The Walt Disney Company’s financial position is a subject of great interest, and at HOW.EDU.VN, we offer expert analysis on this topic by providing an in-depth look at their assets, revenue streams, and overall financial health, further it includes an evaluation of Disney’s market capitalization and revenue, alongside its investments in parks, resorts, and media networks. By understanding Disney’s financial standing, one can gain insights into the company’s strategic decisions and future prospects.

1. What Is Disney’s Net Worth?

Determining Disney’s exact net worth involves a comprehensive analysis of its assets, liabilities, and equity. While the market capitalization of Disney, which is a real-time valuation based on its stock price, is readily available, the net worth provides a more profound understanding of the company’s financial health.

- Market Capitalization: Reflects investor sentiment and the perceived value of Disney’s stock.

- Assets: Include everything from theme parks and resorts to media networks and intellectual property.

- Liabilities: Consist of debts and obligations that Disney owes to creditors.

- Equity: Represents the residual value of assets minus liabilities, showcasing the company’s book value.

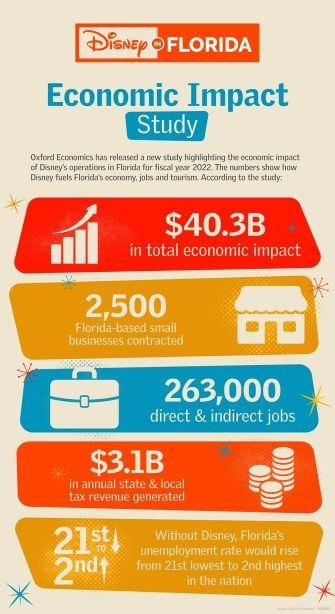

According to a study by Oxford Economics, the Walt Disney World Resort generated $40 billion in economic impact across the state of Florida and more than a quarter of a million total jobs in fiscal year 2022.

1.1. Assessing Disney’s Assets

Disney’s assets are vast and diverse, contributing significantly to its overall financial stability.

| Asset Category | Description |

|---|---|

| Theme Parks & Resorts | Include Walt Disney World, Disneyland, and international parks, driving substantial revenue. |

| Media Networks | Encompass television networks like ESPN and Disney Channel, generating income from advertising and subscriptions. |

| Studio Entertainment | Covers film production and distribution, including franchises like Marvel, Star Wars, and Pixar. |

| Direct-to-Consumer & International | Includes streaming services like Disney+ and Hulu, representing a growing segment of Disney’s business. |

| Consumer Products | Encompasses merchandise licensing and retail, leveraging Disney’s iconic characters and brands. |

1.2. Understanding Disney’s Liabilities

Disney’s liabilities are an essential factor in determining its net worth, as they represent the company’s obligations to external parties.

- Debt: Disney, like many large corporations, carries a significant amount of debt, which is used to finance its operations and investments.

- Deferred Revenue: Represents payments received for services or products that have not yet been delivered.

- Other Obligations: Include pension liabilities, lease obligations, and other financial commitments.

1.3. Calculating Disney’s Equity

Equity is calculated by subtracting total liabilities from total assets, providing a clear picture of Disney’s net worth.

- Retained Earnings: Accumulated profits that have not been distributed as dividends, contributing to Disney’s equity.

- Shareholder Equity: Represents the total investment made by shareholders in the company.

- Treasury Stock: Shares that Disney has repurchased from the open market, reducing the number of outstanding shares.

2. What Is Disney’s Revenue?

Disney’s revenue is a critical indicator of its financial performance, reflecting the company’s ability to generate income from its diverse business segments.

- Parks, Experiences, and Products: Includes revenue from theme parks, resorts, cruises, and merchandise sales.

- Media and Entertainment Distribution: Encompasses revenue from television networks, studio entertainment, and direct-to-consumer services.

- Direct-to-Consumer: Focuses on revenue from streaming services like Disney+ and Hulu, reflecting the shift towards digital entertainment.

- Content Sales/Licensing: Generates income from licensing Disney’s intellectual property to third parties.

2.1. Analyzing Disney’s Revenue Streams

Understanding the different sources of Disney’s revenue is essential for assessing its overall financial health.

| Revenue Stream | Description |

|---|---|

| Theme Park Revenue | Generated from ticket sales, hotel accommodations, food and beverage, and merchandise purchases. |

| Media Network Revenue | Derived from advertising, affiliate fees, and content licensing. |

| Studio Entertainment Revenue | Comes from theatrical releases, home entertainment sales, and licensing agreements. |

| Direct-to-Consumer Revenue | Obtained from subscription fees, advertising revenue, and in-app purchases. |

| Consumer Products Revenue | Generated from the sale of merchandise, licensing agreements, and retail operations. |

2.2. Key Factors Affecting Disney’s Revenue

Several factors can impact Disney’s revenue, including economic conditions, consumer preferences, and competitive pressures.

- Economic Conditions: Economic downturns can lead to reduced consumer spending on discretionary items like vacations and entertainment.

- Consumer Preferences: Changes in consumer tastes and preferences can impact the popularity of Disney’s products and services.

- Competitive Pressures: Increased competition from other entertainment companies can lead to reduced market share and revenue.

- Technological Disruption: The rise of streaming services and other digital platforms has disrupted traditional media business models.

2.3. How Disney Manages Revenue Fluctuations

Disney employs various strategies to manage revenue fluctuations and maintain financial stability.

- Diversification: By operating in multiple business segments, Disney can offset declines in one area with gains in another.

- Cost Management: Disney focuses on controlling costs and improving operational efficiency to protect its bottom line.

- Innovation: Investing in new technologies and content can help Disney attract new customers and generate additional revenue.

- Strategic Partnerships: Collaborating with other companies can expand Disney’s reach and create new revenue opportunities.

3. Disney’s Investments and Acquisitions

Disney’s strategic investments and acquisitions have played a crucial role in its growth and financial success.

- Pixar: Acquired in 2006 for $7.4 billion, bringing groundbreaking animation technology and beloved characters to Disney’s portfolio.

- Marvel Entertainment: Acquired in 2009 for $4 billion, adding iconic superheroes and a vast library of comic book properties.

- Lucasfilm: Acquired in 2012 for $4.05 billion, bringing the Star Wars franchise and its associated revenue streams.

- 21st Century Fox: Acquired in 2019 for $71.3 billion, expanding Disney’s content library and direct-to-consumer offerings.

3.1. Impact of Acquisitions on Disney’s Finances

Disney’s acquisitions have had a significant impact on its financial performance, contributing to revenue growth, market share, and brand recognition.

| Acquisition | Impact |

|---|---|

| Pixar | Enhanced Disney’s animation capabilities and added beloved characters like Toy Story and Finding Nemo. |

| Marvel | Expanded Disney’s content library with superhero franchises like Avengers and Iron Man, driving significant revenue. |

| Lucasfilm | Brought the Star Wars franchise to Disney, generating billions of dollars in box office revenue and merchandise sales. |

| 21st Century Fox | Expanded Disney’s content library and direct-to-consumer offerings, including Hulu and various TV networks. |

3.2. Disney’s Investment Strategy

Disney’s investment strategy focuses on acquiring and developing high-quality content, expanding its direct-to-consumer offerings, and investing in new technologies.

- Content Creation: Disney invests heavily in producing original content for its theme parks, television networks, and streaming services.

- Direct-to-Consumer Expansion: Disney is focused on growing its direct-to-consumer business through investments in Disney+, Hulu, and ESPN+.

- Technological Innovation: Disney invests in new technologies like virtual reality and augmented reality to enhance its theme park experiences and create new entertainment options.

- International Expansion: Disney is expanding its presence in international markets through new theme parks, resorts, and content offerings.

3.3. How Disney Finances Its Investments

Disney finances its investments through a combination of cash flow from operations, debt financing, and equity offerings.

- Cash Flow From Operations: Disney generates significant cash flow from its various business segments, which it uses to fund its investments.

- Debt Financing: Disney issues bonds and other debt instruments to raise capital for its acquisitions and investments.

- Equity Offerings: Disney may issue new shares of stock to raise capital for its strategic initiatives.

- Strategic Partnerships: Disney collaborates with other companies to share the cost of investments and mitigate risk.

4. Disney’s Financial Challenges and Opportunities

Despite its financial success, Disney faces several challenges and opportunities in the ever-evolving entertainment industry.

- Challenges: Include cord-cutting, increased competition from streaming services, and economic uncertainty.

- Opportunities: Include expanding its direct-to-consumer business, leveraging its intellectual property, and investing in new technologies.

4.1. Overcoming Financial Obstacles

Disney has demonstrated its ability to overcome financial obstacles through strategic decision-making and a focus on innovation.

- Adaptation to Changing Consumer Preferences: Disney has successfully adapted to changing consumer preferences by investing in streaming services and creating original content for digital platforms.

- Cost Management and Efficiency Improvements: Disney is focused on controlling costs and improving operational efficiency to mitigate the impact of economic uncertainty.

- Strategic Partnerships and Collaborations: Disney collaborates with other companies to share the cost of investments and mitigate risk.

- Diversification of Revenue Streams: Disney operates in multiple business segments, which helps to offset declines in one area with gains in another.

4.2. Capitalizing on Emerging Opportunities

Disney is well-positioned to capitalize on emerging opportunities in the entertainment industry, including the growth of streaming services, the increasing demand for high-quality content, and the potential of new technologies.

- Expansion of Direct-to-Consumer Business: Disney is focused on growing its direct-to-consumer business through investments in Disney+, Hulu, and ESPN+.

- Leveraging Intellectual Property: Disney has a vast library of intellectual property, which it can leverage to create new content and experiences.

- Investing in New Technologies: Disney invests in new technologies like virtual reality and augmented reality to enhance its theme park experiences and create new entertainment options.

- International Expansion: Disney is expanding its presence in international markets through new theme parks, resorts, and content offerings.

4.3. Future Financial Outlook for Disney

The future financial outlook for Disney remains positive, despite the challenges and uncertainties in the entertainment industry.

- Strong Brand Recognition: Disney has a strong brand recognition and a loyal customer base, which provides a solid foundation for future growth.

- Diversified Business Model: Disney’s diversified business model helps to mitigate risk and ensure financial stability.

- Focus on Innovation: Disney’s focus on innovation and investment in new technologies positions it for long-term success.

- Strategic Acquisitions: Disney’s strategic acquisitions have expanded its content library and direct-to-consumer offerings, driving revenue growth and market share.

5. Disney’s Real Estate Holdings

Disney’s real estate portfolio is a significant part of its asset base, contributing to its overall financial strength. These holdings include theme parks, resorts, studios, and other properties critical to its operations.

- Theme Parks and Resorts: Disney’s theme parks and resorts are iconic destinations that attract millions of visitors each year.

- Studio Facilities: Disney’s studio facilities are used for film and television production, supporting its content creation efforts.

- Other Properties: Disney also owns other properties, such as office buildings, retail spaces, and land holdings.

5.1. Valuation of Disney’s Real Estate Assets

The valuation of Disney’s real estate assets is a complex process that involves assessing the market value of each property.

- Market Value: The price at which a property would likely sell in a competitive market.

- Appraisal Process: Involves assessing the property’s location, size, condition, and comparable sales data.

- Factors Affecting Valuation: Include economic conditions, interest rates, and local market trends.

5.2. Role of Real Estate in Disney’s Financial Strategy

Real estate plays a vital role in Disney’s financial strategy, providing a stable asset base and generating revenue through operations.

- Asset Appreciation: Disney’s real estate assets tend to appreciate in value over time, contributing to its overall net worth.

- Revenue Generation: Disney’s theme parks, resorts, and studio facilities generate significant revenue through operations.

- Strategic Locations: Disney’s real estate holdings are strategically located in key markets, attracting visitors and supporting its business operations.

5.3. Sustainability and Development of Disney’s Properties

Disney is committed to the sustainable development of its properties, incorporating environmentally friendly practices and energy-efficient technologies.

- Environmental Initiatives: Disney has implemented various environmental initiatives, such as reducing waste, conserving water, and using renewable energy sources.

- Sustainable Building Practices: Disney follows sustainable building practices, such as using recycled materials and designing energy-efficient structures.

- Community Engagement: Disney engages with local communities to ensure that its development projects are environmentally and socially responsible.

6. Disney’s Philanthropic Efforts

Disney is committed to giving back to the community through various philanthropic efforts.

- Charitable Donations: Disney donates millions of dollars each year to various charitable organizations.

- Volunteer Programs: Disney encourages its employees to volunteer their time to support local communities.

- Environmental Conservation: Disney supports environmental conservation efforts through various initiatives.

6.1. Disney’s Charitable Contributions

Disney’s charitable contributions support a wide range of causes, including education, health, and environmental conservation.

| Cause | Description |

|---|---|

| Education | Disney supports education initiatives through scholarships, grants, and educational programs. |

| Health | Disney supports health initiatives through donations to hospitals, medical research, and health education programs. |

| Environmental Conservation | Disney supports environmental conservation efforts through donations to conservation organizations and environmental projects. |

| Community Development | Disney supports community development initiatives through donations to local organizations and community programs. |

6.2. Impact of Disney’s Philanthropy

Disney’s philanthropy has a significant impact on the communities it serves, providing support to those in need and helping to create a better world.

- Improved Education: Disney’s support for education initiatives helps to improve educational opportunities for students of all ages.

- Enhanced Healthcare: Disney’s support for health initiatives helps to improve healthcare access and outcomes for patients and communities.

- Environmental Protection: Disney’s support for environmental conservation efforts helps to protect the environment and preserve natural resources.

- Community Development: Disney’s support for community development initiatives helps to strengthen local communities and improve the quality of life for residents.

6.3. How Disney Chooses Its Charitable Partners

Disney chooses its charitable partners based on their mission, impact, and alignment with Disney’s values.

- Mission Alignment: Disney seeks out charitable partners whose mission aligns with its own values and priorities.

- Proven Impact: Disney supports charitable organizations that have a proven track record of success and a demonstrated impact on the communities they serve.

- Financial Stability: Disney supports charitable organizations that are financially stable and well-managed.

- Community Engagement: Disney seeks out charitable partners that are actively engaged in the communities they serve.

7. Disney’s Stock Performance

Disney’s stock performance is a key indicator of its financial health, reflecting investor sentiment and the company’s overall value.

- Stock Price: The price of Disney’s stock is determined by supply and demand in the stock market.

- Market Capitalization: The total value of Disney’s outstanding shares, calculated by multiplying the stock price by the number of shares.

- Earnings Per Share (EPS): A measure of Disney’s profitability, calculated by dividing net income by the number of outstanding shares.

7.1. Factors Influencing Disney’s Stock Price

Several factors can influence Disney’s stock price, including financial performance, economic conditions, and industry trends.

| Factor | Description |

|---|---|

| Financial Performance | Disney’s stock price is influenced by its financial performance, including revenue, earnings, and cash flow. |

| Economic Conditions | Economic conditions, such as interest rates and inflation, can impact Disney’s stock price. |

| Industry Trends | Industry trends, such as the growth of streaming services, can impact Disney’s stock price. |

| Company News | Company news, such as acquisitions and product launches, can impact Disney’s stock price. |

| Investor Sentiment | Investor sentiment, such as optimism or pessimism about Disney’s future prospects, can impact its stock price. |

7.2. Historical Stock Performance of Disney

Disney’s stock has generally performed well over the long term, reflecting the company’s strong brand, diversified business model, and strategic acquisitions.

- Long-Term Growth: Disney’s stock has experienced long-term growth, driven by its strong financial performance and strategic initiatives.

- Market Fluctuations: Disney’s stock has experienced market fluctuations due to economic conditions and industry trends.

- Outperformance: Disney’s stock has often outperformed the broader market, reflecting its strong brand and financial performance.

7.3. How to Invest in Disney Stock

Investors can invest in Disney stock through various channels, including brokerage accounts, retirement accounts, and direct stock purchase plans.

- Brokerage Accounts: Investors can purchase Disney stock through a brokerage account, which allows them to buy and sell stocks, bonds, and other investments.

- Retirement Accounts: Investors can invest in Disney stock through retirement accounts, such as 401(k)s and IRAs.

- Direct Stock Purchase Plans: Disney offers a direct stock purchase plan, which allows investors to purchase shares directly from the company.

- Financial Advisor: Investors can consult with a financial advisor to determine the best way to invest in Disney stock based on their individual financial goals and risk tolerance.

8. Disney’s Competitive Landscape

Disney operates in a highly competitive landscape, facing competition from other entertainment companies, media networks, and streaming services.

- Entertainment Companies: Disney competes with other entertainment companies, such as Comcast, Warner Bros. Discovery, and Paramount Global.

- Media Networks: Disney competes with other media networks, such as ESPN, CNN, and Fox News.

- Streaming Services: Disney competes with other streaming services, such as Netflix, Amazon Prime Video, and Hulu.

8.1. Key Competitors of Disney

Disney’s key competitors include:

- Netflix: A leading streaming service with a vast library of original and licensed content.

- Amazon Prime Video: A streaming service offered by Amazon as part of its Prime membership program.

- Comcast: A diversified media and entertainment company with theme parks, television networks, and film studios.

- Warner Bros. Discovery: A media and entertainment company with a wide range of television networks, film studios, and streaming services.

8.2. How Disney Maintains Its Competitive Edge

Disney maintains its competitive edge through its strong brand, diversified business model, strategic acquisitions, and focus on innovation.

- Strong Brand: Disney has a strong brand recognition and a loyal customer base, which provides a solid foundation for future growth.

- Diversified Business Model: Disney’s diversified business model helps to mitigate risk and ensure financial stability.

- Strategic Acquisitions: Disney’s strategic acquisitions have expanded its content library and direct-to-consumer offerings, driving revenue growth and market share.

- Focus on Innovation: Disney’s focus on innovation and investment in new technologies positions it for long-term success.

8.3. Strategies for Staying Ahead in the Entertainment Industry

To stay ahead in the entertainment industry, Disney must continue to:

- Invest in High-Quality Content: Disney must continue to invest in high-quality content that appeals to a wide audience.

- Expand Direct-to-Consumer Offerings: Disney must continue to expand its direct-to-consumer offerings to compete with other streaming services.

- Embrace New Technologies: Disney must embrace new technologies to enhance its theme park experiences and create new entertainment options.

- Adapt to Changing Consumer Preferences: Disney must adapt to changing consumer preferences to remain relevant and competitive.

9. Expert Financial Analysis of Disney

Expert financial analysts provide valuable insights into Disney’s financial health, offering recommendations and projections based on thorough research and analysis.

- Financial Ratios: Analysts use financial ratios to assess Disney’s profitability, liquidity, and solvency.

- Market Trends: Analysts monitor market trends to identify opportunities and challenges for Disney.

- Company News: Analysts track company news to stay informed about Disney’s strategic initiatives and financial performance.

9.1. Financial Metrics to Evaluate Disney

Key financial metrics used to evaluate Disney include:

| Metric | Description |

|---|---|

| Revenue | The total amount of money Disney generates from its various business segments. |

| Net Income | The amount of money Disney earns after deducting all expenses from its revenue. |

| Earnings Per Share (EPS) | A measure of Disney’s profitability, calculated by dividing net income by the number of outstanding shares. |

| Price-to-Earnings (P/E) Ratio | A valuation ratio that compares Disney’s stock price to its earnings per share. |

| Debt-to-Equity Ratio | A financial ratio that measures the amount of debt Disney uses to finance its operations. |

9.2. Financial Projections for Disney

Financial analysts provide projections for Disney’s future financial performance, including revenue, earnings, and stock price targets.

- Revenue Projections: Analysts forecast Disney’s future revenue based on market trends, company initiatives, and economic conditions.

- Earnings Projections: Analysts project Disney’s future earnings based on revenue projections, cost management efforts, and tax rates.

- Stock Price Targets: Analysts set stock price targets for Disney based on their financial projections and valuation analysis.

9.3. Recommendations from Financial Analysts

Financial analysts provide recommendations on whether to buy, sell, or hold Disney stock based on their analysis of the company’s financial health and future prospects.

- Buy Recommendations: Analysts recommend buying Disney stock when they believe it is undervalued and has the potential to increase in value.

- Sell Recommendations: Analysts recommend selling Disney stock when they believe it is overvalued and has the potential to decline in value.

- Hold Recommendations: Analysts recommend holding Disney stock when they believe it is fairly valued and has limited potential for significant gains or losses.

10. Factors That Contribute to Disney’s Financial Success

Disney’s financial success can be attributed to several factors, including its strong brand, diversified business model, strategic acquisitions, and focus on innovation.

- Strong Brand: Disney has a strong brand recognition and a loyal customer base, which provides a solid foundation for future growth.

- Diversified Business Model: Disney’s diversified business model helps to mitigate risk and ensure financial stability.

- Strategic Acquisitions: Disney’s strategic acquisitions have expanded its content library and direct-to-consumer offerings, driving revenue growth and market share.

- Focus on Innovation: Disney’s focus on innovation and investment in new technologies positions it for long-term success.

10.1. The Power of the Disney Brand

The Disney brand is one of the most recognizable and valuable brands in the world, representing quality, entertainment, and family-friendly values.

- Brand Loyalty: Disney has a loyal customer base that is willing to pay a premium for its products and services.

- Brand Recognition: Disney’s brand is recognized worldwide, giving it a competitive advantage in the entertainment industry.

- Brand Equity: Disney’s brand equity is a valuable asset that contributes to its financial success.

10.2. Diversification as a Key Strategy

Disney’s diversified business model helps to mitigate risk and ensure financial stability. By operating in multiple business segments, Disney can offset declines in one area with gains in another.

- Theme Parks and Resorts: Disney’s theme parks and resorts generate significant revenue from ticket sales, hotel accommodations, and merchandise purchases.

- Media Networks: Disney’s media networks generate revenue from advertising, affiliate fees, and content licensing.

- Studio Entertainment: Disney’s studio entertainment division generates revenue from theatrical releases, home entertainment sales, and licensing agreements.

- Direct-to-Consumer: Disney’s direct-to-consumer business generates revenue from subscription fees, advertising revenue, and in-app purchases.

10.3. Strategic Acquisitions and Growth

Disney’s strategic acquisitions have expanded its content library and direct-to-consumer offerings, driving revenue growth and market share.

- Pixar: Acquired in 2006 for $7.4 billion, bringing groundbreaking animation technology and beloved characters to Disney’s portfolio.

- Marvel Entertainment: Acquired in 2009 for $4 billion, adding iconic superheroes and a vast library of comic book properties.

- Lucasfilm: Acquired in 2012 for $4.05 billion, bringing the Star Wars franchise and its associated revenue streams.

- 21st Century Fox: Acquired in 2019 for $71.3 billion, expanding Disney’s content library and direct-to-consumer offerings.

10.4. Innovation and Future Investments

Disney’s focus on innovation and investment in new technologies positions it for long-term success.

- Technological Advancements: Disney invests in new technologies like virtual reality and augmented reality to enhance its theme park experiences and create new entertainment options.

- Content Creation: Disney invests heavily in producing original content for its theme parks, television networks, and streaming services.

- Direct-to-Consumer Expansion: Disney is focused on growing its direct-to-consumer business through investments in Disney+, Hulu, and ESPN+.

- International Expansion: Disney is expanding its presence in international markets through new theme parks, resorts, and content offerings.

Understanding Disney’s financial standing requires a comprehensive analysis of its assets, liabilities, revenue streams, investments, and competitive landscape. While market capitalization provides a snapshot of its current value, a deeper dive into its financial health reveals the strategies and decisions that have contributed to its enduring success.

Navigating the complexities of financial analysis can be challenging. At HOW.EDU.VN, we connect you with top-tier experts who can provide personalized guidance and insights. Whether you’re seeking strategic advice, investment strategies, or answers to specific financial questions, our team of experienced PhDs is ready to assist. Contact us today at 456 Expertise Plaza, Consult City, CA 90210, United States, or via WhatsApp at +1 (310) 555-1212. Visit our website at HOW.EDU.VN to learn more and get started.

FAQ: Frequently Asked Questions About Disney’s Finances

1. How does Disney generate its revenue?

Disney generates revenue through its theme parks, media networks, studio entertainment, direct-to-consumer services, and consumer products. Each segment contributes to the company’s overall financial health.

2. What are the main factors that influence Disney’s stock price?

Disney’s stock price is influenced by financial performance, economic conditions, industry trends, company news, and investor sentiment. Monitoring these factors can help investors make informed decisions.

3. What strategic acquisitions has Disney made to enhance its financial position?

Disney’s strategic acquisitions include Pixar, Marvel Entertainment, Lucasfilm, and 21st Century Fox. These acquisitions have expanded Disney’s content library and direct-to-consumer offerings.

4. What are the key challenges and opportunities facing Disney in the entertainment industry?

Disney faces challenges such as cord-cutting and increased competition from streaming services. Opportunities include expanding its direct-to-consumer business and leveraging its intellectual property.

5. How does Disney manage its financial challenges and fluctuations?

Disney manages financial challenges through diversification, cost management, innovation, and strategic partnerships. These strategies help to maintain financial stability.

6. What is Disney’s approach to philanthropic efforts and charitable contributions?

Disney supports various causes through charitable donations, volunteer programs, and environmental conservation efforts. The company aligns its philanthropic activities with its values and priorities.

7. How does Disney ensure the sustainability and development of its real estate properties?

Disney is committed to sustainable development, incorporating environmentally friendly practices and energy-efficient technologies. The company also engages with local communities to ensure responsible development.

8. What financial metrics are used to evaluate Disney’s financial health?

Key financial metrics include revenue, net income, earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio. These metrics provide insights into Disney’s financial performance.

9. How can investors invest in Disney stock?

Investors can invest in Disney stock through brokerage accounts, retirement accounts, and direct stock purchase plans. Consulting with a financial advisor can help determine the best approach.

10. What strategies does Disney employ to maintain its competitive edge in the entertainment industry?

Disney maintains its competitive edge through its strong brand, diversified business model, strategic acquisitions, and focus on innovation. These strategies ensure Disney remains a leader in the entertainment industry.

If you need personalized guidance on financial analysis or have more specific questions about Disney’s financial standing, don’t hesitate to reach out to our team of PhDs at HOW.EDU.VN. We’re here to provide expert insights and support to help you make informed decisions. Contact us at 456 Expertise Plaza, Consult City, CA 90210, United States, or via WhatsApp at +1 (310) 555-1212. Visit our website at how.edu.vn to learn more.