates Inc. This allowed them to reduce Fred Trump’s taxable income and transfer wealth to his children. |

10. What Can Be Said With Certainty About the Original Source of Donald Trump’s Wealth?

The investigation revealed that Donald Trump’s wealth was fundamentally derived from his father, Fred Trump. Had Donald Trump simply invested the money his father gave him in an index fund, he would be worth $1.96 billion today. Fred Trump lent him at least $60.7 million, or $140 million in today’s dollars. This underscores the significant financial support and opportunities provided by his father, which were instrumental in building Donald Trump’s business ventures.

10.1 Verifiable Facts About the Original Source of Donald Trump’s Wealth:

| Fact | Description |

|---|---|

| $413 Million from His Father’s Real Estate Empire | Donald Trump received at least $413 million in today’s dollars from his father’s real estate empire. |

| Dubious Tax Schemes | Many of these funds were transferred through tax dodges in the 1990s, as revealed by a New York Times investigation. |

| Investment in an Index Fund | Had Donald Trump simply invested the money his father gave him in an index fund that tracks the Standard & Poor’s 500, he would be worth $1.96 billion today. |

| Loans from Fred Trump | Fred Trump lent Donald Trump at least $60.7 million, or $140 million in today’s dollars. |

| Starrett City Investment | Donald Trump’s share of the proceeds from the sale of Starrett City, a Brooklyn housing complex that the Trumps invested in back in the 1970s, is expected to exceed $16 million. |

| Consistent Financial Support | Throughout his life, Donald Trump received consistent financial support from his father. By the age of 3, he was earning $200,000 annually in today’s dollars, and after college, he received the equivalent of $1 million a year. |

| Role in Undervaluing Real Estate Holdings | Donald Trump played a role in formulating a strategy to undervalue real estate holdings by hundreds of millions of dollars on tax returns, which sharply reduced the tax bill when those properties were transferred to him and his siblings. |

In conclusion, understanding the complexities surrounding wealth transfer and tax strategies is crucial for financial planning. Navigating these intricacies requires expert guidance. At HOW.EDU.VN, our team of experienced financial professionals is dedicated to providing tailored solutions that meet your unique needs. Whether you’re seeking advice on estate planning, tax compliance, or wealth management, we’re here to help you make informed decisions and achieve your financial goals. Contact us today for a consultation and let us help you secure your financial future.

Address: 456 Expertise Plaza, Consult City, CA 90210, United States.

Whatsapp: +1 (310) 555-1212.

Website: how.edu.vn

FAQ About Donald Trump’s Inheritance

1. What is the primary source of Donald Trump’s wealth?

The primary source of Donald Trump’s wealth is his father, Fred Trump, who provided significant financial support and opportunities throughout his life.

2. How much money did Donald Trump receive from his father’s real estate empire?

Donald Trump received at least $413 million in today’s dollars from his father’s real estate empire, much of it through tax dodges in the 1990s.

3. What were some of the tax schemes used by the Trump family to transfer wealth?

The Trump family used various tax schemes, including setting up a sham corporation (All County Building Supply & Maintenance), taking improper tax deductions, and undervaluing real estate holdings.

4. How did Fred Trump help Donald Trump during financial difficulties?

Fred Trump provided an emergency line of credit, purchased casino chips to help Donald avoid defaulting on bonds, and increased distributions from family partnerships and companies.

5. What was the role of All County Building Supply & Maintenance in dodging gift taxes?

All County Building Supply & Maintenance was used to make large cash gifts to Fred Trump’s children, disguised as legitimate business transactions.

6. How did the Trumps manipulate the value of assets to minimize taxes?

The Trumps manipulated asset values by obtaining “friendly” appraisals and changing the ownership structure to make the empire appear less valuable.

7. What was the outcome of selling Fred Trump’s real estate empire?

Donald Trump and his siblings sold Fred Trump’s real estate empire for $737.9 million, with Donald’s cut being $177.3 million.

8. How did the Trump family evade estate taxes?

The Trump family evaded estate taxes through undervaluing assets, creating sham corporations, and exploiting legal loopholes such as GRATs.

9. How did Donald Trump try to change his father’s will, and what were the consequences?

Donald Trump attempted to change his father’s will to gain more control over his assets, but Fred Trump rewrote the will, stripping Donald of sole control and ensuring assets were protected from his creditors.

10. What can be said with certainty about the original source of Donald Trump’s wealth?

It can be said with certainty that Donald Trump’s wealth was fundamentally derived from his father, Fred Trump, who provided substantial financial support and opportunities.